Expert Systems With Applications 83 (2017) 187–205

Contents lists available at ScienceDirect

Expert Systems With Applications

journal homepage: www.elsevier.com/locate/eswa

Deep learning networks for stock market analysis and prediction:

Methodology, data representations, and case studies

Eunsuk Chong

∗

a ,

a , Chulwoo Han

b , Frank C. Park

a Robotics Laboratory, Seoul National University, Seoul 08826, Korea

b Durham University Business School, Mill Hill Lane, Durham DH1 3LB, UK

a r t i c l e

i n f o

a b s t r a c t

Article history:

Received 15 November 2016

Revised 15 April 2017

Accepted 16 April 2017

Available online 22 April 2017

Keywords:

Stock market prediction

Deep learning

Multilayer neural network

Covariance estimation

We offer a systematic analysis of the use of deep learning networks for stock market analysis and pre-

diction. Its ability to extract features from a large set of raw data without relying on prior knowledge

of predictors makes deep learning potentially attractive for stock market prediction at high frequencies.

Deep learning algorithms vary considerably in the choice of network structure, activation function, and

other model parameters, and their performance is known to depend heavily on the method of data repre-

sentation. Our study attempts to provides a comprehensive and objective assessment of both the advan-

tages and drawbacks of deep learning algorithms for stock market analysis and prediction. Using high-

frequency intraday stock returns as input data, we examine the effects of three unsupervised feature

extraction methods—principal component analysis, autoencoder, and the restricted Boltzmann machine—

on the network’s overall ability to predict future market behavior. Empirical results suggest that deep

neural networks can extract additional information from the residuals of the autoregressive model and

improve prediction performance; the same cannot be said when the autoregressive model is applied to

the residuals of the network. Covariance estimation is also noticeably improved when the predictive net-

work is applied to covariance-based market structure analysis. Our study offers practical insights and

potentially useful directions for further investigation into how deep learning networks can be effectively

used for stock market analysis and prediction.

© 2017 Elsevier Ltd. All rights reserved.

1. Introduction

Research on the predictability of stock markets has a long his-

tory in financial economics ( e.g., Ang & Bekaert, 2007; Bacchetta,

Mertens, & Van Wincoop, 2009; Bondt & Thaler, 1985; Bradley,

1950; Campbell & Hamao, 1992; Campbell & Thompson, 2008;

Campbell, 2012; Granger & Morgenstern, 1970 ). While opinions dif-

fer on the efficiency of markets, many widely accepted empirical

studies show that financial markets are to some extent predictable

( Bollerslev, Marrone, Xu, & Zhou, 2014; Ferreira & Santa-Clara,

2011; Kim, Shamsuddin, & Lim, 2011; Phan, Sharma, & Narayan,

2015 ). Among methods for stock return prediction, econometric or

statistical methods based on the analysis of past market move-

ments have been the most widely adopted ( Agrawal, Chourasia, &

Mittra, 2013 ). These approaches employ various linear and nonlin-

ear methods to predict stock returns, e.g., autoregressive models

∗

Corresponding author.

E-mail addresses: bear3498@snu.ac.kr (E. Chong), chulwoo.han@durham.ac.uk

(C. Han), fcp@snu.ac.kr (F.C. Park).

http://dx.doi.org/10.1016/j.eswa.2017.04.030

0957-4174/© 2017 Elsevier Ltd. All rights reserved.

and artificial neural networks (ANN) ( Adebiyi, Adewumi, & Ayo,

2014; Armano, Marchesi, & Murru, 2005; Atsalakis & Valavanis,

2009; Bogullu, Dagli, & Enke, 2002; Cao, Leggio, & Schniederjans,

2005; Chen, Leung, & Daouk, 2003; Enke & Mehdiyev, 2014; Gure-

sen, Kayakutlu, & Daim, 2011a; Kara, Boyacioglu, & Baykan, 2011;

Kazem, Sharifi, Hussain, Saberi, & Hussain, 2013; Khashei & Bi-

jari, 2011; Kim & Enke, 2016a; 2016b; Monfared & Enke, 2014;

Rather, Agarwal, & Sastry, 2015; Thawornwong & Enke, 2004; Tic-

knor, 2013; Tsai & Hsiao, 2010; Wang, Wang, Zhang, & Guo, 2011;

Yeh, Huang, & Lee, 2011; Zhu, Wang, Xu, & Li, 2008 ). While there

is uniform agreement that stock returns behave nonlinearly, many

empirical studies show that for the most part nonlinear models do

not necessarily outperform linear models: e.g., Lee, Sehwan, and

Jongdae (2007) , Lee, Chi, Yoo, and Jin (2008) , Agrawal et al. (2013) ,

and Adebiyi et al. (2014) propose linear models that outperform

or perform as well as nonlinear models, whereas Thawornwong

and Enke (2004) , Cao et al. (2005) , Enke and Mehdiyev (2013) ,

and Rather et al. (2015) find nonliner models outperfrom linear

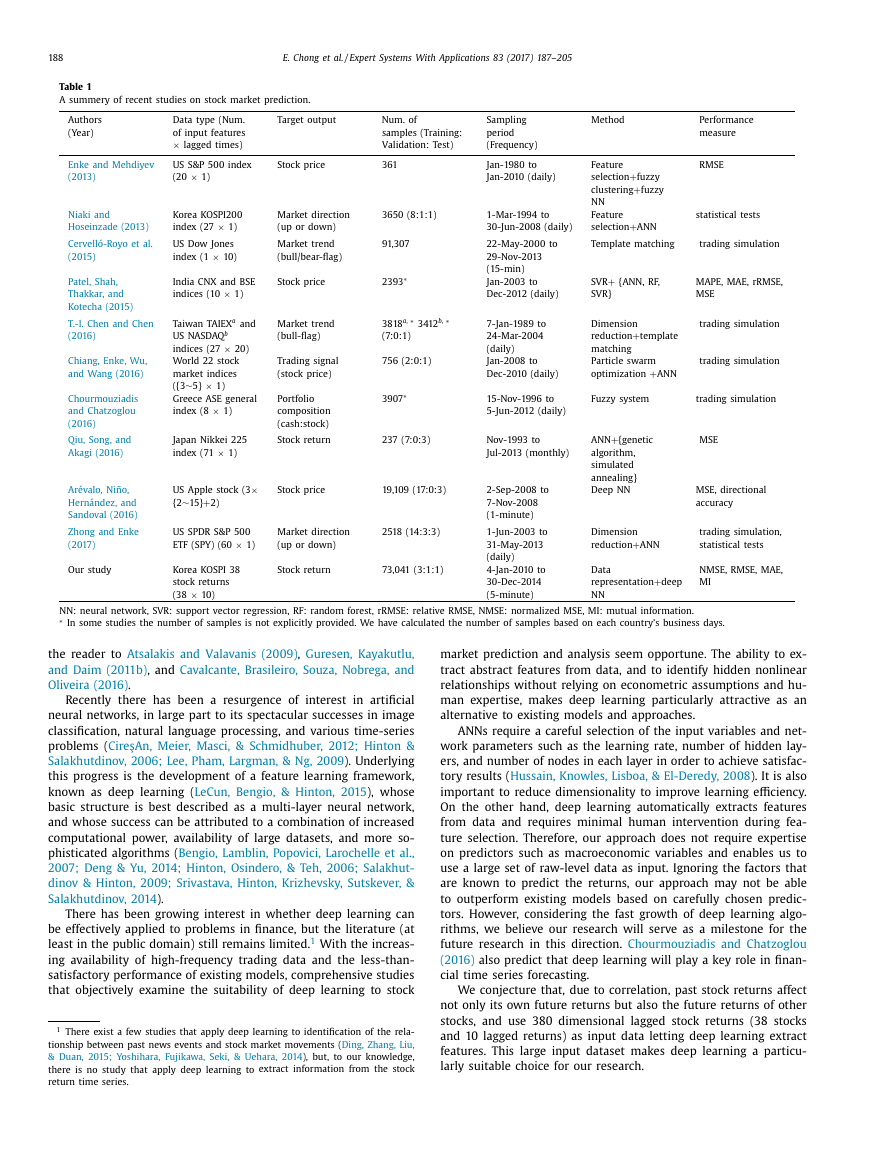

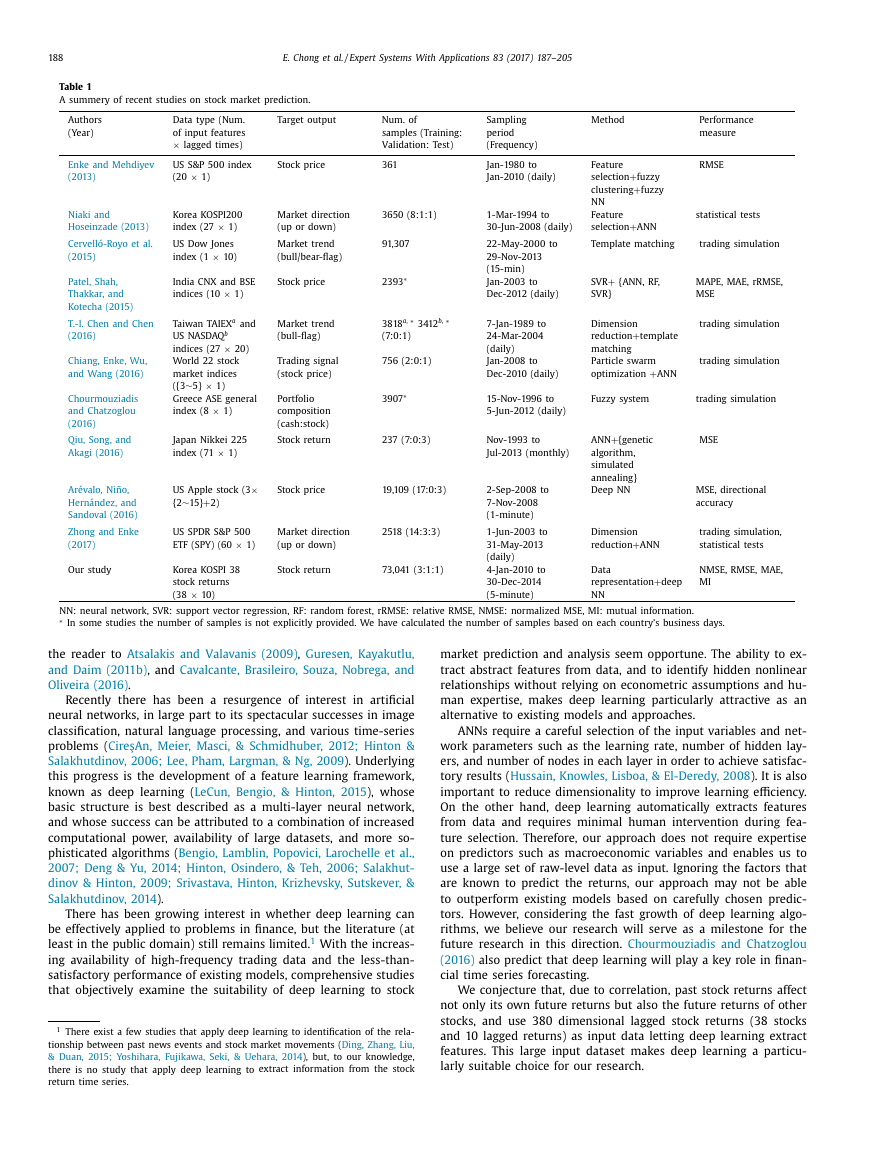

models. Table 1 provides a summary of recent works relevant to

our research. For more exhaustive and detailed reviews, we refer

�

188

E. Chong et al. / Expert Systems With Applications 83 (2017) 187–205

Table 1

A summery of recent studies on stock market prediction.

Authors

(Year)

Data type (Num.

of input features

× lagged times)

Target output

Num. of

samples (Training:

Validation: Test)

Sampling

period

(Frequency)

Method

Enke and Mehdiyev

(2013)

US S&P 500 index

(20

× 1)

Stock price

361

Jan-1980 to

Jan-2010 (daily)

Niaki and

Hoseinzade (2013)

Cervelló-Royo et al.

(2015)

Korea KOSPI200

× 1)

index (27

US Dow Jones

× 10)

index (1

Market direction

(up or down)

Market trend

(bull/bear-flag)

Performance

measure

RMSE

statistical tests

Feature

+

fuzzy

selection

+

clustering

fuzzy

NN

Feature

+

selection

ANN

Template matching

trading simulation

+

SVR

SVR}

{ANN, RF,

MAPE, MAE, rRMSE,

MSE

template

Dimension

+

reduction

matching

Particle swarm

+

optimization

ANN

trading simulation

trading simulation

Fuzzy system

trading simulation

{genetic

+

ANN

algorithm,

simulated

annealing}

Deep NN

MSE

MSE, directional

accuracy

Dimension

+

reduction

ANN

trading simulation,

statistical tests

Data

+

representation

NN

deep

NMSE, RMSE, MAE,

MI

1-Mar-1994 to

30-Jun-2008 (daily)

22-May-20 0 0 to

29-Nov-2013

(15-min)

Jan-2003 to

Dec-2012 (daily)

7-Jan-1989 to

24-Mar-2004

(daily)

Jan-2008 to

Dec-2010 (daily)

15-Nov-1996 to

5-Jun-2012 (daily)

Nov-1993 to

Jul-2013 (monthly)

2-Sep-2008 to

7-Nov-2008

(1-minute)

1-Jun-2003 to

31-May-2013

(daily)

4-Jan-2010 to

30-Dec-2014

(5-minute)

3650 (8:1:1)

91,307

∗

2393

∗

b ,

3412

∗

a ,

3818

(7:0:1)

756 (2:0:1)

∗

3907

India CNX and BSE

indices (10

× 1)

Stock price

a and

× 20)

Taiwan TAIEX

b

US NASDAQ

indices (27

World 22 stock

market indices

({3

Greece ASE general

index (8

× 1)

× 1)

∼5}

Market trend

(bull-flag)

Trading signal

(stock price)

Portfolio

composition

(cash:stock)

Japan Nikkei 225

index (71

× 1)

Stock return

237 (7:0:3)

×

US Apple stock (3

{2

∼15}

+

2)

Stock price

19,109 (17:0:3)

US SPDR S&P 500

× 1)

ETF (SPY) (60

Market direction

(up or down)

2518 (14:3:3)

Korea KOSPI 38

stock returns

(38

× 10)

Stock return

73,041 (3:1:1)

Patel, Shah,

Thakkar, and

Kotecha (2015)

T.-l. Chen and Chen

(2016)

Chiang, Enke, Wu,

and Wang (2016)

Chourmouziadis

and Chatzoglou

(2016)

Qiu, Song, and

Akagi (2016)

Arévalo, Niño,

Hernández, and

Sandoval (2016)

Zhong and Enke

(2017)

Our study

NN: neural network, SVR: support vector regression, RF: random forest, rRMSE: relative RMSE, NMSE: normalized MSE, MI: mutual information.

∗

In some studies the number of samples is not explicitly provided. We have calculated the number of samples based on each country’s business days.

the reader to Atsalakis and Valavanis (2009) , Guresen, Kayakutlu,

and Daim (2011b) , and Cavalcante, Brasileiro, Souza, Nobrega, and

Oliveira (2016) .

Recently there has been a resurgence of interest in artificial

neural networks, in large part to its spectacular successes in image

classification, natural language processing, and various time-series

problems ( Cire ¸s An, Meier, Masci, & Schmidhuber, 2012; Hinton &

Salakhutdinov, 2006; Lee, Pham, Largman, & Ng, 2009 ). Underlying

this progress is the development of a feature learning framework,

known as deep learning ( LeCun, Bengio, & Hinton, 2015 ), whose

basic structure is best described as a multi-layer neural network,

and whose success can be attributed to a combination of increased

computational power, availability of large datasets, and more so-

phisticated algorithms ( Bengio, Lamblin, Popovici, Larochelle et al.,

2007; Deng & Yu, 2014; Hinton, Osindero, & Teh, 2006; Salakhut-

dinov & Hinton, 2009; Srivastava, Hinton, Krizhevsky, Sutskever, &

Salakhutdinov, 2014 ).

There has been growing interest in whether deep learning can

be effectively applied to problems in finance, but the literature (at

1 With the increas-

least in the public domain) still remains limited.

ing availability of high-frequency trading data and the less-than-

satisfactory performance of existing models, comprehensive studies

that objectively examine the suitability of deep learning to stock

1 There exist a few studies that apply deep learning to identification of the rela-

tionship between past news events and stock market movements ( Ding, Zhang, Liu,

& Duan, 2015; Yoshihara, Fujikawa, Seki, & Uehara, 2014 ), but, to our knowledge,

there is no study that apply deep learning to extract information from the stock

return time series.

market prediction and analysis seem opportune. The ability to ex-

tract abstract features from data, and to identify hidden nonlinear

relationships without relying on econometric assumptions and hu-

man expertise, makes deep learning particularly attractive as an

alternative to existing models and approaches.

ANNs require a careful selection of the input variables and net-

work parameters such as the learning rate, number of hidden lay-

ers, and number of nodes in each layer in order to achieve satisfac-

tory results ( Hussain, Knowles, Lisboa, & El-Deredy, 2008 ). It is also

important to reduce dimensionality to improve learning efficiency.

On the other hand, deep learning automatically extracts features

from data and requires minimal human intervention during fea-

ture selection. Therefore, our approach does not require expertise

on predictors such as macroeconomic variables and enables us to

use a large set of raw-level data as input. Ignoring the factors that

are known to predict the returns, our approach may not be able

to outperform existing models based on carefully chosen predic-

tors. However, considering the fast growth of deep learning algo-

rithms, we believe our research will serve as a milestone for the

future research in this direction. Chourmouziadis and Chatzoglou

(2016) also predict that deep learning will play a key role in finan-

cial time series forecasting.

We conjecture that, due to correlation, past stock returns affect

not only its own future returns but also the future returns of other

stocks, and use 380 dimensional lagged stock returns (38 stocks

and 10 lagged returns) as input data letting deep learning extract

features. This large input dataset makes deep learning a particu-

larly suitable choice for our research.

�

E. Chong et al. / Expert Systems With Applications 83 (2017) 187–205

189

We test our model on high-frequency data from the Korean

stock market. Previous studies have predominantly focused on re-

turn prediction at a low frequency, and high frequency return

prediction studies haven been rare. However, market microstruc-

ture noise can cause temporal market inefficiency and we ex-

pect that many profit opportunities can be found at a high fre-

quency. Also, high-frequency trading allows more trading opportu-

nities and makes it possible to achieve statistical arbitrage. Another

advantage of using high-frequency data is that we can get a large

dataset, which is essential to overcome data-snooping and over-

fitting problems inevitable in neural network or any other non-

linear models. Whilst it should be possible to train the network

within 5 min given a reasonable size of training set, we believe

daily training should be enough.

Put together, the aim of the paper is to assess the potential of

deep feature learning as a tool for stock return prediction, and

more broadly for financial market prediction. Viewed as multi-

layer neural networks, deep learning algorithms vary considerably

in the choice of network structure, activation function, and other

model parameters; their performance is also known to depend

heavily on the method of data representation. In this study, we

offer a systematic and comprehensive analysis of the use of deep

learning. In particular, we use stock returns as input data to a stan-

dard deep neural network, and examine the effects of three un-

supervised feature extraction methods—principal component anal-

ysis, autoencoder, and the restricted Boltzmann machine—on the

network’s overall ability to predict future market behavior. The

network’s performance is compared against a standard autoregres-

sive model and ANN model for high-frequency intraday data taken

from the Korean KOSPI stock market.

The empirical analysis suggests that the predictive performance

of deep learning networks is mixed and depends on a wide range

of both environmental and user-determined factors. On the other

hand, deep feature learning is found to be particularly effective

when used to complement an autoregressive model, considerably

improving stock return prediction. Moreover, applying this predic-

tion model to covariance-based market structure analysis is also

shown to improve covariance estimation effectively. Beyond these

findings, the main contributions of our study are to demonstrate

how deep feature learning-based stock return prediction models

can be constructed and evaluated, and to shed further light on fu-

ture research directions.

The remainder of the paper is organized as follows.

Section 2 describes the framework for stock return prediction

adopted in our research, with a brief review of deep neural net-

works and data representation methods. Section 3 describes the

sample data construction process using stock returns from the

KOSPI stock market. A simple experiment to show evidence of pre-

dictability is also demonstrated in this section. Section 4 proposes

several data representations that are used as inputs to the deep

neural network, and assesses their predictive power via a stock

market trend prediction test. Section 5 is devoted to construction

and evaluation of the deep neural network; here we compare our

model with a standard autoregressive model, and also test a hybrid

model that merges the two models. In Section 6 , we apply the

results of return predictions to covariance structure analysis, and

show that incorporating return predictions improves estimation of

correlations between stocks. Concluding remarks with suggestions

for the future research are given in Section 7 .

2. Deep feature learning for stock return prediction

2.1. The framework

+

the stock return at time t

For each stock, we seek a predictor function f in order to predict

r t+1

,

,

1

given the features ( represen-

f (u t

)

,

and the unpredictable part

tation ) u t extracted from the information available at time t . We

assume that r t+1 can be decomposed into two parts: the predicted

=

output ˆ r t+1

γ , which we re-

gard as Gaussian noise:

=

+

γ ∼ N

ˆ r t+1

r t+1

N

β )

(0

,

where

denotes a normal distribution with zero mean and

β. The representation u t can be either a linear or a non-

variance

linear transformation of the raw level information R t . Denoting the

transformation function by

φ, we have

(0

,

(1)

β )

γ ,

,

φ(R t

)

,

(2)

=

u t

.

◦ φ(R t

)

and

=

ˆ r t+1

f

For our research, we define the raw level information as the past

returns of the stocks in our sample. If there are M stocks in the

sample and g lagged returns are chosen, R t will have the form

(3)

.

.

.

r 1

,t−g+1

,

.

.

.

,

,

r M,t

.

.

.

,

r M,t−g+1 ]

Mg ,

R

(4)

T ∈

=

,

[ r 1

R t

,t

where r i, t

denotes the return on stock i at time t . In the remainder

of this section, we illustrate the construction of the predictor func-

tion f using a deep neural network, and the transformation func-

tion

φ using different data representation methods.

2.2. Deep neural network

,

and h l+1

A Neural network specifies the nonlinear relationship between

through a network function, which typi-

two variables h l

cally has the form

=

+

δ(W h l

b)

h l+1

(5)

δ is called an activation function, and the matrix W and

where

vector b are model parameters. The variables h l

are said to

form a layer; when there is only one layer between the variables,

their relationship is called a single-layer neural network. Multi-

layer neural networks augmented with advanced learning methods

are generally referred to as deep neural networks (DNN). A DNN

=

,

for the predictor function, y

can be constructed by serially

stacking the network functions as follows:

and h l+1

f (u

)

=

=

h 1

h 2

=

y

+

δ1

(

)

b 1

W 1 u

+

δ2

(

)

b 2

W 2 h 1

. . .

δL

(

W L h L

where L is the number of layers.

,

+

−1

)

b L

{

n ,

u

τ n }

N

=1

n

Given a dataset

E

(y

n ,

f (u

n )

of inputs and targets, and an error

τ n )

that measures the difference between the out-

function

n =

τ n , the model parameters for the

and the target

put y

θ =

,

,

,

,

entire network,

can be chosen so as to

b 1

W L

minimize the sum of the errors:

{

,

W 1

}

,

b L

.

.

.

.

.

.

(y

n ,

τ n )

.

(6)

N

E

=1

n

=

J

min θ

E (·)

,

its gradient can be obtained

Given an appropriate choice of

analytically through error backpropagation ( Bishop, 2006 ). In this

case, the minimization problem in (6) can be solved by the usual

gradient descent method. A typical choice for the objective func-

tion that we adopt in this paper has the form:

=

J

N

L

2 +

λ ·

(7)

y

W l

l=1

,

2

respectively denote the Euclidean norm and

norm. The second term is a “regularizer” added to

λ is a user-defined coefficient.

1

N

=1

n

·

n − τ n

·

and

where

the matrix L 2

avoid overfitting, while

2

�

190

E. Chong et al. / Expert Systems With Applications 83 (2017) 187–205

2.3. Data representation methods

Transforming (representing) raw data before inputing it into a

machine learning task often enhances the performance of the task.

It is generally accepted that the performance of a machine learn-

ing algorithm depends heavily on the choice of the data repre-

sentation method ( Bengio, Courville, & Vincent, 2013; Längkvist,

Karlsson, & Loutfi, 2014 ). There are various data representation

methods such as zero-to-one scaling, standardization, log-scaling,

and principal component analysis (PCA) ( Atsalakis & Valavanis,

2009 ). More recently, nonlinear methods became popular: Zhong

and Enke (2017) compare PCA and two of its nonlinear variants;

fuzzy robust PCA and kernel-based PCA. In this paper, we consider

three unsupervised data representation methods: PCA, the autoen-

coder (AE), and the restricted Boltzmann machine (RBM). PCA in-

volves a linear transformation while the other two are nonlinear

transformations. These representation methods are widely used in,

e.g., image data classification ( Coates, Lee, & Ng, 2010 ).

For raw data x and a transformation function

φ(x

)

is

called a representation of x , while each element of u is called a

→

ψ : u

x ,

feature. In some cases we can also define a reverse map,

=

ψ (u

)

,

and retrieve x from u ; in this case the retrieved value, x rec

ψ

is called a reconstruction of x . The functions

can be

learned from x and x rec by minimizing the difference (reconstruc-

tion error) between them. We now briefly describe each method

below.

φ and

=

φ, u

R

R

R

(i) Principal Component Analysis, PCA

=

D via a linear transformation u

∈

∈

d is generated from the raw

In PCA, the representation u

∈

b,

data x

∈

d×D ,

d . The rows of W are

and b

where W

the eigenvectors of the first d largest eigenvalues, and b is

−W E[ x ] so that E[ u ]

=

0 . Reconstruction of

usually set to

=

the original data from the representation is given by x rec

− b)

ψ (u

)

(ii) Autoencoder, AE

+

W x

φ(x

)

W W

T =

T (u

W

=

=

I,

.

R

δ

=

/

1

(W l

l

(−z)

δ

. Although

+

δ(z)

(1

AE is a neural network model characterized by a structure

in which the model parameters are calibrated by minimiz-

+

=

h l−1

)

be the

ing the reconstruction error. Let h l

b l

network function of the l th layer with input h l−1

and out-

can differ across layers, a sigmoid func-

put h l

l

,

is typically used for all lay-

tion,

exp

ers, which we also adopt in our research.

as

a function of the input, the representation of x can be writ-

=

φ(x

)

ten as u

x ).

Then the reconstruction of the data can be similarly de-

=

,

fined: x rec

and the model can

be calibrated by minimizing the reconstruction error over

a training dataset,

. We adopt the following learning

criterion:

◦ h 1

(x

)

.

◦ h L

◦ .

+1

(

h 2 L

n }

2 Regarding h l

=

for an L -layer AE ( h 0

◦ .

h L

=

{

ψ (u

)

N

=1

n

=

)

u

x

)

.

.

.

2 ,

||

1

N

min θ

◦ φ(x

n )

||

n − ψ

x

=1

n

}

{

=

θ =

,

,

is often set as the

b i

where

i

W i

=

−i

+1

,

L,

,

,

i

in which case only W i

transpose of W L

need to be estimated. In this paper, we consider a single-

layer AE and estimate both W 1

+

,

2 L . W L

i

and W 2

.

(8)

,

1

,

1

.

.

.

.

.

.

N

(iii) Restricted Boltzmann Machine, RBM

RBM ( Hinton, 2002 ) has the same network structure as a

single-layer autoencoder, but it uses a different learning

method. RBM treats the input and output variables, x and

,

u , random, and defines an energy function ,

from

which the joint probability density function of x and u is

(x,

)

u

E

determined from the formula

(−E

(x,

Z

exp

,

))

u

)

u

exp

p(x,

=

=

where Z

is the partition function. In

most cases, u is assumed to be a d -dimensional binary vari-

d , and x is assumed to be either binary

able, i.e., u

or real-valued. When x is a real-valued variable, the energy

function has the following form ( Cho, Ilin, & Raiko, 2011 ):

∈

{0, 1}

(−E

(9)

(x,

x,u

u

))

E

(x,

)

u

=

− b)

T �−1 (x

− b)

(x

1

2

− c

T u

− u

T W

�−1

/

2 x , (10)

,

�, W, b, c are model parameters. We set

=

+

δ(c j

W ( j,

+

(b i

T

,

u

W (:

)

,i

i

� to be

where

the identity matrix; this makes learning simpler with little

performance sacrifice ( Taylor, Hinton, & Roweis, 2006 ). From

Eqs. (9) and (10) , the conditional distributions are obtained

as follows:

|

=

p(u j

)

1

x

|

=

N

)

p(x i

D,

u

·) is the sigmoid function, and W ( j , : )

δ(

where

are

the j th row and the i th column of W , respectively. This type

of RBM is denoted the Gaussian–Bernoulli RBM. The input

data is then represented and reconstructed in a probabilis-

tic way using the conditional distributions. Given an input

N

=1

,

dataset

maximum log-likelihood learning is formu-

n

lated as the following optimization:

=

,

1

j

=

,

1

i

and W (:, i )

)

x

:)

1)

(12)

(11)

d,

{

x

,

,

,

.

.

.

.

.

.

,

(13)

n }

N

max

θ

n ; θ )

=

L

log p(x

c}

b,

=1

n

{

W,

θ =

where

are the model parameters, and u is

marginalized out ( i.e., integrated out via expectation). This

problem can be solved via standard gradient descent. How-

ever, due to the computationally intractable partition func-

tion Z , an analytic formula for the gradient is usually un-

available. The model parameters are instead estimated us-

ing a learning method called the contrastive divergence (CD)

method ( Carreira-Perpinan & Hinton, 2005 ); we refer the

reader to Hinton (2002) for details on learning with RBM.

3. Data specification

We construct a deep neural network using stock returns from

the KOSPI market, the major stock market in South Korea. We

first choose the fifty largest stocks in terms of market capitaliza-

tion at the beginning of the sample period, and keep only the

stocks which have a price record over the entire sample period.

This leaves 38 stocks in the sample, which are listed in Table 2 .

The stock prices are collected every five minutes during the trad-

ing hours of the sample period (04-Jan-2010 to 30-Dec-2014), and

five-minute logarithmic returns are calculated using the formula

=

�t is

r t

five minutes. We only consider intraday prediction, i.e., the first ten

=

five-minute returns ( i.e., lagged returns with g

10 ) each day are

used only to construct the raw level input R t , and not included in

the target data. The sample contains a total of 1239 trading days

and 73,041 five-minute returns (excluding the first ten returns each

day) for each stock.

,

where S t is the stock price at time t , and

/S t−�t

)

(S t

ln

The training set consists of the first 80% of the sample (from

) stock re-

04-Jan-2010 to 24-Dec-2013) which contains 58,421 ( N 1

turns, while the remaining 20% (from 26-Dec-2013 to 30-Dec-

2014) with 14,620 ( N 2

}

n

i,t+1

r

) returns is used as the test set:

=

,

1

i

}

n

i,t+1

r

Training set:

Test set:

n

,

R

t

n

,

R

t

N 1

,

=1

n

N 2

,

=1

n

M.

{

{

,

.

.

.

2 exp ( z ) is applied to each element of z .

To avoid over-fitting during training, the last 20% of the training

set is further separated as a validation set.

�

E. Chong et al. / Expert Systems With Applications 83 (2017) 187–205

191

Fig. 1. Mean and variance of stock returns in each group in the test set. The upper graph displays the mean returns of the stocks in each group defined by the mean of the

past returns. The lower graph displays the variance of the returns in each group defined by the variance of the past returns. x -axis represents the stock ID. The details of the

grouping method can be found in Section 3.1 .

Fig. 2. Up/down prediction accuracy of RawData. Upper graph: prediction accuracies in each dataset, and the reference accuracies. Lower graph: The difference between the

test set accuracy and the reference accuracy. x -axis represents the stock ID.

All stock returns are normalized using the training set mean

and the standard de-

over the training set, the normalized return is de-

)

. Henceforth, for notational convenience we

i

i

and standard deviation, i.e., for the mean

σ

of r i, t

viation

− μ

i

(r i,t

fined as

to denote the normalized return.

will use r i, t

/σ

μ

i

At each time t , we use ten lagged returns of the stocks in the

sample to construct the raw level input:

=

,

[ r 1

R t

,t

.

.

.

,

r 1

,t−9

,

.

.

.

,

,

r 38

,t

.

.

.

,

r 38

,t−9 ]

T .

3.1. Evidence of predictability in the Korean stock market

As a motivating example, we carry out a simple experiment to

see whether past returns have predictable power for future returns.

We first divide the returns of each stock into two groups accord-

ing to the mean or variance of ten lagged returns: If the mean of

η, the re-

the lagged returns, M (10), is greater than some threshold

turn is assigned to one group; otherwise, it is assigned to the other

group. Similarly, by comparing the variance of the lagged returns,

�, the returns are divided into two groups.

V (10), with a threshold

�

192

E. Chong et al. / Expert Systems With Applications 83 (2017) 187–205

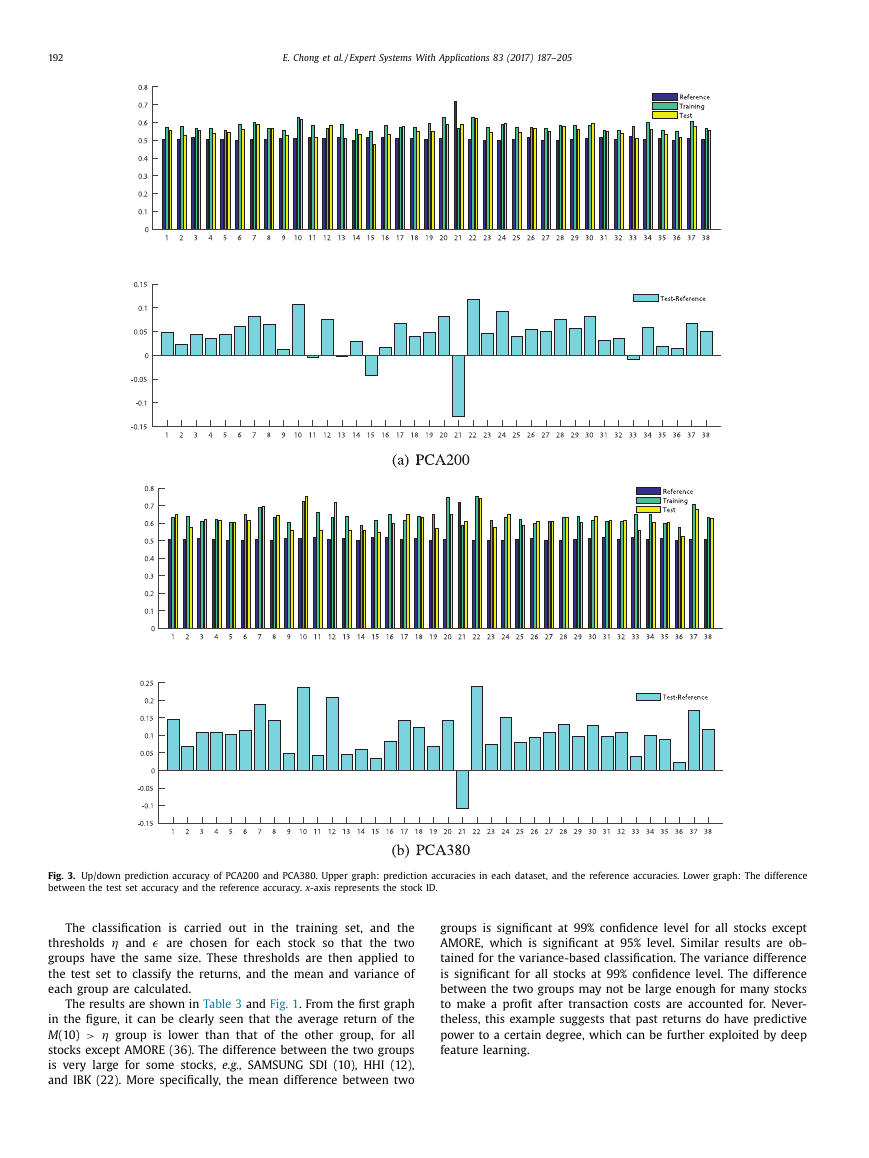

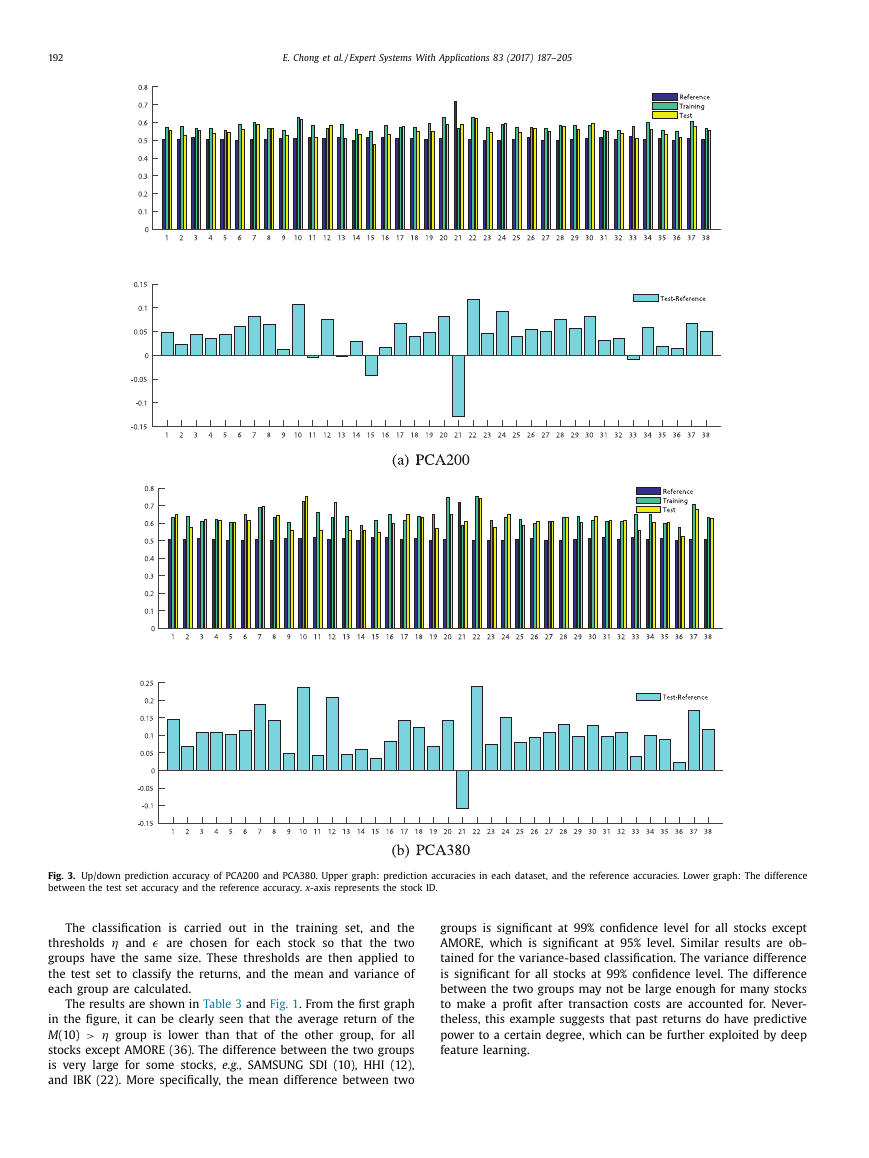

Fig. 3. Up/down prediction accuracy of PCA200 and PCA380. Upper graph: prediction accuracies in each dataset, and the reference accuracies. Lower graph: The difference

between the test set accuracy and the reference accuracy. x -axis represents the stock ID.

η and

The classification is carried out in the training set, and the

� are chosen for each stock so that the two

thresholds

groups have the same size. These thresholds are then applied to

the test set to classify the returns, and the mean and variance of

each group are calculated.

>

The results are shown in Table 3 and Fig. 1 . From the first graph

in the figure, it can be clearly seen that the average return of the

η group is lower than that of the other group, for all

M (10)

stocks except AMORE (36). The difference between the two groups

is very large for some stocks, e.g., SAMSUNG SDI (10), HHI (12),

and IBK (22). More specifically, the mean difference between two

groups is significant at 99% confidence level for all stocks except

AMORE, which is significant at 95% level. Similar results are ob-

tained for the variance-based classification. The variance difference

is significant for all stocks at 99% confidence level. The difference

between the two groups may not be large enough for many stocks

to make a profit after transaction costs are accounted for. Never-

theless, this example suggests that past returns do have predictive

power to a certain degree, which can be further exploited by deep

feature learning.

�

E. Chong et al. / Expert Systems With Applications 83 (2017) 187–205

193

Fig. 4. Up/down prediction accuracy of RBM400 and RBM800. Upper graph: prediction accuracies in each dataset, and the reference accuracies. Lower graph: The difference

between the test set accuracy and the reference accuracy. x -axis represents the stock ID.

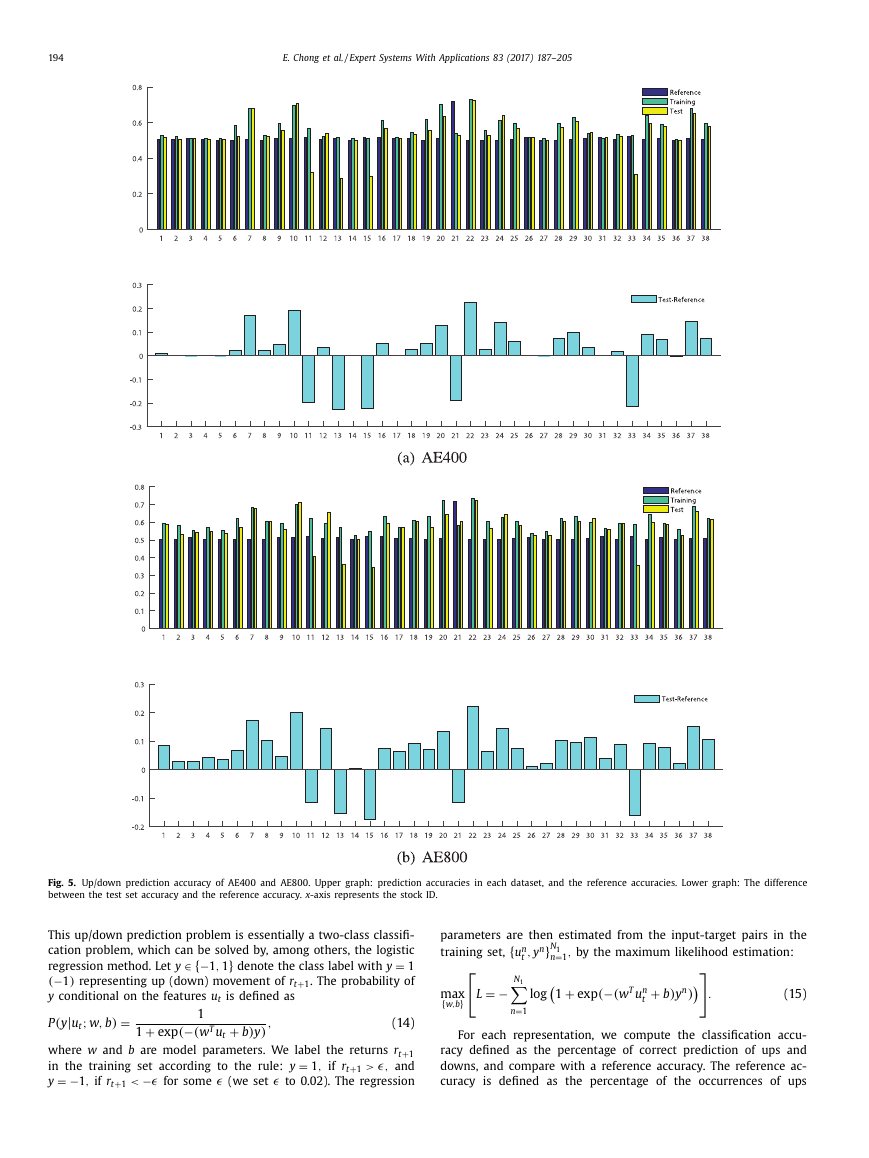

4. Market representation and trend prediction

In this section, we compare the representation methods de-

scribed in Section 2.3 , and analyze their effects on stock return

prediction. Each representation method receives the raw level mar-

∈

380 as the input, and produces the represen-

ket movements R t

=

tation output (features), u t

. Several sizes of u t are con-

sidered: 200 and 380 for PCA, and 400 and 800 for both RBM

and AE. These representations are respectively denoted by PCA200,

PCA380, RBM40 0, RBM80 0, AE40 0, and AE80 0 throughout the

φ(R t

)

R

paper. For comparison, the raw level data R t , denote by RawData,

is also considered as a representation. Therefore, there are total 7

representations.

4.1. Stock market trend prediction via logistic regression

Before training DNN using the features obtained from the rep-

resentation methods, we perform a test to assess the predictive

power of the features. The test is designed to check whether the

features can predict the up/down movement of the future return.

�

194

E. Chong et al. / Expert Systems With Applications 83 (2017) 187–205

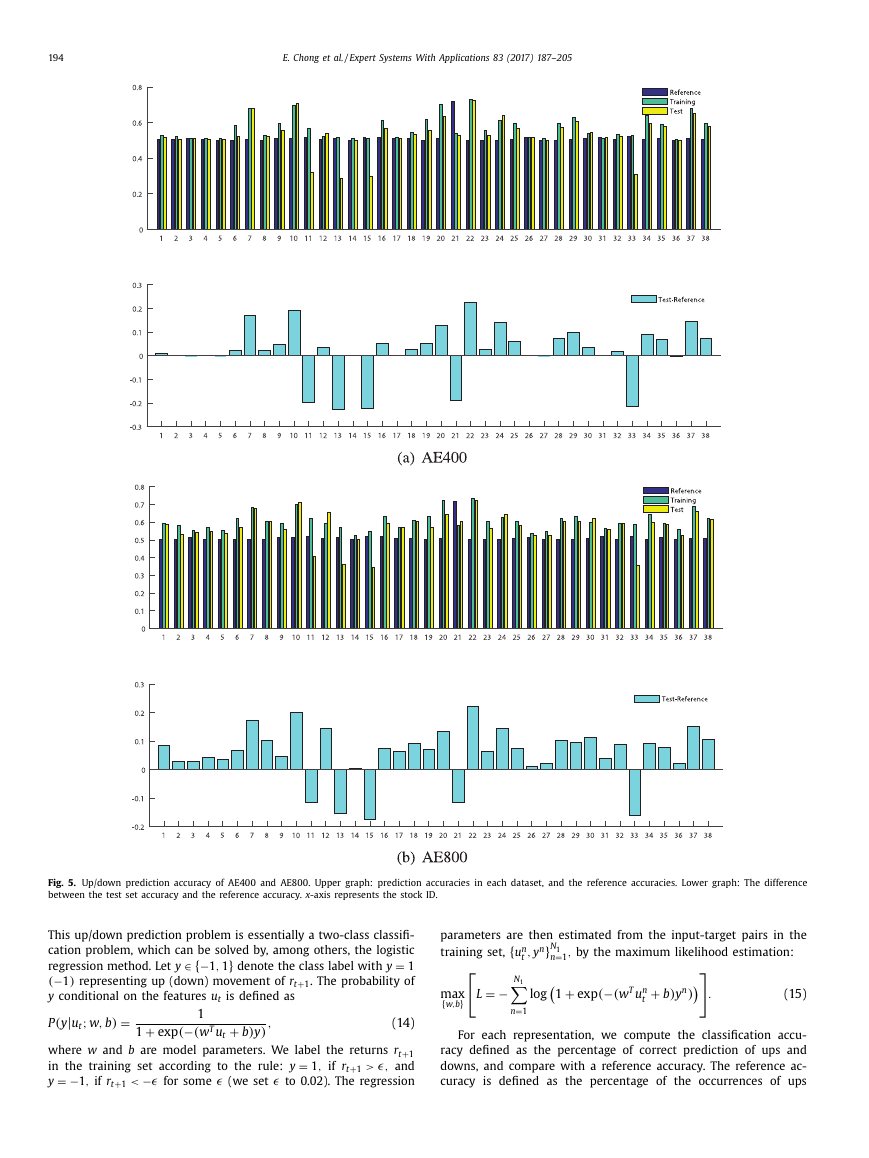

Fig. 5. Up/down prediction accuracy of AE400 and AE800. Upper graph: prediction accuracies in each dataset, and the reference accuracies. Lower graph: The difference

between the test set accuracy and the reference accuracy. x -axis represents the stock ID.

This up/down prediction problem is essentially a two-class classifi-

cation problem, which can be solved by, among others, the logistic

∈

regression method. Let y

1

(−1)

representing up (down) movement of r t+1 . The probability of

y conditional on the features u t is defined as

=

denote the class label with y

{−1

,

1

}

|

; w,

(y

u t

P

=

b)

+

exp

1

1

(−(w

+

b)

T u t

,

)

y

(14)

where w and b are model parameters. We label the returns r t+1

=

in the training set according to the rule: y

and

=

� to 0.02). The regression

y

−� for some

if r t+1

>

,

1

� (we set

−1

if r t+1

<

,

�,

{

− N 1

n }

=

L

max

{

w,b}

log

=1

n

For each representation, we compute the classification accu-

racy defined as the percentage of correct prediction of ups and

downs, and compare with a reference accuracy. The reference ac-

curacy is defined as the percentage of the occurrences of ups

parameters are then estimated from the input-target pairs in the

training set,

N 1

=1

,

by the maximum likelihood estimation:

n

n

,

u

y

t

+

exp

1

(−(w

n

T u

t

+

b)

n )

y

.

(15)

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc