Doob

Polya

Kolmogorov

Cramer

�

Borel

Levy

Keynes

Feller

�

Contents

PREFACE TO THE FOURTH EDITION

PROLOGUE TO INTRODUCTION TO

MATHEMATICAL FINANCE

1 SET

1.1 Sample sets

1.2 Operations with sets

1.3 Various relations

1.4 Indicator

Exercises

2 PROBABILITY

2.1 Examples of probability

2.2 Definition and illustrations

2.3 Deductions from the axioms

2.4 Independent events

2.5 Arithmetical density

Exercises

3 COUNTING

3.1 Fundamental rule

3.2 Diverse ways of sampling

3.3 Allocation models; binomial coefficients

3.4 How to solve it

Exercises

xi

xiii

1

1

3

7

13

17

20

20

24

31

35

39

42

46

46

49

55

62

70

vii

�

viii

Contents

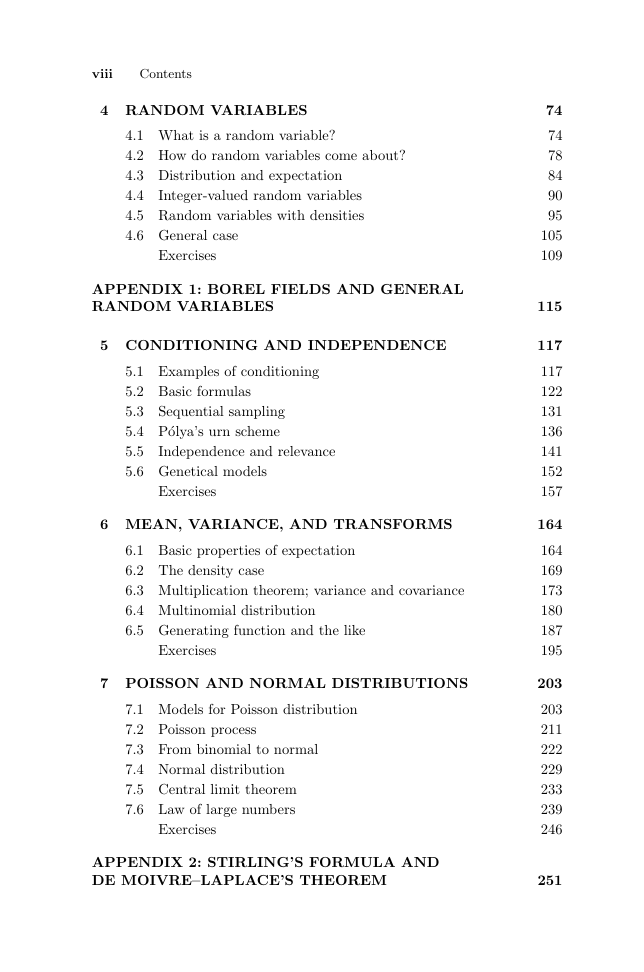

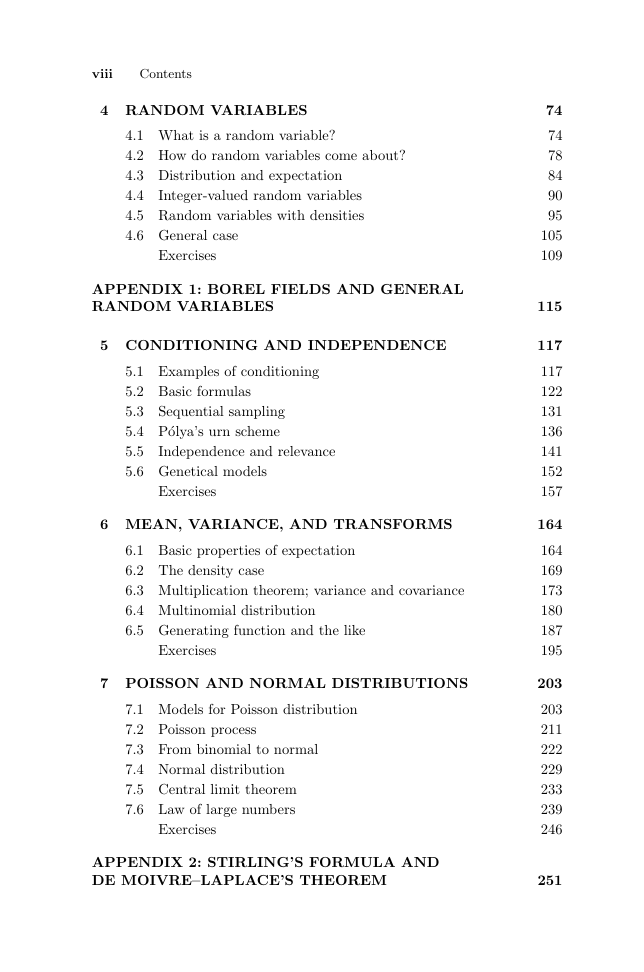

4 RANDOM VARIABLES

4.1 What is a random variable?

4.2 How do random variables come about?

4.3 Distribution and expectation

4.4 Integer-valued random variables

4.5 Random variables with densities

4.6 General case

Exercises

APPENDIX 1: BOREL FIELDS AND GENERAL

RANDOM VARIABLES

5 CONDITIONING AND INDEPENDENCE

5.1 Examples of conditioning

5.2 Basic formulas

5.3 Sequential sampling

5.4 P´olya’s urn scheme

5.5 Independence and relevance

5.6 Genetical models

Exercises

6 MEAN, VARIANCE, AND TRANSFORMS

6.1 Basic properties of expectation

6.2 The density case

6.3 Multiplication theorem; variance and covariance

6.4 Multinomial distribution

6.5 Generating function and the like

Exercises

7 POISSON AND NORMAL DISTRIBUTIONS

7.1 Models for Poisson distribution

7.2 Poisson process

7.3 From binomial to normal

7.4 Normal distribution

7.5 Central limit theorem

7.6 Law of large numbers

Exercises

APPENDIX 2: STIRLING’S FORMULA AND

DE MOIVRE–LAPLACE’S THEOREM

74

74

78

84

90

95

105

109

115

117

117

122

131

136

141

152

157

164

164

169

173

180

187

195

203

203

211

222

229

233

239

246

251

�

Contents

ix

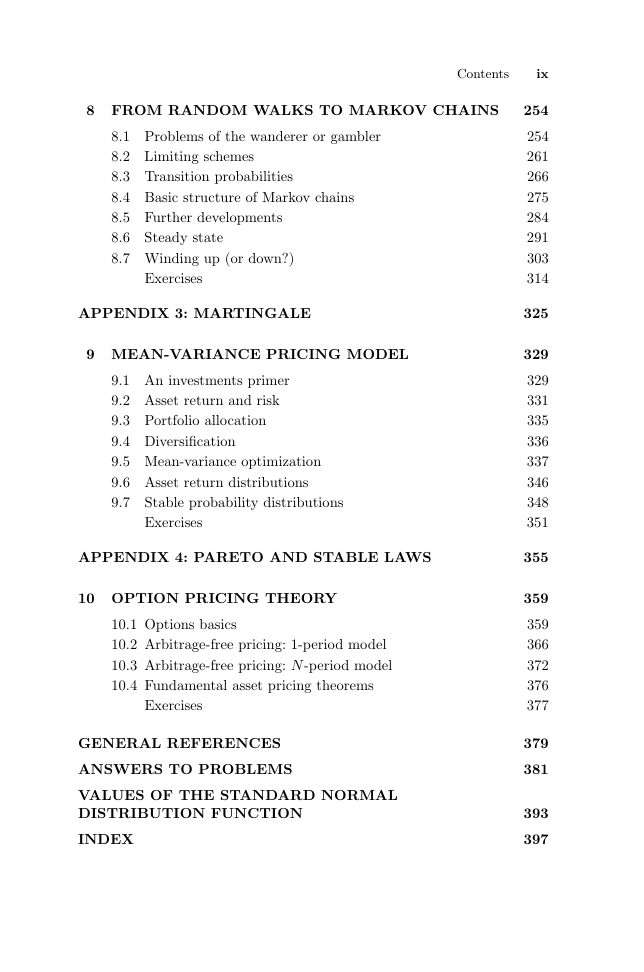

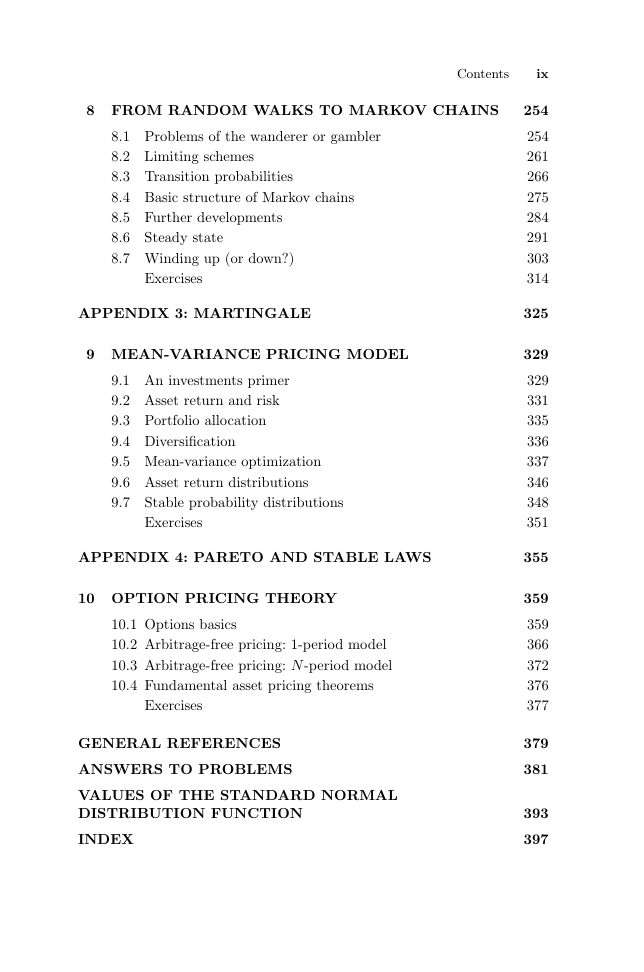

8 FROM RANDOM WALKS TO MARKOV CHAINS

8.1 Problems of the wanderer or gambler

8.2 Limiting schemes

8.3 Transition probabilities

8.4 Basic structure of Markov chains

8.5 Further developments

8.6 Steady state

8.7 Winding up (or down?)

Exercises

APPENDIX 3: MARTINGALE

9 MEAN-VARIANCE PRICING MODEL

9.1 An investments primer

9.2 Asset return and risk

9.3 Portfolio allocation

9.4 Diversification

9.5 Mean-variance optimization

9.6 Asset return distributions

9.7 Stable probability distributions

Exercises

APPENDIX 4: PARETO AND STABLE LAWS

10 OPTION PRICING THEORY

10.1 Options basics

10.2 Arbitrage-free pricing: 1-period model

10.3 Arbitrage-free pricing: N-period model

10.4 Fundamental asset pricing theorems

Exercises

GENERAL REFERENCES

ANSWERS TO PROBLEMS

VALUES OF THE STANDARD NORMAL

DISTRIBUTION FUNCTION

INDEX

254

254

261

266

275

284

291

303

314

325

329

329

331

335

336

337

346

348

351

355

359

359

366

372

376

377

379

381

393

397

�

�

Preface to the Fourth Edition

In this edition two new chapters, 9 and 10, on mathematical finance are

added. They are written by Dr. Farid AitSahlia, ancien ´el`eve, who has

taught such a course and worked on the research staff of several industrial

and financial institutions.

The new text begins with a meticulous account of the uncommon vocab-

ulary and syntax of the financial world; its manifold options and actions,

with consequent expectations and variations, in the marketplace. These are

then expounded in clear, precise mathematical terms and treated by the

methods of probability developed in the earlier chapters. Numerous graded

and motivated examples and exercises are supplied to illustrate the appli-

cability of the fundamental concepts and techniques to concrete financial

problems. For the reader whose main interest is in finance, only a portion

of the first eight chapters is a “prerequisite” for the study of the last two

chapters. Further specific references may be scanned from the topics listed

in the Index, then pursued in more detail.

I have taken this opportunity to fill a gap in Section 8.1 and to expand

Appendix 3 to include a useful proposition on martingale stopped at an

optional time. The latter notion plays a basic role in more advanced finan-

cial and other disciplines. However, the level of our compendium remains

elementary, as befitting the title and scheme of this textbook. We have also

included some up-to-date financial episodes to enliven, for the beginners,

the stratified atmosphere of “strictly business”. We are indebted to Ruth

Williams, who read a draft of the new chapters with valuable suggestions

for improvement; to Bernard Bru and Marc Barbut for information on the

Pareto-L´evy laws originally designed for income distributions. It is hoped

that a readable summary of this renowned work may be found in the new

Appendix 4.

Kai Lai Chung

August 3, 2002

xi

�

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc