Ethical and Professional Standards

Study Session 1 Ethical and Professional Standards

Reading 2 Guidance for Standards I-VII

PRACTICE PROBLEMS

SOLUTIONS

Reading 4 Introduction to Linear Regression

PRACTICE PROBLEMS

SOLUTIONS

Reading 5 Multiple Regression

PRACTICE PROBLEMS

SOLUTIONS

Reading 6 Time-Series Analysis

PRACTICE PROBLEMS

SOLUTIONS

Quantitative Methods

STUDY SESSION 3

Quantitative Methods (2)

Reading 7 Machine Learning

PRACTICE PROBLEMS

SOLUTIONS

Reading 8 Big Data Projects

PRACTICE PROBLEMS

SOLUTIONS

Reading 9 Excerpt from “Probabilistic Approaches:

PRACTICE PROBLEMS

SOLUTIONS

Study Session 4 Economics

Reading 10 Currency Exchange Rates: Understanding

PRACTICE PROBLEMS

SOLUTIONS

Reading 11 Economic Growth and the Investment Deci

PRACTICE PROBLEMS

SOLUTIONS

Reading 12 Economics of Regulation

PRACTICE PROBLEMS

SOLUTIONS

Financial Reporting and Analysis

Study Session 5 Financial Reporting and Analysis (

Reading 13 Intercorporate Investments

PRACTICE PROBLEMS

SOLUTIONS

Reading 14 Employee Compensation: Post- Employment

PRACTICE PROBLEMS

SOLUTIONS

Reading 15 Multinational Operations

PRACTICE PROBLEMS

SOLUTIONS

Reading 16 Analysis of Financial Institutions

PRACTICE PROBLEMS

SOLUTIONS

STUDY SESSION 6 Financial Reporting and Analysis (

Reading 17 Evaluating Quality of Financial Reports

PRACTICE PROBLEMS

SOLUTIONS

Reading 18 Integration of Financial Statement Anal

PRACTICE PROBLEMS

SOLUTIONS

Corporate Finance

Study Session 7 Corporate Finance (1)

Reading 19 Capital Budgeting

PRACTICE PROBLEMS

SOLUTIONS

Reading 20 Capital Structure

PRACTICE PROBLEMS

SOLUTIONS

Reading 21 Analysis of Dividends and Share Repurch

PRACTICE PROBLEMS

SOLUTIONS

STUDY SESSION 8 Corporate Finance (2)

Reading 22 Corporate Governance and Other ESG Con

PRACTICE PROBLEMS

SOLUTIONS

Reading 23 Mergers and Acquisitions

PRACTICE PROBLEMS

SOLUTIONS

Equity Valuation

Study Session 9 Equity Valuation (1) 3

Reading 24 Equity Valuation: Applications and Proc

PRACTICE PROBLEMS

SOLUTIONS

Reading 25 Return Concepts

PRACTICE PROBLEMS

SOLUTIONS

Study Session 10 Equity Valuation (2)

Reading 26 Industry and Company Analysis

PRACTICE PROBLEMS

SOLUTIONS

Reading 27 Discounted Dividend Valuation

PRACTICE PROBLEMS

SOLUTIONS

Study Session 11 Equity Valuation (3)

Reading 28 Free Cash Flow Valuation

PRACTICE PROBLEMS

SOLUTIONS

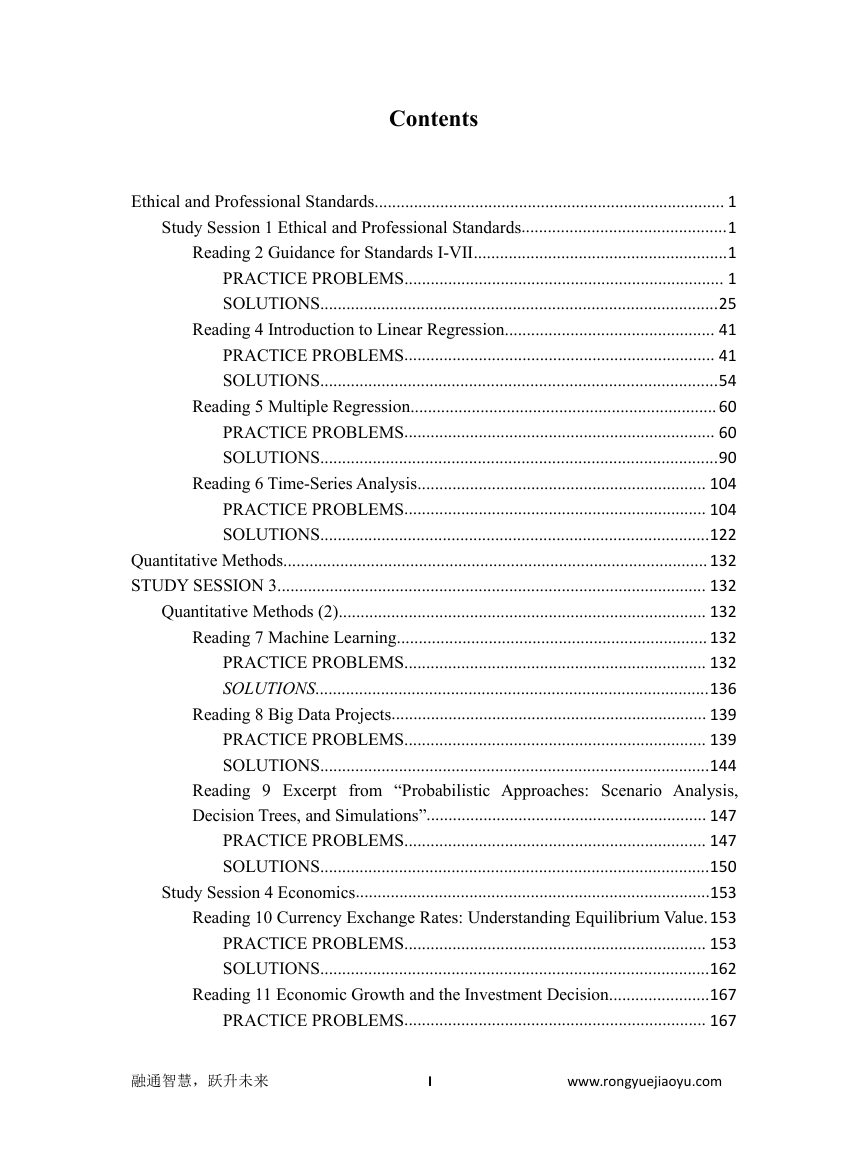

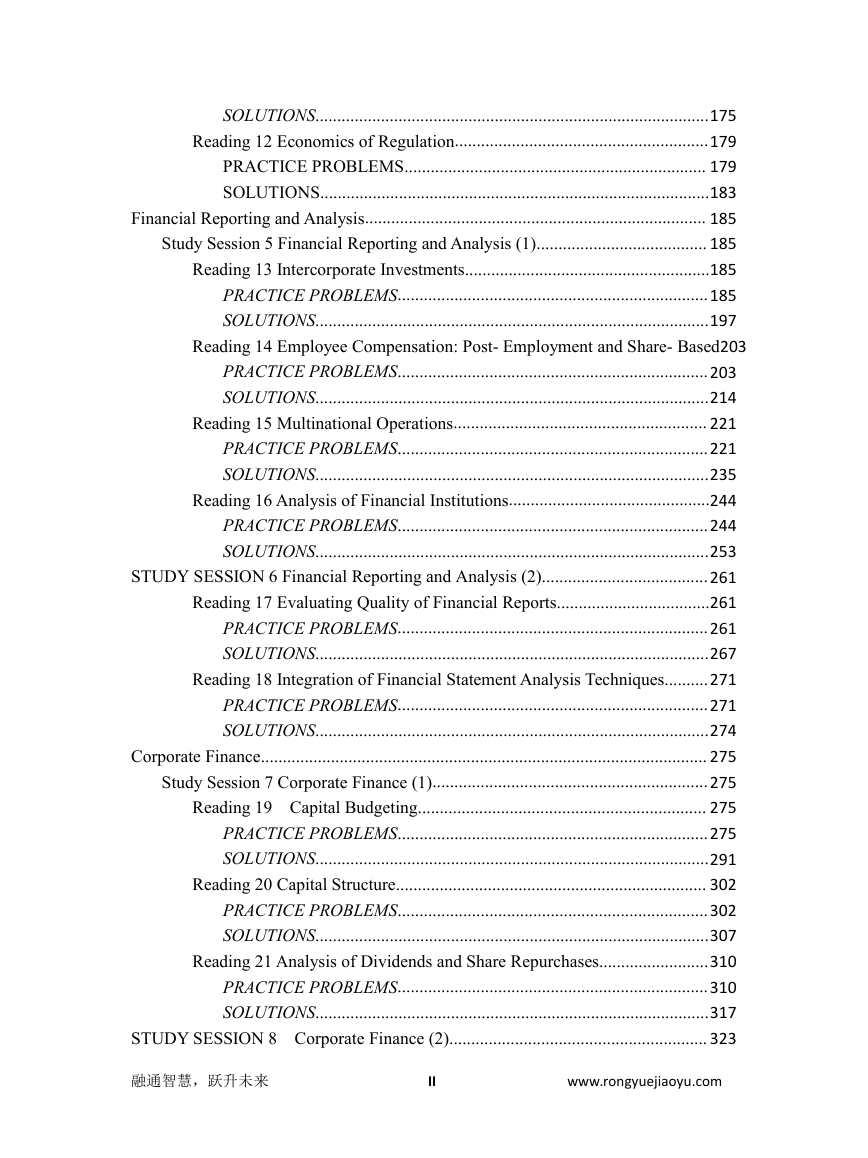

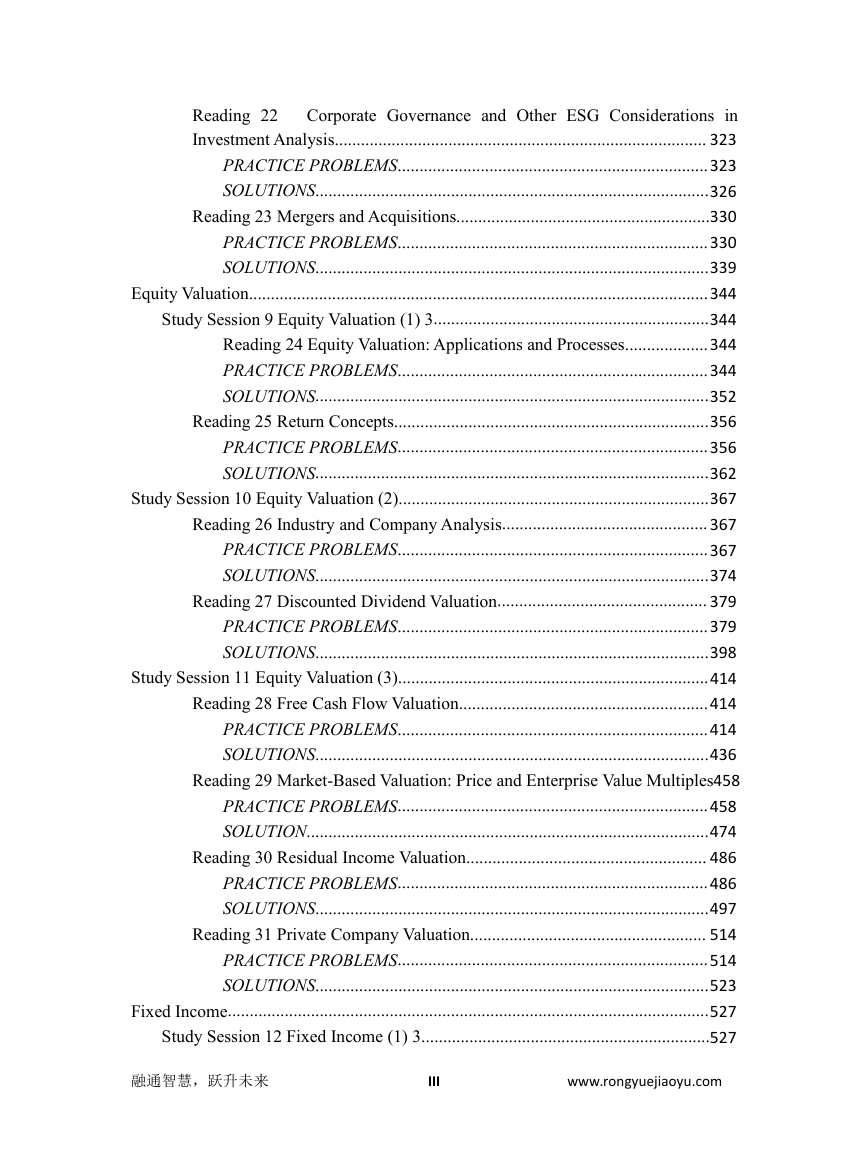

Year

0

1

2

3

4

g

1.50%

1.50%

1.50%

0.75%

FCFF n

(€ millions)

3,226

3,274.39

3,323.51

3,373.36

3,398.66

Present Value Factor

0.928529

0.862167

0.800547

Present Value

(€millions)

3,040.37

2,865.42

2,700.53

The terminal value at the end of Year 3 is TV 3 =

TV 3 = 3,398.66/(0.0770 – 0.0075) = €48,921.38 mil

The total value of operating assets = (3,040.37 +

= 8,606.32 + 39,163.88

= €47,770.20 million.

Value of Bern’s common stock = Value of operating

= 47,770.20 + 50.00 – 15,400 – 4,000

= €28,420.20 million.

Since the current market value of Bern’s common st

Reading 29 Market-Based Valuation: Price and Enter

PRACTICE PROBLEMS

SOLUTION

Reading 30 Residual Income Valuation

PRACTICE PROBLEMS

SOLUTIONS

Reading 31 Private Company Valuation

PRACTICE PROBLEMS

SOLUTIONS

Fixed Income

Study Session 12 Fixed Income (1) 3

Reading 32 The Term Structure and Interest Rate Dy

PRACTICE PROBLEMS

SOLUTIONS

Reading 33 The Arbitrage-Free Valuation Framework

PRACTICE PROBLEMS

SOLUTIONS

Study Session 13 Fixed Income (2) 119

Reading 34 Valuation and Analysis of Bonds with Em

PRACTICE PROBLEMS

SOLUTIONS

Reading 35 Credit Analysis Models

PRACTICE PROBLEMS

The following information relates to questions 1–1

SOLUTIONS

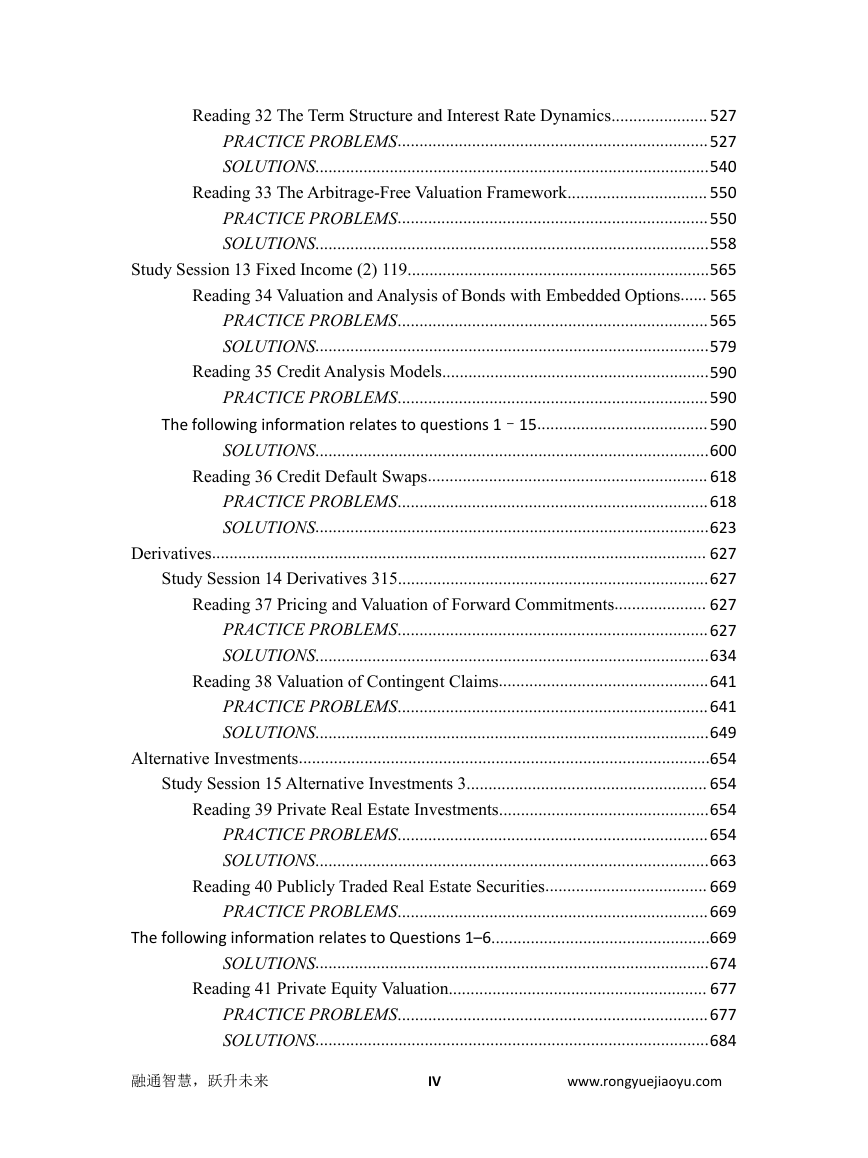

Reading 36 Credit Default Swaps

PRACTICE PROBLEMS

SOLUTIONS

Derivatives

Study Session 14 Derivatives 315

Reading 37 Pricing and Valuation of Forward Commit

PRACTICE PROBLEMS

SOLUTIONS

Reading 38 Valuation of Contingent Claims

PRACTICE PROBLEMS

SOLUTIONS

Alternative Investments

Study Session 15 Alternative Investments 3

Reading 39 Private Real Estate Investments

PRACTICE PROBLEMS

SOLUTIONS

Reading 40 Publicly Traded Real Estate Securities

PRACTICE PROBLEMS

The following information relates to Questions 1–6

SOLUTIONS

Reading 41 Private Equity Valuation

PRACTICE PROBLEMS

SOLUTIONS

Reading 42 Introduction to Commodities and Commodi

PRACTICE PROBLEMS

SOLUTIONS

Portfolio Management

Study Session 16 Portfolio Management (1) 251

Reading 43 Exchange-Traded Funds: Mechanics and Ap

PRACTICE PROBLEMS

SOLUTIONS

Reading 44 Using Multifactor Models

PRACTICE PROBLEMS

SOLUTIONS

Reading 45 Measuring and Managing Market Risk

PRACTICE PROBLEMS

SOLUTIONS

Study Session 17 Portfolio Management (2) 399

Reading 46 Economics and Investment Markets

PRACTICE PROBLEMS

SOLUTIONS

Reading 47 Analysis of Active Portfolio Management

PRACTICE PROBLEMS

SOLUTIONS

Reading 48 Trading Costs and Electronic Markets

PRACTICE PROBLEMS

SOLUTIONS

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc