Contents

1 Set

1.1 Sample sets

1.2 Operations with sets

1.3 Various relations

1.4 Indicator

Exercises

2 Probability

2.1 Examples of probability

2.2 Definition and illustrations

2.3 Deductions from the axioms

2.4 Independent events

2.5 Arithmetical density

Exercises

3 Counting

3.1 Fundamental rule

3.2 Diverse ways of sampling

3.3 Allocation models: binomial coefficients

3.4 How to solve it

Exercises

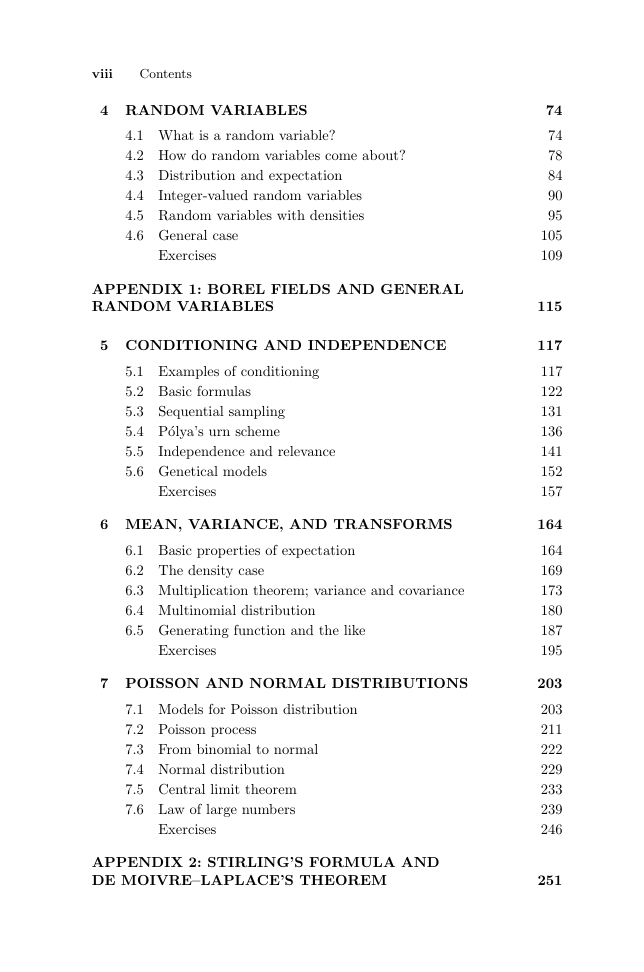

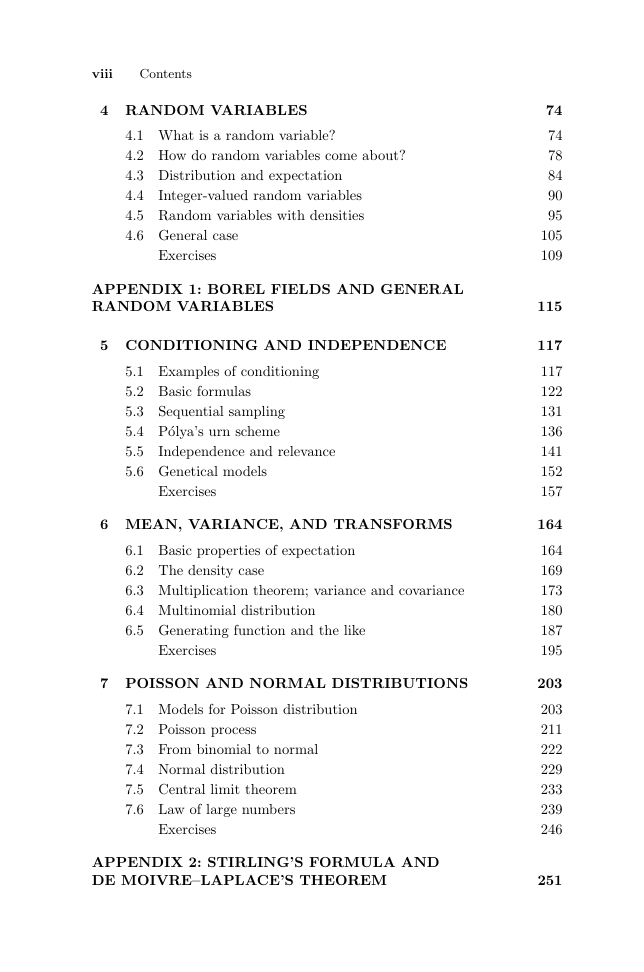

4 Random Variables

4.1 What is a random variable

4.2 How do random variables come about

4.3 Distribution and expectation

4.4 Integer-valued random variables

4.5 Random variables with densities

4.6 General case

Exercises

Appendix 1: Borel Fields and General Random Variables

5 Conditioning and Independence

5.1 Examples of conditioning

5.2 Basic formulas

5.3 Sequential sampling

5.4 Polya's urn scheme

5.5 Independence and relevance

5.6 Genetical models

Exercises

6 Mean, Variance, and Transforms

6.1 Basic properties of expectation

6.2 The density case

6.3 Multiplication theorem: variance and covariance

6.4 Multinomial distribution

6.5 Generating function and the like

Exercises

7 Poisson and Normal Distributions

7.1 Models for Poisson distribution

7.2 Poisson process

7.3 From binomial to normal

7.4 Normal distribution

7.5 Central limit theorem

7.6 Law of large numbers

Exercises

Appendix 2: Stirling's Formula and De Moivre-Laplace's Theorem

8 From Random Walks to Markov Chains

8.1 Problems of the wanderer or gambler

8.2 Limiting schemes

8.3 Transition probabilities

8.4 Basic structure of Markov chains

8.5 Further developments

8.6 Steady state

8.7 Winding up (or down?)

Exercises

Appendix 3 Martingale

9 Mean-Variance Pricing Model

9.1 An investments primer

9.2 Asset return and risk

9.3 Portfolio allocation

9.4 Diversification

9.5 Mean-variance optimization

9.6 Asset return distributions

9.7 Stable probability distributions

Exercises

Appendix 4 Pareto and Stable Laws

10 Option Pricing THeory

10.1 Options basics

10.2 Arbitrage-free pricing: 1-period model

10.3 Arbitrage-free pricing: N-period model

10.4 Fundamental asset pricing theorems

Exercises

General References

Answers to Problems

Values of the Standard Normal Distribution Function

Index

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc