LTE evolution for IoT

connectivity

Nokia white paper

LTE evolution for IoT connectivity white paper

�

Contents

1. Executive summary

2.

3.

IoT market landscape

LPWA IoT requirements

4. LPWA IoT technology landscape

5.

LTE evolution for cellular IoT

6. Conclusion

3

4

6

7

9

17

Page 2

www.nokia.com

�

1. Executive summary

The Internet of Things (IoT) is the next revolution in the mobile ecosystem. IoT services are likely to be a

key driver for further growth in cellular. An estimated 30 billion connected devices will be deployed by 2025

[Machina Research, May 2015], of which cellular IoT (i.e. 2G, 3G and 4G technologies used for IoT but not

specifically optimized for IoT) and Low-Power Wide-Area (LPWA) modules are forecast to account for

7 billion units in 2025 [Machina Research, May 2015].

Cellular IoT is expected to provide numerous services, including utility meters, vending machines,

automotive (fleet management, smart traffic, real time traffic information to the vehicle, security

monitoring and reporting), medical metering and alerting. Already, devices such as e-book readers, GPS

navigation aids and digital cameras are connected to the internet.

The key requirements for cellular IoT to enable these services and be competitive are:

• Long battery life

• Low device cost

• Low deployment cost

• Extended coverage

• Support for a massive number of devices.

This white paper outlines a cellular IoT solution based on LTE that meets these requirements and

enhances the radio and core networks. The radio network needs to work with simple, low cost devices.

The transmission and higher layer protocols need to help devices consume less power, with the aim of

achieving a battery life of over ten years. Finally, extended coverage is required for deep indoor and rural

areas.

Network elements need to handle charging, subscription and massive support for small packages. Today,

LTE supports IoT with so-called Cat.1 devices, while LTE-Advanced extends device battery life to ten years

with a power saving mode. LTE-Advanced Pro further optimizes coverage, device battery life and costs, as

well as capacity for a massive number of connected devices with the introduction of two new technologies:

eMTC (enhanced Machine Type Communication, often referred to as LTE-M) and NB-IoT (NarrowBand-

Internet of Things).

These two systems will support a scalable solution for data rates. Both solutions can be deployed either in

shared spectrum together with legacy LTE, or as stand-alone, in a refarmed GSM carrier with a bandwidth

as narrow as 180kHz for NB-IoT. Nokia believes that LTE-M, NB-IoT, and EC-GSM-IoT (Extended Coverage

GSM for IoT) are better able to satisfy the connectivity profiles and requirements for IoT than legacy

cellular networks. This is because by upgrading existing networks with an easy software upgrade, they

provide optimized device KPIs, battery life, coverage and cost, along with the expected benefits from the

use of licensed spectrum, such as no coexistence issue with other cellular networks.

Page 3

www.nokia.com

�

2. IoT market landscape

The IoT interconnects “things” and autonomously exchanges data between them. “Things” may be

machines, parts of machines, smart meters, sensors or even everyday objects such as retail goods or

wearables. This capability will bring about tremendous improvements in user experience and system

efficiency. Support for IoT requires Machine-to-Machine (M2M) communication. M2M is defined as data

communication among devices without the need for human interaction. This may be data communication

between devices and a server, or device-to-device, either directly or over a network. Examples of M2M

services include security, tracking, payment, smart grid and remote maintenance/monitoring. The total

M2M market is estimated to be 30 billion connected devices by 2025 [Machina Research, May 2015].

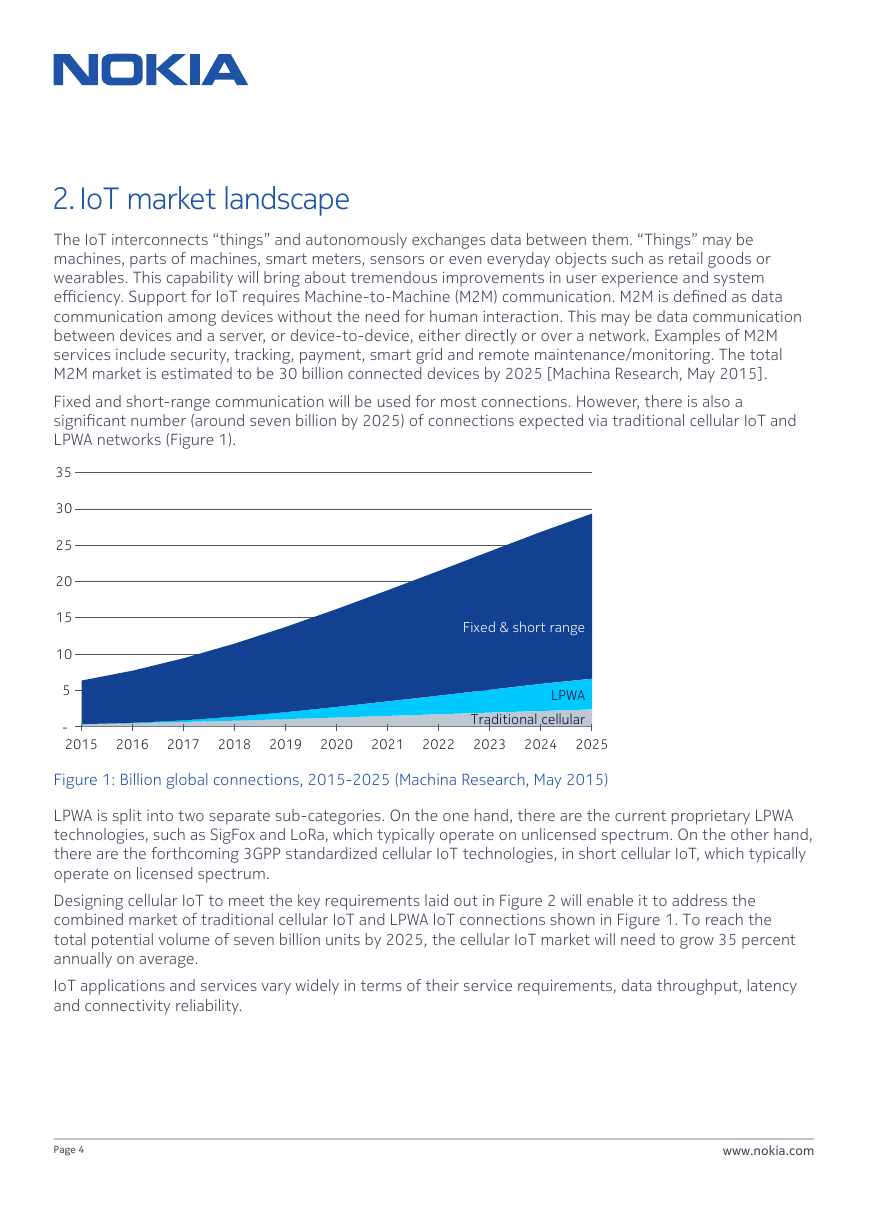

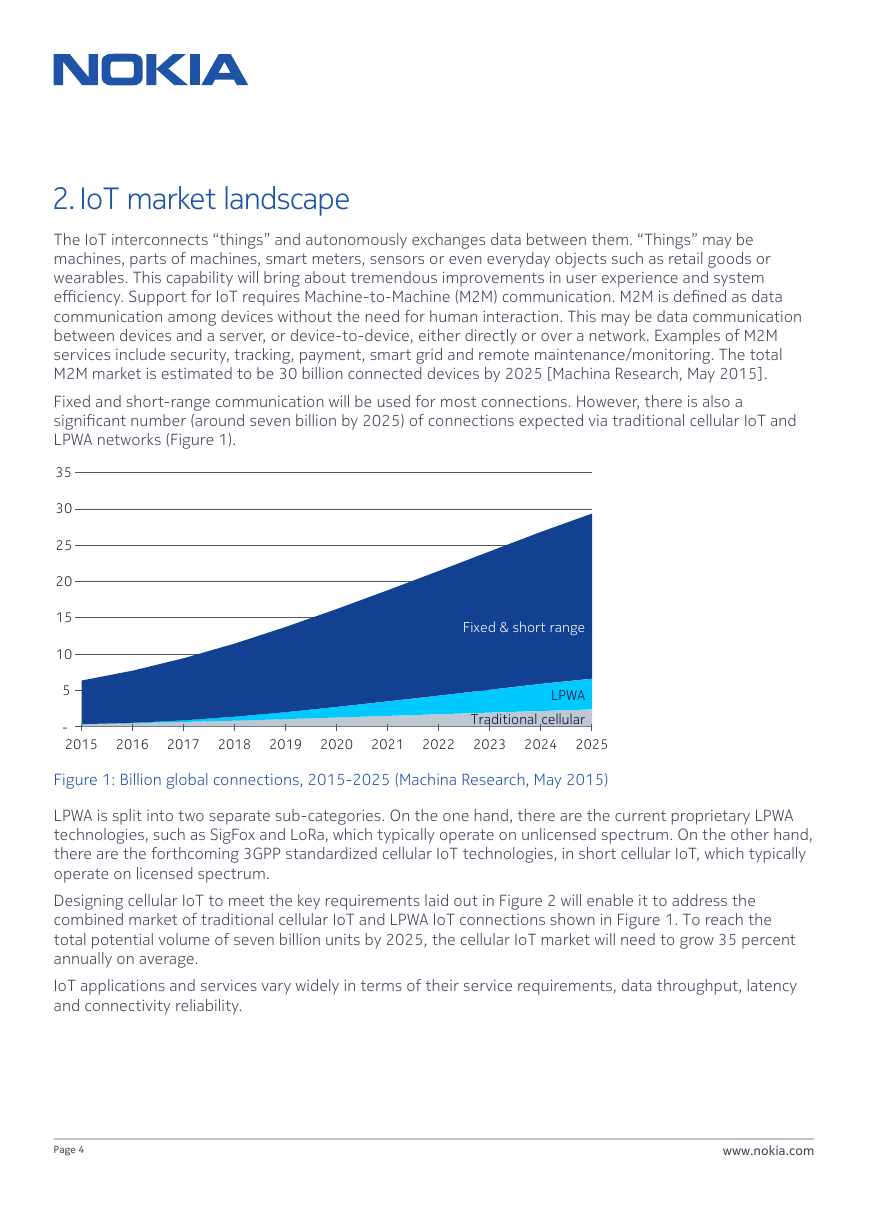

Fixed and short-range communication will be used for most connections. However, there is also a

significant number (around seven billion by 2025) of connections expected via traditional cellular IoT and

LPWA networks (Figure 1).

35

30

25

20

15

10

5

-

2015

-

2016

2017

2018

2019

2020

2021

2022

Fixed & short range

LPWA

Traditional cellular

2023

2024

2025

Figure 1: Billion global connections, 2015-2025 (Machina Research, May 2015)

© Nokia 2016

LPWA is split into two separate sub-categories. On the one hand, there are the current proprietary LPWA

1

technologies, such as SigFox and LoRa, which typically operate on unlicensed spectrum. On the other hand,

there are the forthcoming 3GPP standardized cellular IoT technologies, in short cellular IoT, which typically

operate on licensed spectrum.

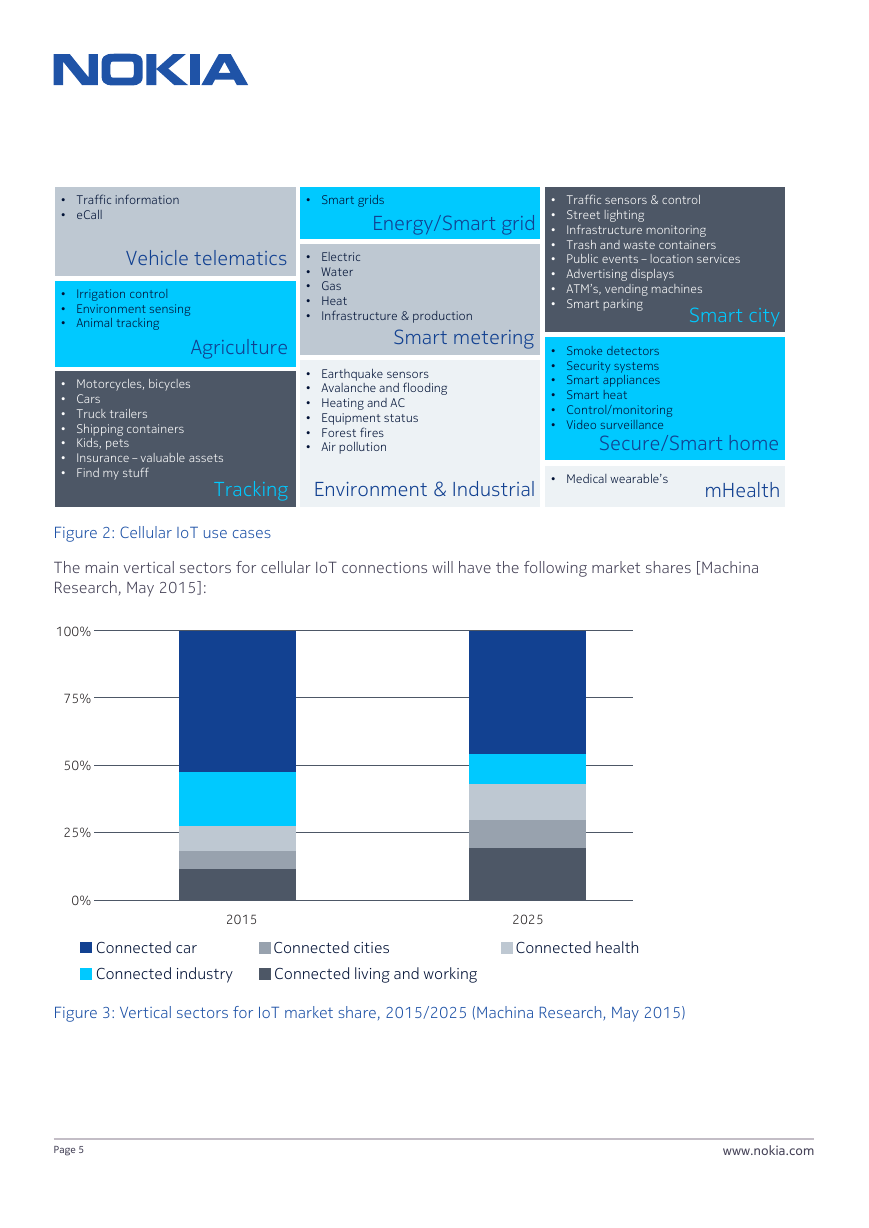

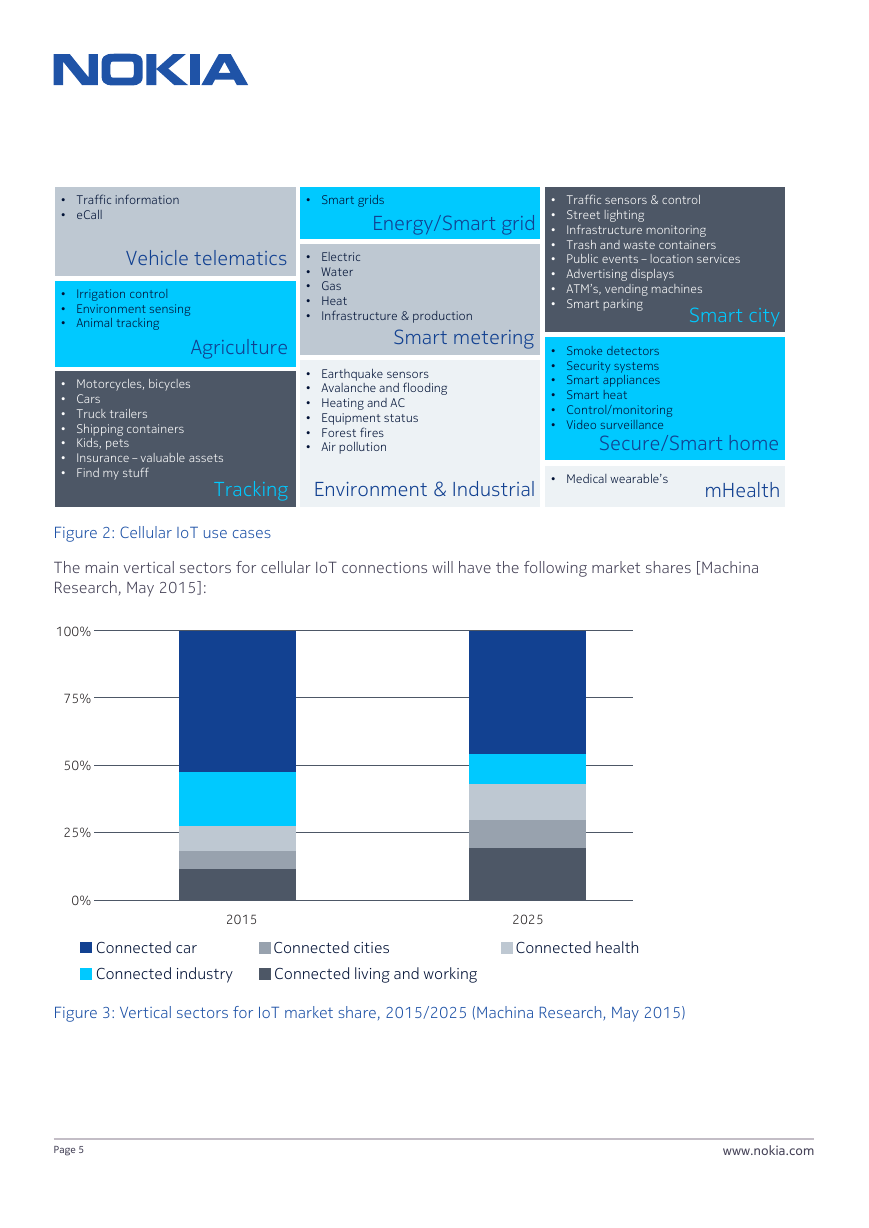

Designing cellular IoT to meet the key requirements laid out in Figure 2 will enable it to address the

combined market of traditional cellular IoT and LPWA IoT connections shown in Figure 1. To reach the

total potential volume of seven billion units by 2025, the cellular IoT market will need to grow 35 percent

annually on average.

IoT applications and services vary widely in terms of their service requirements, data throughput, latency

and connectivity reliability.

Page 4

www.nokia.com

�

• Traffic information

• eCall

• Smart grids

Energy/Smart grid

Vehicle telematics

Irrigation control

•

• Environment sensing

• Animal tracking

Agriculture

• Electric

• Water

• Gas

• Heat

•

Infrastructure & production

Smart metering

Infrastructure monitoring

• Traffic sensors & control

• Street lighting

•

• Trash and waste containers

• Public events – location services

• Advertising displays

• ATM’s, vending machines

• Smart parking

Smart city

• Smoke detectors

• Security systems

• Smart appliances

• Smart heat

• Control/monitoring

• Video surveillance

Secure/Smart home

• Motorcycles, bicycles

• Cars

• Truck trailers

• Shipping containers

• Kids, pets

•

• Find my stuff

Insurance – valuable assets

• Earthquake sensors

• Avalanche and flooding

• Heating and AC

• Equipment status

• Forest fires

• Air pollution

Tracking

Environment & Industrial

• Medical wearable’s

mHealth

Figure 2: Cellular IoT use cases

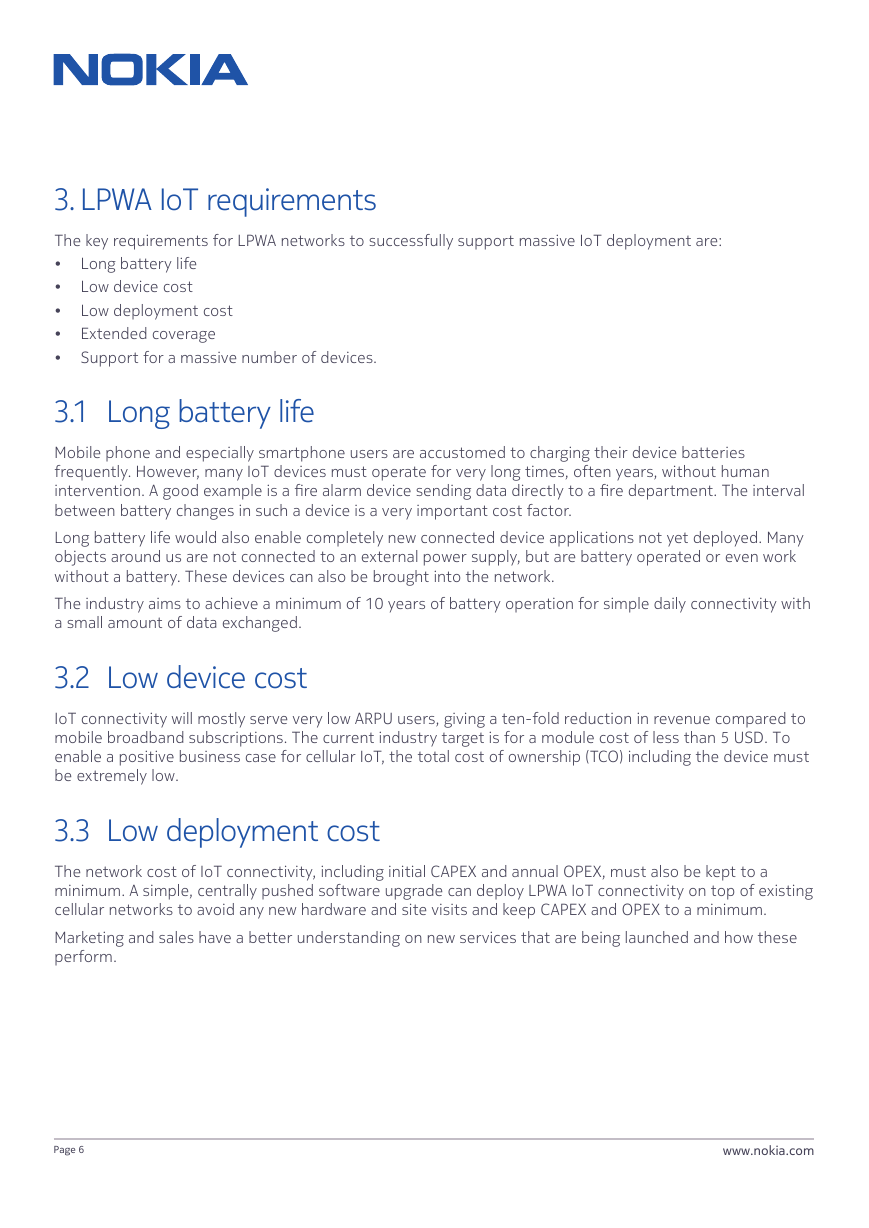

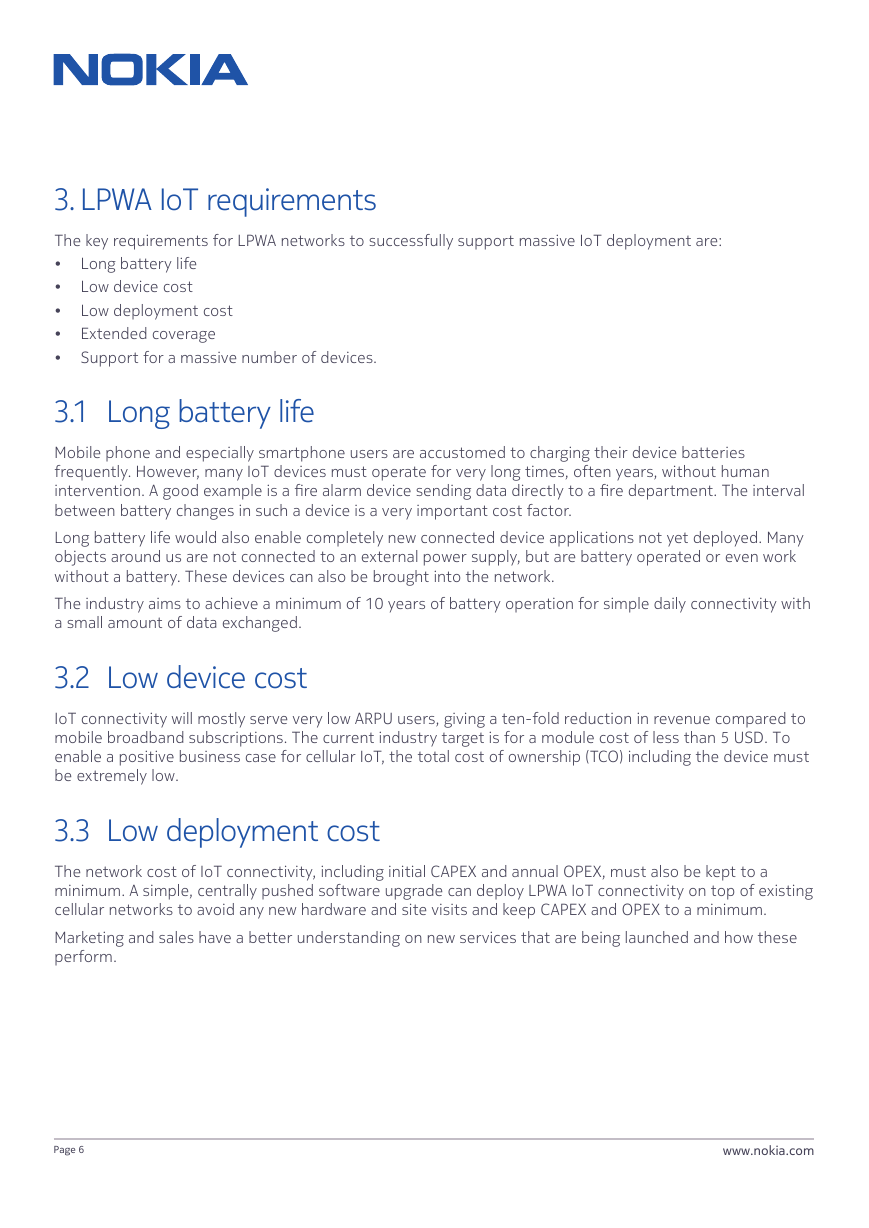

The main vertical sectors for cellular IoT connections will have the following market shares [Machina

Research, May 2015]:

100%

75%

50%

25%

0%

2015

Connected car

Connected industry

Connected cities

Connected living and working

2025

Connected health

Figure 3: Vertical sectors for IoT market share, 2015/2025 (Machina Research, May 2015)

3

© Nokia 2016

Page 5

www.nokia.com

�

3. LPWA IoT requirements

The key requirements for LPWA networks to successfully support massive IoT deployment are:

• Long battery life

• Low device cost

• Low deployment cost

• Extended coverage

• Support for a massive number of devices.

3.1 Long battery life

Mobile phone and especially smartphone users are accustomed to charging their device batteries

frequently. However, many IoT devices must operate for very long times, often years, without human

intervention. A good example is a fire alarm device sending data directly to a fire department. The interval

between battery changes in such a device is a very important cost factor.

Long battery life would also enable completely new connected device applications not yet deployed. Many

objects around us are not connected to an external power supply, but are battery operated or even work

without a battery. These devices can also be brought into the network.

The industry aims to achieve a minimum of 10 years of battery operation for simple daily connectivity with

a small amount of data exchanged.

3.2 Low device cost

IoT connectivity will mostly serve very low ARPU users, giving a ten-fold reduction in revenue compared to

mobile broadband subscriptions. The current industry target is for a module cost of less than 5 USD. To

enable a positive business case for cellular IoT, the total cost of ownership (TCO) including the device must

be extremely low.

3.3 Low deployment cost

The network cost of IoT connectivity, including initial CAPEX and annual OPEX, must also be kept to a

minimum. A simple, centrally pushed software upgrade can deploy LPWA IoT connectivity on top of existing

cellular networks to avoid any new hardware and site visits and keep CAPEX and OPEX to a minimum.

Marketing and sales have a better understanding on new services that are being launched and how these

perform.

Page 6

www.nokia.com

�

3.4 Extended coverage

Extended coverage is important in many IoT applications. Simple examples are smart meters, which are

often in the basements of buildings behind concrete walls. Industrial applications such as elevators or

conveyor belts can also be located deep indoors. This has driven the M2M community to look for methods

to increase coverage by tolerating lower signal strength than is required for other devices. The target

for the IoT connectivity link budget is an enhancement of 15-20dB. This coverage enhancement would

typically be equivalent to the signal penetrating a wall or floor, enabling deeper indoor coverage.

3.5 Support for a massive number of devices

IoT connectivity is growing significantly faster than normal mobile broadband connections and by 2025

there will be seven billion connected devices over cellular IoT networks. This is equivalent to the current

number of global cellular subscriptions. The density of connected devices may not be uniform, leading to

some cells having very high numbers of connected devices. This means that LPWA IoT connectivity needs

to handle many simultaneous connected devices.

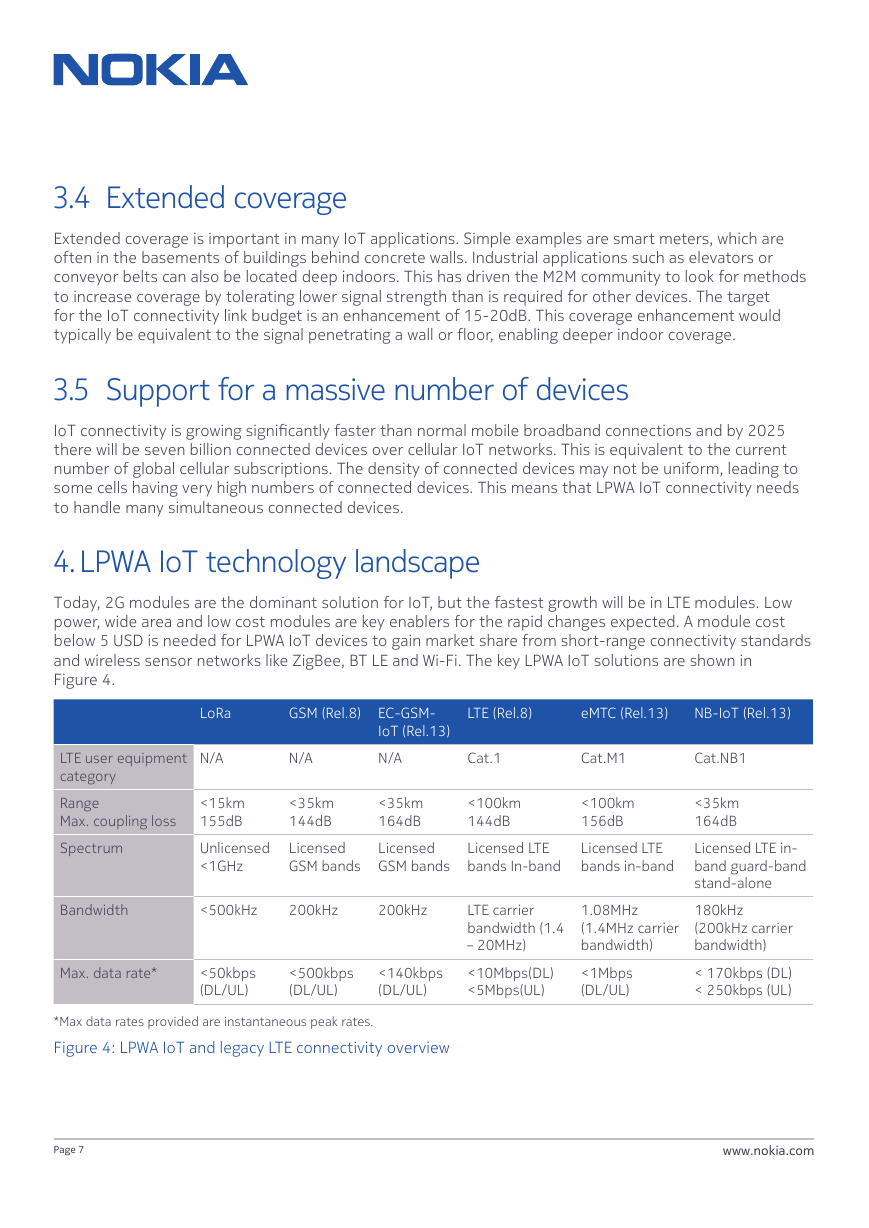

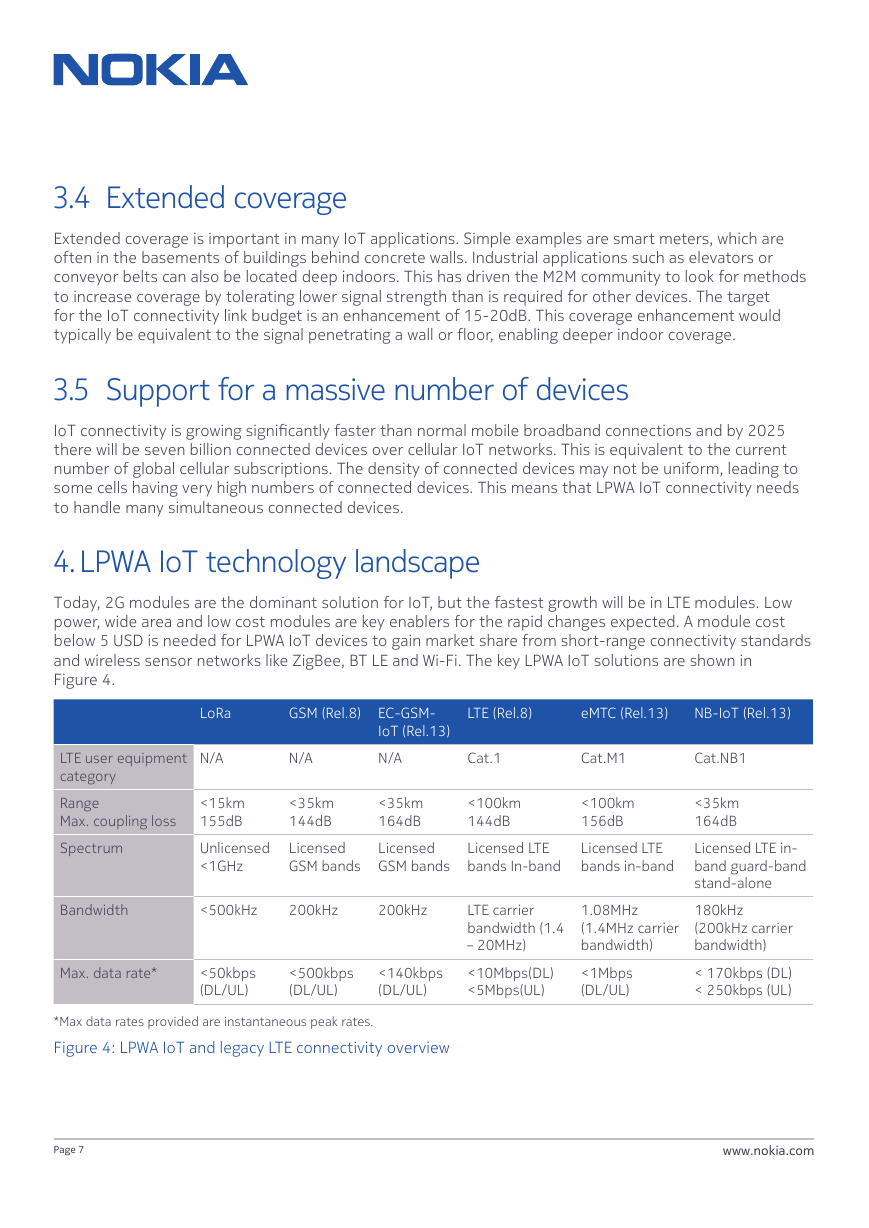

4. LPWA IoT technology landscape

Today, 2G modules are the dominant solution for IoT, but the fastest growth will be in LTE modules. Low

power, wide area and low cost modules are key enablers for the rapid changes expected. A module cost

below 5 USD is needed for LPWA IoT devices to gain market share from short-range connectivity standards

and wireless sensor networks like ZigBee, BT LE and Wi-Fi. The key LPWA IoT solutions are shown in

Figure 4.

LoRa

N/A

GSM (Rel.8)

N/A

EC-GSM-

IoT (Rel.13)

N/A

LTE (Rel.8)

eMTC (Rel.13)

NB-IoT (Rel.13)

Cat.1

Cat.M1

Cat.NB1

LTE user equipment

category

Range

Max. coupling loss

Spectrum

<15km

155dB

Unlicensed

<1GHz

<35km

144dB

Licensed

GSM bands

<35km

164dB

Licensed

GSM bands

<100km

144dB

Licensed LTE

bands In-band

<100km

156dB

Licensed LTE

bands in-band

Bandwidth

<500kHz

200kHz

200kHz

Max. data rate*

<50kbps

(DL/UL)

<500kbps

(DL/UL)

<140kbps

(DL/UL)

*Max data rates provided are instantaneous peak rates.

Figure 4: LPWA IoT and legacy LTE connectivity overview

LTE carrier

bandwidth (1.4

– 20MHz)

<10Mbps(DL)

<5Mbps(UL)

1.08MHz

(1.4MHz carrier

bandwidth)

<1Mbps

(DL/UL)

<35km

164dB

Licensed LTE in-

band guard-band

stand-alone

180kHz

(200kHz carrier

bandwidth)

< 170kbps (DL)

< 250kbps (UL)

Page 7

www.nokia.com

�

LPWA IoT solutions can be divided into proprietary (i.e. non-3GPP) LPWA technologies and (3GPP) cellular

IoT; SigFox and LoRa are both proprietary technologies deployed in unlicensed bands. For all these

technologies, deployment in spectrum lower than 1GHz spectrum helps achieve maximum coverage, but

higher bands in the spectrum may still be used.

Three separate tracks for licensed cellular IoT technologies are being standardized in 3GPP:

• LTE-M, an evolution of LTE optimized for IoT in 3GPP RAN. First released in Rel.12 in Q4 2014, further

optimization is being included in Rel.13 with specifications completed in Q1 2016.

• NB-IoT, the narrowband evolution of LTE for IoT in 3GPP RAN, included in Rel.13 with specifications

completed in Q2 2016.

• EC-GSM-IoT, an evolution of GSM optimized for IoT in 3GPP GERAN, included in Rel.13 with

specifications completed in Q2 2016.

Finally, a 5G solution for cellular IoT is expected to be part of the new 5G framework by 2020. The link

budget is similar in all solutions, with a slight improvement for narrowband solutions such as NB-IoT and

EC-GSM-IoT. LoRa and SigFox are planned to share spectrum with other solutions in the unlicensed bands.

Some alternative proposals for NB-IoT operate in a dedicated 200kHz carrier refarmed from GSM, but do

not support spectrum sharing with LTE networks. This is why Nokia has supported the NB-IoT proposal

from the 3GPP Study Item phase. Based on an LTE narrowband evolution, this is designed to operate in

a 200kHz carrier refarmed from GSM but has the further advantage of being able to operate in shared

spectrum with an existing LTE network, thus requiring no additional deployment of antennas, radio or other

hardware. The solutions for LTE-M, NB-IoT and EC-GSM-IoT will equally operate in spectrum shared with

existing LTE or GSM networks - LTE-M and NB-IoT would be supplementary solutions addressing different

use cases, with higher capacity on LTE-M and slightly lower cost and better coverage on NB-IoT.

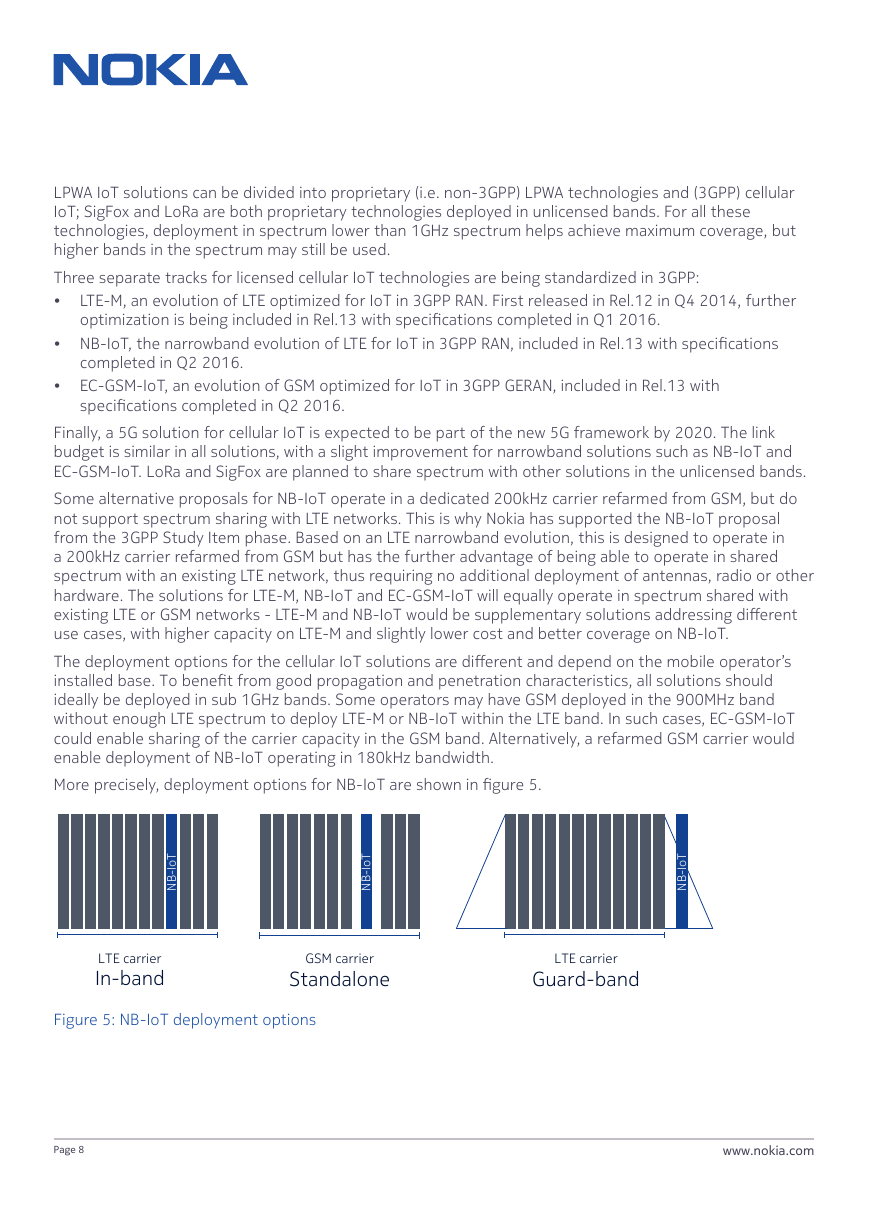

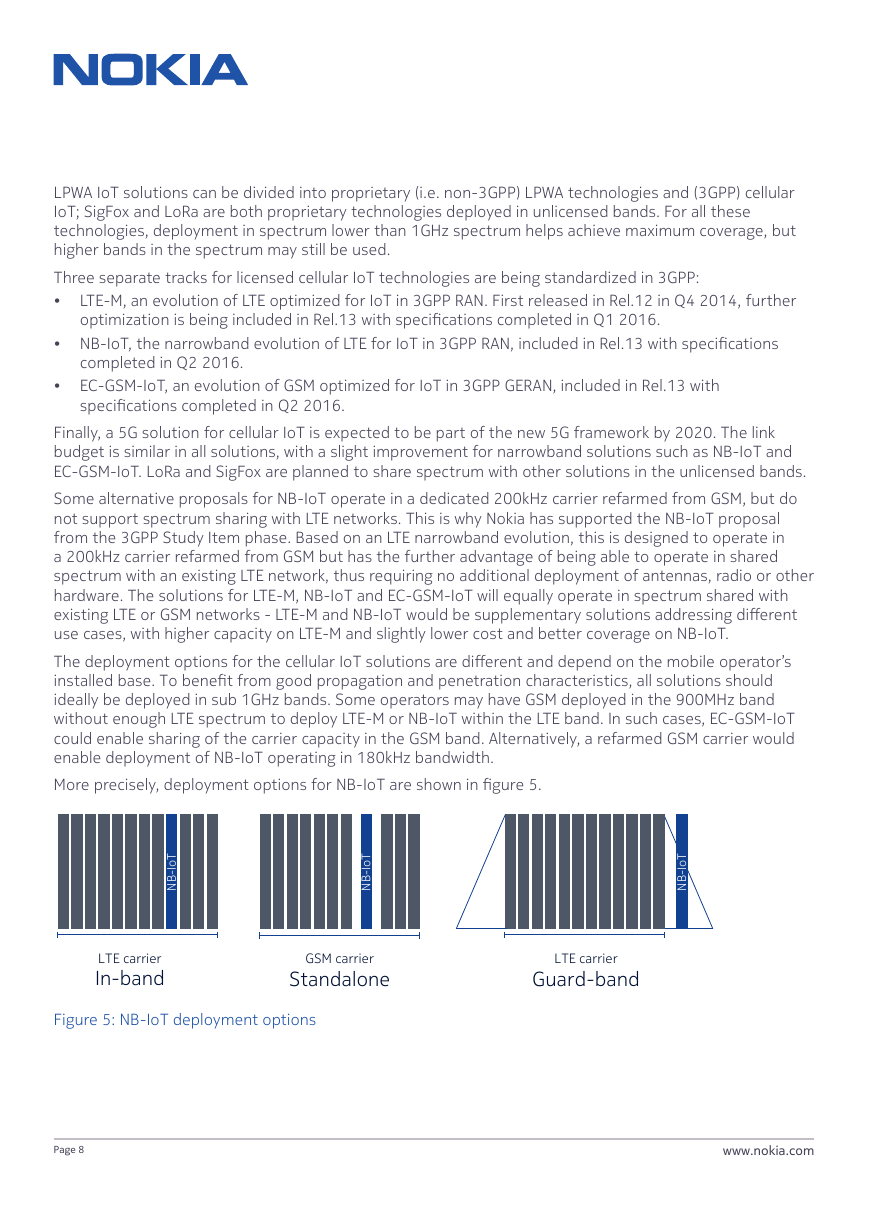

The deployment options for the cellular IoT solutions are different and depend on the mobile operator’s

installed base. To benefit from good propagation and penetration characteristics, all solutions should

ideally be deployed in sub 1GHz bands. Some operators may have GSM deployed in the 900MHz band

without enough LTE spectrum to deploy LTE-M or NB-IoT within the LTE band. In such cases, EC-GSM-IoT

could enable sharing of the carrier capacity in the GSM band. Alternatively, a refarmed GSM carrier would

enable deployment of NB-IoT operating in 180kHz bandwidth.

More precisely, deployment options for NB-IoT are shown in figure 5.

T

o

I

-

B

N

T

o

I

-

B

N

T

o

I

-

B

N

LTE carrier

In-band

GSM carrier

Standalone

LTE carrier

Guard-band

Figure 5: NB-IoT deployment options

4

© Nokia 2016

Page 8

www.nokia.com

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc