Fraud Detection:

Discovering Connections

with Graph Databases

Gorka Sadowksi & Philip Rathle

neo4j.com

The #1 Database for Connected DataWHITE PAPER�

White Paper

TABLE OF CONTENTS

Introduction

First-Party Bank Fraud

Insurance Fraud

e-Commerce Fraud

Conclusion

1

2

6

8

10

Fraud Detection:

Discovering Connections

Using Graph Databases

Gorka Sadowksi & Philip Rathle

Introduction

Banks and Insurance companies lose billions of dollars every year to fraud. Traditional methods

of fraud detection play an important role in minimizing these losses. However increasingly

sophisticated fraudsters have developed a variety of ways to elude discovery, both by working

together, and by leveraging various other means of constructing false identities.

Graph databases offer new methods of uncovering fraud rings and other sophisticated scams

with a high-level of accuracy, and are capable of stopping advanced fraud scenarios in real-

time.

While no fraud prevention measures can ever be perfect, significant opportunity for

improvement can be achieved by looking beyond the individual data points, to the connections

that link them. Oftentimes these connections go unnoticed until it is too late — something that

is unfortunate, as these connections oftentimes hold the best clues.

Understanding the connections between data, and deriving meaning from these links, doesn’t

necessarily mean gathering new data. Significant insights can be drawn from one’s existing

data, simply by reframing the problem and looking at it in a new way: as a graph.

Unlike most other ways of looking at data, graphs are designed to express relatedness. Graph

databases can uncover patterns that are difficult to detect using traditional representations

such as tables. An increasing number of companies are using graph databases to solve a

variety of connected data problems, including fraud detection.

This paper discusses some of the common patterns that appear in three of the most damaging

types of fraud: first-party bank fraud, insurance fraud, and e-commerce fraud. While these are

three entirely different types of fraud, they all hold one very important thing in common: the

deception relies upon layers of indirection that can be uncovered through connected analysis.

In each of these examples, graph databases offer a significant opportunity to augment one’s

existing methods of fraud detection, making evasion substantially more difficult.

1

neo4j.com

White PaperThe #1 Database for Connected Data�

Example 1: First-Party Bank Fraud

Background

First-party fraud involves fraudsters who apply for credit cards, loans, overdrafts and unsecured banking credit lines, with no intention

of paying them back. It is a serious problem for banking institutions.

U.S. banks lose tens of billions of dollars every year1 to first-party fraud, which is estimated account for as much as one-quarter or more

of total consumer credit chargeoffs in the United States.2 It is further estimated that 10%-20% of unsecured bad debt at leading US and

European banks is misclassified, and is actually first party fraud.3

The surprising magnitude of these losses is likely the result of two factors. The first is that first-party fraud is very difficult to detect.

Fraudsters behave very similarly to legitimate customers, until the moment they “bust out”, cleaning out all their accounts and promptly

disappearing.

A second factor— which will also be explored later in greater detail—is the exponential nature of the relationship between the number

of participants in the fraud ring and the overall dollar value controlled by the operation. This connected explosion is a feature often

exploited by organized crime.

However while this characteristic makes these schemes potentially very damaging, it also renders them particularly susceptible to

graph-based methods of fraud detection.

Typical Scenario

While the exact details behind each first-party fraud collusion vary from operation to operation, the pattern below illustrates how fraud

rings commonly operate:

1. A group of two or more people organize into a fraud ring

2. The ring shares a subset of legitimate contact information, for example phone numbers and addresses, combining them to

create a number of synthetic identities

3. Ring members open accounts using these synthetic identities

4. New accounts are added to the original ones: unsecured credit lines, credit cards, overdraft protection, personal loans, etc.

5. The accounts are used normally, with regular purchases and timely payments

6. Banks increase the revolving credit lines over time, due to the observed responsible credit behavior

7. One day the ring “busts out”, coordinating their activity, maxing out all of their credit lines, and disappearing

8. Sometimes fraudsters will go a step further and bring all of their balances to zero using fake checks immediately before the

prior step, doubling the damage

9. Collections processes ensue, but agents are never able to reach the fraudster

10.The uncollectible debt is written off

1. Experian at http://www.experian.com/assets/decision-analytics/whitepapers/first-partyfraud-wp.pdf

2. Experian at http://www.experian.com/assets/decision-analytics/whitepapers/first-partyfraud-wp.pdf

3. Business Insider 2011 at http://www.businessinsider.com/how-to-usesocial-networks-in-the-fight-against-first-party-fraud-2011-3

2

neo4j.com

Fraud Detection: Discovering Connections with Graph Databases�

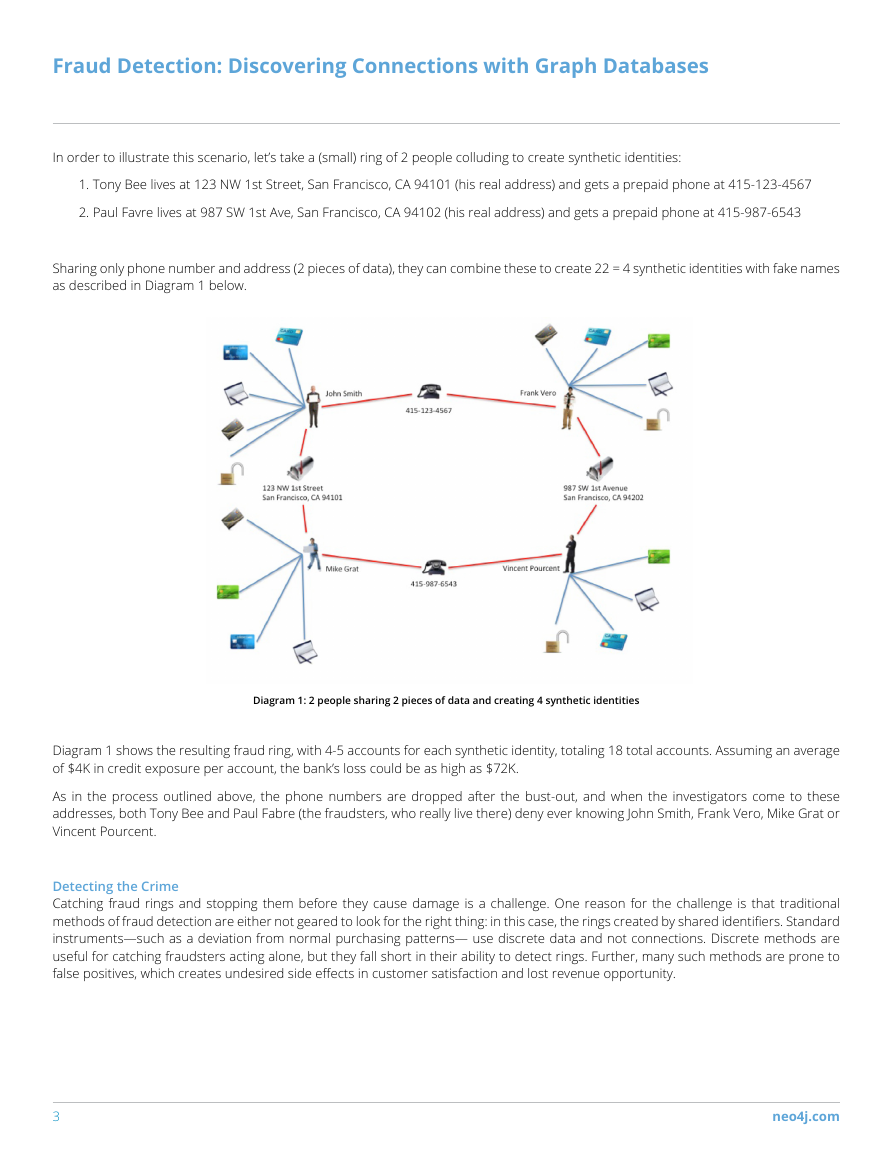

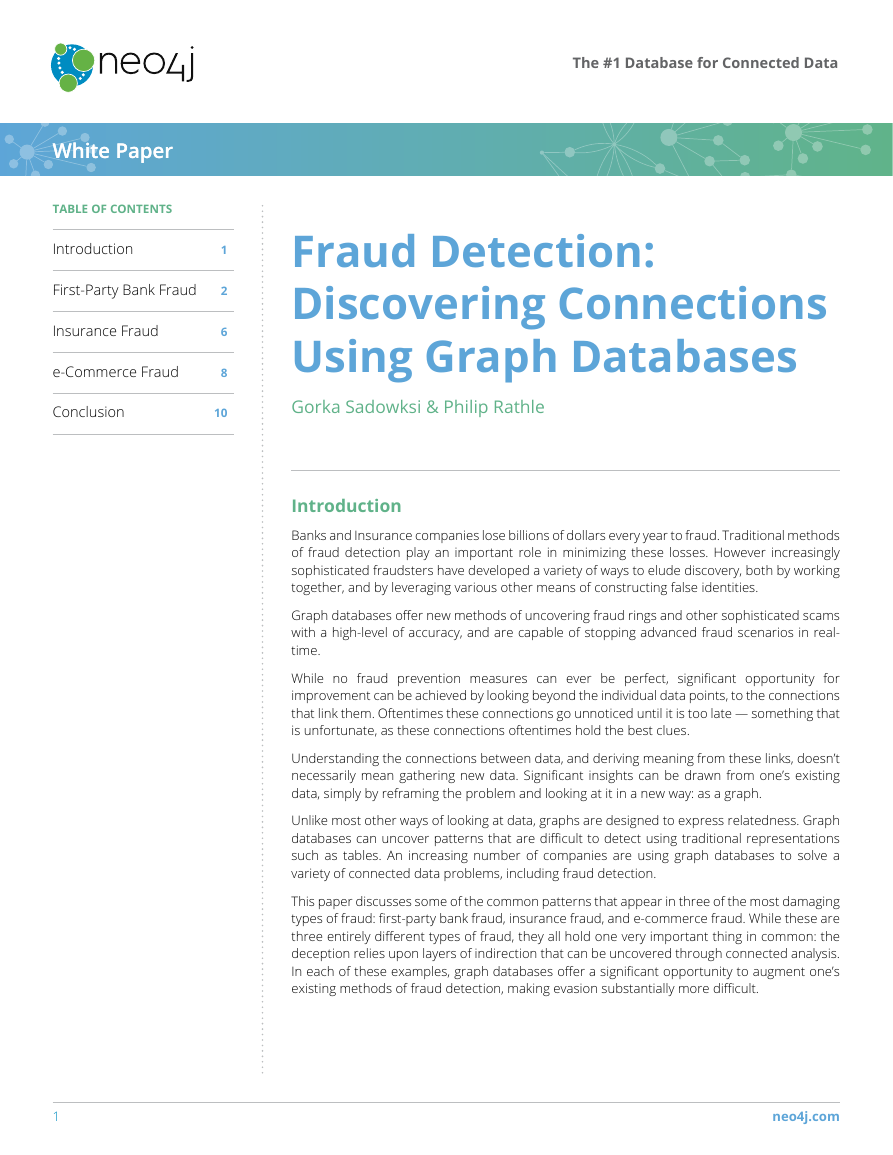

In order to illustrate this scenario, let’s take a (small) ring of 2 people colluding to create synthetic identities:

1. Tony Bee lives at 123 NW 1st Street, San Francisco, CA 94101 (his real address) and gets a prepaid phone at 415-123-4567

2. Paul Favre lives at 987 SW 1st Ave, San Francisco, CA 94102 (his real address) and gets a prepaid phone at 415-987-6543

Sharing only phone number and address (2 pieces of data), they can combine these to create 22 = 4 synthetic identities with fake names

as described in Diagram 1 below.

Diagram 1: 2 people sharing 2 pieces of data and creating 4 synthetic identities

Diagram 1 shows the resulting fraud ring, with 4-5 accounts for each synthetic identity, totaling 18 total accounts. Assuming an average

of $4K in credit exposure per account, the bank’s loss could be as high as $72K.

As in the process outlined above, the phone numbers are dropped after the bust-out, and when the investigators come to these

addresses, both Tony Bee and Paul Fabre (the fraudsters, who really live there) deny ever knowing John Smith, Frank Vero, Mike Grat or

Vincent Pourcent.

Detecting the Crime

Catching fraud rings and stopping them before they cause damage is a challenge. One reason for the challenge is that traditional

methods of fraud detection are either not geared to look for the right thing: in this case, the rings created by shared identifiers. Standard

instruments—such as a deviation from normal purchasing patterns— use discrete data and not connections. Discrete methods are

useful for catching fraudsters acting alone, but they fall short in their ability to detect rings. Further, many such methods are prone to

false positives, which creates undesired side effects in customer satisfaction and lost revenue opportunity.

3

neo4j.com

Fraud Detection: Discovering Connections with Graph Databases�

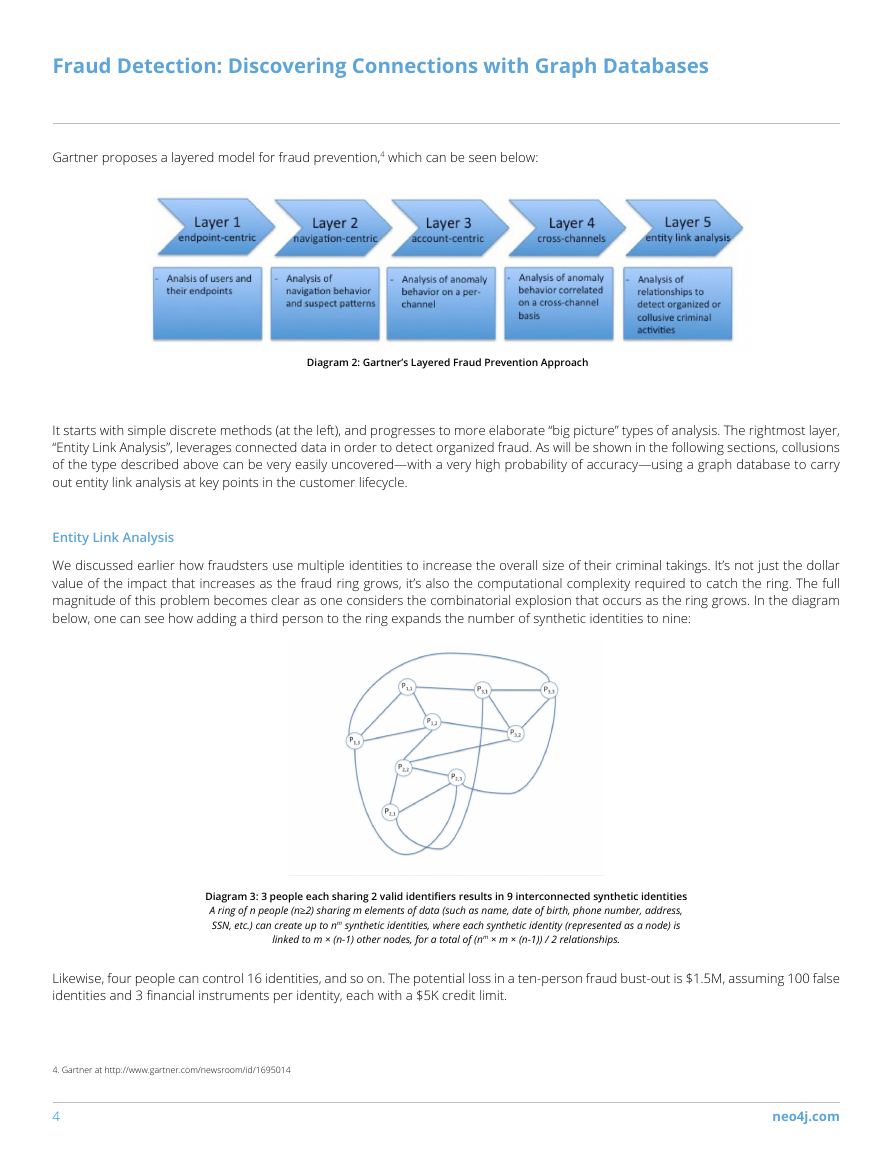

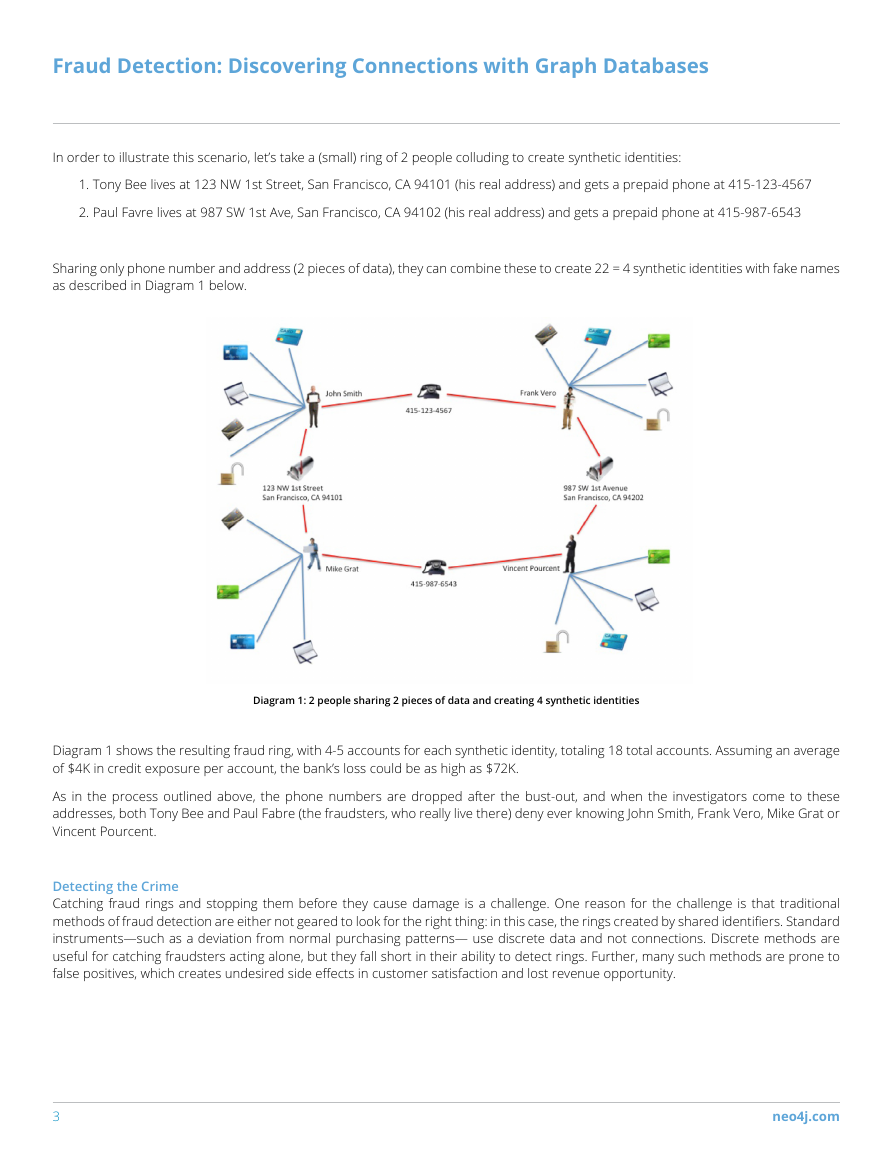

Gartner proposes a layered model for fraud prevention,4 which can be seen below:

Diagram 2: Gartner’s Layered Fraud Prevention Approach

It starts with simple discrete methods (at the left), and progresses to more elaborate “big picture” types of analysis. The rightmost layer,

“Entity Link Analysis”, leverages connected data in order to detect organized fraud. As will be shown in the following sections, collusions

of the type described above can be very easily uncovered—with a very high probability of accuracy—using a graph database to carry

out entity link analysis at key points in the customer lifecycle.

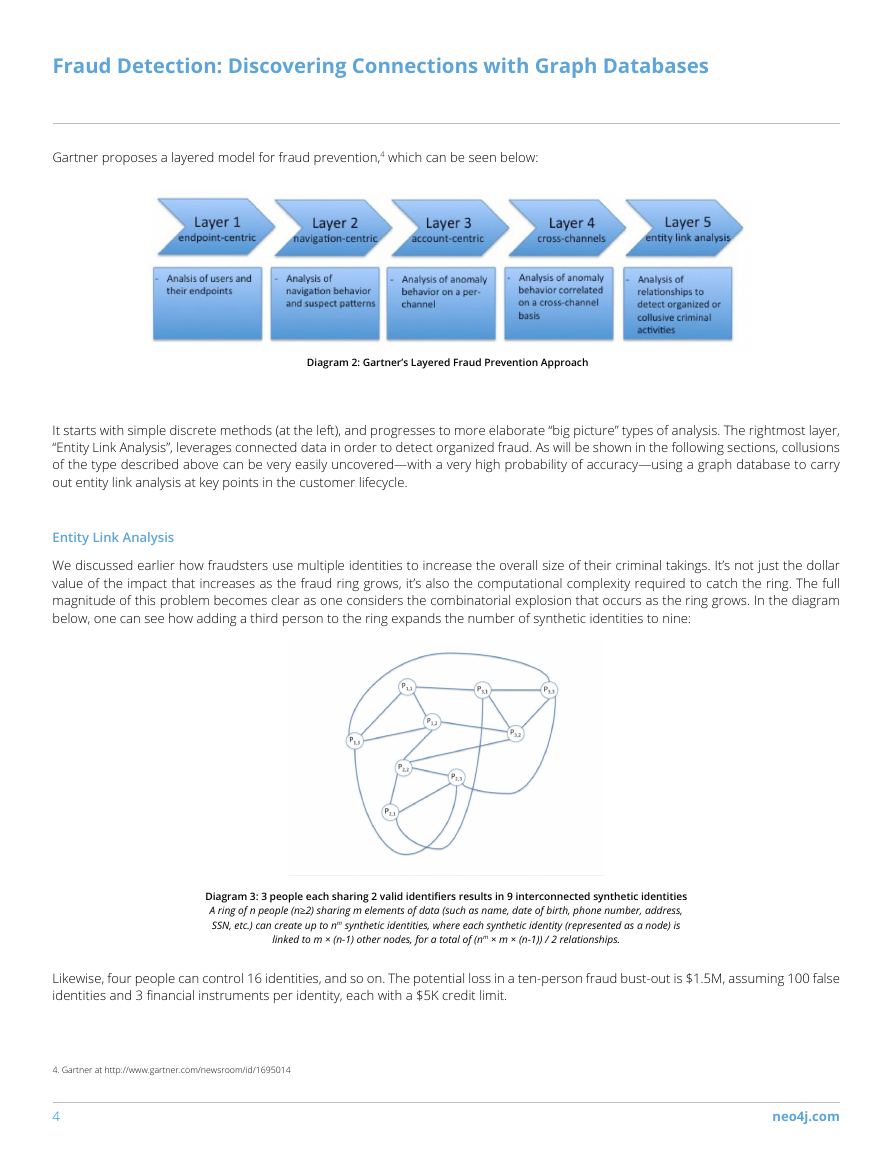

Entity Link Analysis

We discussed earlier how fraudsters use multiple identities to increase the overall size of their criminal takings. It’s not just the dollar

value of the impact that increases as the fraud ring grows, it’s also the computational complexity required to catch the ring. The full

magnitude of this problem becomes clear as one considers the combinatorial explosion that occurs as the ring grows. In the diagram

below, one can see how adding a third person to the ring expands the number of synthetic identities to nine:

Diagram 3: 3 people each sharing 2 valid identifiers results in 9 interconnected synthetic identities

A ring of n people (n≥2) sharing m elements of data (such as name, date of birth, phone number, address,

SSN, etc.) can create up to nm synthetic identities, where each synthetic identity (represented as a node) is

linked to m × (n-1) other nodes, for a total of (nm × m × (n-1)) / 2 relationships.

Likewise, four people can control 16 identities, and so on. The potential loss in a ten-person fraud bust-out is $1.5M, assuming 100 false

identities and 3 financial instruments per identity, each with a $5K credit limit.

4. Gartner at http://www.gartner.com/newsroom/id/1695014

4

neo4j.com

Fraud Detection: Discovering Connections with Graph Databases�

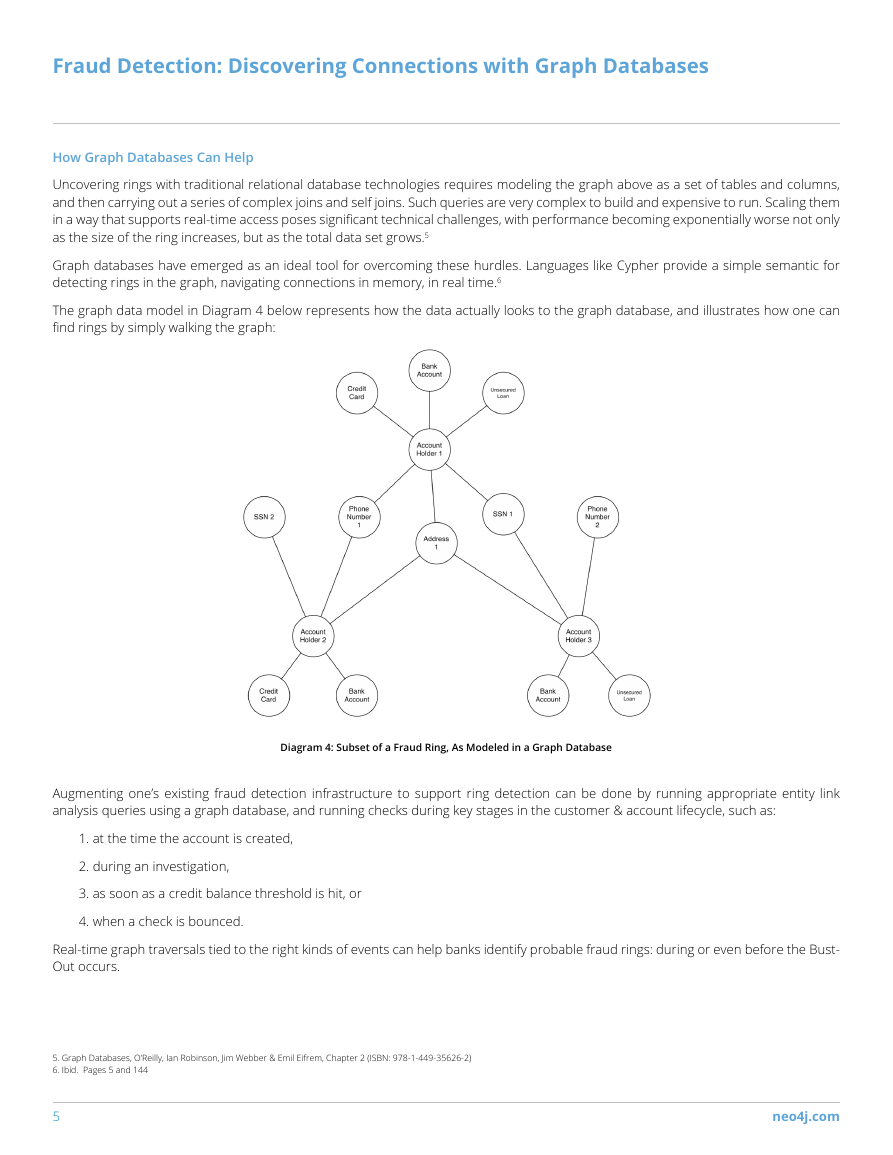

How Graph Databases Can Help

Uncovering rings with traditional relational database technologies requires modeling the graph above as a set of tables and columns,

and then carrying out a series of complex joins and self joins. Such queries are very complex to build and expensive to run. Scaling them

in a way that supports real-time access poses significant technical challenges, with performance becoming exponentially worse not only

as the size of the ring increases, but as the total data set grows.5

Graph databases have emerged as an ideal tool for overcoming these hurdles. Languages like Cypher provide a simple semantic for

detecting rings in the graph, navigating connections in memory, in real time.6

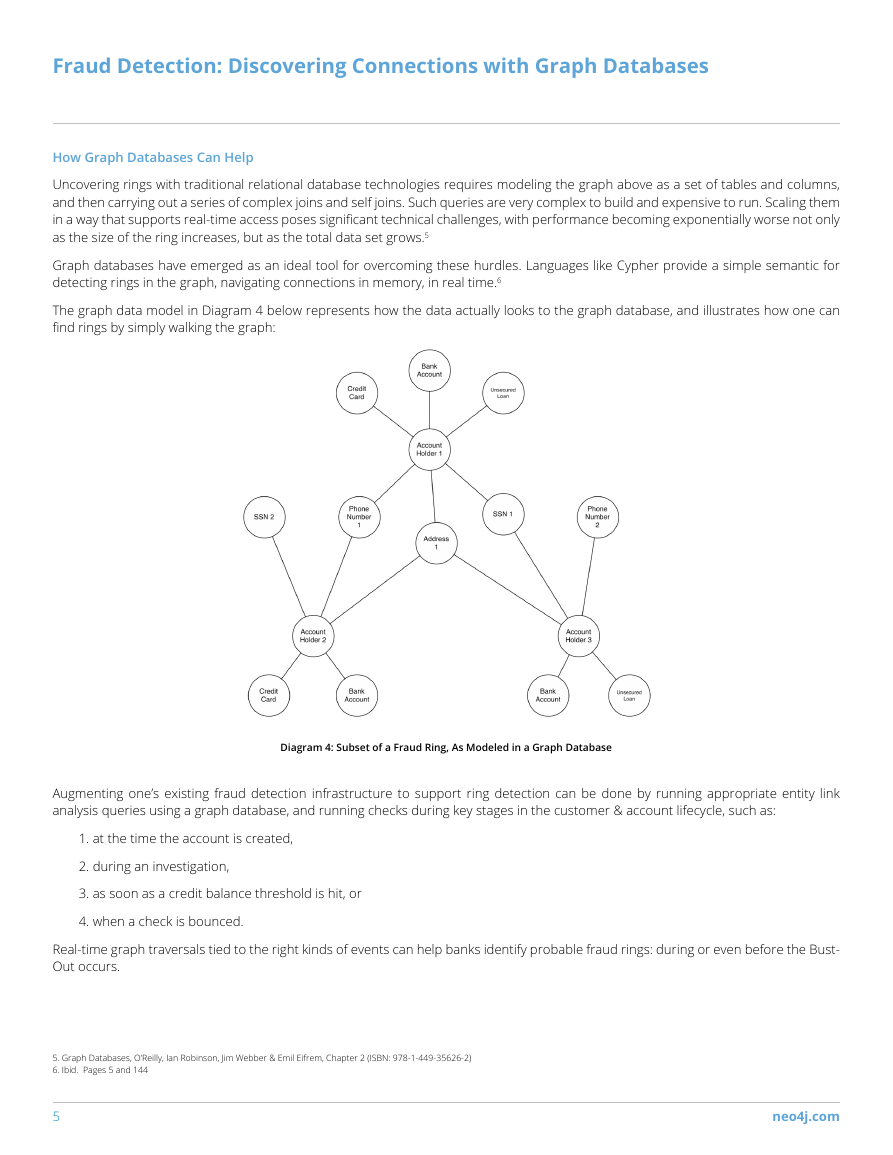

The graph data model in Diagram 4 below represents how the data actually looks to the graph database, and illustrates how one can

find rings by simply walking the graph:

Diagram 4: Subset of a Fraud Ring, As Modeled in a Graph Database

Augmenting one’s existing fraud detection infrastructure to support ring detection can be done by running appropriate entity link

analysis queries using a graph database, and running checks during key stages in the customer & account lifecycle, such as:

1. at the time the account is created,

2. during an investigation,

3. as soon as a credit balance threshold is hit, or

4. when a check is bounced.

Real-time graph traversals tied to the right kinds of events can help banks identify probable fraud rings: during or even before the Bust-

Out occurs.

5. Graph Databases, O’Reilly, Ian Robinson, Jim Webber & Emil Eifrem, Chapter 2 (ISBN: 978-1-449-35626-2)

6. Ibid. Pages 5 and 144

5

neo4j.com

Fraud Detection: Discovering Connections with Graph Databases�

Example 2: Insurance Fraud

Background

The impact of fraud on the insurance industry is estimated to be $80 billion annually in the US, a number that has been growing in

recent years.7 From 2010 to 2012, questionable claims in the U.S. jumped 27 percent, to 116,171 claims in 2012, nearly half resulting

from faked or exaggerated injury claims.8 In the UK, insurers estimate that bogus whiplash claims add $144 per year to each driver’s

policy.9

Insurance fraud attracts sophisticated criminal rings who are often very effective in circumventing fraud detection measures, Once

again, graph databases can be a powerful tool in combating collusive fraud.

Typical Scenario

In a typical hard fraud scenario, rings of fraudsters work together to stage fake accidents and claim soft tissue injuries. These fake

accidents never really happen. They are “paper collisions”, complete with fake drivers, fake passengers, fake pedestrians and even fake

witnesses.

Because soft tissue injuries are easy to falsify, difficult to validate, and expensive to treat, they are a favorite among fraudsters, who have

even developed a term for them “whiplash for cash”.

Such rings normally include a number of roles.

1. Providers. Collusions typically involve participation from professionals in several categories:

a. Doctors, who diagnose false injuries

b. Lawyers, who file fraudulent claims, and

c. Body shops, which misrepresent damage to cars

2. Participants. These are the people involved in the (false) accident, and normally include:

a. Drivers

b. Passengers

c. Pedestrians

d. Witnesses

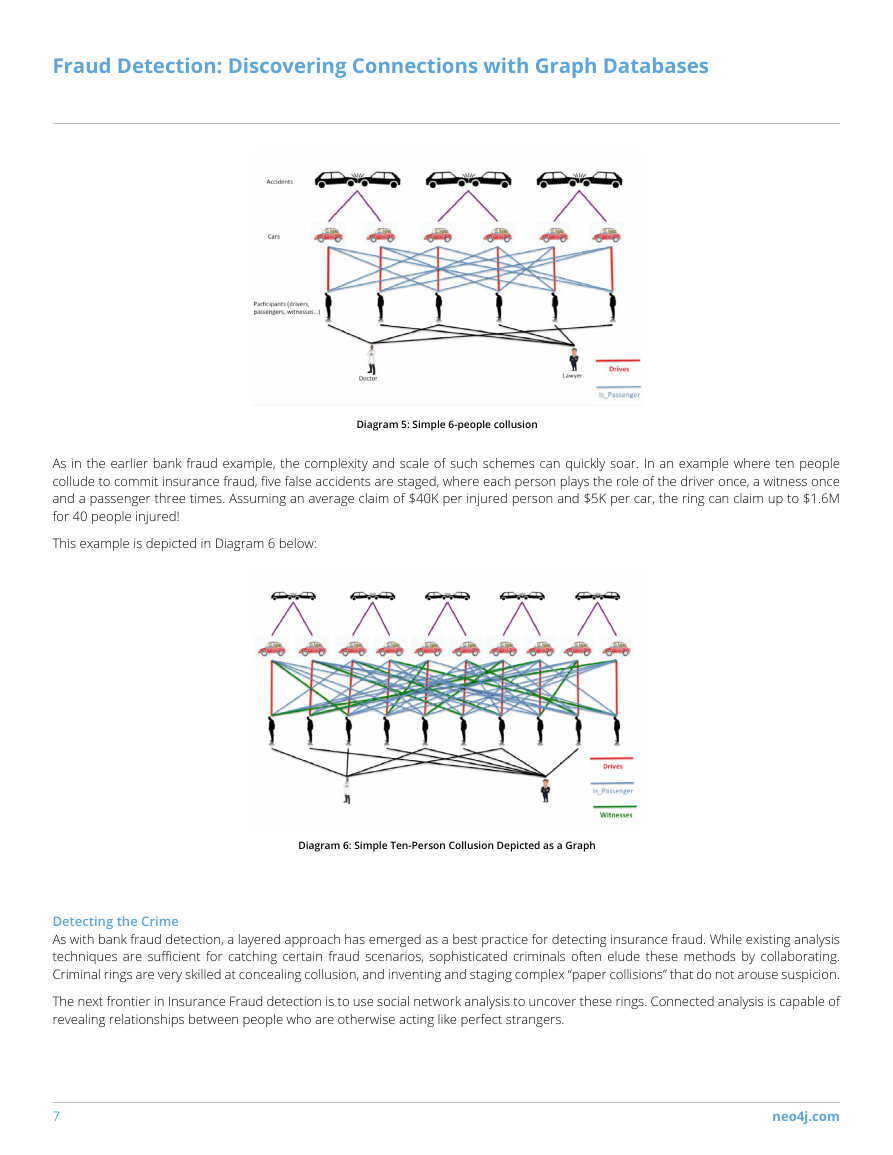

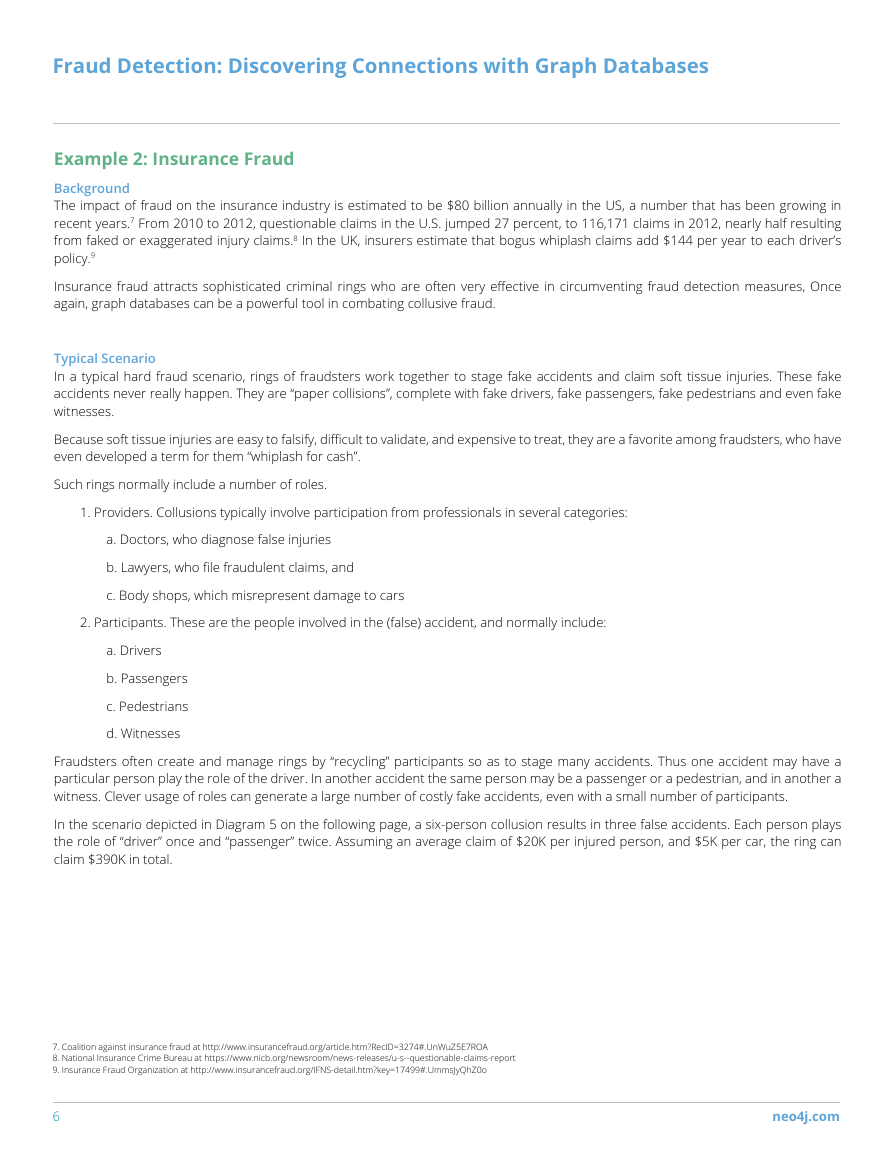

Fraudsters often create and manage rings by “recycling” participants so as to stage many accidents. Thus one accident may have a

particular person play the role of the driver. In another accident the same person may be a passenger or a pedestrian, and in another a

witness. Clever usage of roles can generate a large number of costly fake accidents, even with a small number of participants.

In the scenario depicted in Diagram 5 on the following page, a six-person collusion results in three false accidents. Each person plays

the role of “driver” once and “passenger” twice. Assuming an average claim of $20K per injured person, and $5K per car, the ring can

claim $390K in total.

7. Coalition against insurance fraud at http://www.insurancefraud.org/article.htm?RecID=3274#.UnWuZ5E7ROA

8. National Insurance Crime Bureau at https://www.nicb.org/newsroom/news-releases/u-s--questionable-claims-report

9. Insurance Fraud Organization at http://www.insurancefraud.org/IFNS-detail.htm?key=17499#.UmmsJyQhZ0o

6

neo4j.com

Fraud Detection: Discovering Connections with Graph Databases�

Diagram 5: Simple 6-people collusion

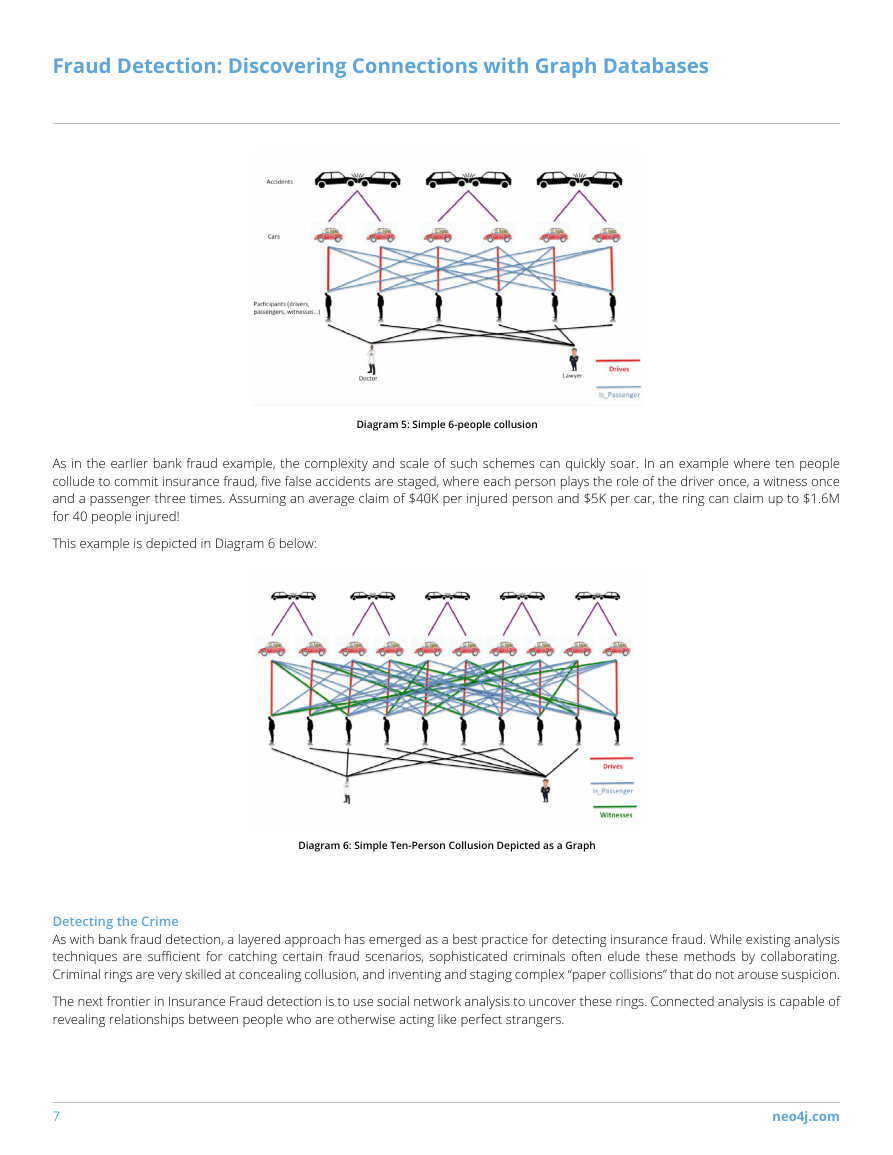

As in the earlier bank fraud example, the complexity and scale of such schemes can quickly soar. In an example where ten people

collude to commit insurance fraud, five false accidents are staged, where each person plays the role of the driver once, a witness once

and a passenger three times. Assuming an average claim of $40K per injured person and $5K per car, the ring can claim up to $1.6M

for 40 people injured!

This example is depicted in Diagram 6 below:

Diagram 6: Simple Ten-Person Collusion Depicted as a Graph

Detecting the Crime

As with bank fraud detection, a layered approach has emerged as a best practice for detecting insurance fraud. While existing analysis

techniques are sufficient for catching certain fraud scenarios, sophisticated criminals often elude these methods by collaborating.

Criminal rings are very skilled at concealing collusion, and inventing and staging complex “paper collisions” that do not arouse suspicion.

The next frontier in Insurance Fraud detection is to use social network analysis to uncover these rings. Connected analysis is capable of

revealing relationships between people who are otherwise acting like perfect strangers.

7

neo4j.com

Fraud Detection: Discovering Connections with Graph Databases�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc