Cover������������

Title Page�����������������

Copyright����������������

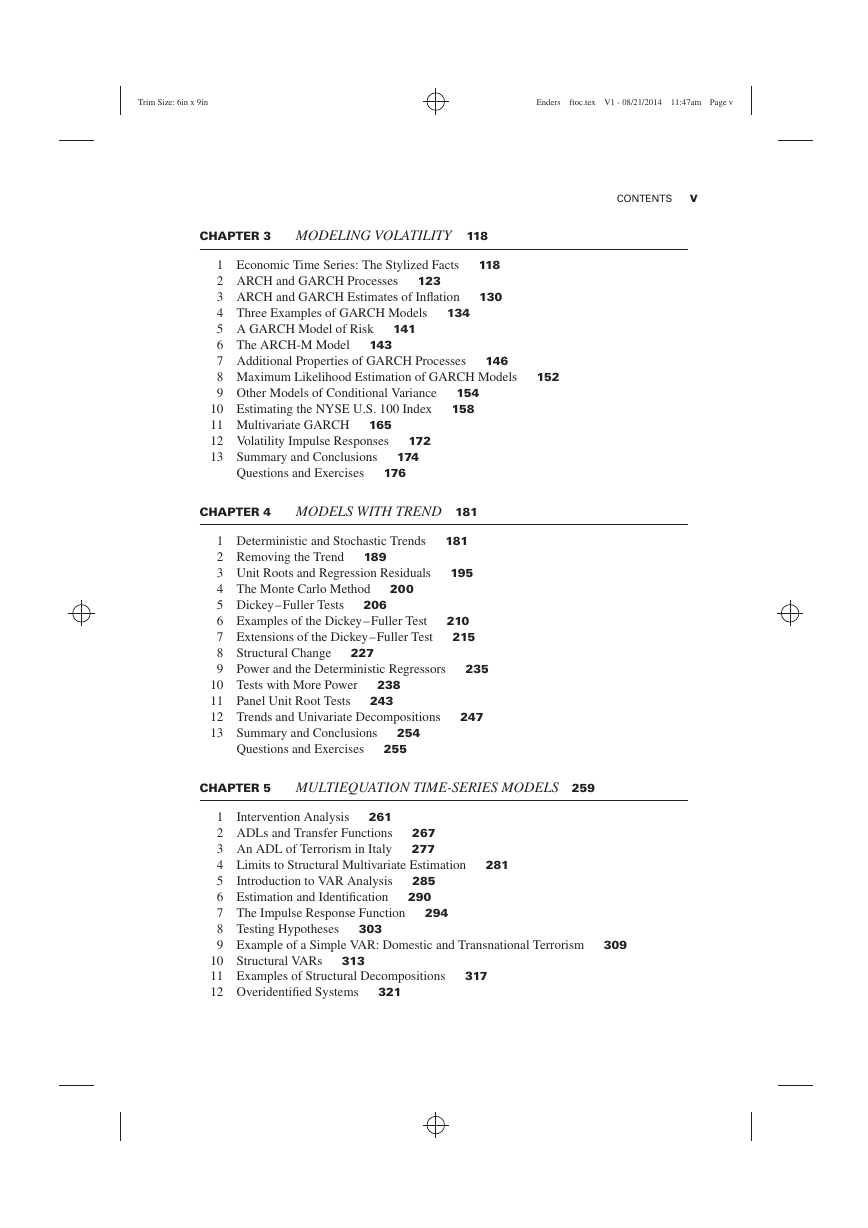

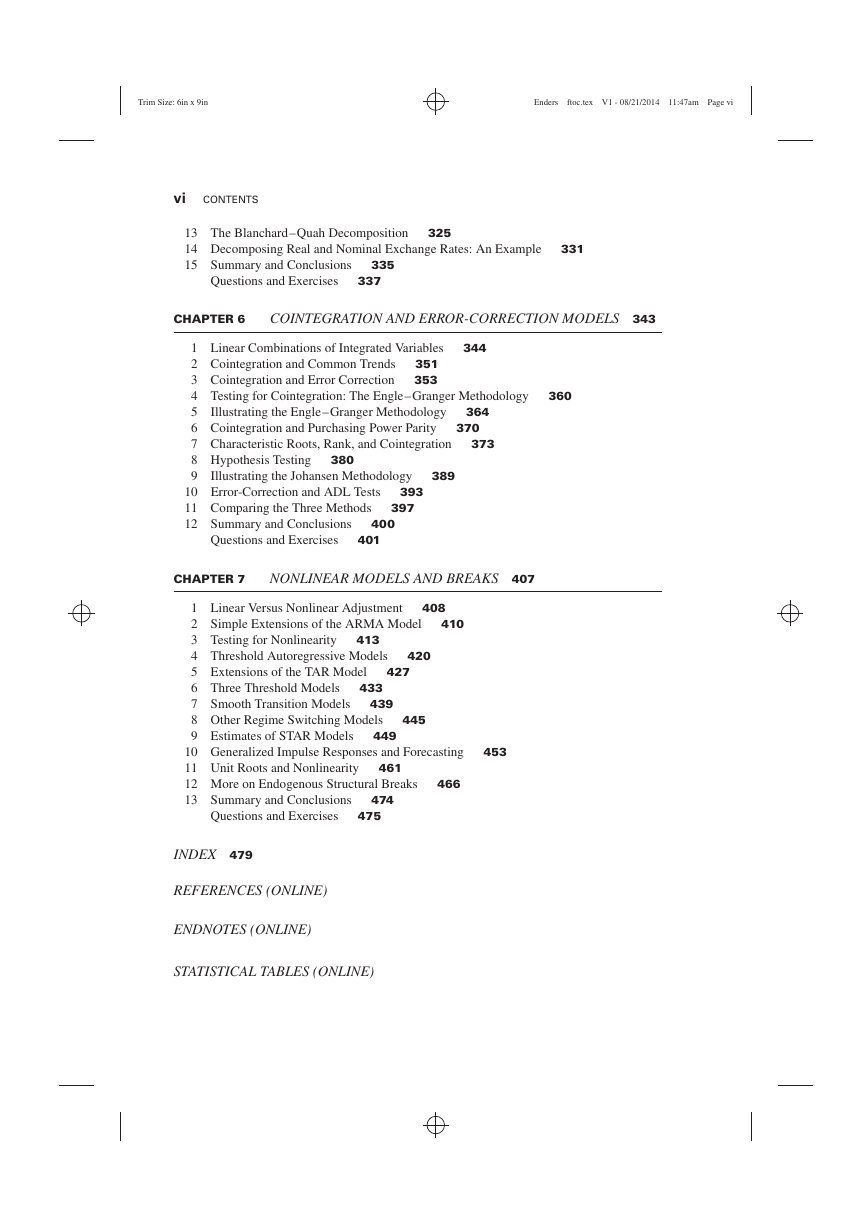

Contents���������������

Preface

About the Author�����������������������

Chapter 1 Difference Equations�������������������������������������

Introduction�������������������

1 Time-Series Models���������������������������

2 Difference Equations and Their Solutions�������������������������������������������������

3 Solution by Iteration������������������������������

Iteration without an Initial Condition

Reconciling the Two Iterative Methods

Nonconvergent Sequences

4 An Alternative Solution Methodology��������������������������������������������

The Solution Methodology

Generalizing the Method

5 The Cobweb Model�������������������������

6 Solving Homogeneous Difference Equations�������������������������������������������������

Stability Conditions

Higher Order Systems

7 Particular Solutions for Deterministic Processes���������������������������������������������������������

8 The Method of Undetermined Coefficients������������������������������������������������

Higher Order Systems

A Solved Problem

9 Lag Operators����������������������

Lag Operators in Higher Order Systems

10 Summary�����������������

Questions and Exercises������������������������������

Chapter 2 Stationary Time-Series Models����������������������������������������������

1 Stochastic Difference Equation Models����������������������������������������������

2 ARMA Models��������������������

3 Stationarity���������������������

Stationarity Restrictions for an AR(1) Process

4 Stationarity Restrictions for an ARMA (p, q) Model�����������������������������������������������������������

Stationarity Restrictions for the Autoregressive Coefficients

5 The Autocorrelation Function�������������������������������������

The Autocorrelation Function of an AR(2) Process

The Autocorrelation Function of an MA(1) Process

The Autocorrelation Function of an ARMA(1,1) Process

6 The Partial Autocorrelation Function���������������������������������������������

7 Sample Autocorrelations of Stationary Series�����������������������������������������������������

Model Selection Criteria

Estimation of an AR(1) Model

Estimation of an ARMA(1, 1) Model

Estimation of an AR(2) Model

8 Box-Jenkins Model Selection������������������������������������

Parsimony

Stationarity and Invertibility

Goodness of Fit

Postestimation Evaluation

9 Properties of Forecasts��������������������������������

Higher-Order Models

Forecast Evaluation

10 A Model of the Interest Rate Spread���������������������������������������������

Out-of-Sample Forecasts

11 Seasonality���������������������

Models of Seasonal Data

Seasonal Differencing

12 Parameter Instability and Structural Change�����������������������������������������������������

Testing for Structural Change

Endogenous Breaks

Parameter Instability

An Example of a Break

13 Combining Forecasts�����������������������������

Optimal Weights

Example Using the Spread

14 Summary and Conclusions���������������������������������

Questions and Exercises������������������������������

Chapter 3 Modeling Volatility������������������������������������

1 Economic Time Series: The Stylized Facts�������������������������������������������������

2 ARCH and GARCH Processes���������������������������������

ARCH Processes

The GARCH Model

3 ARCH and GARCH Estimates of Inflation����������������������������������������������

Engle’s Model of U.K. Inflation

Bollerslev’s Estimates of U.S. Inflation

4 Three Examples of GARCH Models���������������������������������������

A GARCH Model of Oil Prices

Volatility Moderation

A GARCH Model of the Spread

Formal Tests for ARCH Errors

Alternative Estimates of the Model

5 A GARCH Model of Risk������������������������������

6 The ARCH-M Model�������������������������

Implementation

7 Additional Properties of GARCH Processes�������������������������������������������������

Properties of GARCH(1, 1) Error Processes

Assessing the Fit

Diagnostic Checks for Model Adequacy

Forecasting the Conditional Variance

8 Maximum Likelihood Estimation of GARCH Models������������������������������������������������������

9 Other Models of Conditional Variance���������������������������������������������

The IGARCH Model

Models with Explanatory Variables

Models with Asymmetry: TARCH and EGARCH

Testing for Leverage Effects

Nonnormal Errors

10 Estimating the NYSE U.S. 100 Index��������������������������������������������

The Model of the Mean

Testing for GARCH errors

Alternative Estimates of the Model

Diagnostic Checking

The Asymmetric Models

11 Multivariate GARCH����������������������������

Updating the Study

12 Volatility Impulse Responses��������������������������������������

An Example

13 Summary and Conclusions���������������������������������

Questions and Exercises������������������������������

Chapter 4 Models with Trend����������������������������������

1 Deterministic and Stochastic Trends��������������������������������������������

The Random Walk Model

The Random Walk Plus Drift Model

Generalizations of the Stochastic Trend Model

2 Removing the Trend���������������������������

Differencing

Detrending

Difference versus Trend Stationary Models

Are There Business Cycles?

The Trend in Real GDP

3 Unit Roots and Regression Residuals��������������������������������������������

4 The Monte Carlo Method�������������������������������

Monte Carlo Experiments

Example of the Monte Carlo Method

Generating the Dickey–Fuller Distribution

5 Dickey-Fuller Tests����������������������������

An Example

6 Examples of the Dickey-Fuller Test�������������������������������������������

Quarterly Real U.S. GDP

Unit Roots and Purchasing Power Parity

7 Extensions of the Dickey-Fuller Test���������������������������������������������

Selection of the Lag Length

The Test with MA Components

Multiple Roots

Seasonal Unit Roots

8 Structural Change��������������������������

Perron’s Test for Structural Change

Perron’s Test and Real Output

Tests with Simulated Data

9 Power and the Deterministic Regressors�����������������������������������������������

Power

Determination of the Deterministic Regressors

10 Tests with More Power�������������������������������

An Example

11 Panel Unit Root Tests�������������������������������

Limitations of the Panel Unit Root Test

12 Trends and Univariate Decompositions����������������������������������������������

The General ARIMA(p, 1,q) Model

The Hodrick–Prescott Decomposition

13 Summary and Conclusions���������������������������������

Questions and Exercises������������������������������

Chapter 5 Multiequation Time-Series Models�������������������������������������������������

1 Intervention Analysis������������������������������

Estimating the Effect of Metal Detectors on Skyjackings

Estimating the Effect of the Libyan Bombing

2 ADLs and Transfer Functions������������������������������������

ADL Models

The Cross-Covariances of a Second-Order Process

Higher-Order Input Processes

Identification and Estimation

3 An ADL of Terrorism in Italy�������������������������������������

4 Limits to Structural Multivariate Estimation�����������������������������������������������������

Multivariate Macroeconometric Models: Some Historical Background

5 Introduction to VAR Analysis�������������������������������������

Stability and Stationarity

Dynamics of a VAR Model

6 Estimation and Identification��������������������������������������

Forecasting

Identification

7 The Impulse Response Function��������������������������������������

Confidence Intervals and Impulse Responses

Variance Decomposition

8 Testing Hypotheses���������������������������

Granger Causality

Granger Causality and Money Supply Changes

9 Example of a Simple VAR: Domestic and Transnational Terrorism����������������������������������������������������������������������

Empirical Methodology

Empirical Results

10 Structural VARs�������������������������

Structural Decompositions

11 Examples of Structural Decompositions�����������������������������������������������

12 Overidentified Systems��������������������������������

Two Examples

13 The Blanchard-Quah Decomposition������������������������������������������

The Blanchard and Quah Results

14 Decomposing Real and Nominal Exchange Rates: An Example�����������������������������������������������������������������

Limitations of the Technique

15 Summary and Conclusions���������������������������������

Questions and Exercises������������������������������

Chapter 6 Cointegration and Error-Correction Models����������������������������������������������������������

1 Linear Combinations of Integrated Variables����������������������������������������������������

2 Cointegration and Common Trends����������������������������������������

3 Cointegration and Error Correction�������������������������������������������

The n-Variable Case

4 Testing for Cointegration: The Engle-Granger Methodology�����������������������������������������������������������������

5 Illustrating the Engle-Granger Methodology���������������������������������������������������

The Engle–Granger Procedure with I(2) Variables

6 Cointegration and Purchasing Power Parity��������������������������������������������������

7 Characteristic Roots, Rank, and Cointegration������������������������������������������������������

8 Hypothesis Testing���������������������������

Lag Length and Causality Tests

To Difference or Not to Difference

Tests on Multiple Cointegrating Vectors

The Test in the Presence of I(2) Variables

9 Illustrating the Johansen Methodology����������������������������������������������

10 Error-Correction and ADL Tests����������������������������������������

Cointegration with Weak Exogeneity

Inference on the Cointegrating Vector

11 Comparing the Three Methods�������������������������������������

The Engle–Granger Methodology

The Johansen Methodology

The Error-Correction Methodology

12 Summary and Conclusions���������������������������������

Questions and Exercises������������������������������

Chapter 7 Nonlinear Models and Breaks��������������������������������������������

1 Linear Versus Nonlinear Adjustment�������������������������������������������

2 Simple Extensions of the ARMA Model��������������������������������������������

The GAR Model

The Bilinear Model

An Example

3 Testing for Nonlinearity���������������������������������

The ACF and the McLeod–Li Test

The RESET

Other Portmanteau Tests

Lagrange Multiplier Tests

Two Examples

Inference with Unidentified Nuisance Parameters

4 Threshold Autoregressive Models����������������������������������������

The Basic Threshold Model

Estimation

Unknown Threshold

5 Extensions of the TAR Model������������������������������������

Selecting the Delay Parameter

Multiple Regimes

More on Estimating the Threshold

Threshold Regression Models

Pretesting for a TAR Model

TAR Models and Endogenous Breaks

6 Three Threshold Models�������������������������������

The Unemployment Rate

Asymmetric Monetary Policy

Capital Stock Adjustment with Multiple Thresholds

7 Smooth Transition Models���������������������������������

Pretests for STAR Models

8 Other Regime Switching Models��������������������������������������

The Artificial Neural Network

The Markov Switching Model

9 Estimates of STAR Models���������������������������������

An LSTAR Model

The Real Exchange Rate as an ESTAR Process

10 Generalized Impulse Responses and Forecasting�������������������������������������������������������

Nonlinear Estimates of GNP Growth

Impulse Responses

Terrorist Incidents with Casualties

11 Unit Roots and Nonlinearity�������������������������������������

An Example

12 More on Endogenous Structural Breaks����������������������������������������������

Two Examples

Nonlinear Breaks

Estimates of a Logistic Break

13 Summary and Conclusions���������������������������������

Questions and Exercises������������������������������

Index������������

EULA

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc