Fotografía de página completa.pdf

00.pdf

Preface

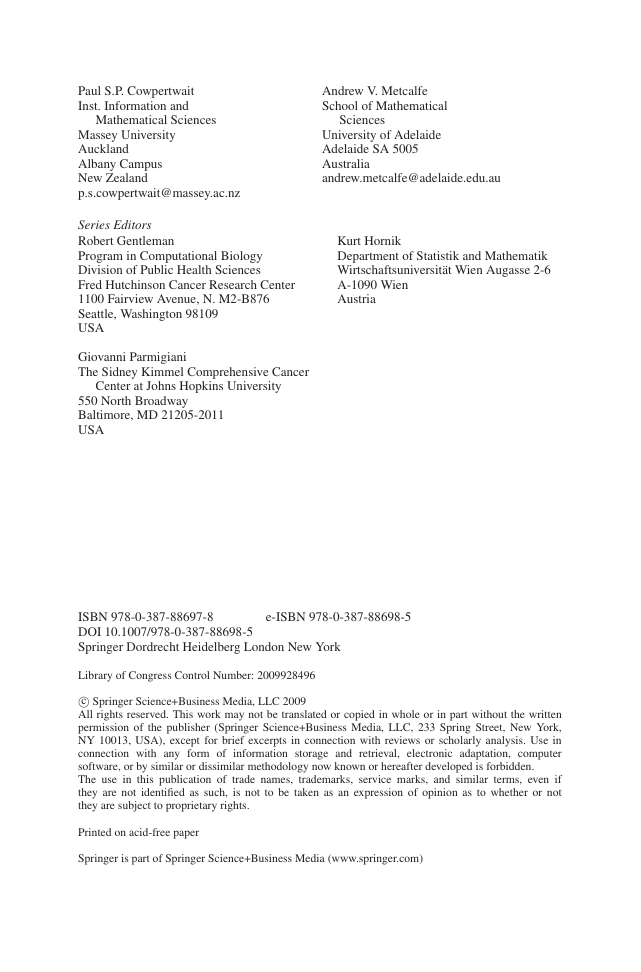

Contents

01.pdf

Time Series Data

Purpose

Time series

R language

Plots, trends, and seasonal variation

A flying start: Air passenger bookings

Unemployment: Maine

Multiple time series: Electricity, beer and chocolate data

Quarterly exchange rate: GBP to NZ dollar

Global temperature series

Decomposition of series

Notation

Models

Estimating trends and seasonal effects

Smoothing

Decomposition in R

Summary of commands used in examples

Exercises

02.pdf

Correlation

Purpose

Expectation and the ensemble

Expected value

The ensemble and stationarity

Ergodic series*

Variance function

Autocorrelation

The correlogram

General discussion

Example based on air passenger series

Example based on the Font Reservoir series

Covariance of sums of random variables

Summary of commands used in examples

Exercises

03.pdf

Forecasting Strategies

Purpose

Leading variables and associated variables

Marine coatings

Building approvals publication

Gas supply

Bass model

Background

Model definition

Interpretation of the Bass model*

Example

Exponential smoothing and the Holt-Winters method

Exponential smoothing

Holt-Winters method

Four-year-ahead forecasts for the air passenger data

Summary of commands used in examples

Exercises

04.pdf

Basic Stochastic Models

Purpose

White noise

Introduction

Definition

Simulation in R

Second-order properties and the correlogram

Fitting a white noise model

Random walks

Introduction

Definition

The backward shift operator

Random walk: Second-order properties

Derivation of second-order properties*

The difference operator

Simulation

Fitted models and diagnostic plots

Simulated random walk series

Exchange rate series

Random walk with drift

Autoregressive models

Definition

Stationary and non-stationary AR processes

Second-order properties of an AR(1) model

Derivation of second-order properties for an AR(1) process*

Correlogram of an AR(1) process

Partial autocorrelation

Simulation

Fitted models

Model fitted to simulated series

Exchange rate series: Fitted AR model

Global temperature series: Fitted AR model

Summary of R commands

Exercises

05.pdf

Regression

Purpose

Linear models

Definition

Stationarity

Simulation

Fitted models

Model fitted to simulated data

Model fitted to the temperature series (1970--2005)

Autocorrelation and the estimation of sample statistics*

Generalised least squares

GLS fit to simulated series

Confidence interval for the trend in the temperature series

Linear models with seasonal variables

Introduction

Additive seasonal indicator variables

Example: Seasonal model for the temperature series

Harmonic seasonal models

Simulation

Fit to simulated series

Harmonic model fitted to temperature series (1970--2005)

Logarithmic transformations

Introduction

Example using the air passenger series

Non-linear models

Introduction

Example of a simulated and fitted non-linear series

Forecasting from regression

Introduction

Prediction in R

Inverse transform and bias correction

Log-normal residual errors

Empirical correction factor for forecasting means

Example using the air passenger data

Summary of R commands

Exercises

06.pdf

Stationary Models

Purpose

Strictly stationary series

Moving average models

MA(q) process: Definition and properties

R examples: Correlogram and simulation

Fitted MA models

Model fitted to simulated series

Exchange rate series: Fitted MA model

Mixed models: The ARMA process

Definition

Derivation of second-order properties*

ARMA models: Empirical analysis

Simulation and fitting

Exchange rate series

Electricity production series

Wave tank data

Summary of R commands

Exercises

07.pdf

Non-stationary Models

Purpose

Non-seasonal ARIMA models

Differencing and the electricity series

Integrated model

Definition and examples

Simulation and fitting

IMA(1, 1) model fitted to the beer production series

Seasonal ARIMA models

Definition

Fitting procedure

ARCH models

S&P500 series

Modelling volatility: Definition of the ARCH model

Extensions and GARCH models

Simulation and fitted GARCH model

Fit to S&P500 series

Volatility in climate series

GARCH in forecasts and simulations

Summary of R commands

Exercises

08.pdf

Long-Memory Processes

Purpose

Fractional differencing

Fitting to simulated data

Assessing evidence of long-term dependence

Nile minima

Bellcore Ethernet data

Bank loan rate

Simulation

Summary of additional commands used

Exercises

09.pdf

Spectral Analysis

Purpose

Periodic signals

Sine waves

Unit of measurement of frequency

Spectrum

Fitting sine waves

Sample spectrum

Spectra of simulated series

White noise

AR(1): Positive coefficient

AR(1): Negative coefficient

AR(2)

Sampling interval and record length

Nyquist frequency

Record length

Applications

Wave tank data

Fault detection on electric motors

Measurement of vibration dose

Climatic indices

Bank loan rate

Discrete Fourier transform (DFT)*

The spectrum of a random process*

Discrete white noise

AR

Derivation of spectrum

Autoregressive spectrum estimation

Finer details

Leakage

Confidence intervals

Daniell windows

Padding

Tapering

Spectral analysis compared with wavelets

Summary of additional commands used

Exercises

10.pdf

System Identification

Purpose

Identifying the gain of a linear system

Linear system

Natural frequencies

Estimator of the gain function

Spectrum of an AR(p) process

Simulated single mode of vibration system

Ocean-going tugboat

Non-linearity

Exercises

11.pdf

Multivariate Models

Purpose

Spurious regression

Tests for unit roots

Cointegration

Definition

Exchange rate series

Bivariate and multivariate white noise

Vector autoregressive models

VAR model fitted to US economic series

Summary of R commands

Exercises

12.pdf

State Space Models

Purpose

Linear state space models

Dynamic linear model

Filtering*

Prediction*

Smoothing*

Fitting to simulated univariate time series

Random walk plus noise model

Regression model with time-varying coefficients

Fitting to univariate time series

Bivariate time series -- river salinity

Estimating the variance matrices

Discussion

Summary of additional commands used

Exercises

13.pdf

References

Index

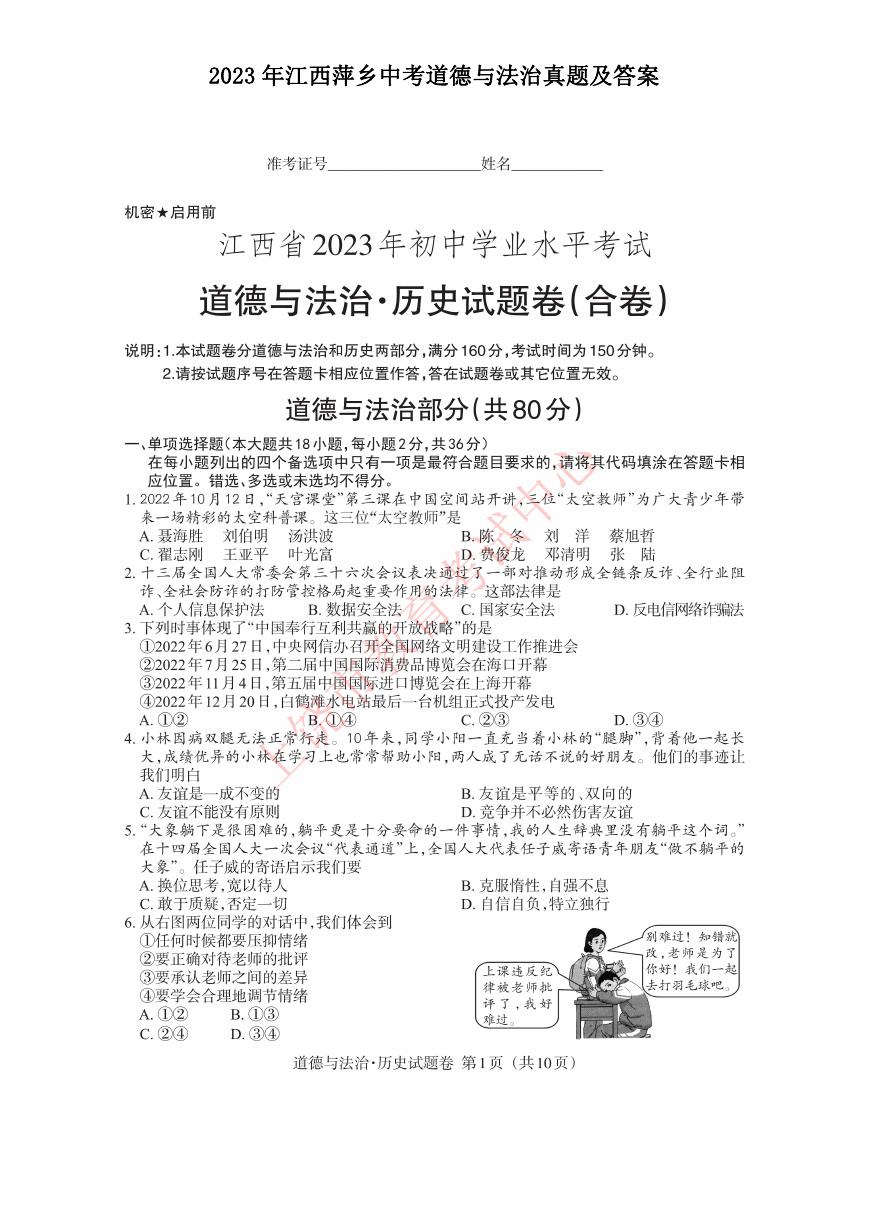

2023年江西萍乡中考道德与法治真题及答案.doc

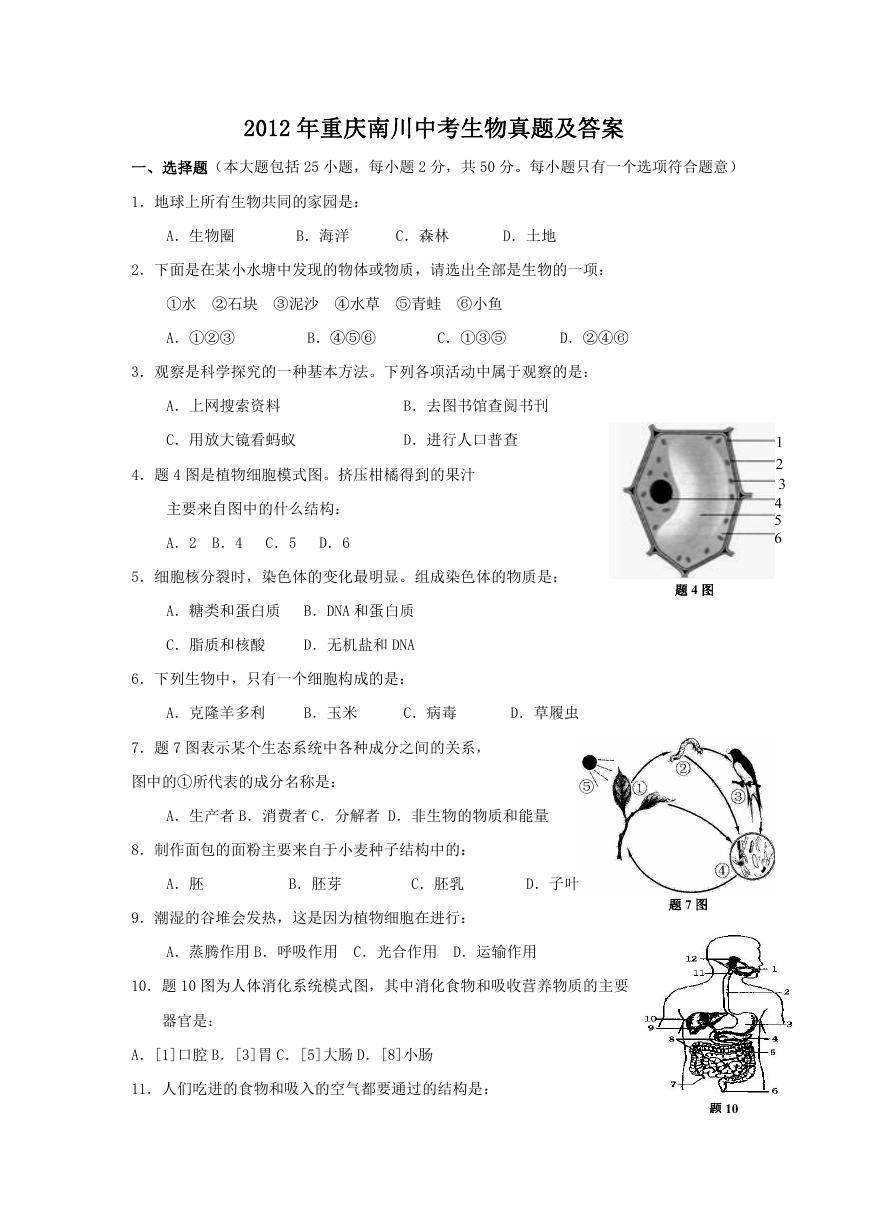

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

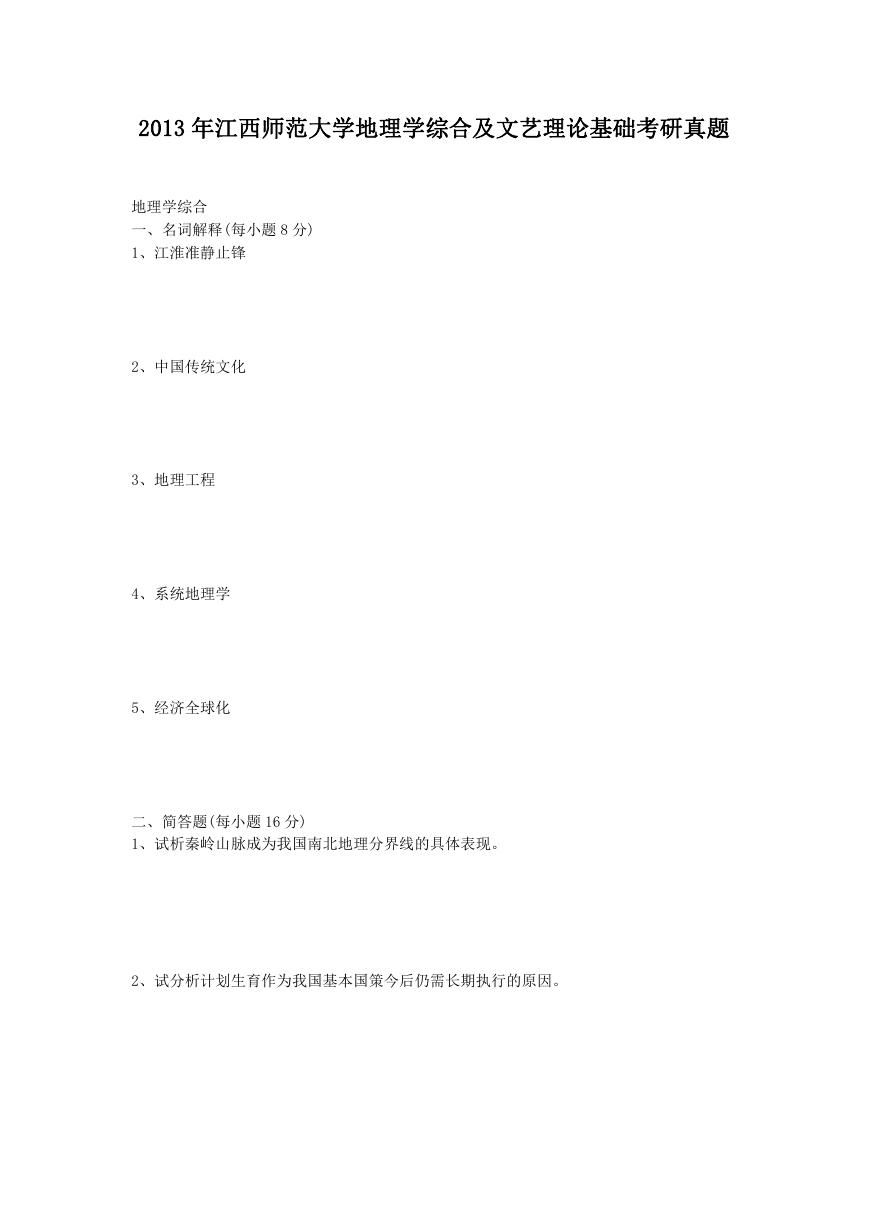

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

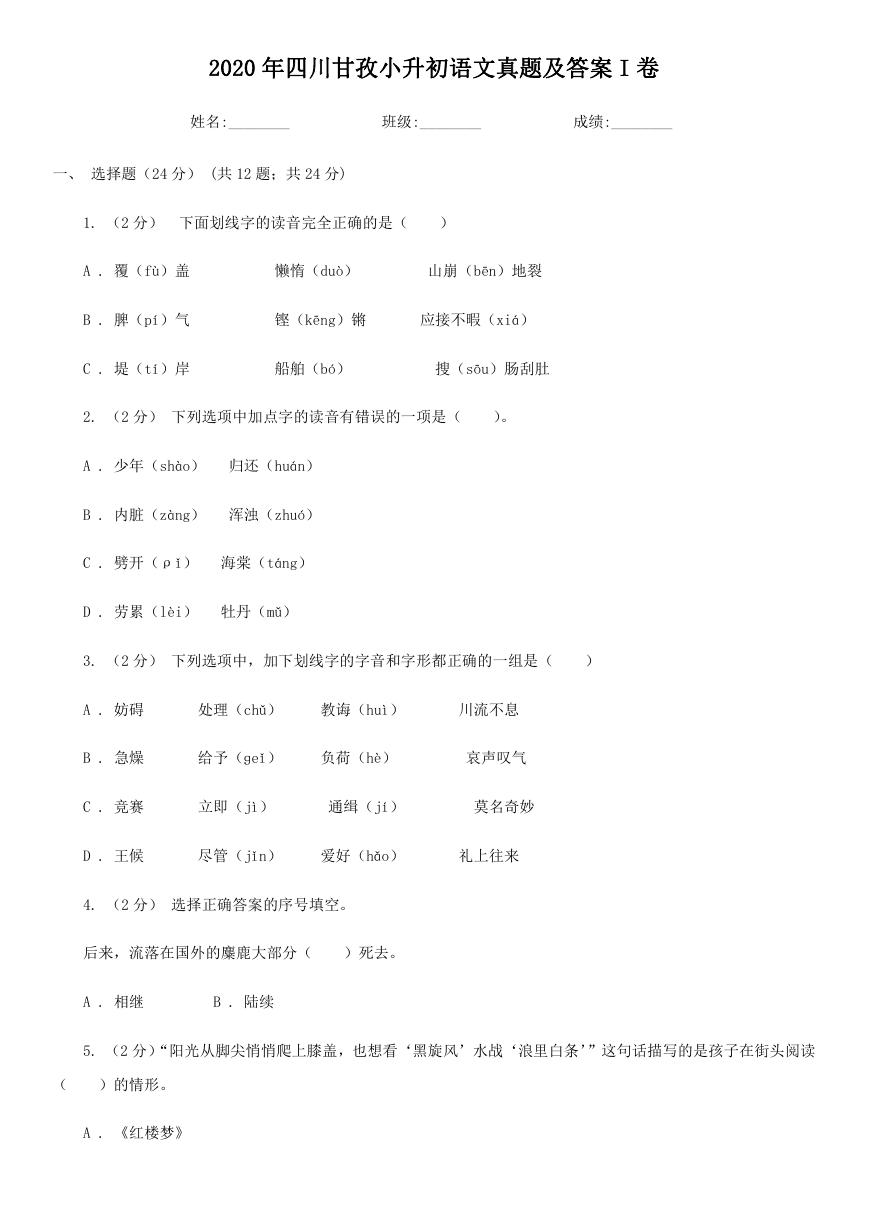

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

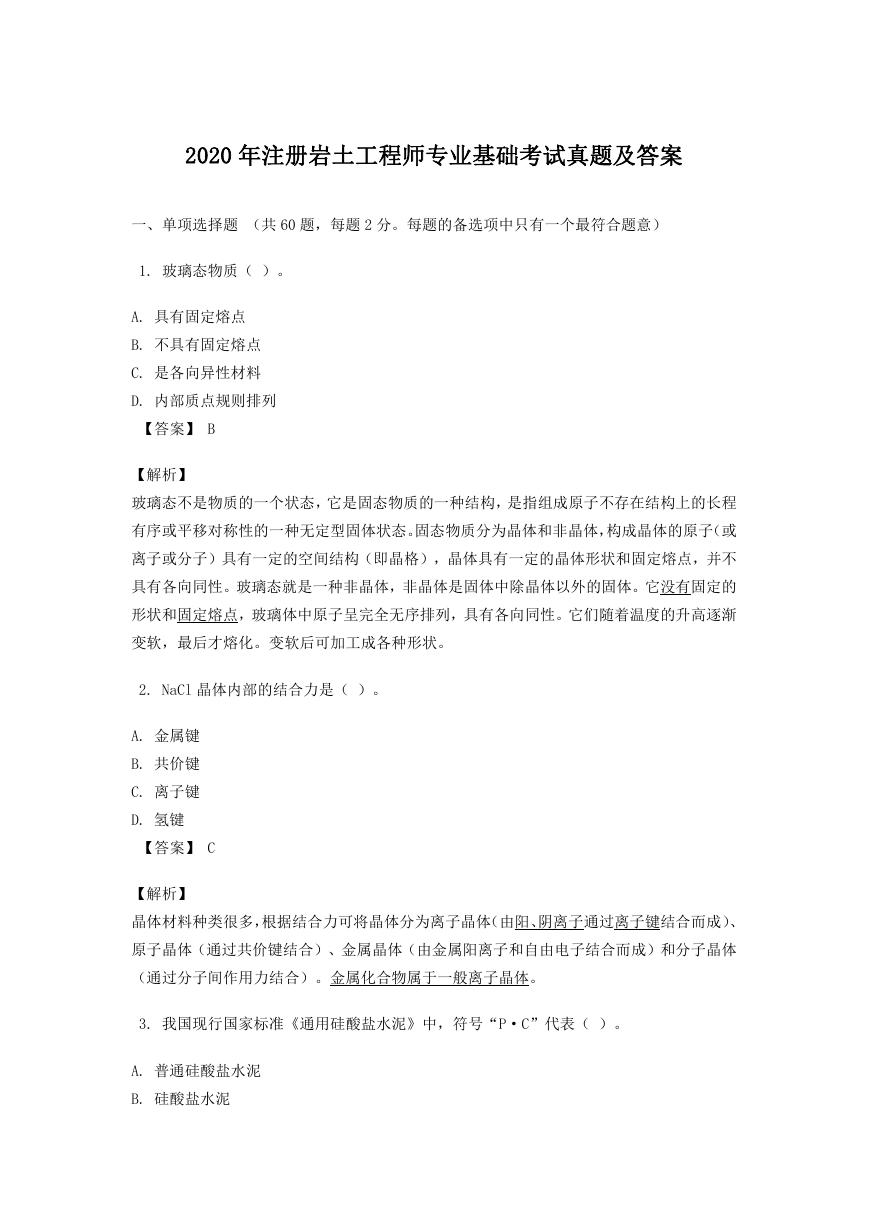

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

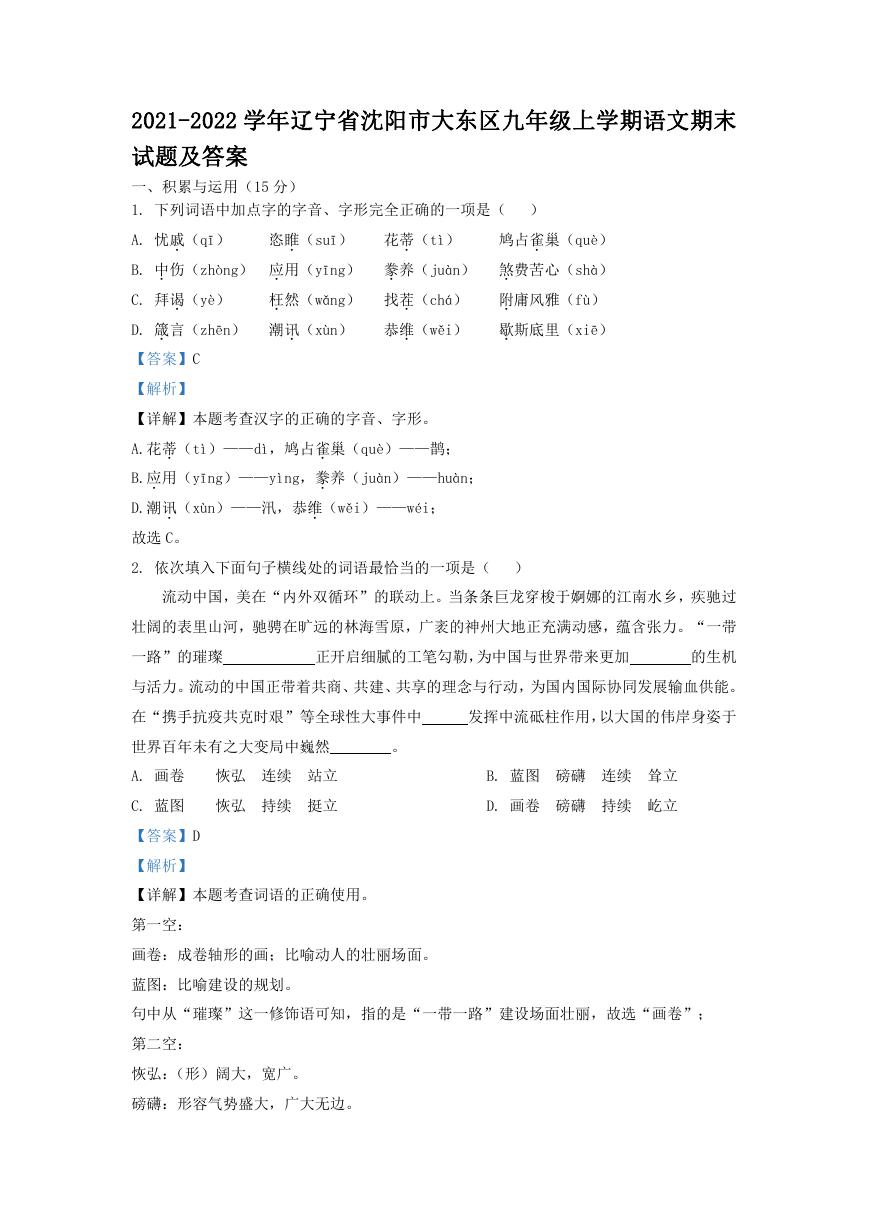

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

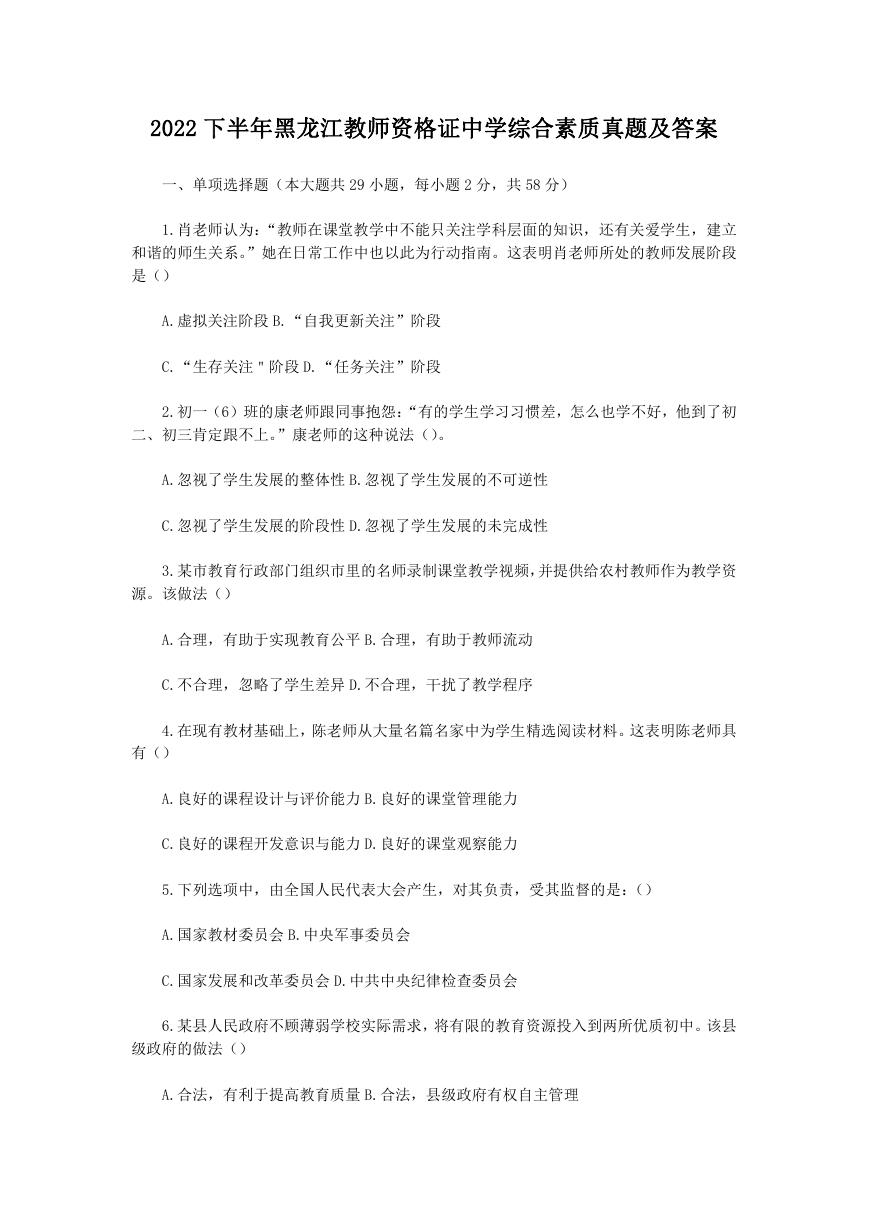

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc