Nonlinear Time Series:

Nonparametric and

Parametric Methods

Jianqing Fan

Qiwei Yao

SPRINGER

�

Springer Series in Statistics

Advisors:

P. Bickel, P. Diggle, S. Fienberg, K. Krickeberg,

I. Olkin, N. Wermuth, S. Zeger

�

Jianqing Fan

Qiwei Yao

Nonlinear Time Series

Nonparametric and Parametric Methods

�

Jianqing Fan

Department of Operations Research

and Financial Engineering

Princeton University

Princeton, NJ 08544

USA

jqfan@princeton.edu

Qiwei Yao

Department of Statistics

London School of Economics

London WC2A 2AE

UK

q.yao@lse.ac.uk

Library of Congress Cataloging-in-Publication Data

Fan, Jianqing.

Nonlinear time series : nonparametric and parametric methods / Jianqing Fan, Qiwei Yao.

p. cm. — (Springer series in statistics)

Includes bibliographical references and index.

ISBN 0-387-95170-9 (alk. paper)

1. Time-series analysis.

2. Nonlinear theories.

QA280 .F36 2003

519.2′32—dc21

I. Yao, Qiwei.

II. Title.

III. Series.

2002036549

Printed on acid-free paper.

ISBN 0-387-95170-9

2003 Springer-Verlag New York, Inc.

All rights reserved. This work may not be translated or copied in whole or in part without the

written permission of the publisher (Springer-Verlag New York, Inc., 175 Fifth Avenue, New York,

NY 10010, USA), except for brief excerpts in connection with reviews or scholarly analysis. Use

in connection with any form of information storage and retrieval, electronic adaptation, computer

software, or by similar or dissimilar methodology now known or hereafter developed is forbidden.

The use in this publication of trade names, trademarks, service marks, and similar terms, even if

they are not identified as such, is not to be taken as an expression of opinion as to whether or not

they are subject to proprietary rights.

Printed in the United States of America.

9 8 7 6 5 4 3 2 1

SPIN 10788773

Typesetting: Pages created by the authors using a Springer

2e macro package.

www.springer-ny.com

Springer-Verlag New York Berlin Heidelberg

A member of BertelsmannSpringer Science+Business Media GmbH

�

To those

Who educate us;

Whom we love; and

With whom we collaborate

�

Preface

Among many exciting developments in statistics over the last two decades,

nonlinear time series and data-analytic nonparametric methods have greatly

advanced along seemingly unrelated paths. In spite of the fact that the ap-

plication of nonparametric techniques in time series can be traced back to

the 1940s at least, there still exists healthy and justified skepticism about

the capability of nonparametric methods in time series analysis. As en-

thusiastic explorers of the modern nonparametric toolkit, we feel obliged

to assemble together in one place the newly developed relevant techniques.

The aim of this book is to advocate those modern nonparametric techniques

that have proven useful for analyzing real time series data, and to provoke

further research in both methodology and theory for nonparametric time

series analysis.

Modern computers and the information age bring us opportunities with

challenges. Technological inventions have led to the explosion in data col-

lection (e.g., daily grocery sales, stock market trading, microarray data).

The Internet makes big data warehouses readily accessible. Although clas-

sic parametric models, which postulate global structures for underlying

systems, are still very useful, large data sets prompt the search for more

refined structures, which leads to better understanding and approximations

of the real world. Beyond postulated parametric models, there are infinite

other possibilities. Nonparametric techniques provide useful exploratory

tools for this venture, including the suggestion of new parametric models

and the validation of existing ones.

In this book, we present an up-to-date picture of techniques for analyz-

ing time series data. Although we have tried to maintain a good balance

�

viii

Preface

among methodology, theory, and numerical illustration, our primary goal

is to present a comprehensive and self-contained account for each of the

key methodologies. For practical relevant time series models, we aim for

exposure with definition, probability properties (if possible), statistical in-

ference methods, and numerical examples with real data sets. We also in-

dicate where to find our (only our!) favorite computing codes to implement

these statistical methods. When soliciting real-data examples, we attempt

to maintain a good balance among different disciplines, although our per-

sonal interests in quantitative finance, risk management, and biology can

be easily seen. It is our hope that readers can apply these techniques to

their own data sets.

We trust that the book will be of interest to those coming to the area

for the first time and to readers more familiar with the field. Application-

oriented time series analysts will also find this book useful, as it focuses on

methodology and includes several case studies with real data sets. We be-

lieve that nonparametric methods must go hand-in-hand with parametric

methods in applications. In particular, parametric models provide explana-

tory power and concise descriptions of the underlying dynamics, which,

when used sensibly, is an advantage over nonparametric models. For this

reason, we have also provided a compact view of the parametric methods

for both linear and selected nonlinear time series models. This will also

give new comers sufficient information on the essence of the more classical

approaches. We hope that this book will reflect the power of the integration

of nonparametric and parametric approaches in analyzing time series data.

The book has been prepared for a broad readership—the prerequisites are

merely sound basic courses in probability and statistics. Although advanced

mathematics has provided valuable insights into nonlinear time series, the

methodological power of both nonparametric and parametric approaches

can be understood without sophisticated technical details. Due to the in-

nate nature of the subject, it is inevitable that we occasionally appeal to

more advanced mathematics; such sections are marked with a “*”. Most

technical arguments are collected in a “Complements” section at the end

of each chapter, but key ideas are left within the body of the text.

The introduction in Chapter 1 sets the scene for the book. Chapter 2

deals with basic probabilistic properties of time series processes. The high-

lights include strict stationarity via ergodic Markov chains (§2.1) and mix-

ing properties (§2.6). We also provide a generic central limit theorem for

kernel-based nonparametric regression estimation for α-mixing processes.

A compact view of linear ARMA models is given in Chapter 3, including

Gaussian MLE (§3.3), model selection criteria (§3.4), and linear forecasting

with ARIMA models (§3.7). Chapter 4 introduces three types of paramet-

ric nonlinear models. An introduction on threshold models that emphasizes

developments after Tong (1990) is provided. ARCH and GARCH models

are presented in detail, as they are less exposed in statistical literature.

The chapter concludes with a brief account of bilinear models. Chapter 5

�

Preface

ix

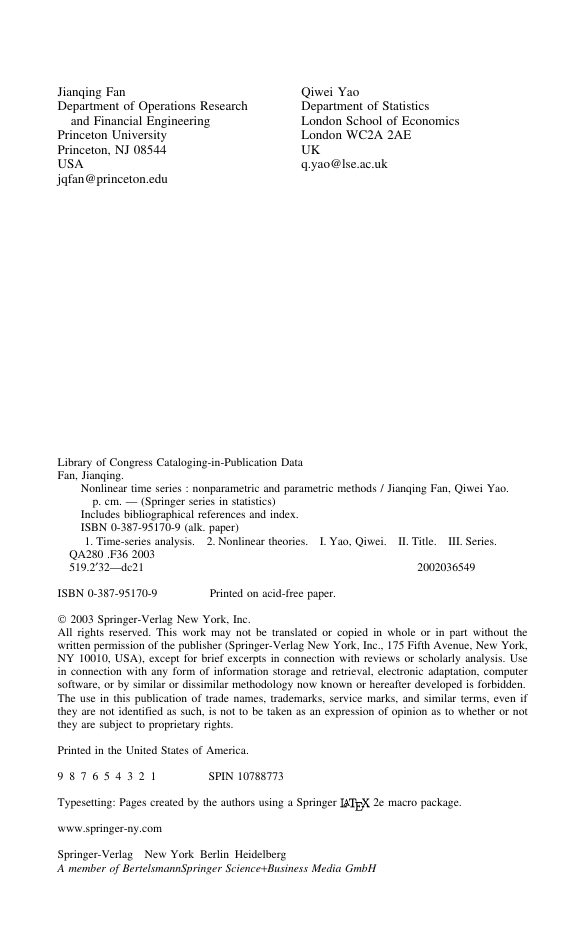

introduces the nonparametric kernel density estimation. This is arguably

the simplest problem for understanding nonparametric techniques. The re-

lation between “localization” for nonparametric problems and “whitening”

for time series data is elucidated in §5.3. Applications of nonparametric

techniques for estimating time trends and univariate autoregressive func-

tions can be found in Chapter 6. The ideas in Chapter 5 and §6.3 provide a

foundation for the nonparametric techniques introduced in the rest of the

book. Chapter 7 introduces spectral density estimation and nonparametric

procedures for testing whether a series is white noise. Various high-order au-

toregressive models are highlighted in Chapter 8. In particular, techniques

for estimating nonparametric functions in FAR models are introduced in

§8.3. The additive autoregressive model is exposed in §8.5, and methods for

estimating conditional variance or volatility functions are detailed in §8.7.

Chapter 9 outlines approaches to testing a parametric family of models

against a family of structured nonparametric models. The wide applicabil-

ity of the generalized likelihood ratio test is emphasized. Chapter 10 deals

with nonlinear prediction. It highlights the features that distinguish non-

linear prediction from linear prediction. It also introduces nonparametric

estimation for conditional predictive distribution functions and conditional

minimum volume predictive intervals.

�

1

�

ppppppppppppppppp-

�

2

�

3

��

�

�

�

@

@

@R

�

5

�

-

I

ppppppppppppppppppppppppppppppppppppppppppp

-

pppppppppppppppppppp

�

4

6

�

7

6

�

-

�

6

�

@

@

@

�

pppppppppppppppppppppppppppppppppppppppppppppppppppU

�

@

-

�

8

ppppppppppppppppppppppppppppppppppppppppppp

�

�

?

10

@

@

�

@@R

-

�

9

�

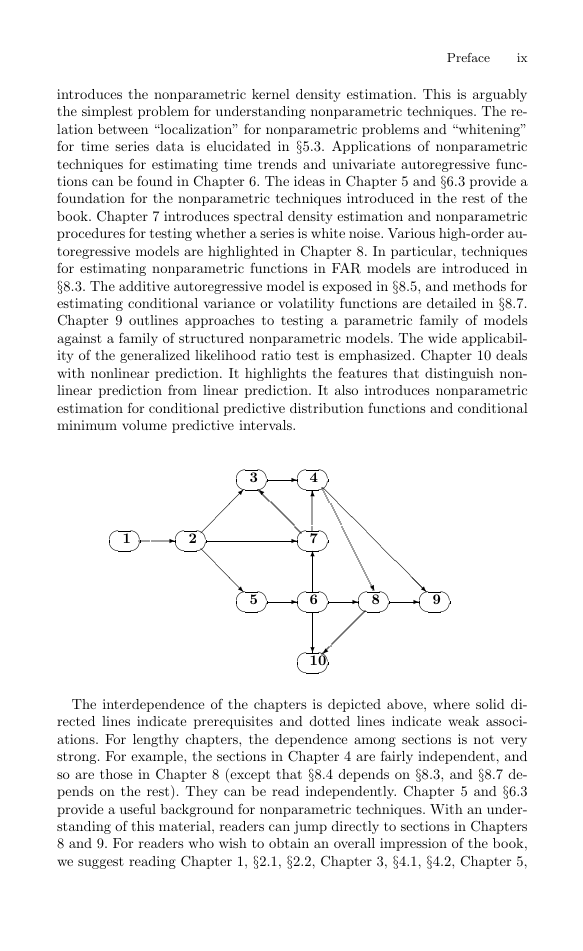

The interdependence of the chapters is depicted above, where solid di-

rected lines indicate prerequisites and dotted lines indicate weak associ-

ations. For lengthy chapters, the dependence among sections is not very

strong. For example, the sections in Chapter 4 are fairly independent, and

so are those in Chapter 8 (except that §8.4 depends on §8.3, and §8.7 de-

pends on the rest). They can be read independently. Chapter 5 and §6.3

provide a useful background for nonparametric techniques. With an under-

standing of this material, readers can jump directly to sections in Chapters

8 and 9. For readers who wish to obtain an overall impression of the book,

we suggest reading Chapter 1, §2.1, §2.2, Chapter 3, §4.1, §4.2, Chapter 5,

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc