2010 年 12 月 ACCA 考试 P3 真题

Section A-BOTH questions are compulsory and MUST be attempted

1

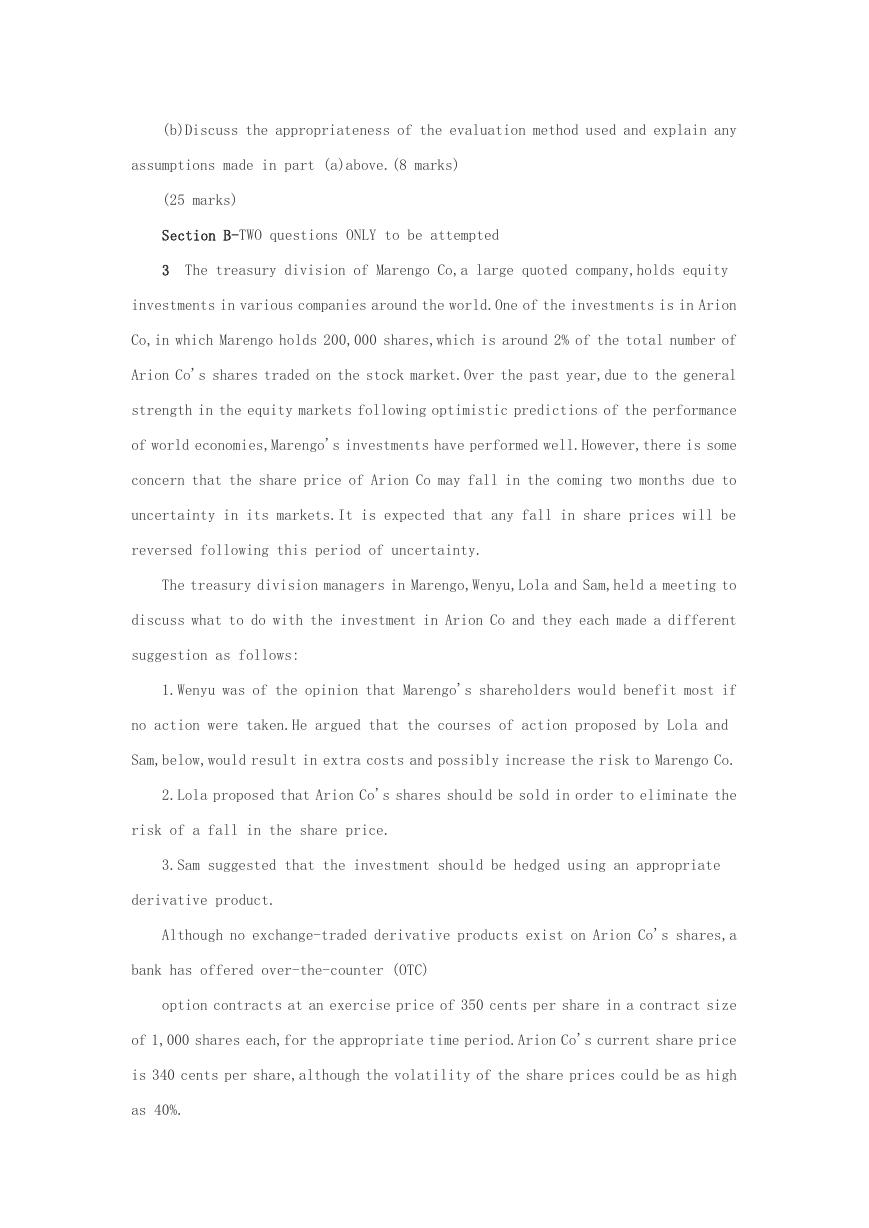

Doric Co,a listed company,has two manufacturing divisions:parts and

fridges.It has been manufacturing parts for domestic refrigeration and air

conditioning systems for a number of years,which it sells to producers of fridges

and air conditioners worldwide.It also sells around 30% of the parts it manufactures

to its fridge production division.It started producing and selling its own brand

of fridges a few years ago.After limited initial success,competition in the fridge

market became very tough and revenue and profits have been declining.Without further

investment there are currently few growth prospects in either the parts or the fridge

divisions.Doric Co borrowed heavily to finance the development and launch of its

fridges,and has now reached its maximum overdraft limit.The markets have taken a

pessimistic view of the company and its share price has declined to 50c per share

from a high of $2.83 per share around three years ago.

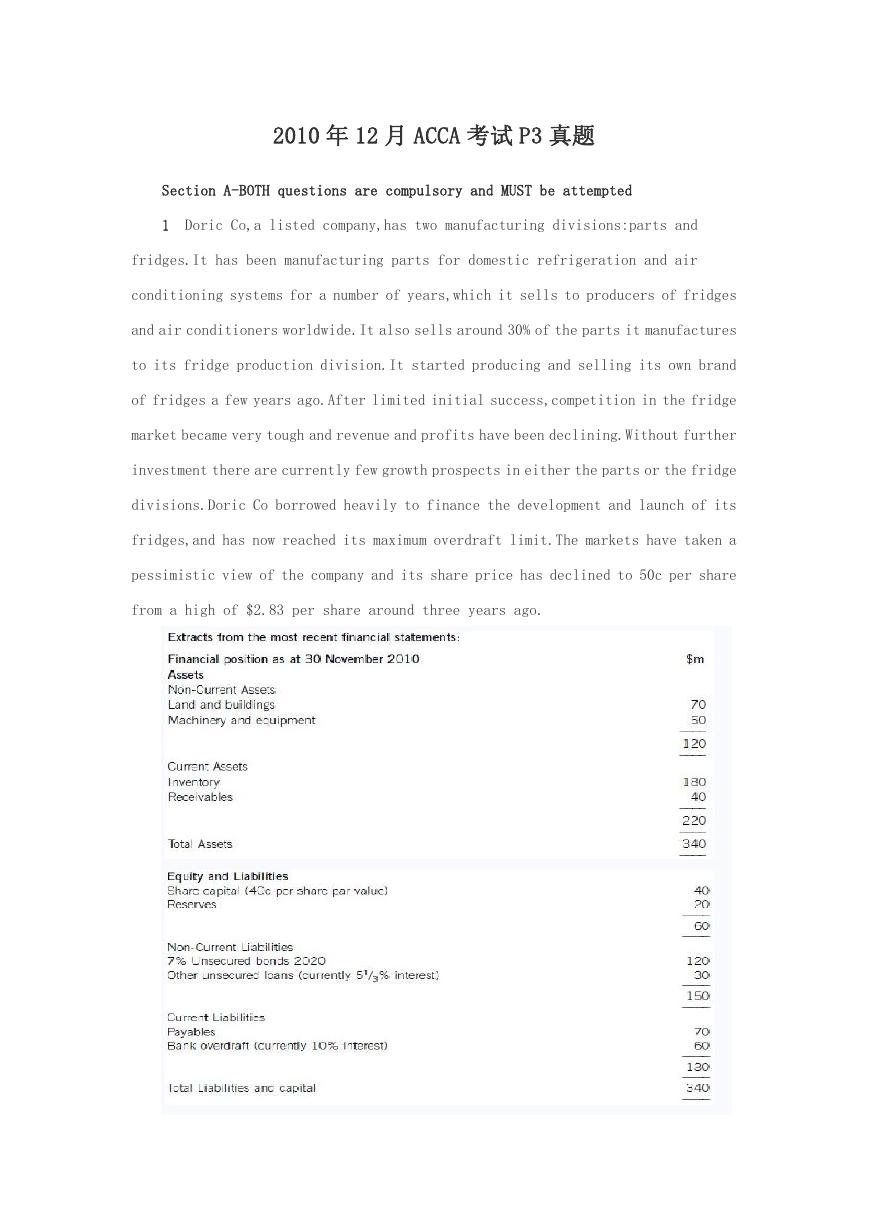

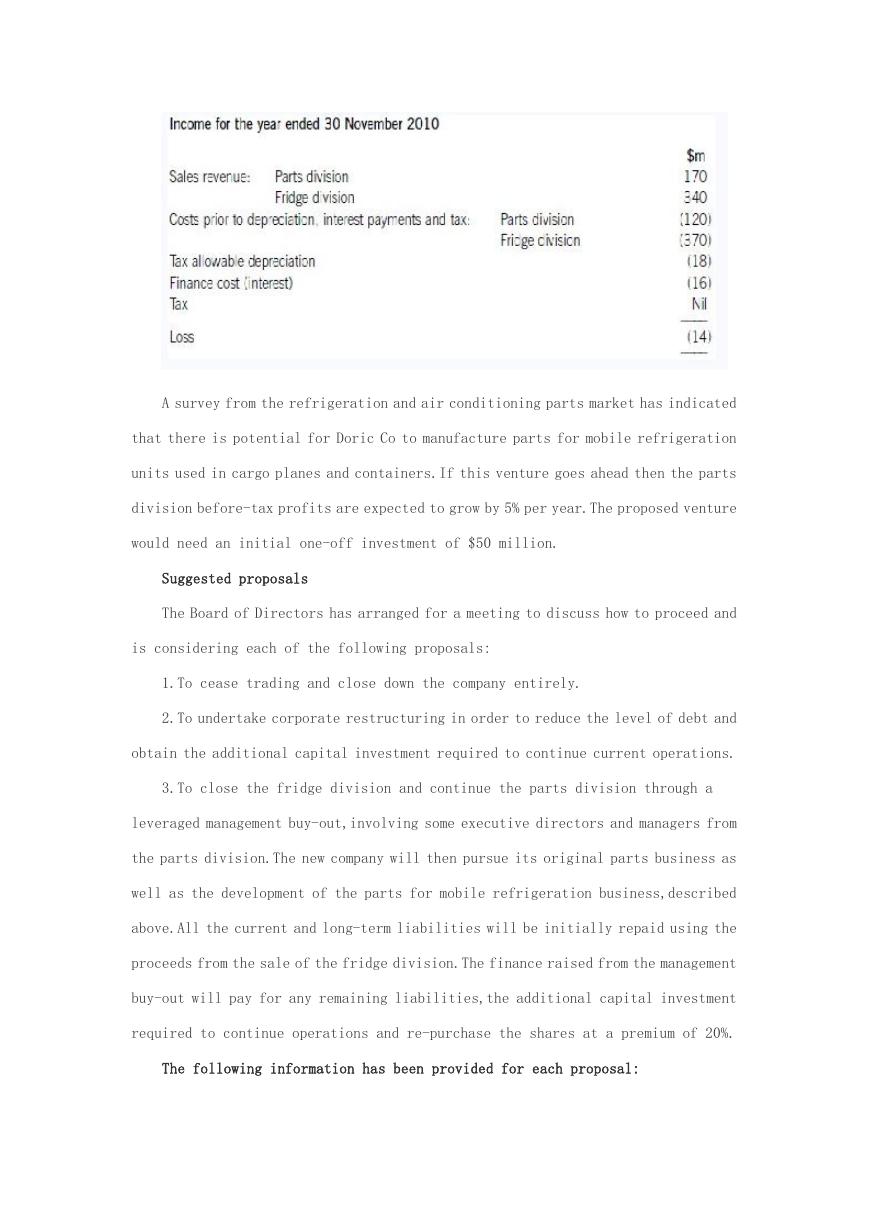

�

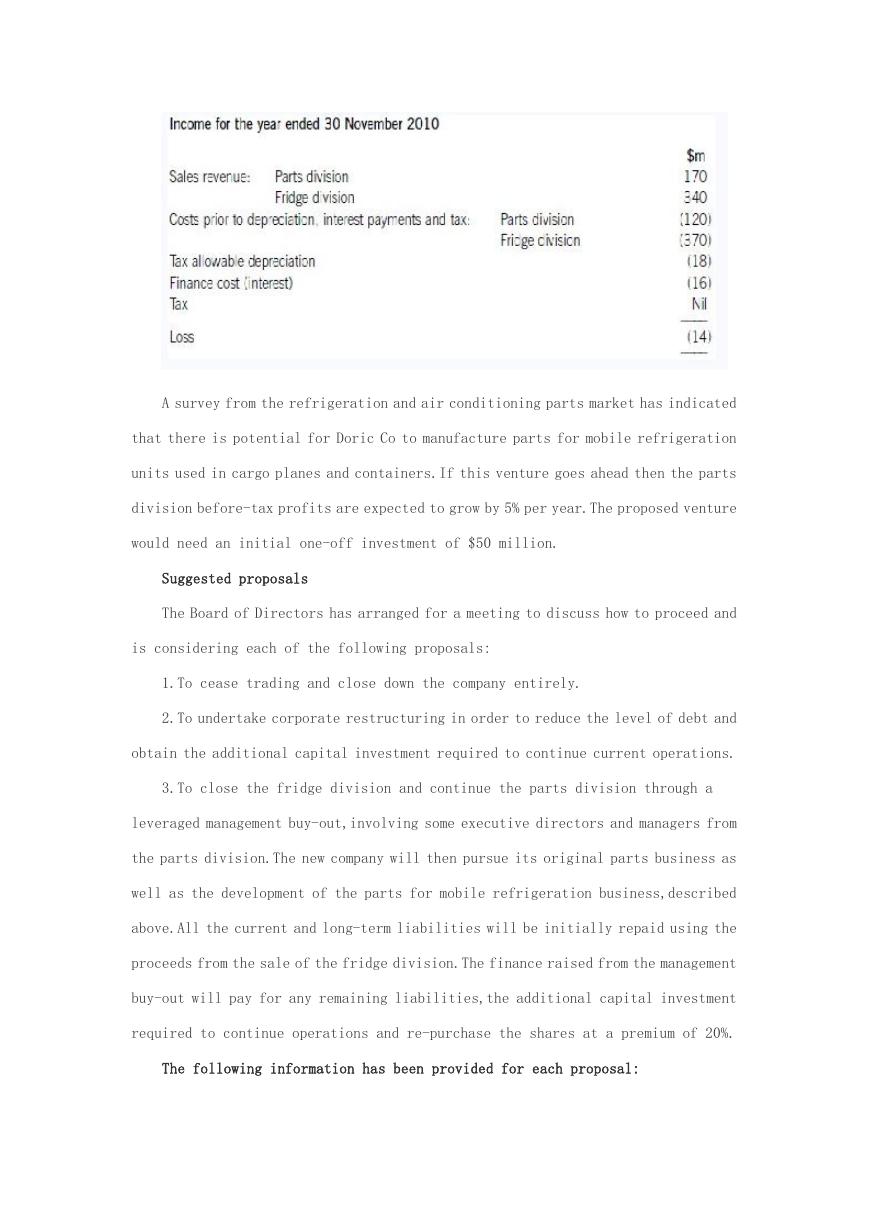

A survey from the refrigeration and air conditioning parts market has indicated

that there is potential for Doric Co to manufacture parts for mobile refrigeration

units used in cargo planes and containers.If this venture goes ahead then the parts

division before-tax profits are expected to grow by 5% per year.The proposed venture

would need an initial one-off investment of $50 million.

Suggested proposals

The Board of Directors has arranged for a meeting to discuss how to proceed and

is considering each of the following proposals:

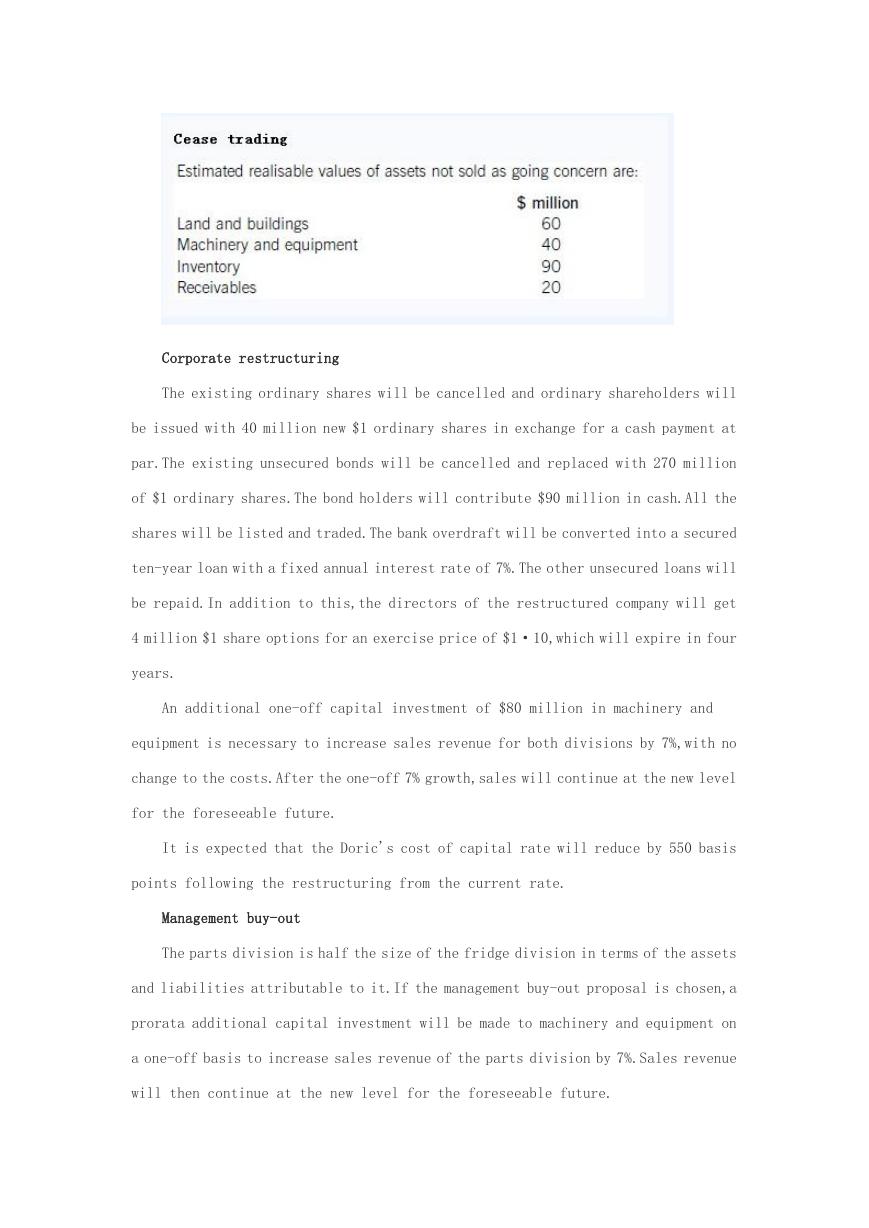

1.To cease trading and close down the company entirely.

2.To undertake corporate restructuring in order to reduce the level of debt and

obtain the additional capital investment required to continue current operations.

3.To close the fridge division and continue the parts division through a

leveraged management buy-out,involving some executive directors and managers from

the parts division.The new company will then pursue its original parts business as

well as the development of the parts for mobile refrigeration business,described

above.All the current and long-term liabilities will be initially repaid using the

proceeds from the sale of the fridge division.The finance raised from the management

buy-out will pay for any remaining liabilities,the additional capital investment

required to continue operations and re-purchase the shares at a premium of 20%.

The following information has been provided for each proposal:

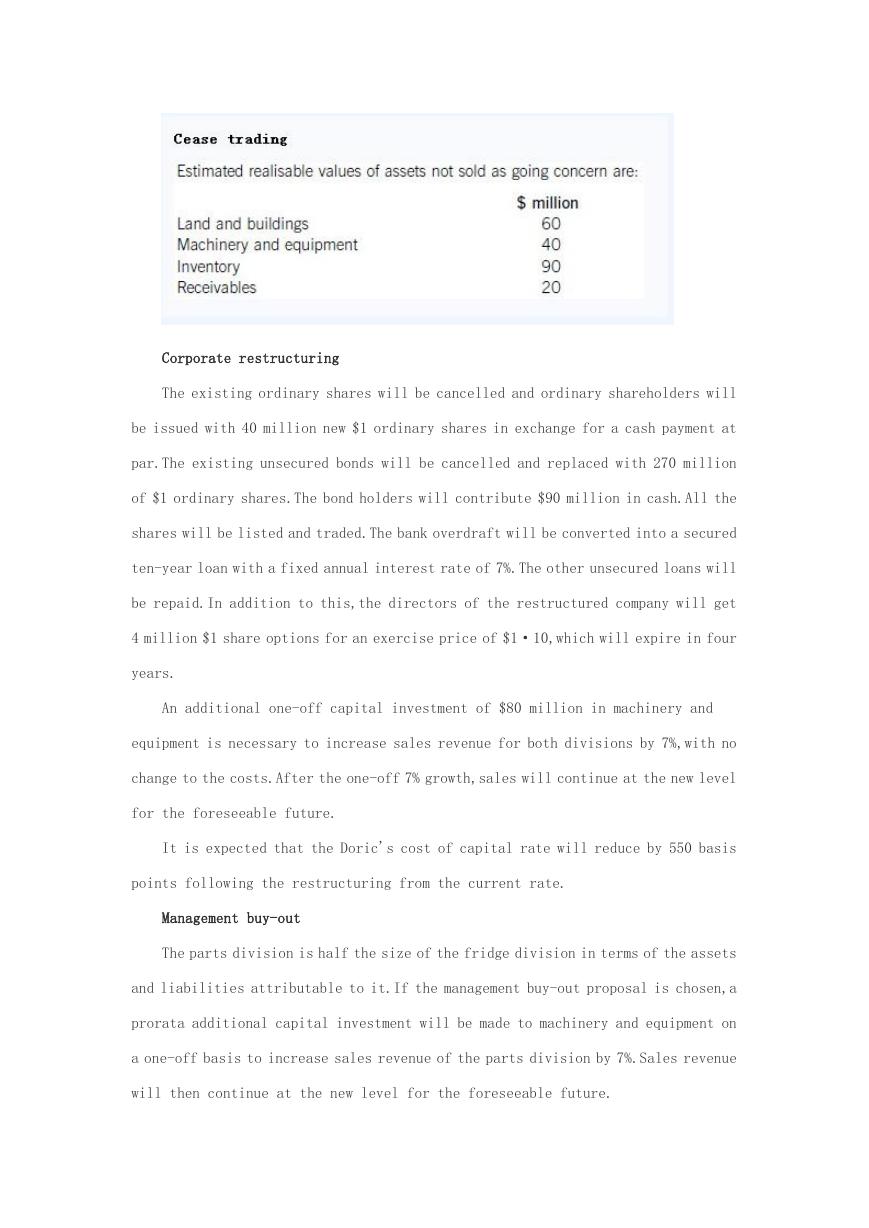

�

Corporate restructuring

The existing ordinary shares will be cancelled and ordinary shareholders will

be issued with 40 million new $1 ordinary shares in exchange for a cash payment at

par.The existing unsecured bonds will be cancelled and replaced with 270 million

of $1 ordinary shares.The bond holders will contribute $90 million in cash.All the

shares will be listed and traded.The bank overdraft will be converted into a secured

ten-year loan with a fixed annual interest rate of 7%.The other unsecured loans will

be repaid.In addition to this,the directors of the restructured company will get

4 million $1 share options for an exercise price of $1·10,which will expire in four

years.

An additional one-off capital investment of $80 million in machinery and

equipment is necessary to increase sales revenue for both divisions by 7%,with no

change to the costs.After the one-off 7% growth,sales will continue at the new level

for the foreseeable future.

It is expected that the Doric's cost of capital rate will reduce by 550 basis

points following the restructuring from the current rate.

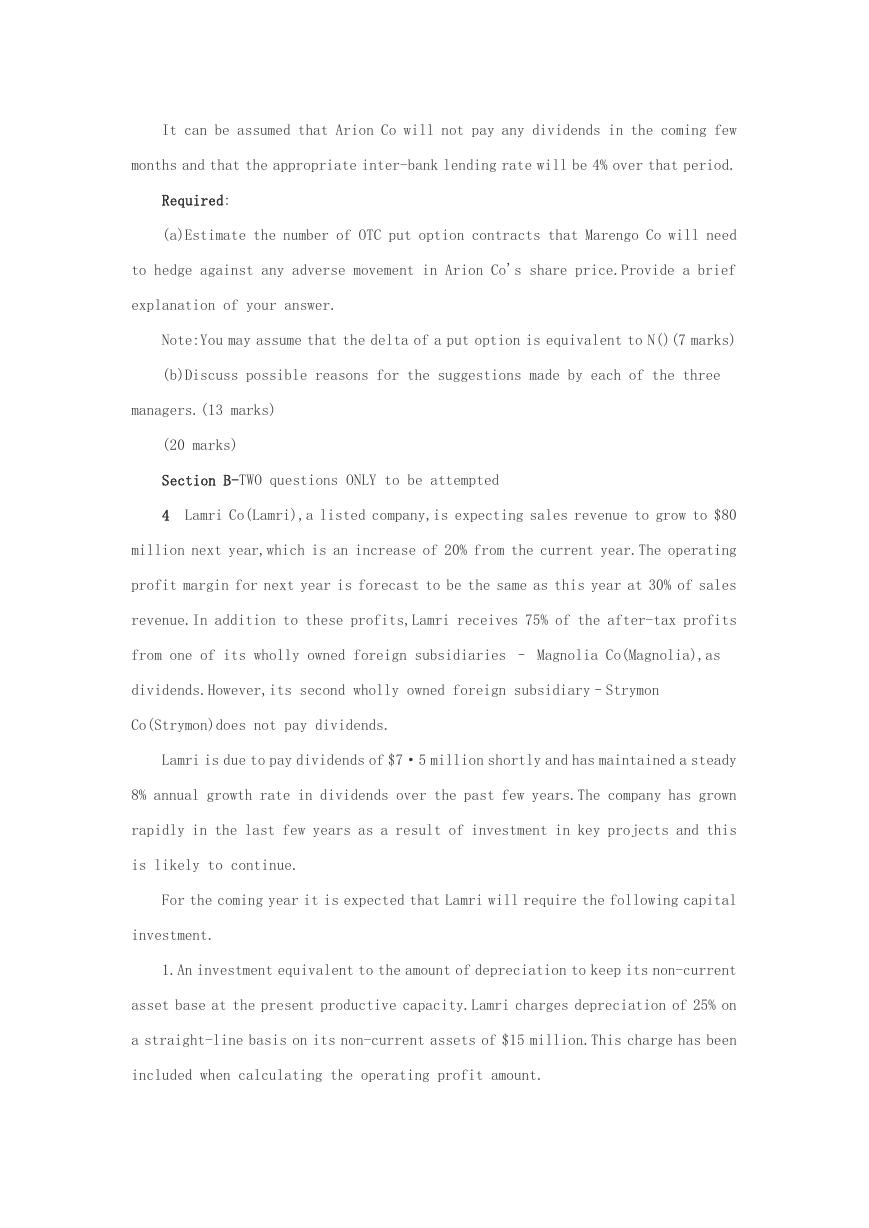

Management buy-out

The parts division is half the size of the fridge division in terms of the assets

and liabilities attributable to it.If the management buy-out proposal is chosen,a

prorata additional capital investment will be made to machinery and equipment on

a one-off basis to increase sales revenue of the parts division by 7%.Sales revenue

will then continue at the new level for the foreseeable future.

�

All liabilities categories have equal claim for repayment against the company's

assets.

It is expected that Doric's cost of capital rate will decrease by 100 basis points

following the management buy-out from the current rate.

5.Fubuki Co will need to make working capital available of 15% of the anticipated

sales revenue for the year,at the beginning of each year.The working capital is

expected to be released at the end of the fourth year when the project is sold.

Fubuki Co's tax rate is 25% per year on taxable profits.Tax is payable in the

same year as when the profits are earned.Tax allowable depreciation is available

on the plant and machinery on a straight-line basis.It is anticipated that the value

attributable to the plant and machinery after four years is $400,000 of the price

at which the project is sold.No tax allowable depreciation is available on the

premises.

Fubuki Co uses 8% as its discount rate for new projects but feels that this rate

may not be appropriate for this new type of investment.It intends to raise the full

amount of funds through debt finance and take advantage of the government's offer

of a subsidised loan.Issue costs are 4% of the gross finance required.It can be

assumed that the debt capacity available to the company is equivalent to the actual

amount of debt finance raised for the project.

Although no other companies produce mobility vehicles in Megaera,Haizum Co,a

listed company,produces electrical-powered vehicles using similar technology to

that required for the mobility vehicles.Haizum Co's cost of equity is estimated to

be 14% and it pays tax at 28%.Haizum Co has 15 million shares in issue trading at

$2·53 each and $40 million bonds trading at $94·88 per $100.The five-year government

debt yield is currently estimated at 4·5% and the market risk premium at 4%.

Required:

(a)Evaluate,on financial grounds,whether Fubuki Co should proceed with the

project.(17 marks)

�

(b)Discuss the appropriateness of the evaluation method used and explain any

assumptions made in part (a)above.(8 marks)

(25 marks)

Section B-TWO questions ONLY to be attempted

3

The treasury division of Marengo Co,a large quoted company,holds equity

investments in various companies around the world.One of the investments is in Arion

Co,in which Marengo holds 200,000 shares,which is around 2% of the total number of

Arion Co's shares traded on the stock market.Over the past year,due to the general

strength in the equity markets following optimistic predictions of the performance

of world economies,Marengo's investments have performed well.However,there is some

concern that the share price of Arion Co may fall in the coming two months due to

uncertainty in its markets.It is expected that any fall in share prices will be

reversed following this period of uncertainty.

The treasury division managers in Marengo,Wenyu,Lola and Sam,held a meeting to

discuss what to do with the investment in Arion Co and they each made a different

suggestion as follows:

1.Wenyu was of the opinion that Marengo's shareholders would benefit most if

no action were taken.He argued that the courses of action proposed by Lola and

Sam,below,would result in extra costs and possibly increase the risk to Marengo Co.

2.Lola proposed that Arion Co's shares should be sold in order to eliminate the

risk of a fall in the share price.

3.Sam suggested that the investment should be hedged using an appropriate

derivative product.

Although no exchange-traded derivative products exist on Arion Co's shares,a

bank has offered over-the-counter (OTC)

option contracts at an exercise price of 350 cents per share in a contract size

of 1,000 shares each,for the appropriate time period.Arion Co's current share price

is 340 cents per share,although the volatility of the share prices could be as high

as 40%.

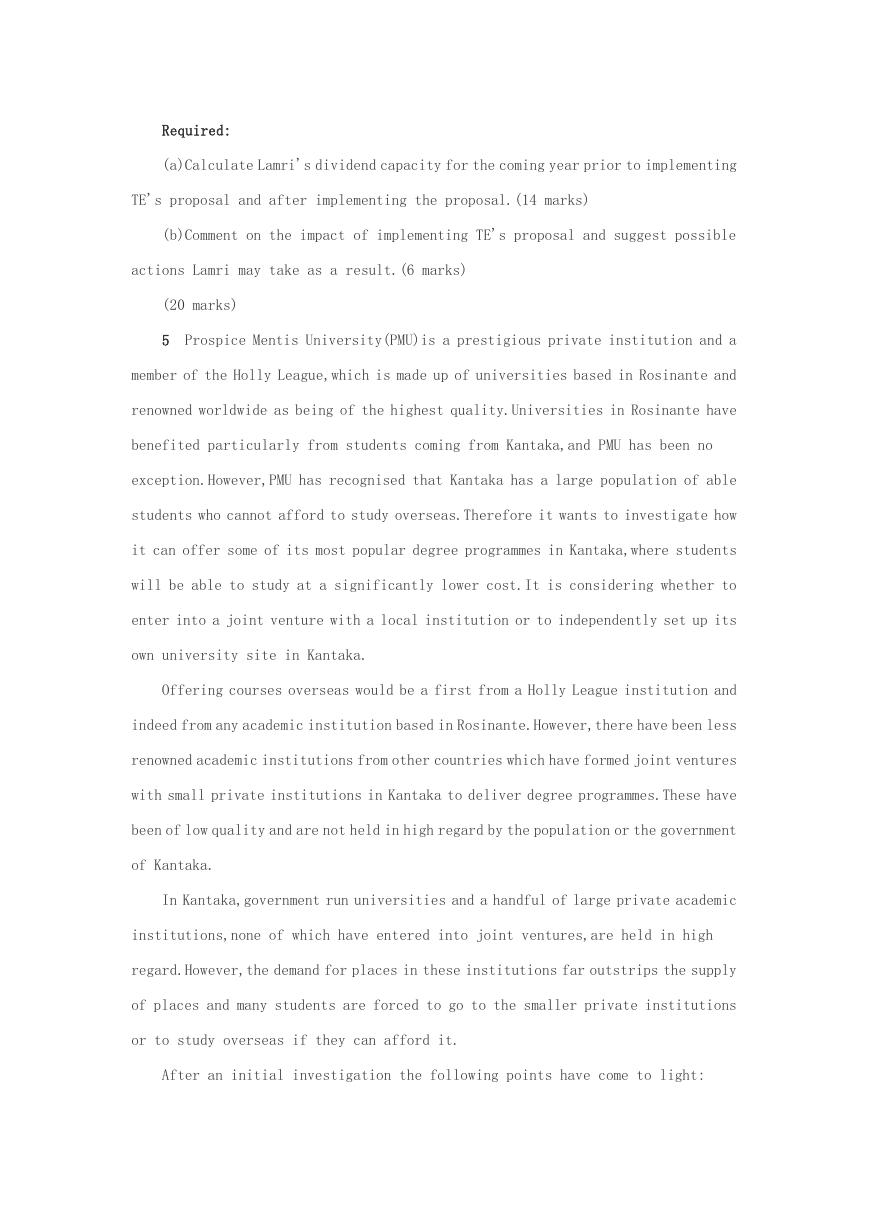

�

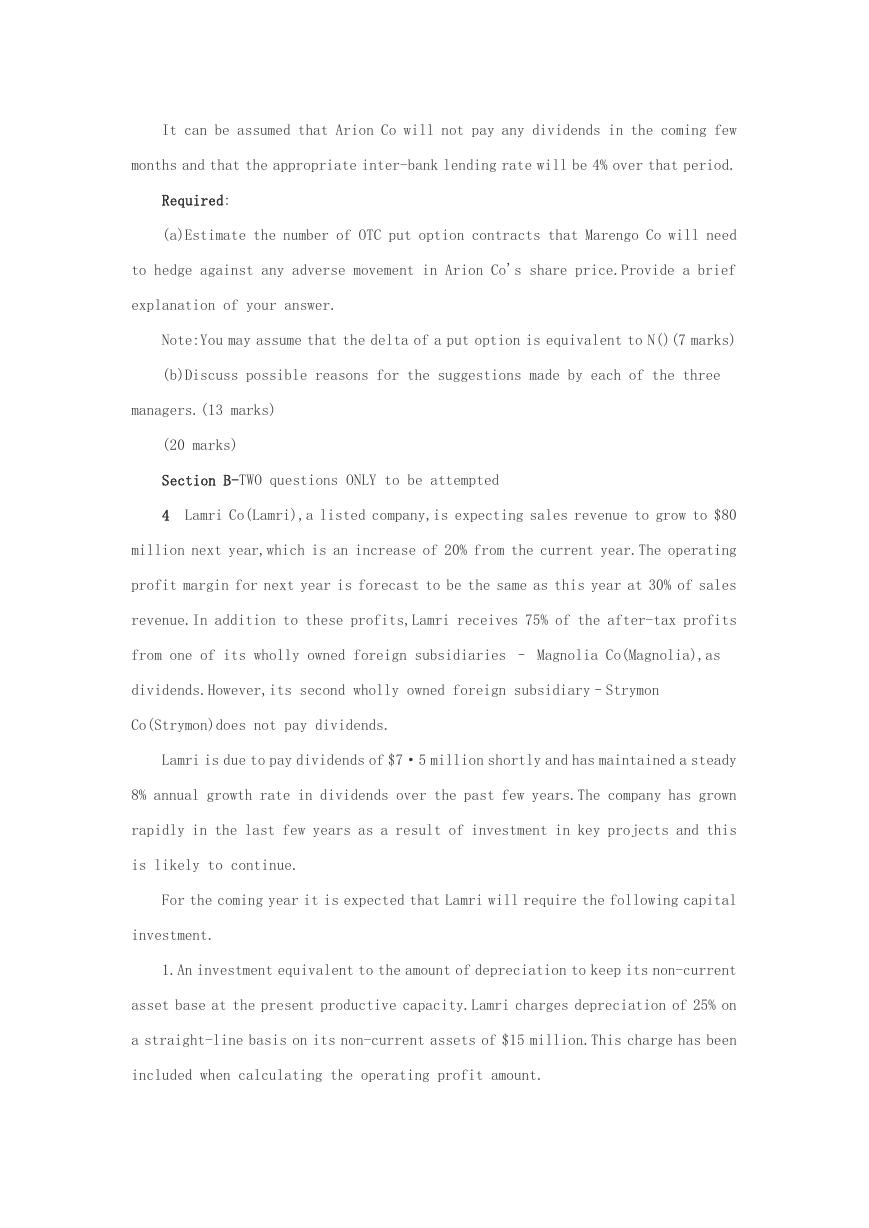

It can be assumed that Arion Co will not pay any dividends in the coming few

months and that the appropriate inter-bank lending rate will be 4% over that period.

Required:

(a)Estimate the number of OTC put option contracts that Marengo Co will need

to hedge against any adverse movement in Arion Co's share price.Provide a brief

explanation of your answer.

Note:You may assume that the delta of a put option is equivalent to N()(7 marks)

(b)Discuss possible reasons for the suggestions made by each of the three

managers.(13 marks)

(20 marks)

Section B-TWO questions ONLY to be attempted

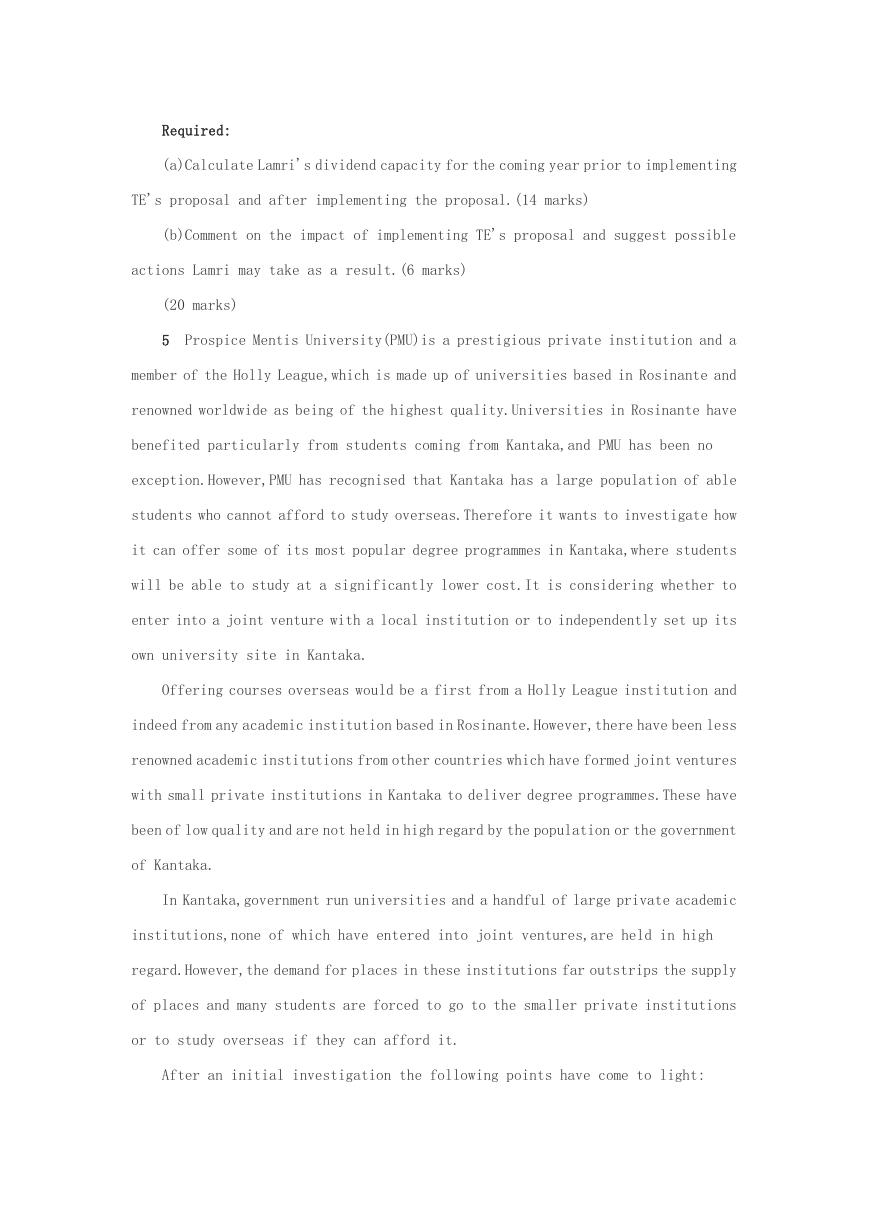

4

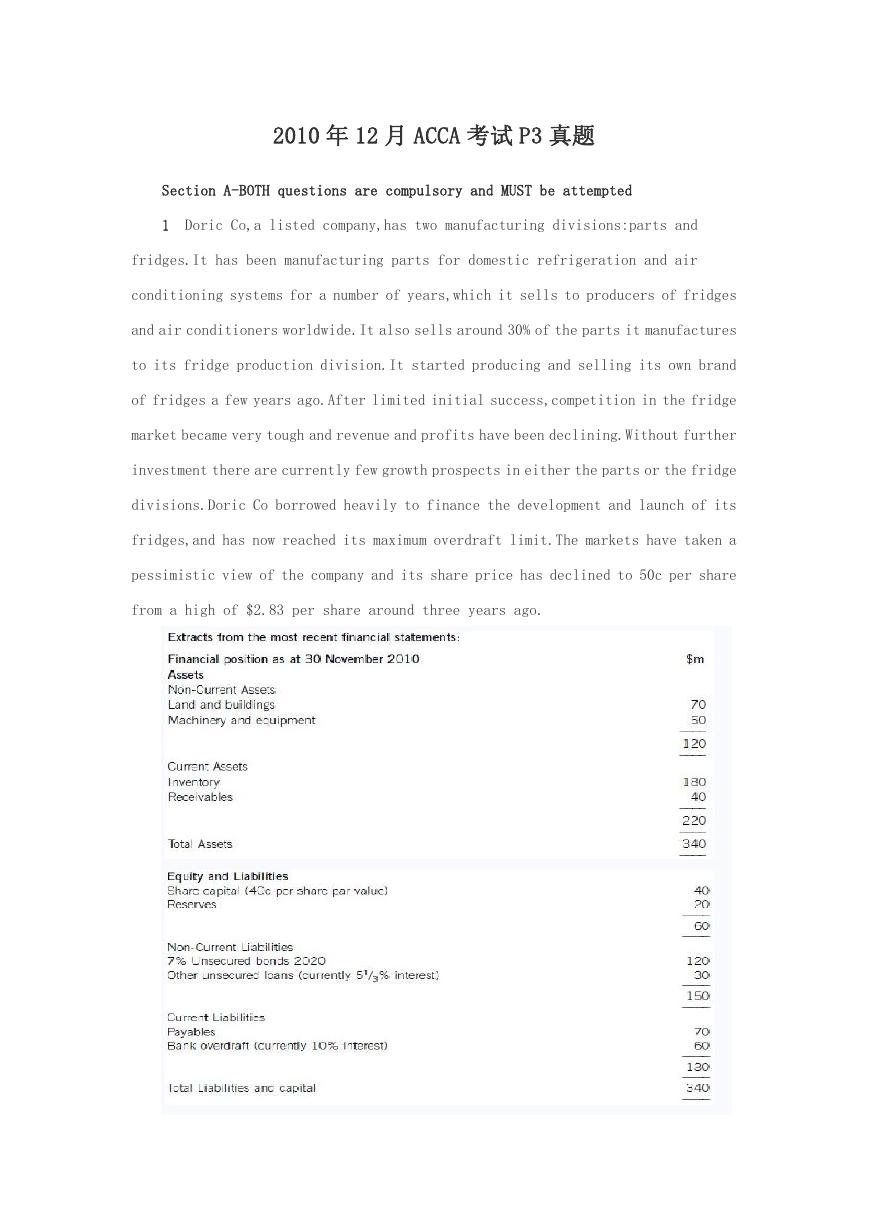

Lamri Co(Lamri),a listed company,is expecting sales revenue to grow to $80

million next year,which is an increase of 20% from the current year.The operating

profit margin for next year is forecast to be the same as this year at 30% of sales

revenue.In addition to these profits,Lamri receives 75% of the after-tax profits

from one of its wholly owned foreign subsidiaries – Magnolia Co(Magnolia),as

dividends.However,its second wholly owned foreign subsidiary–Strymon

Co(Strymon)does not pay dividends.

Lamri is due to pay dividends of $7·5 million shortly and has maintained a steady

8% annual growth rate in dividends over the past few years.The company has grown

rapidly in the last few years as a result of investment in key projects and this

is likely to continue.

For the coming year it is expected that Lamri will require the following capital

investment.

1.An investment equivalent to the amount of depreciation to keep its non-current

asset base at the present productive capacity.Lamri charges depreciation of 25% on

a straight-line basis on its non-current assets of $15 million.This charge has been

included when calculating the operating profit amount.

�

2.A 25% investment in additional non-current assets for every $1 increase in

sales revenue.

3.$4·5 million additional investment in non-current assets for a new project.

Lamri also requires a 15% investment in working capital for every $1 increase

in sales revenue.Strymon produces specialist components solely for Magnolia to

assemble into finished goods.Strymon will produce 300,000 specialist components at

$12 variable cost per unit and will incur fixed costs of $2·1 million for the coming

year.It will then transfer the components to Magnolia at full cost price,where they

will be assembled at a cost of $8 per unit and sold for $50 per unit.Magnolia will

incur additional fixed costs of $1·5 million in the assembly process.

Tax-Ethic(TE)is a charitable organisation devoted to reducing tax avoidance

schemes by companies operating in poor countries around the world.TE has petitioned

Lamri's Board of Directors to reconsider Strymon's policy of transferring goods at

full cost.TE suggests that the policy could be changed to cost plus 40% mark-up.If

Lamri changes Strymon's policy,it is expected that Strymon would be asked to remit

75% of its after-tax profits as dividends to Lamri.

Section B-TWO questions ONLY to be attempted

Other Information

1.Lamri's outstanding non-current liabilities of $35 million,on which it pays

interest of 8% per year,and its 30 million $1 issued equity capital will not change

for the coming year.

2.Lamri's,Magnolia's and Strymon's profits are taxed at 28%,22% and 42%

respectively.A withholding tax of 10% is deducted from any dividends remitted from

Strymon.

3.The tax authorities where Lamri is based charge tax on profits made by

subsidiary companies but give full credit for tax already paid by overseas

subsidiaries.

4.All costs and revenues are in $ equivalent amounts and exchange rate

fluctuations can be ignored.

�

Required:

(a)Calculate Lamri's dividend capacity for the coming year prior to implementing

TE's proposal and after implementing the proposal.(14 marks)

(b)Comment on the impact of implementing TE's proposal and suggest possible

actions Lamri may take as a result.(6 marks)

(20 marks)

5

Prospice Mentis University(PMU)is a prestigious private institution and a

member of the Holly League,which is made up of universities based in Rosinante and

renowned worldwide as being of the highest quality.Universities in Rosinante have

benefited particularly from students coming from Kantaka,and PMU has been no

exception.However,PMU has recognised that Kantaka has a large population of able

students who cannot afford to study overseas.Therefore it wants to investigate how

it can offer some of its most popular degree programmes in Kantaka,where students

will be able to study at a significantly lower cost.It is considering whether to

enter into a joint venture with a local institution or to independently set up its

own university site in Kantaka.

Offering courses overseas would be a first from a Holly League institution and

indeed from any academic institution based in Rosinante.However,there have been less

renowned academic institutions from other countries which have formed joint ventures

with small private institutions in Kantaka to deliver degree programmes.These have

been of low quality and are not held in high regard by the population or the government

of Kantaka.

In Kantaka,government run universities and a handful of large private academic

institutions,none of which have entered into joint ventures,are held in high

regard.However,the demand for places in these institutions far outstrips the supply

of places and many students are forced to go to the smaller private institutions

or to study overseas if they can afford it.

After an initial investigation the following points have come to light:

�

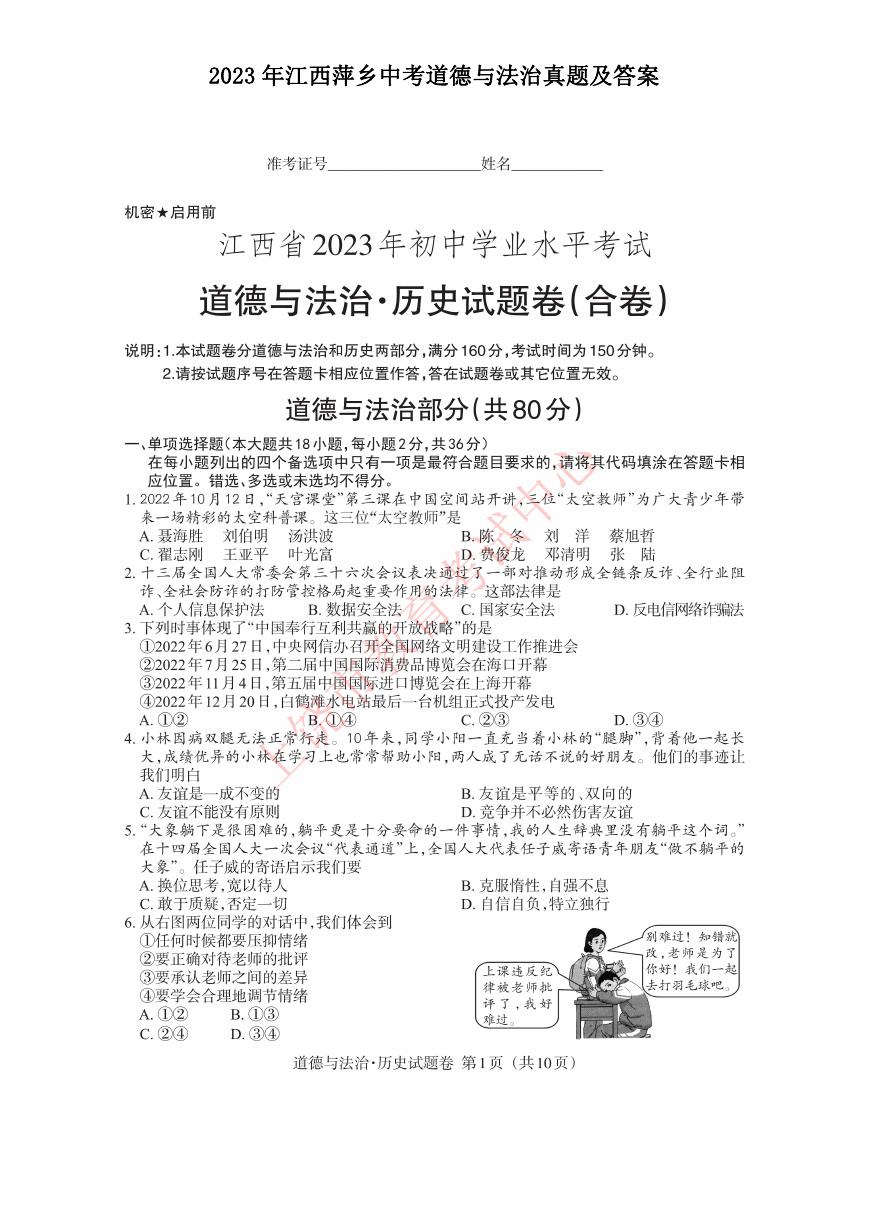

2023年江西萍乡中考道德与法治真题及答案.doc

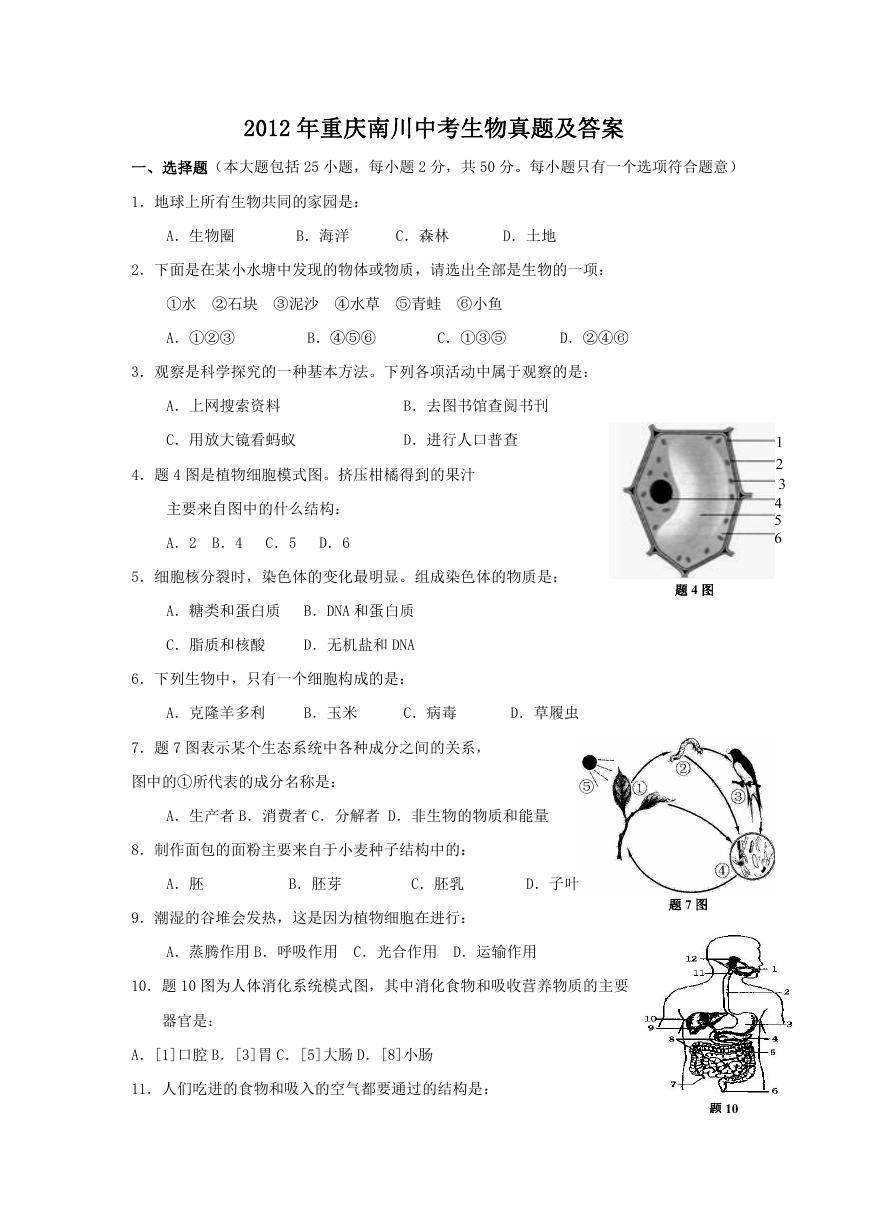

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

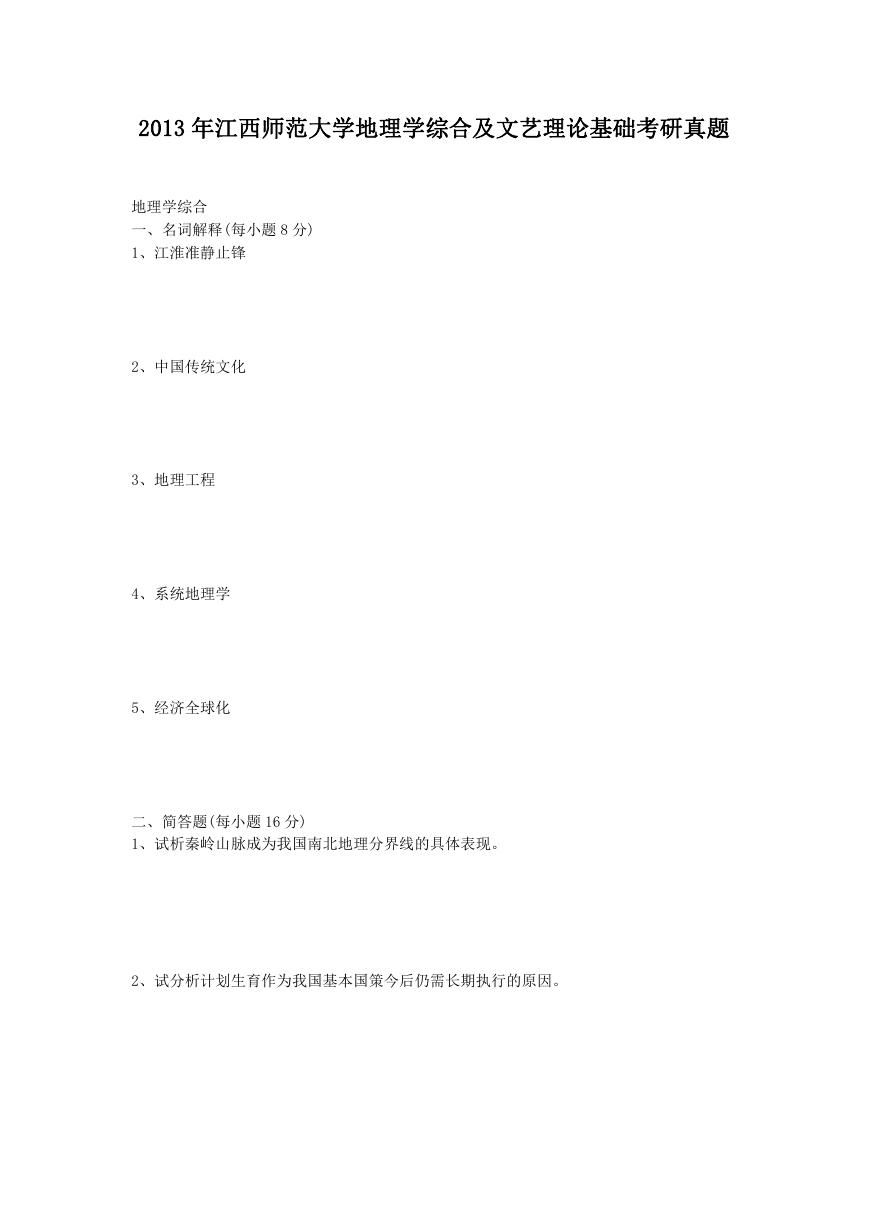

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

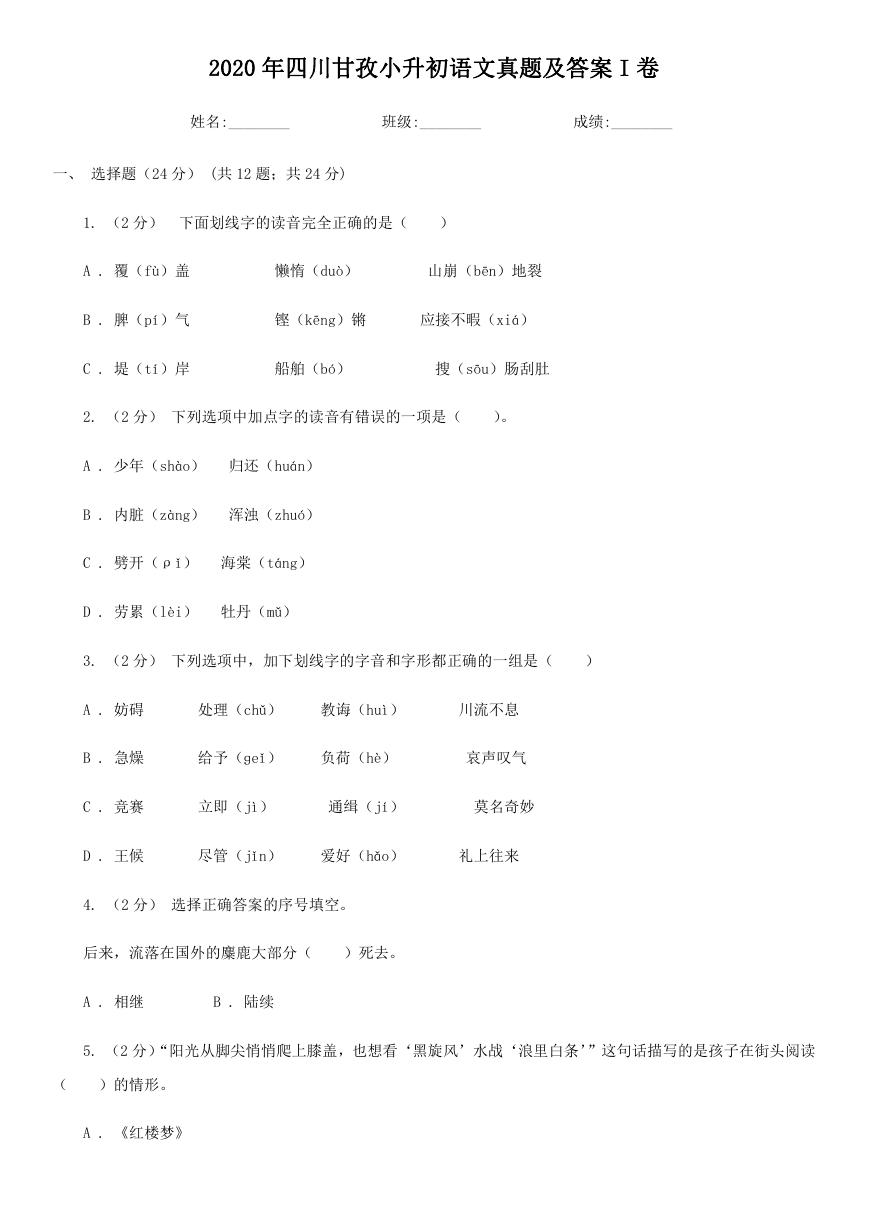

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

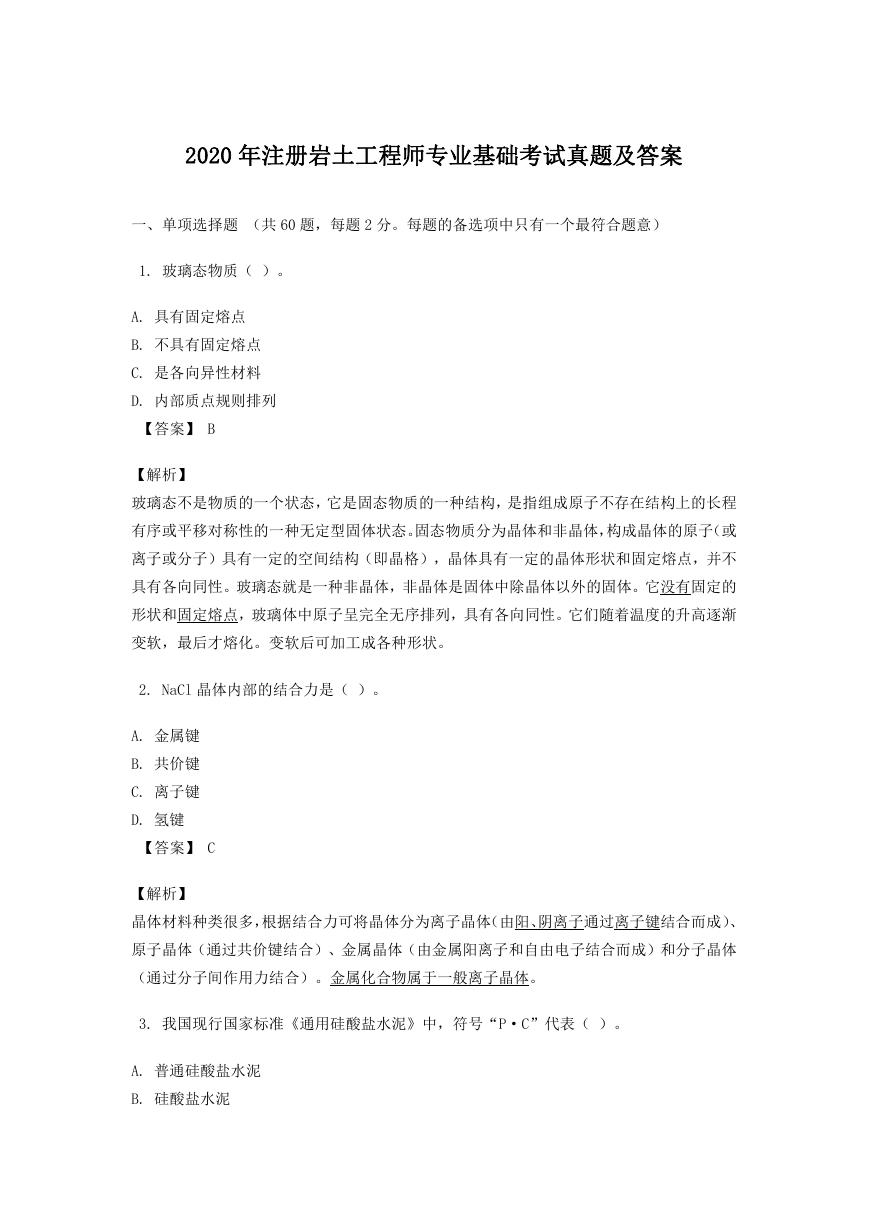

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

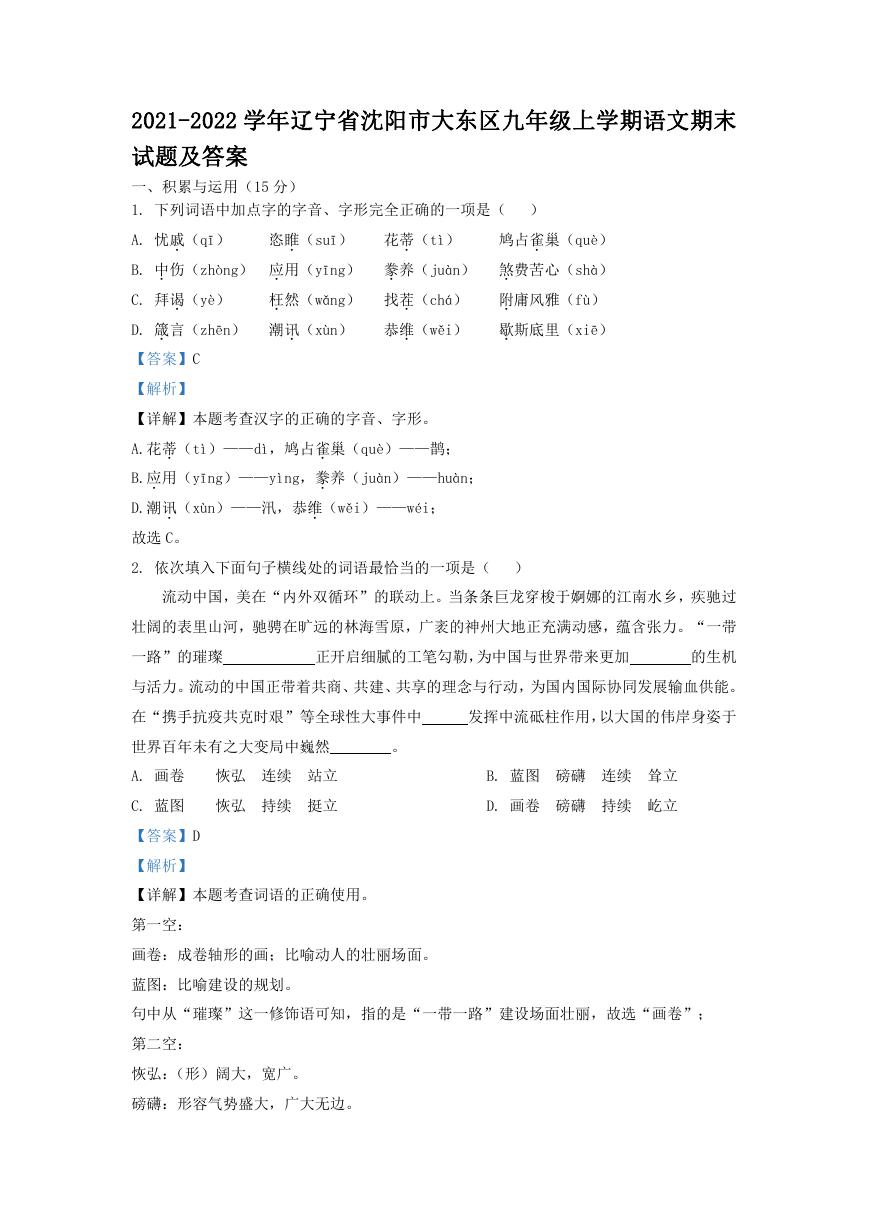

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

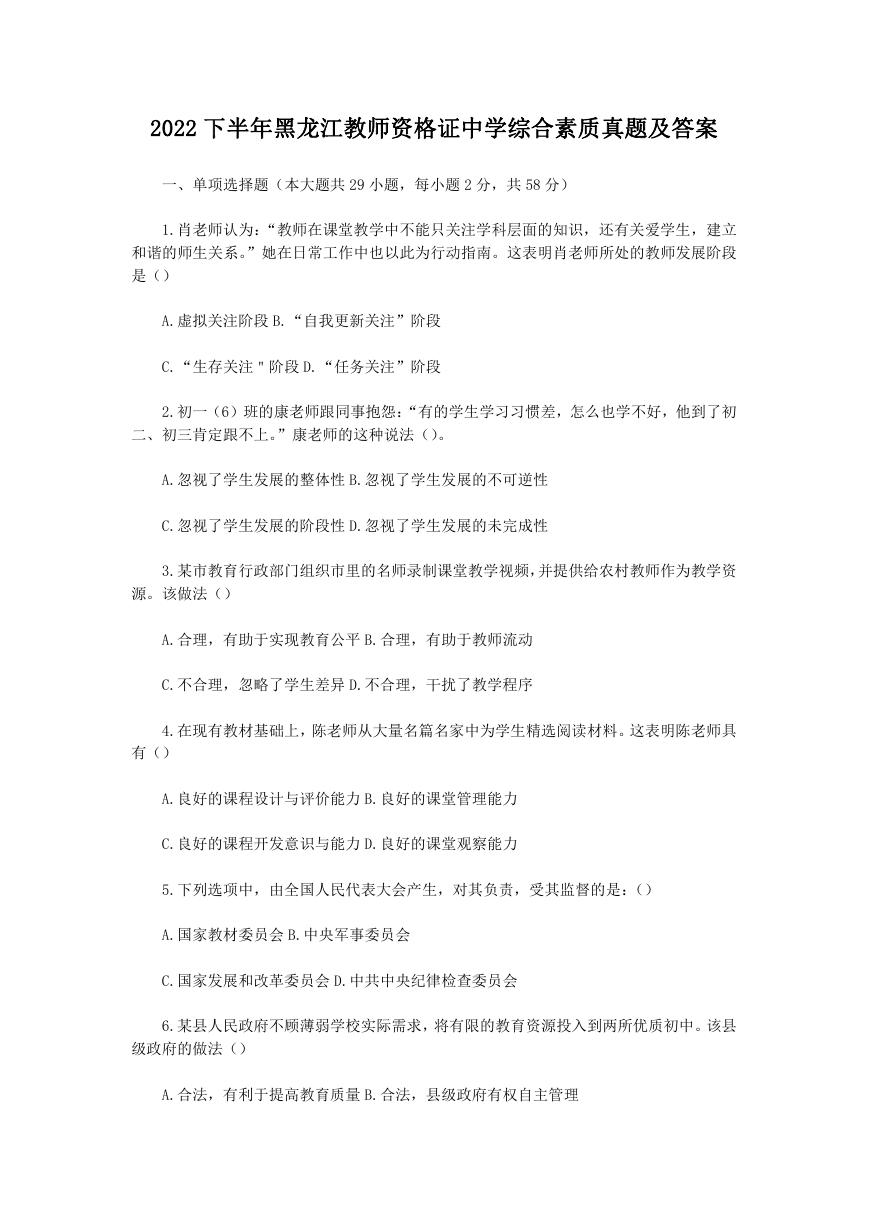

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc