Do human resource management practices

have an impact on financial performance of

banks?

Human resource management (HRM) practices are being increasingly considered as major

contributory factors in financial performance of organizations. This research study effectively

highlights the importance of HRM practices with impact on financial performance of banks

(FPB) operating in Pakistan. The major objective of the study is to find out the relationship

between ‘HRM Practices’ and the ‘Financial Performance of Banks’. As a sample, 46 scheduled

banks were contacted, of which 38 responded. The HRM practices selected for the research

study were selection, training, performance appraisal system, compensation system and

employee participation. Empirical evidence was calculated through stepwise regression analysis,

Pearson correlation and descriptive statistics to support theoretical models that link HRM

practices with financial performance of banks. The study concluded that all tested variables

have a positive relation and impact on financial performance of banks but the major

contributory practices are selection, training, compensation and employee participation.

Key words: HRM practices, selection system, training, job description, performance

appraisal system,

financial performance of the banks, planning, development, rewards.

compensation system, career planning system, employees participation,

INTRODUCTION

The study of human resource management practices has been an important and critical

area in management and organizational performance from last several years especially in

the banking industry. Influence of human resource management practices on organizational

performance has been an important area of research in past 25 years indicating positive

relationship between HR practices and organizational performance (Qureshi et al., 2007).

Human resource management (HRM) practices are being increasingly treated as

dependent rather than independent variables (Jackson, 1992). In the olden days,

management gurus and researchers were involved in exploring how HRM practices affected

employee performance, and organizational performance. Now they are beginning to ask how

these practices impacts on financial performance of organizations. This study focuses on the

impact of HRM practices on the financial performance of banks. This sector performs

momentous functions in the present-day world for overall economic development of

countries.

Pakistan started without a strong banking network in 1947 and recorded an earth-

shattering growth in the third quarter of the 20th century, but a sudden nationalization decision

of banks in the seventies proved not to be a good decision. In the nineties, there was a

�

paradigm shift

in deregulation, privatization and restructuring in the banking industry. After this shift, the

country now has a well-developed banking network, consisting of different

including a Central Bank and many commercial banks (DFID, 2006). One good thing about

institutions

that particular period was the recruitment of fresh officers in the banking industry through

well-organized policies (Akhtar, 2007). In this research, we will investigate the banking sector

performance in the last three years. During these years, hiring of officers was done under the

application of human resource management practices. Human resource management is

linked with all the managerial functions involved in planning for recruiting, selecting,

developing, utilizing, rewarding, and maximizing the potential of the human resources in an

organization (Franklin and Byrd, 1995). Human resources management (HRM) is defined

as the policies and practices needed to carry out the “people” or human resource aspect of a

management position, including selection, job definition, training, performance appraisal,

compensation, career planning and encouraging employee participation in decision

making. From another point of view, HRM is defined as a process for the development of

abilities and the attitude of the individuals, leading to personal growth and self actualization

which enables the individual to contribute towards organizational objectives. Much of the

debate has been around the meaning of HRM, yet there is no

universally accepted definition of HRM. Some definitions

interchange HRM with personnel management.

Personnel management characteristically focused on a

range of activities centered to the supply and

development of labor to meet the immediate and shortterm

needs of the organization. Under personnel

management, the activities of recruitment, selection,

rewards, development, training, compensation and the

others are viewed as separate individual functions.

HRM aims to integrate all of the personnel functions

into a cohesive strategy. Personnel management is

largely something that managers do to the

subordinates, whereas HRM takes the entire

organization as a focal point for analysis.

Success in today's competitive market depends less on

advantages associated with economies of scale,

technology, patents and access to capital and more on

innovation, speed and adaptability. Competitive

advantages and organizational performance are largely

derived from organizational human resources and high

�

involvement of human resource management practices.

Although in most of the developing countries, the main

impediment of organizational growth and profitability is

the lethargic use of professional HRM practices but

struggle is going on to find out best ways to utilize these

practices optimally. Pakistan is very much focused on

banking growth for the last few decades. As a result,

different banks are performing a momentous role in the

economic development of the country. Despite their

economic importance, different banks suffer from a

variety of structural and institutional weaknesses, which

has constrained their ability to take full advantage of the

rapidly advancing process of globalization and HRM

practices. This research is an attempt to explore the

relationship of (HRM) practices and financial performance

of banks (FBP) operating in Pakistan. In this research,

different HRM practices will be discussed.

LITERATURE REVIEW

This study is conducted based on universalistic

perspective, indicating that fixed set of best practices

can create surplus value in various business

frameworks (Delery and Doty, 1996). Justifying our

choice for the universalistic perspective, the Harvard

model by Beer et al. (1984) guided the initial process

of domain identification. In this study, the most

relevant HRM domains (e.g. selection, training, job

description, performance appraisal system,

compensation system career planning system and

employee participation) followed by universalistic perspective

are selected for research. In the field of human

resource management and behavioral sciences, plenty

of example and discussions are highlighting that there

is an uplifting connection between effective HRM

practices and organizational performance (Deepak et

al., 2003; Sels et al., 2003; Singh, 2004).

Qureshi et al. (2007) explored the positive effect of

selection (r = 0.53), performance appraisal (r = 0.55),

training (r = 0.61), compensation system (r = 0.39) and

�

employee participation (r = 0.46) with organizational

performance. Out of these practices, only selection (=

0.27, 0.30), training (= 0.31, 0.28) and employee

participation (= 0.19, 0.26) had positive impacts on

organizational performance and market performance of

the organization. This indicated that an increase of 1 unit

in selection will increase firm performance by 0.27 and

firm market performance by 0.30; secondly, an increase

of 1 unit in training will increase firm performance by 0.31

and firms market performance by 0.28. Finally, an

increase of 1 unit in employee participation will increase

firm performance by 0.19 and firm market performance

by 0.26. Supporting these findings, Singh (2004) found

that there is a positive relationship amongst several HR

practices like selection (r = 0.32), performance appraisal

(r = 0.32), training (r = 0.32), compensation system (r =

0.32) employee participation (r = 0.32) with firm

performance. Out of these practices, only training (=

0.37, 0.39) and compensation system (= 0.41, 0.43) had

positive impacts on firm performance and market performance

of the firm. This indicated that an increase of 1 unit

in training will increase firm performances by 0.37 and

firm market performance by 0.39; secondly, an increase

of 1 unit in compensation will increase firm performance

by 0.41 and 0.43 in a firm’s market performance. On the

other hand, two practices namely, job definition (= -

0.21) and career planning system (= -0.15) have a

negative and insignificant impact on firm performance.

Deepak et al. (2003) concluded that organizational

performance and competitiveness can be enhanced by

utilizing high performance work system. Through

Universalistic and contingency approach using

regression (189 at 95% level of confidence) analysis, it is

identified that relative use of HR practices displays

stronger association with organizational performance.

Supporting the same arguments, Arthur (1994) found

that steel mills that use an HRM ‘Commitment System’

have higher productivity levels than those that do not.

�

HPW system has significant positive effects on

organization productivity. Huselid (1995), in his study

of 968 US companies, identified a positive link between

HRM practices and firm performance. One standard

deviation increase in HRM practices increases firm

performance by 25%.

Wan et al. (2002) examined the relationship between

HRM practices and firm performance. HRM practices

were creating positive effect on organizational

performance. Results calculated through regression

suggested that effective implementation of key HRM

practices increases organizational performance. On

the other hand, companies interested in enhancing HR

performance may emphasize the need for

empowerment and training.

Few studies, however, did not find clear effects of

HRM practices on productivity (Delaney et al., 1989).

Kelley (1996) found that HRM practices do not affect

performance of organizations; Batt (2002) found that

HRM practices do not pay off in small organizations

that operate in local markets. Cappelli and Newmark

(2001) identified that human resource management

practices may raise productivity slightly, but they also

raise labor costs. Huselid (1995) evaluated that HRM

practices are statistically significant and having

positive effect on corporate financial performance of

the organization. Numerous researchers found the

relationship between corporate financial performance

and HRM practices. Flamholtz (1985) and Cascio

(1991) concluded that financial returns associated with

investments in progressive HRM practices are

generally substantial. Schmidt et al. (1979) explored

that increasing one unit of employee performance is

equivalent to 40% of salary increase. Each of these

studies has emphasized on the impact of human

resource management practices on organizational

performance. Research on relationship and impact of

HRM practices with financial performance of the banks

�

is much more limited in the world and in Pakistan

nothing has been done so for in this regard. This

research study in the context of financial performance

of banks with relation to HRM practices will be first of

its nature.

PURPOSE OF RESEARCH STUDY

In the banking industry, there is one common slogan

that “all our stakeholders are important” but clients are

at the top. Clients can be satisfied when they will

entertain desired services with all protocols. This is

possible when employees of the banks are fully

committed and involved in their professional working.

They will be involved when banks utilize human

resource management practices at the apex and

altitude of sublimity. Many banks are now investing in

human resource management but few banks still

ignore this area. This assumption needs to be carefully

tested. This research study addresses this assumption

directly and therefore the focus of the research borders

around whether human resource management practices

make a difference in the financial performance of

banks or not. If so, which practices appear to be more

performance contributories? In a nutshell, the major

objectives of this study are to explore the relationship

between HRM practices and financial performance of

banks and finding impact intensity of HRM practices on

the financial performance of banks functioning in

Pakistan.

RESEARCH DESIGN

“Convenience sampling” technique, a form of non-probability

sampling, is used for data selection. This technique is used to

make research process faster by obtaining a large number of

completed questionnaires quickly and economically from the

banks. All operating banks in Pakistan were selected for the

study. A list of these operating schedule banks was taken from

the official website of the State Bank of Pakistan and other

necessary information like addresses and phone numbers of

different banks were taken from the websites of respective

�

banks, after which questionnaires were posted to them.

Following the tradition of social sciences, we used the

questionnaire for primary data collection as there were no

sufficient data available in Pakistan. This questionnaire was

designed on a five point-Likert scale with options; 5 for strongly

agree, 4 for agree, 3 for indifferent, 2 for disagree and 1 for

strongly disagree. For data collection, human resource

managers of 46 schedule banks of Pakistan were mailed

questionnaires. After one week, respondents were given 1st

reminder through email and telephone calls. A 2nd reminder was

given three days after the first one, while respondents started

responding. However, the process of data collection took 36

days. Aggregately, we collected 38 participants’ responses, so

the response rate was 82.6%, which is many times better than

previous researches by Singh (2004) and Qureshi (2007).

Human resource managers from different banks were

contacted for information collection regarding perceived financial

performance of the banks and human resource management

practices. These managers were appealed to to answer all the

questions to the best of their knowledge. There was another

open option; where there is no HR manager in the bank, any

person from the HRM department at the managerial level can fill

the questionnaire. After data collection, we coded it in Excel

2003 and SPSS 12.0. statistical tool. Stepwise regression

analysis, correlation and descriptive statistics were used to

strengthen the results with numerical evidences.

Description of the instruments

The questionnaire included life of the bank, number of

employees, years of education of employees, experience of HR

manager with this bank and in the banking industry and HRM

practices. Out of these items, only HR practices were

considered for analyses. Perceived financial performance of the

banks in the last three years including increase in sales, market

share and share price and net profit growth are selected as

dependent variables. Statistical tools used were multiple

stepwise regression analysis and correlation based on the

methodology adopted by Deepak et al. (2003), Singh (2004) and

Qureshi (2007) for finding organizational performance.

�

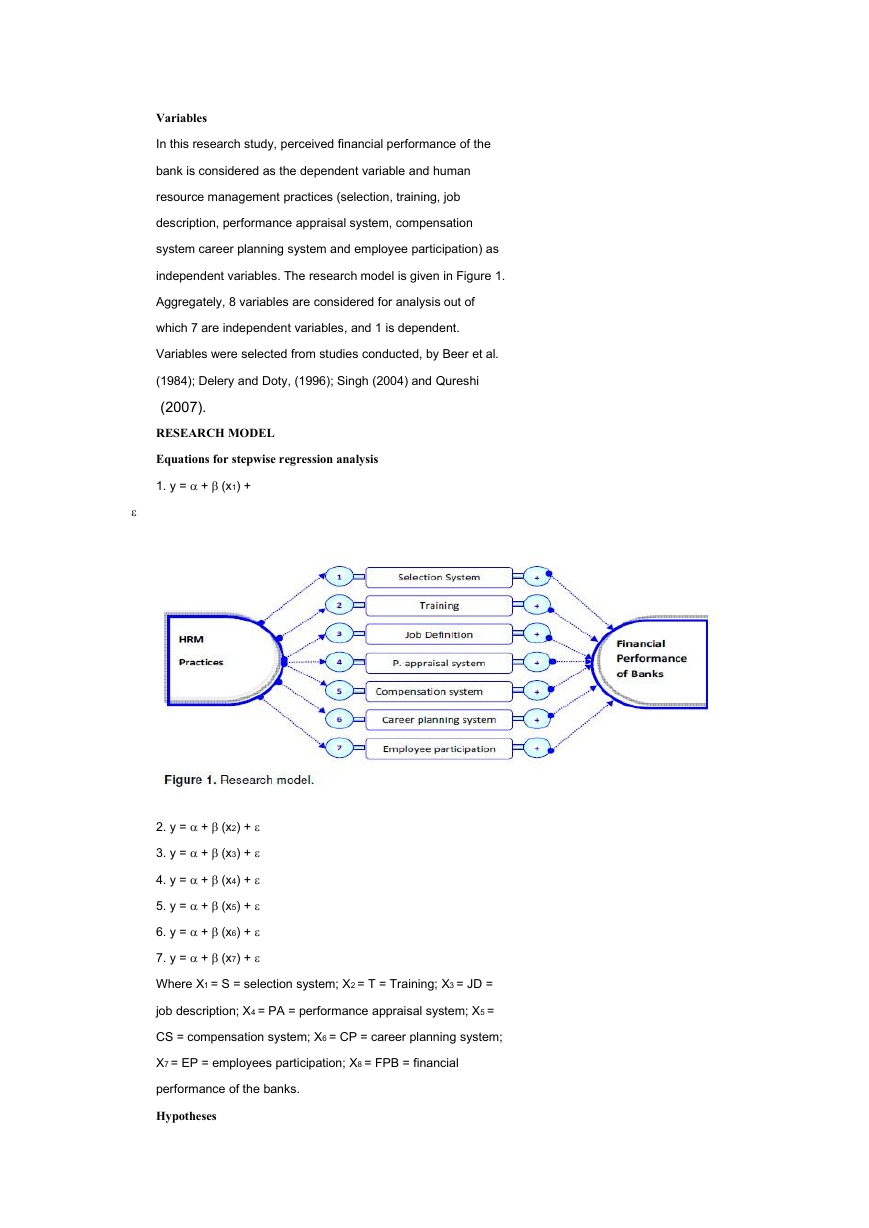

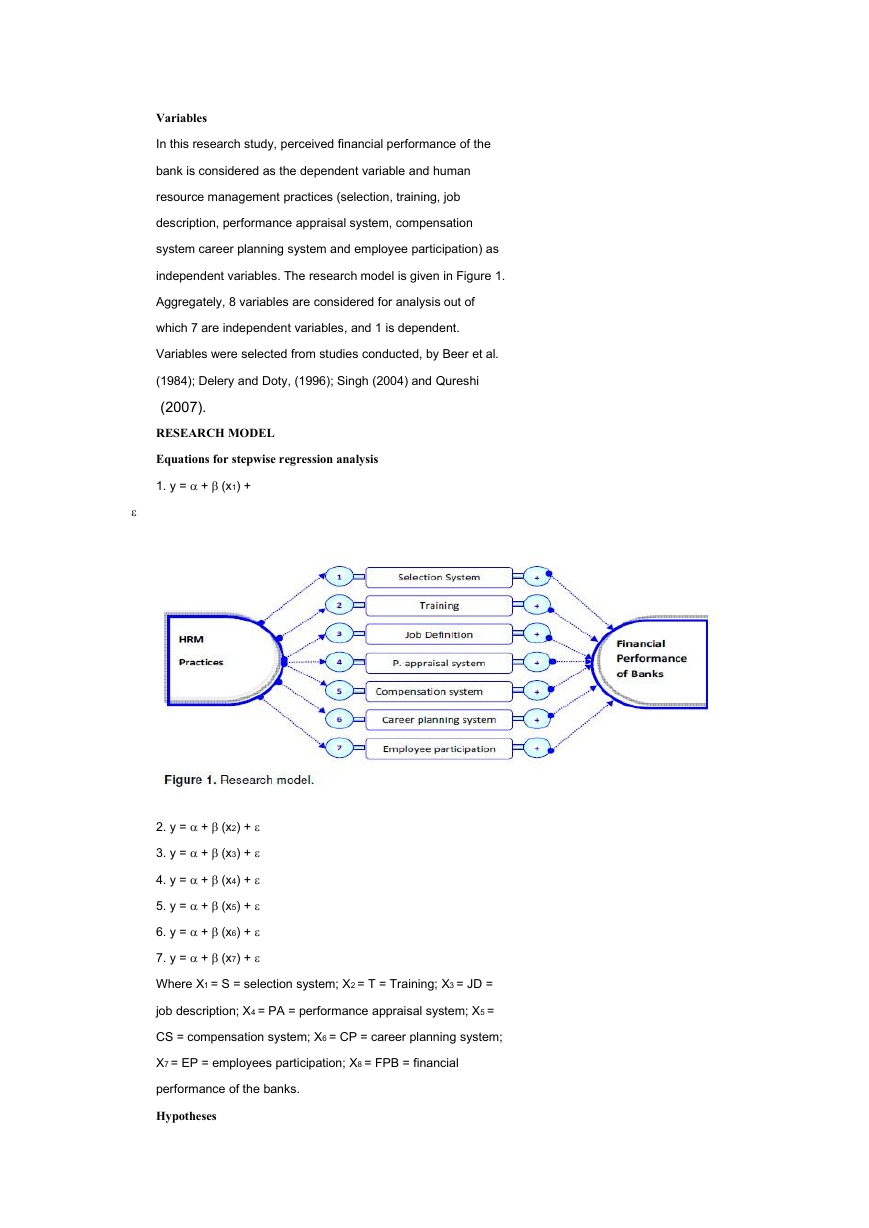

Variables

In this research study, perceived financial performance of the

bank is considered as the dependent variable and human

resource management practices (selection, training, job

description, performance appraisal system, compensation

system career planning system and employee participation) as

independent variables. The research model is given in Figure 1.

Aggregately, 8 variables are considered for analysis out of

which 7 are independent variables, and 1 is dependent.

Variables were selected from studies conducted, by Beer et al.

(1984); Delery and Doty, (1996); Singh (2004) and Qureshi

(2007).

RESEARCH MODEL

Equations for stepwise regression analysis

1. y = + (x1) +

2. y = + (x2) +

3. y = + (x3) +

4. y = + (x4) +

5. y = + (x5) +

6. y = + (x6) +

7. y = + (x7) +

Where X1 = S = selection system; X2 = T = Training; X3 = JD =

job description; X4 = PA = performance appraisal system; X5 =

CS = compensation system; X6 = CP = career planning system;

X7 = EP = employees participation; X8 = FPB = financial

performance of the banks.

Hypotheses

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc