CoVaR

Tobias Adriany

Federal Reserve Bank of New Yorkz

Markus K. Brunnermeierx

Princeton University

This Version: November 1, 2010

Abstract

We propose a measure for systemic risk: CoVaR, the value at risk (VaR) of the

nancial system conditional on institutions being under distress. We dene an insti-

tutions contribution to systemic risk as the di⁄erence between CoVaR conditional

on the institution being under distress and the CoVaR in the median state of the

institution. From our estimates of CoVaR for the universe of publicly traded nan-

cial institutions, we quantify the extent to which characteristics such as leverage,

size, and maturity mismatch predict systemic risk contribution. We show that pre-

dicted systemic risk contribution is countercyclical, and argue for macroprudential

regulation based on the degree to which such characteristics predict systemic risk

contribution.

Keywords: Value at Risk, Systemic Risk, Adverse Feedback Loop, Endogenous

Risk, Risk Spillovers, Financial Architecture, Capital Requirements

JEL classication: G01, G10, G18, G20, G28, G32, G38

Special thanks go to Daniel Green and Hoai-Luu Nguyen for outstanding research assistance. The

authors also thank Paolo Angelini, Gadi Barlevy, RenØ Carmona, Stephen Brown, Robert Engle, Mark

Flannery, Xavier Gabaix, Paul Glasserman, Beverly Hirtle, Jon Danielson, John Kambhu, Arvind Kr-

ishnamurthy, Burton Malkiel, Maureen OHara, Andrew Patton, Matt Pritsker, Matt Richardson, Jean-

Charles Rochet, JosØ Scheinkman, Jeremy Stein, Kevin Stiroh, and Skander Van den Heuvel for feedback,

as well as seminar participants at numerous universities, central banks, and conferences. We are grateful

for support from the Institute for Quantitative Investment Research Europe. Brunnermeier also acknowl-

edges nancial support from the Alfred P. Sloan Foundation. An earlier version of this paper with the

denition of CoVaR was presented at the NBER Summer Institute under the title Risk Spillovers of

Financial Institutionsin July 2008.

yFederal Reserve Bank of New York, Capital Markets, 33 Liberty Street, New York, NY 10045,

http://nyfedeconomists.org/adrian, e-mail: tobias.adrian@ny.frb.org.

zThe views expressed in this paper are those of the authors and do not necessarily represent those of

the Federal Reserve Bank of New York or the Federal Reserve System.

xPrinceton University, Department of Economics, Bendheim Center for Finance, Princeton, NJ 08540-

5296, NBER, CEPR, CESIfo, http://www.princeton.edu/~markus, e-mail: markus@princeton.edu.

�

1 Introduction

During times of nancial crises, losses tend to spread across nancial institutions, threat-

ening the nancial system as a whole.1 While comovement of nancial institutionsassets

and liabilities is primarily driven by fundamentals in normal times, comovement tends

to increase during times of crisis. Such increases of comovement give rise to systemic

risk the risk that institutional distress spreads widely and distorts the supply of credit

and capital to the real economy. Negative spillover e⁄ects can be direct, because of di-

rect contractual links and heightened counterparty credit risk, or indirect through price

e⁄ects via liquidity spirals. Measures of systemic risk that capture the increase in tail

comovement during nancial crises should become supervisory tools and form the basis

of any macroprudential regulation.

The most common measure of risk used by nancial institutions the value at risk

(VaR) focuses on the risk of an individual institution in isolation. The q%-VaR is

the maximum dollar loss within the q%-condence interval; see the overviews by Kupiec

(2002) and Jorion (2006). However, a single institutions risk measure does not necessarily

reect systemic risk the risk that the stability of the nancial system as a whole is

threatened. First, according to the classication in Brunnermeier, Crocket, Goodhart,

Perssaud, and Shin (2009), a systemic risk measure should identify the risk on the system

by individually systemic institutions, which are so interconnected and large that they

can cause negative risk spillover e⁄ects on others, as well as by institutions that are

systemic as part of a herd. A group of 100 institutions that act like clones can be as

precarious and dangerous to the system as the large merged identity. The S&L crisis in the

1980s is a prominent example of many small institutions being systemic as part of herd.

1Examples include the 1987 equity market crash, which was started by portfolio hedging of pension

funds and led to substantial losses of investment banks; the 1998 crisis, which was started with losses of

hedge funds and spilled over to the trading oors of commercial and investment banks; and the 2007-09

crisis, which spread from SIVs to commercial banks and on to investment banks and hedge funds. See

Brady (1988), Rubin, Greenspan, Levitt, and Born (1999), Brunnermeier (2009), and Adrian and Shin

(2010a).

1

�

Second, risk measures should recognize that risk typically builds up in the background in

the form of imbalances and bubbles and materializes only during a crisis. Hence, high-

frequency risk measures that rely primarily on contemporaneous price movements are

misleading and procyclical. Regulation based on such contemporaneous measures tends

to be procyclical and potentially amplies business cycles (see Adrian and Shin (2010b)).

The objective of this paper is twofold: First, we propose a measure for systemic risk.

Second, we outline a method that allows for a countercyclical implementation of macro-

prudential policy by predicting future systemic risk using current institutional character-

istics such as size, leverage, and maturity mismatch. To emphasize the systemic nature

of our risk measure, we add to existing risk measures the prex Co, which stands for

conditional, comovement, contagion, or contributing. We focus primarily on CoVaR,

where institution is CoVaR relative to the system is dened as the VaR of the whole

nancial sector conditional on institution i being in distress.2 The di⁄erence between

the CoVaR conditional on the distress of an institution and the CoVaR conditional on

the normal state of the institution, CoVaR, captures the marginal contribution of a

particular institution (in a non-causal sense) to the overall systemic risk.

There are several advantages to our CoVaR measure. First, while CoVaR focuses

on the contribution of each institution to overall system risk, current prudential regulation

focuses on the risk of individual institutions. Regulation based on the risk of institutions in

isolation can lead, in the aggregate, to excessive risk-taking along systemic risk dimensions.

To see this more explicitly, consider two institutions, A and B, which report the same VaR,

but for institution A the CoVaR= 0, while for institution B the CoVaR is large (in

absolute value). Based on their VaRs, both institutions appear equally risky. However,

the high CoVaR of institution B indicates that it contributes more to system risk. Since

2Just as VaR sounds like variance, CoVaR sounds like covariance. This analogy is no coincidence.

In fact, under many distributional assumptions (such as the assumption that shocks are conditionally

Gaussian), the VaR of an institution is indeed proportional to the variance of the institution, and the

CoVaR of an institution is proportional to the covariance of the nancial system and the individual

institution.

2

�

system risk might carry a higher risk premium, institution B might outshine institution

A in terms of generating returns, so that competitive pressure might force institution A

to follow suit. Imposing stricter regulatory requirements on institution B would break

this tendency to generate systemic risk.

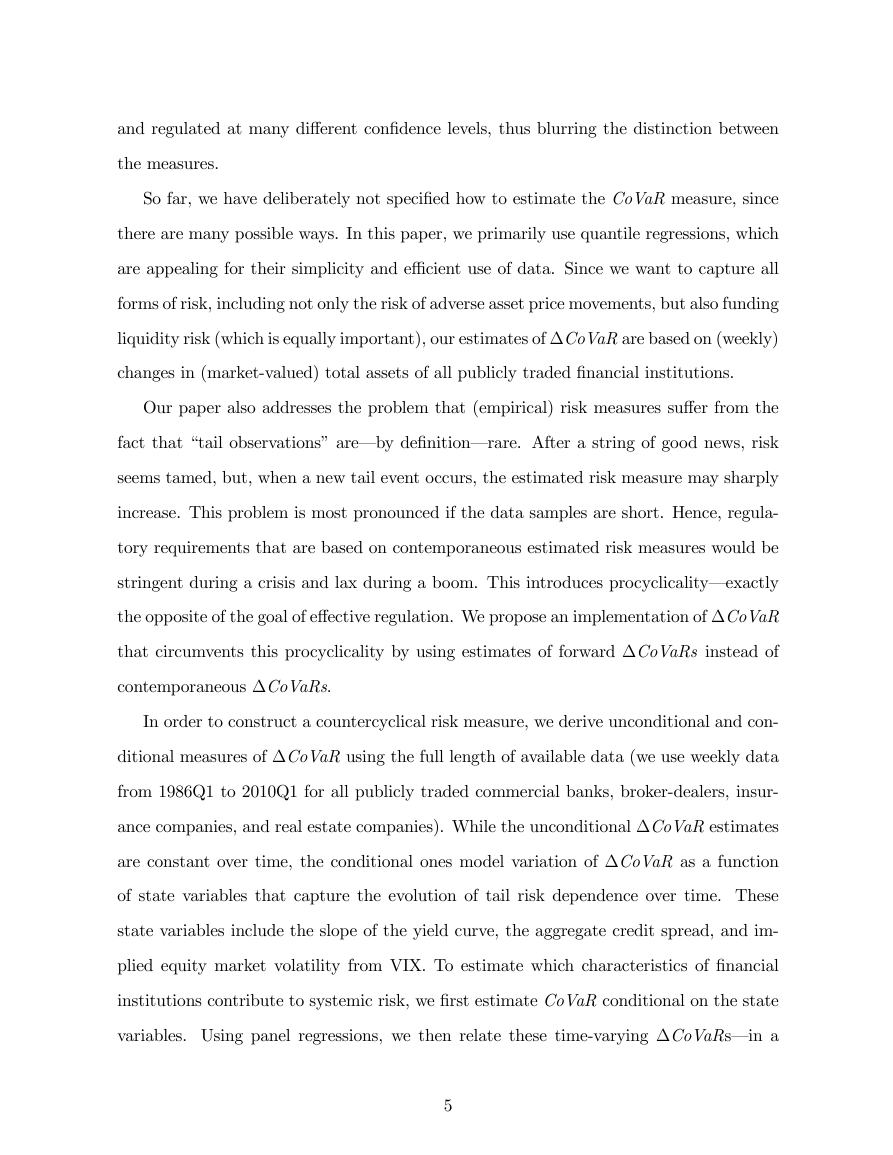

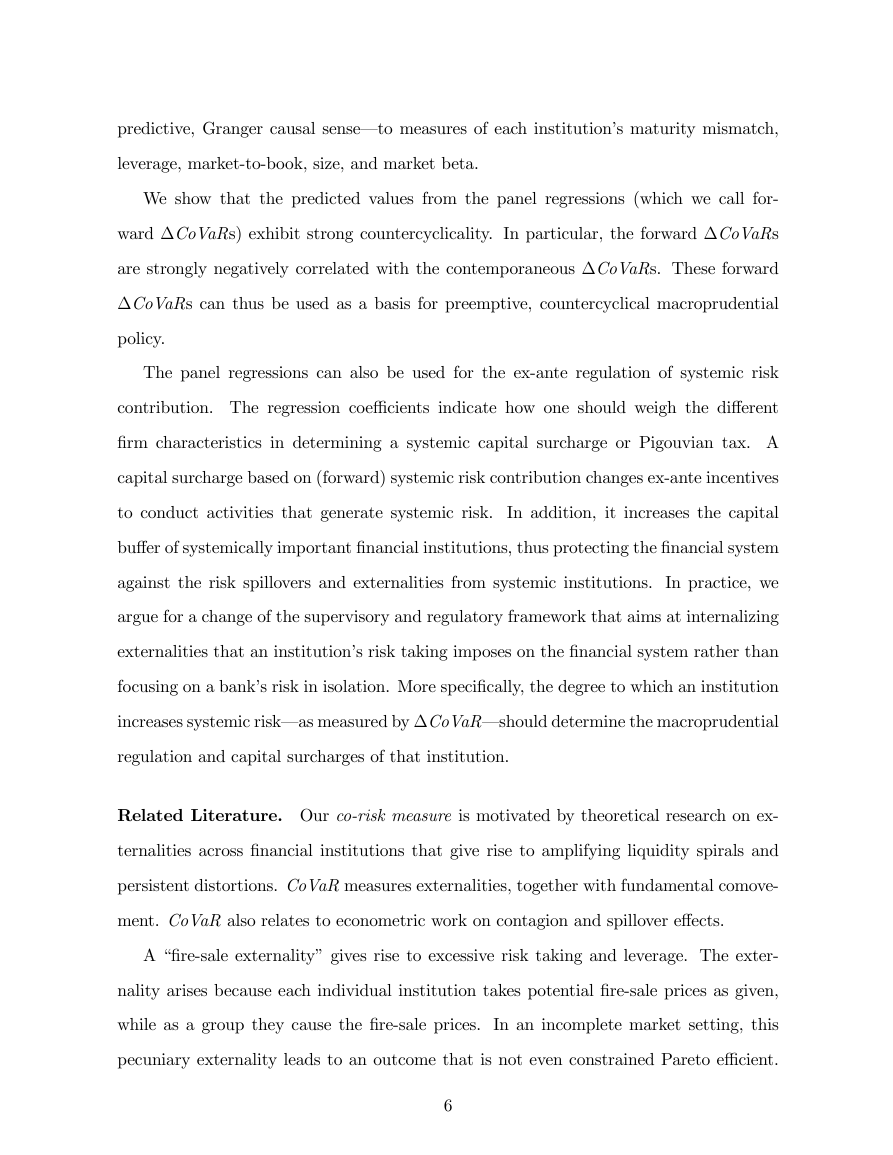

One could argue that regulating institutionsVaR might be su¢ cient as long as each

institutions CoVaR goes hand in hand with its VaR. However, this is not the case, as

(i) it is not desirable that institution A should increase its contribution to systemic risk

by following a strategy similar to institution B and (ii) empirically, there is no one-to-one

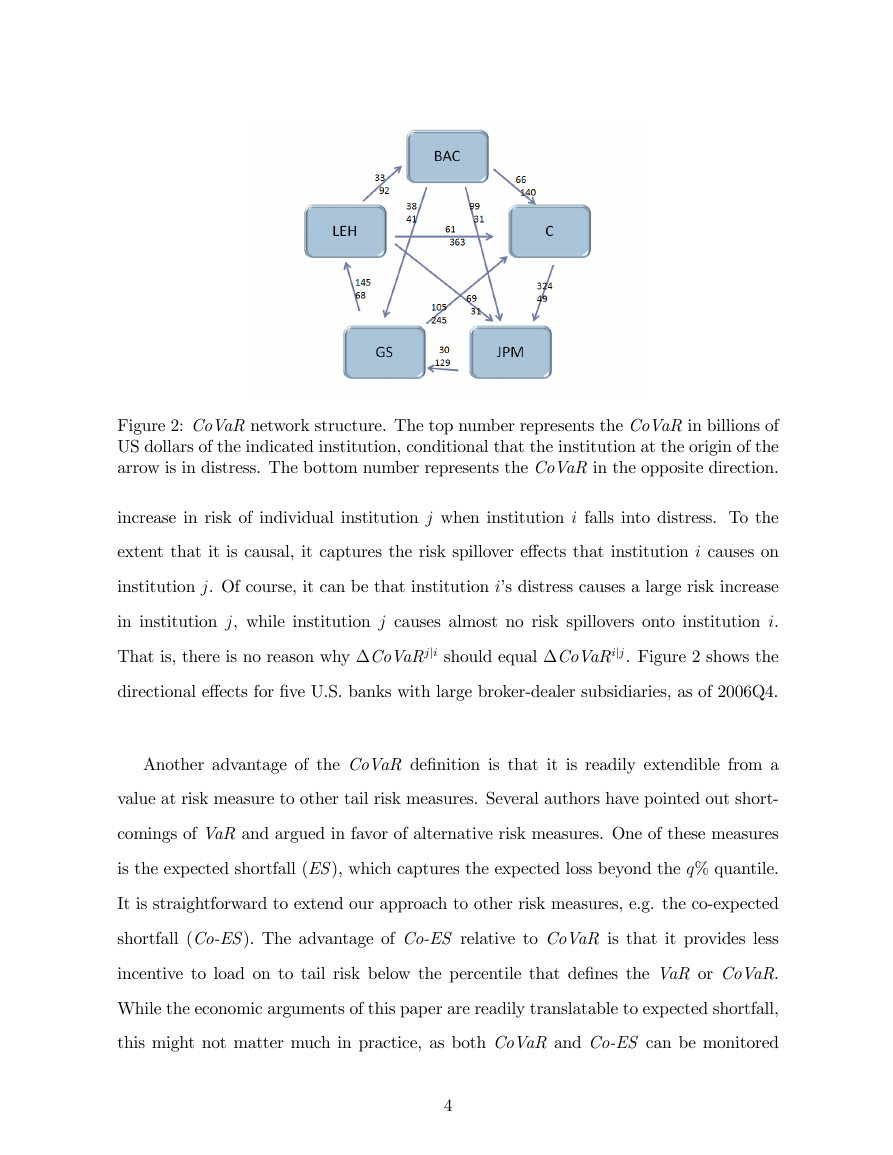

connection between an institutions CoVaR (y-axis) and its VaR (x-axis), as Figure 1

shows. Overall, Figure 1 questions the usefulness of bank regulation to rely primarily on

VaR.

Figure 1: The scatter plot shows the weak link between institutions risk in isolation,

measured by VaRi (x-axis), and institutions contribution to system risk, measured by

CoVaRi (y-axis). The VaRi and CoVaRi are measured in 2006Q4 and are reported

in returns. A list with the names of the institutions corresponding to the tickers in this

plot is given in Appendix C.

Another advantage of our co-risk measure is that it is general enough to study the

risk spillovers across the whole nancial network. For example, CoVaRjji captures the

3

CFCWBBACJPMCWFCBSCMERMSLEHGSAIGBRKMETFNMFRE.8.6.4.20DCoVaR1.61.41.21.8Institution VaRCommercial BanksInvestment BanksInsurance CompaniesGSEsDCoVaR vs. VaR Returns�

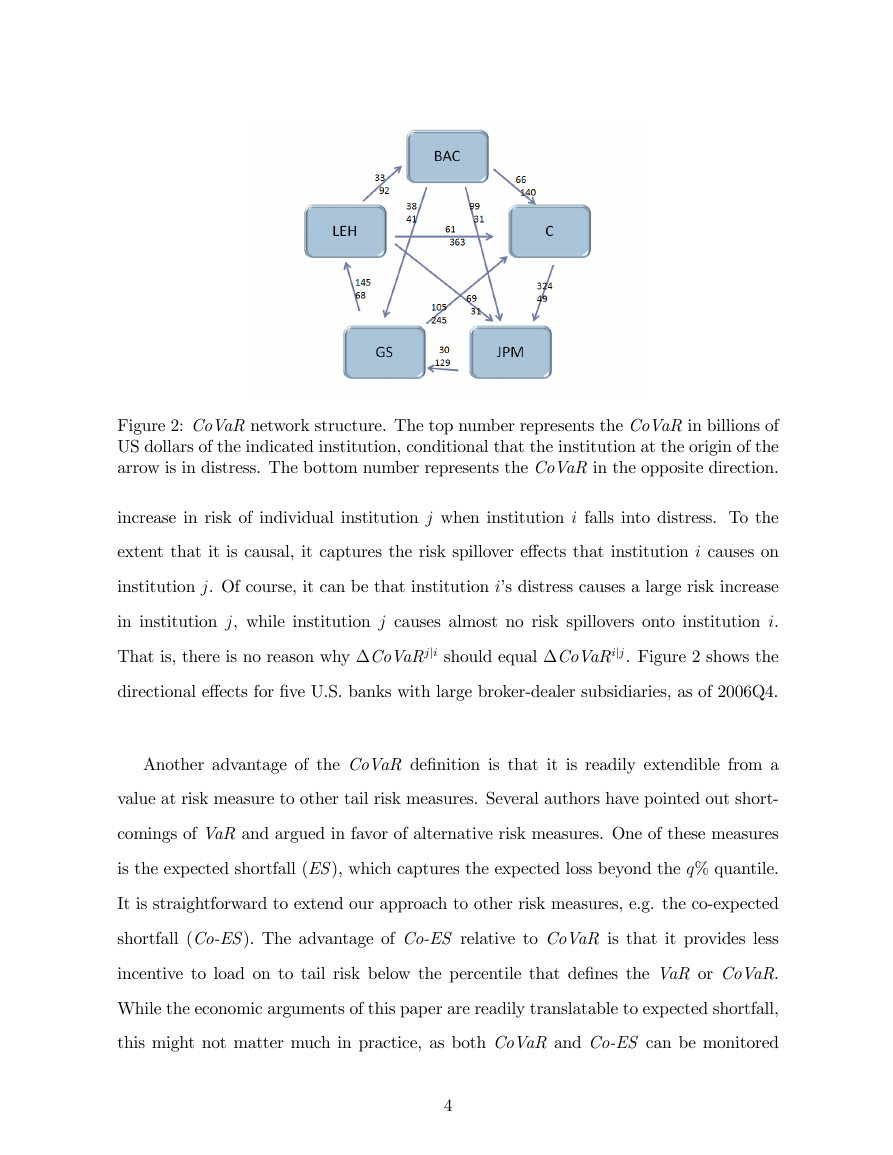

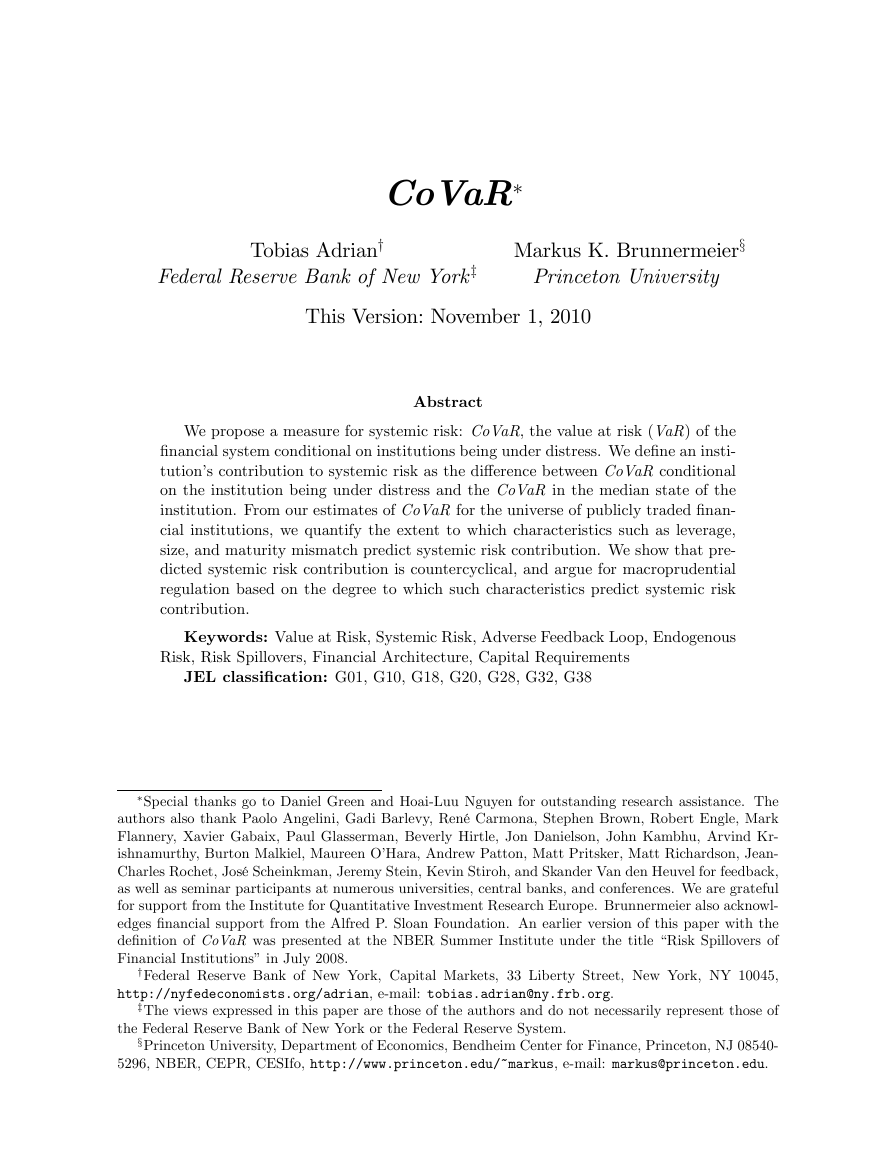

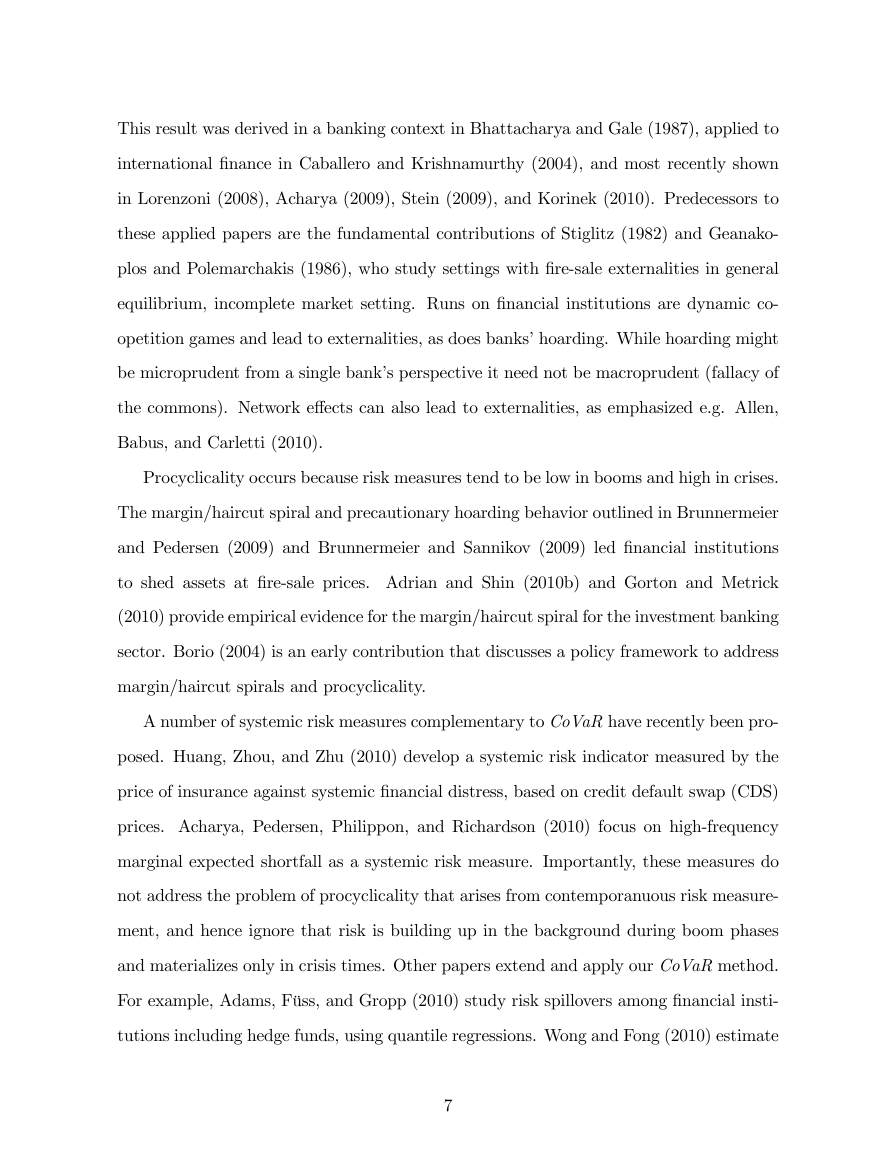

Figure 2: CoVaR network structure. The top number represents the CoVaR in billions of

US dollars of the indicated institution, conditional that the institution at the origin of the

arrow is in distress. The bottom number represents the CoVaR in the opposite direction.

increase in risk of individual institution j when institution i falls into distress. To the

extent that it is causal, it captures the risk spillover e⁄ects that institution i causes on

institution j. Of course, it can be that institution is distress causes a large risk increase

in institution j, while institution j causes almost no risk spillovers onto institution i.

That is, there is no reason why CoVaRjji should equal CoVaRijj. Figure 2 shows the

directional e⁄ects for ve U.S. banks with large broker-dealer subsidiaries, as of 2006Q4.

Another advantage of the CoVaR denition is that it is readily extendible from a

value at risk measure to other tail risk measures. Several authors have pointed out short-

comings of VaR and argued in favor of alternative risk measures. One of these measures

is the expected shortfall (ES), which captures the expected loss beyond the q% quantile.

It is straightforward to extend our approach to other risk measures, e.g. the co-expected

shortfall (Co-ES). The advantage of Co-ES relative to CoVaR is that it provides less

incentive to load on to tail risk below the percentile that denes the VaR or CoVaR.

While the economic arguments of this paper are readily translatable to expected shortfall,

this might not matter much in practice, as both CoVaR and Co-ES can be monitored

4

�

and regulated at many di⁄erent condence levels, thus blurring the distinction between

the measures.

So far, we have deliberately not specied how to estimate the CoVaR measure, since

there are many possible ways. In this paper, we primarily use quantile regressions, which

are appealing for their simplicity and e¢ cient use of data. Since we want to capture all

forms of risk, including not only the risk of adverse asset price movements, but also funding

liquidity risk (which is equally important), our estimates of CoVaR are based on (weekly)

changes in (market-valued) total assets of all publicly traded nancial institutions.

Our paper also addresses the problem that (empirical) risk measures su⁄er from the

fact that tail observations are by denition rare. After a string of good news, risk

seems tamed, but, when a new tail event occurs, the estimated risk measure may sharply

increase. This problem is most pronounced if the data samples are short. Hence, regula-

tory requirements that are based on contemporaneous estimated risk measures would be

stringent during a crisis and lax during a boom. This introduces procyclicality exactly

the opposite of the goal of e⁄ective regulation. We propose an implementation of CoVaR

that circumvents this procyclicality by using estimates of forward CoVaRs instead of

contemporaneous CoVaRs.

In order to construct a countercyclical risk measure, we derive unconditional and con-

ditional measures of CoVaR using the full length of available data (we use weekly data

from 1986Q1 to 2010Q1 for all publicly traded commercial banks, broker-dealers, insur-

ance companies, and real estate companies). While the unconditional CoVaR estimates

are constant over time, the conditional ones model variation of CoVaR as a function

of state variables that capture the evolution of tail risk dependence over time. These

state variables include the slope of the yield curve, the aggregate credit spread, and im-

plied equity market volatility from VIX. To estimate which characteristics of nancial

institutions contribute to systemic risk, we rst estimate CoVaR conditional on the state

variables. Using panel regressions, we then relate these time-varying CoVaRs in a

5

�

predictive, Granger causal sense to measures of each institutions maturity mismatch,

leverage, market-to-book, size, and market beta.

We show that the predicted values from the panel regressions (which we call for-

ward CoVaRs) exhibit strong countercyclicality. In particular, the forward CoVaRs

are strongly negatively correlated with the contemporaneous CoVaRs. These forward

CoVaRs can thus be used as a basis for preemptive, countercyclical macroprudential

policy.

The panel regressions can also be used for the ex-ante regulation of systemic risk

contribution. The regression coe¢ cients indicate how one should weigh the di⁄erent

rm characteristics in determining a systemic capital surcharge or Pigouvian tax. A

capital surcharge based on (forward) systemic risk contribution changes ex-ante incentives

to conduct activities that generate systemic risk.

In addition, it increases the capital

bu⁄er of systemically important nancial institutions, thus protecting the nancial system

against the risk spillovers and externalities from systemic institutions. In practice, we

argue for a change of the supervisory and regulatory framework that aims at internalizing

externalities that an institutions risk taking imposes on the nancial system rather than

focusing on a banks risk in isolation. More specically, the degree to which an institution

increases systemic risk as measured by CoVaR should determine the macroprudential

regulation and capital surcharges of that institution.

Related Literature. Our co-risk measure is motivated by theoretical research on ex-

ternalities across nancial institutions that give rise to amplifying liquidity spirals and

persistent distortions. CoVaR measures externalities, together with fundamental comove-

ment. CoVaR also relates to econometric work on contagion and spillover e⁄ects.

A re-sale externality gives rise to excessive risk taking and leverage. The exter-

nality arises because each individual institution takes potential re-sale prices as given,

while as a group they cause the re-sale prices. In an incomplete market setting, this

pecuniary externality leads to an outcome that is not even constrained Pareto e¢ cient.

6

�

This result was derived in a banking context in Bhattacharya and Gale (1987), applied to

international nance in Caballero and Krishnamurthy (2004), and most recently shown

in Lorenzoni (2008), Acharya (2009), Stein (2009), and Korinek (2010). Predecessors to

these applied papers are the fundamental contributions of Stiglitz (1982) and Geanako-

plos and Polemarchakis (1986), who study settings with re-sale externalities in general

equilibrium, incomplete market setting. Runs on nancial institutions are dynamic co-

opetition games and lead to externalities, as does bankshoarding. While hoarding might

be microprudent from a single banks perspective it need not be macroprudent (fallacy of

the commons). Network e⁄ects can also lead to externalities, as emphasized e.g. Allen,

Babus, and Carletti (2010).

Procyclicality occurs because risk measures tend to be low in booms and high in crises.

The margin/haircut spiral and precautionary hoarding behavior outlined in Brunnermeier

and Pedersen (2009) and Brunnermeier and Sannikov (2009) led nancial institutions

to shed assets at re-sale prices. Adrian and Shin (2010b) and Gorton and Metrick

(2010) provide empirical evidence for the margin/haircut spiral for the investment banking

sector. Borio (2004) is an early contribution that discusses a policy framework to address

margin/haircut spirals and procyclicality.

A number of systemic risk measures complementary to CoVaR have recently been pro-

posed. Huang, Zhou, and Zhu (2010) develop a systemic risk indicator measured by the

price of insurance against systemic nancial distress, based on credit default swap (CDS)

prices. Acharya, Pedersen, Philippon, and Richardson (2010) focus on high-frequency

marginal expected shortfall as a systemic risk measure. Importantly, these measures do

not address the problem of procyclicality that arises from contemporanuous risk measure-

ment, and hence ignore that risk is building up in the background during boom phases

and materializes only in crisis times. Other papers extend and apply our CoVaR method.

For example, Adams, Fss, and Gropp (2010) study risk spillovers among nancial insti-

tutions including hedge funds, using quantile regressions. Wong and Fong (2010) estimate

7

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc