�

Springer Finance

Editorial Board

M. Avellaneda

G. Barone-Adesi

M. Broadie

M.H.A. Davis

E. Derman

C. Klüppelberg

E. Kopp

W. Schachermayer

Springer Finance

Springer Finance is a programme of books aimed at students, academics

and practitioners working on increasingly technical approaches to the

analysis of financial markets. It aims to cover a variety of topics, not only

mathematical finance but foreign exchanges, term structure, risk

management, portfolio theory, equity derivatives, and financial economics.

M. Ammann, Credit Risk Valuation: Methods, Models, and Application (2001)

K. Back, A Course in Derivative Securities: Introduction to Theory and

Computation (2005)

E. Barucci, Financial Markets Theory. Equilibrium, Efficiency and Information (2003)

T.R. Bielecki and M. Rutkowski, Credit Risk: Modeling, Valuation and Hedging (2002)

N.H. Bingham and R. Kiesel, Risk-Neutral Valuation: Pricing and Hedging of Financial

Derivatives (1998, 2nd ed. 2004)

D. Brigo and F. Mercurio, Interest Rate Models: Theory and Practice (2001)

R. Buff, Uncertain Volatility Models-Theory and Application (2002)

R.A. Dana and M. Jeanblanc, Financial Markets in Continuous Time (2002)

G. Deboeck and T. Kohonen (Editors), Visual Explorations in Finance with

Self-Organizing Maps (1998)

R.J. Elliott and P.E. Kopp, Mathematics of Financial Markets (1999, 2nd ed. 2005)

H. Geman, D. Madan, S.R. Pliska and T. Vorst (Editors), Mathematical Finance-

Bachelier Congress 2000 (2001)

M. Gundlach, F. Lehrbass (Editors), CreditRisk+ in the Banking Industry (2004)

B.P. Kellerhals, Asset Pricing (2004)

Y.-K. Kwok, Mathematical Models of Financial Derivatives (1998)

M. Külpmann, Irrational Exuberance Reconsidered (2004)

P. Malliavin and A. Thalmaier, Stochastic Calculus of Variations in Mathematical

Finance (2005)

A. Meucci, Risk and Asset Allocation (2005)

A. Pelsser, Efficient Methods for Valuing Interest Rate Derivatives (2000)

J.-L. Prigent, Weak Convergence of Financial Markets (2003)

B. Schmid, Credit Risk Pricing Models (2004)

S.E. Shreve, Stochastic Calculus for Finance I (2004)

S.E. Shreve, Stochastic Calculus for Finance II (2004)

M. Yor, Exponential Functionals of Brownian Motion and Related Processes (2001)

R. Zagst, Interest-Rate Management (2002)

Y.-L. Zhu, X. Wu, I.-L. Chern, Derivative Securities and Difference Methods (2004)

A. Ziegler, Incomplete Information and Heterogeneous Beliefs in Continuous-time

Finance (2003)

A. Ziegler, A Game Theory Analysis of Options (2004)

�

Attilio Meucci

Risk and

Asset Allocation

With 141 Figures

123

�

Attilio Meucci

Lehman Brothers, Inc.

745 Seventh Avenue

New York, NY 10019

USA

e-mail: attilio meucci@symmys.com

Mathematics Subject Classification (2000): 15-xx, 46-xx, 62-xx, 65-xx, 90-xx

JEL Classification: C1, C3, C4, C5, C6, C8, G0, G1

Library of Congress Control Number: 2005922398

ISBN-10 3-540-22213-8 Springer-Verlag Berlin Heidelberg New York

ISBN-13 978-3-540-22213-2 Springer-Verlag Berlin Heidelberg New York

This work is subject to copyright. All rights are reserved, whether the whole or part of the material

is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitation,

broadcasting, reproduction on microfilm or in any other way, and storage in data banks.

Duplication of this publication or parts thereof is permitted only under the provisions of the

German Copyright Law of September 9, 1965, in its current version, and permission for use must

always be obtained from Springer-Verlag. Violations are liable to prosecution under the German

Copyright Law.

Springer is a part of Springer Science+Business Media

springeronline.com

© Springer-Verlag Berlin Heidelberg 2005

Printed in The Netherlands

Scientific WorkPlace® is a trademark of MacKichan Software, Inc. and is used with permission.

MATLAB® is a trademark of The MathWorks, Inc. and is used with permission. The MathWorks

does not warrant the accuracy of the text or exercises in this book. This book’s use or discussion of

MATLAB® software or related products does not constitute endorsement or sponsorship by The

MathWorks of a particular pedagogical approach or particular use of the MATLAB® software.

The use of general descriptive names, registered names, trademarks, etc. in this publication does

not imply, even in the absence of a specific statement, that such names are exempt from the relevant

protective laws and regulations and therefore free for general use.

Cover design: design & production, Heidelberg

Cover illustration: courtesy of Linda Gaylord

Typesetting by the author

Printed on acid-free paper

41/sz - 5 4 3 2 1 0

�

to my true love,

should she come

�

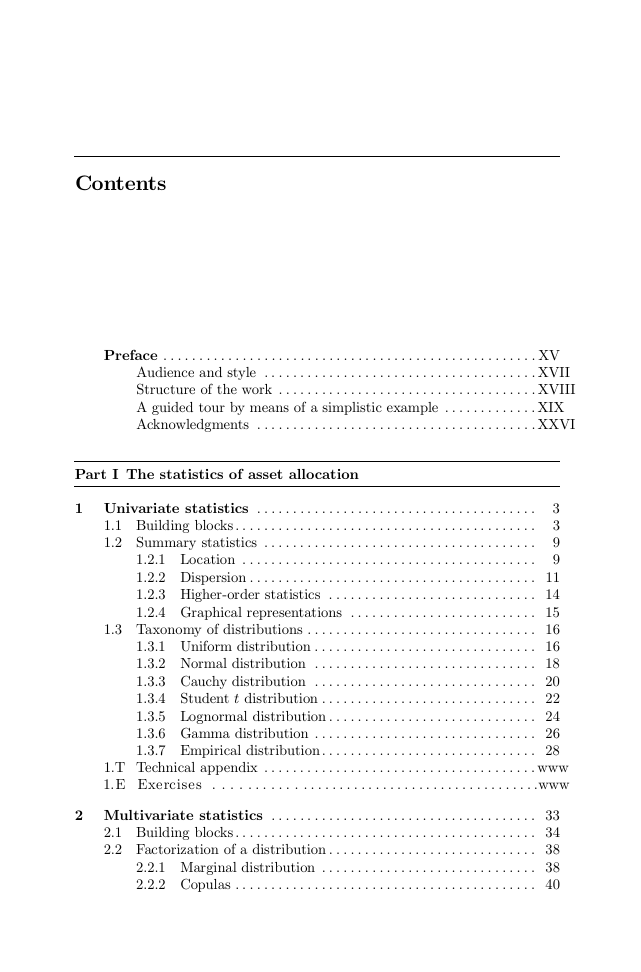

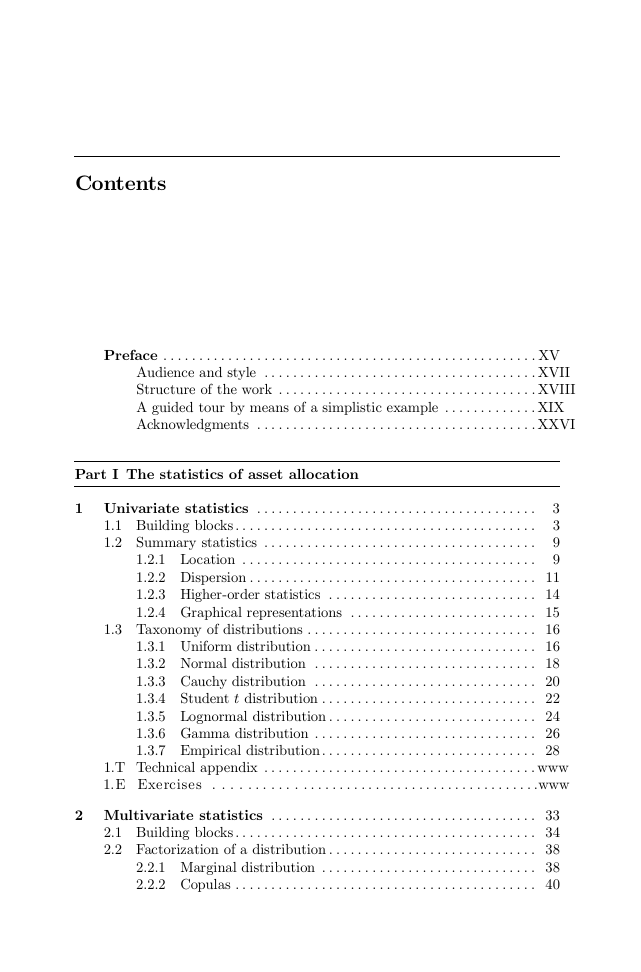

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . XV

Audience and style . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . XVII

Structure of the work . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . XVIII

A guided tour by means of a simplistic example . . . . . . . . . . . . . XIX

Acknowledgments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . XXVI

Part I The statistics of asset allocation

3

1 Univariate statistics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

1.1 Building blocks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

1.2 Summary statistics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.2.1 Location . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

1.2.2 Dispersion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

1.2.3 Higher-order statistics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

1.2.4 Graphical representations . . . . . . . . . . . . . . . . . . . . . . . . . . 15

1.3 Taxonomy of distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

1.3.1 Uniform distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

1.3.2 Normal distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

1.3.3 Cauchy distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

1.3.4 Student t distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

1.3.5 Lognormal distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

1.3.6 Gamma distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

1.3.7 Empirical distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

1.T Technical appendix . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . www

1.E Exercises . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .www

. . . . . . .

..

2 Multivariate statistics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

2.1 Building blocks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

2.2 Factorization of a distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

2.2.1 Marginal distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

2.2.2 Copulas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

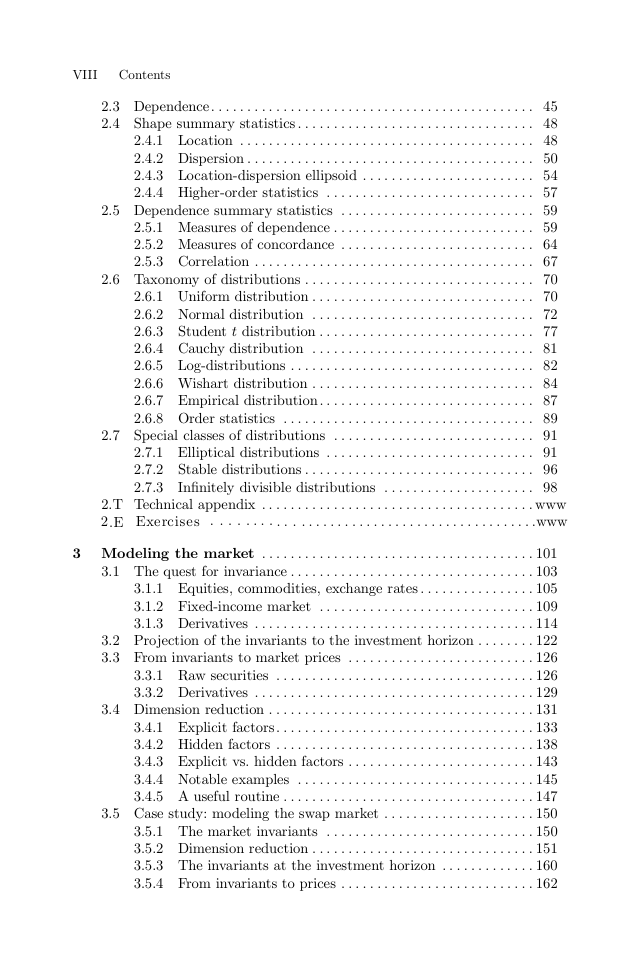

�

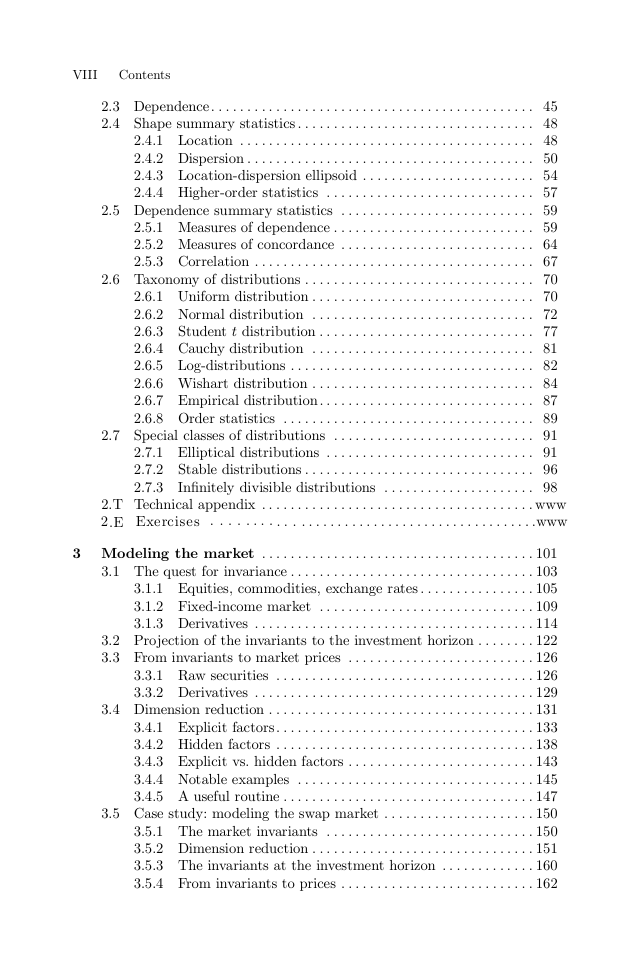

VIII

Contents

2.3 Dependence . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

2.4 Shape summary statistics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

2.4.1 Location . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

2.4.2 Dispersion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

2.4.3 Location-dispersion ellipsoid . . . . . . . . . . . . . . . . . . . . . . . . 54

2.4.4 Higher-order statistics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

2.5 Dependence summary statistics . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

2.5.1 Measures of dependence . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

2.5.2 Measures of concordance . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

2.5.3 Correlation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

2.6 Taxonomy of distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70

2.6.1 Uniform distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70

2.6.2 Normal distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

2.6.3 Student t distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

2.6.4 Cauchy distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

2.6.5 Log-distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

2.6.6 Wishart distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84

2.6.7 Empirical distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

2.6.8 Order statistics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89

2.7 Special classes of distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

2.7.1 Elliptical distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

2.7.2 Stable distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96

2.7.3 In…nitely divisible distributions . . . . . . . . . . . . . . . . . . . . . 98

2.T Technical appendix . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . www

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .www

.E2

Exercises . .

..

. . . . . . .

3 Modeling the market . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101

3.1 The quest for invariance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103

3.1.1 Equities, commodities, exchange rates . . . . . . . . . . . . . . . . 105

3.1.2 Fixed-income market . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 109

3.1.3 Derivatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 114

3.2 Projection of the invariants to the investment horizon . . . . . . . . 122

3.3 From invariants to market prices . . . . . . . . . . . . . . . . . . . . . . . . . . 126

3.3.1 Raw securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 126

3.3.2 Derivatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 129

3.4 Dimension reduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 131

3.4.1 Explicit factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 133

3.4.2 Hidden factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 138

3.4.3 Explicit vs. hidden factors . . . . . . . . . . . . . . . . . . . . . . . . . . 143

3.4.4 Notable examples . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 145

3.4.5 A useful routine . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 147

3.5 Case study: modeling the swap market . . . . . . . . . . . . . . . . . . . . . 150

3.5.1 The market invariants . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 150

3.5.2 Dimension reduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 151

3.5.3 The invariants at the investment horizon . . . . . . . . . . . . . 160

3.5.4 From invariants to prices . . . . . . . . . . . . . . . . . . . . . . . . . . . 162

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc