Series Title

Series Contents

Title

Date-line

Preface

Contents

Introduction

Summary of Volume I

Summary of Volume II

1 General Probability Theory

1.1 Infinite Probability Spaces

1.2 Random Variables and Distributions

1.3 Expectations

1.4 Convergence of Integrals

1.5 Computation of Expectations

1.6 Change of Measure

1.7 Summary

1.8 Notes

1.9 Exercises

2 Information and Conditioning

2.1 Information and ?-algebras

2.2 Independence

2.3 General Conditional Expectations

2.4 Summary

2.5 Notes

2.6 Exercises

3 Brownian Motion

3.1 Introduction

3.2 Scaled Random Walks

3.2.1 Symmetric Random Walk

3.2.2 Increments of the Symmetric Random Walk

3.2.3 Martingale Property for the Symmetric Random Walk

3.2.4 Quadratic Variation of the Symmetric Random Walk

3.2.5 Scaled Symmetric Random Walk

3.2.6 Limiting Distribution of the Scaled Random Walk

3.2.7 Log-Normal Distribution as the Limit of the Binomial Model

3.3 Brownian Motion

3.3.1 Definition of Brownian Motion

3.3.2 Distribution of Brownian Motion

3.3.3 Filtration for Brownian Motion

3.3.4 Martingale Property for Brownian Motion

3.4 Quadratic Variation

3.4.1 First-Order Variation

3.4.2 Quadratic Variation

3.4.3 Volatility of Geometric Brownian Motion

3.5 Markov Property

3.6 First Passage Time Distribution

3.7 Reflection Principle

3.7.1 Reflection Equality

3.7.2 First Passage Time Distribution

3.7.3 Distribution of Brownian Motion and Its Maximum

3.8 Summary

3.9 Notes

3.10 Exercises

4 Stochastic Calculus

4.1 Introduction

4.2 Ito's Integral for Simple Integrands

4.2.1 Construction of the Integral

4.2.2 Properties of the Integral

4.3 Ito's Integral for General Integrands

4.4 Ito-Doeblin Formula

4.4.1 Formula for Brownian Motion

4.4.2 Formula for Ito Processes

4.4.3 Examples

4.5 Black-Scholes-Merton Equation

4.5.1 Evolution of Portfolio Value

4.5.2 Evolution of Option Value

4.5.3 Equating the Evolutions

4.5.4 Solution to the Black-Scholes-Merton Equation

4.5.5 The Greeks

4.5.6 Put-Call Parity

4.6 Multivariable Stochastic Calculus

4.6.1 Multiple Brownian Motions

4.6.2 Ito-Doeblin Formula for Multiple Processes

4.6.3 Recognizing a Brownian Motion

4.7 Brownian Bridge

4.7.1 Gaussian Processes

4.7.2 Brownian Bridge as a Gaussian Process

4.7.3 Brownian Bridge as a Scaled Stochastic Integral

4.7.4 Multidimensional Distribution of the Brownian Bridge

4.7.5 Brownian Bridge as a Conditioned Brownian Motion

4.8 Summary

4.9 Notes

4.10 Exercises

5 Risk-Neutral Pricing

5.1 Introduction

5.2 Risk-Neutral Measure

5.2.1 Girsanov's Theorem for a Single Brownian Motion

5.2.2 Stock Under the Risk-Neutral Measure

5.2.3 Value of Portfolio Process Under the Risk-Neutral Measure

5.2.4 Pricing Under the Risk-Neutral Measure

5.2.5 Deriving the Black-Scholes-Merton Formula

5.3 Martingale Representation Theorem

5.3.1 Martingale Representation with One Brownian Motion

5.3.2 Hedging with One Stock

5.4 Fundamental Theorems of Asset Pricing

5.4.1 Girsanov and Martingale Representation Theorems

5.4.2 Multidimensional Market Model

5.4.3 Existence of the Risk-Neutral Measure

5.4.4 Uniqueness of the Risk-Neutral Measure

5.5 Dividend-Paying Stocks

5.5.1 Continuously Paying Dividend

5.5.2 Continuously Paying Dividend with Constant Coefficients

5.5.3 Lump Payments of Dividends

5.5.4 Lump Payments of Dividends with Constant Coefficients

5.6 Forwards and Futures

5.6.1 Forward Contracts

5.6.2 Futures Contracts

5.6.3 Forward-Futures Spread

5.7 Summary

5.8 Notes

5.9 Exercises

6 Connections with Partial Differential Equations

6.1 Introduction

6.2 Stochastic Differential Equations

6.3 The Markov Property

6.4 Partial Differential Equations

6.5 Interest Rate Models

6.6 Multidimensional Feynman-Kac Theorems

6.7 Summary

6.8 Notes

6.9 Exercises

7 Exotic Options

7.1 Introduction

7.2 Maximum of Brownian Motion with Drift

7.3 Knock-out Barrier Options

7.3.1 Up-and-Out Call

7.3.2 Black-Scholes-Merton Equation

7.3.3 Computation of the Price of the Up-and-Out Call

7.4 Lookback Options

7.4.1 Floating Strike Lookback Option

7.4.2 Black-Scholes-Merton Equation

7.4.3 Reduction of Dimension

7.4.4 Computation of the Price of the Lookback Option

7.5 Asian Options

7.5.1 Fixed-Strike Asian Call

7.5.2 Augmentation of the State

7.5.3 Change of Numeraire

7.6 Summary

7.7 Notes

7.8 Exercises

8 American Derivative Securities

8.1 Introduction

8.2 Stopping Times

8.3 Perpetual American Put

8.3.1 Price Under Arbitrary Exercise

8.3.2 Price Under Optimal Exercise

8.3.3 Analytical Characterization of the Put Price

8.3.4 Probabilistic Characterization of the Put Price

8.4 Finite-Expiration American Put

8.4.1 Analytical Characterization of the Put Price

8.4.2 Probabilistic Characterization of the Put Price

8.5 American Call

8.5.1 Underlying Asset Pays No Dividends

8.5.2 Underlying Asset Pays Dividends

8.6 Summary

8.7 Notes

8.8 Exercises

9 Change of Numeraire

9.1 Introduction

9.2 Numeraire

9.3 Foreign and Domestic Risk-Neutral Measures

9.3.1 The Basic Processes

9.3.2 Domestic Risk-Neutral Measure

9.3.3 Foreign Risk-Neutral Measure

9.3.4 Siegel's Exchange Rate Paradox

9.3.5 Forward Exchange Rates

9.3.6 Garman-Kohlhagen Formula

9.3.7 Exchange Rate Put-Call Duality

9.4 Forward Measures

9.4.1 Forward Price

9.4.2 Zero-Coupon Bond as Numeraire

9.4.3 Option Pricing with a Random Interest Rate

9.5 Summary

9.6 Notes

9.7 Exercises

10 Term-Structure Models

10.1 Introduction

10.2 Affine-Yield Models

10.2.1 Two-Factor Vasicek Model

10.2.2 Two-Factor CIR Model

10.2.3 Mixed Model

10.3 Heath-Jarrow-Morton Model

10.3.1 Forward Rates

10.3.2 Dynamics of Forward Rates and Bond Prices

10.3.3 No-Arbitrage Condition

10.3.4 HJM Under Risk-Neutral Measure

10.3.5 Relation to Affine-Yield Models

10.3.6 Implementation of HJM

10.4 Forward LIBOR Model

10.4.1 The Problem with Forward Rates

10.4.2 LIBOR and Forward LIBOR

10.4.3 Pricing a Backset LIBOR Contract

10.4.4 Black Caplet Formula

10.4.5 Forward LIBOR and Zero-Coupon Bond Volatilities

10.4.6 A Forward LIBOR Term-Structure Model

10.5 Summary

10.6 Notes

10.7 Exercises

11 Introduction to Jump Processes

11.1 Introduction

11.2 Poisson Process

11.2.1 Exponential Random Variables

11.2.2 Construction of a Poisson Process

11.2.3 Distribution of Poisson Process Increments

11.2.4 Mean and Variance of Poisson Increments

11.2.5 Martingale Property

11.3 Compound Poisson Process

11.3.1 Construction of a Compound Poisson Process

11.3.2 Moment-Generating Function

11.4 Jump Processes and Their Integrals

11.4.1 Jump Processes

11.4.2 Quadratic Variation

11.5 Stochastic Calculus for Jump Processes

11.5.1 Ito-Doeblin Formula for One Jump Process

11.5.2 Ito-Doeblin Formula for Multiple Jump Processes

11.6 Change of Measure

11.6.1 Change of Measure for a Poisson Process

11.6.2 Change of Measure for a Compound Poisson Process

11.6.3 Change of Measure for a Compound Poisson Process and a Brownian Motion

11.7 Pricing a European Call in a Jump Model

11.7.1 Asset Driven by a Poisson Process

11.7.2 Asset Driven by a Brownian Motion and a Compound Poisson Process

11.8 Summary

11.9 Notes

11.10 Exercises

A Advanced Topics in Probability Theory

A.1 Countable Additivity

A.2 Generating $\sigma$-algebras

A.3 Random Variable with Neither Density nor Probability Mass Function

B Existence of Conditional Expectations

C Completion of the Proof of the Second Fundamental Theorem of Asset Pricing

References

Index

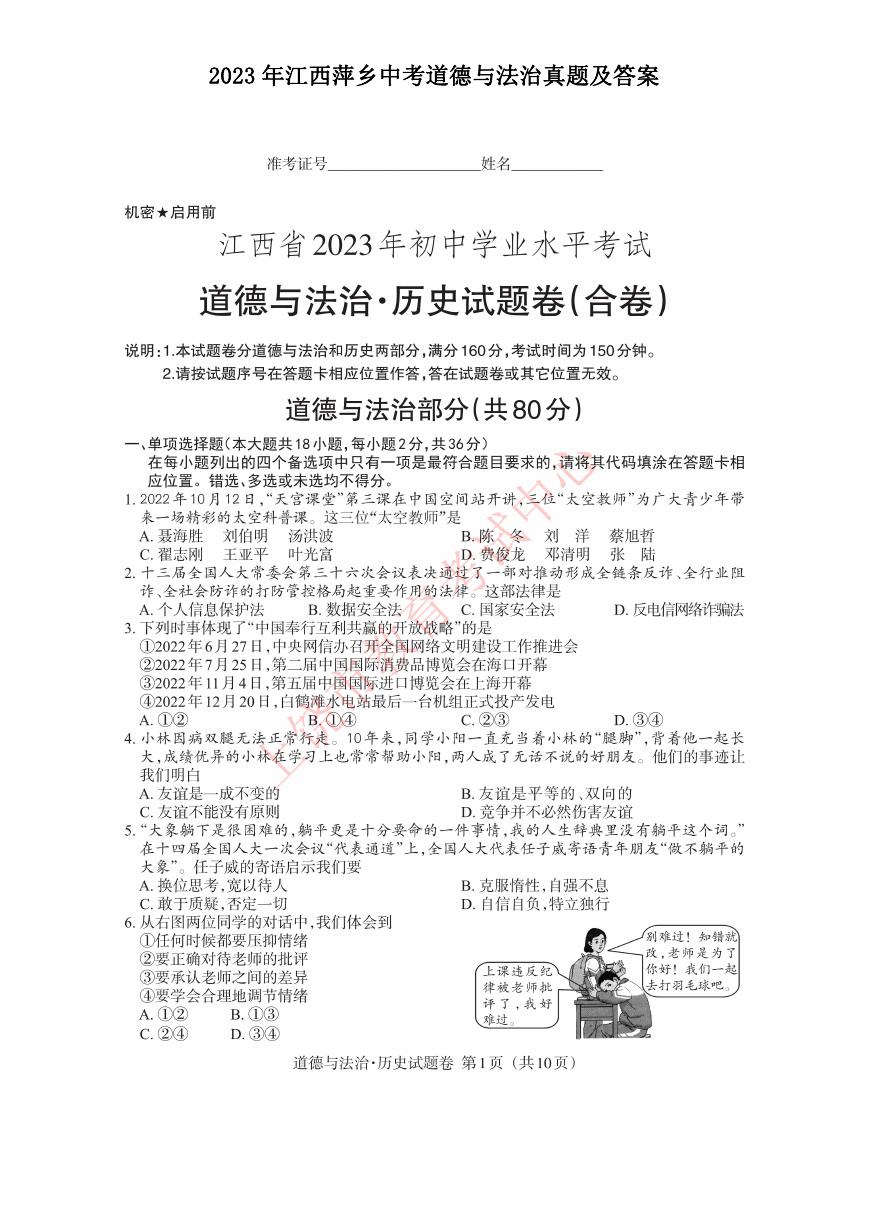

2023年江西萍乡中考道德与法治真题及答案.doc

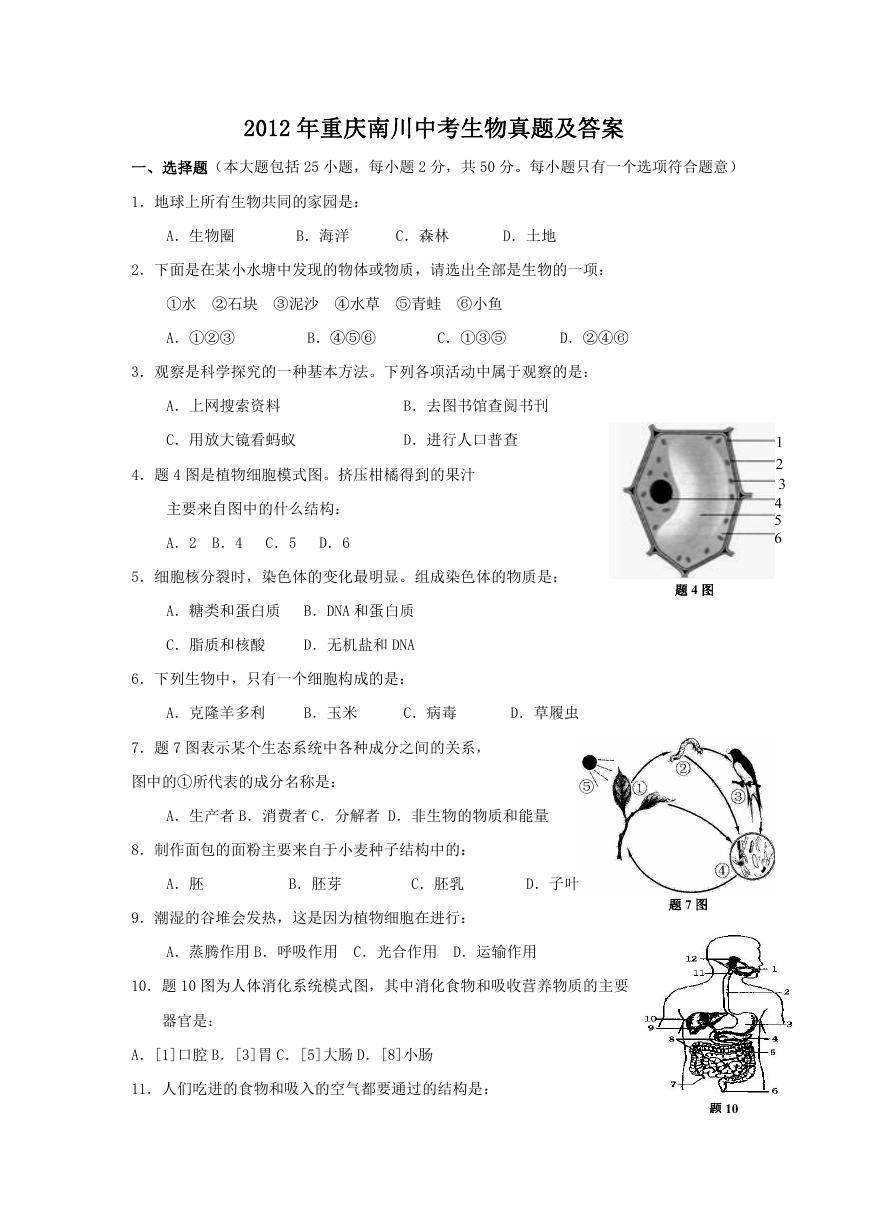

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

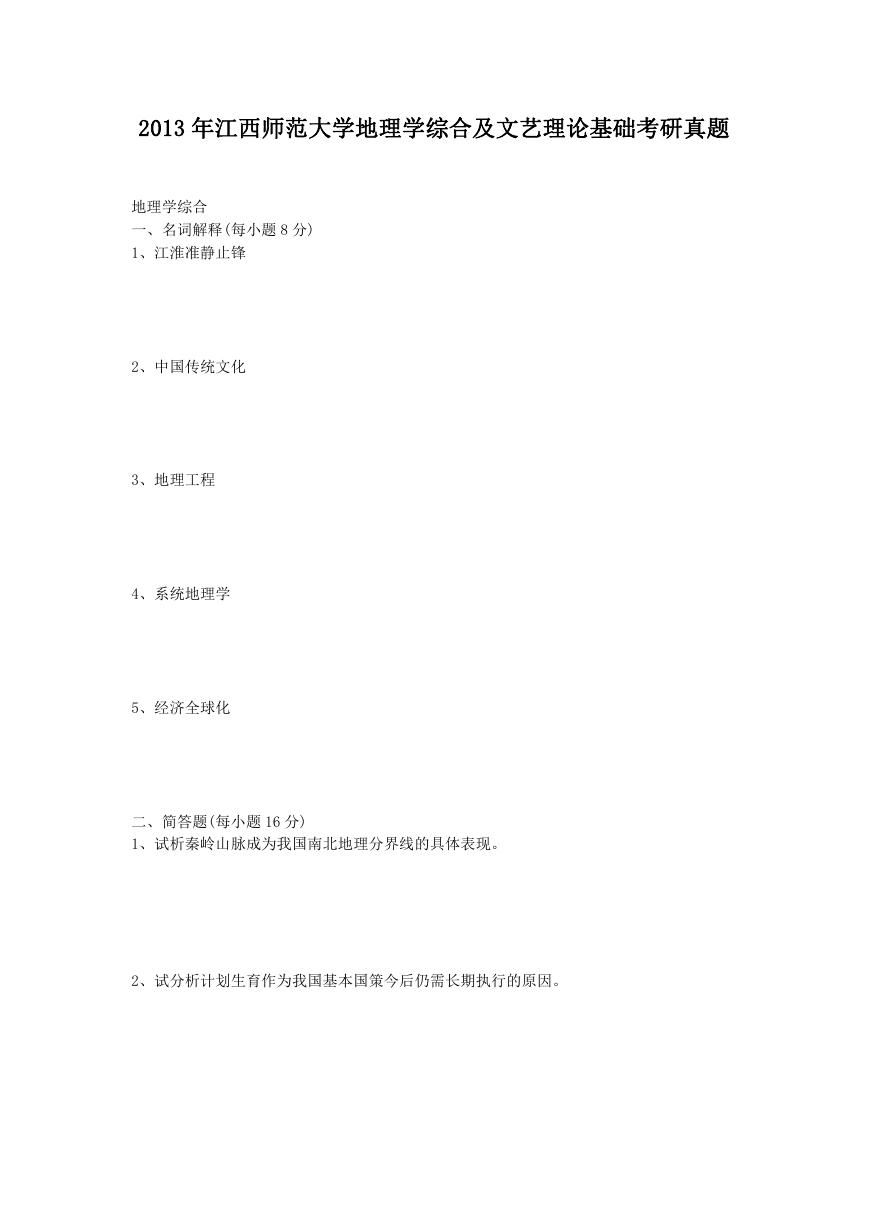

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

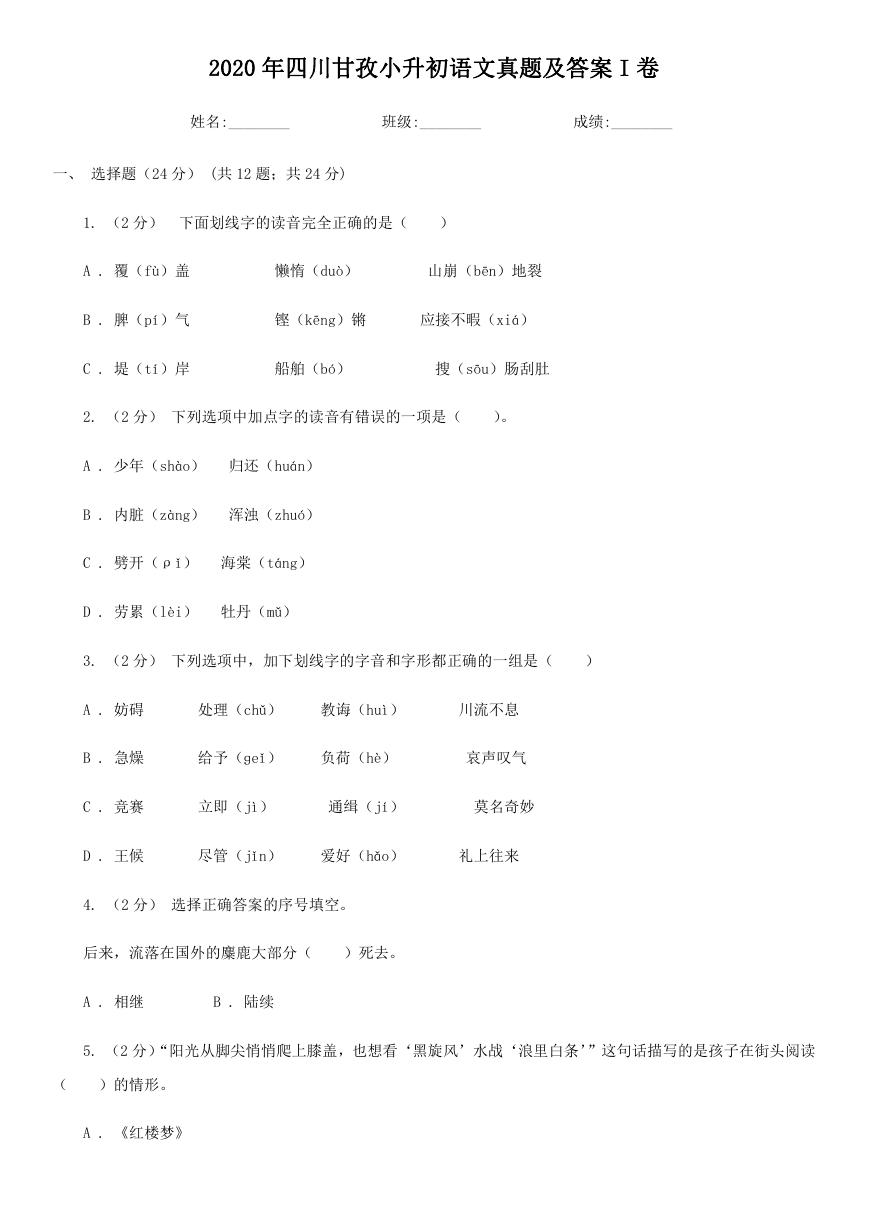

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

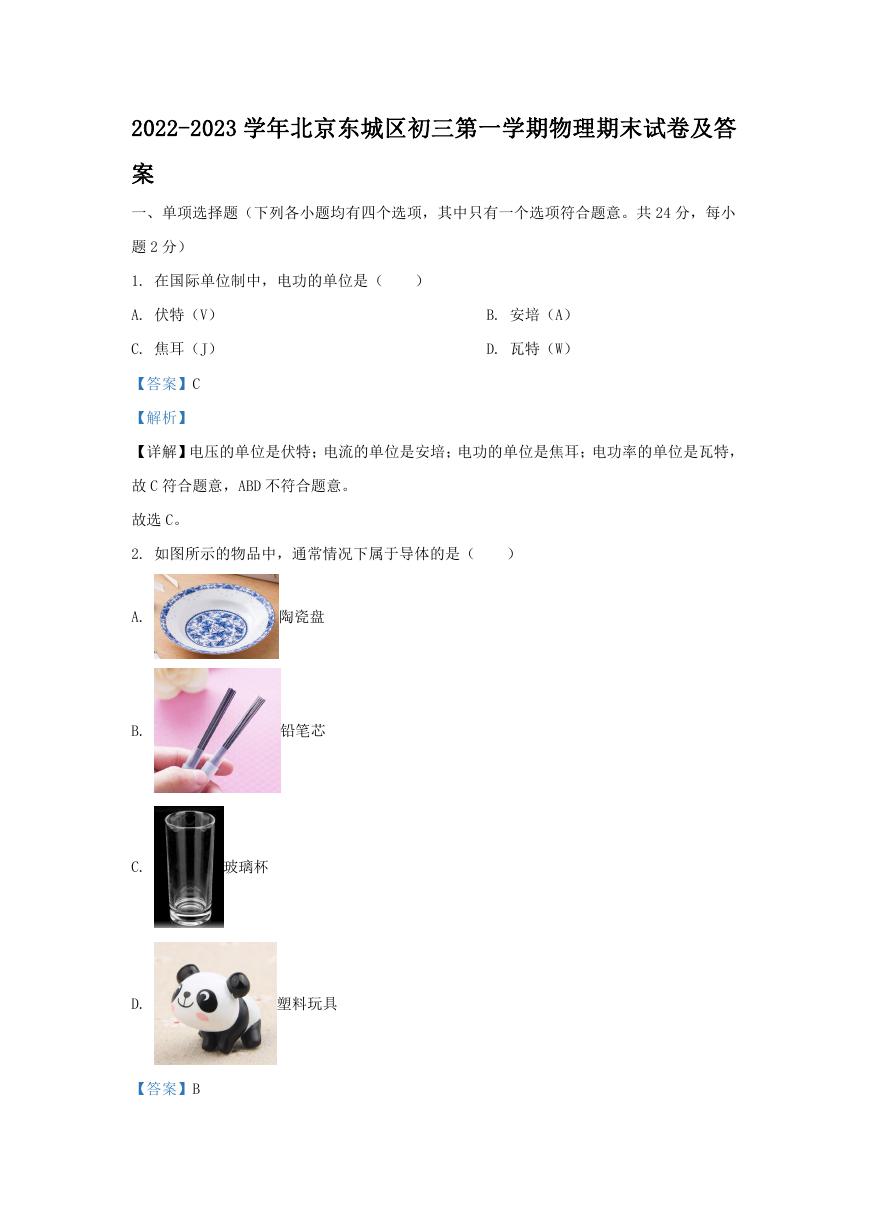

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc