Application of Cluster-Based Local Outlier Factor

Algorithm in Anti-Money Laundering

Gao Zengan

Post Doctoral Station of Theoretical Economics

China Center for Anti-Money Laundering Studies

Fudan University

Shanghai, P. R. China

School of Economics and Management

Southwest Jiaotong University

Chengdu, P. R. China

E-mail address: gaozengan133@163.com

institutions’ capability

Abstract—Financial

in recognizing

suspicious money laundering transactional behavioral patterns

(SMLTBPs) is critical to anti-money laundering. Combining

distance-based unsupervised clustering and

local outlier

detection, this paper designs a new cluster-based local outlier

factor (CBLOF) algorithm to identify SMLTBPs and use

authentic and synthetic data experimentally

its

applicability and effectiveness.

test

to

Keywords-clustering; outlier detection; local outlier factor

(LOF); suspicious money laundering transactional behavioral

patterns (SMLTBPs); anti-money laundering (AML)

I. INTRODUCTION

Anti-money laundering (AML) in financial industry is

based on the analysis and processing of Suspicious Activity

Reports (SARs) filed by financial institutions (FIs), but the

very

large number of SARs usually makes financial

intelligence units’ (FIUs’) analysis a waste of time and

resources simply because only a few transactions are really

suspicious in a given amount [1], so financial AML is far from

a real-time, dynamic, and self-adaptable recognition of

suspicious money laundering transactional behavioral patterns

(SMLTBPs). Literature review finds that artificial intelligence

[2], support vector machine (SVM) [3], outlier detection [4],

and break-point analysis (BPA) [5] are used to improve FIs’

ability in processing suspicious data, various approaches to

novelty detection on time series data are examined in [6],

outlier detection methodologies are surveyed by [7], and a

data mining-based framework for AML research is proposed

in [8] after a comprehensive comment is made on relative

studies. But the effectiveness and efficiency of SMLTBP

identification remains a hot spot for research since the passage

of the USA Patriot Act and the creation of the U.S.

Department of Homeland Security signaled a new era in

applying information technology and data mining in detecting

money laundering and terrorist financing [9].

As SMLTBP recognition is short of training data, the

number of clusters is usually unknown, and the result of

clustering is always changing dynamically [10, 11], this paper

designs a cluster-based local outlier factor (CBLOF) algorithm

to help FIUs concentrate on a desirable number of SMLTBPs

having a proper degree of suspiciousness as determined by

their actual needs and resources endowments. Following the

introduction, Section II describes the design of the algorithm,

Section III is about the experimental process, and Section IV

ends the paper with a suggestion for future research.

II. ALGORITHM DESIGN

combines

algorithm

The CBLOF

distance-based

unsupervised clustering and local outlier [12] detection, and

clustering is for the purpose of pre-processing data for the

consequent anomaly identification.

A. Clustering

As far as the nature of money laundering (ML) is

concerned, the chosen clustering algorithm should be able to

generate the number of clusters automatically (with no need

for pre-establishment) and all the clusters are to be ranked

according to the number of the components in each. Thus we

propose the following procedures:

1) Start with any object (say p) in a dataset and create a

cluster. The initial cluster is supposed to be C1.

2) Choose any other object q, calculate its distance to the

existing clusters C1, C2, C3, …, Ci and denote it by

distance q Ci

, and then figure out the minimal distance

( ,

value

( ,

distance q Cmin .

)

)

3) Let the threshold be ε. If

distance q Cmin ε≤ holds

and “q has never been clustered” satisfies, add q to the cluster

Ci which is assumed to be nearest to q when compared with all

( ,

)

The research is supported by the National Social Science Foundation of China (No. 08BGJ013).

978-1-4244-4639-1/09/$25.00 ©2009 IEEE

�

( ,

distance q Cmin ε> ,

the other known clusters. Conversely, if

implying that q has not yet been clustered into any category,

build a new cluster Cj and embed q into it. Nevertheless,

distance q Cm ε≤ ,

suppose there is a cluster Cm outside Ci, if

then integrate Cm and Ci into one cluster, that is, if we have

distance q Cm ε≤ and

distance q Ci ε≤ simultaneously,

then clusters Cm and Ci are merged into one.

( ,

( ,

( ,

)

)

)

)

4) Repeat Steps 2) and 3) until all the objects have been

clustered.

5) Rank all the clusters in the decreasing number of their

components involved.

B. Outlier Detection

An outlier is a point that deviates so much from

surrounding “normal” points as to arouse suspicion that it was

generated by a different mechanism. After clustering, all the

samples have been categorized into mutually exclusive

clusters ranked as per the number of their components. As

most transactions in an account are usually normal or legal,

the clusters generated from above are divided into Large

Category (LC) and Small Category (SC) in this paper, with the

former being supposed to represent normal transactional

behavioral patterns free of ML suspicion and the latter, on the

contrary, for anomalous patterns worth notice.

+

1

C

b

for LC, that is,

}

b

c i

{

i

>

b

}

≤

=

where

and

c

=

. While (1) represents the majority of the

SC

c j

{

j

objects in the dataset, (2) indicates that the number of LC

components is greatly different from that of SC components.

c i

i

LC

=

≤

b

{

}

Furthermore, the points in SC are all outliers when

compared with those in LC [13, 14]. But for AML research,

seasonal industries and some special industries must be

exempted because abnormal phenomena in a particular period

can never be treated as ML red flags. So the paper will study n

number of data points with top local outlier factor (LOF)

values because they are more of ML suspicion. Also, this can

effectively improve AML pertinence.

In the light of the local outlier definition in [12], LOF can

be employed to measure the deviant degree of SC points from

LC, i.e., how far the transactional behavioral patterns

represented by the points in SC deviate from the normal or

legitimate patterns, where LOF value is determined by the

number of the components in the clusters sample data belong

to and the distance from sample data to the nearest LC.

Given a point o in the dataset, its LOF value is:

LOF( o )

=

∗

c min[distance( o,c )]

i

i

(3)

2

k

,

c

}

of

c

the

,

dataset D,

For

{

=

c c

,

1

clustering

c

c

and 1

let

> . Given any two

result

>

C

parameters α and β, we have:

+

≥ (2)

β

(1)

D α

= ∑

c

C

b

T a

c

b

ta

+

+

≥

∗

c

ij

=

n

1

2

1

2

k

i

j

j

o

∈

∈

LC

c c

,

i

i

the farther

∈

SC c

,

the point o deviates from

. The higher the LOF value

where

the normal

is,

transactional behavioral patterns. Once the LOF value is fixed

for each object, we can get to know how suspicious the

transactional behavioral patterns are in the given account.

Rank the data points as per their LOF values, we can get a

feature-oriented ordering of SMLTBPs to help FIs choose n

number of objects as they like for a detailed exploration and

finally determine what to file to FIUs under the restraints of

investigation resources in labor, capital, and technology, etc.

III. EXPERIMENTAL PROCESS

The experimental process mainly includes extracting

research variables, preparing data samples, actualize the

algorithm, and discussing the experimental results.

A. Choose and Define the Features to Be Studied

We are more interested in the transactional behavioral

attributes like amount and frequency than in the account

owner’s subjective characters,

transaction amount,

transaction amount deviation coefficiency, and transaction

frequency (i.e., withdrawal frequency and deposit frequency)

are chosen to be research variables with the following

definitions:

thus

Definition 1: Transaction amount (Tai) is the total amount

of all the transactional segments or subsequences, that is,

(4)

where, Tai is the transaction amount of the ith transactional

segment of a given account, Taij is the amount of the jth

transaction in the ith segment (and so and so forth hereinafter).

Transaction amount is a critical criterion for us to determine

whether a transaction is suspicious or not since a large cash

transaction is viewed as a special kind of suspicious

transaction in this research.

Definition 2: Transaction amount deviation coefficiency

2)

(Tadi) is the ratio between transaction amount variation (Tsi

and average transaction amount (

2

Ts

i

=

Tad

i

=

n

i

−

n

i

1

•

Ta

i

iTa ), that is,

∑

Ta

i

ta

ij

−

(

)

in

=

1

j

n

∑

=

1

j

ta

ij

2

(5)

Tadi is used to measure the degree of equalization of

transaction amount (i.e., structuring) which means a large cash

transaction, either deposit or withdrawal, is purposefully

divided into several transactions of a nearly equal amount in

order to exempt from filing Currency Transaction Reports

(CTRs) as required by the authority. The less the Tadi value is,

the more equalized the transaction amount is, and the more

suspicious the transaction is as far as CTR regulations are

concerned.

Definition 3: Withdrawal/deposit frequency is the ratio of

�

the number of withdrawal/deposit transfers to the aggregated

frequency of transactions.

Denote

the withdrawal

the deposit

frequency of the ith transactional segment of a given account

by Tfwi and Tfdi, respectively, and denote the total frequency

of transactions by tf, we have the following formulas:

frequency and

t f

=

T f w

T f d

i

i

t f w

=

i

t f w

+

i

t f d

i

=

t f d

i

t f

t f

(6)

is

capital

centralized

Analyzing withdrawal frequency and deposit frequency

can identify two novel capital flows within a short time frame:

followed by

one

in-transfers

decentralized capital out-transfers, and

the other

is

decentralized capital in-transfers followed by centralized

out-transfers. Also, this analysis can compensate for the

research of [5].

B. Prepare Data Samples

Just like the authors of [6], we are most interested in data

patterns that deviate from the normal operational data. So

historical transaction records are to be transformed into

several segments or subsequences of neighboring single

transactions, with one segment (subsequence) representing

one behavioral pattern, and the transactional data embedded in

SMLTBPs are just the suspicious objects we hope to find out.

For each feature as above mentioned, calculate its feature

value for each segment and take the feature vectors composed

of feature values as research samples.

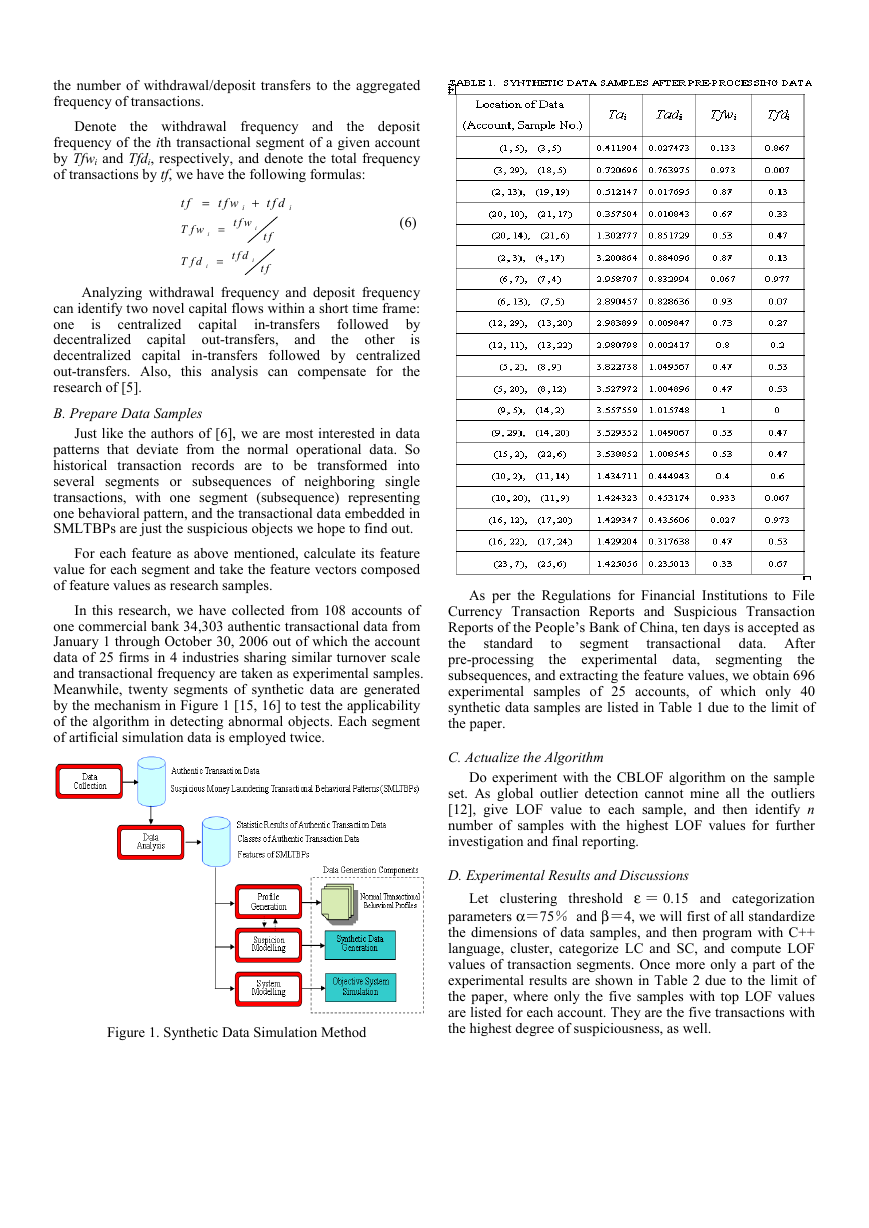

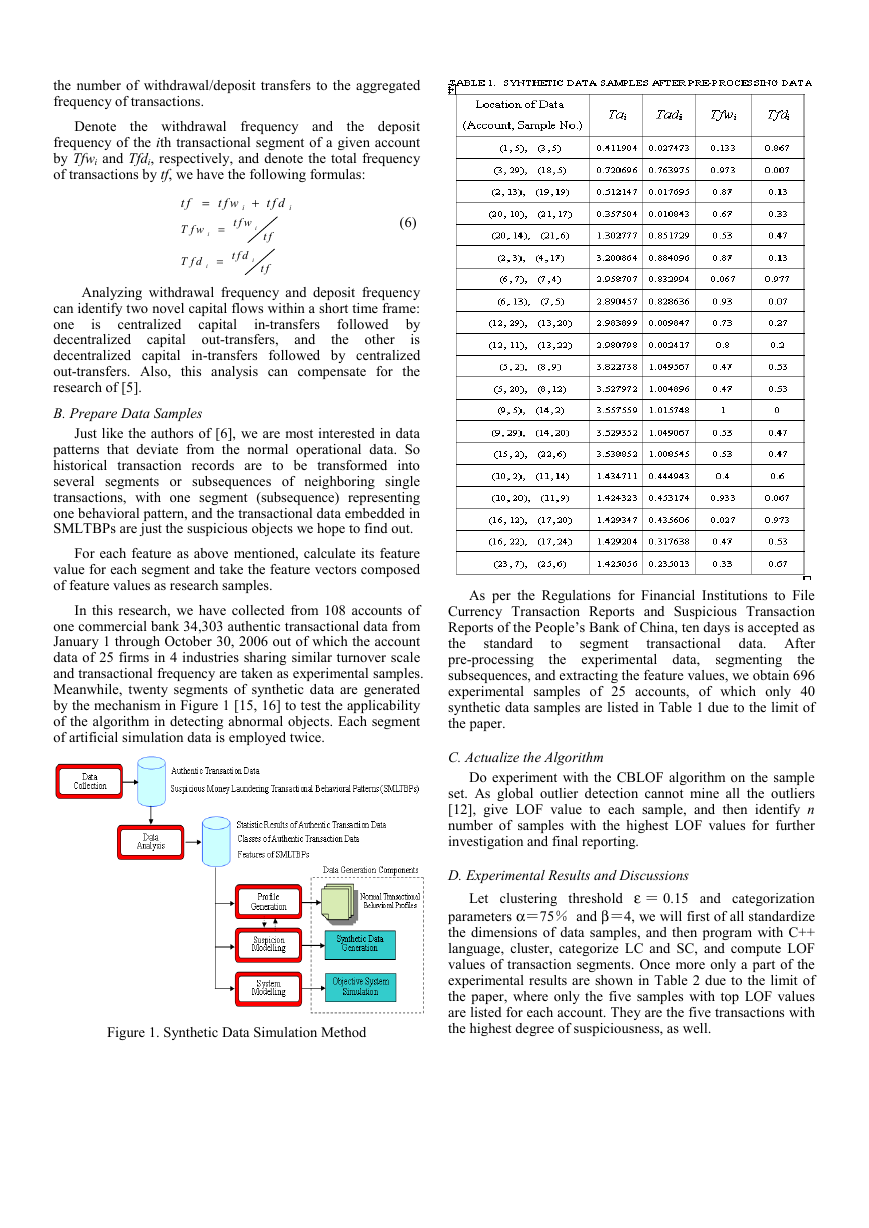

In this research, we have collected from 108 accounts of

one commercial bank 34,303 authentic transactional data from

January 1 through October 30, 2006 out of which the account

data of 25 firms in 4 industries sharing similar turnover scale

and transactional frequency are taken as experimental samples.

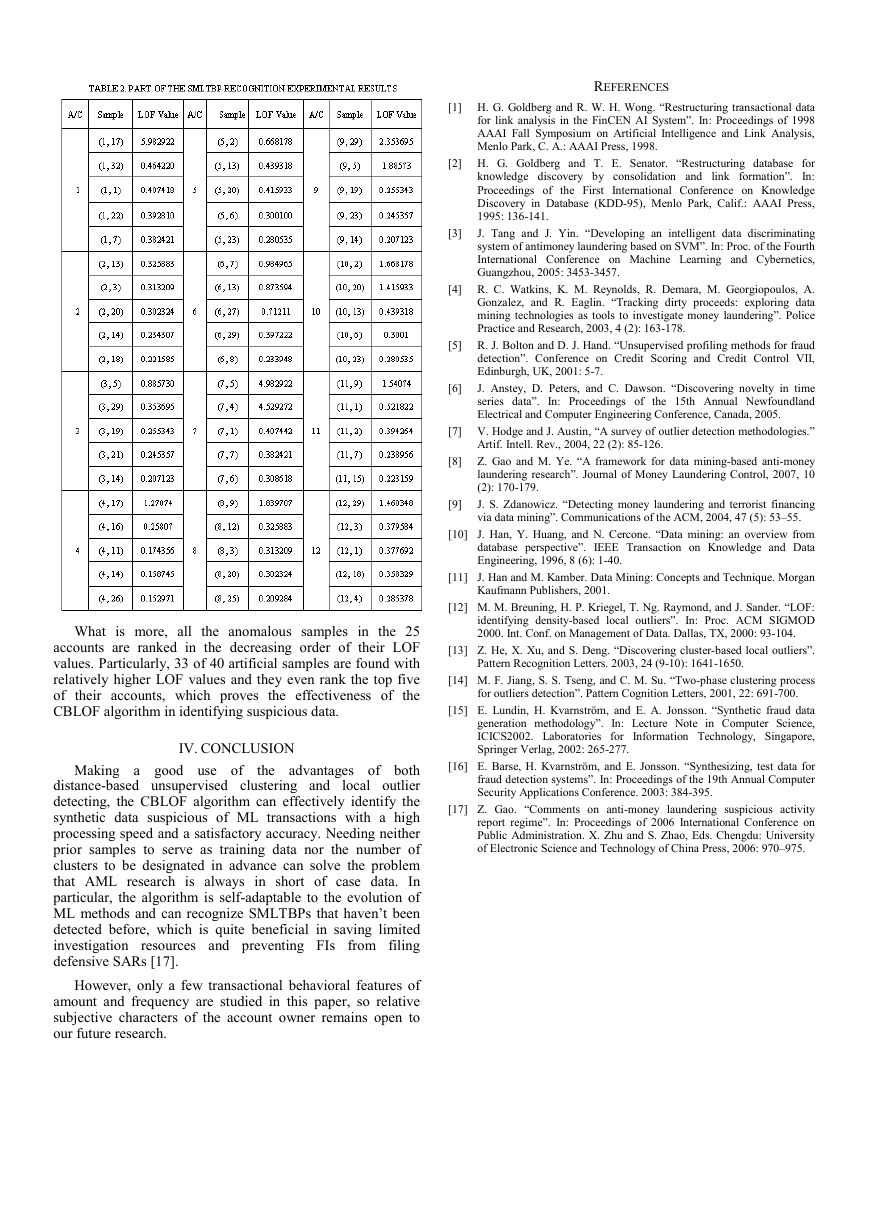

Meanwhile, twenty segments of synthetic data are generated

by the mechanism in Figure 1 [15, 16] to test the applicability

of the algorithm in detecting abnormal objects. Each segment

of artificial simulation data is employed twice.

As per the Regulations for Financial Institutions to File

Currency Transaction Reports and Suspicious Transaction

Reports of the People’s Bank of China, ten days is accepted as

transactional data. After

the

standard

pre-processing

the

subsequences, and extracting the feature values, we obtain 696

experimental samples of 25 accounts, of which only 40

synthetic data samples are listed in Table 1 due to the limit of

the paper.

to

the experimental data, segmenting

segment

C. Actualize the Algorithm

Do experiment with the CBLOF algorithm on the sample

set. As global outlier detection cannot mine all the outliers

[12], give LOF value to each sample, and then identify n

number of samples with the highest LOF values for further

investigation and final reporting.

D. Experimental Results and Discussions

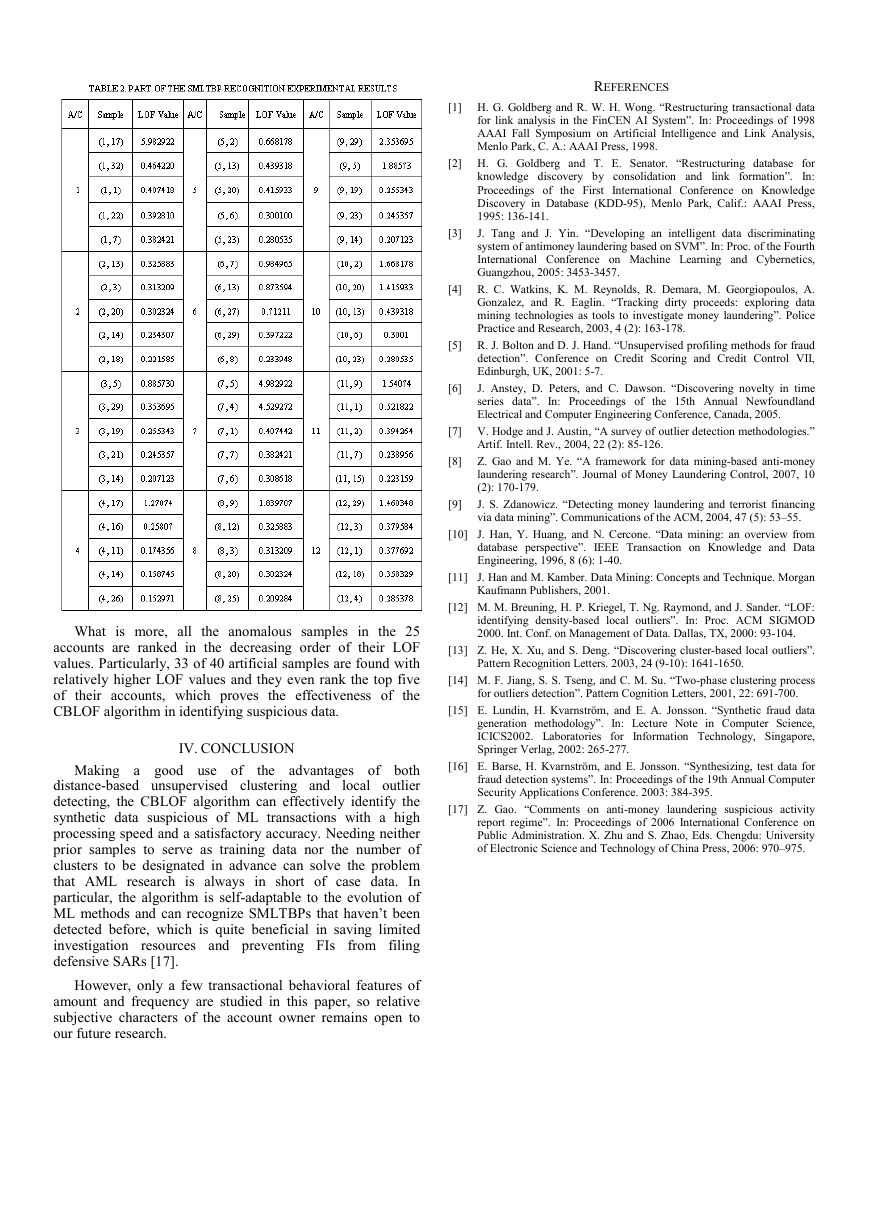

Let clustering threshold ε = 0.15 and categorization

parameters α=75% and β=4, we will first of all standardize

the dimensions of data samples, and then program with C++

language, cluster, categorize LC and SC, and compute LOF

values of transaction segments. Once more only a part of the

experimental results are shown in Table 2 due to the limit of

the paper, where only the five samples with top LOF values

are listed for each account. They are the five transactions with

the highest degree of suspiciousness, as well.

Figure 1. Synthetic Data Simulation Method

�

REFERENCES

[1] H. G. Goldberg and R. W. H. Wong. “Restructuring transactional data

for link analysis in the FinCEN AI System”. In: Proceedings of 1998

AAAI Fall Symposium on Artificial Intelligence and Link Analysis,

Menlo Park, C. A.: AAAI Press, 1998.

[2] H. G. Goldberg and T. E. Senator. “Restructuring database for

knowledge discovery by consolidation and link formation”. In:

Proceedings of the First International Conference on Knowledge

Discovery in Database (KDD-95), Menlo Park, Calif.: AAAI Press,

1995: 136-141.

J. Tang and J. Yin. “Developing an intelligent data discriminating

system of antimoney laundering based on SVM”. In: Proc. of the Fourth

International Conference on Machine Learning and Cybernetics,

Guangzhou, 2005: 3453-3457.

[3]

[4] R. C. Watkins, K. M. Reynolds, R. Demara, M. Georgiopoulos, A.

Gonzalez, and R. Eaglin. “Tracking dirty proceeds: exploring data

mining technologies as tools to investigate money laundering”. Police

Practice and Research, 2003, 4 (2): 163-178.

[5] R. J. Bolton and D. J. Hand. “Unsupervised profiling methods for fraud

detection”. Conference on Credit Scoring and Credit Control VII,

Edinburgh, UK, 2001: 5-7.

J. Anstey, D. Peters, and C. Dawson. “Discovering novelty in time

series data”. In: Proceedings of the 15th Annual Newfoundland

Electrical and Computer Engineering Conference, Canada, 2005.

[6]

[7] V. Hodge and J. Austin, “A survey of outlier detection methodologies.”

Artif. Intell. Rev., 2004, 22 (2): 85-126.

[8] Z. Gao and M. Ye. “A framework for data mining-based anti-money

laundering research”. Journal of Money Laundering Control, 2007, 10

(2): 170-179.

J. S. Zdanowicz. “Detecting money laundering and terrorist financing

via data mining”. Communications of the ACM, 2004, 47 (5): 53–55.

[9]

[10] J. Han, Y. Huang, and N. Cercone. “Data mining: an overview from

database perspective”. IEEE Transaction on Knowledge and Data

Engineering, 1996, 8 (6): 1-40.

[11] J. Han and M. Kamber. Data Mining: Concepts and Technique. Morgan

Kaufmann Publishers, 2001.

[12] M. M. Breuning, H. P. Kriegel, T. Ng. Raymond, and J. Sander. “LOF:

identifying density-based local outliers”. In: Proc. ACM SIGMOD

2000. Int. Conf. on Management of Data. Dallas, TX, 2000: 93-104.

[13] Z. He, X. Xu, and S. Deng. “Discovering cluster-based local outliers”.

Pattern Recognition Letters. 2003, 24 (9-10): 1641-1650.

[14] M. F. Jiang, S. S. Tseng, and C. M. Su. “Two-phase clustering process

for outliers detection”. Pattern Cognition Letters, 2001, 22: 691-700.

[15] E. Lundin, H. Kvarnström, and E. A. Jonsson. “Synthetic fraud data

generation methodology”. In: Lecture Note in Computer Science,

ICICS2002. Laboratories for Information Technology, Singapore,

Springer Verlag, 2002: 265-277.

[16] E. Barse, H. Kvarnström, and E. Jonsson. “Synthesizing, test data for

fraud detection systems”. In: Proceedings of the 19th Annual Computer

Security Applications Conference. 2003: 384-395.

[17] Z. Gao. “Comments on anti-money laundering suspicious activity

report regime”. In: Proceedings of 2006 International Conference on

Public Administration. X. Zhu and S. Zhao, Eds. Chengdu: University

of Electronic Science and Technology of China Press, 2006: 970–975.

What is more, all the anomalous samples in the 25

accounts are ranked in the decreasing order of their LOF

values. Particularly, 33 of 40 artificial samples are found with

relatively higher LOF values and they even rank the top five

of their accounts, which proves the effectiveness of the

CBLOF algorithm in identifying suspicious data.

IV. CONCLUSION

Making a good use of

the advantages of both

distance-based unsupervised clustering and

local outlier

detecting, the CBLOF algorithm can effectively identify the

synthetic data suspicious of ML transactions with a high

processing speed and a satisfactory accuracy. Needing neither

prior samples to serve as training data nor the number of

clusters to be designated in advance can solve the problem

that AML research is always in short of case data. In

particular, the algorithm is self-adaptable to the evolution of

ML methods and can recognize SMLTBPs that haven’t been

detected before, which is quite beneficial in saving limited

investigation resources and preventing FIs from filing

defensive SARs [17].

However, only a few transactional behavioral features of

amount and frequency are studied in this paper, so relative

subjective characters of the account owner remains open to

our future research.

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc