1.

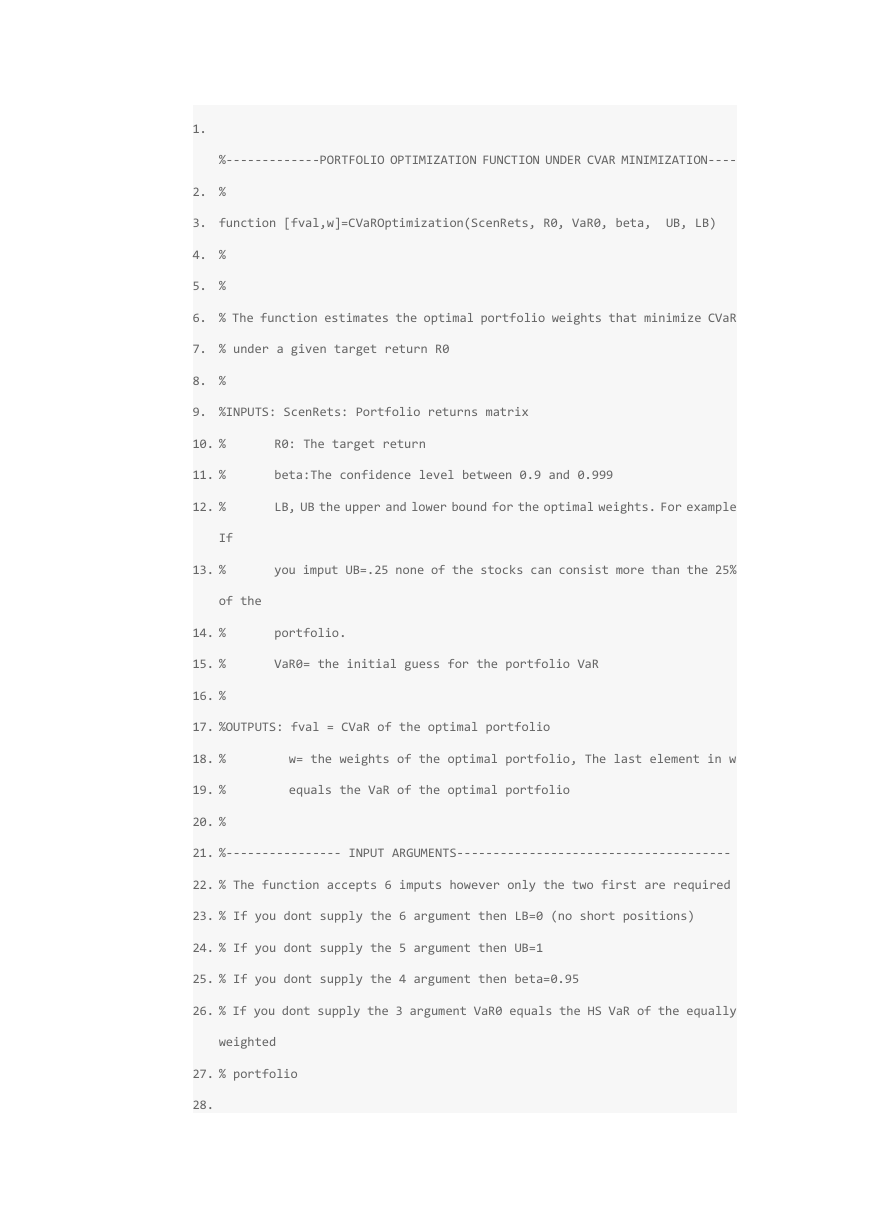

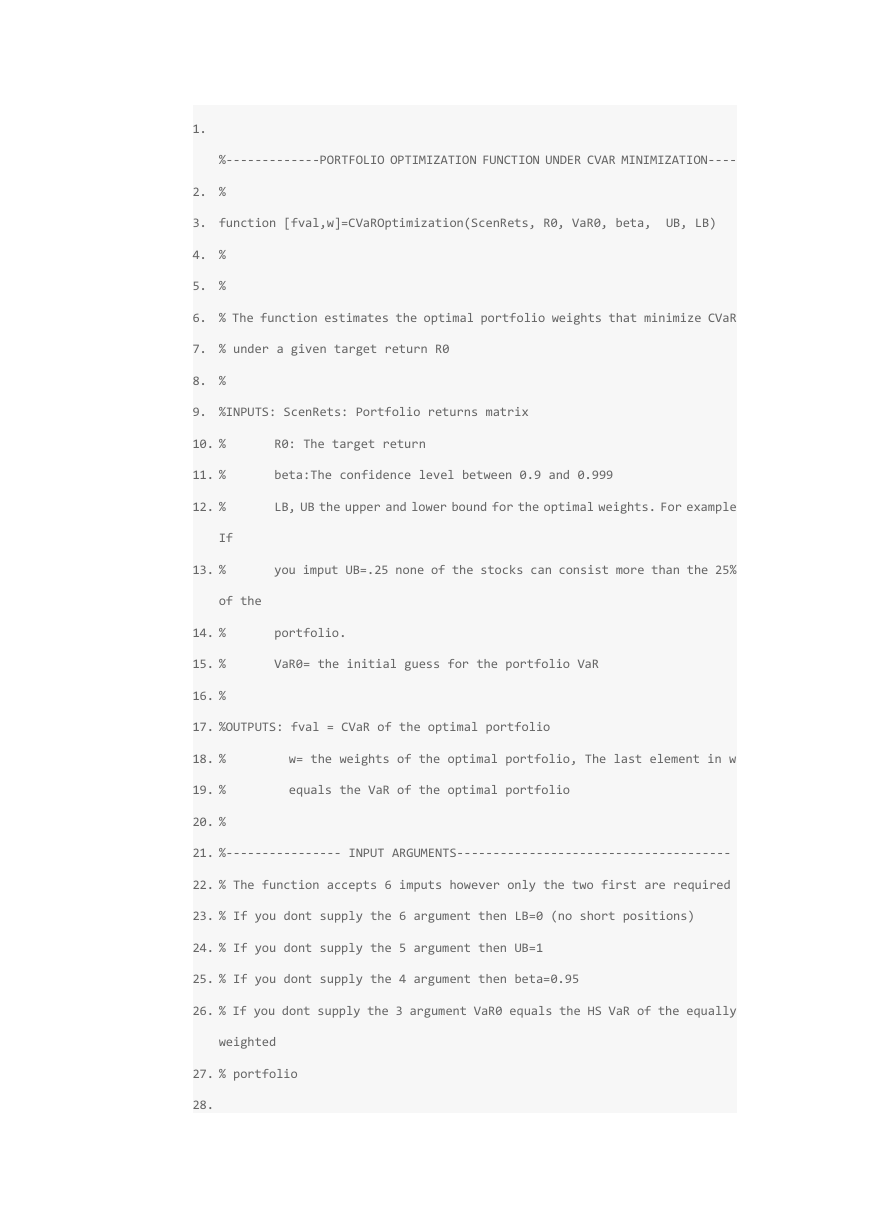

%-------------PORTFOLIO OPTIMIZATION FUNCTION UNDER CVAR MINIMIZATION----

2. %

3. function [fval,w]=CVaROptimization(ScenRets, R0, VaR0, beta,

UB, LB)

4. %

5. %

6. % The function estimates the optimal portfolio weights that minimize CVaR

7. % under a given target return R0

8. %

9. %INPUTS: ScenRets: Portfolio returns matrix

R0: The target return

beta:The confidence level between 0.9 and 0.999

LB, UB the upper and lower bound for the optimal weights. For example

10. %

11. %

12. %

If

13. %

you imput UB=.25 none of the stocks can consist more than the 25%

of the

14. %

15. %

16. %

portfolio.

VaR0= the initial guess for the portfolio VaR

17. %OUTPUTS: fval = CVaR of the optimal portfolio

18. %

19. %

20. %

w= the weights of the optimal portfolio, The last element in w

equals the VaR of the optimal portfolio

21. %---------------- INPUT ARGUMENTS--------------------------------------

22. % The function accepts 6 imputs however only the two first are required

23. % If you dont supply the 6 argument then LB=0 (no short positions)

24. % If you dont supply the 5 argument then UB=1

25. % If you dont supply the 4 argument then beta=0.95

26. % If you dont supply the 3 argument VaR0 equals the HS VaR of the equally

weighted

27. % portfolio

28.

�

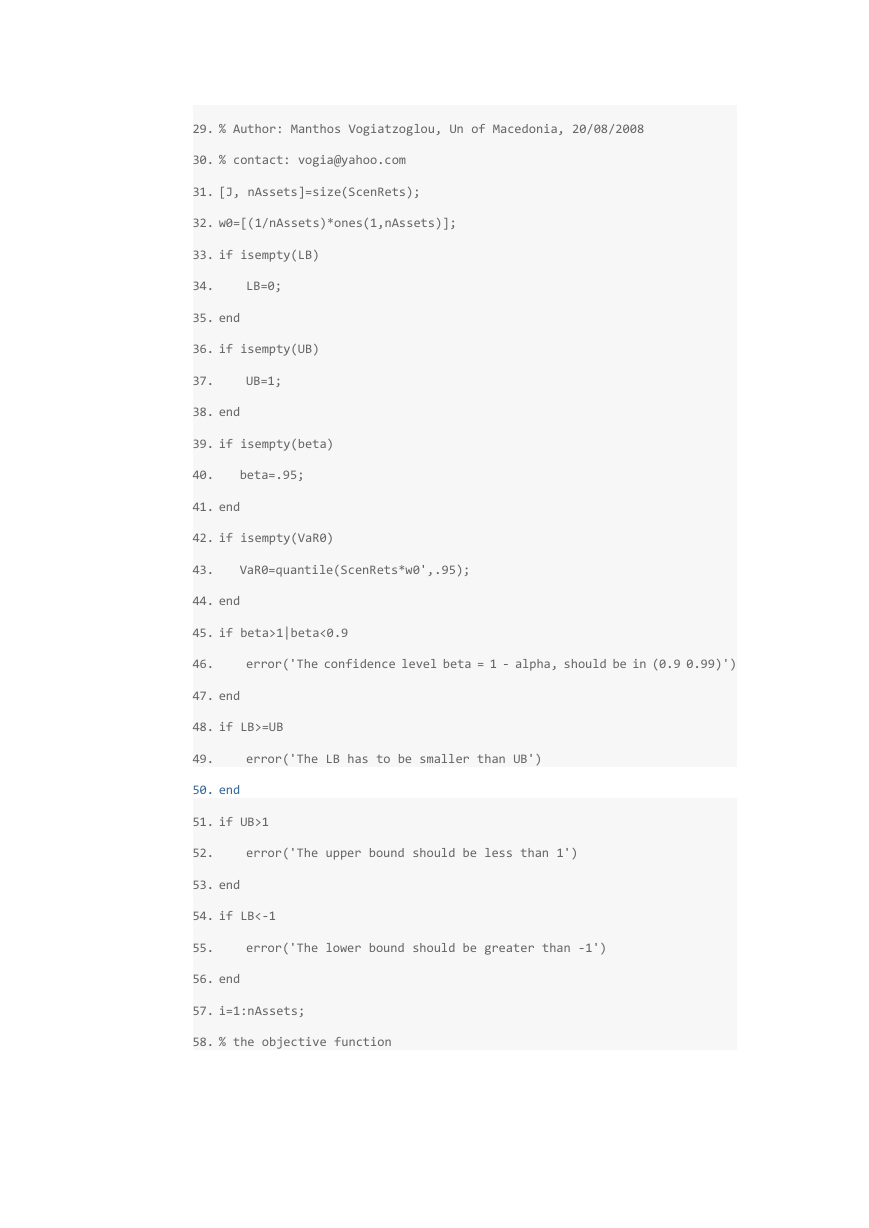

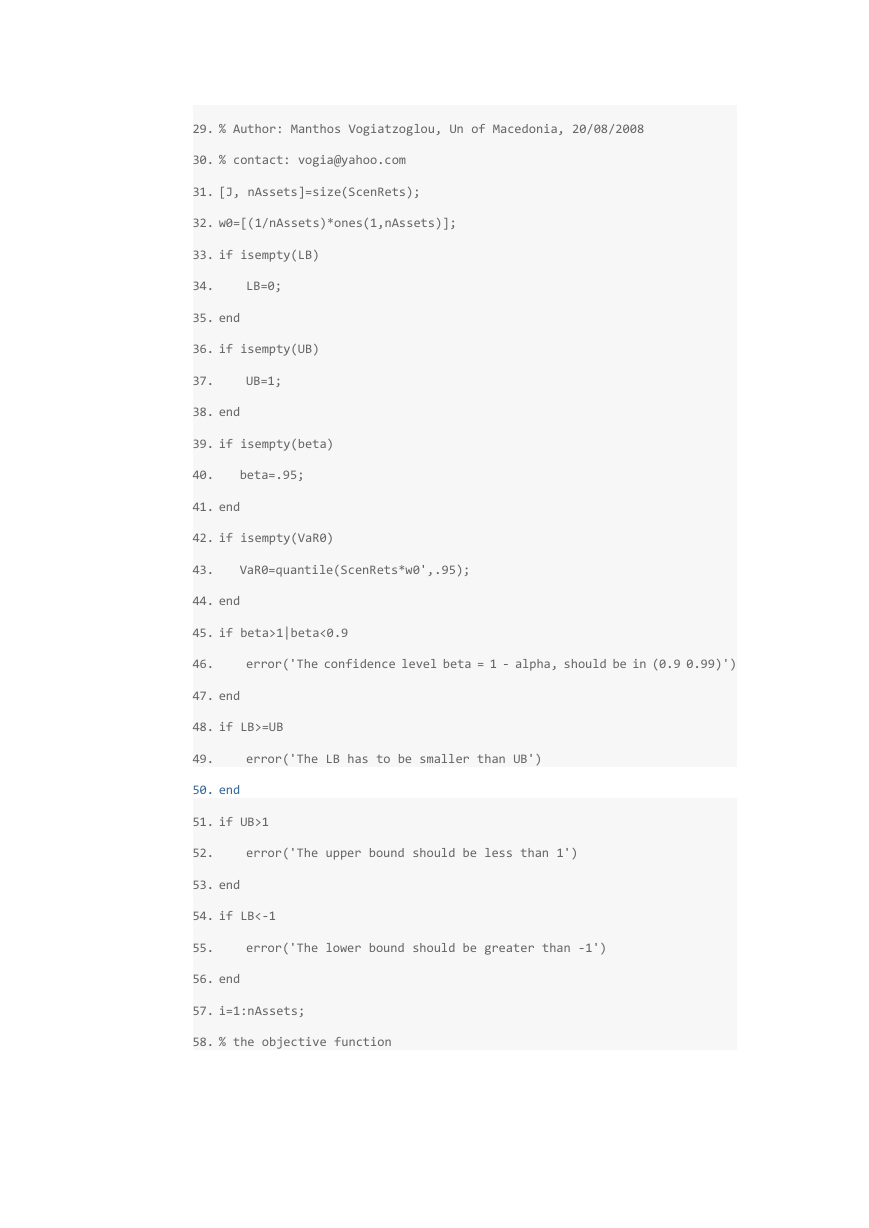

29. % Author: Manthos Vogiatzoglou, Un of Macedonia, 20/08/2008

30. % contact: vogia@yahoo.com

31. [J, nAssets]=size(ScenRets);

32. w0=[(1/nAssets)*ones(1,nAssets)];

33. if isempty(LB)

34.

LB=0;

35. end

36. if isempty(UB)

37.

UB=1;

38. end

39. if isempty(beta)

40.

beta=.95;

41. end

42. if isempty(VaR0)

43.

VaR0=quantile(ScenRets*w0',.95);

44. end

45. if beta>1|beta<0.9

46.

error('The confidence level beta = 1 - alpha, should be in (0.9 0.99)')

47. end

48. if LB>=UB

49.

error('The LB has to be smaller than UB')

50. end

51. if UB>1

52.

error('The upper bound should be less than 1')

53. end

54. if LB<-1

55.

error('The lower bound should be greater than -1')

56. end

57. i=1:nAssets;

58. % the objective function

�

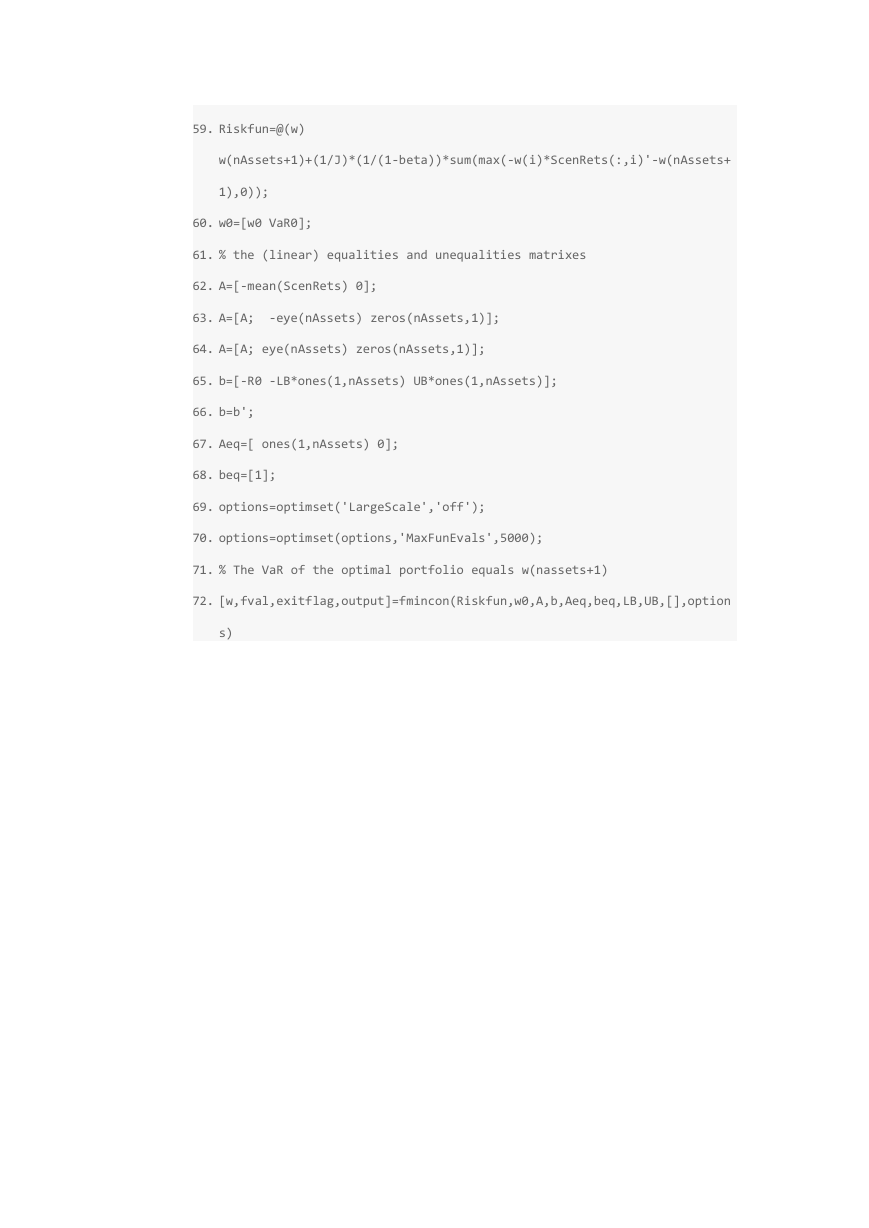

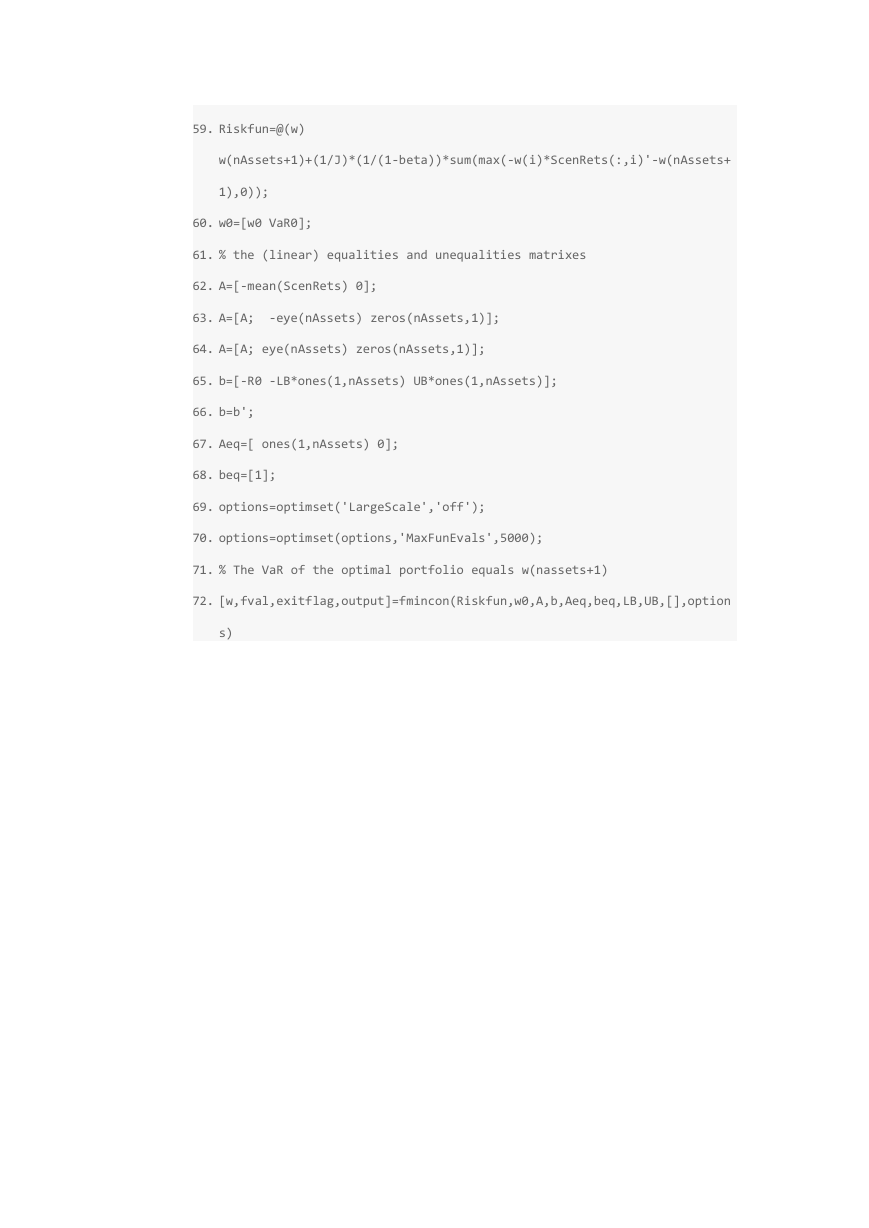

59. Riskfun=@(w)

w(nAssets+1)+(1/J)*(1/(1-beta))*sum(max(-w(i)*ScenRets(:,i)'-w(nAssets+

1),0));

60. w0=[w0 VaR0];

61. % the (linear) equalities and unequalities matrixes

62. A=[-mean(ScenRets) 0];

63. A=[A;

-eye(nAssets) zeros(nAssets,1)];

64. A=[A; eye(nAssets) zeros(nAssets,1)];

65. b=[-R0 -LB*ones(1,nAssets) UB*ones(1,nAssets)];

66. b=b';

67. Aeq=[ ones(1,nAssets) 0];

68. beq=[1];

69. options=optimset('LargeScale','off');

70. options=optimset(options,'MaxFunEvals',5000);

71. % The VaR of the optimal portfolio equals w(nassets+1)

72. [w,fval,exitflag,output]=fmincon(Riskfun,w0,A,b,Aeq,beq,LB,UB,[],option

s)

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc