1 Installation

Requirements and versions

Python 2.x/3.x compatibility

Install from pypi

Install from pypi (including matplotlib )

Install from source

Run from source in your project

2 Quickstart

Using the platform

From 0 to 100: the samples

Basic Setup

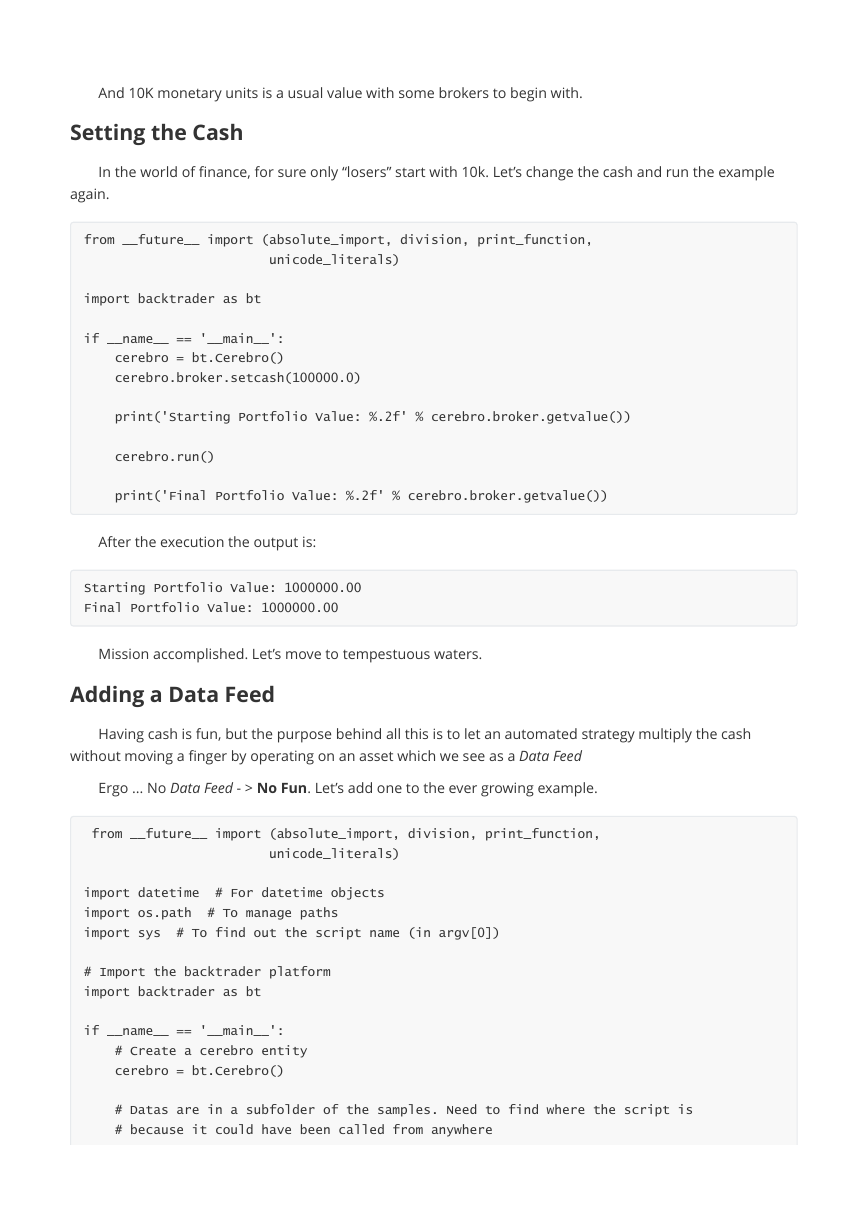

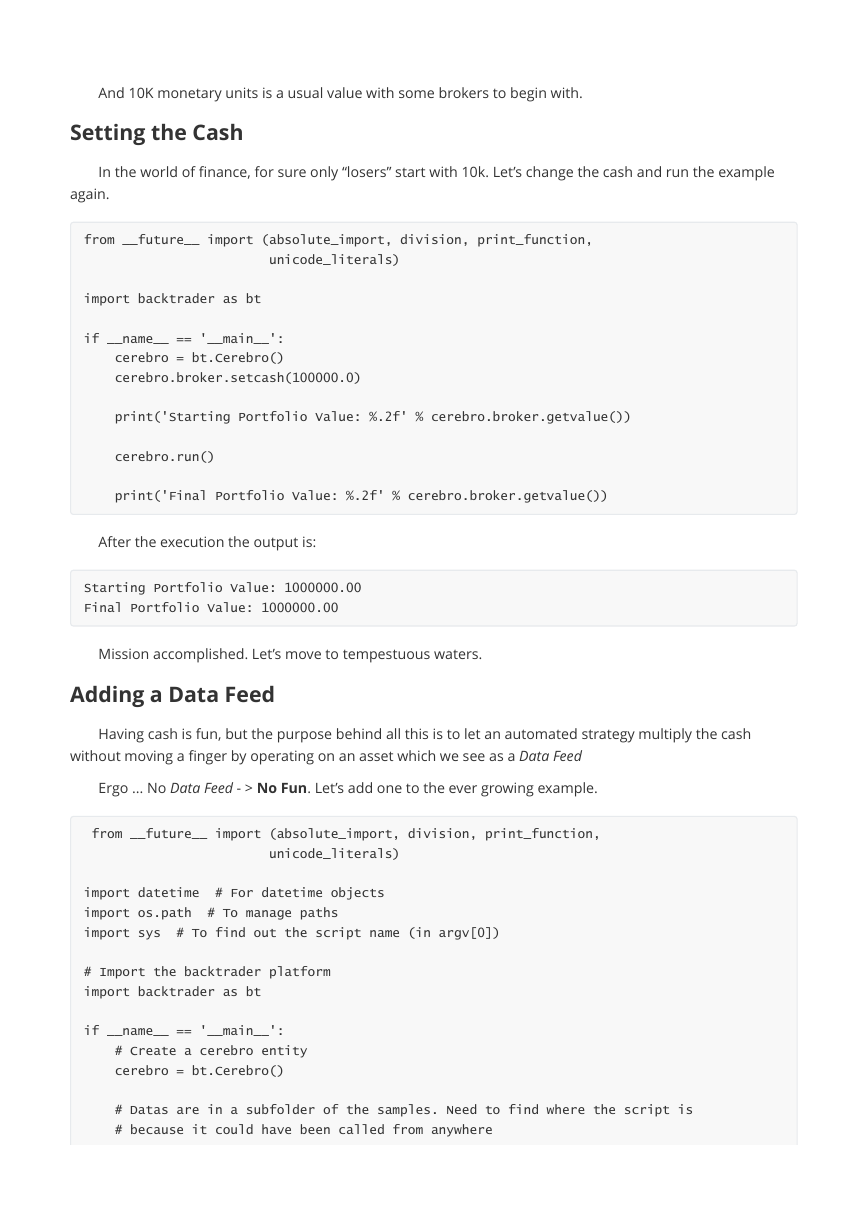

Setting the Cash

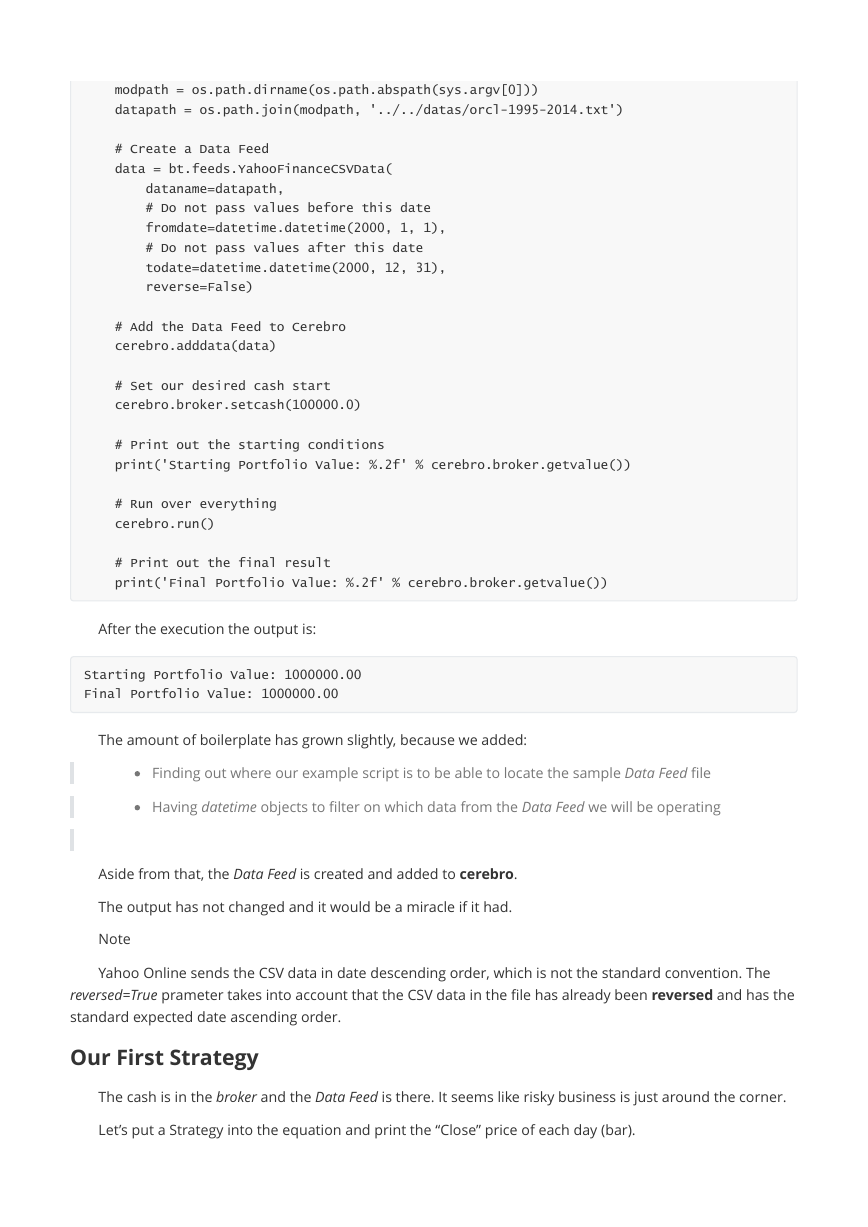

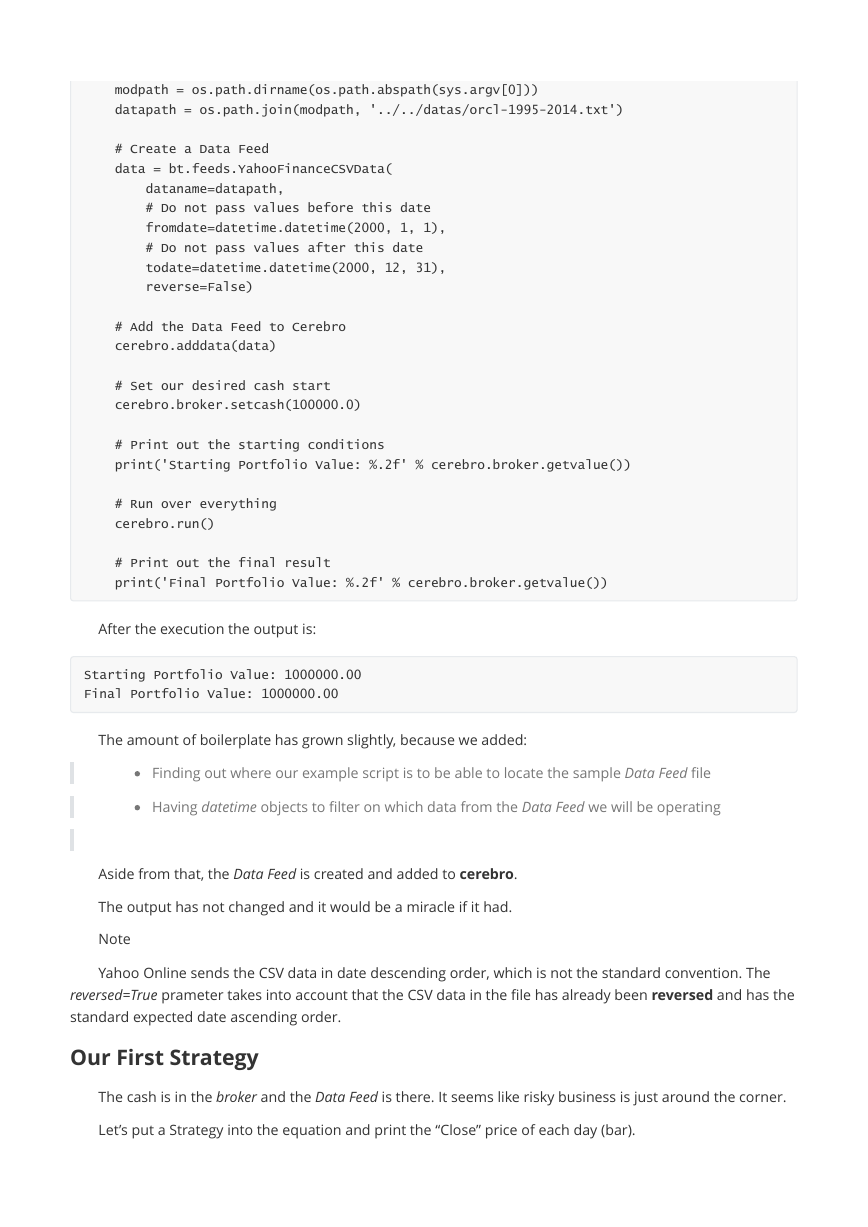

Adding a Data Feed

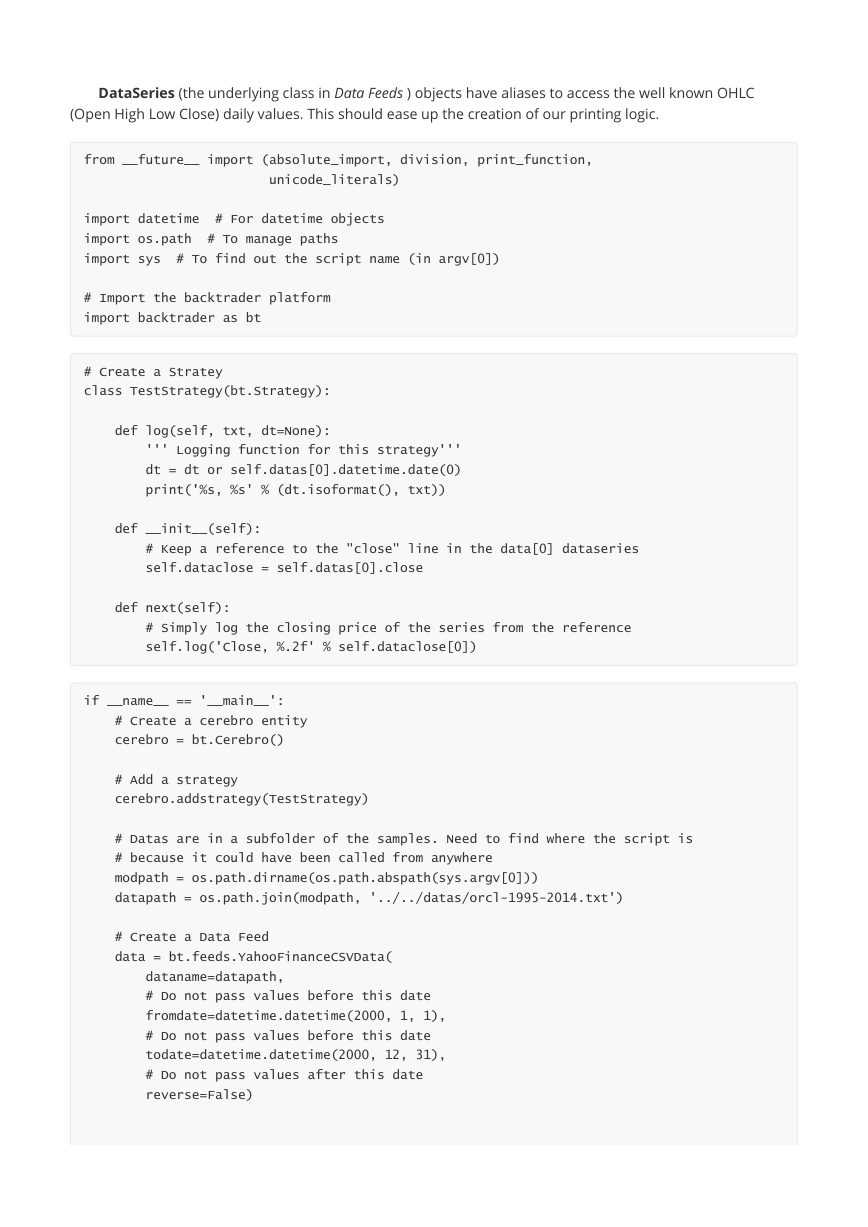

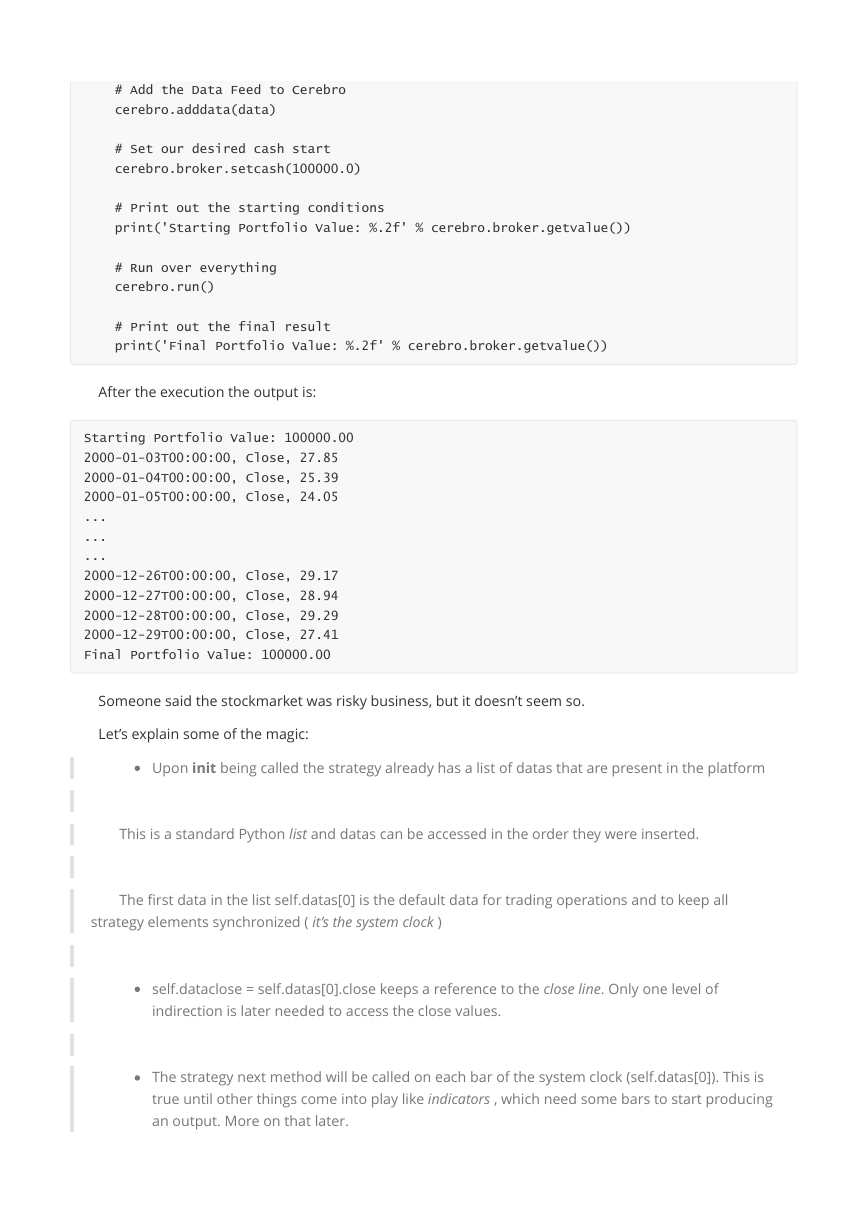

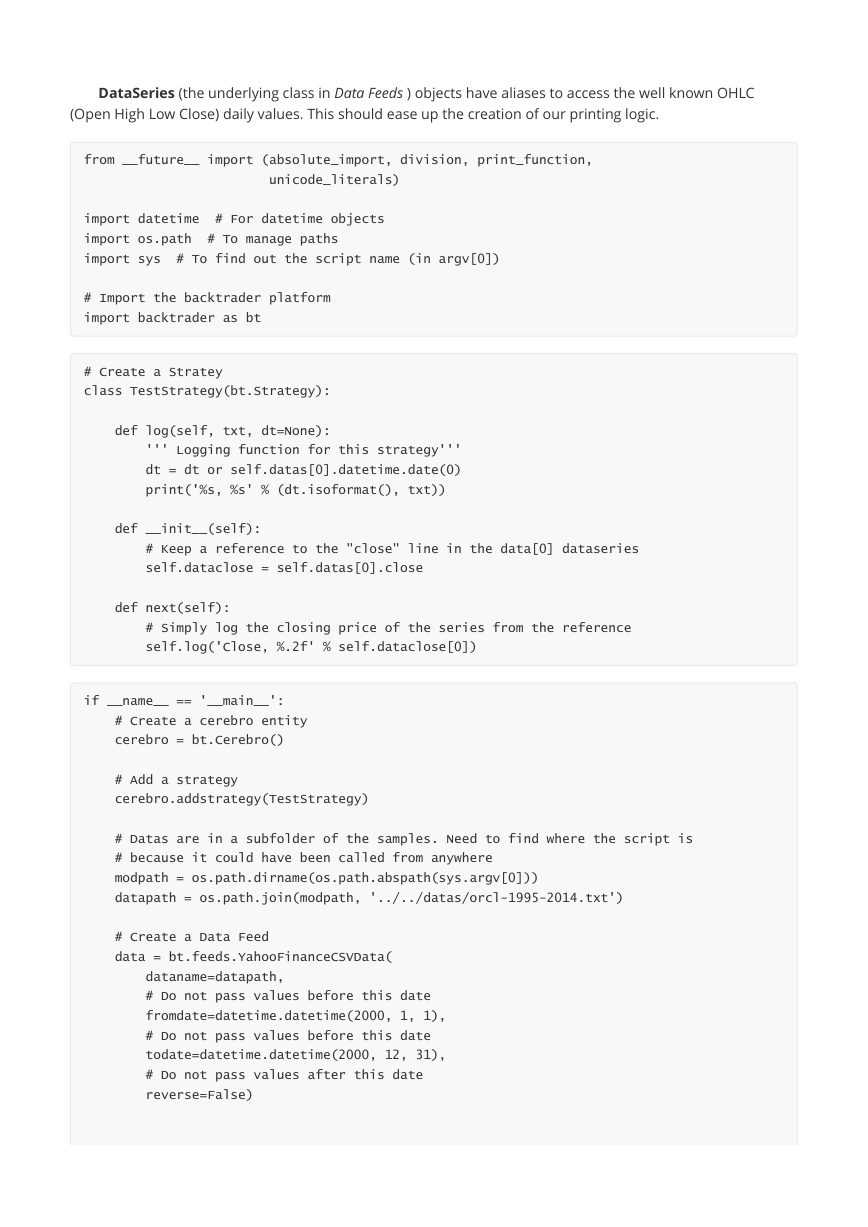

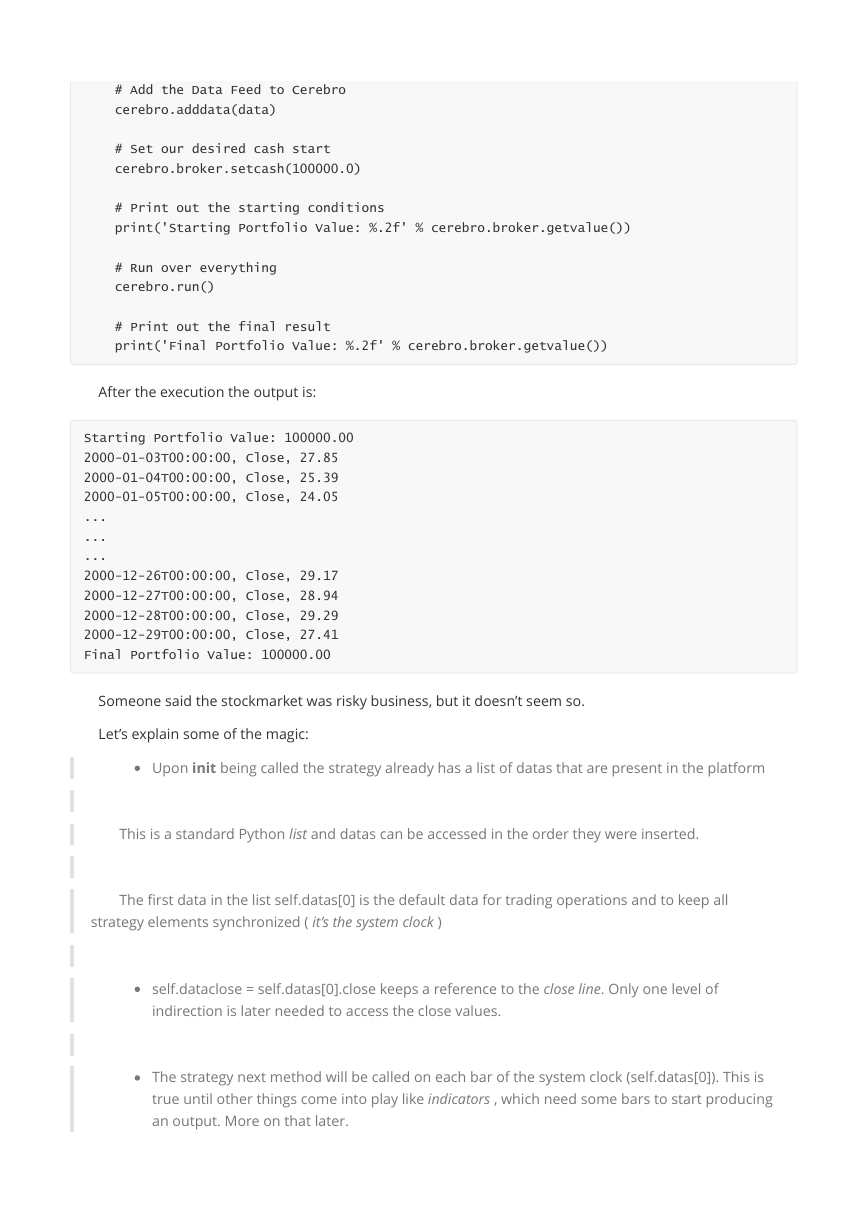

Our First Strategy

Adding some Logic to the Strategy

Do not only buy ... but SELL

The broker says: Show me the money!

Customizing the Strategy: Parameters

Adding an indicator

Visual Inspection: Plotting

Let’s Optimize

Conclusion

3 Platform Concepts

Before Starting

Data Feeds - Passing them around

Shortcuts for Data Feeds

Omitting the Data Feeds

Almost everything is a Data Feed

Parameters

Lines

Lines declaration

Accessing lines in Data Feeds

Lines len

Inheritance of Lines and Params

Params inheritance

Lines Inheritance

Indexing: 0 and -1

Slicing

Getting a slice

Lines: DELAYED indexing

Lines Coupling

Operators, using natural constructs

Stage 1 - Operators Create Objects

Stage 2 - Operators true to nature

Some non-overriden operators/functions

4 Operating the platform

Line Iterators

Extra methods for Indicators

Minimum Period

Up and Running

Data Feeds

A Strategy (derived) class

A Cerebro

5 Exceptions

Hierarchy

Location

Exceptions

StrategySkipError

6 Cerebro

Gathering input

Execute the backtesting

Standard Observers

Returning the results

Giving access to the plotting facilities

Backtesting logic

Reference

7 Cheat On Open

Trying cheat-on-open

Conclusion

Sample usage

Sample source

8 Strategy

How to Buy/Sell/Close

Information Bits:

Member Attributes:

Member Attributes (meant for statistics/observers/analyzers):

Reference: Strategy

9 Sizers - Smart Staking

Using Sizers

From Cerebro

From Strategy

Sizer Development

Practical Sizer Applicability

bt.Sizer Reference

10 Timers

Options

Usage pattern

Adding timers - Via Strategy

Adding timers - Via Cerebro

When are timers called

If cheat=False

If cheat=True

Running with daily bars

Running with 5-minute bars

Additional scenarios

Parameters to add_timer

Sample usage scheduled.py

Sample usage scheduled-min.py

Sample source scheduled.py

Sample source scheduled-min.py

11 Target Orders

The Sample

order_target_size

order_target_value

order_target_percent

Sample Usage

Sample Code

12 Strategy with Signals

Initial FAQ

Signals technicalities

Signals indications

Signals Types

Accumulation and Order Concurrency

The sample

First run: long and short

Second run: long only

Third run: short only

Fourth run: long + longexit

Usage

The code

13 Broker

Reference

14 Slippage

How it works

Configuring slippage

Practical examples

15 Fillers

The fillers signature

Adding a Filler to the broker

The sample

Reference

16 Orders

Order creation

Order notification

Order Status values

Reference: Order and associated classes

17 Order Management and Execution

Order Management

Order Execution Logic

Market

Close

Limit

Stop

StopLimit

Some samples

Execution Type: Market

Execution Type: Close

Execution Type: Limit

Execution Type: Limit with validity

Execution Type: Stop

Execution Type: StopLimit

Test Script Execution

The full code

18 OCO orders

Sample usage

Sample Code

19 StopTrail(Limit)

20 Bracket Orders

Usage Pattern

Single Issuing of a Bracket

Manual Issuing of a Bracket

A sample of it

Some reference

Sample usage

Sample Code

21 Futures and Spot Compensation

Putting it all together

Sample Usage

Sample Code

22 Data Feeds

Data Feeds Common parameters

CSV Data Feeds Common parameters

GenericCSVData

23 CSV Data Feed Development

Caveat Emptor

24 Binary Datafeed Development

Sample binary datafeed

Initialization

Start

Stop

Actual Loading

Other Binary Formats

VChartData Test

VChartData Full Code

25 Extending a Datafeed

6](https://github.com/mementum/backtrader/issues/6)):

6](https://github.com/mementum/backtrader/issues/6)

Plotting that extra P/E line

26 Pandas DataFeed Example

27 Trading Calendar

Trading Calendar Interface

Implementations

PandasMarketCalendar

TradingCalendar

Usage pattern

Global Trading Calendar

Per data-feed

Examples

Daily to Weekly

Minutes to Daily

Extra bonus for the strategy

Sample usage (tcal.py)

Sample usage (tcal-intra.py)

Sample Code (tcal.py)

Sample Code (tcal-intra.py)

28 Data Resampling

29 Data - Multiple Timeframes

Example 1 - Daily and Weekly

Example 2 - Daily and Daily Compression (2 bars to 1)

Example 3 - Strategy with SMA

Invocation 1:

Invocation 2:

Conclusion

30 Data - Replay

Example - Replay Daily to Weekly

Example 2 - Daily to Daily with Compression

Conclusion

31 Rolling over Futures

The RollOver Data Feed

Options for the Roll-Over

Subclassing RollOver

Let’s Roll

Futures concatenation

Futures roll-over with no checks

Changing during the Week

Adding a volume condition

Concluding

Sample Usage

Sample Code

32 Filters

Purpose

Filters at work

Filter Interface

A Sample Filter

Data Pseudo-API for Filters

Another example: Pinkfish Filter

33 Using Indicators

Indicators in action

__init__ vs next

During __init__

During next

The __init__ vs next why

Some notes

Indicator Plotting

Controlling plotting

34 TA-Lib

Requirements

Using ta-lib

Moving Averages and MA_Type

Plotting ta-lib indicators

Examples and comparisons

KAMA (Kaufman Moving Average)

SMA

EMA

Stochastic

RSI

MACD

Bollinger Bands

AROON

Ultimate Oscillator

Trix

ADXR

DEMA

TEMA

PPO

WilliamsR

ROC

Sample Usage

Sample Code

35 Mixing Timeframes in Indicators

Full coupling syntax

Conclusion

Script Code and Usage

36 Indicator Development

Important note: Idempotence

A dummy (but functional) indicator

Manual/Automatic Minimum Period

A full custom indicator

37 Observers and Statistics

Accesing the Observers

Observer Implementation

Adding Observers to the Strategy

Developing Observers

Custom OrderObserver

Saving/Keeping the statistics

38 Benchmarking

Analyzers - Benchmarking

Observers - Benchmarking

Observing TimeReturn

Observing Benchmarking

Observing Benchmarking - Another data

Concluding

The code

39 Analyzers

Nature of analyzers

Location in the ecosystem

Additional Location

Attributes

Returning the analysis

Modus operandi

Analyzer Patterns

A quick example

Forensic Analysis of an Analyzer

Reference

40 PyFolio Overview

Usage

Sample Code

Reference

41 Pyfolio Integration

No PyFolio

A PyFolio run

42 Writer

Reference

43 Commissions: Stocks vs Futures

Agnosticity

Using the broker shortcuts

The meaning of the setcommission parameters

Two examples now: stocks vs futures

Creating permanent Commission schemes

Now a “real” comparison with a SMA Crossover

Commissions for futures

Commissions for stocks

The code

Reference

44 Extending Commissions

Commissions for futures (fixed and with margin)

Commissions for stocks (perc and withoout margin)

Commissions for futures (perc and with margin)

The code for the sample

45 User Defined Commissions

Defining a Commission Scheme

How to apply this to the platform

A practical example

Explaining pseudoexec

CommInfoBase docstring and params

46 Commissions: Credit

Parameters

The formula

Overriding the formula

47 Position

Reference: Position

48 Trade

Reference: Trade

49 Plotting

How to plot

Plotted Elements

Plotting Options

Object-wide plotting options

The meaning of the options

Line specific plotting options

Passing options to a not yet known line

Some plotlines examples

Methods controlling plotting

System-wide plotting options

PlotScheme

Colors in PlotScheme

50 Plotting Date Ranges

Sample Usage

Sample Code

51 Plotting on the same axis

Sample Usage

Sample Code

52 Optimization improvements

Data Feed Management

Results management

Some test runs

Single Core Run

Multiple Core Runs

Both optdata and optreturn active

optreturn deactivated

optdatas deactivated

Both deactivated

Concluding

Sample Usage

53 Automating BackTesting

Applying a User Defined Strategy

Using a built-in Strategy

Using no Strategy

Adding Analyzers

Adding Indicators and Observers

Plotting Control

Usage of the script

54 Saving Memory

Script Code and Usage

55 DateTime Management

Operation with timezones

Datetime Input

Datetime output

56 Live Data Feeds and Live Trading

57 Data Feeds Reference

57 AbstractDataBase

57 BacktraderCSVData

57 CSVDataBase

57 Chainer

57 DataClone

57 DataFiller

57 DataFilter

57 GenericCSVData

57 IBData

57 InfluxDB

57 MT4CSVData

57 OandaData

57 PandasData

57 PandasDirectData

57 Quandl

57 QuandlCSV

57 RollOver

57 SierraChartCSVData

57 VCData

57 VChartCSVData

57 VChartData

57 VChartFile

57 YahooFinanceCSVData

57 YahooFinanceData

57 YahooLegacyCSV

58 Yahoo Data Feed Notes

Using the v7 API/format

Using the legacy API/format

59 Indicator Reference

59 AccelerationDecelerationOscillator

59 Accum

59 AdaptiveMovingAverage

59 AdaptiveMovingAverageEnvelope

59 AdaptiveMovingAverageOscillator

59 AllN

59 AnyN

59 ApplyN

59 AroonDown

59 AroonOscillator

59 AroonUp

59 AroonUpDown

59 AroonUpDownOscillator

59 Average

59 AverageDirectionalMovementIndex

59 AverageDirectionalMovementIndexRating

59 AverageTrueRange

59 AwesomeOscillator

59 BaseApplyN

59 BollingerBands

59 BollingerBandsPct

59 CointN

59 CommodityChannelIndex

59 CrossDown

59 CrossOver

59 CrossUp

59 DV2

59 DemarkPivotPoint

59 DetrendedPriceOscillator

59 DicksonMovingAverage

59 DicksonMovingAverageEnvelope

59 DicksonMovingAverageOscillator

59 DirectionalIndicator

59 DirectionalMovement

59 DirectionalMovementIndex

59 DoubleExponentialMovingAverage

59 DoubleExponentialMovingAverageEnvelope

59 DoubleExponentialMovingAverageOscillator

59 DownDay

59 DownDayBool

59 DownMove

59 Envelope

59 ExponentialMovingAverage

59 ExponentialMovingAverageEnvelope

59 ExponentialMovingAverageOscillator

59 ExponentialSmoothing

59 ExponentialSmoothingDynamic

59 FibonacciPivotPoint

59 FindFirstIndex

59 FindFirstIndexHighest

59 FindFirstIndexLowest

59 FindLastIndex

59 FindLastIndexHighest

59 FindLastIndexLowest

59 Fractal

59 HeikinAshi

59 Highest

59 HullMovingAverage

59 HullMovingAverageEnvelope

59 HullMovingAverageOscillator

59 HurstExponent

59 Ichimoku

59 KnowSureThing

59 LaguerreFilter

59 LaguerreRSI

59 LinePlotterIndicator

59 Lowest

59 MACD

59 MACDHisto

59 MeanDeviation

59 MinusDirectionalIndicator

59 Momentum

59 MomentumOscillator

59 MovingAverageBase

59 MovingAverageSimple

59 MovingAverageSimpleEnvelope

59 MovingAverageSimpleOscillator

59 OLS_BetaN

59 OLS_Slope_InterceptN

59 OLS_TransformationN

59 OperationN

59 Oscillator

59 OscillatorMixIn

59 ParabolicSAR

59 PercentChange

59 PercentRank

59 PercentagePriceOscillator

59 PercentagePriceOscillatorShort

59 PeriodN

59 PivotPoint

59 PlusDirectionalIndicator

59 PrettyGoodOscillator

59 PriceOscillator

59 RSI_EMA

59 RSI_SMA

59 RSI_Safe

59 RateOfChange

59 RateOfChange100

59 ReduceN

59 RelativeMomentumIndex

59 RelativeStrengthIndex

59 Signal

59 SmoothedMovingAverage

59 SmoothedMovingAverageEnvelope

59 SmoothedMovingAverageOscillator

59 StandardDeviation

59 Stochastic

59 StochasticFast

59 StochasticFull

59 SumN

59 TripleExponentialMovingAverage

59 TripleExponentialMovingAverageEnvelope

59 TripleExponentialMovingAverageOscillator

59 Trix

59 TrixSignal

59 TrueHigh

59 TrueLow

59 TrueRange

59 TrueStrengthIndicator

59 UltimateOscillator

59 Buying Pressure = Close - TrueLow BP = Close - Minimum(Low or Prior Close)

59 TrueRange = TrueHigh - TrueLow TR = Maximum(High or Prior Close) -

59 UpDay

59 UpDayBool

59 UpMove

59 Vortex

59 WeightedAverage

59 WeightedMovingAverage

59 WeightedMovingAverageEnvelope

59 WeightedMovingAverageOscillator

59 WilliamsAD

59 WilliamsR

59 ZeroLagExponentialMovingAverage

59 ZeroLagExponentialMovingAverageEnvelope

59 ZeroLagExponentialMovingAverageOscillator

59 ZeroLagIndicator

59 ZeroLagIndicatorEnvelope

59 ZeroLagIndicatorOscillator

59 haDelta

60 TA-Lib Indicator Reference

TA-Lib Indicator Reference

61 Strategies Reference

61 MA_CrossOver

61 SignalStrategy

62 Analyzers Reference

AnnualReturn

Calmar

DrawDown

TimeDrawDown

GrossLeverage

PositionsValue

PyFolio

LogReturnsRolling

PeriodStats

Returns

SharpeRatio

SharpeRatio_A

SQN

TimeReturn

TradeAnalyzer

Transactions

VWR

63 Observers Reference

Benchmark

Broker

Broker - Cash

Broker - Value

BuySell

DrawDown

TimeReturn

Trades

LogReturns

LogReturns2

FundValue

FundShares

64 Sizers Reference

FixedSize

FixedReverser

PercentSizer

AllInSizer

65 Filters Reference

SessionFilter

SessionFilterSimple

SessionFilller

CalendarDays

BarReplayer_Open

DaySplitter_Close

HeikinAshi

Renko

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc