中国科技论文在线

http://www.paper.edu.cn

Zero-inflated Negative Binomial Model and its Application

in Car Insurance

Jiang Tingting, Huang Wei**

(College of Mathematics and Statistics of Chongqing University, Chongqing 401331)

Abstract: Under many circumstances, most car insurance data appears to be zero-inflated and their

risks are nonhomogeneous. These lead to general traditional claim frequency models lost their

prediction effect, so they are unsuitable to fit this kind of data. This paper is using the car insurance

data for GINB model, ZINB model and C-ZINB model to do empirical research, the results

demonstrate that the C-ZINB model can overcome the risk of homogeneity and zero inflation very well.

In addition, C-ZINB model has good simulation prediction effect.

Key words: Statistics;Negative Binomial Distribution;Zero-inflated Model;Car Insurance

5

10

15

0 Introduction

Relative to other financial industry, the insurance is a new type of financial industry. With the

expansion of the various risks, the insurance is gradually developing into a global industry in just a

few decades. Insurance usually can be divided into two categories: life insurance and non-life

insurance. Life insurance has developed for a long time and had a lot of historical data, so scholars

20

have already get much achievement. Although formation of non-life insurance is earlier than life

insurance, the study of non-life insurance is far later than life insurance. Therefore, the

development of non-life insurance is slow and the historical data is less. Moreover, different

insurance object obey different distribution. Even if we can determine what distribution the

insurance object obeys, its parameter estimation is also very difficult. Sometimes, the loss

25

distribution of same risk also varies with time and environment. Because of the complexity of the

loss factors, the scholars have difficulties making non-life insurance pricing.

Generally speaking, non-life insurance is property insurance. In property insurance, the

development of car insurance is most rapidly. With the development of economy, car becomes

people’s main traffic tool. The increasing of the number of car is creating condition for the

30

development of car insurance. The birth of third-party liability insurance and mandatory traffic

liability insurance is speeding up the development of car insurance too. Now, the proportion of car

insurance in property insurance is the largest. The operating conditions of car insurance directly

affect the economic benefits of property insurance company.

Because of the rapid development of car insurance, how to stable the premiums and at the same

35

time reduce the loss ratios of car insurance is becoming the main problem. So the study of claim

number of car insurance is particularly important. Secondly, because of deductible, no claims

discount, personal factors and some other reasons, make insurant may not claim to the insurance

company after the traffic accident. This lead to zero probability increases means spearing zero

inflation. Therefore, how to solve the zero inflation becomes the major problem to actuaries.

40

This paper is modeling zero-inflated model with negative binomial distribution, and discussing

the application of zero-inflated model in car insurance combined with the practical experience

data.

Brief author introduction:Jiang Tingting(1989-), female, Master, Main research: Statistical Methods and

Application

Correspondance author: Huang Wei(1968-), female, Associate Professor, Main research: Probability Statistics and

Applications, Financial Engineering and Application, Stochastic Analysis and Application. E-mail:

tan16.tt@163.com

- 1 -

�

中国科技论文在线

1 Negative Binomial Model

http://www.paper.edu.cn

Negative binomial distribution not only can be satisfactorily used for fitting the claims data, but

45

also has a very simple property that its variance is greater than its mean. So it is good for fitting

the actual data which is nonhomogeneous. Negative binomial distribution has been widely used in

risk management because of this simple property.

In early study, we generally assume that risk is homogeneous. The claim number

obey the

poisson distribution

. It means

in each risk is fixed and be a constant. But in practice, the

50

risk may not be homogeneity. Nonhomogeneous risk caused impossible be a constant.

Let

be the kind of risk’s random variable and

probability distribution is as follow:

. Then the

,

Assume that

, then the probability density function of

is:

55

Using the total probability formula, the probability distribution of the claim is given by:

So

obey the negative binomial distribution:

.

For

, let

,

.Then the form of negative binomial

60

distribution becomes

. The parameter means divergence parameter,

the higher the

, the more serious the risk of nonhomogeneous. And the probability density

function is transformed as follow:

(1)

Its mean and variance are:

65

Let

, then the negative binomial model

is

transformed

into

the generalized negative binomial model, namely GLNB model.

- 2 -

NPiNiiiNP1,2,,is,0,1,2!iiyiiiiiiPNyeyy,ii11iiife101!1111iiiiiiiiiiiyiiiiyiiPNyPNyfdeedyyyiN1,1iNNBiiiE22iiVark111,iikNNBkkkk1111111ikyiiiiiiiykkPNykkykiiEN1iiiVarNk01122expexp+iiiiippxxxx�

中国科技论文在线

http://www.paper.edu.cn

70

the zero-inflated model is established by the generalized negative binomial model.

means

kinds of factor which affect the claim frequency. In this paper,

2 Zero-inflated Negative Binomial Model

2.1 Zero-inflated Model

Zero-inflated model was first put forward by Johnson and Kotz[1]. They divide the source of

count data into two parts: The first part explains the cause of zero inflation, and the count data can

75

only be zero. The second part is subject to a discrete distribution, the count data can be zero or a

positive integer. It means the zero count process is a mixed probability distribution, the probability

of zero comes from two parts: structural zero and sample zero.

Let the random variable of claim frequency be

, structural zero be

,

then the zero-inflated model is:

80

(2)

Among it, the random variable

is subject to a discrete distribution. The mean and variance

of

are:

85

2.2 Zero-inflated Negative Binomial Model

Let the random variable

of formula (2) obey the negative binomial distribution which means

, then the zero-inflated model is transformed into zero-inflated negative

binomial model:

90

Its mean and variance are:

(3)

Under normal circumstances, structural zero be a constant, In order to ensure

, we

usually let:

95

(4)

- 3 -

12,,,iiipxxxixp1,,iYis01(1)(1)1,2iiiiiiiiiiPYyPKyy=0PYyPKyy=,,,iKiY(1)iiEYEK2()(1)()iiiVarYEKkEKiK111,iikKNBkk111111111(1)(1)1,21ikiiiikyiiiiiiiikPYyy=0kykkPYyy=kkyk,,,1iiEY21iiiVarYk01logln1ita�

中国科技论文在线

http://www.paper.edu.cn

Solution of this equation is

. Take it into formula (3), it is known as the ZINB

model:

(5)

Generally, we use the maximum likelihood estimation method to estimate ZINB model’s

100

parameters. Due to the logarithmic likelihood function of ZINB model is nonlinear, so it needs to

use the numerical iteration method.

The logarithmic likelihood function of ZINB model can be expressed as:

Using the logarithm likelihood function and numerical iteration method, the parameter estimation

105

can be determined.

2.3 C-ZINB model

As mentioned above, various factors influence zero probability. In practical problems, the

abnormal zero probability is generally not only caused by single factor, it also may be caused by a

number of factors. So it seems not very reasonable if assume

as a constant. Now, on the basis of

110

the ZINB model, transform formula (4) as follows:

Among it,

,

means

kinds of

factor which affect the zero probability. Then the formula (5) is transformed into the C-ZINB

model:

115

3 Empirical Research

3.1 Model Select Criteria

In this paper, we compare models’ fitting effect according to the following principles.

- 4 -

exp1expaa11111111111111,211ikaiiiaaikyiiiiiaiiiekPYyy=0eekykkPYyy=ekkyk,,,101101lnln1ln1ln1lnln!lnln1iiikaaiyyiiiiiiyrlLneekkrykyykykklogln1iiiiiitaz01122+ziiiimmzzz12,,,iiiimzzzzm11111111111111,211iiiiikziiizzikyiiiiiziiiekPYyy=0eekykkPYyy=ekkyk,,,�

中国科技论文在线

3.1.1

Akaike Information Criterion (AIC)

http://www.paper.edu.cn

120

Akaike information criterion is created by Japanese statistician Akaike[2]. It can eatimate the

complexity and superiority of model. The formula of AIC is as follow:

is the logarithmic likelihood function value of model,

is the number of parameters. Akaike

suggests that the best model has the smallest AIC value.

125

3.1.2

Bayesian Information Criterion (BIC)

Schwarz[3] created bayesian information criterion on the basis of AIC. BIC is established under

the bayesian formula, its formula is as follow:

is the logarithmic likelihood function value of model,

is the number of parameters.

is the

130

sample size. Like the AIC, the smaller the BIC value is, the beat the model is. But the difference is

that the BIC considers the effect of sample size.

3.1.3

Vuong Test

Vuong test can be used to estimate the goodness of fit between the non-nested models. Firstly

let:

135

means the sample’s predicted probability of the model. Then the Vuong test

statistics of model 1 relative to model 2 can be defined as:

In this formula,

,

, statistics

obeys normal distribution.

140

Vuong[4] have proved that, Model 1 is better than model 2 while

; Model 2 is better

than model 1 while

; but it cannot judge while

.

3.2 Data Description

In order to do research with car insurance, the data comes from “Generalized Linear Models for

Insurance Data” which is third party liability insurance of Australia. It contains 10303 samples.

145

The statistical description of claim frequency and the frequency distribution are as follow:

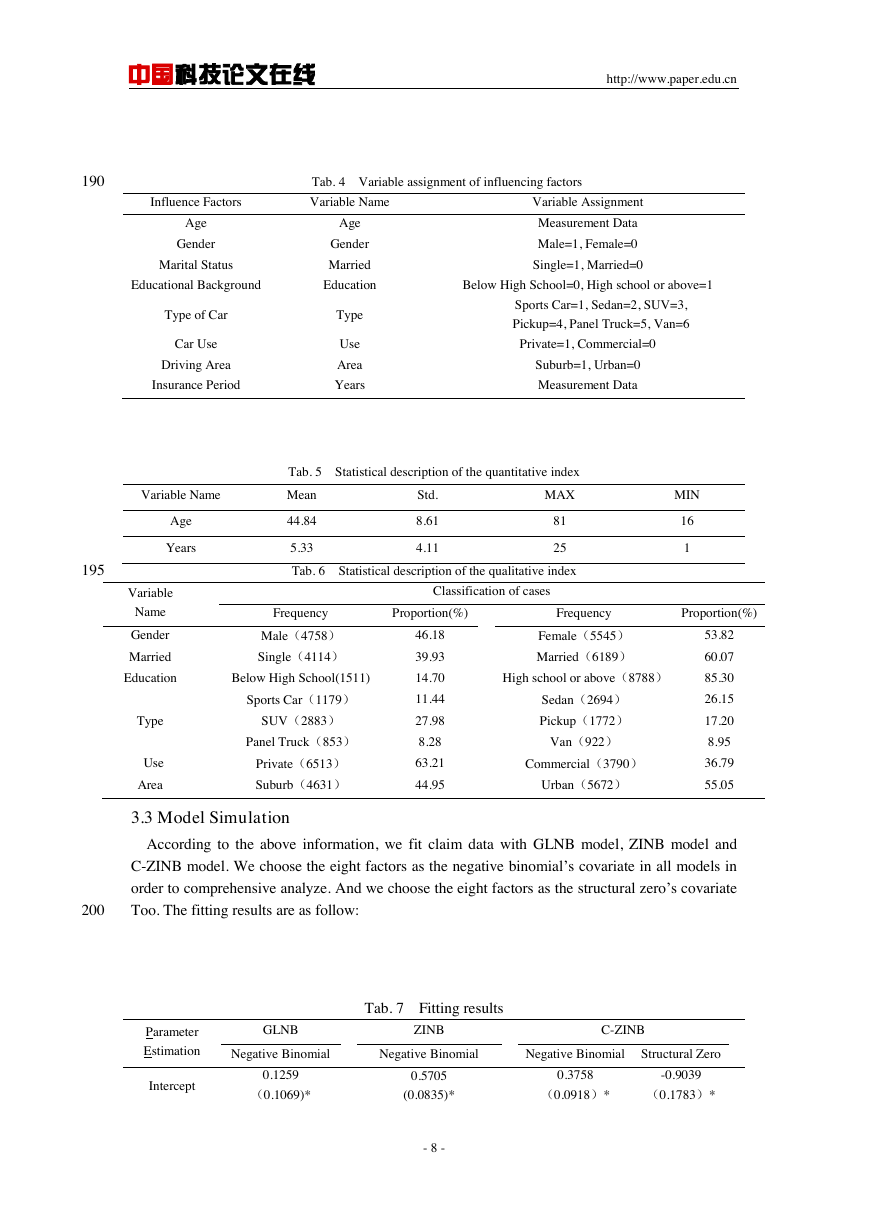

Tab. 1 Statistical description of the claim counts

Variable Name

Mean

Claim Counts

0.80

150

MAX

5

MIN

0

Std.

1.15

- 5 -

22AIClplp2lnBIClpnlpn12lniiiiiPYXmPYXjiiPYXijmnmVS11niimmn211nmiiSmmnV1.96V1.96V1.96V�

中国科技论文在线

http://www.paper.edu.cn

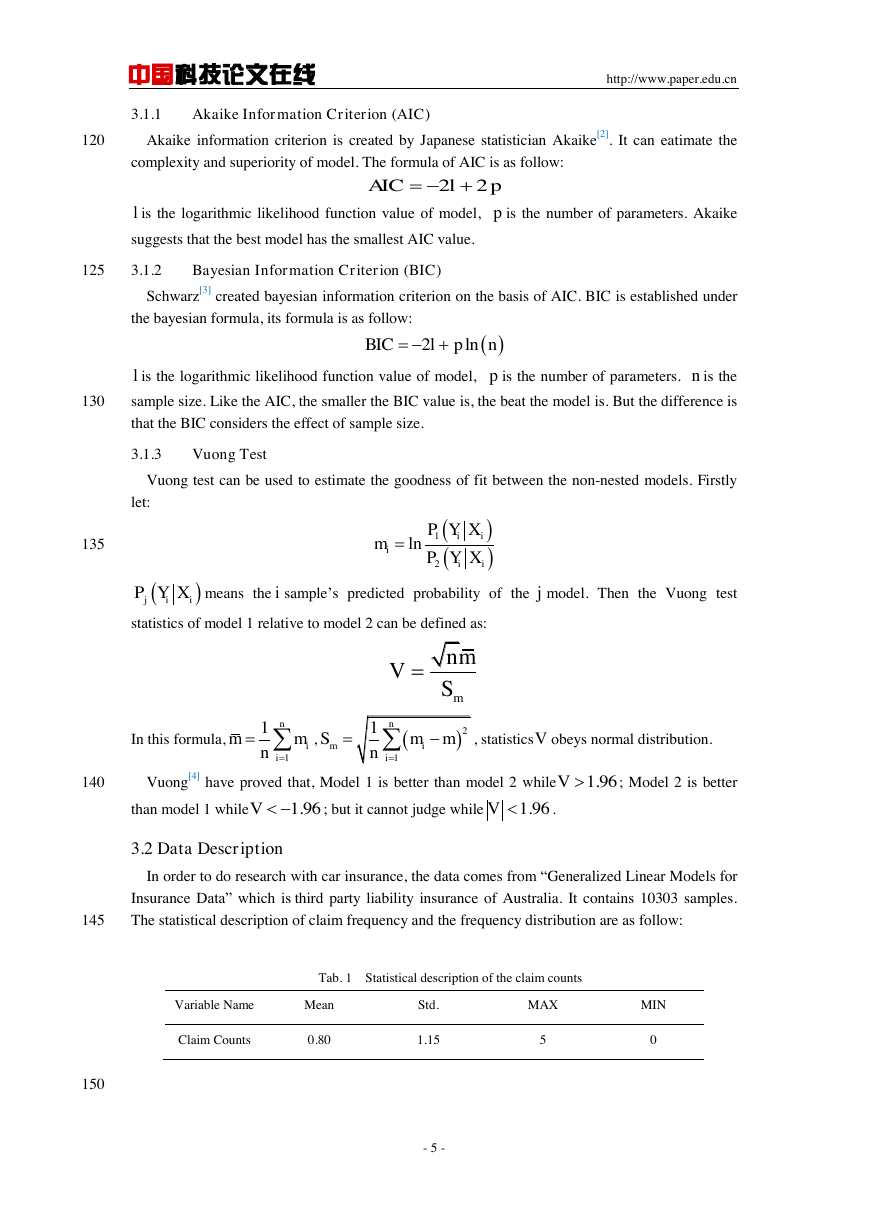

Tab. 2 Frequency of the claim counts

Claim Counts

Frequency

Frequency

Cumulative Frequency

0

1

2

3

4

5

6293

1279

1492

992

225

22

0.6108

0.1241

0.1448

0.0963

0.0219

0.0021

0.6108

0.7349

0.8797

0.9760

0.9979

1.0000

155

160

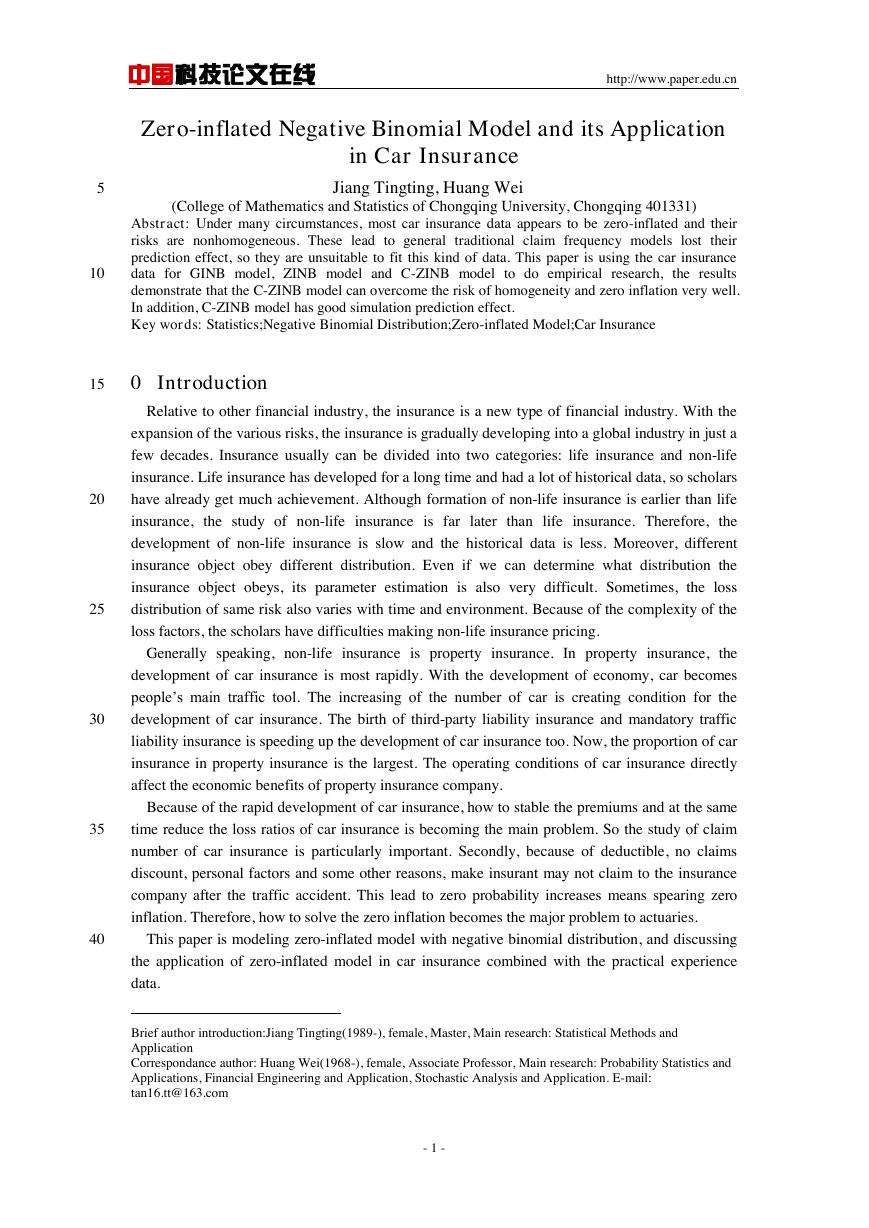

Fig. 1 Histogram of the claim frequency

It can be seen that the claim number of zero is bigger, the proportion of zero accounts for

62.08%. Using the traditional poisson distribution and negative binomial distribution to fit claim

165

frequency will lead the results appeared deviation. The fitting results of traditional poisson

distribution and negative binomial distribution are as follow:

- 6 -

�

中国科技论文在线

http://www.paper.edu.cn

170

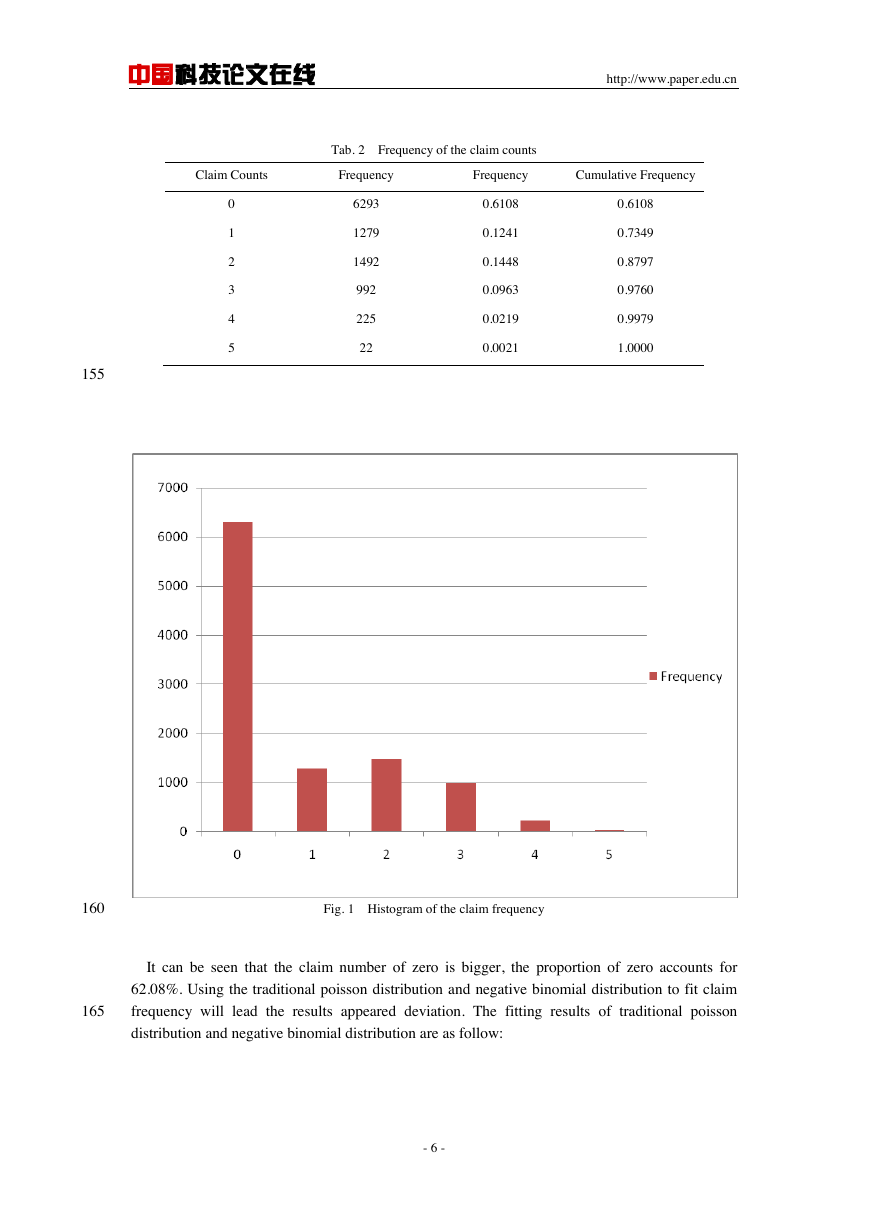

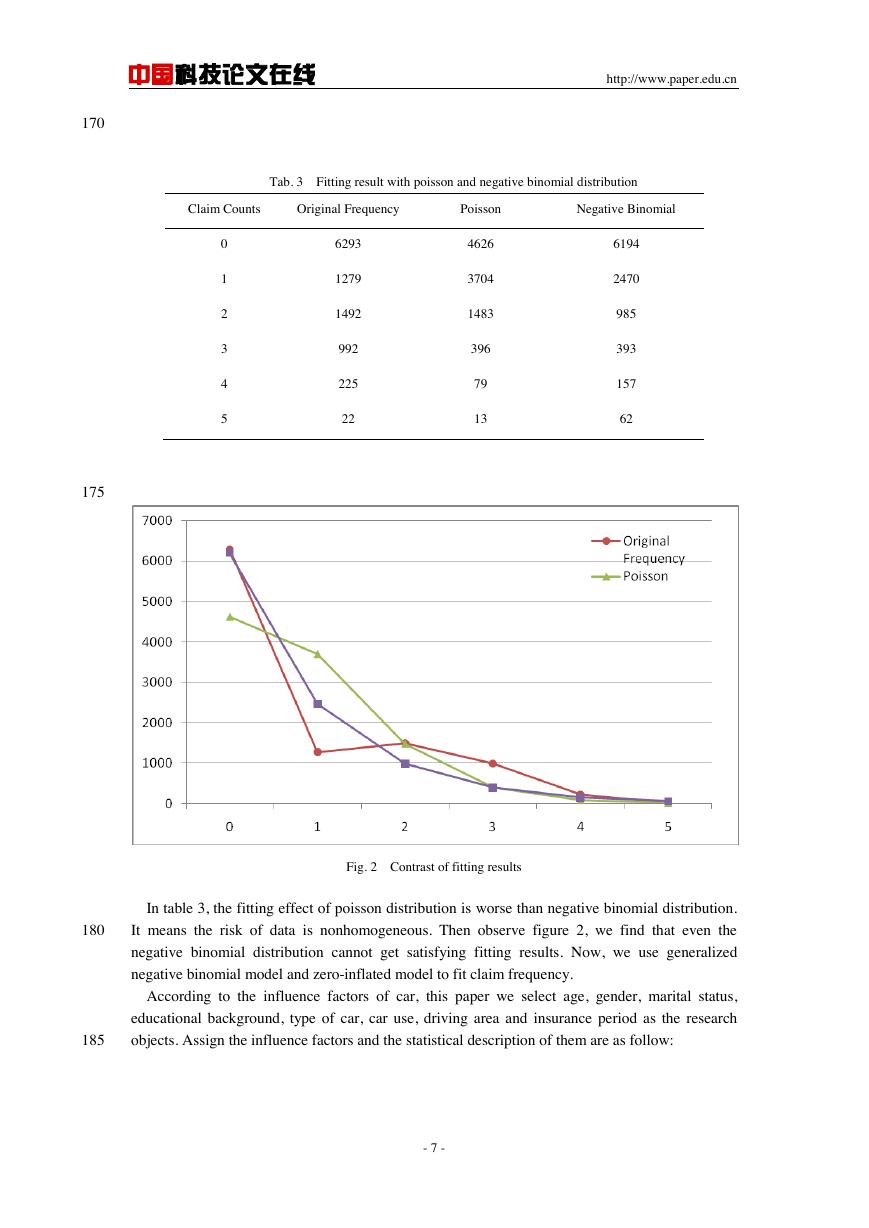

Tab. 3 Fitting result with poisson and negative binomial distribution

Claim Counts

Original Frequency

Poisson

Negative Binomial

0

1

2

3

4

5

6293

1279

1492

992

225

22

4626

3704

1483

396

79

13

6194

2470

985

393

157

62

175

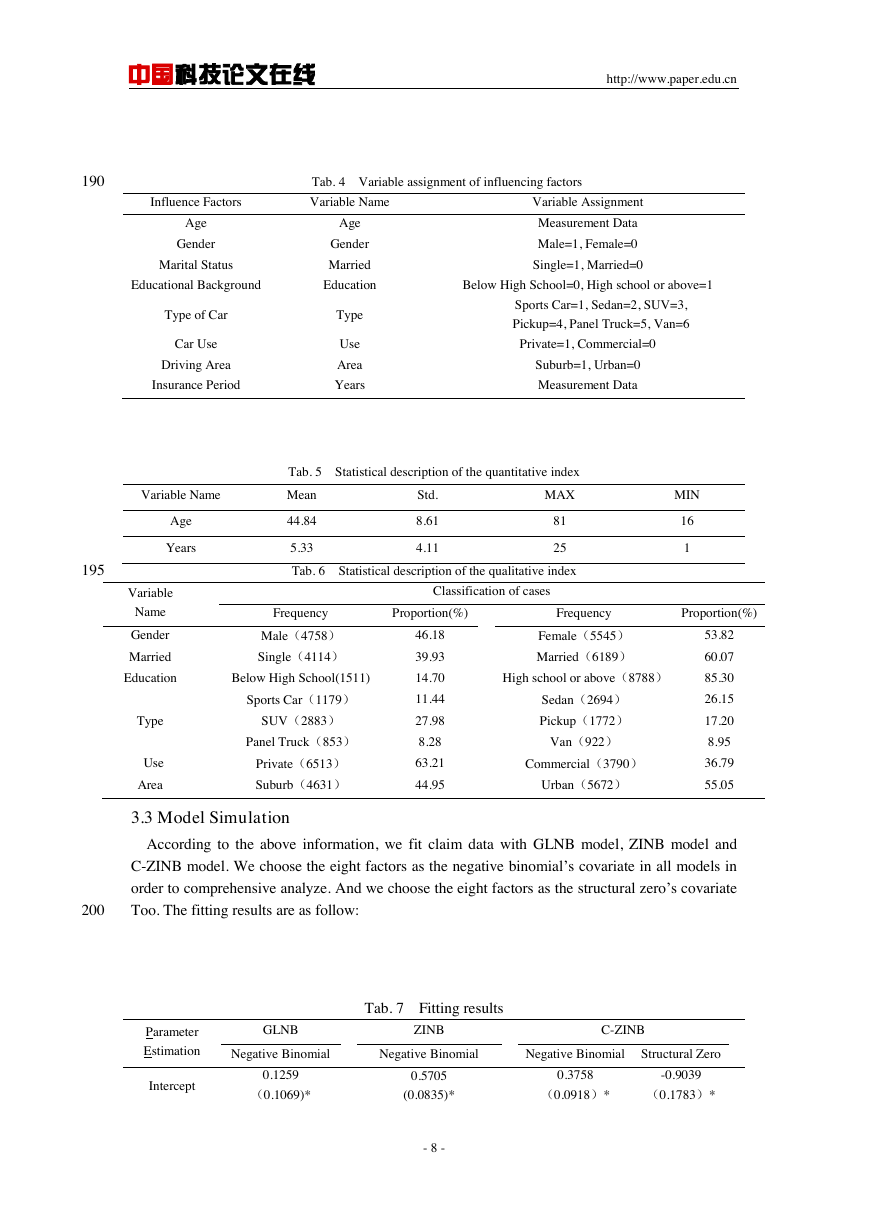

Fig. 2 Contrast of fitting results

In table 3, the fitting effect of poisson distribution is worse than negative binomial distribution.

180

It means the risk of data is nonhomogeneous. Then observe figure 2, we find that even the

negative binomial distribution cannot get satisfying fitting results. Now, we use generalized

negative binomial model and zero-inflated model to fit claim frequency.

According to the influence factors of car, this paper we select age, gender, marital status,

educational background, type of car, car use, driving area and insurance period as the research

185

objects. Assign the influence factors and the statistical description of them are as follow:

- 7 -

�

中国科技论文在线

http://www.paper.edu.cn

190

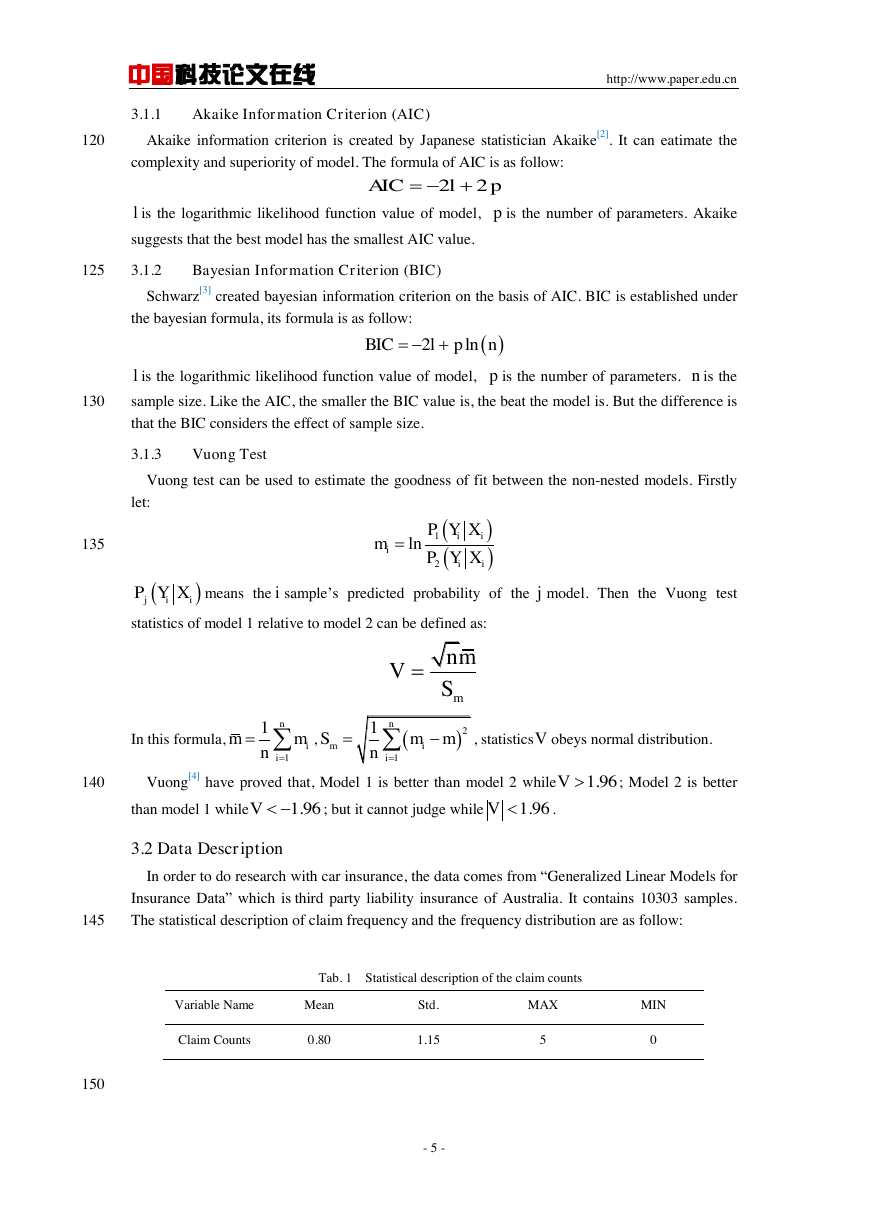

Tab. 4 Variable assignment of influencing factors

Influence Factors

Variable Name

Age

Gender

Marital Status

Age

Gender

Married

Variable Assignment

Measurement Data

Male=1, Female=0

Single=1, Married=0

Educational Background

Education

Below High School=0, High school or above=1

Type of Car

Car Use

Driving Area

Insurance Period

Type

Use

Area

Years

Sports Car=1, Sedan=2, SUV=3,

Pickup=4, Panel Truck=5, Van=6

Private=1, Commercial=0

Suburb=1, Urban=0

Measurement Data

Tab. 5 Statistical description of the quantitative index

Variable Name

Age

Years

Mean

44.84

5.33

Std.

8.61

4.11

MAX

81

25

MIN

16

1

195

Tab. 6 Statistical description of the qualitative index

Variable

Name

Gender

Married

Education

Type

Use

Area

Frequency

Proportion(%)

Frequency

Proportion(%)

Classification of cases

Male(4758)

Single(4114)

Below High School(1511)

Sports Car(1179)

SUV(2883)

Panel Truck(853)

Private(6513)

Suburb(4631)

46.18

39.93

14.70

11.44

27.98

8.28

63.21

44.95

Female(5545)

Married(6189)

High school or above(8788)

Sedan(2694)

Pickup(1772)

Van(922)

Commercial(3790)

Urban(5672)

53.82

60.07

85.30

26.15

17.20

8.95

36.79

55.05

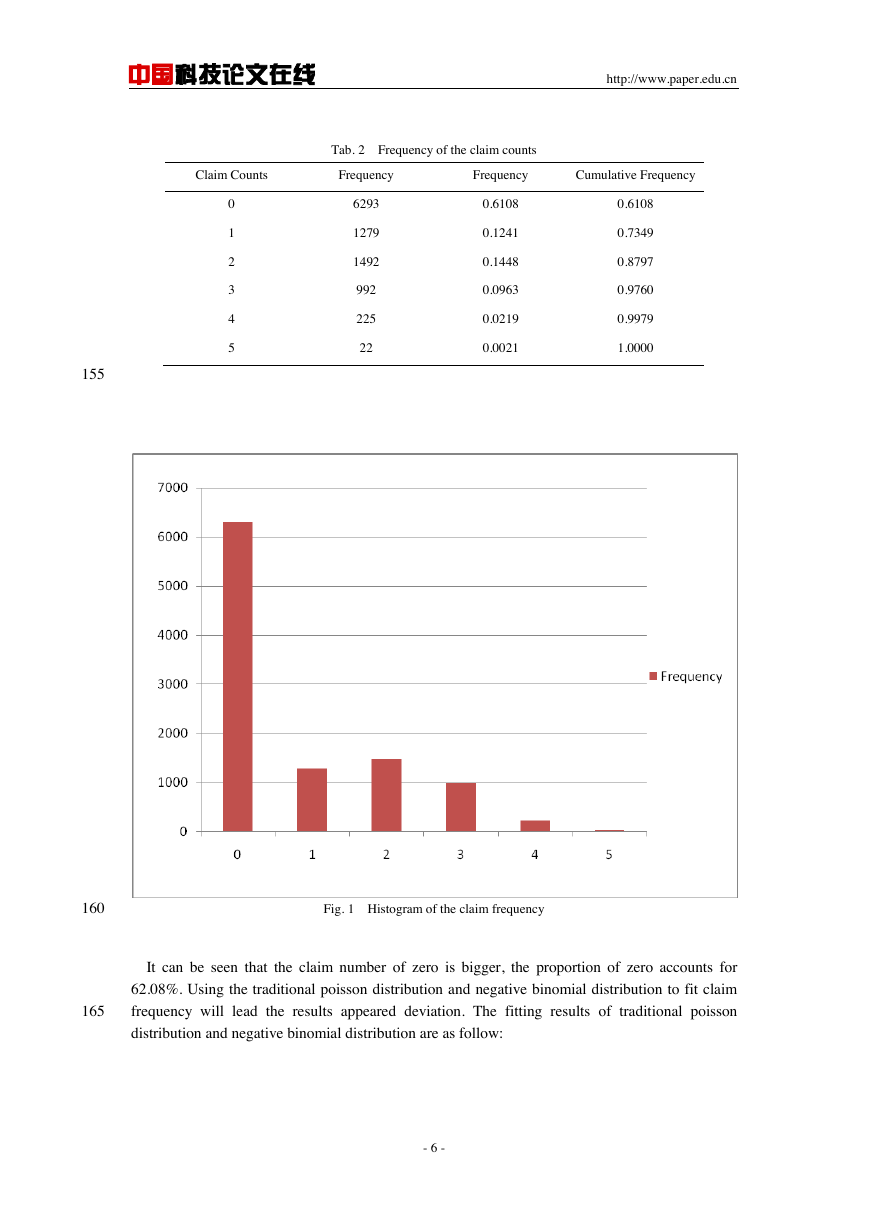

3.3 Model Simulation

According to the above information, we fit claim data with GLNB model, ZINB model and

C-ZINB model. We choose the eight factors as the negative binomial’s covariate in all models in

order to comprehensive analyze. And we choose the eight factors as the structural zero’s covariate

200

Too. The fitting results are as follow:

Tab. 7 Fitting results

Parameter

Estimation

Intercept

GLNB

Negative Binomial

0.1259

(0.1069)*

ZINB

Negative Binomial

0.5705

(0.0835)*

C-ZINB

Negative Binomial Structural Zero

0.3758

-0.9039

(0.0918)*

(0.1783)*

- 8 -

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc