2010 年 12 月 ACCA 考试 F6 真题

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. All apportionments should be made to the nearest month.

3. All workings should be shown.

TAX RATES AND ALLOWANCES.

The following tax rates and allowances are to be used in answering the questions.

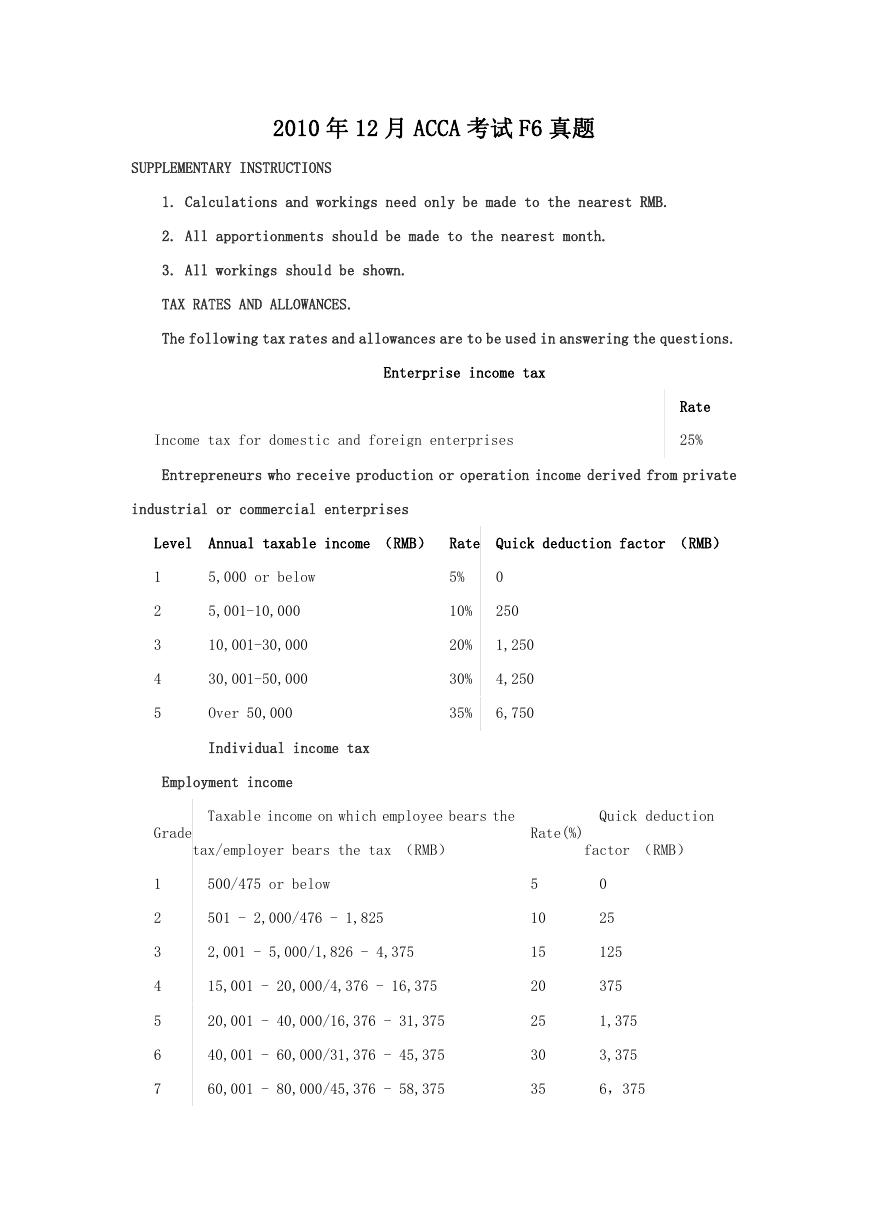

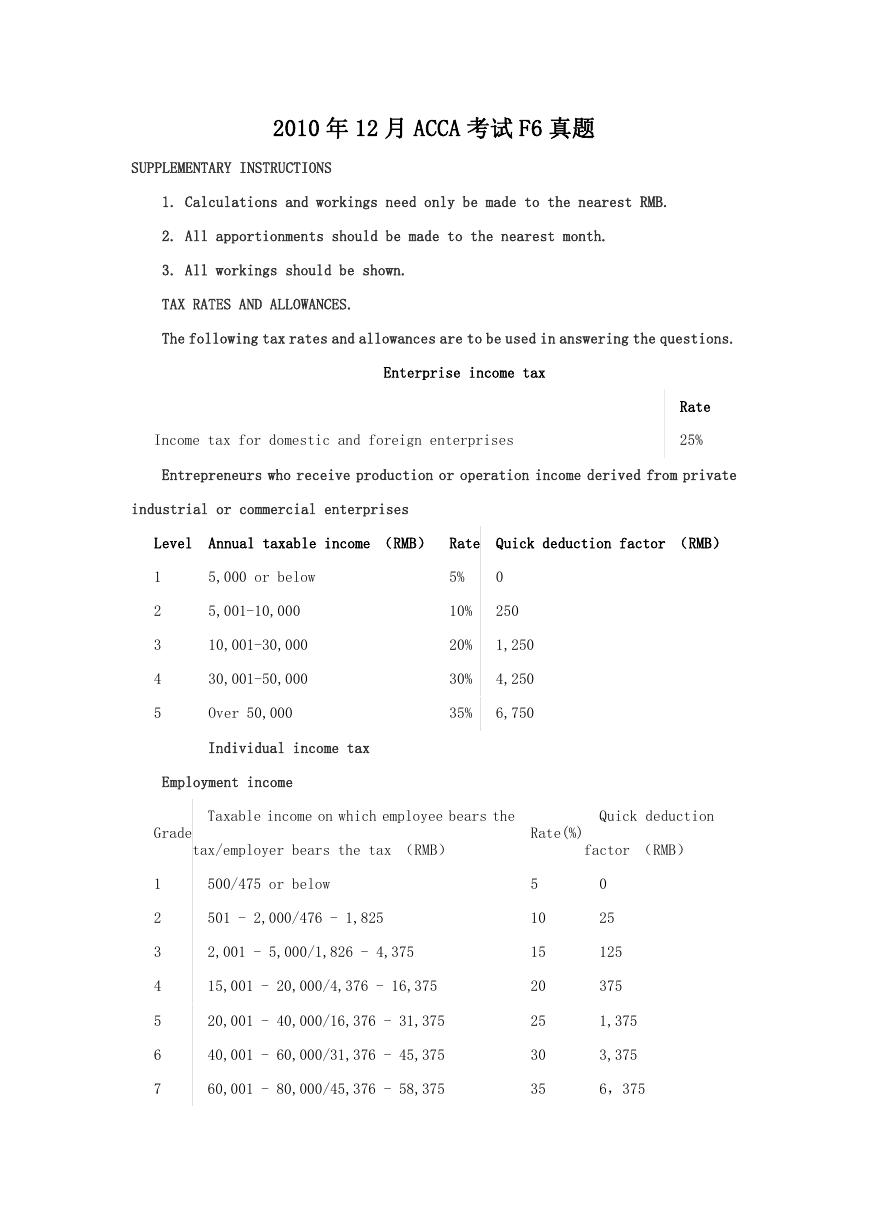

Enterprise income tax

Income tax for domestic and foreign enterprises

Rate

25%

Entrepreneurs who receive production or operation income derived from private

industrial or commercial enterprises

Level

Annual taxable income (RMB) Rate

Quick deduction factor (RMB)

1

2

3

4

5

5,000 or below

5,001-10,000

10,001-30,000

30,001-50,000

Over 50,000

Individual income tax

Employment income

5%

0

10%

250

20%

1,250

30%

4,250

35%

6,750

Taxable income on which employee bears the

Quick deduction

Grade

Rate(%)

tax/employer bears the tax (RMB)

factor (RMB)

1

2

3

4

5

6

7

500/475 or below

501 - 2,000/476 - 1,825

2,001 - 5,000/1,826 - 4,375

15,001 - 20,000/4,376 - 16,375

20,001 - 40,000/16,376 - 31,375

40,001 - 60,000/31,376 - 45,375

60,001 - 80,000/45,376 - 58,375

5

10

15

20

25

30

35

0

25

125

375

1,375

3,375

6,375

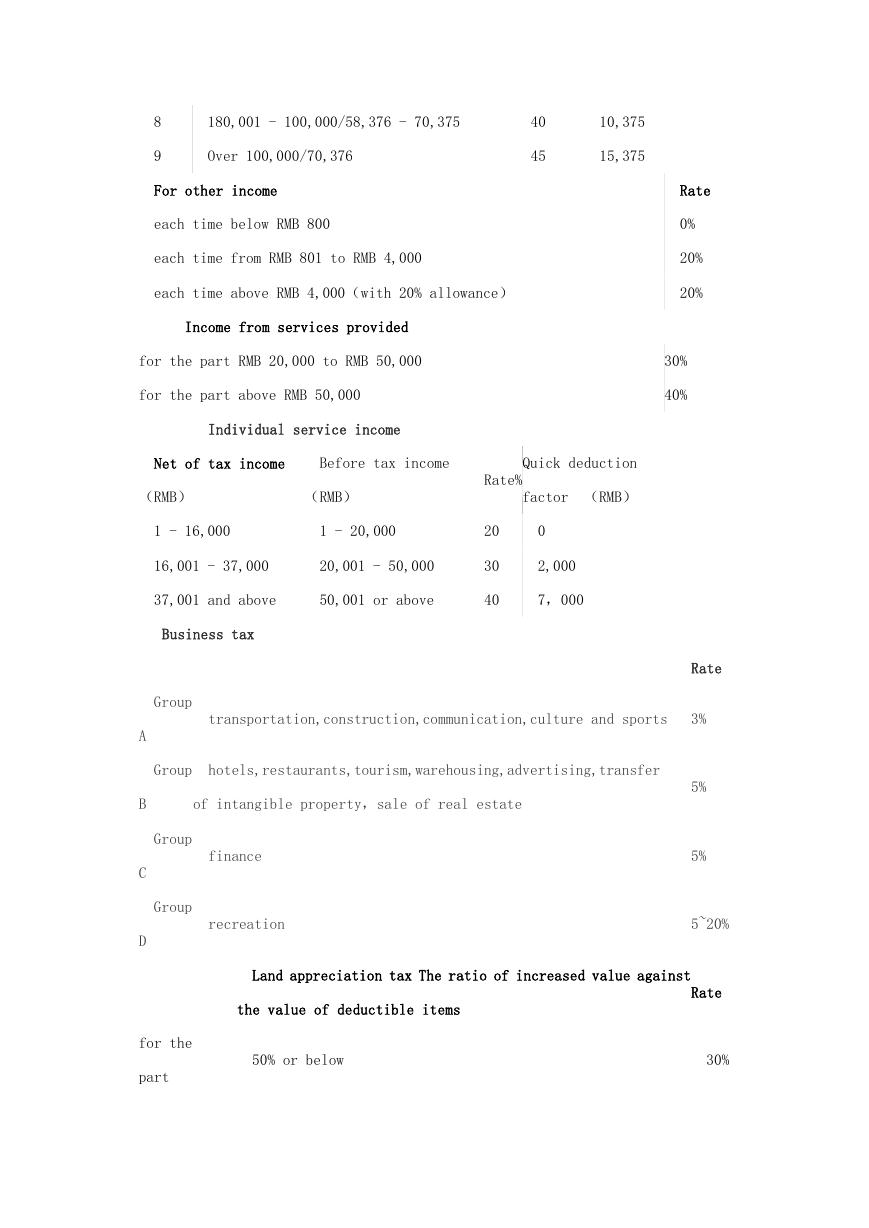

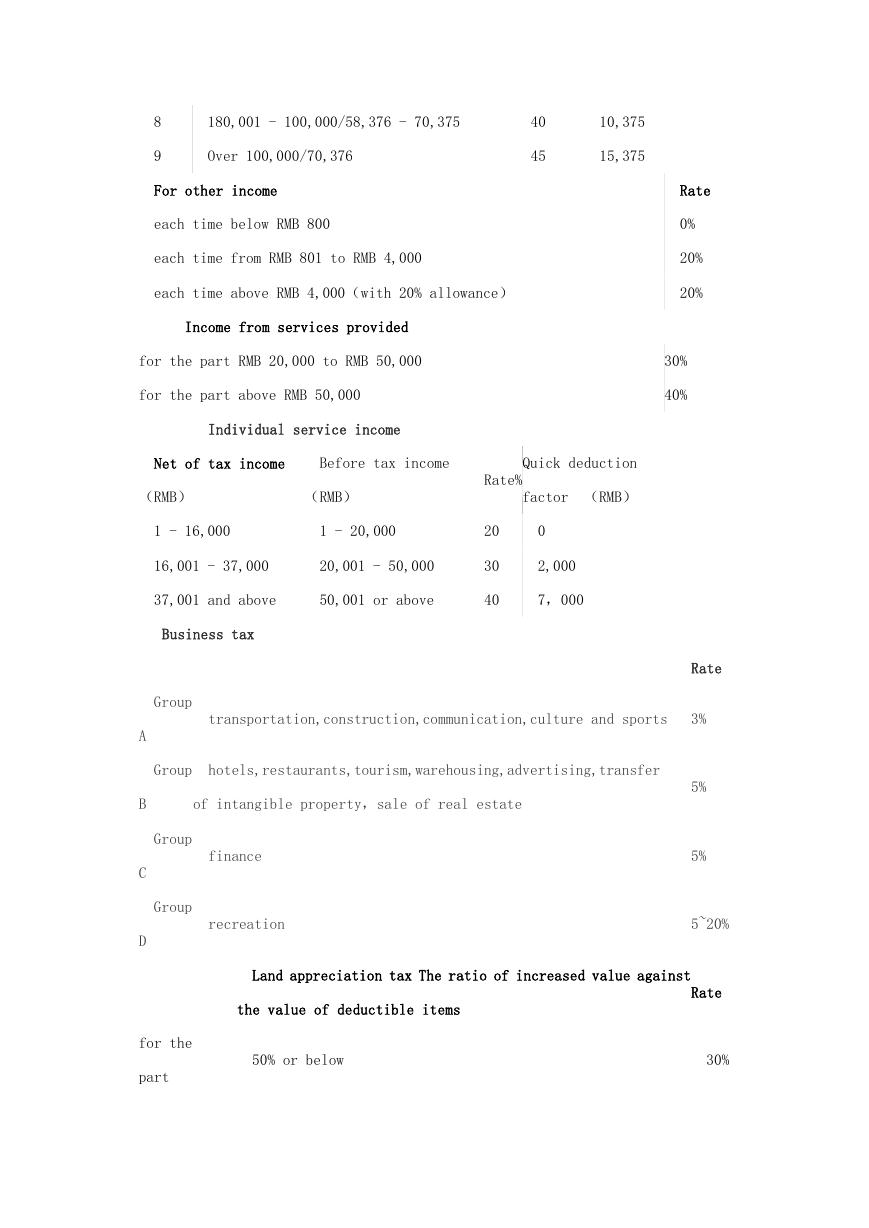

�

8

9

180,001 - 100,000/58,376 - 70,375

Over 100,000/70,376

40

45

10,375

15,375

For other income

each time below RMB 800

each time from RMB 801 to RMB 4,000

each time above RMB 4,000(with 20% allowance)

Income from services provided

for the part RMB 20,000 to RMB 50,000

for the part above RMB 50,000

Individual service income

Net of tax income

Before tax income

Quick deduction

Rate%

(RMB)

(RMB)

factor (RMB)

1 - 16,000

1 - 20,000

16,001 - 37,000

20,001 - 50,000

37,001 and above

50,001 or above

20

30

40

0

2,000

7,000

Business tax

Group

Rate

0%

20%

20%

30%

40%

Rate

transportation,construction,communication,culture and sports

3%

A

B

C

D

Group

hotels,restaurants,tourism,warehousing,advertising,transfer

of intangible property,sale of real estate

Group

Group

finance

recreation

Land appreciation tax The ratio of increased value against

the value of deductible items

for the

part

50% or below

5%

5%

5~20%

Rate

30%

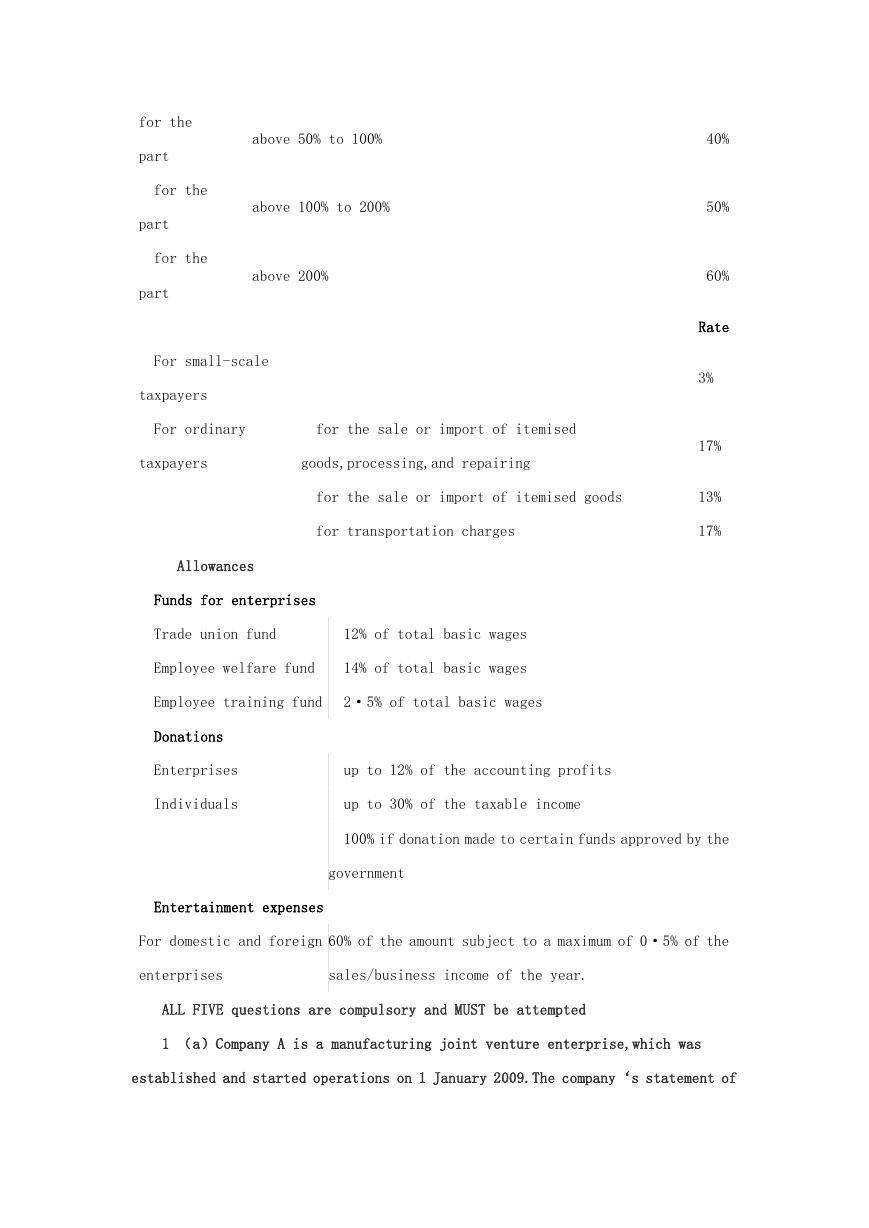

�

for the

part

for the

part

for the

part

above 50% to 100%

above 100% to 200%

above 200%

For small-scale

taxpayers

For ordinary

for the sale or import of itemised

taxpayers

goods,processing,and repairing

for the sale or import of itemised goods

for transportation charges

Allowances

Funds for enterprises

Trade union fund

12% of total basic wages

Employee welfare fund

14% of total basic wages

Employee training fund

2·5% of total basic wages

40%

50%

60%

Rate

3%

17%

13%

17%

Donations

Enterprises

Individuals

up to 12% of the accounting profits

up to 30% of the taxable income

100% if donation made to certain funds approved by the

government

Entertainment expenses

For domestic and foreign

60% of the amount subject to a maximum of 0·5% of the

enterprises

sales/business income of the year.

ALL FIVE questions are compulsory and MUST be attempted

1 (a)Company A is a manufacturing joint venture enterprise,which was

established and started operations on 1 January 2009.The company‘s statement of

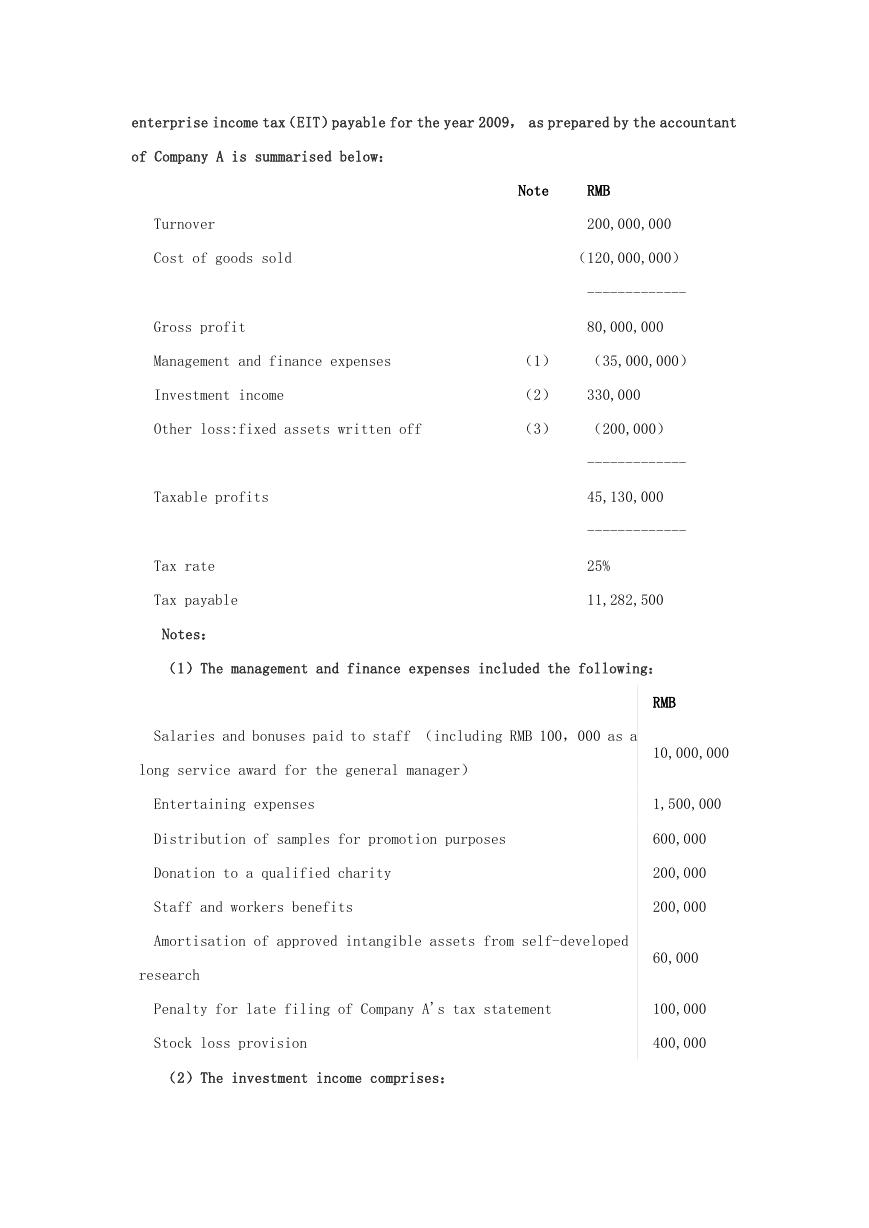

�

enterprise income tax(EIT)payable for the year 2009, as prepared by the accountant

of Company A is summarised below:

Turnover

Cost of goods sold

Gross profit

Note

RMB

200,000,000

(120,000,000)

-------------

80,000,000

Management and finance expenses

(1)

(35,000,000)

Investment income

(2)

330,000

Other loss:fixed assets written off

(3)

(200,000)

Taxable profits

Tax rate

Tax payable

Notes:

-------------

45,130,000

-------------

25%

11,282,500

(1)The management and finance expenses included the following:

Salaries and bonuses paid to staff (including RMB 100,000 as a

long service award for the general manager)

Entertaining expenses

Distribution of samples for promotion purposes

Donation to a qualified charity

Staff and workers benefits

Amortisation of approved intangible assets from self-developed

research

Penalty for late filing of Company A's tax statement

Stock loss provision

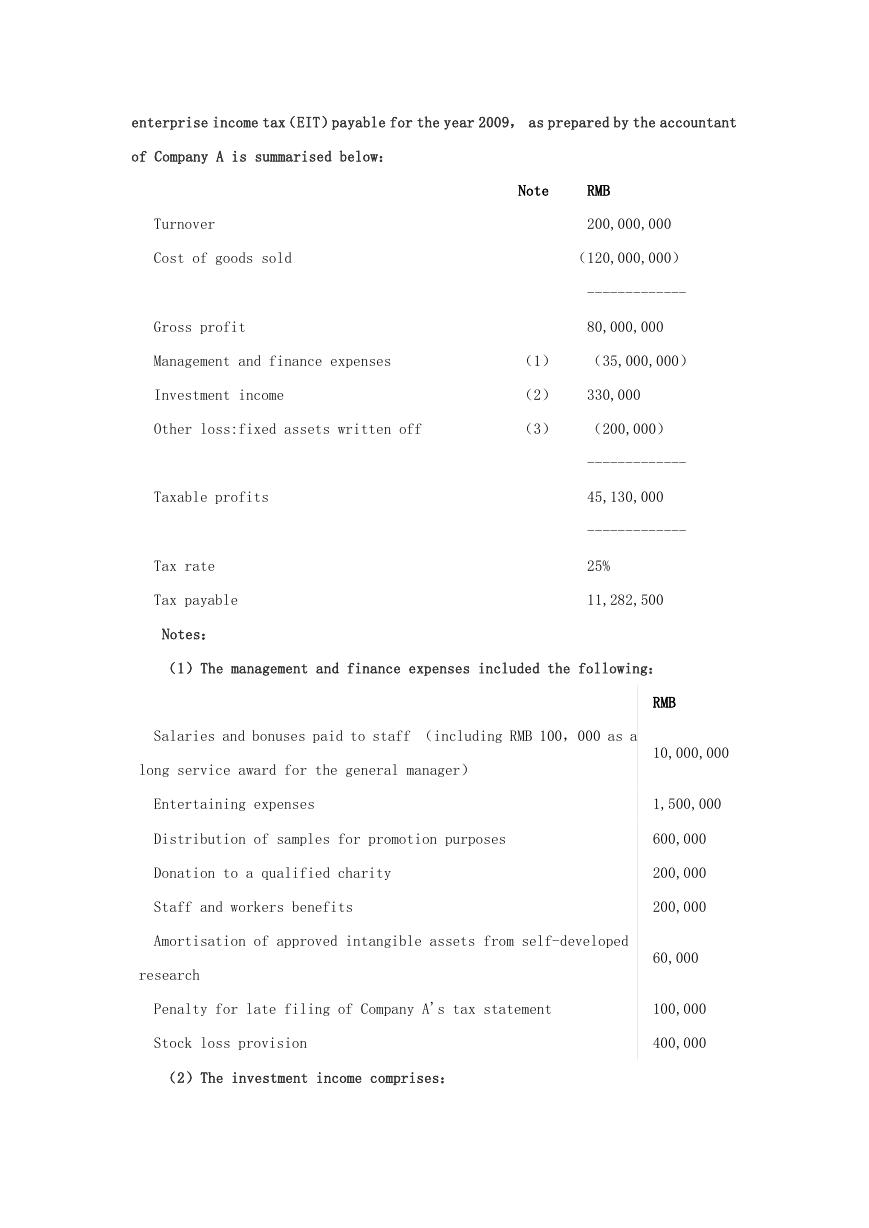

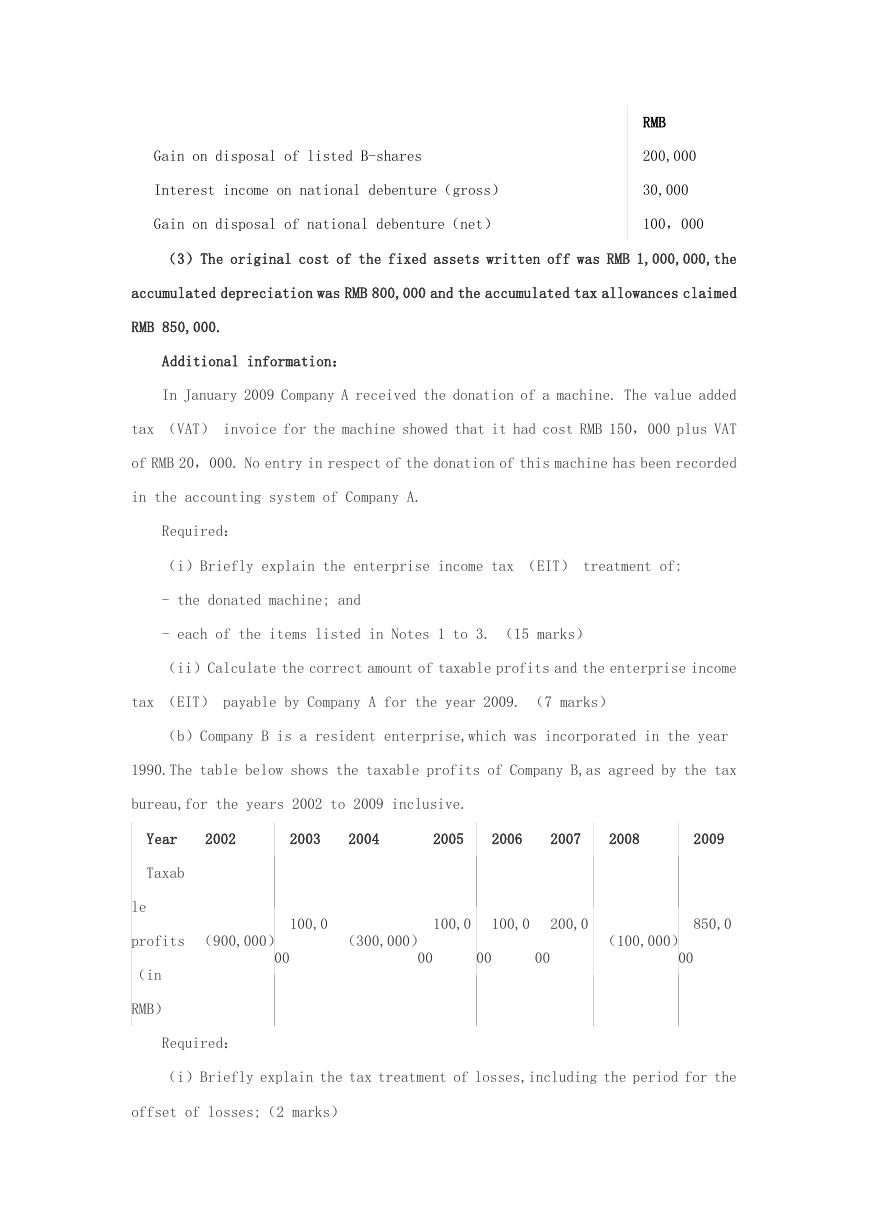

(2)The investment income comprises:

RMB

10,000,000

1,500,000

600,000

200,000

200,000

60,000

100,000

400,000

�

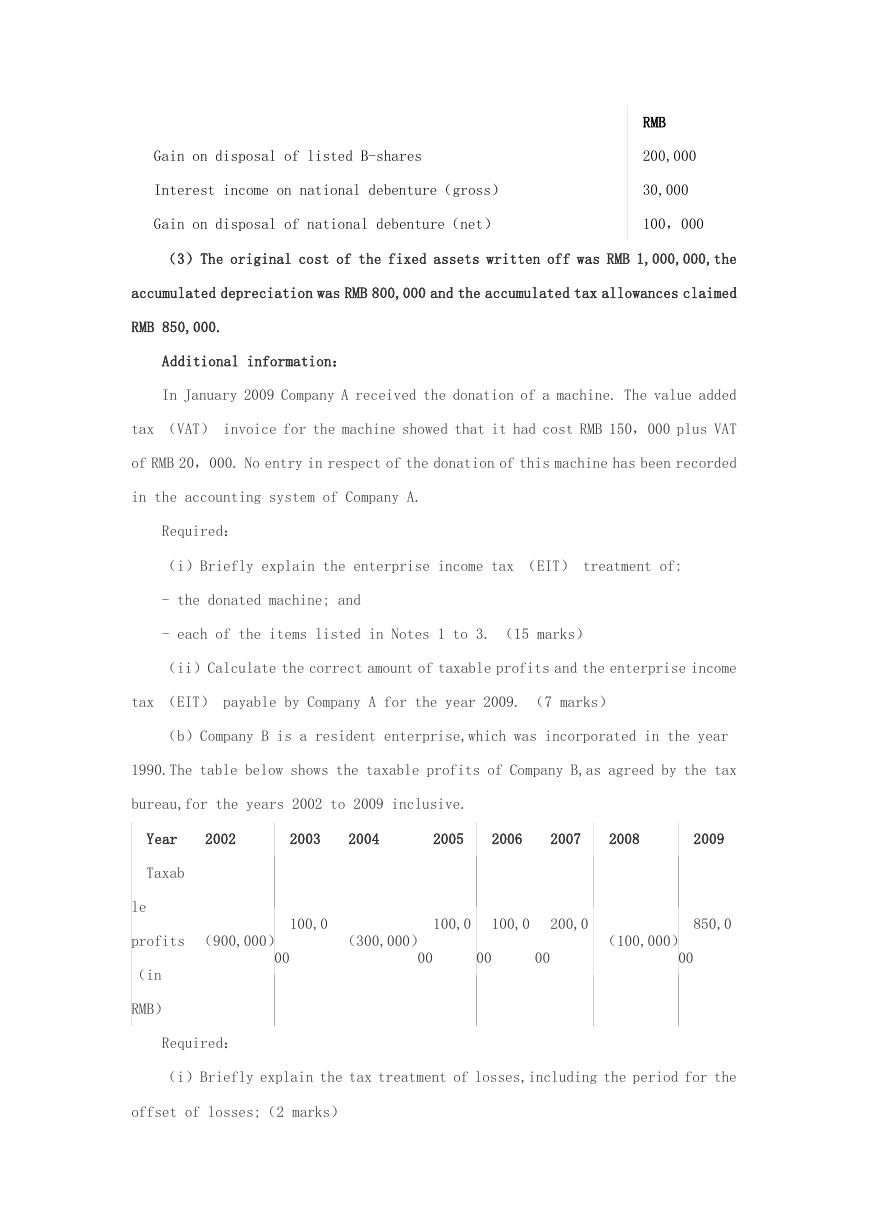

Gain on disposal of listed B-shares

Interest income on national debenture(gross)

Gain on disposal of national debenture(net)

RMB

200,000

30,000

100,000

(3)The original cost of the fixed assets written off was RMB 1,000,000,the

accumulated depreciation was RMB 800,000 and the accumulated tax allowances claimed

RMB 850,000.

Additional information:

In January 2009 Company A received the donation of a machine. The value added

tax (VAT) invoice for the machine showed that it had cost RMB 150,000 plus VAT

of RMB 20,000. No entry in respect of the donation of this machine has been recorded

in the accounting system of Company A.

Required:

(i)Briefly explain the enterprise income tax (EIT) treatment of:

- the donated machine; and

- each of the items listed in Notes 1 to 3. (15 marks)

(ii)Calculate the correct amount of taxable profits and the enterprise income

tax (EIT) payable by Company A for the year 2009. (7 marks)

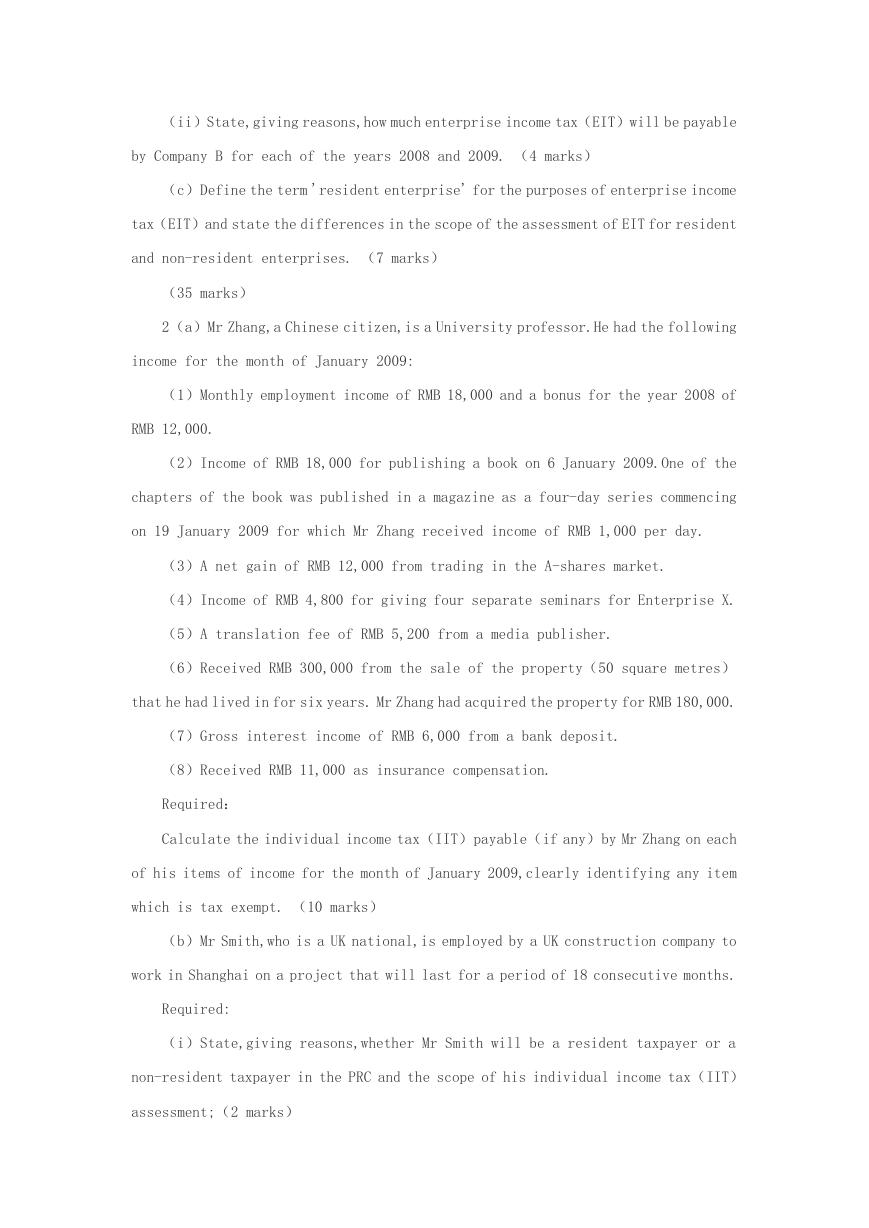

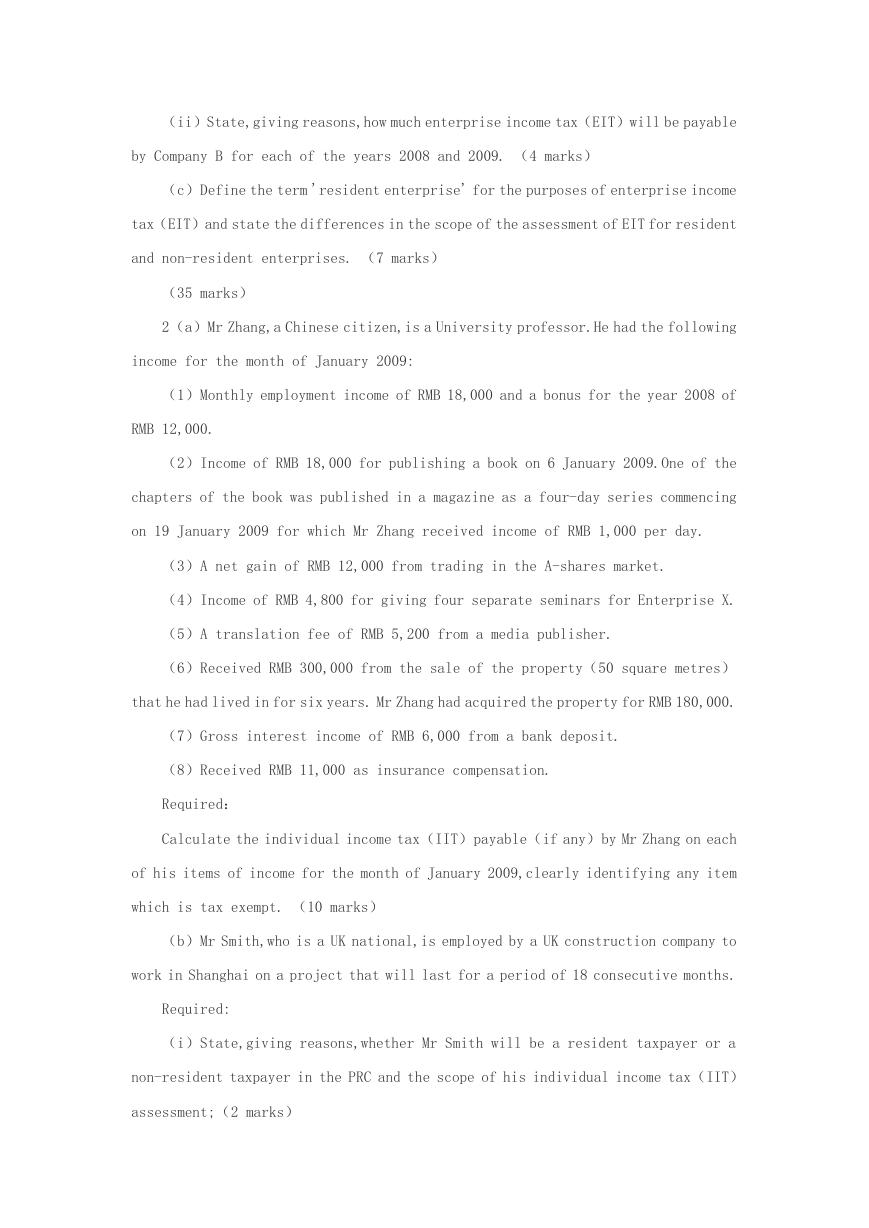

(b)Company B is a resident enterprise,which was incorporated in the year

1990.The table below shows the taxable profits of Company B,as agreed by the tax

bureau,for the years 2002 to 2009 inclusive.

Year

2002

2003

2004

2005

2006

2007

2008

2009

Taxab

le

profits

(900,000)

00

(300,000)

00

00

00

(100,000)

00

100,0

100,0

100,0

200,0

850,0

(in

RMB)

Required:

(i)Briefly explain the tax treatment of losses,including the period for the

offset of losses;(2 marks)

�

(ii)State,giving reasons,how much enterprise income tax(EIT)will be payable

by Company B for each of the years 2008 and 2009. (4 marks)

(c)Define the term 'resident enterprise' for the purposes of enterprise income

tax(EIT)and state the differences in the scope of the assessment of EIT for resident

and non-resident enterprises. (7 marks)

(35 marks)

2(a)Mr Zhang,a Chinese citizen,is a University professor.He had the following

income for the month of January 2009:

(1)Monthly employment income of RMB 18,000 and a bonus for the year 2008 of

RMB 12,000.

(2)Income of RMB 18,000 for publishing a book on 6 January 2009.One of the

chapters of the book was published in a magazine as a four-day series commencing

on 19 January 2009 for which Mr Zhang received income of RMB 1,000 per day.

(3)A net gain of RMB 12,000 from trading in the A-shares market.

(4)Income of RMB 4,800 for giving four separate seminars for Enterprise X.

(5)A translation fee of RMB 5,200 from a media publisher.

(6)Received RMB 300,000 from the sale of the property(50 square metres)

that he had lived in for six years. Mr Zhang had acquired the property for RMB 180,000.

(7)Gross interest income of RMB 6,000 from a bank deposit.

(8)Received RMB 11,000 as insurance compensation.

Required:

Calculate the individual income tax(IIT)payable(if any)by Mr Zhang on each

of his items of income for the month of January 2009,clearly identifying any item

which is tax exempt. (10 marks)

(b)Mr Smith,who is a UK national,is employed by a UK construction company to

work in Shanghai on a project that will last for a period of 18 consecutive months.

Required:

(i)State,giving reasons,whether Mr Smith will be a resident taxpayer or a

non-resident taxpayer in the PRC and the scope of his individual income tax(IIT)

assessment;(2 marks)

�

(ii)List any THREE fringe benefits that can be provided to Mr Smith that will

not be subject to individual income tax(IIT)in China; (3 marks)

(iii)Briefly explain the requirements for the reporting and payment of the

individual income tax(IIT)due for Mr Smith if he is paid RMB 30,000 per month.

(5 marks)

(20 marks)

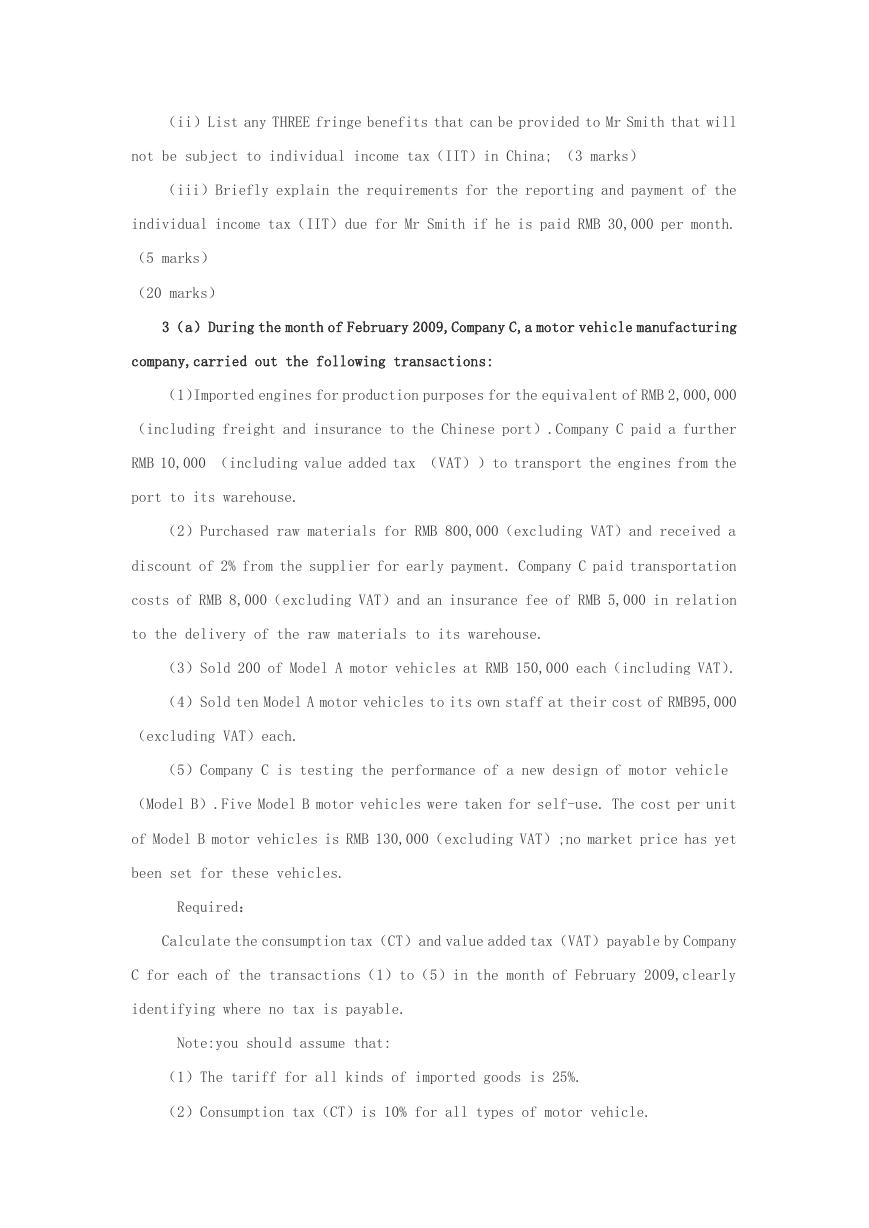

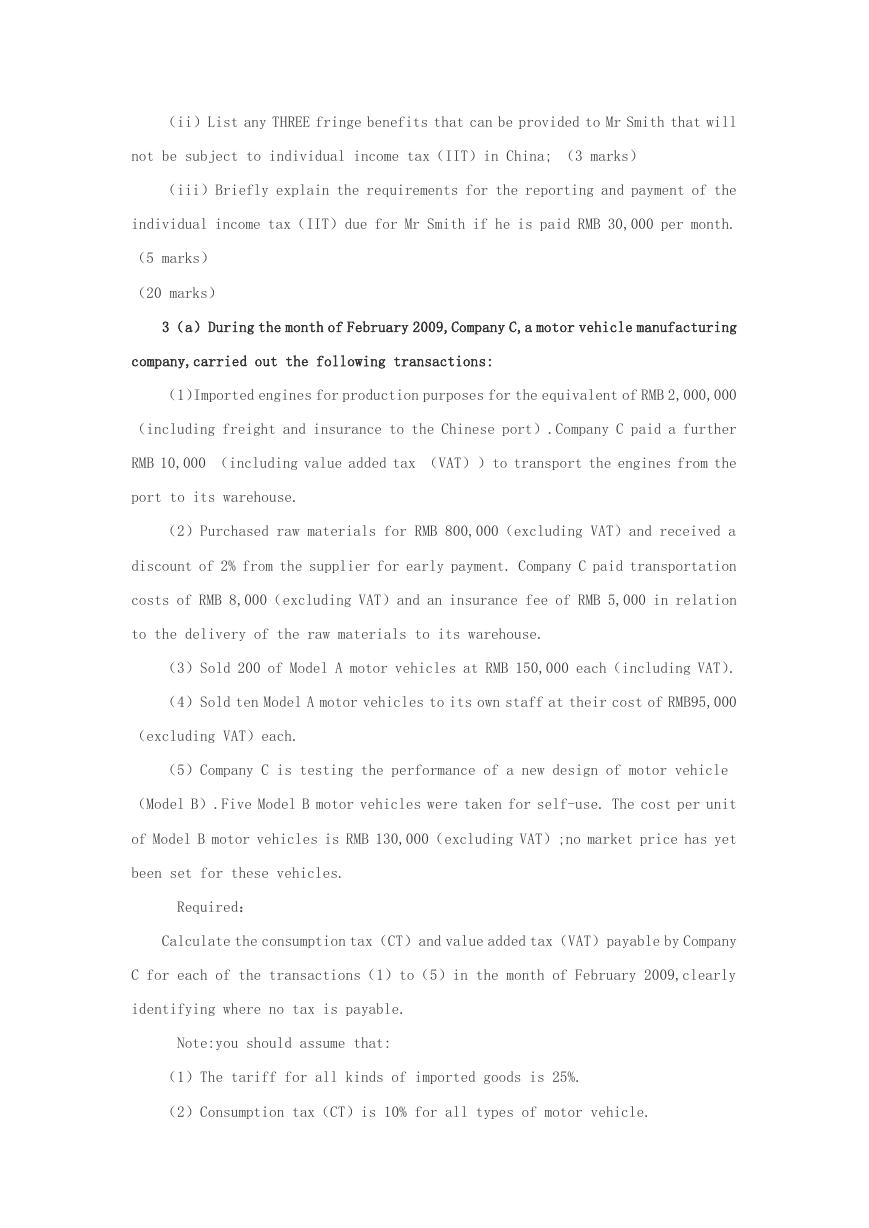

3(a)During the month of February 2009,Company C,a motor vehicle manufacturing

company,carried out the following transactions:

(1)Imported engines for production purposes for the equivalent of RMB 2,000,000

(including freight and insurance to the Chinese port).Company C paid a further

RMB 10,000 (including value added tax (VAT))to transport the engines from the

port to its warehouse.

(2)Purchased raw materials for RMB 800,000(excluding VAT)and received a

discount of 2% from the supplier for early payment. Company C paid transportation

costs of RMB 8,000(excluding VAT)and an insurance fee of RMB 5,000 in relation

to the delivery of the raw materials to its warehouse.

(3)Sold 200 of Model A motor vehicles at RMB 150,000 each(including VAT).

(4)Sold ten Model A motor vehicles to its own staff at their cost of RMB95,000

(excluding VAT)each.

(5)Company C is testing the performance of a new design of motor vehicle

(Model B).Five Model B motor vehicles were taken for self-use. The cost per unit

of Model B motor vehicles is RMB 130,000(excluding VAT);no market price has yet

been set for these vehicles.

Required:

Calculate the consumption tax(CT)and value added tax(VAT)payable by Company

C for each of the transactions(1)to(5)in the month of February 2009,clearly

identifying where no tax is payable.

Note:you should assume that:

(1)The tariff for all kinds of imported goods is 25%.

(2)Consumption tax(CT)is 10% for all types of motor vehicle.

�

(3)The deemed profit rate for the Model B motor vehicles is 8%. (11 marks)

(b)(i)State the value added tax(VAT)treatment of the disposal of self-used

fixed assets. Your answer should deal with assets which were bought both before and

after 1 January 2009; (2 marks)

(ii)State the value added tax(VAT)treatment of the disposal of used articles

(other than those used as fixed assets)and used cars; (2 marks)

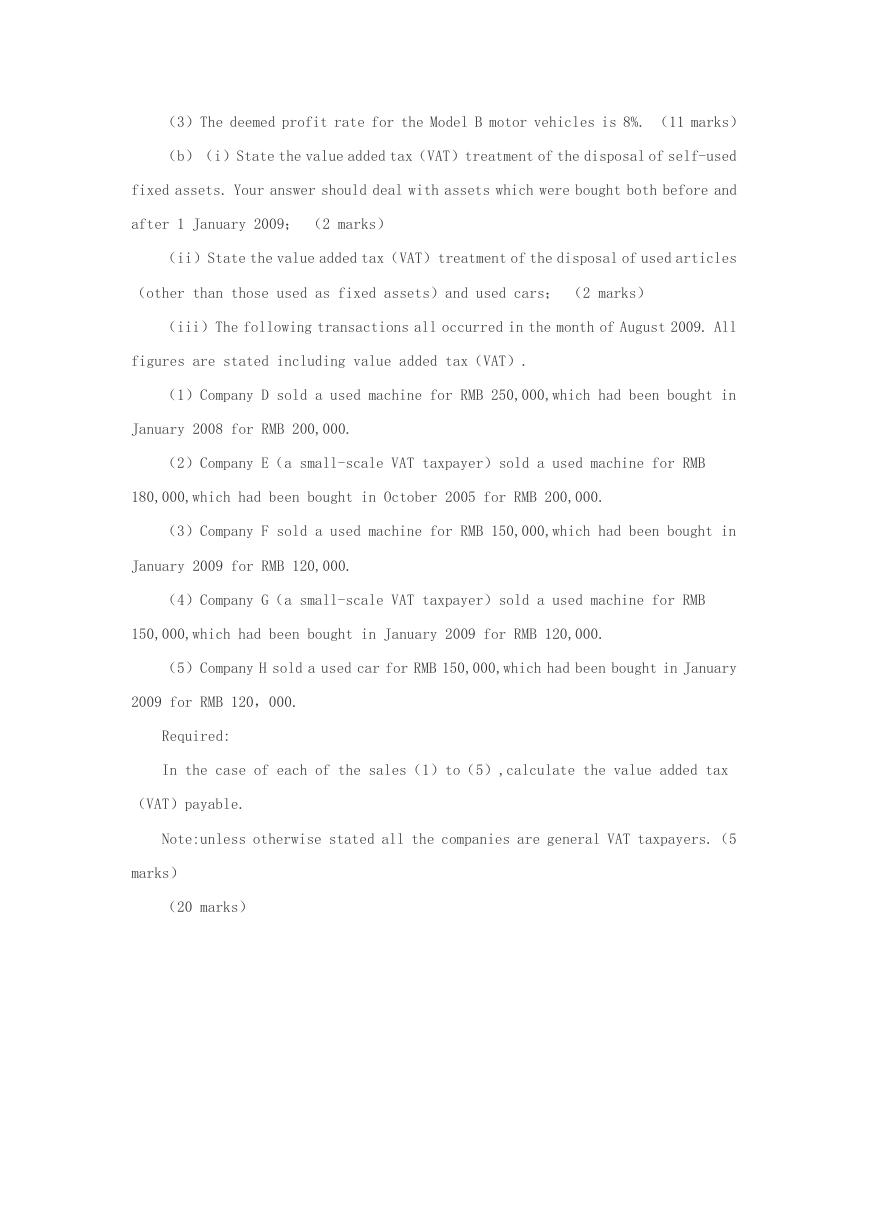

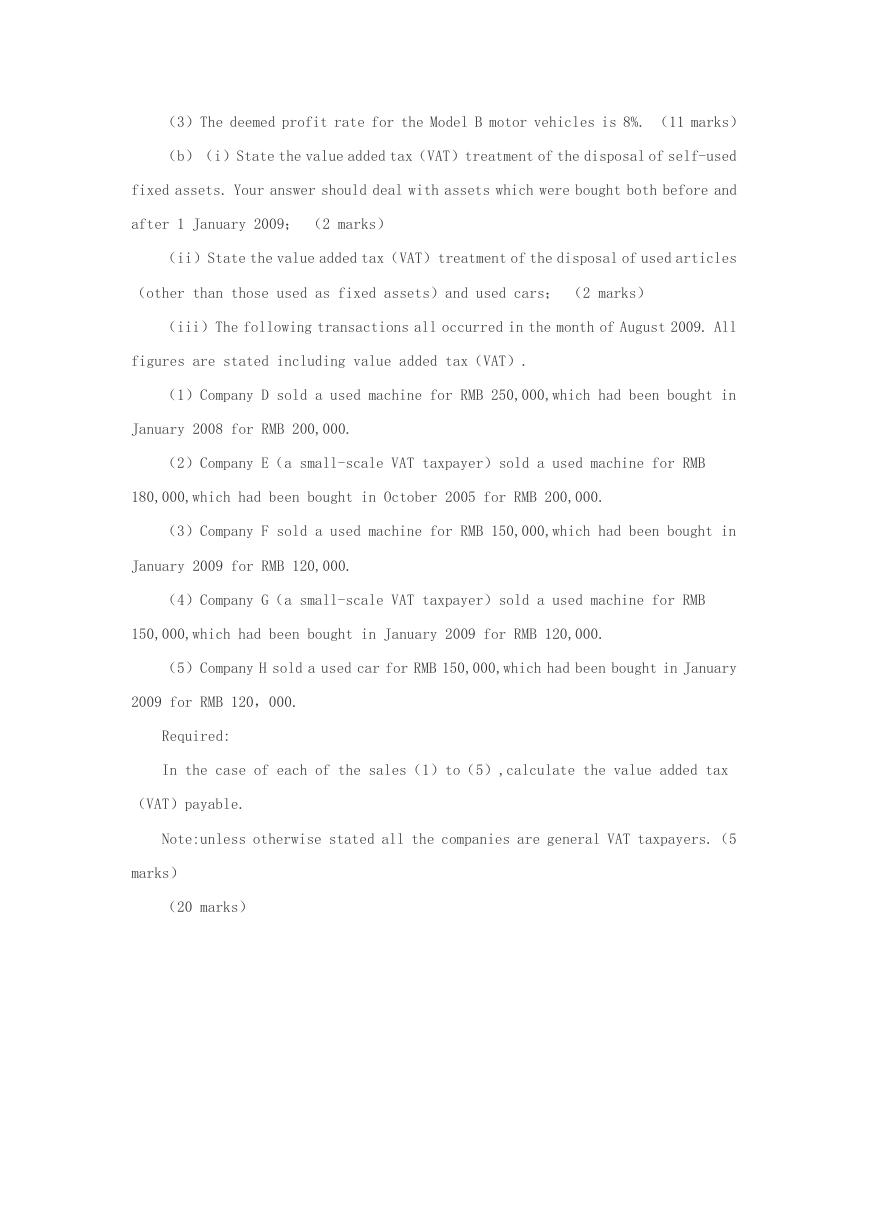

(iii)The following transactions all occurred in the month of August 2009. All

figures are stated including value added tax(VAT).

(1)Company D sold a used machine for RMB 250,000,which had been bought in

January 2008 for RMB 200,000.

(2)Company E(a small-scale VAT taxpayer)sold a used machine for RMB

180,000,which had been bought in October 2005 for RMB 200,000.

(3)Company F sold a used machine for RMB 150,000,which had been bought in

January 2009 for RMB 120,000.

(4)Company G(a small-scale VAT taxpayer)sold a used machine for RMB

150,000,which had been bought in January 2009 for RMB 120,000.

(5)Company H sold a used car for RMB 150,000,which had been bought in January

2009 for RMB 120,000.

Required:

In the case of each of the sales(1)to(5),calculate the value added tax

(VAT)payable.

Note:unless otherwise stated all the companies are general VAT taxpayers.(5

marks)

(20 marks)

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc