Systems Engineering — Theory & Practice

X�ó§��†¢‚

¥ã©aÒ: F830.92

[|,4�©

(ú�óûŒÆ7�Æ,ɲ 310018)

1 31ò1 4Ï

2011

4

©�?Ò: 1000-6788(2011)04-0778-07

©z��è: A

Ä žC Copula7���†�xD/

Á‡|^žC CopulaïÄ��?§e¥�Œ� †�Ṡ ��xD/¯�.

^ AR(1)-GJR(1,1)-t.£ãˆ�Â�Ç>S©�,±žC SJC Copula£ãÂ�

Ç�ă5,©�¥�Œ� †{� !=� !F ±9†� 2000

1� 2010

11Ï��xéÄ.¢y���²:3��?§¥¥�Œ� †{�!

=�±9F �†�±‡fe�ƒ�X,††� �e�ƒ5����§

��\��¥wÍ��ª³;†ˆ�S ��ƒ5��†�±�Y².

�…

�xD/;7���;žC Copula

Vol.31, No.4

Apr., 2011

Financial market openness and risk contagion: A time-varying

Copula approach

WANG Yong-qiao, LIU Shi-wen

(College of Finance, Zhejiang Gongshang University, Hangzhou 310018, China)

Keywords financial contagion; capital market openness; time-varying Copula

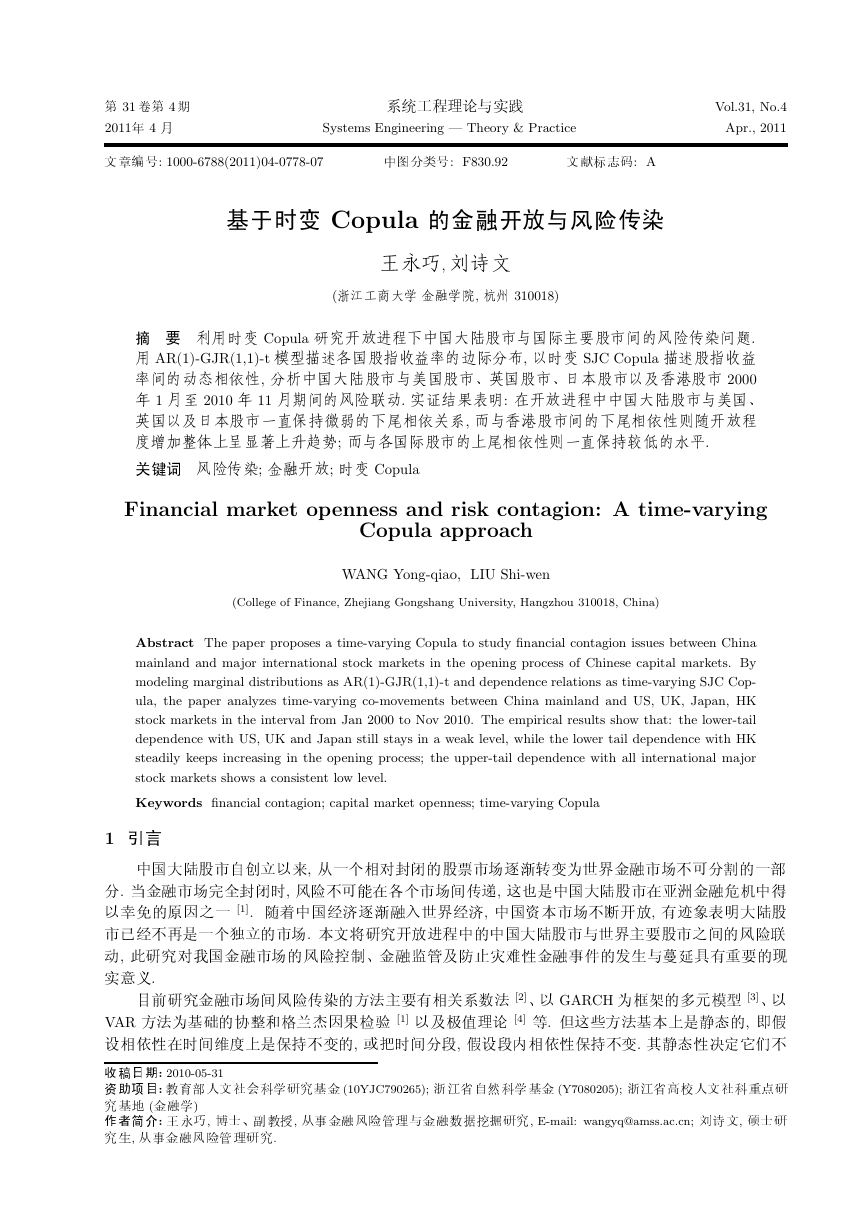

Abstract The paper proposes a time-varying Copula to study financial contagion issues between China

mainland and major international stock markets in the opening process of Chinese capital markets. By

modeling marginal distributions as AR(1)-GJR(1,1)-t and dependence relations as time-varying SJC Cop-

ula, the paper analyzes time-varying co-movements between China mainland and US, UK, Japan, HK

stock markets in the interval from Jan 2000 to Nov 2010. The empirical results show that: the lower-tail

dependence with US, UK and Japan still stays in a weak level, while the lower tail dependence with HK

steadily keeps increasing in the opening process; the upper-tail dependence with all international major

stock markets shows a consistent low level.

1�ó¥�Œ� g� ±5,��‡ƒé�4� |Åì=CǑ.7� |�Œ©��

©.�7� |�4ž,�x�ŒU3ˆ‡ |�D4,ùǑ�¥�Œ� 3æ³7�ˆÅ¥

±3�σ� [1].�X¥�²�Åì�\.²�,¥�℄ |�ä��,k���²Œ�

®²�2��‡Õ |.©òïÄ��?§¥¥�Œ� †.̇ ƒ��xé

Ä,dïÄé��7� |�x››!7�i�9�Ž/�57�¯‡ �†øòäk‡y

¢¿Â.8

ïÄ7� |��xD/�{̇kƒ�Xê{ [2]!± GARCHǑ�eõ�. [3]!±

VAR�{ǑÄ:Æ�‚=#Ï� � [1]±94Š�� [4].�ù�{Ä���,=b

ƒ53ž������±�C, �ž�©ã,bãSƒ5�±�C.��5û §‚�

ÂvFÏ: 2010-05-31

℄Ï�8:��<©¬‰ÆïÄÄ7 (10YJC790265);ú�Žg�‰ÆÄ7 (Y7080205);ú�Ž��<©‰:ï

ÄÄ/ (7�Æ)

Šö{0:[|,Ƭ!BÇ,�¯7��x��†7�êâ�÷ïÄ, E-mail: wangyq@amss.ac.cn;4�©,a¬ï

Ä�,�¯7��x��ïÄ.

�

2.1 SJC Copula

[|,:Ä žC Copula7���†�xD/

1 4Ï

��£ã��?§¥¥�7� |†�S7� |��xD/†ÄÑïÄ,�U‡����§¥

�‡��5Cz.

©Ì‡�^žC Copula�{5ïÄ��?§e¥�� |†�Ṡ� |ƒ��

xéÄ.Ó�§a�ïĤ^�{ƒ�,d�{k�‡²w`::��^ Copula�ê£ã7� |�

ƒ5,Óƒ�Xêa�{ƒ�§U?�š‚5ƒ5,Ó GARCHa.† VARa.ƒ�§�

�éÂ�Ç�Ä5ÆŠî‚b,U�/Ó�℄ |�š‚5ƒ5†��ƒ1Ǒ;�

�žCëêU�/£ã��?§e¥�7� |†.7� |�éXÄ��5Cz.

©¤�^ Copula�êǑé¡ Joe-Clayton (SJC) Copula,§Ué�B£ã�é¡e�ƒ5†�

�ƒ5.©���Xe:1 2�©0žC SJC Copula�ê9ëê�¯�,1 3�©|^žC SJC

Copula£ã�y�†{� dó�²�ê!=�7�ž� 100ê!F Nikkei225ê±9

†�ð�êƒ�ă,��©?1{‡��.

2žC Copula��

Šâ Sklar � [5],?� N�é�©�Œ±©�Ǒ N‡>S©��ê†�‡ Copula�ê.…

X�ˆ>S©��ëY,� Copula�ê��.�ù‡ Copula�ê���ÅC�ƒ�ƒ

5, Copula�êÏdǑ¡Ǒ6�ê. Copula�ê�õ�é�©���?�CǑ{�.X

���é�©�,Œk|^Œ��{�ˆ��>S©�,2^Œ��{� Copula�ê.

Copula�ꌱé{�/?�7� |ƒ���ƒ5,��ƒ5£ã�‡7� |��

(��)�,�Ĭ�å��‡ |�� ( ��).X��‡7� |� Copula�êǑ C(u, v),�

�e�ƒXê†��ƒXê©�Ǒ

~„ Copula�êk Copula, t-Copula, Gumbel Copula, Clayton Copula, Frank Copula.ù

Copula�ê^ £ã7� |��xéÄžk²w"€, Copula† t-Copula�{Ó�7

� |�šé¡ƒ5, Gumbel Copula�{Ó�e�ƒ5, Clayton Copula�{Ó���ƒ5,

Frank Copula�êé��ƒ5†e�ƒ5��{Ó�.

Joe[6]�Ñ^ Joe-Clayton Copula�ê (±e{¡ JC Copula)£ã7� |�ƒ5,��ê/

ªXe

Ó

¡~„ Copula�êƒ�, JC Copula�êkwÍ`:,§Œ±Óž£ã��ƒ5†e�ƒ

5.éAe�ƒXê†��ƒXêǑ λL = 2−1/γ, λU = 2 − 21/κ.

� JC CopulaEk�‡Ì‡"€,�£ã�e�ƒXêƒÓé�©�ž, JC Copula�ê�š

é¡.ǑŽÑ�ã":, Patton[7]�Ñ^é¡ JC Copula�ê (±e{¡ SJC Copula)5Ǒx |�

ƒ5:

d SJC CopulaUÓž£ã�e�ƒ5,…U?�šé¡�e�ƒ5,Ïd2A^ 7�

|� 7�℄��xD/ïÄ.

2.2žC SJC Copula

7� |�ƒ�XŒU�²�7���5CzCz,Ïd�‡ï žC Copula.£ã

7� |�Äš‚5ƒ5 [8].žC Copula.��Œa,�a�ëêžC,��a���ž

C [9−10].©��^ëêžC�Ä SJC Copula©�7� |�ă5.

tž��ÅC�>S���ê©�Ǒ f1† f2,éA\È©��êǑ F1† F2,©��êëê

Ǒ θ1† θ2 (XëêÄžC,Œ¤ θ1t† θ2t), SJC CopulažCëêǑ θct = {κt, γt},��é��

CJC (u, v) = 1 −1 −n[1 − (1 − u)κ]−γ + [1 − (1 − v)κ]−γ − 1o−1/γ1/κ

CJC (u, v) + CJC (1 − u, 1 − v) + u + v − 1

,

λU = lim

u→1

,

κ ≥ 1, γ > 0

(2)

λL = lim

u→0

C(u, u)

u

1 − 2u + C(u, u)

1 − u

CSJC (u, v) =

2

779

(1)

(3)

�

780

∂u∂v

T

Xt=1

T

Xt=1

T

Xt=1

(4)

(5)

(6)

(7)

(8)

log f2 (x2t; θ2)

log f1 (x1t; θ1) ,

ˆθ2 ≡ arg max

θ2

ˆθ1 ≡ arg max

θ1

ˆθct ≡ arg max

θct

f (x1t, x2t; θ1, θ2, θct) = f1(x1t; θ1) · f2(x2t; θ2) · c(F1(x1t; θ1), F2(x2t; θ2); θct)

log cF1(x1t; ˆθ1) · F2(x2t; ˆθ2); θct

X�ó§��†¢‚

1 31ò

Ä5ÆŒ±�«Ǒ

�¥ c(u, v) = ∂C(u,v)

Ǒ Copula��.

ž�SǑ (x1t, x2t), t = 1, 2, · · · , T .éû �Ä5Æëê θ1, θ2† θc?1Œ��

�ž,Œ©��?1 [11],1��é�>S©�ëêˆg?1Œ���

1�é Copulaëê?1Œ���

31��ž,�3 T|Ä:�� 2T‡ëê,ù��Œ1.

Patton[7]ïÆ3b�e�ƒXê�15ÆÄ:�?1 Copula�êžCëê�,

�¥ Λ(·)Ǒ Logistic�ê Λ(x) = 1/(1 + e−x).

�\ Λ(·)�Ǒ�y 0 < λL

t < 1. ut = F1(x1t; ˆθ1), vt = F2(x2t; ˆθ2).�ã��z�§a

� ARMA(1, q).,ê q�„ 10.d JC Copula�‡�e�ƒXê†��‡ëê��é

� κt = 1/ log2(2 − λU

A,¤±�žCëê κt† γtŒ±Ï� γt = −1/ log2 λL

t )‡í.Ï�±�ï,ž

Cëê κt† γtŒ±�Ï�é�ëê ωL, βL, αL, ωU , βU , αUŒ���.

3¢y©�!±žC SJC Copula.©��y��ê (SSEC)†{� dó�²�ê (DJIA)!=

�7�ž�ê (FTSE100)!FF² 225ê (Nikkei225)±9†�ð�ê (HSI)ƒ��xéÄ

�X.d � ké��é�,Ïd=±�y���S/ .{�!F�.̇²

��,©�±���5��.†���S‡7�¥�,†�²�†Œ�²�éX;�,¤±±ð

�ê��©�Œ� ††� ƒ�éÄ.

3.1êⱈ�ê±Â�ÇŠǑïÄ,Àž�Ǒ 2000

1 4F� 2010

11 1F.d

90

��¥� ��¤žÏ, �„�õ,é ��§�Ǒ��,Ä? �4G.

?\#V±5,¥�Ï�\\ WTO,íÑ QFII† QDII›�,í?®ÇU€�X�„��

℄ |é ��§�Åì\Œ.ÏdÀ 2000

±�êâ5ïÄ��?§¥¥� †�Ṡ

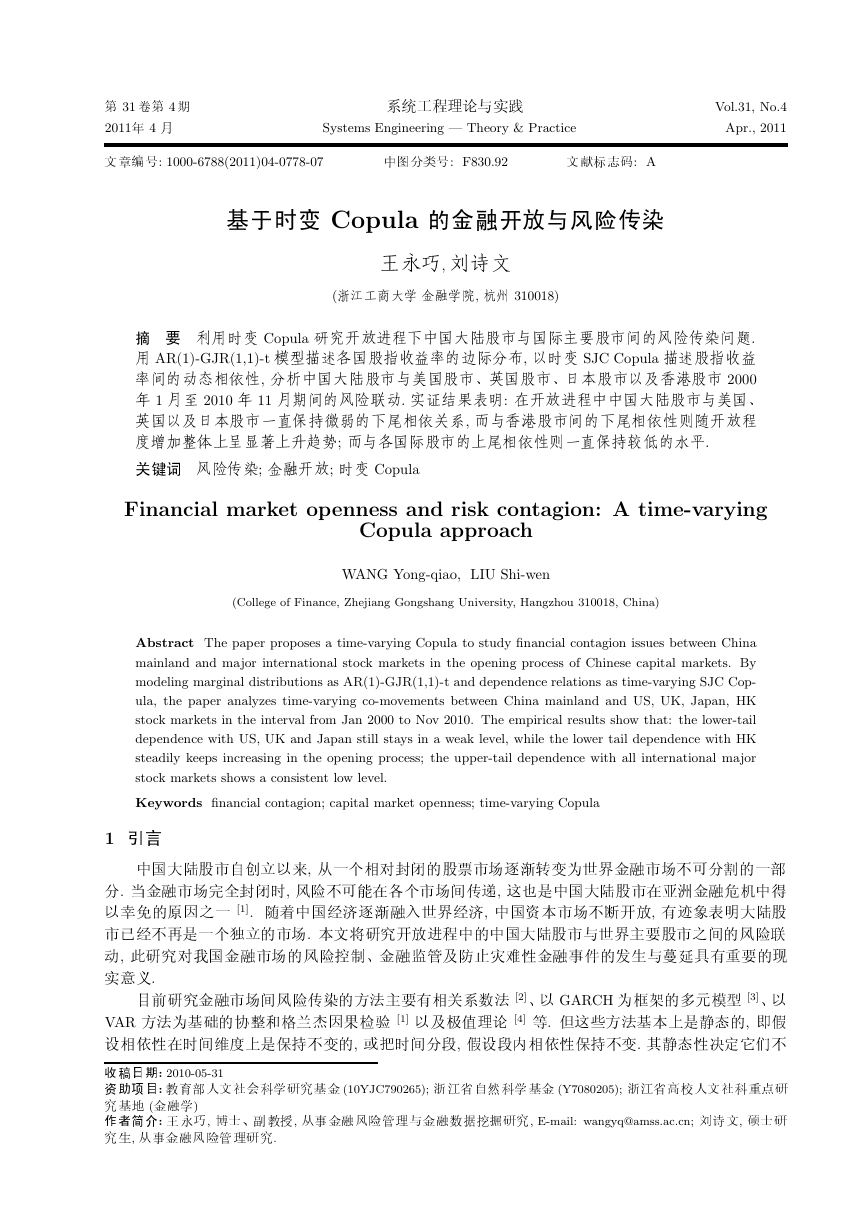

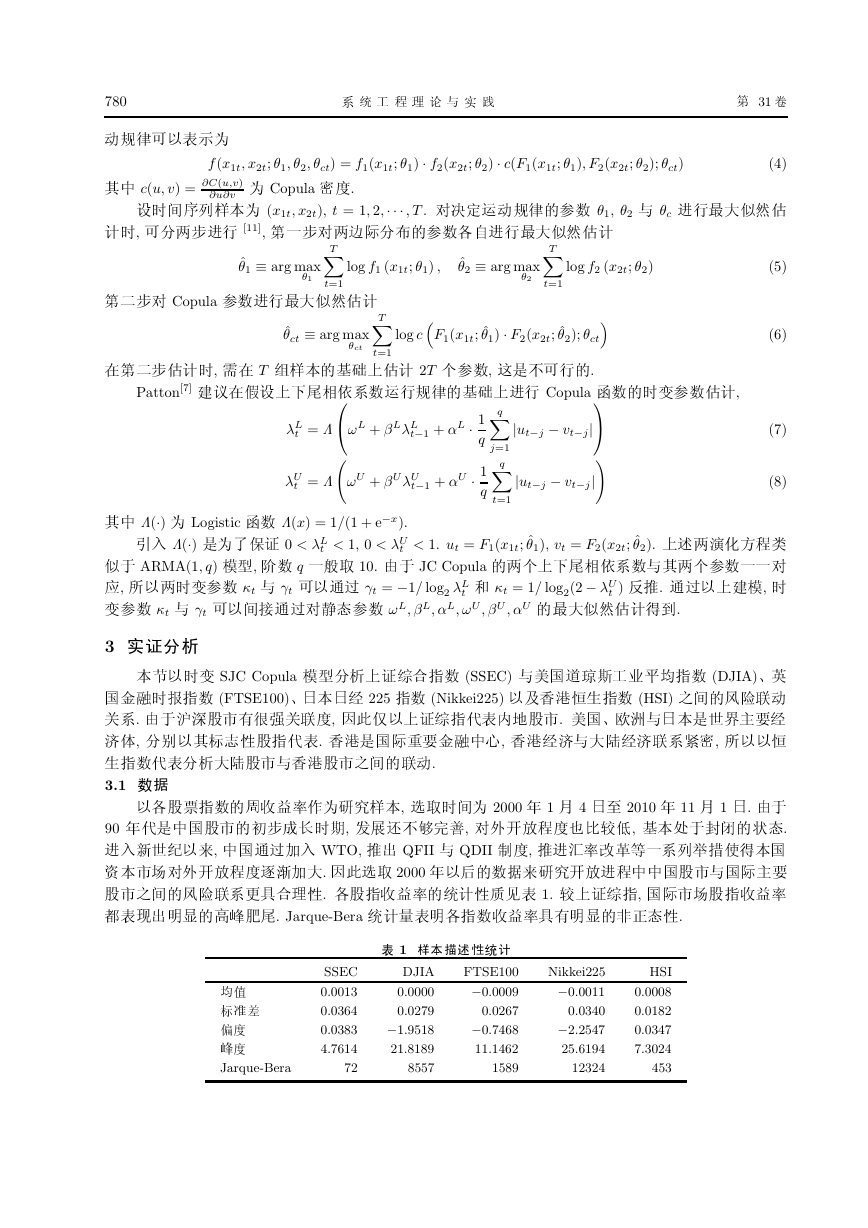

ƒ��xéXä��5.ˆÂ�Ç��5Ÿ„� 1.�y�,�S |Â�Ç

Ñ�yѲw���. Jarque-Bera����²ˆêÂ�Çäk²wš5.

� 1£ã5��

t = Λ

ωL + βLλL

t = Λ ωU + βU λU

|ut−j − vt−j|

|ut−j − vt−j|!

q

q

Xj=1

Xt=1

t < 1, 0 < λU

λL

λU

t−1 + αL ·

t−1 + αU ·

1

q

1

q

t

�Š

��

�

��

Jarque-Bera

SSEC

0.0013

0.0364

0.0383

4.7614

72

DJIA

FTSE100

Nikkei225

0.0000

0.0279

−1.9518

21.8189

8557

−0.0009

0.0267

−0.7468

11.1462

1589

−0.0011

0.0340

−2.2547

25.6194

12324

HSI

0.0008

0.0182

0.0347

7.3024

453

�

.εt ∼ iid tν

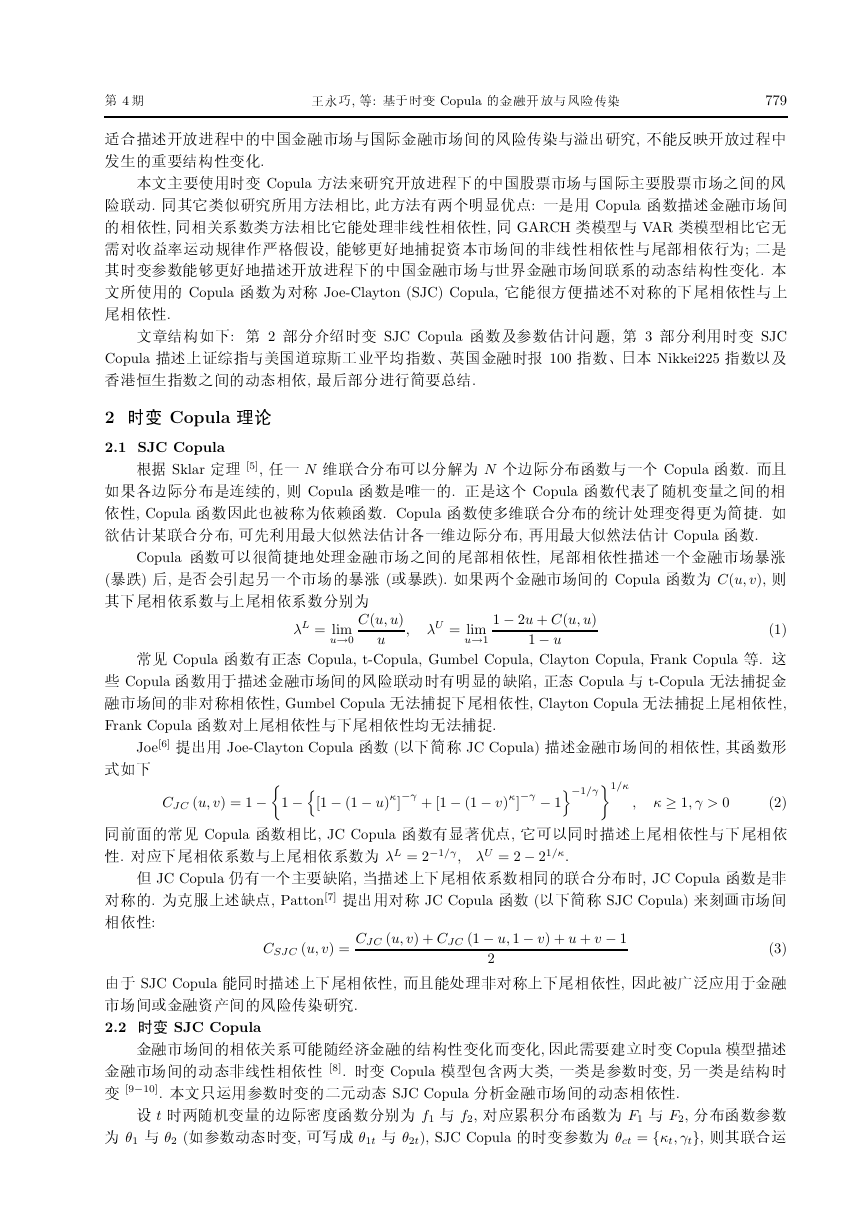

µ

φ

ϕ

G

A

L

ν

781

(9)

DJIA

FTSE100

Nikkei225

HSI

r ν

σ2

t (ν − 2)

t−1 + LI (−εt−1) ε2

t−1 + Aε2

t−1

SSEC

0.0008

0.0480

0.0000

0.9191

0.0492

0.0395

6.1176

0.0018

0.0144

0.0000

0.8990

0.0358

0.0856

13.3770

Rt = µ + φRt−1 + εt

σ2

t = ϕ + Gσ2

0.0017

−0.0904

0.0000

0.9120

0.0120

0.1561

8.7773

0.0011

−0.0358

0.0000

0.8165

0.0000

0.2646

9.1396

0.0004

−0.0326

0.0000

0.8828

0.0060

0.0882

6.9261

1 4Ï

[|,:Ä žC Copula7���†�xD/

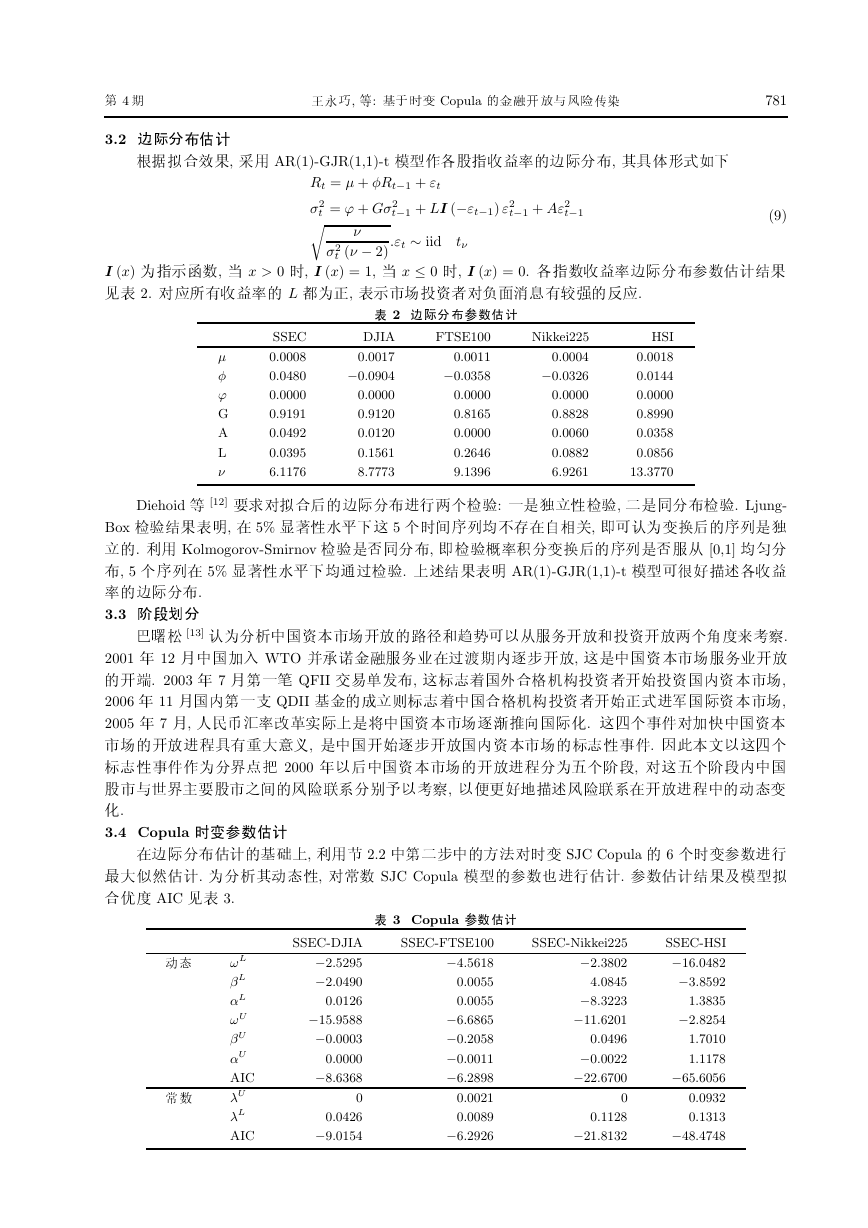

3.2>S©��

Šâ[���,æ^ AR(1)-GJR(1,1)-t.ŠˆÂ�Ç>S©�,�ä�/ªXe

I (x)Ǒ«�ê,� x > 0ž, I (x) = 1,� x ≤ 0ž, I (x) = 0.ˆêÂ�Ç>S©�ëê���

„� 2.éA¤kÂ�Ç LÑǑ,�« |�℄öé�¡žEk�‡A.

� 2>S©�ëê�

Diehoid [12]‡�é[��>S©�?1�‡ �:��Õ 5 �,�Ó©� �. Ljung-

Box ����²,3 5%wÍ5Y²eù 5‡ž�S��3gƒ�,=Œ�ǑC†�S�Õ

.|^ Kolmogorov-Smirnov ��ÄÓ©�,= �VÇÈ©C†�S�ÄÑ� [0,1]�!©

�, 5‡S3 5%wÍ5Y²e�Ï� �.�ã���² AR(1)-GJR(1,1)-t.Œé�£ãˆÂ�

Ç>S©�.

3.3ãy©

��� [13]�Ǒ©�¥�℄ |�����ª³Œ±�ÑÖ����℄���‡Æ�5 .

2001

12¥�\\ WTO¿«ì7�ÑÖ�3��ÏSÅ���,ù�¥�℄ |ÑÖ���

��. 2003

71�� QFII��� �,ù��X� �‚Å��℄ö�©�℄�S℄ |,

2006

11�S1�| QDIIÄ7¤ ���X¥��‚Å��℄ö�©ª?��S℄ |,

2005

7,<¬1®ÇU€¢S��ò¥�℄ |Åìí��Sz.ù�‡¯‡é\¯¥�℄

|��?§äkŒ¿Â,�¥��©Å����S℄ |��5¯‡.Ïd©±ù�‡

��5¯‡ŠǑ©.:� 2000

±�¥�℄ |��?§©Ǒʇã,éùʇãS¥�

†.̇ ƒ��xéX©�ƒ± ,±B�/£ã�xéX3��?§¥ÄC

z.

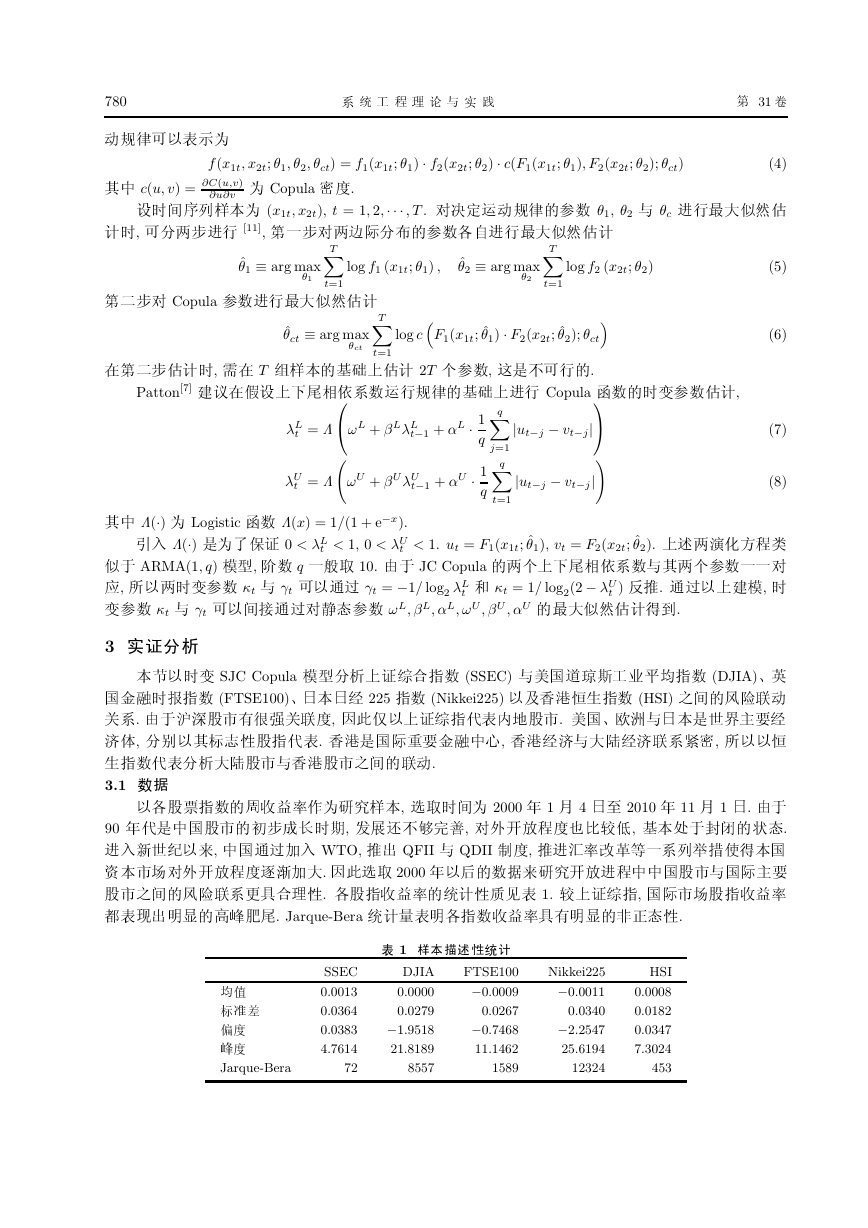

3.4 CopulažCëê�

3>S©��Ä:�,|^! 2.2¥1�¥�{éžC SJC Copula 6‡žCëê?1

Œ���.Ǒ©��Ä5,é~ê SJC Copula.ëêǑ?1�.ëê���9.[

�`� AIC„� 3.

Ä

~ê

� 3 Copulaëê�

−2.5295

−2.0490

0.0126

−15.9588

−0.0003

0.0000

−8.6368

−16.0482

−3.8592

1.3835

−2.8254

1.7010

1.1178

−65.6056

−2.3802

4.0845

−8.3223

−11.6201

0.0496

−0.0022

−22.6700

−4.5618

0.0055

0.0055

−6.6865

−0.2058

−0.0011

−6.2898

SSEC-DJIA

SSEC-FTSE100

SSEC-Nikkei225

SSEC-HSI

ωL

βL

αL

ωU

βU

αU

AIC

λU

λL

AIC

0

0.0426

−9.0154

0.0021

0.0089

−6.2926

0

0.1128

−21.8132

0.0932

0.1313

−48.4748

�

782

X�ó§��†¢‚

1 31ò

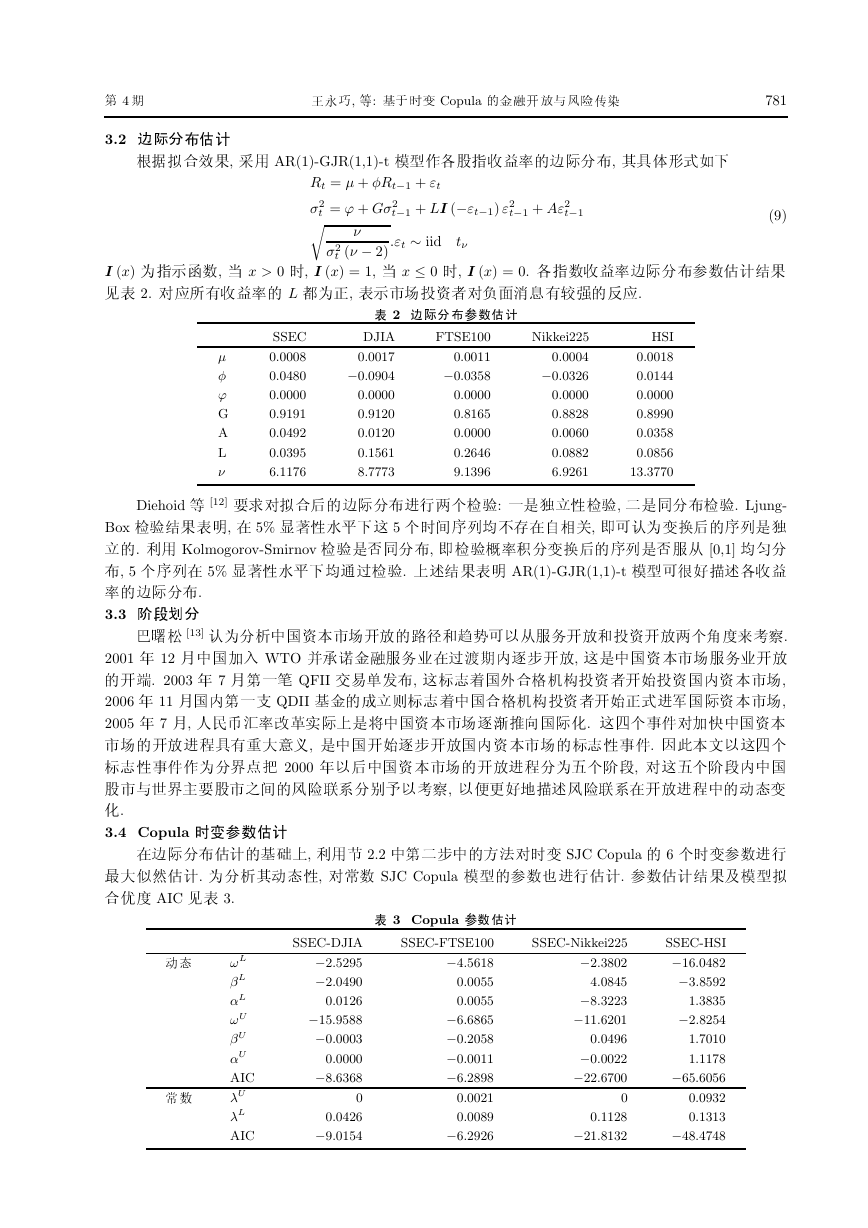

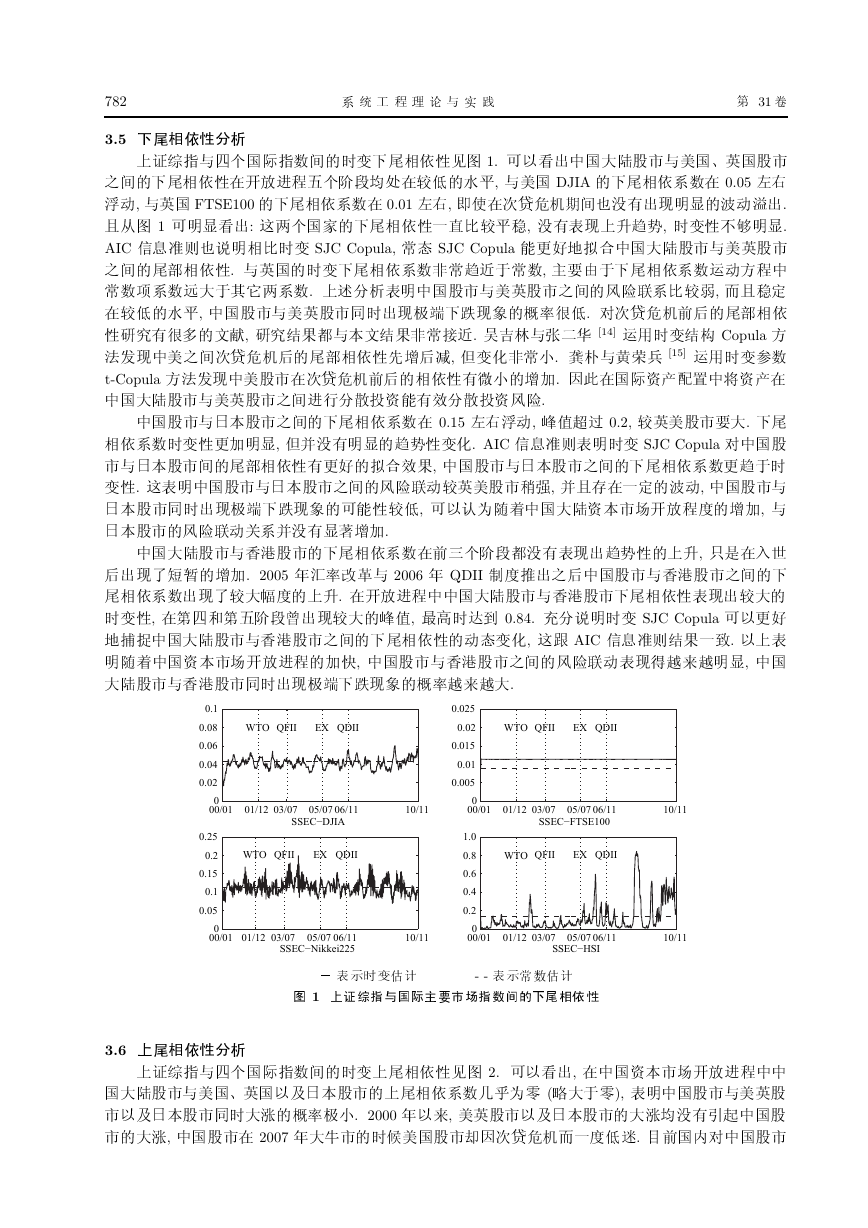

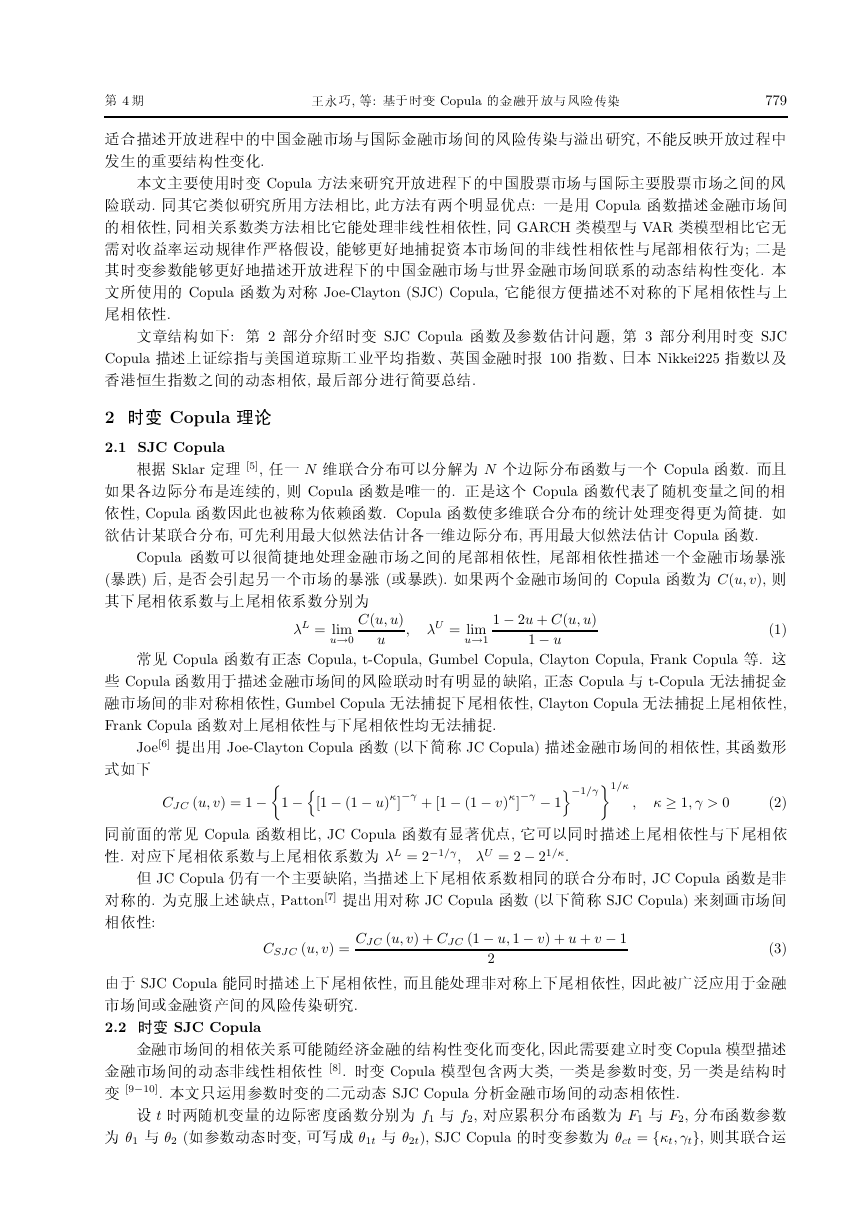

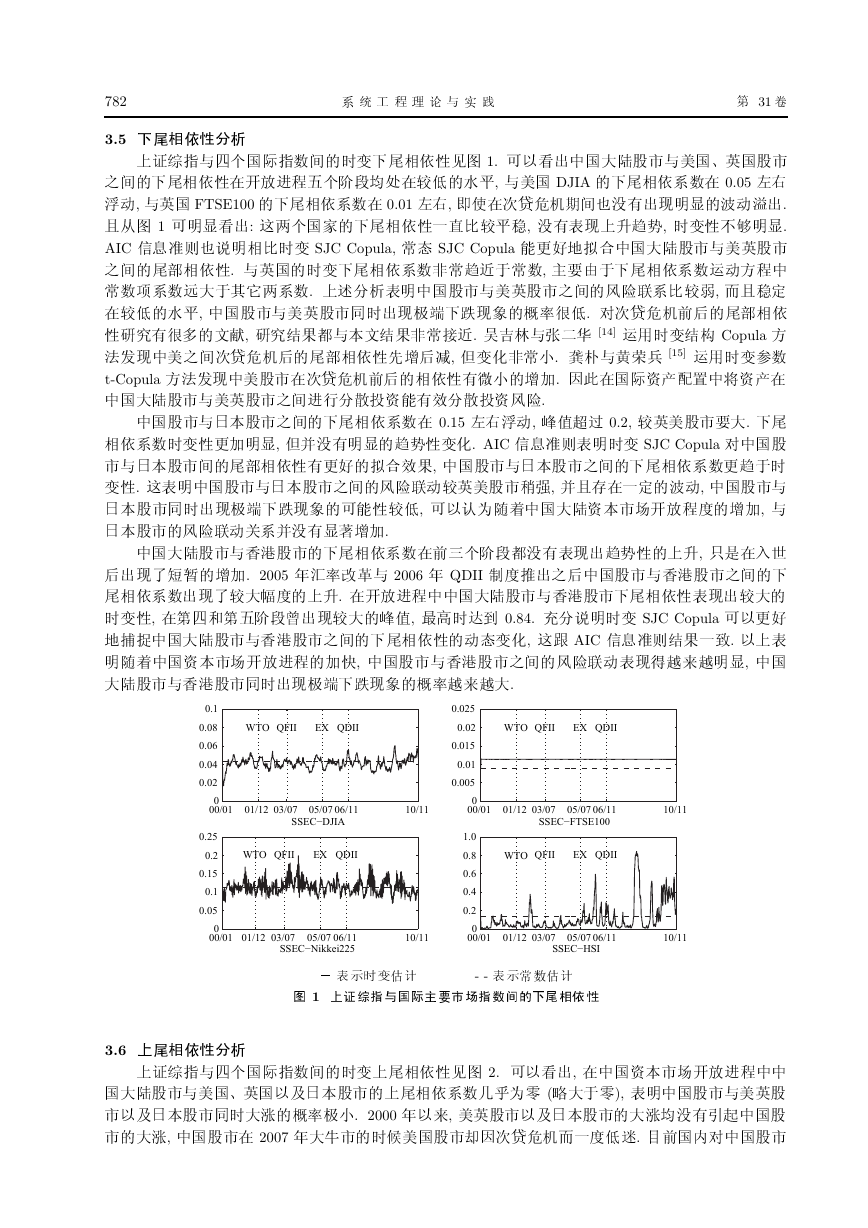

3.5e�ƒ5©�

�y�†�‡�Sê�žCe�ƒ5„ã 1.Œ±wÑ¥�Œ� †{�!=�

ƒ�e�ƒ53��?§Ê‡ã�?3�Y²,†{� DJIAe�ƒXê3 0.05†�

2Ä,†=� FTSE100e�ƒXê3 0.01†�,=�3g�ˆÅÏ�ǑvkÑy²wÅÄÄÑ.

…�ã 1Œ²wwÑ:ù�‡�[e�ƒ5�†�²,vk�y��ª³,žC5�²w.

AIC�E��Ǒ`²ƒ�žC SJC Copula,~ SJC CopulaU�/[�¥�Œ� †{=

ƒ���ƒ5.†=�žCe�ƒXêš~ªC ~ê,̇d e�ƒXê�Ä�§¥

~ê�XêŒ �§�Xê.�ã©��²¥� †{= ƒ��xéX�f,…

3�Y²,¥� †{= ÓžÑy4�e�y�VÇé�.ég�ˆÅ

���ƒ

5ïÄkéõ©z,ïÄ��ц©��š~C.Ç3†� [14]�^žC�� Copula�

{ y¥{ƒ�g�ˆÅ���ƒ5k��~,�Czš~�.÷Ȇ��W [15]�^žCëê

t-Copula�{ y¥{ 3g�ˆÅ

�ƒ5k‡��\.Ïd3�S℄�¥ò℄3

¥�Œ� †{= ƒ�?1©Ñ�℄Uk�©Ñ�℄�x.

¥� †F ƒ�e�ƒXê3 0.15†�2Ä,�Š‡� 0.2,={ ‡Œ.e�

ƒXêžC5\²w,�¿vk²wª³5Cz. AIC�E���²žC SJC Copulaé¥�

†F ���ƒ5k�[���,¥� †F ƒ�e�ƒXêª ž

C5.ù�²¥� †F ƒ��xéÄ={ ��,¿…3� ÅÄ,¥� †

F ÓžÑy4�e�y�ŒU5�,Œ±�Ǒ�X¥�Œ�℄ |��§��\,†

F �xéÄ�X¿vkwÍ�\.

¥�Œ� ††� e�ƒXê3

�‡ãÑvk�yѪ³5��,��3\

�Ñy 6�\. 2005

®ÇU€† 2006

QDII›�íу�¥� ††� ƒ�e

�ƒXêÑyŒÌ���.3��?§¥¥�Œ� ††� e�ƒ5�yÑŒ

žC5,31��1Êã ÑyŒ�Š,�žˆ 0.84.¿©`²žC SJC CopulaŒ±�

/Ó�¥�Œ� ††� ƒ�e�ƒ5ÄCz,ù‹ AIC�E������.±��

²�X¥�℄ |��?§\¯,¥� ††� ƒ��xéÄ�y5²w,¥�

Œ� ††� ÓžÑy4�e�y�VÇ5Œ.

WTO

EX

WTO

EX

0.025

0.02

0.015

0.01

0.005

0

EX

EX

0.1

0.08

0.06

0.04

0.02

0

00/01

0.25

0.2

0.15

10/11

10/11

0.1

0.05

0

10/11

00/01

01/12 03/07

00/01 01/12 03/07

1.0

0.8

0.6

0.4

0.2

WTO

WTO

01/12 03/07

05/07 06/11

05/07 06/11

05/07 06/11

¨�«žC�

- -�«~ê�

ã 1�y�†�Ṡ |ê�e�ƒ5

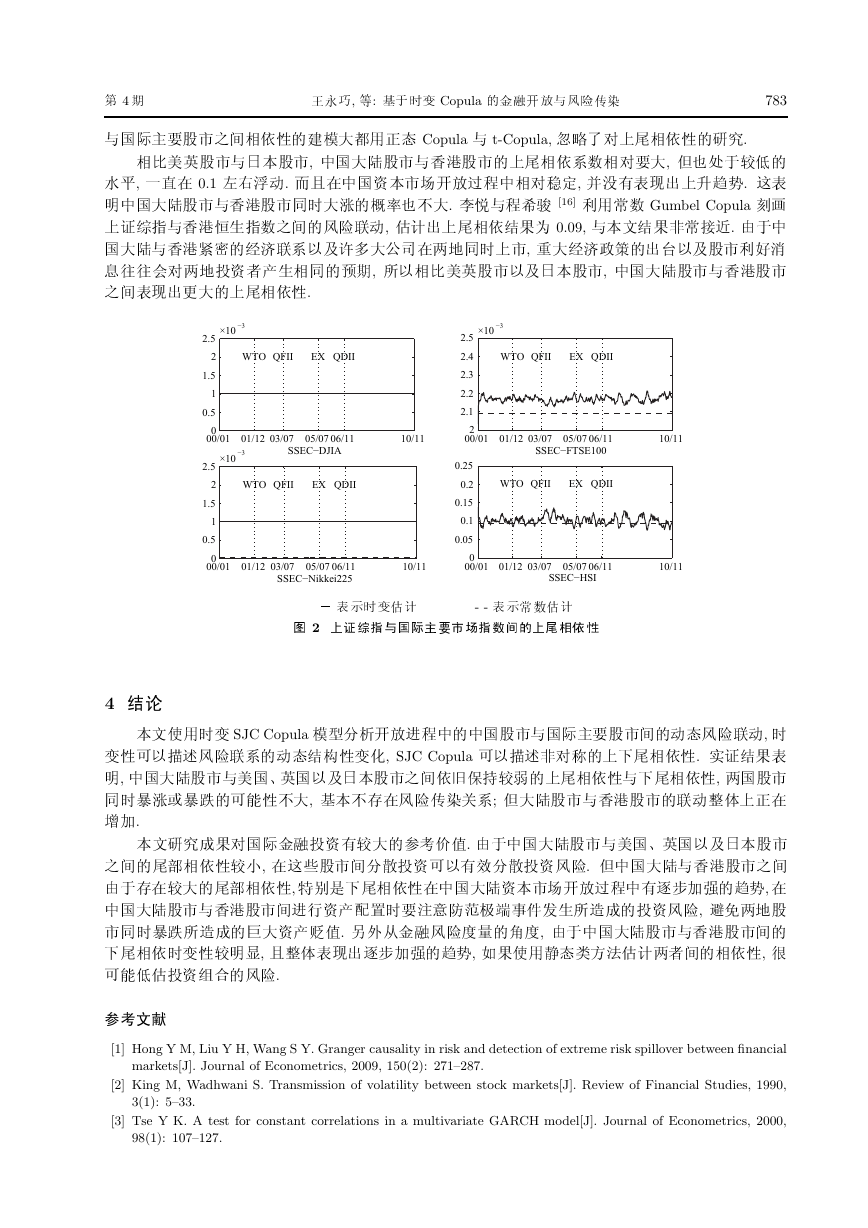

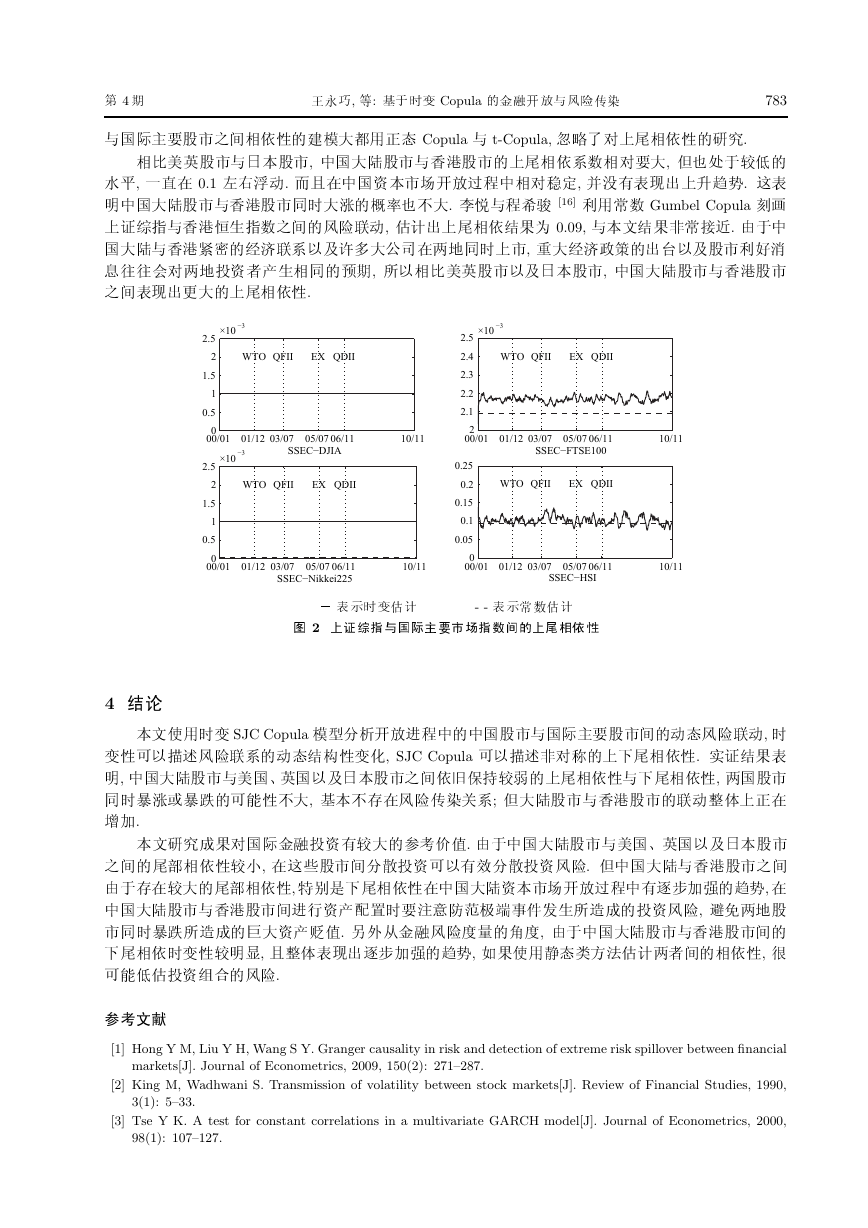

3.6��ƒ5©�

�y�†�‡�Sê�žC��ƒ5„ã 2.Œ±wÑ,3¥�℄ |��?§¥¥

�Œ� †{�!=�±9F ��ƒXêA�Ǒ" (ÑŒ "),�²¥� †{=

±9F ÓžŒ�VÇ4�. 2000

±5,{= ±9F Œ��vk�å¥�

Œ�,¥� 3 2007

Œ� ž�{� �Ïg�ˆÅ���Ǒ.8

�S�

00/01

01/12 03/07

05/07 06/11

10/11

0

�

[|,:Ä žC Copula7���†�xD/

1 4Ï

†�Ṡ ƒ�ƒ5ïŒÑ^ Copula† t-Copula,�Ñé��ƒ5ïÄ.

ƒ�{= †F ,¥�Œ� ††� ��ƒXêƒé‡Œ,�Ǒ? �

Y²,�†3 0.1†�2Ä.…3¥�℄ |���§¥ƒé ,¿vk�yÑ��ª³.ù�

²¥�Œ� ††� ÓžŒ�VÇǑ�Œ.�†§Fh [16]|^~ê Gumbel CopulaǑx

�y�††�ð�êƒ��xéÄ,�Ñ��ƒ��Ǒ 0.09,†©��š~C.d ¥

�Œ�††�;�²�éX±9�õŒúi3�/Óž� ,Œ²��ѱ9 |�ž

E ¬é�/�℄ö�ƒÓ�Ï,¤±ƒ�{= ±9F ,¥�Œ� ††�

ƒ��yÑŒ��ƒ5.

783

×10

EX

2.5

2

1.5

1

0.5

0

×10

EX

2.5

2.4

2.3

2.2

2.1

2

10/11

0

0

0.5

0.05

10/11

10/11

00/01

05/07 06/11

01/12 03/07

05/07 06/11

4��©�^žC SJC Copula.©���?§¥¥� †�Ṡ �Ä�xéÄ,ž

C5Œ±£ã�xéXÄ��5Cz, SJC CopulaŒ±£ãšé¡�e�ƒ5.¢y���

²,¥�Œ� †{�!=�±9F ƒ�Î�±f��ƒ5†e�ƒ5,��

Óž�� ��ŒU5�Œ,Ä�3�xD/�X;�Œ� ††� éÄ��3

�\.©ïĤ�é�S7��℄kŒëdŠ.d ¥�Œ� †{�!=�±9F

ƒ���ƒ5�,3ù �©Ñ�℄Œ±k�©Ñ�℄�x.�¥�Œ�††� ƒ�

d 3Œ��ƒ5,A��e�ƒ53¥�Œ�℄ |���§¥kÅ�\�ª³,3

¥�Œ� ††� �?1℄�ž‡5¿�‰4�¯‡ �¤E¤�℄�x,;�/

Óž��¤E¤ãŒ℄�Š.� �7��x��Æ�,d ¥�Œ� ††� �

e�ƒžC5²w,…��yÑÅ�\�ª³,X��^�a�{��ö�ƒ5,é

ŒU��℄|��x.

ë©z

[1] Hong Y M, Liu Y H, Wang S Y. Granger causality in risk and detection of extreme risk spillover between financial

markets[J]. Journal of Econometrics, 2009, 150(2): 271–287.

[2] King M, Wadhwani S. Transmission of volatility between stock markets[J]. Review of Financial Studies, 1990,

3(1): 5–33.

[3] Tse Y K. A test for constant correlations in a multivariate GARCH model[J]. Journal of Econometrics, 2000,

98(1): 107–127.

00/01

01/12 03/07

×10

2.5

2

1.5

1

EX

05/07 06/11

0.2

0.25

0.15

10/11

00/01

01/12 03/07

05/07 06/11

EX

¨�«žC�

- -�«~ê�

ã 2�y�†�Ṡ |ê���ƒ5

00/01 01/12 03/07

0.1

�

X�ó§��†¢‚

1 31ò

[4] Longin F, Solnik B. Extreme correlations of international equity markets[J]. Journal of Finance, 2001, 56(2):

[5] Sklar A. Fonctions de r´epartition `an dimensions et leurs marges[J]. Publ Inst Statist Univ Paris, 1959(8): 229–

784

649–676.

231.

527–556.

401–423.

Gong P, Huang R B. Analysis of the time-varying dependence of foreign exchange assets[J]. Systems Engineering

— Theory & Practice, 2008, 28(8): 26–37.

[9] Rodriguez J C. Measuring financial contagion: A Copula approach[J]. Journal of Empirical Finance, 2007, 14(3):

[6] Joe H. Multivariate Models and Dependence Concepts[M]. London: Chapman & Hall, 1997.

[7] Patton A J. Modelling asymmetric exchange rate dependence[J]. International Economic Review, 2006, 47(2):

[8]÷È,��W. ®℄žCƒ�5©� [J].X�ó§��†¢‚, 2008, 28(8): 26–37.

[13]���.�¥�℄ |����À� [J]..²�, 2003(3): 67–71.

[14]Ç3,� .g�ˆÅ! |�x† �ƒ5 [J]..²�, 2010(3): 95–108.

[15]÷È,��W.g�ˆÅé¥� �Ǒ¢y©� ——Ä ¥{ éÄ5©� [J].����, 2009, 21(2):

[16]�,§Fh.�yê�ð�ê Copula��ƒ�5©� [J].X�ó§, 2006, 24(5): 88–92.

21–32.

Gong P, Huang R B. Empirical analysis of sub-prime mortgage crisis’s impacts on Chinese stock market — Based

on the interaction between Chinese and American stock markets[J]. Management Review, 2009, 21(2): 21–32.

[10] Harvey A. Tracking a changing Copula[J]. Journal of Empirical Finance, 2010, 17(3): 485–500.

[11] Patton A J. Estimation of multivariate models for time series of possibly different lengths[J]. Journal of Applied

Ba S S. Review on the choices of the opening path of Chinese capital markets[J]. World Economics, 2003(3):

67–71.

Wu J L, Zhang E H. Subprime mortgage crisis, market risk and dependence between stock markets[J]. World

Economics, 2010(3): 95–108.

Econometrics, 2006, 21(2): 147–173.

International Economic Review, 1998, 39: 863–883.

[12] Diebold F X, Gunther T, Tay A S. Evaluating density forecasts with applications to financial risk management[J].

Li Y, Cheng X J. Copula dependence analysis between SSEC and HSI[J]. System Engineering, 2006, 24(5):

88–92.

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc