GARCH Models

Contents

Preface

Notation

1 Classical Time Series Models and Financial Series

1.1 Stationary Processes

1.2 ARMA and ARIMA Models

1.3 Financial Series

1.4 Random Variance Models

1.5 Bibliographical Notes

1.6 Exercises

Part I Univariate GARCH Models

2 GARCH(p, q) Processes

2.1 Definitions and Representations

2.2 Stationarity Study

2.2.1 The GARCH(1, 1) Case

2.2.2 The General Case

2.3 ARCH (∞) Representation

2.3.1 Existence Conditions

2.3.2 ARCH (∞) Representation of a GARCH

2.3.3 Long-Memory ARCH

2.4 Properties of the Marginal Distribution

2.4.1 Even-Order Moments

2.4.2 Kurtosis

2.5 Autocovariances of the Squares of a GARCH

2.5.1 Positivity of the Autocovariances

2.5.2 The Autocovariances Do Not Always Decrease

2.5.3 Explicit Computation of the Autocovariances of the Squares

2.6 Theoretical Predictions

2.7 Bibliographical Notes

2.8 Exercises

3 Mixing*

3.1 Markov Chains with Continuous State Space

3.2 Mixing Properties of GARCH Processes

3.3 Bibliographical Notes

3.4 Exercises

4 Temporal Aggregation and Weak GARCH Models

4.1 Temporal Aggregation of GARCH Processes

4.1.1 Nontemporal Aggregation of Strong Models

4.1.2 Nonaggregation in the Class of Semi-Strong GARCH Processes

4.2 Weak GARCH

4.3 Aggregation of Strong GARCH Processes in the Weak GARCH Class

4.4 Bibliographical Notes

4.5 Exercises

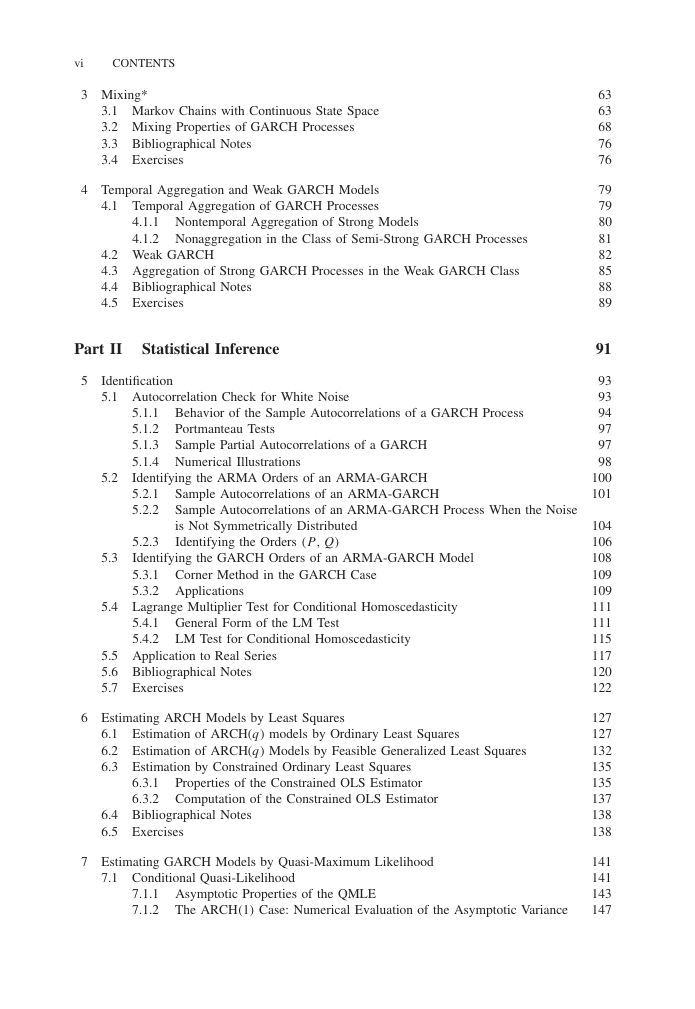

Part II Statistical Inference

5 Identification

5.1 Autocorrelation Check for White Noise

5.1.1 Behavior of the Sample Autocorrelations of a GARCH Process

5.1.2 Portmanteau Tests

5.1.3 Sample Partial Autocorrelations of a GARCH

5.1.4 Numerical Illustrations

5.2 Identifying the ARMA Orders of an ARMA-GARCH

5.2.1 Sample Autocorrelations of an ARMA-GARCH

5.2.2 Sample Autocorrelations of an ARMA-GARCH Process When the Noise is Not Symmetrically Distributed

5.2.3 Identifying the Orders (P,Q)

5.3 Identifying the GARCH Orders of an ARMA-GARCH Model

5.3.1 Corner Method in the GARCH Case

5.3.2 Applications

5.4 Lagrange Multiplier Test for Conditional Homoscedasticity

5.4.1 General Form of the LM Test

5.4.2 LM Test for Conditional Homoscedasticity

5.5 Application to Real Series

5.6 Bibliographical Notes

5.7 Exercises

6 Estimating ARCH Models by Least Squares

6.1 Estimation of ARCH(q) models by Ordinary Least Squares

6.2 Estimation of ARCH(q) Models by Feasible Generalized Least Squares

6.3 Estimation by Constrained Ordinary Least Squares

6.3.1 Properties of the Constrained OLS Estimator

6.3.2 Computation of the Constrained OLS Estimator

6.4 Bibliographical Notes

6.5 Exercises

7 Estimating GARCH Models by Quasi-Maximum Likelihood

7.1 Conditional Quasi-Likelihood

7.1.1 Asymptotic Properties of the QMLE

7.1.2 The ARCH(1) Case: Numerical Evaluation of the Asymptotic Variance

7.1.3 The Nonstationary ARCH(1)

7.2 Estimation of ARMA-GARCH Models by Quasi-Maximum Likelihood

7.3 Application to Real Data

7.4 Proofs of the Asymptotic Results*

7.5 Bibliographical Notes

7.6 Exercises

8 Tests Based on the Likelihood

8.1 Test of the Second-Order Stationarity Assumption

8.2 Asymptotic Distribution of the QML When ¥è0 is at the Boundary

8.2.1 Computation of the Asymptotic Distribution

8.3 Significance of the GARCH Coefficients

8.3.1 Tests and Rejection Regions

8.3.2 Modification of the Standard Tests

8.3.3 Test for the Nullity of One Coefficient

8.3.4 Conditional Homoscedasticity Tests with ARCH Models

8.3.5 Asymptotic Comparison of the Tests

8.4 Diagnostic Checking with Portmanteau Tests

8.5 Application: Is the GARCH(1,1) Model Overrepresented?

8.6 Proofs of the Main Results

8.7 Bibliographical Notes

8.8 Exercises

9 Optimal Inference and Alternatives to the QMLE*

9.1 Maximum Likelihood Estimator

9.1.1 Asymptotic Behavior

9.1.2 One-Step Efficient Estimator

9.1.3 Semiparametric Models and Adaptive Estimators

9.1.4 Local Asymptotic Normality

9.2 Maximum Likelihood Estimator with Misspecified Density

9.2.1 Condition for the Convergence of [omitted]

9.2.2 Reparameterization Implying the Convergence of [omitted]

9.2.3 Choice of Instrumental Density h

9.2.4 Asymptotic Distribution of [omitted]

9.3 Alternative Estimation Methods

9.3.1 Weighted LSE for the ARMA Parameters

9.3.2 Self-Weighted QMLE

9.3.3 Lp Estimators

9.3.4 Least Absolute Value Estimation

9.3.5 Whittle Estimator

9.4 Bibliographical Notes

9.5 Exercises

Part III Extensions and Applications

10 Asymmetries

10.1 Exponential GARCH Model

10.2 Threshold GARCH Model

10.3 Asymmetric Power GARCH Model

10.4 Other Asymmetric GARCH Models

10.5 A GARCH Model with Contemporaneous Conditional Asymmetry

10.6 Empirical Comparisons of Asymmetric GARCH Formulations

10.7 Bibliographical Notes

10.8 Exercises

11 Multivariate GARCH Processes

11.1 Multivariate Stationary Processes

11.2 Multivariate GARCH Models

11.2.1 Diagonal Model

11.2.2 Vector GARCH Model

11.2.3 Constant Conditional Correlations Models

11.2.4 Dynamic Conditional Correlations Models

11.2.5 BEKK-GARCH Model

11.2.6 Factor GARCH Models

11.3 Stationarity

11.3.1 Stationarity of VEC and BEKK Models

11.3.2 Stationarity of the CCC Model

11.4 Estimation of the CCC Model

11.4.1 Identifiability Conditions

11.4.2 Asymptotic Properties of the QMLE of the CCC-GARCH model

11.4.3 Proof of the Consistency and the Asymptotic Normality of the QML

11.5 Bibliographical Notes

11.6 Exercises

12 Financial Applications

12.1 Relation between GARCH and Continuous-Time Models

12.1.1 Some Properties of Stochastic Differential Equations

12.1.2 Convergence of Markov Chains to Diffusions

12.2 Option Pricing

12.2.1 Derivatives and Options

12.2.2 The Black–Scholes Approach

12.2.3 Historic Volatility and Implied Volatilities

12.2.4 Option Pricing when the Underlying Process is a GARCH

12.3 Value at Risk and Other Risk Measures

12.3.1 Value at Risk

12.3.2 Other Risk Measures

12.3.3 Estimation Methods

12.4 Bibliographical Notes

12.5 Exercises

Part IV Appendices

A Ergodicity, Martingales, Mixing

A.1 Ergodicity

A.2 Martingale Increments

A.3 Mixing

A.3.1 α-Mixing and β-Mixing Coefficients

A.3.2 Covariance Inequality

A.3.3 Central Limit Theorem

B Autocorrelation and Partial Autocorrelation

B.1 Partial Autocorrelation

B.2 Generalized Bartlett Formula for Nonlinear Processes

C Solutions to the Exercises

D Problems

References

Index

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc