European Journal of Operational Research 173 (2006) 351–369

www.elsevier.com/locate/ejor

Continuous Optimization

Fractional programming with convex quadratic

forms and functions

Harold P. Benson *

Department of Decision and Information Sciences, University of Florida, Gainesville, FL 32611, USA

Received 7 March 2004; accepted 7 February 2005

Available online 13 June 2005

Abstract

This article is concerned with two global optimization problems (P1) and (P2). Each of these problems is a fractional

programming problem involving the maximization of a ratio of a convex function to a convex function, where at least

one of the convex functions is a quadratic form. First, the article presents and validates a number of theoretical prop-

erties of these problems. Included among these properties is the result that, under a mild assumption, any globally opti-

mal solution for problem (P1) must belong to the boundary of its feasible region. Also among these properties is a result

that shows that problem (P2) can be reformulated as a convex maximization problem. Second, the article presents

for the first time an algorithm for globally solving problem (P2). The algorithm is a branch and bound algorithm in

which the main computational effort involves solving a sequence of convex programming problems. Convergence prop-

erties of the algorithm are presented, and computational issues that arise in implementing the algorithm are discussed.

Preliminary indications are that the algorithm can be expected to provide a practical approach for solving problem (P2),

provided that the number of variables is not too large.

Ó 2005 Elsevier B.V. All rights reserved.

Keywords: Global optimization; Fractional programming; Quadratic form; Branch and bound

1. Introduction

Consider the single-ratio fractional program

s.t. x 2 X ;

ð1Þ

nðxÞ

dðxÞ ;

sup

* Tel.: +1 352 392 0134; fax: +1 352 392 5438.

E-mail address: harold.benson@cba.ufl.edu

0377-2217/$ - see front matter Ó 2005 Elsevier B.V. All rights reserved.

doi:10.1016/j.ejor.2005.02.069

�

352

H.P. Benson / European Journal of Operational Research 173 (2006) 351–369

where X is a nonempty, closed convex set in Rn and n and d are real-valued functions defined on X such that

d(x) > 0 for all x 2 X. Systematic studies and applications of single-ratio fractional programs generally be-

gan to appear in the literature in the early 1960s. Since then, a rich body of work on the classification, the-

ory, solution and applications of these problems has been published. For an overview of this work, see, for

instance, the monographs by Craven [5], Martos [21] and Stancu-Minasian [27], the surveys contained in

the articles by Frenk and Schaible [10,11] and Schaible [23,25] and references therein.

Suppose that, in addition to the assumptions given above for problem (1), n is concave on X, d is convex

on X and, if d is not affine, then n is nonnegative on X. Then problem (1) is called as concave fractional

program. A concave fractional program shares many important properties with general concave nonlinear

programs. In particular, any local maximum for a concave fractional program is a global maximum, and, if

n and d are differentiable on an open set containing X, then a solution of the Karush–Kuhn–Tucker opti-

mality conditions is a maximum [1,21]. In addition, the objective function of a concave fractional program

is semistrictly quasiconcave [1], and, by using an appropriate variable transformation, a concave fractional

program can be formulated as an equivalent concave program [10,26]. Because of these properties, there are

a number of approaches available for globally solving concave fractional programs. In fact, by transform-

ing a concave fractional program (1) into an equivalent concave program, a great number of the methods of

concave programming become available for solving problem (1).

When the additional assumptions for problem (1) given in the previous paragraph do not hold, problem

(1) is called a nonconcave fractional program. Nonconcave fractional programs arise in certain important

applications. Included among these applications, for instance, are certain portfolio selection problems

[19,22], stochastic decision making problems [27] and problems in economics [25]. In a nonconcave frac-

tional program, a local maximum need not be a global maximum, and in general, many locally optimal

solutions will exist that are not globally optimal solutions. Nonconcave fractional programs therefore fall

into the domain of global optimization [16,28].

Most of the theoretical and algorithmic work in fractional programming applies only to concave frac-

tional programs or to special cases of concave fractional programs. For this reason, Frenk and Schaible

[10] and Schaible [24] have encouraged that more research be done into the solutions of nonconcave frac-

tional programs.

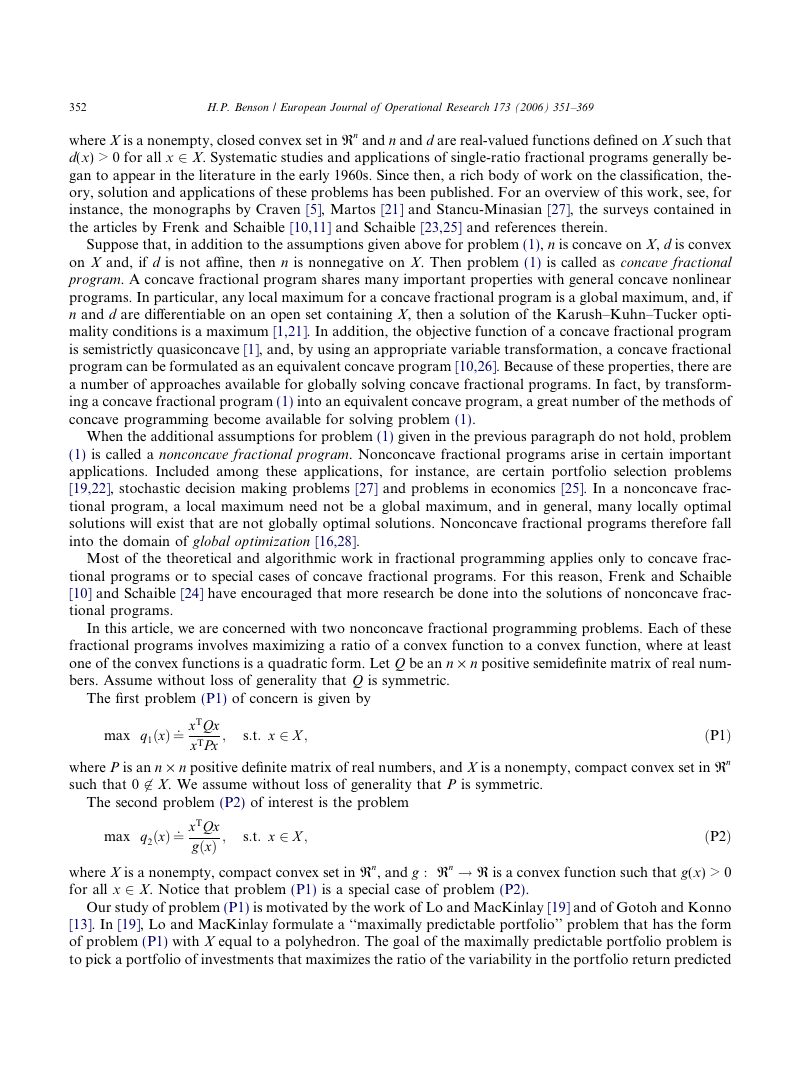

In this article, we are concerned with two nonconcave fractional programming problems. Each of these

fractional programs involves maximizing a ratio of a convex function to a convex function, where at least

one of the convex functions is a quadratic form. Let Q be an n · n positive semidefinite matrix of real num-

bers. Assume without loss of generality that Q is symmetric.

The first problem (P1) of concern is given by

max q1ðxÞ¼: xTQx

xTPx

;

s:t: x 2 X ;

ðP1Þ

where P is an n · n positive definite matrix of real numbers, and X is a nonempty, compact convex set in Rn

such that 0 62 X. We assume without loss of generality that P is symmetric.

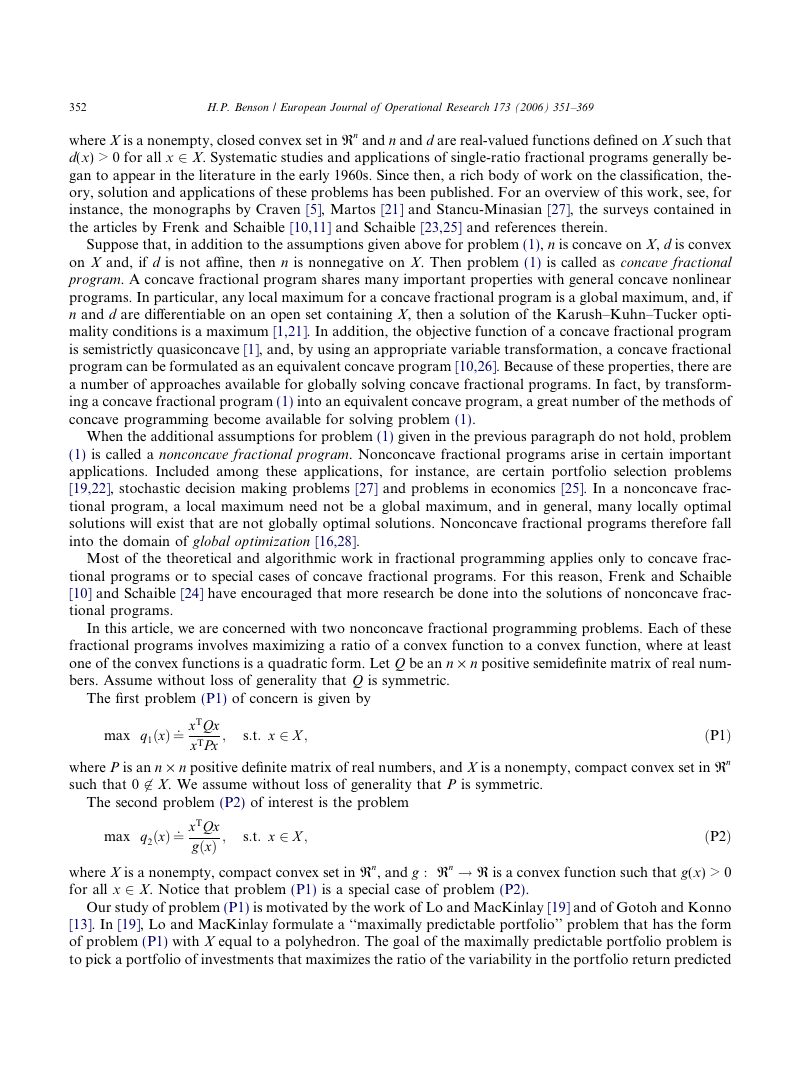

The second problem (P2) of interest is the problem

max q2ðxÞ¼: xTQx

gðxÞ ;

ðP2Þ

where X is a nonempty, compact convex set in Rn, and g : Rn ! R is a convex function such that g(x) > 0

for all x 2 X. Notice that problem (P1) is a special case of problem (P2).

s:t: x 2 X ;

Our study of problem (P1) is motivated by the work of Lo and MacKinlay [19] and of Gotoh and Konno

[13]. In [19], Lo and MacKinlay formulate a ‘‘maximally predictable portfolio’’ problem that has the form

of problem (P1) with X equal to a polyhedron. The goal of the maximally predictable portfolio problem is

to pick a portfolio of investments that maximizes the ratio of the variability in the portfolio return predicted

�

H.P. Benson / European Journal of Operational Research 173 (2006) 351–369

353

by a linear regression model to the variability of the portfolio return. Lo and MacKinlay argue that a port-

folio that maximizes this ratio gives important new insights into asset return findings that are based upon

less formal methods.

In [13], Gotoh and Konno propose an algorithm for globally solving problem (P1) under the additional

assumption that X is polyhedral. This algorithm implements the fractional programming approach of Din-

kelbach [6] by using IbarakiÕs binary search algorithm [17]. In general, the main computational effort re-

quired in the Gotoh–Konno algorithm arises from the need to solve a sequence of separable, nonconvex

optimization problems by a global optimization algorithm of Falk and Soland [9].

We study problem (P2) because it is a natural extension of the nonconvex fractional program (P1), and

because of the need expressed by others for more research results for nonconvex fractional programs [10,24].

The purpose of this article is two-fold. First, the article presents and validates some theoretical properties

of problems (P1) and (P2). Included among these properties is the result that, under a mild assumption, any

globally optimal solution for problem (P1) must belong to the boundary of X. Also among these properties

is a result showing that problem (P2) can be reformulated as a maximization of a convex function over a

nonempty, compact convex set.

The second purpose of the article is to propose an algorithm for globally solving problem (P2). This

algorithm uses the branch and bound approach. In contrast to the Gotoh–Konno algorithm, the branch

and bound algorithm calls for solving a single, nonconvex program rather than a sequence of nonconvex

programs. Indications are that the branch and bound algorithm can be expected to provide a practical ap-

proach for globally solving problem (P2), at least for values of n that are not too large.

The article is organized as follows. Theoretical results for problems (P1) and (P2) are given in Section 2.

Section 3 presents and discusses the branch and bound algorithm for globally solving problem (P2). In Sec-

tion 4, the solution of a sample problem via the algorithm is described. Some concluding observations are

given in Section 5.

2. Theoretical properties

First, we concretely demonstrate that problems (P1) and (P2) are global optimization problems. To help

accomplish this, we need the following definitions and result.

Definition 1. Let f be a real-valued function defined on a convex set C, where C � Rn. Then f is a

quasiconcave (quasiconvex) function on C when

f½kx1 þ ð1 � kÞx2 P min½fðx1Þ; fðx2Þ

ðf½kx1 þ ð1 � kÞx2 6 max½fðx1Þ; fðx2ÞÞ

for every x1, x2 2 C and k such that 0 6 k 6 1.

Quasiconcave functions belong to the set of generalized concave functions, i.e., they possess some, but not

all, of the properties of concave functions. In fact, quasiconcave functions constitute the weakest class of

generalized concave functions. Similar comments apply to quasiconvex functions [1].

The next result is well known (see, e.g., [20]).

Proposition 1. Let f be a real-valued function defined on the convex set C � Rn. Then f is quasiconcave

(quasiconvex) on C if and only if

fx 2 CjfðxÞ P ag

ðfx 2 CjfðxÞ 6 agÞ

is a convex set for each a 2 R.

�

354

H.P. Benson / European Journal of Operational Research 173 (2006) 351–369

The following two examples demonstrate that the objective function of problem (P1) is not, in general,

quasiconcave over X, and it is not, in general, quasiconvex over X.

Example 1. Consider problem (P1) with

X ¼ fðx1; x2Þ 2 R2j � x1 þ 4x2 P 2;�2 6 x1 6 2; x2 6 2g;

�

P ¼ 1

0

�

0

2

.

�

;

Q ¼ 1 0

0 1

�

Let

�

�

�

�

LU ¼ x 2 Xjq1ðxÞ P 5

6

.

Then, by Proposition 1, since (2, 1), (�2, 1) 2 LU but (0, 1) 62 LU, q1 is not quasiconcave on X.

Example 2. In problem (P1), let

X ¼ fðx1; x2Þ 2 R2jx1 þ x2 P 1; xj 6 4; j ¼ 1; 2g;

�

P ¼ 1

0

�

0

6

.

Q ¼ 1 2

2 6

;

Consider

�

LL ¼ fx 2 Xjq1ðxÞ 6 1g.

�

Then (1, 0), (0, 1) 2 LL, but

1

2 ; 1

2

62 LL. Therefore, by Proposition 1, q1(x) is not quasiconvex on X.

From Examples 1 and 2, we surmise that the nonconcave fractional programs (P1) and (P2) do not share

the basic properties of concave maximization or, even, of convex maximization problems. For instance, we

do not expect problems (P1) and (P2) to have the property that any locally maximal solution is globally

maximal. In fact, as we shall see, they do not have this property, and a stronger statement can be made.

To make this statement, we need the following definition.

Definition 2. Let f be a real-valued function defined on a set C � Rn. A point x* 2 C is called a strict locally

maximal solution of f over C when there exists a d > 0 such that for every x 5 x* that belongs to the set Nd

(x*) \ C, where

N dðx�Þ ¼ fx 2 Rnjkx � x�k < dg;

we have f(x) < f(x*).

From [1], if f is a quasiconcave function defined on a convex set C � Rn, then any strict locally maximal

solution of f over C is a (strict) globally maximal solution of f on C. However, for problems (P1) and (P2),

the corresponding result does not hold, even if X is polyhedral. For instance, in Example 1, it can be shown

that �x ¼ ð2; 1Þ is a strict locally maximal solution for q1(x) over X with q1ð�xÞ ¼ 5

6. However, since

q1(�2, 0) = 1 and (�2, 0) 2 X, �x is not a globally maximal solution of q1 over X.

We have thus shown that in problems (P1) and (P2), locally maximal solutions, even in the strict sense,

need not be globally maximal solutions. From [1], we may view the reason for this to be the fact that q1(x)

and q2(x) need not be quasiconcave functions on X.

�

H.P. Benson / European Journal of Operational Research 173 (2006) 351–369

355

For certain classes of global optimization problems, locally or globally optimal solutions are guaranteed

to exist on the boundaries or on certain subsets of the boundaries of their feasible regions. For instance, if a

function g is continuous and quasiconvex on Rn, then the global maximum of g over a nonempty, compact

convex set Y in Rn is attained at some extreme point of Y [15]. However for problem (P2), there is no guar-

antee that the global maximum is attained at an extreme point of X, or even on the boundary of X. This is

shown by the following example. For any set Y, let oY and (int Y) denote the boundary and the interior of

Y, respectively.

Example 3. In problem (P2), let

X ¼ fðx1; x2Þ 2 R2j0 6 xj 6 2; j ¼ 1; 2g;

"

Q ¼ 1

0

#

0

1

;

and, for each ðx1; x2Þ 2 R2, define g(x1, x2) by

gðx1; x2Þ ¼ x4

1 þ x4

2 þ 1.

Then (1, 1) 2 (int X) and q2ð1; 1Þ ¼ 2

q2(a, 0), q2(0, a), q2(2, a) and q2(a, 2) are all less than 2

mum of q2(x1, x2) over X is not attained on oX.

3. For any a such that 0 6 a 6 2, it is not difficult to show that

3. This implies that, in this problem, the global maxi-

For problem (P1), certain guarantees exist concerning the locations for globally and locally optimal solu-

tions. To help establish the first of these guarantees, we need the following result. For a proof, see Prop-

osition 3.18 and its proof in [28].

Proposition 2. Let M be an n · n symmetric indefinite matrix of real numbers, and let Y � Rn be a nonempty,

compact set. Then any globally optimal solution to the problem

max yTMy;

must belong to oY.

s.t. y 2 Y

Theorem 1. Let v1 denote the globally optimal value of problem (P1). Suppose that

v1 < max q1ðxÞ;

s:t: x 2 Rn n f0g.

Then any globally optimal solution for problem (P1) must belong to oX.

ð2Þ

Proof. Let x* be a globally optimal solution for problem (P1). Then, from Dinkelbach [6], x* is a globally

optimal solution to the problem

max xTQx � v1xTP x;

s:t: x 2 X .

Notice that this problem may be written

max xTðQ � v1PÞx;

s:t: x 2 X .

ð3Þ

From Gantmacher [12],

�k ¼ max q1ðxÞ;

s:t: x 2 Rn n f0g;

�

356

H.P. Benson / European Journal of Operational Research 173 (2006) 351–369

�1Q. Thus, by assumption (2), v1 < �k. From Gotoh and

where �k is the largest eigenvalue of the matrix P

Konno [13], this implies that (Q � v1P) is an indefinite matrix. Since x* is a globally optimal solution to

the problem (3), by Proposition 2, this implies that x* 2 oX. h

Remark 1. Assumption (2) in Theorem 1 assumes that the condition x 2 X in problem (P1) is essential in

the sense that if this condition were removed, then values for q1(x) larger than v1 could be achieved. Thus,

Theorem 1 states that in problem (P1), whenever the condition x 2 X is essential, every globally optimal

solution for problem (P1) must belong to oX.

Remark 2. Let T = P

�k ¼ max q1ðxÞ;

�1Q. As explained in the proof of Theorem 1,

s:t: x 2 Rn n f0g;

where �k is the largest eigenvalue of the matrix T. Furthermore, from Gantmacher [12], �k is attained only by

eigenvectors associated with the eigenvalue �k of T. To check whether or not assumption (2) holds in The-

orem 1, we may therefore proceed by computing �k and then solving the convex programming problem

max x1;

s:t:

ðT � �kIÞx ¼ 0;

x 2 X ;

where I denotes the n · n identity matrix. This problem either has an optimal solution or it is infeasible. If

the former holds, then assumption (2) fails, while if the latter holds, then assumption (2) holds.

Remark 3. Theorem 1 is not valid if assumption (2) is deleted. To see this, consider problem (P1) with

X ¼ fðx1; x2Þ 2 R2j1 6 x1 6 2;�1 6 x2 6 2g;

"

Q ¼ 1

0

#

;

0

1

2

"

P ¼ 1

0

#

0

1

.

In this case, �k ¼ 1 is the largest eigenvalue of T, and the eigenvectors associated with �k are all points in R2

of the form ð�x1; 0Þ, where �x1 6¼ 0. Therefore, in this case,

1 ¼ max q1ðxÞ;

ð4Þ

and the maximum in (4) is attained by any point in R2 of the form ð�x1; 0Þ, where �x1 6¼ 0. From this it is easy

to see that the globally optimal solution set for the problem (P1) is given by

s:t: x 2 R2 n f0g;

fð�x1; 0Þj1 6 �x1 6 2g.

Notice that this set contains many points in (int X), so that in this problem, the conclusion of Theorem 1

does not hold. This is because in this problem, v1 = 1, so that, by (4), assumption (2) does not hold.

Remark 4. The example given in Remark 3 also shows that problems (P1) and (P2) need not have globally

optimal solutions that are extreme points of X.

Even without assumption (2), there must exist a globally optimal solution for problem (P1) that belongs

to oX. In fact, we have the following stronger result.

Theorem 2. Let X 0 be a nonempty compact set in Rn such that 0 62 X 0. Let Q and P be n · n, symmetric

positive semidefinite and positive definite matrices, respectively. Then any locally optimal value for the

maximum of q1(x) over X 0 is attained by at least one point that belongs to oX 0.

�

H.P. Benson / European Journal of Operational Research 173 (2006) 351–369

357

Proof. Let �v1 denote a locally optimal value for the maximum of q1(x) over X 0, and let �x 2 X 0 satisfy

q1ð�xÞ ¼ �v1.

suppose that �x 62 oX 0. Then

�x 2 ðint X 0Þ. Consider the set F given by

F ¼ fb 2 Rjb P 0;ð1 þ bÞ�x 2 X 0g.

then the desired result

follows. Therefore,

If �x 2 oX 0,

Since �x 2 ðint X 0Þ, F 5 /. Also, because X 0 is compact, it is easy to show that F is compact. Therefore, we

may choose an optimal solution �b > 0 to the problem

max b;

s:t: b 2 F .

ð5Þ

Notice that ð1 þ �bÞ�x 2 oX 0, because if this were not the case, then for some e > 0, ð1 þ �b þ eÞ�x would belong

to X 0, which contradicts the optimality of �b in (5). Also, by the definition of q1(x), q1½ð1 þ �bÞ�x ¼ q1ð�xÞ ¼ �v1.

Thus, the point ð1 þ �bÞ�x has the desired properties, and the proof is complete. h

It can be shown that for a concave fractional program (1) in which n(x) and d(x) are continuous func-

tions, the globally optimal solution set is a convex set. Since problems (P1) and (P2) are nonconcave frac-

tional programs, we may not expect this property to hold for these problems. Indeed, it does not, as can be

shown by examples. For brevity, however, we omit providing such an example.

Although the objective functions of problem (P1) and (P2) are generally neither quasiconcave nor quasi-

convex over X, the next result shows that these problems can be reformulated as maximizations of quasi-

convex functions over nonempty, compact convex sets. To show this, let m and M satisfy

m ¼ min gðxÞ;

M P max gðxÞ;

s:t: x 2 X ;

s:t: x 2 X ;

and consider the problem (P3) given by

;

max q3ðx; tÞ¼: xTQx

t

t � gðxÞ P 0;

s:t:

m 6 t 6 M;

x 2 X ;

ðP3Þ

where X, g(x) and Q are as given in problem (P2). Then problems (P2) and (P3) are equivalent in the sense

of the following result.

Proposition 3. If ðx�; t�Þ 2 Rnþ1 is a globally optimal solution for problem (P3), then x* is a globally optimal

solution for problem (P2). Conversely, if x* is a globally optimal solution for problem (P2), then ðx�; t�Þ 2 Rnþ1

is a globally optimal solution for problem (P3), where t* = g(x*).

Proof. The proof of this result is straightforward and therefore is omitted. h

Since X is a nonempty, compact convex set in Rn and g : Rn ! R is a convex function, it is easy to see

that the feasible region Z of problem (P3) is a nonempty, compact convex set in Rnþ1. Also, from Propo-

sitions 3.30 and 5.20 in [1], since Q is a symmetric, positive semidefinite matrix and g(x) is positive for all

x 2 X, q3(x, t) is a continuous, quasiconvex function on Z. From [16], this implies that the global maximum

of problem (P3) is attained at an extreme point of Z, and that various global optimization algorithms for

convex maximization problems, including, for example, outer approximation algorithms, can potentially be

effectively used to globally solve problem (P3). By Proposition 3, this provides a potential avenue for glob-

ally solving problems (P1) and (P2).

�

358

H.P. Benson / European Journal of Operational Research 173 (2006) 351–369

To close this section, we will show that problem (P2) and, therefore problem (P1), can be reformulated as

a maximization of a convex function over a nonempty, compact convex set. To yield a more concrete result,

we assume henceforth in problem (P2) that X is given by

X ¼ fx 2 RnjgiðxÞ 6 0; i ¼ 1; 2; . . . ; q; L 6 x 6 Ug;

ð6Þ

where L, U 2 Rn and, for each i = 1, 2, . . . , q, gi (x) is a convex function on Rn. The assumption that

L 6 x 6 U

for all x 2 X can be made without loss of generality, since X is a compact set.

Since Q is an n · n symmetric positive semidefinite matrix of real numbers, it is well known that we may

choose an orthonormal basis {w1, w2, . . . , wn} of Rn such that for each j 2 {1, 2, . . . , n}, w j is an eigenvector

of Q with eigenvalue aj P 0 [14]. Let W be the n · n matrix with columns w1, w2, . . . , wn. The matrix W and

the eigenvalues aj, j = 1, 2, . . . , n, of Q can be found, for instance, by using the characteristic polynomial of

Q to compute the eigenvalues a1,a2, . . . , an. The corresponding orthonormal eigenvectors w1, w2, . . . , wn can

then be easily found.

Let h(y) and hi(y), i = 1, 2, . . . , q, be functions defined for each y 2 Rn by

hðyÞ ¼ gðWyÞ

and

respectively, and consider the problem (P4) given by

hiðyÞ ¼ giðWyÞ;

i ¼ 1; 2; . . . ; q;

X

max q4ðy; tÞ¼:

n

ajy2

j

;

t

s:t:

j¼1

t � hðyÞ P 0;

m 6 t 6 M;

hiðyÞ 6 0;

L 6 Wy 6 U.

i ¼ 1; 2; . . . ; q;

ð7Þ

ð8Þ

ðP4Þ

Theorem 3.

(a) If ðy�; t�Þ 2 Rnþ1 is a globally optimal solution for problem (P4), then x* = Wy* is a globally optimal

(b) Conversely, if x* is a globally optimal solution for problem (P2), then ðy�; t�Þ 2 Rnþ1 is a globally optimal

solution for problem (P2).

solution for problem (P4), where y* = W

�1x* and t* = g(x*).

Proof. (a) Let ðy�; t�Þ 2 Rnþ1 be a globally optimal solution for problem (P4), and let x* = Wy*. Then

t� � gðx�Þ ¼ t� � gðWy�Þ ¼ t� � hðy�Þ P 0;

ð9Þ

where the second equation is from (7) and the inequality follows from the feasibility of (y*, t*) in problem

(P4). Similarly, it follows from (8) and the feasibility of (y*, t*) in problem (P4) that

giðx�Þ 6 0;

i ¼ 1; 2; . . . ; q.

ð10Þ

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc