2019 Asia and Pacific Mathematical Contest in Modeling

Problem B

Analysis and Decision-making of Regional Economic Vitality

and Its Influencing Factors

The regional (or urban or provincial) economic vitality is an important part of regional

comprehensive competitiveness. In recent years, in order to improve the economic vitality,

some regions have launched many preferential policies for stimulating the economy vitality,

such as reducing the investment attraction approval steps, providing the capital support to start-

ups and lowering the settlement threshold to attract the talented. However, due to different

resource endowments, these policies have different effects in different regions. How to seize

the key factors and effectively improve the regional economic vitality is a worth study topic.

In order to study how to improve the regional economic vitality, we have obtained some data.

Please build a suitable model and solve the following problems based on these data and your

own data obtained through survey.

1. The regional (or urban or provincial) economic vitality is affected by variety of factors. Take

a region (or city or province) as an example, please build the suitable relational model of

influencing factors of economic vitality, and study the program of action to improve the regional

economic vitality. Analyze the effects on the regional economic vitality change from the

perspective of changing trend of population and enterprise vitality.

2. Select a region (or city or province), and analyze the short-term and long-term effects of

economic policies transformation on the economic vitality of such region (or city ore province)

based on the suitable data surveyed by you.

3. Measuring the regional economic vitality is a complex issue. Please select the suitable index

system, establish the mathematical model which analyzes and measures the regional (or urban

or provincial) economic vitality, and rank the economic vitality of cities in Attachment 3.

4. If you are a decision-maker of regional economic development, according to the conclusions

for Problems 1-3, provide a development proposal for the region (or city or province) discussed

in Problem 2 so that the economic vitality in this region presents the benign sustainable

development and the regional competitiveness is stronger.

�

Attachment

(5 attachments in total)

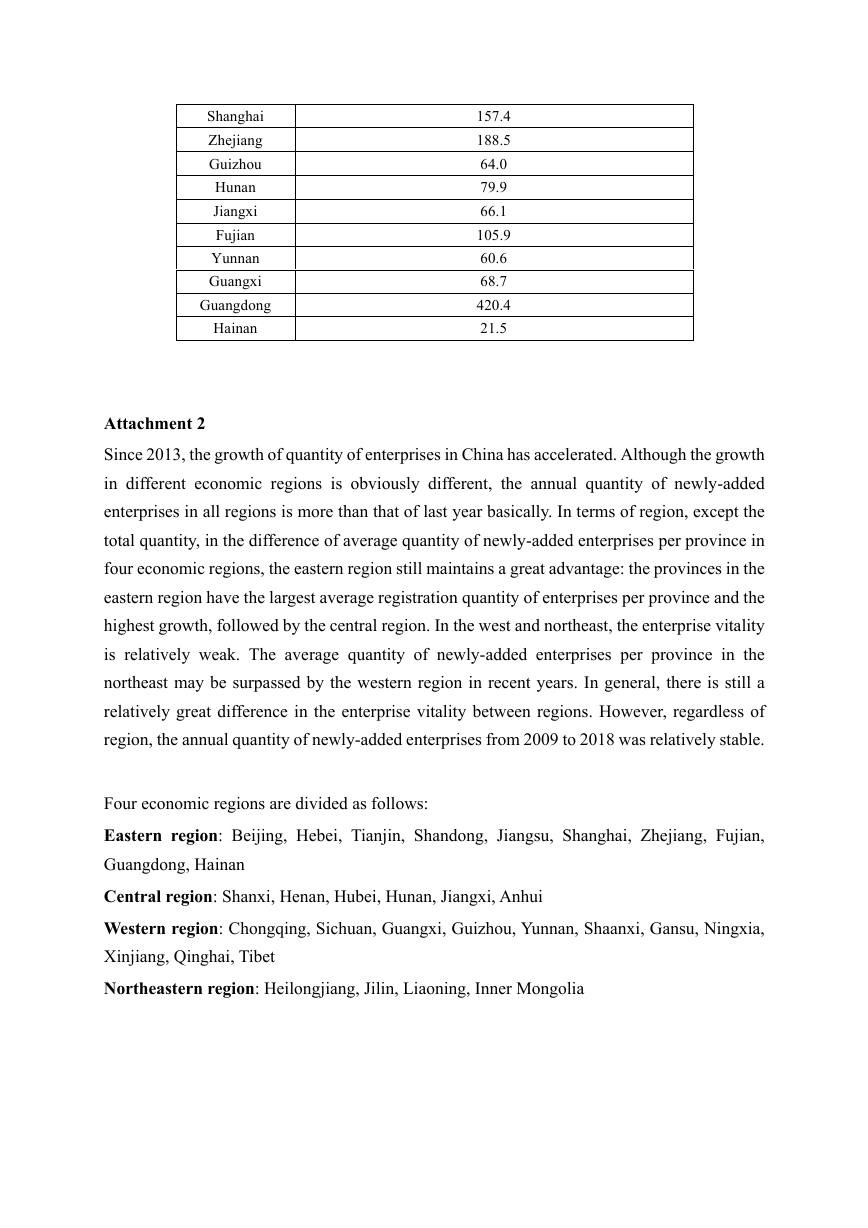

Attachment 1

The quantity of enterprises is an important index to measure the regional economic vitality. The

quantity of enterprises has a direct effect on the available job opportunities, and to what extent

the resource circulation is promoted, and decides the economic benefits. According to the data,

from 2009 to 2018, there were 40,176,400 registered and established enterprises (excluding

individual business, the same below) in total in 31 provinces/municipalities directly under the

Central Government/autonomous regions (excluding Hong Kong, Macau and Taiwan Province).

As of September 2019, 9,753,800 enterprises were cancelled (cancellation rate of 24.28%), and

there were still 30,422,600 surviving enterprises. The quantity of enterprises which were

registered and established from 2009 to 2018 and survive up in 2019 is as follows (Unit: 10,000):

Table 1: The quantity of enterprises which were registered and established from 2009 to 2018 and survive

up in 2019

Province

Quantity of Surviving Enterprises in 2019 (Unit: 10,000)

Heilongjiang

Jilin

Liaoning

Beijing

Tianjin

Inner Mongolia

Xinjiang

Qinghai

Tibet

Ningxia

Shanxi

Hebei

Shandong

Henan

Shaanxi

Gansu

Sichuan

Chongqing

Hubei

Anhui

Jiangsu

43.6

44.4

76.1

118.3

43.7

42.1

31.8

10.0

6.7

15.1

55.6

134.8

243.9

146.3

73.0

43.3

122.4

69.8

105.3

113.8

269.4

�

Shanghai

Zhejiang

Guizhou

Hunan

Jiangxi

Fujian

Yunnan

Guangxi

Guangdong

Hainan

157.4

188.5

64.0

79.9

66.1

105.9

60.6

68.7

420.4

21.5

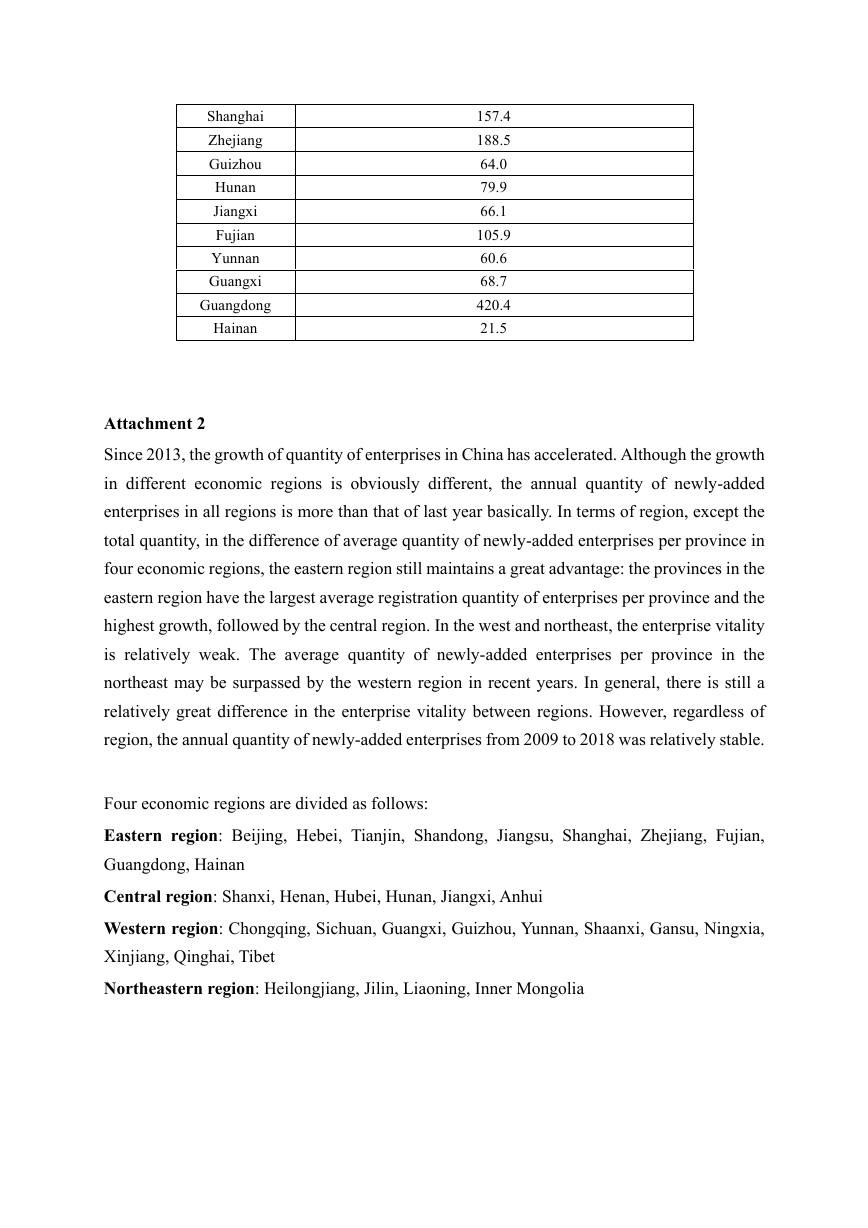

Attachment 2

Since 2013, the growth of quantity of enterprises in China has accelerated. Although the growth

in different economic regions is obviously different, the annual quantity of newly-added

enterprises in all regions is more than that of last year basically. In terms of region, except the

total quantity, in the difference of average quantity of newly-added enterprises per province in

four economic regions, the eastern region still maintains a great advantage: the provinces in the

eastern region have the largest average registration quantity of enterprises per province and the

highest growth, followed by the central region. In the west and northeast, the enterprise vitality

is relatively weak. The average quantity of newly-added enterprises per province in the

northeast may be surpassed by the western region in recent years. In general, there is still a

relatively great difference in the enterprise vitality between regions. However, regardless of

region, the annual quantity of newly-added enterprises from 2009 to 2018 was relatively stable.

Four economic regions are divided as follows:

Eastern region: Beijing, Hebei, Tianjin, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian,

Guangdong, Hainan

Central region: Shanxi, Henan, Hubei, Hunan, Jiangxi, Anhui

Western region: Chongqing, Sichuan, Guangxi, Guizhou, Yunnan, Shaanxi, Gansu, Ningxia,

Xinjiang, Qinghai, Tibet

Northeastern region: Heilongjiang, Jilin, Liaoning, Inner Mongolia

�

Table 2: Trend in Incremental Changes to Enterprises in Four Economic Regions from 2009 to 2018

(Unit: 10,000)

Eastern

Region

Central

Region

Northeastern

Region

Western

Region

7.9

9.4

10.3

9.9

12.7

19.5

23.8

30.3

32.8

35.8

4.4

5.0

5.6

5.7

7.2

11.1

12.9

16.4

19.6

22.6

3.3

3.6

3.8

3.6

4.6

7.0

7.1

8.6

10.1

10.3

2.3

2.6

2.9

3.1

3.7

6.0

7.0

8.6

9.8

10.5

Year

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Attachment 3

If we look away from economic region and province, and focus on city, in addition to Beijing,

Shanghai, Guangzhou and Shenzhen, the second-tier cities are also worth attention. The data of

stock and cancellation distribution of enterprises in Beijing, Shanghai, Guangzhou and

Shenzhen and some second-tier cities are given as follows. (Unit: 10,000)

Table 2: The data of stock and cancellation distribution of enterprises in Beijing, Shanghai, Guangzhou and

Shenzhen and some second-tier cities (Unit: 10,000)

Quantity of Newly-

City

established Enterprises

Quantity of Surviving

Enterprises in 2019

Quantity of Cancelled

Enterprises from 2009

from 2009 to 2018

to 2018

Shanghai

Shenzhen

Beijing

Guangzhou

Chongqing

Chengdu

Nanjing

Hangzhou

Suzhou

Tianjin

Qingdao

Dongguan

Zhengzhou

Wuhan

204.8

203.1

152.1

110.2

97.5

85.0

64.6

64.1

63.8

62.0

55.6

53.4

53.3

52.6

157.4

174.1

118.3

89.6

69.8

60.6

55.8

48.7

53.6

43.7

41.0

43.4

43.1

39.8

47.4

29.0

33.8

20.6

27.7

24.4

8.8

15.4

10.2

18.3

14.6

10.0

10.2

12.8

�

Xi’an

Ningbo

Changsha

Shenyang

Kunming

Attachment 4

51.4

44.4

36.8

33.4

33.2

37.5

31.1

28.5

21.8

23.5

13.9

13.4

8.3

11.6

9.7

The registered capital is an index to measure the enterprise size. In the distribution of enterprise

size, there is not so large difference as imagined between the second-tier cities and Beijing,

Shanghai, Guangzhou and Shenzhen. The distribution data of registered capital of enterprise

entity are given as follows:

Table 3: Distribution Data of Registered Capital of Enterprise Entity from 2009 to 2018 (Unit: 10,000)

Nationwide

Beijing

Shanghai Guangzhou

Shenzhen

9%

13%

16%

21%

40%

>10,000,000

5,000,000-

10,000,000

2,000,000-

5,000,000

1,000,000-

2,000,000

0-1,000,000

Attachment 5

13%

16%

16%

21%

35%

9%

14%

16%

22%

39%

9%

11%

13%

25%

42%

8%

12%

12%

25%

44%

Second-tier

Cities

9%

12%

15%

22%

42%

How to narrow the difference in the quantity of enterprises between the second-tier cities and

Beijing, Shanghai, Guangzhou and Shenzhen? “Investment attraction” and “talent attraction

policy” may be common methods. Therefore, the “talent attraction” between cities presently

becomes increasingly fierce. In fact, the resident population in a region is closely related to the

quantity of enterprises in this region. The data of resident population in 2019 are given as

follows.

Table 4: Data of Resident Population and Quantity of Surviving Enterprises in Some Second-tier Cities in

2019

City

Shanghai

Shenzhen

Quantity of Surviving Enterprises in 2019

Resident Population in 2019

Unit: 10,000

157.4

174.1

Unit: 10,000

2419.70

1190.84

�

Beijing

Guangzhou

Chongqing

Chengdu

Nanjing

Hangzhou

Suzhou

Tianjin

Qingdao

Dongguan

Zhengzhou

Wuhan

Xi’an

Ningbo

Changsha

Shenyang

Kunming

118.3

89.6

69.8

60.6

55.8

48.7

53.6

43.7

41.0

43.4

43.1

39.8

37.5

31.1

28.5

21.8

23.5

2172.9

1404.35

683.07

1194.05

827.0

787.5

1068.4

1562.12

920.4

826.1

972.4

1091.4

992.32

787.5

731.15

752

667

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc