Cover

Title Page

Copyright Page

Contents

Preface

ACKNOWLEDGMENTS

Chapter 1 Introduction to Derivatives

1.1 What Is a Derivative?

1.2 An Overview of Financial Markets

Trading of Financial Assets

Measures of Market Size and Activity

Stock and Bond Markets

Derivatives Markets

1.3 The Role of Financial Markets

Financial Markets and the Averages

Risk-Sharing

1.4 The Uses of Derivatives

Uses of Derivatives

Perspectives on Derivatives

Financial Engineering and Security Design

1.5 Buying and Short-Selling Financial Assets

Transaction Costs and the Bid-Ask Spread

Ways to Buy or Sell

Short-Selling

The Lease Rate of an Asset

Risk and Scarcity in Short-Selling

Chapter Summary

Further Reading

Problems

PART ONE: Insurance, Hedging, and Simple Strategies

Chapter 2 An Introduction to Forwards and Options

2.1 Forward Contracts

2.2 Call Options

2.3 Put Options

2.4 Summary of Forward and Option Positions

2.5 Options Are Insurance

2.6 Example: Equity-Linked CDs

Chapter Summary

Further Reading

Problems

2.A: More on Buying a Stock Option

Chapter 3 Insurance, Collars, and Other Strategies

3.1 Basic Insurance Strategies

3.2 Put-Call Parity

3.3 Spreads and Collars

3.4 Speculating on Volatility

Chapter Summary

Further Reading

Problems

Chapter 4 Introduction to Risk Management

4.1 Basic Risk Management: The Producer’s Perspective

4.2 Basic Risk Management: The Buyer’s Perspective

4.3 Why Do Firms Manage Risk?

4.4 Golddiggers Revisited

4.5 Selecting the Hedge Ratio

Chapter Summary

Further Reading

Problems

PART TWO: Forwards, Futures, and Swaps

Chapter 5 Financial Forwards and Futures

5.1 Alternative Ways to Buy a Stock

5.2 Prepaid Forward Contracts on Stock

5.3 Forward Contracts on Stock

5.4 Futures Contracts

5.5 Uses of Index Futures

5.6 Currency Contracts

5.7 Eurodollar Futures

Chapter Summary

Further Reading

Problems

5.A: Taxes and the Forward Rate

5.B: Equating Forwards and Futures

5.C: Forward and Futures Prices

Chapter 6 Commodity Forwards and Futures

6.1 Introduction to Commodity Forwards

6.2 Equilibrium Pricing of Commodity Forwards

6.3 Pricing Commodity Forwards by Arbitrage

6.4 Gold

6.5 Corn

6.6 Energy Markets

6.7 Hedging Strategies

6.8 Synthetic Commodities

Chapter Summary

Further Reading

Problems

Chapter 7 Interest Rate Forwards and Futures

7.1 Bond Basics

7.2 Forward Rate Agreements, Eurodollar Futures, and Hedging

7.3 Duration and Convexity

7.4 Treasury-Bond and Treasury-Note Futures

7.5 Repurchase Agreements

Chapter Summary

Further Reading

Problems

7.A: Interest Rate and Bond Price Conventions

Chapter 8 Swaps

8.1 An Example of a Commodity Swap

8.2 Computing the Swap Rate in General

8.3 Interest Rate Swaps

8.4 Currency Swaps

8.5 Swaptions

8.6 Total Return Swaps

Chapter Summary

Further Reading

Problems

PART THREE: Options

Chapter 9 Parity and Other Option Relationships

9.1 Put-Call Parity

9.2 Generalized Parity and Exchange Options

9.3 Comparing Options with Respect to Style, Maturity, and Strike

Chapter Summary

Further Reading

Problems

9.A: Parity Bounds for American Options

9.B: Algebraic Proofs of Strike-Price Relations

Chapter 10 Binomial Option Pricing: Basic Concepts

10.1 A One-Period Binomial Tree

10.2 Constructing a Binomial Tree

10.3 Two or More Binomial Periods

10.4 Put Options

10.5 American Options

10.6 Options on Other Assets

Chapter Summary

Further Reading

Problems

10.A: Taxes and Option Prices

Chapter 11 Binomial Option Pricing: Selected Topics

11.1 Understanding Early Exercise

11.2 Understanding Risk-Neutral Pricing

11.3 The Binomial Tree and Lognormality

11.4 Stocks Paying Discrete Dividends

Chapter Summary

Further Reading

Problems

11.A: Pricing Options with True Probabilities

11.B: Why Does Risk-Neutral Pricing Work?

Chapter 12 The Black-Scholes Formula

12.1 Introduction to the Black-Scholes Formula

12.2 Applying the Formula to Other Assets

12.3 Option Greeks

12.4 Profit Diagrams Before Maturity

12.5 Implied Volatility

12.6 Perpetual American Options

Chapter Summary

Further Reading

Problems

12.A: The Standard Normal Distribution

12.B: Formulas for Option Greeks

Chapter 13 Market-Making and Delta-Hedging

13.1 What Do Market-Makers Do?

13.2 Market-Maker Risk

13.3 Delta-Hedging

13.4 The Mathematics of Delta-Hedging

13.5 The Black-Scholes Analysis

13.6 Market-Making as Insurance

Chapter Summary

Further Reading

Problems

13.A: Taylor Series Approximations

13.B: Greeks in the Binomial Model

Chapter 14 Exotic Options: I

14.1 Introduction

14.2 Asian Options

14.3 Barrier Options

14.4 Compound Options

14.5 Gap Options

14.6 Exchange Options

Chapter Summary

Further Reading

Problems

14.A: Pricing Formulas for Exotic Options

PART FOUR: Financial Engineering and Applications

Chapter 15 Financial Engineering and Security Design

15.1 The Modigliani-Miller Theorem

15.2 Structured Notes without Options

15.3 Structured Notes with Options

15.4 Strategies Motivated by Tax and Regulatory Considerations

15.5 Engineered Solutions for Golddiggers

Chapter Summary

Further Reading

Problems

Chapter 16 Corporate Applications

16.1 Equity, Debt, and Warrants

16.2 Compensation Options

16.3 The Use of Collars in Acquisitions

Chapter Summary

Further Reading

Problems

16.A: An Alternative Approach to Expensing Option Grants

Chapter 17 Real Options

17.1 Investment and the NPV Rule

17.2 Investment under Uncertainty

17.3 Real Options in Practice

17.4 Commodity Extraction as an Option

17.5 Commodity Extraction with Shutdown and Restart Options

Chapter Summary

Further Reading

Problems

17.A: Calculation of Optimal Time to Drill an Oil Well

17.B: The Solution with Shutting Down and Restarting

PART FIVE: Advanced Pricing Theory and Applications

Chapter 18 The Lognormal Distribution

18.1 The Normal Distribution

18.2 The Lognormal Distribution

18.3 A Lognormal Model of Stock Prices

18.4 Lognormal Probability Calculations

18.5 Estimating the Parameters of a Lognormal Distribution

18.6 How Are Asset Prices Distributed?

Chapter Summary

Further Reading

Problems

18.A: The Expectation of a Lognormal Variable

18.B: Constructing a Normal Probability Plot

Chapter 19 Monte Carlo Valuation

19.1 Computing the Option Price as a Discounted Expected Value

19.2 Computing Random Numbers

19.3 Simulating Lognormal Stock Prices

19.4 Monte Carlo Valuation

19.5 Efficient Monte Carlo Valuation

19.6 Valuation of American Options

19.7 The Poisson Distribution

19.8 Simulating Jumps with the Poisson Distribution

19.9 Simulating Correlated Stock Prices

Chapter Summary

Further Reading

Problems

19.A: Formulas for Geometric Average Options

Chapter 20 Brownian Motion and Itô’s Lemma

20.1 The Black-Scholes Assumption about Stock Prices

20.2 Brownian Motion

20.3 Geometric Brownian Motion

20.4 Itô’s Lemma

20.5 The Sharpe Ratio

20.6 Risk-Neutral Valuation

20.7 Jumps in the Stock Price

Chapter Summary

Further Reading

Problems

20.A: Valuation Using Discounted Cash Flow

Chapter 21 The Black-Scholes-Merton Equation

21.1 Differential Equations and Valuation under Certainty

21.2 The Black-Scholes Equation

21.3 Risk-Neutral Pricing

21.4 Changing the Numeraire

21.5 Option Pricing When the Stock Price Can Jump

Chapter Summary

Further Reading

Problems

21.A: Multivariate Black-Scholes Analysis

21.B: Proof of Proposition 21.1

21.C: Solutions for Prices and Probabilities

Chapter 22 Risk-Neutral and Martingale Pricing

22.1 Risk Aversion and Marginal Utility

22.2 The First-Order Condition for Portfolio Selection

22.3 Change of Measure and Change of Numeraire

22.4 Examples of Numeraire and Measure Change

22.5 Examples of Martingale Pricing

22.6 Example: Long-Maturity Put Options

Chapter Summary

Further Reading

Problems

22.A: The Portfolio Selection Problem

22.B: Girsanov’s Theorem

22.C: Risk-Neutral Pricing and Marginal Utility in the Binomial Model

Chapter 23 Exotic Options: II

23.1 All-or-Nothing Options

23.2 All-or-Nothing Barrier Options

23.3 Barrier Options

23.4 Quantos

23.5 Currency-Linked Options

23.6 Other Multivariate Options

Chapter Summary

Further Reading

Problems

23.A: The Reflection Principle

Chapter 24 Volatility

24.1 Implied Volatility

24.2 Measurement and Behavior of Volatility

24.3 Hedging and Pricing Volatility

24.4 Extending the Black-Scholes Model

Chapter Summary

Further Reading

Problems

Chapter 25 Interest Rate and Bond Derivatives

25.1 An Introduction to Interest Rate Derivatives

25.2 Interest Rate Derivatives and the Black-Scholes-Merton Approach

25.3 Continuous-Time Short-Rate Models

25.4 Short-Rate Models and Interest Rate Trees

25.5 Market Models

Chapter Summary

Further Reading

Problems

25.A: Constructing the BDT Tree

Chapter 26 Value at Risk

26.1 Value at Risk

26.2 Issues with VaR

Chapter Summary

Further Reading

Problems

Chapter 27 Credit Risk

27.1 Default Concepts and Terminology

27.2 The Merton Default Model

27.3 Bond Ratings and Default Experience

27.4 Credit Default Swaps

27.5 Tranched Structures

Chapter Summary

Further Reading

Problems

Appendix A: The Greek Alphabet

Appendix B: Continuous Compounding

B.1 The Language of Interest Rates

B.2 The Logarithmic and Exponential Functions

Appendix C: Jensen’s Inequality

C.1 Example: The Exponential Function

C.2 Example: The Price of a Call

C.3 Proof of Jensen’s Inequality

Appendix D: An Introduction to Visual Basic for Applications

D.1 Calculations without VBA

D.2 How to Learn VBA

D.3 Calculations with VBA

D.4 Storing and Retrieving Variables in a Worksheet

D.5 Using Excel Functions from within VBA

D.6 Checking for Conditions

D.7 Arrays

D.8 Iteration

D.9 Reading and Writing Arrays

D.10 Miscellany

Glossary

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

Y

Z

References

Index

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

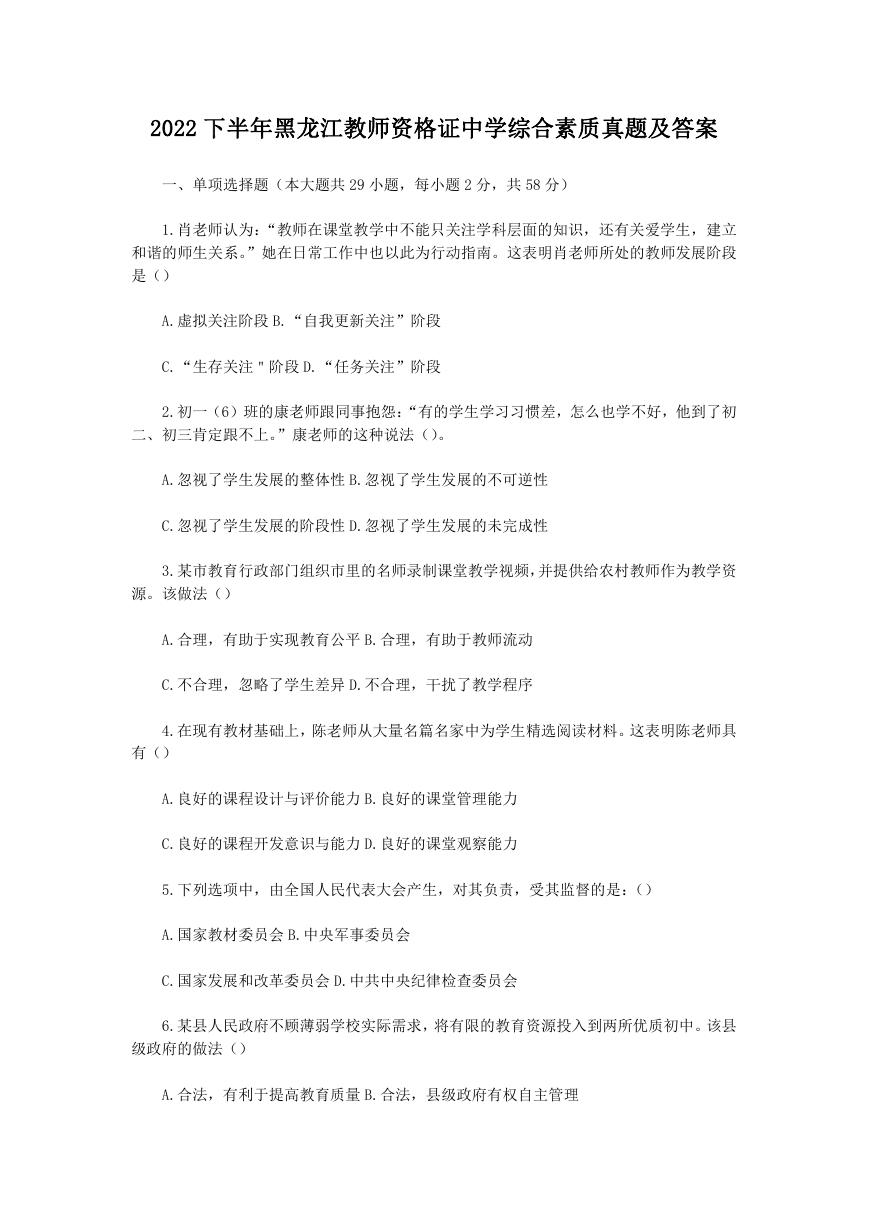

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc