01. The road ahead: Auto suppliers navigate new terrainBy Jason Coffman, Raj Iyer, and Ryan RobinsonInsights from Deloitte’s 2021 Automotive Supplier Study�

To say the global automotive industry has been

through the wringer in the past 17 months is an

understatement. From pandemic-provoked production

shutdowns and an accelerated shift to virtual sales to

crippling parts shortages and a planetary climate crisis,

manufacturers and suppliers have been fighting one

virtual (and literal) fire after another for more than year.

And if that weren’t enough, the automotive industry

is already going through major structural changes

as a result of several megatrends, including a shift

toward electrification, autonomous driving, connected

technologies, and shared mobility. To thrive—or

even just to remain viable in the new market reality—

suppliers should shift gears and adapt to the rapidly

changing nature of their business.

2

The road ahead: Auto suppliers navigate new terrain�

Introduction

As global automotive volumes have risen in the past

decade, suppliers have been emboldened to experiment

with investments in disruptive technologies, notably

electric drivetrains, vehicle connectivity, autonomous

drive, and shared mobility. In effect, by doing so, they

could disrupt their traditional business models from the

inside and potentially set themselves up for future growth.

With any or all of these technologies poised for wider-scale

adoption, suppliers had the luxuries of time and access to

relatively cheap capital to see where these investments

might lead.

Today, the time to experiment with one or more of these

disruptive technologies is quickly coming to an end.

Suppliers face a variety of new challenges, not the least of

which includes a very near-term goal laid out by several

countries to completely transform the way vehicles

operate and the fuel they consume. And while a decade

seems to provide a long runway, 10 years roughly equates

to only two vehicle cycles. When measured in terms of the

magnitude of change needed for the task ahead, this really

isn’t a lot of time.

Compounding this problem even further, the industry

has run into a massive financial jam resulting from a

combination of economic shutdowns in 2020 and 2021

and the continuing semiconductor crisis, with the risk

of other raw material shortages looming large on the

horizon. Unfortunately, with no end in sight, the continuing

chip shortage is challenging businesses to sustain

operations in the face of mounting costs and severe

revenue loss. Under such uncertain conditions, suppliers

should begin to consolidate their investments into truly

viable technologies while recognizing the importance

of these bets relative to the significant valuations new

technologies are encouraging in the market. Making

these more meaningful decisions about which road to

follow could have ramifications for the next decade—

and potentially beyond.

3

The road ahead: Auto suppliers navigate new terrain�

Just around the bend: Continued

growth for new and legacy segments

So far, consumers have been slow to accept the idea that an EV

could fully satisfy their transportation requirements. Data from

the 2021 Deloitte Global Automotive Consumer Study released

in January suggests that nearly three-quarters of US consumers

still want a “traditional” ICE installed in their next vehicle.1

However, we have seen some cause for optimism in the last few

months. For example, a survey of US consumers conducted in

August 2021 suggests that the number of people who want an

ICE-powered vehicle dropped to 64%.2 In addition, the Biden

administration’s new infrastructure bill that earmarks $7.5 billion

to expand electric vehicle charging is expected to help address a

long-standing consumer concern about EV range anxiety.3

In yet another promising sign of things

to come, we see a very robust pipeline

of EV launches from multiple global

OEMs scheduled over the next three

to five years.4

When it comes to predicting the rise and decline of specific parts

segments, a crystal ball is hardly necessary. Not surprisingly,

analysis conducted for this study suggests component clusters

tied to electrified vehicles (EVs) are growing at a frenetic pace,

while parts that EVs make obsolete, such as exhaust systems,

transmissions, and everything that supports propulsion using

an internal combustion engine (ICE), are either stagnant

or declining.

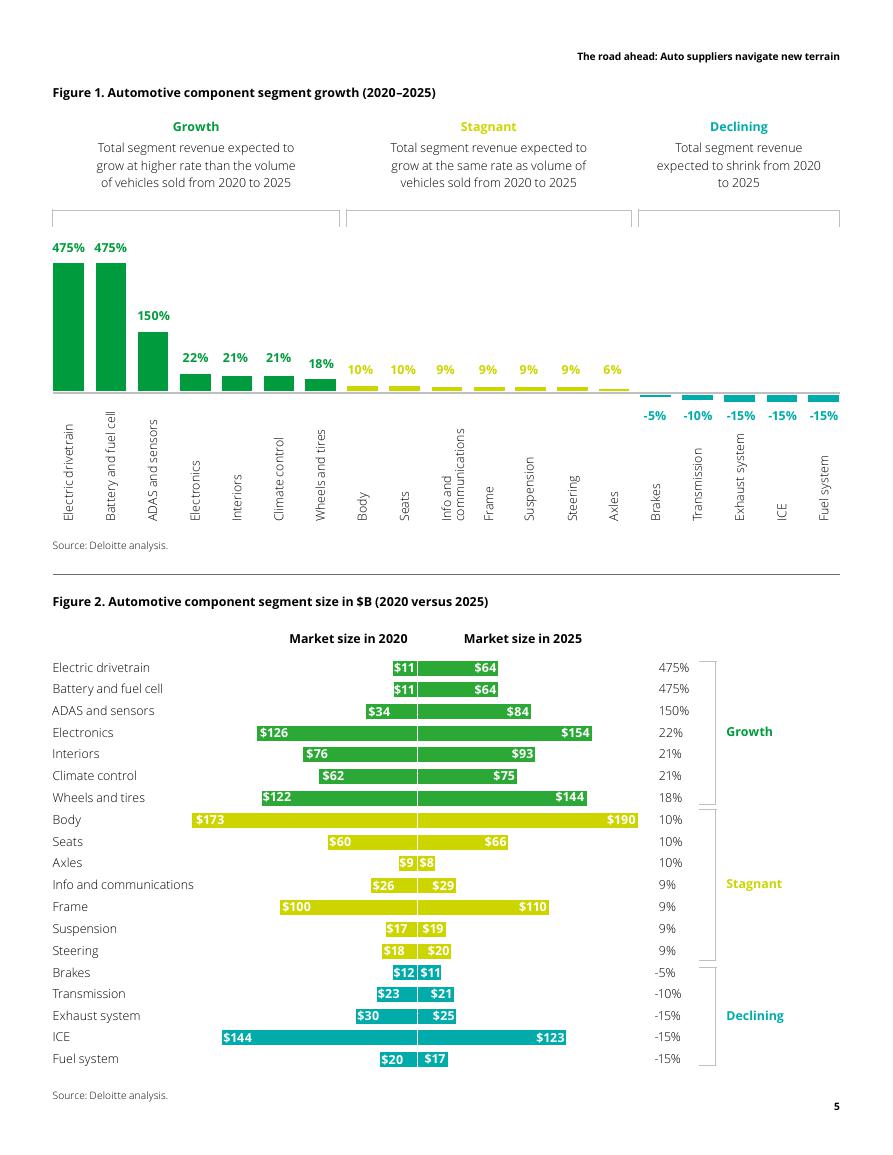

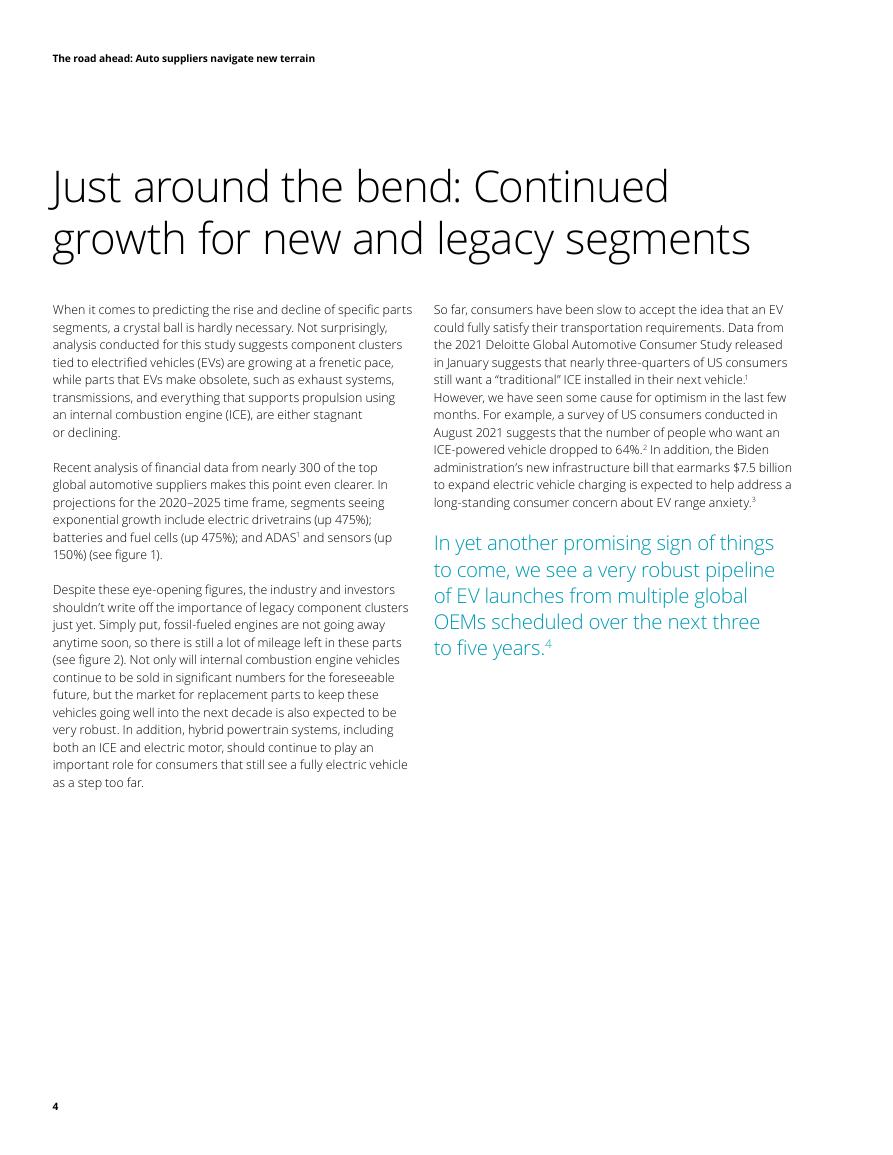

Recent analysis of financial data from nearly 300 of the top

global automotive suppliers makes this point even clearer. In

projections for the 2020–2025 time frame, segments seeing

exponential growth include electric drivetrains (up 475%);

batteries and fuel cells (up 475%); and ADAS1 and sensors (up

150%) (see figure 1).

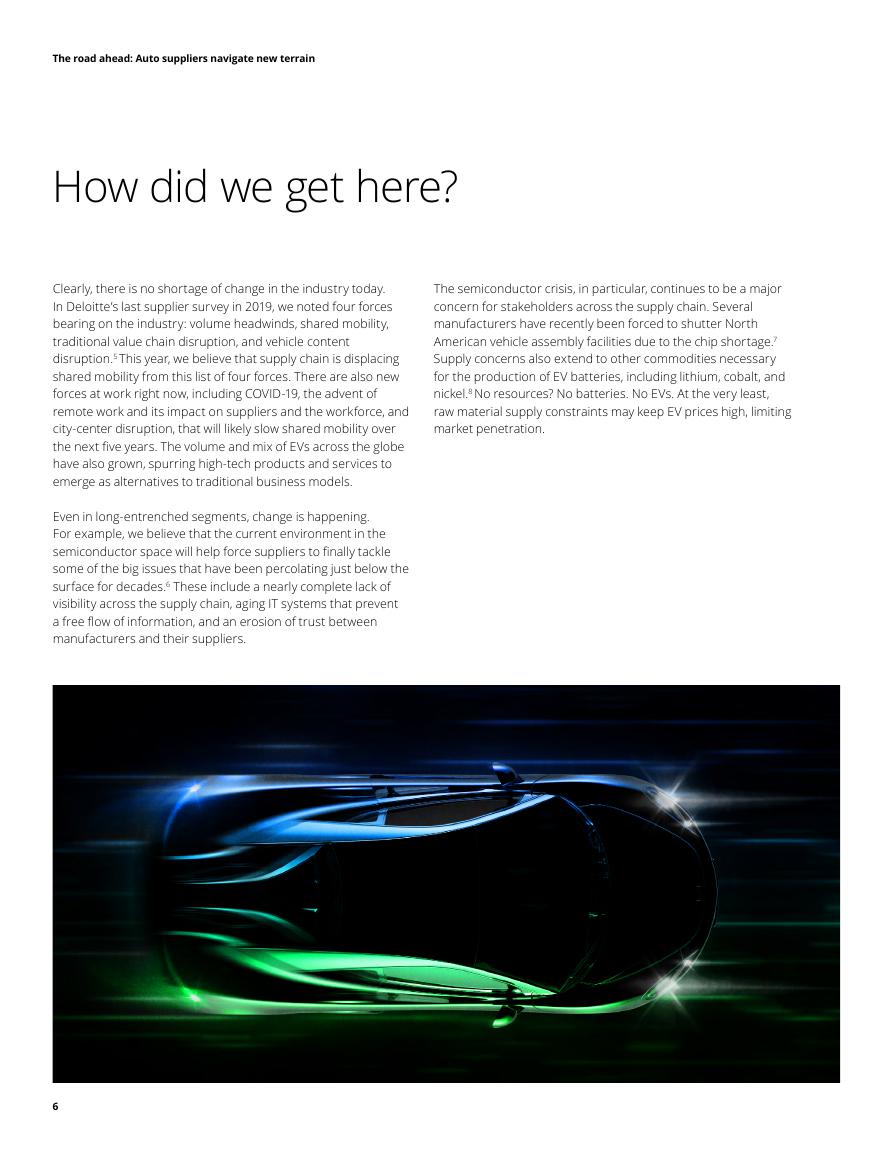

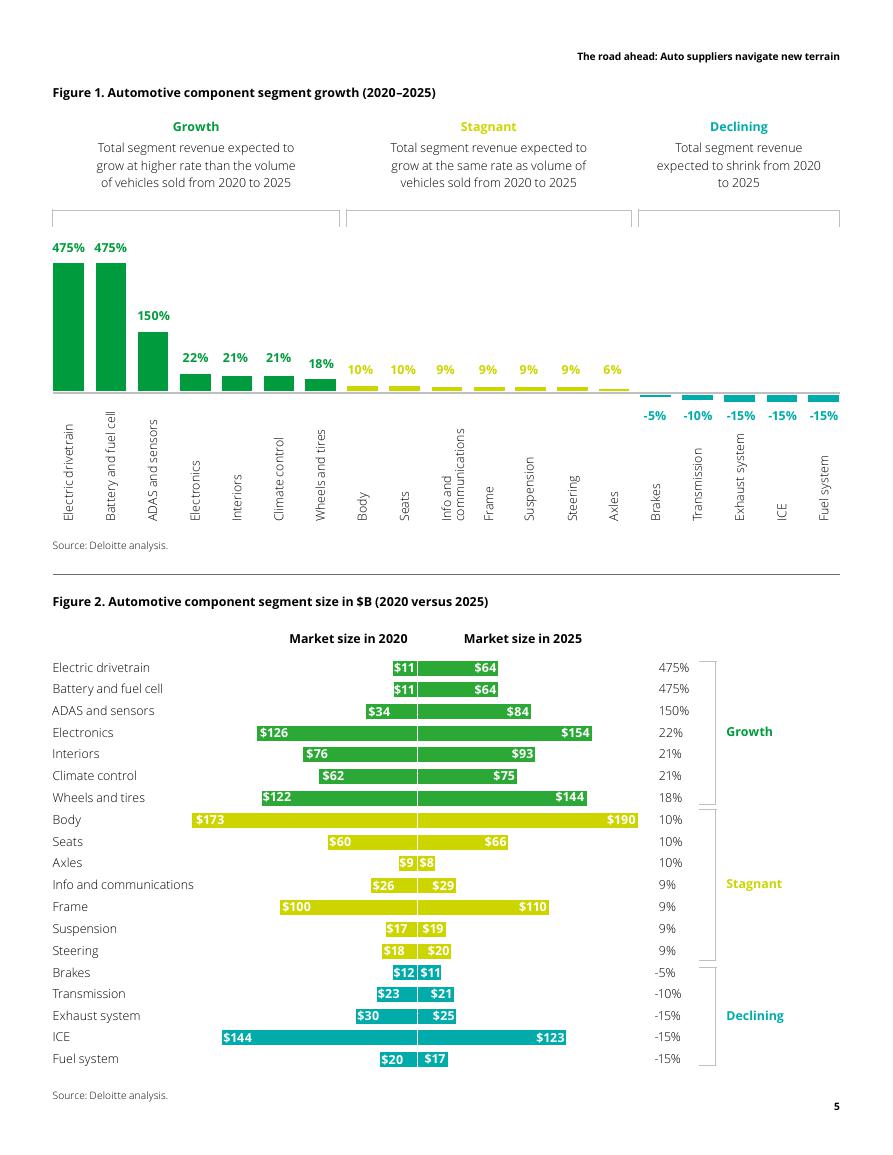

Despite these eye-opening figures, the industry and investors

shouldn’t write off the importance of legacy component clusters

just yet. Simply put, fossil-fueled engines are not going away

anytime soon, so there is still a lot of mileage left in these parts

(see figure 2). Not only will internal combustion engine vehicles

continue to be sold in significant numbers for the foreseeable

future, but the market for replacement parts to keep these

vehicles going well into the next decade is also expected to be

very robust. In addition, hybrid powertrain systems, including

both an ICE and electric motor, should continue to play an

important role for consumers that still see a fully electric vehicle

as a step too far.

4

The road ahead: Auto suppliers navigate new terrain�

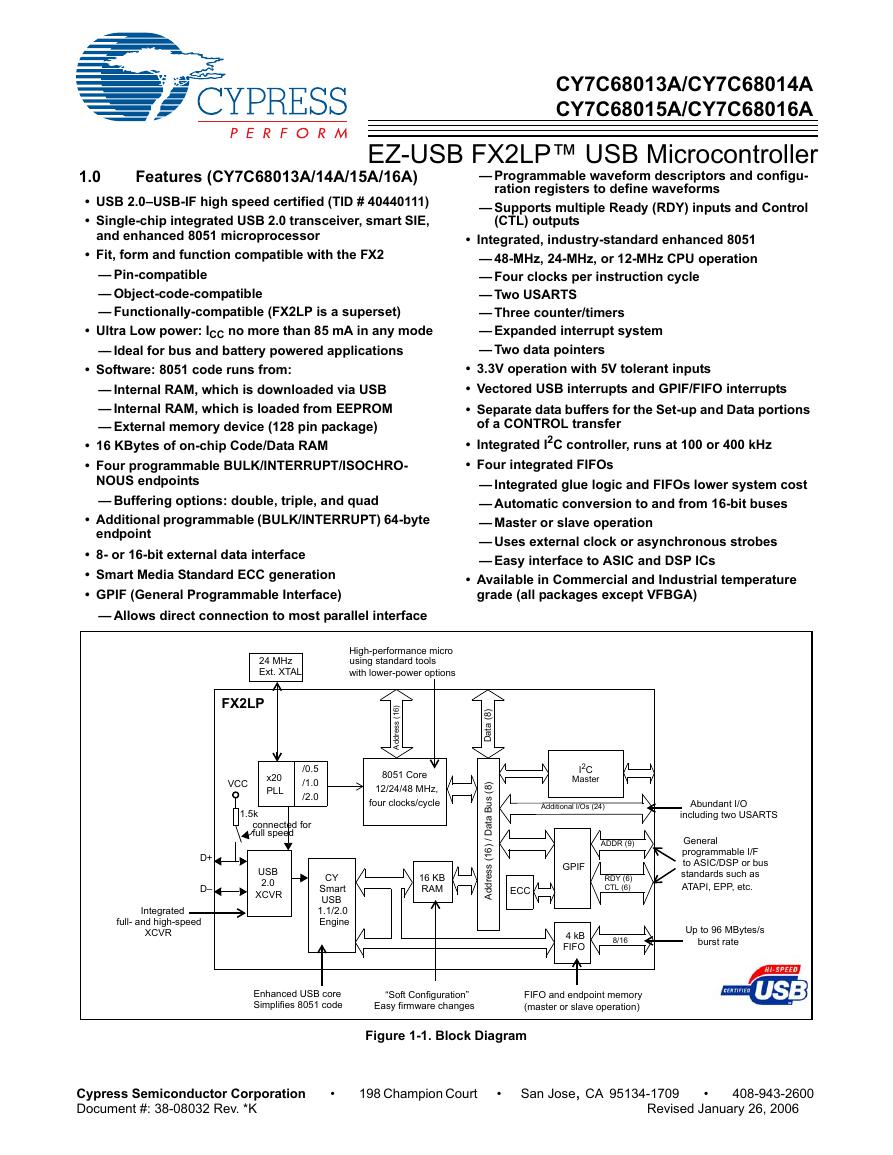

Figure 1. Automotive component segment growth (2020–2025)

Growth

Total segment revenue expected to

grow at higher rate than the volume

of vehicles sold from 2020 to 2025

Stagnant

Total segment revenue expected to

grow at the same rate as volume of

vehicles sold from 2020 to 2025

Declining

Total segment revenue

expected to shrink from 2020

to 2025

475% 475%

150%

i

n

a

r

t

e

v

i

r

d

c

i

r

t

c

e

E

l

l

l

e

c

l

e

u

f

d

n

a

y

r

e

t

t

a

B

s

r

o

s

n

e

s

d

n

a

S

A

D

A

Source: Deloitte analysis.

22% 21% 21% 18% 10% 10% 9%

9%

9%

9%

6%

-5% -10% -15% -15% -15%

l

o

r

t

n

o

c

e

t

a

m

i

l

C

s

e

r

i

t

d

n

a

s

e

e

h

W

l

s

r

o

i

r

e

t

n

I

y

d

o

B

s

t

a

e

S

i

s

c

n

o

r

t

c

e

E

l

i

s

n

o

i

t

a

c

n

u

m

m

o

c

I

d

n

a

o

f

n

i

n

o

s

n

e

p

s

u

S

e

m

a

r

F

g

n

i

r

e

e

t

S

l

s

e

x

A

s

e

k

a

r

B

m

e

t

s

y

s

t

s

u

a

h

x

E

m

e

t

s

y

s

l

e

u

F

E

C

I

i

i

n

o

s

s

m

s

n

a

r

T

Figure 2. Automotive component segment size in $B (2020 versus 2025)

Market size in 2020

Market size in 2025

$11

$11

$34

$64

$64

$84

$93

$75

$154

$144

$190

$126

$122

$76

$62

$173

$60

$66

$100

$144

$9

$8

$26

$29

$17

$18

$12

$19

$20

$11

$23

$30

$21

$25

$20

$17

$110

$123

475%

475%

150%

22%

21%

21%

18%

10%

10%

10%

9%

9%

9%

9%

-5%

-10%

-15%

-15%

-15%

Growth

Stagnant

Declining

Electric drivetrain

Battery and fuel cell

ADAS and sensors

Electronics

Interiors

Climate control

Wheels and tires

Body

Seats

Axles

Info and communications

Frame

Suspension

Steering

Brakes

Transmission

Exhaust system

ICE

Fuel system

Source: Deloitte analysis.

5

The road ahead: Auto suppliers navigate new terrain�

How did we get here?

The semiconductor crisis, in particular, continues to be a major

concern for stakeholders across the supply chain. Several

manufacturers have recently been forced to shutter North

American vehicle assembly facilities due to the chip shortage.7

Supply concerns also extend to other commodities necessary

for the production of EV batteries, including lithium, cobalt, and

nickel.8 No resources? No batteries. No EVs. At the very least,

raw material supply constraints may keep EV prices high, limiting

market penetration.

Clearly, there is no shortage of change in the industry today.

In Deloitte’s last supplier survey in 2019, we noted four forces

bearing on the industry: volume headwinds, shared mobility,

traditional value chain disruption, and vehicle content

disruption.5 This year, we believe that supply chain is displacing

shared mobility from this list of four forces. There are also new

forces at work right now, including COVID-19, the advent of

remote work and its impact on suppliers and the workforce, and

city-center disruption, that will likely slow shared mobility over

the next five years. The volume and mix of EVs across the globe

have also grown, spurring high-tech products and services to

emerge as alternatives to traditional business models.

Even in long-entrenched segments, change is happening.

For example, we believe that the current environment in the

semiconductor space will help force suppliers to finally tackle

some of the big issues that have been percolating just below the

surface for decades.6 These include a nearly complete lack of

visibility across the supply chain, aging IT systems that prevent

a free flow of information, and an erosion of trust between

manufacturers and their suppliers.

6

The road ahead: Auto suppliers navigate new terrain�

Challenges and opportunities

But many leaders hope to emerge stronger from this challenging

year. The ongoing COVID-19 disruption continues to highlight

the need for accelerating investments in supply chain resources

and solutions. Some companies see opportunities to bolster

resilience by acquiring “marginal players that didn’t make it

through COVID-19,” as one respondent put it. Companies

are already moving to build or rebuild relationships with key

suppliers: “If we’re thinking about a supplier that is strategic to

our business objective and business goal,” another respondent

said, “then we want to invest more with them in terms of

economic planning capital and ensuring that they understand

our road map and how we want to proceed.” And some leaders

are looking to vertical integration to shore up weak spots

and avoid having to rely on independent suppliers or,

worse, competitors.

Supply chain challenges are increasingly daunting, with suppliers

and relationships constantly shifting and leaders often unsure

which tools or technologies might help forecast areas of risk.

After all, no single application can anticipate tariff battles, much

less global pandemics. “There’s not a piece of software you

can buy and immediately get a highlight of all your supply chain

issues,” one industry executive noted. COVID-19 has dramatically

altered logistics around the globe as governments, industries,

and companies compete for materials and products and strive

to shore up vulnerabilities. “The pandemic has changed a lot of

scenarios, a lot of situations globally,” said another respondent.

“Logistics are probably not going to go back to normal.”

And as if issues with shipping of

physical goods, both domestically and

internationally, weren’t complicated

enough, strategic realignments,

partnerships, and recent M&A activity

have contributed to a more complex

supply chain in some cases.

7

The road ahead: Auto suppliers navigate new terrain�

Making decisions that count

Despite recent setbacks in the industry, we believe that now is

still the time for suppliers to plan for the future. With a wave of

new technologies either available today or looming large on the

horizon, suppliers should focus on adequately preparing for

what’s to come.

Supply chain effectiveness:

New thinking applied to old problems

When it comes to supply chain footprint, there is ongoing

friction. Suppliers are forced to contend with a variety of issues

at multiple levels, notably global-versus-regional tensions,

complexity, visibility, and talent scarcity.

Global-versus-regional: Suppliers should focus their attention

on several issues, including economics, trade, and geopolitical

tensions, that can lead to the adoption of nationalistic agendas.

All too often, such policies collide with globalized industries,

such as automotive, which have expanded over several decades

to encompass manufacturers, suppliers, and distributors

around the world. Trying to untangle these longstanding (and

profitable) relationships completely would be difficult, to say

the least. Having said that, suppliers should strive for more

regional self-sufficiency, minimizing production uncertainty while

strengthening their ability to wind down a dependence on costly

expedited freight due to the fragility of a global supply chain.

Complexity: Beyond the global-regional issues that suppliers

face, there is great complexity within the industry that affects

suppliers in two ways. First, precision in and coordination with

suppliers, manufacturers, and retailers keeps the industry

motoring ahead. If any one of the three legs of the industry falls

short, the ramifications are immediate and impactful for the

other two. Parts shortages, demand swings, and other examples

of volatility that we’ve seen in the past year offer a cautionary

tale for the automotive industry: It’s “all for one; one for all,”

whether the players realize it or not.9

Suppliers also should manage a second level of complexity

around the reduction of complicated OEM production as they

chase less buildable combinations to improve quality and

margins, both of which can affect a supplier’s business model

and bottom line.

8

Visibility: Your data can be your greatest asset if you have

visibility into how it’s working for you. But suppliers should figure

out their data issues right now. How they position themselves

to take full advantage of their data, making use of more reliable

demand forecasting across the manufacturing value chain, can

be vital to a successful future. This can require considerable

effort to help ensure a proper flow of data and other essential

information to facilitate real-time decision-making and greater

transparency to help manage perceived risks and rewards for

the business.

Suppliers can also benefit from improved visibility into on-vehicle

product performance. This requires working directly with OEMs

to develop data transparency to help manage performance,

quality, and warranties, which, in turn, can foster clearer insights

into the customer experience—a win-win-win experience for

suppliers, OEMs, and customers.

Talent scarcity: Suppliers are facing unprecedented shortages

of both white- and blue-collar talent today and into the future.

On the white-collar side, there is an acute and growing need

for software talent, particularly as it relates to advancing EVs.10

On the blue-collar side, the manufacturing industry has been

relentlessly challenged by a persistent skills gap and the more

recent difficulty of returning workers from COVID-19 lockdowns.

Compounding these issues is a need for attention paid to

diversity, equity, and inclusion (DE&I) across the automotive

sector. Recent study results suggest nearly half of women

working in the auto industry would choose another sector if they

had a chance to start their career over.11

When it comes to the skills gap, the numbers are daunting.

According to our latest survey, 77% of manufacturers expect

ongoing difficulties in attracting and retaining workers in 2021

and beyond. Advanced technologies, such as automation and

artificial intelligence, can help, but won’t solve the problem

outright. In fact, US manufacturers expect this problem to

continue and anticipate having 2.1 million unfilled jobs by 2030.12

The pandemic is also complicating efforts among workers

at assembly and auto parts plants in the United States. For

example, a requirement for all factory workers to wear masks

has been reintroduced shortly after being relaxed and will

remain in place until further notice due to the threat posed by

the Delta variant of COVID-19.13

The road ahead: Auto suppliers navigate new terrain�

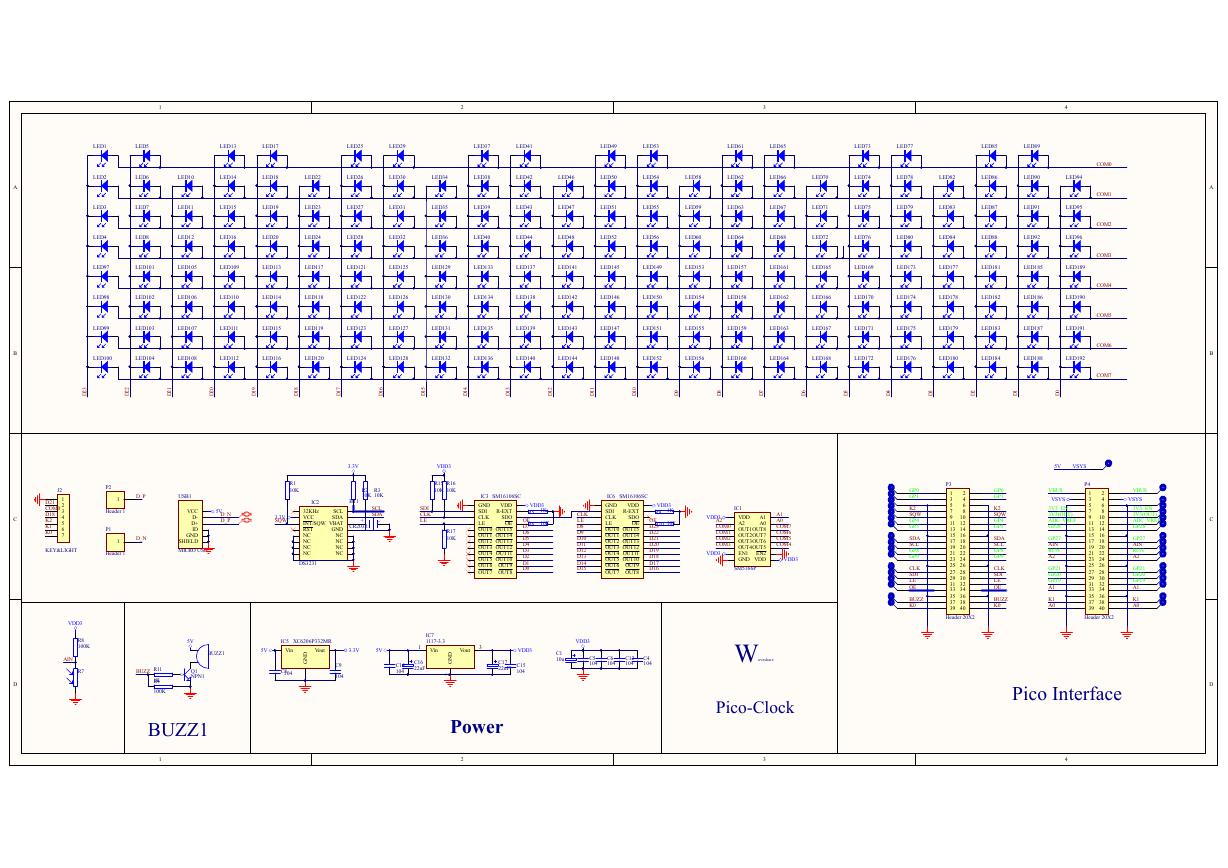

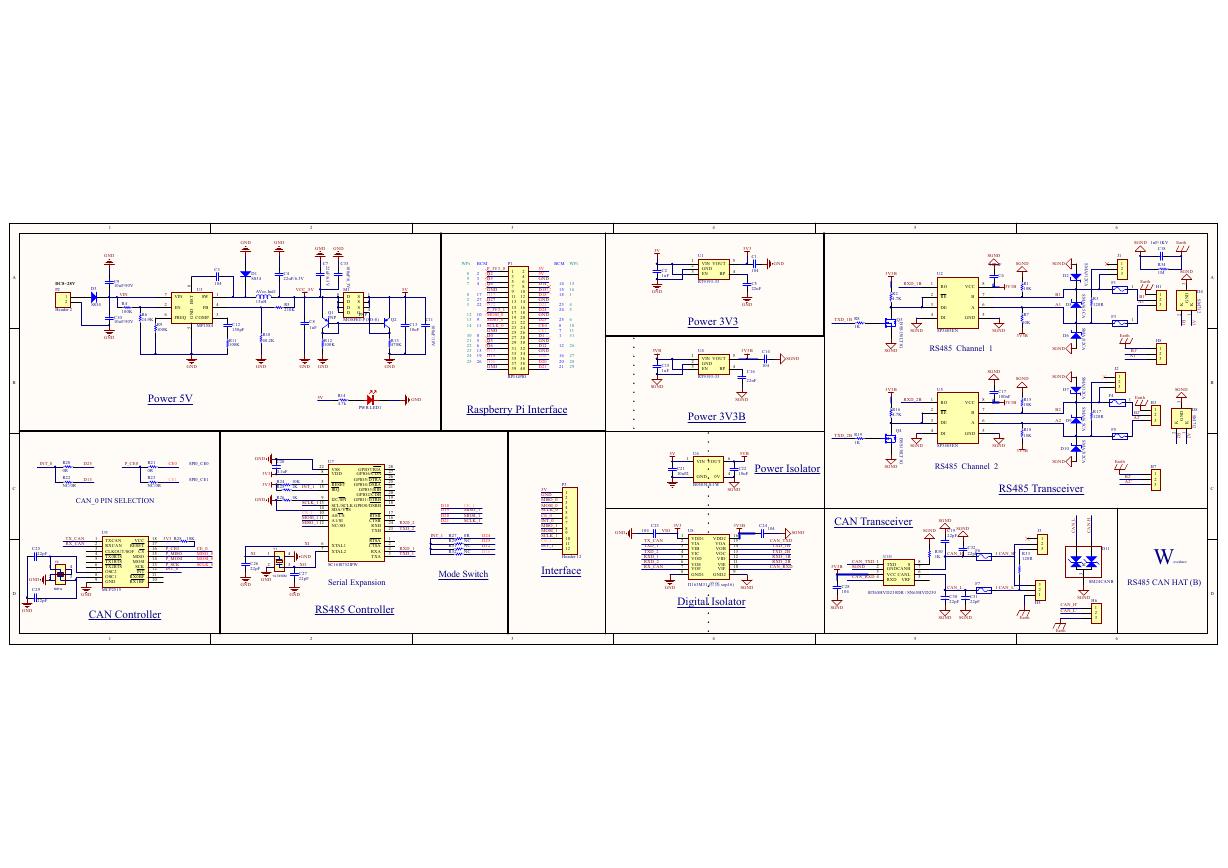

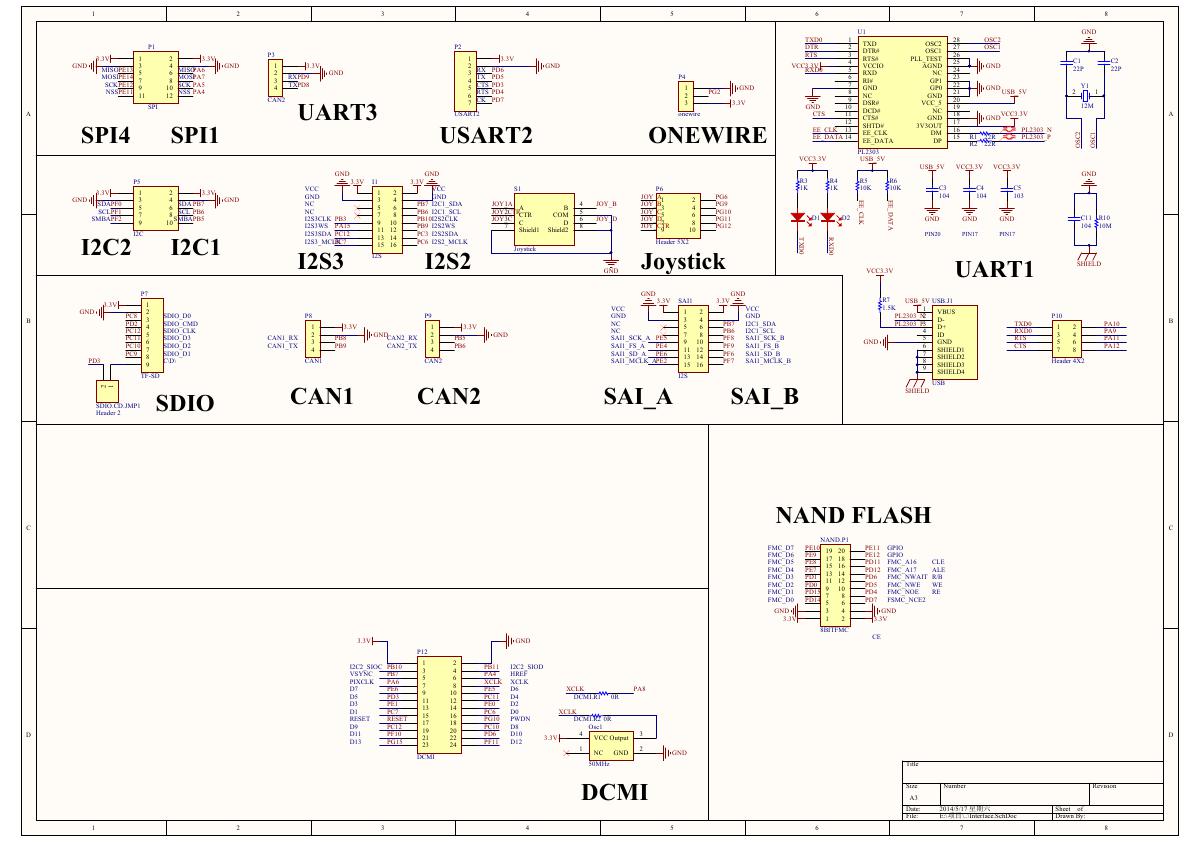

V2版本原理图(Capacitive-Fingerprint-Reader-Schematic_V2).pdf

V2版本原理图(Capacitive-Fingerprint-Reader-Schematic_V2).pdf 摄像头工作原理.doc

摄像头工作原理.doc VL53L0X简要说明(En.FLVL53L00216).pdf

VL53L0X简要说明(En.FLVL53L00216).pdf 原理图(DVK720-Schematic).pdf

原理图(DVK720-Schematic).pdf 原理图(Pico-Clock-Green-Schdoc).pdf

原理图(Pico-Clock-Green-Schdoc).pdf 原理图(RS485-CAN-HAT-B-schematic).pdf

原理图(RS485-CAN-HAT-B-schematic).pdf File:SIM7500_SIM7600_SIM7800 Series_SSL_Application Note_V2.00.pdf

File:SIM7500_SIM7600_SIM7800 Series_SSL_Application Note_V2.00.pdf ADS1263(Ads1262).pdf

ADS1263(Ads1262).pdf 原理图(Open429Z-D-Schematic).pdf

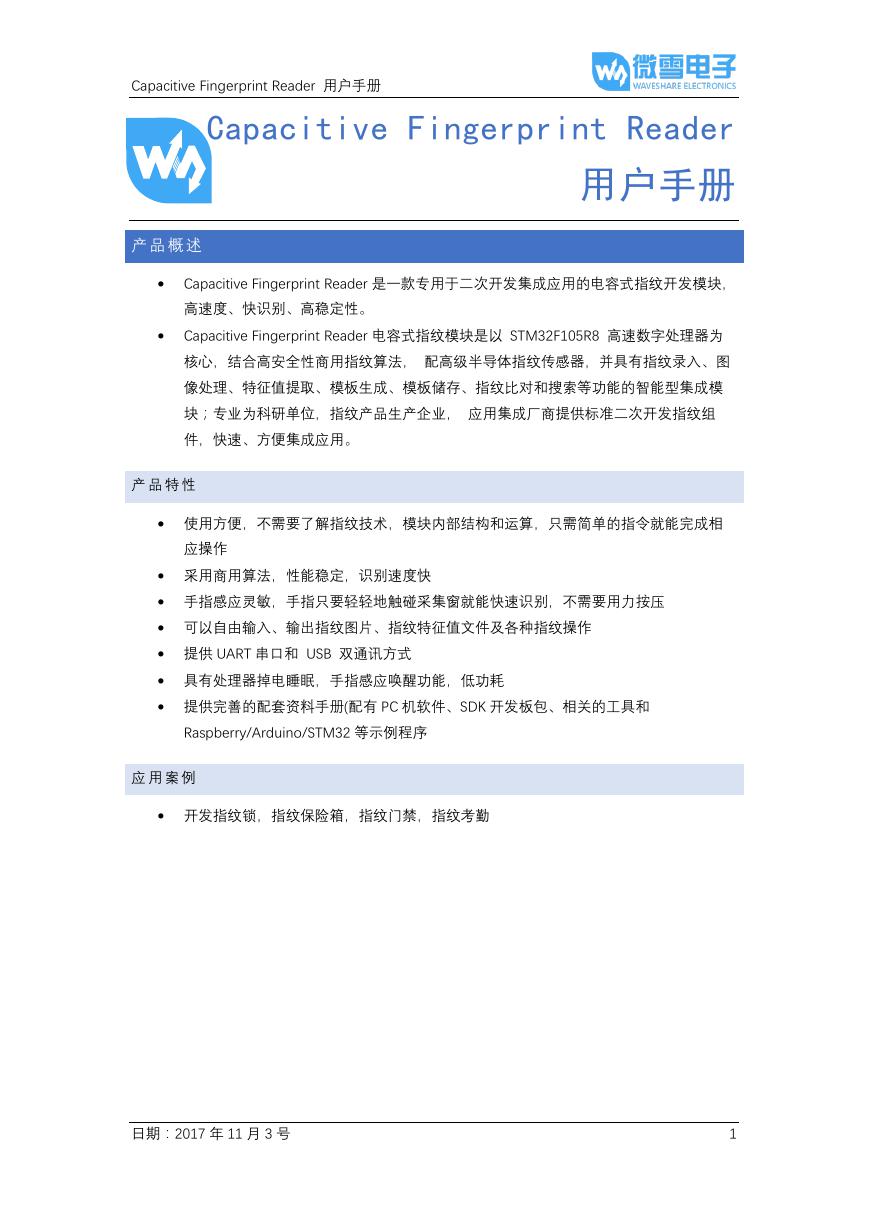

原理图(Open429Z-D-Schematic).pdf 用户手册(Capacitive_Fingerprint_Reader_User_Manual_CN).pdf

用户手册(Capacitive_Fingerprint_Reader_User_Manual_CN).pdf CY7C68013A(英文版)(CY7C68013A).pdf

CY7C68013A(英文版)(CY7C68013A).pdf TechnicalReference_Dem.pdf

TechnicalReference_Dem.pdf