International Journal of Modern Physics C

Vol. 26, No. 6 (2015) 1550071 (12 pages)

#.c World Scienti¯c Publishing Company

DOI: 10.1142/S0129183115500710

The multiscale analysis between stock market time series

Wenbin Shi* and Pengjian Shang†

School of Science, Beijing Jiaotong University

Beijing 100044, P. R. China

*11121739@bjtu.edu.cn

†pjshang@bjtu.edu.cn

Received 5 January 2014

Accepted 27 October 2014

Published 25 November 2014

This paper is devoted to multiscale cross-correlation analysis on stock market time series, where

multiscale DCCA cross-correlation coe±cient as well as multiscale cross-sample entropy

(MSCE) is applied. Multiscale DCCA cross-correlation coe±cient is a realization of DCCA

cross-correlation coe±cient on multiple scales. The results of this method present a good scaling

characterization. More signi¯cantly, this method is able to group stock markets by areas.

Compared to multiscale DCCA cross-correlation coe±cient, MSCE presents a more remarkable

scaling characterization and the value of each log return of ¯nancial time series decreases with

the increasing of scale factor. But the results of grouping is not as good as multiscale DCCA

cross-correlation coe±cient.

Keywords: DCCA cross-correlation coe±cient; multiscale cross-sample entropy; multiscale

analysis; stock market time series.

1. Introduction

In recent years, economy has become an active research area for physicists.

\Econophysics"1,2 is one of the great achievements which successfully applies sta-

tistical mechanics to the economic systems. A range of statistical tools has been

introduced to investigate stock markets, such as the correlation function, multi-

fractal, spin-glass models and complex networks.3–5 As a consequence, it is now found

that all those companies in the stock market are correlated and interconnected, so

the interaction therein is highly nonlinear, unstable and long-ranged.6 To quantify

the long range power-law correlations embedded in a nonstationary time series, the

method of detrended °uctuation analysis (DFA) was proposed.7 A few years later,

Podobnik and Stanley8 extended the DFA method into two time series, and

proposed the detrended cross-correlation analysis (DCCA). Studies using these

techniques have been applied widely,9–20 and they also o®er theoretical and practical

considerations.

1550071-1

Int. J. Mod. Phys. C Downloaded from www.worldscientific.comby BEIJING JIAOTONG UNIVERSITY on 11/25/14. For personal use only.�

W. Shi & P. Shang

Recently, Zebende proposed a DCCA cross-correlation coe±cient �,21 based on

DFA and DCCA. This approach is particularly useful to distinguish between posi-

tive, negative or absence of cross-correlation. The coe±cient always satis¯es �1 �

� � 1 according to the Cauchy–Schwarz inequality. In some cases, however, the

scaling behavior is more complicated, and di®erent scaling properties existed for

di®erent parts of the series. Recent studies showed higher complexity was found in

systems when they take into account the multiple temporal or spatial scales. Zhang22

proposed an innovative approach, based on a weighted sum of various coarse-grained

entropies over multiple scales, which yields higher values for correlated noises (1=f

noise) than uncorrelated ones (white noise). Costa et al.23–27 introduced the multi-

scale entropy (MSE) analysis to quantify the complexity of biological systems using

time series of heart rates and coding and noncoding DNA sequences. They found

correlated noise has a higher complexity level than uncorrelated noise over larger

time scales. Besides, pathologic dynamics associated with either increased regularity

or with increased variability due to loss of correlation properties are both charac-

terized by a reduction in complexity. In this work, we consider the DCCA cross-

correlation coe±cient in multiple scales and hope to ¯nd out the relationship between

this coe±cient and scale �. Then, we compare this method to multiscale cross-sample

entropy (MSCE)28 as veri¯cation.

Originating from signal processing, information is an important keyword in an-

alyzing the market or in estimating the stock price of a given company. A key

measure of information is entropy, which is usually expressed by the average number

of bits needed to store or communicate one symbol in a message. It is known that

entropy increases with the degree of disorder and is maximum for completely random

systems. However, an increase in the entropy may not always be associated with an

increase in dynamical complexity. Diseased systems, when associated with the

emergence of more regular behavior, show reduced entropy values compared to the

dynamical systems. Financial time series, be susceptible to market or government

policy, are linked with highly erratic °uctuations with statistical properties resem-

bling uncorrelated noise. Traditional algorithms will yield an increase in entropy

values for such noisy signals. This inconsistency may be related to the fact that

widely used entropy measures are based on single-scale analysis and do not take into

account the complex temporal °uctuations. Richman and Moorman29 introduced the

information theoretic inspired concept of cross-sample entropy (cross-SampEn),

which is based on the cross approximate entropy,30 aimed at analyzing the degree of

asynchrony between two related time series. For given two related time series, cross-

SampEn computes a non-negative value, where larger value corresponds to greater

asynchrony, smaller value corresponds to greater synchrony.31 The MSCE method is

based on MSE,23 it is the multiscale realization of cross-SampEn and is able to

analyze the complexity and correlation of two time series.

The rest part of this paper is organized as follows. Section 2 presents the multi-

scale procedure as well as two kinds of methods, DCCA cross-correlation coe±cient

and cross-SampEn. Section 3 brie°y describes the database used in our work.

1550071-2

Int. J. Mod. Phys. C Downloaded from www.worldscientific.comby BEIJING JIAOTONG UNIVERSITY on 11/25/14. For personal use only.�

The multiscale analysis between stock market time series

Section 4 is devoted to provide the detailed results for di®erent stock markets.

Finally, it ends with a conclusion.

2. Methods

2.1. Multiscale procedure

u ¼ ðuð1Þ; uð2Þ; . . . ; uðNÞÞ and v ¼ ðvð1Þ; vð2Þ; . . . ; vðNÞÞ are two synchronous time

series of length-N. We construct consecutive coarse-grained time series, fuð�Þg and

fvð�Þg, determined by the scale factor �. The coarse-graining process is like this: we

¯rst divide the original time series into nonoverlapping segments of length � and then

calculate the average of data points in each segment. Generally, each element of the

coarse-grained time series u

�

ð�Þ

ð�Þ

j and v

j are calculated referring to the equation

Xj�

i¼ðj�1Þ�þ1

Xj�

i¼ðj�1Þ�þ1

1 � j � N=�;

1 � j � N=�:

ui;

vi;

�

j ¼ 1

ð�Þ

j ¼ 1

ð�Þ

u

v

For scale one ð� ¼ 1Þ, the time series fuð1Þg and fvð1Þg are the original time series.

The length of each coarse-grained time series is equal to N=�.

Next, we calculate DCCA cross-correlation coe±cient as well as an entropy

measure (cross-sample entropy) for coarse-grained time series plotted as a function of

the scale factor �.

2.2. DCCA cross-correlation coe±cient

Time series always exhibit complex behavior such as self-a±nity, one of the most

frequently cited method to analyze time series of complex problems is the DFA.21

This method provides a relationship between FDFAðnÞ (root mean square °uctua-

tion) and the scale n, characterized for a power law FDFAðnÞ � n�. DFA method has

been very e±cient at detecting long-range auto-correlations embedded in a patch

landscape and also avoiding spurious detection of apparent long-range auto-corre-

lations. However, if we have two time series, fuð�Þg and fvð�Þg, the analysis of cross-

correlation can be applied. The DCCA method is a generalization of the DFA

method and is based on detrended covariance. This method is designed to investigate

power-law cross-correlations between di®erent simultaneously recorded time series in

the presence of nonstationarity. Therefore, for two time series of equal length N=�,

we compute two integrated signals Rk ¼

, where

k ¼ 1; . . . ; N=�. In the next step we divide the entire time series into N=� � n

overlapping boxes, each box containing n þ 1 values. For both time series, in each

box that starts at i and ends at i þ n, we de¯ne the local trend, ^Rk;i and

k;iði � k � i þ nÞ, to be the ordinate of a linear least-squares ¯t. We de¯ne the

^R0

detrended walk as the di®erence between the original walk and the local trend. Next,

and R0

k ¼

k

i¼1 u

P

P

k

i¼1 v

ð�Þ

i

ð�Þ

i

1550071-3

Int. J. Mod. Phys. C Downloaded from www.worldscientific.comby BEIJING JIAOTONG UNIVERSITY on 11/25/14. For personal use only.�

W. Shi & P. Shang

P

the

the

2

F

residuals

calculate

in each box f 2

we

1=ðn þ 1Þ

ance function by summing over all overlapping N=� � n boxes of size n:

DCCAðn; iÞ ¼

k;iÞ. Finally, we calculate the detrended covari-

covariance of

k � ^R0

k¼iðRk � ^Rk;iÞðR0

iþn

DCCA ¼ ðN=� � nÞ�1

XN=��n

i¼1

When Rk ¼ R0

DCCAðnÞ reduces to the detrended

k, the detrended covariance F 2

variance F 2

then

DCCAðnÞ � n2�. The � exponent quanti¯es the long-range power-law cross-corre-

F 2

lation. To quantify the level of cross-correlation, we can apply the DCCA cross-

correlation coe±cient, de¯ned as the ratio between the detrended covariance

function F 2

DFAðnÞ used in the DFA method.

DCCA and the detrended variance function FDFA.

self-a±nity appears,

DCCAðn; iÞ:

2

f

If

�DCCA ¼

F 2

DCCA

FDFAfyigFDFAfy 0

ig

:

This equation leads us to a new scale of cross-correlation in nonstationary time series.

The value of �DCCA ranges between �1 � �DCCA � 1. A value of �DCCA ¼ 0 means

there is no cross-correlation, �DCCA ¼ 1 means the cross-correlation between two

time series is perfect and �DCCA ¼ �1 means there is a perfect anti-cross-correlation.

To perform multiscale analysis, we use n ¼ 100 for all the experiments in this work.

2.3. Multiscale cross-sample entropy

2.3.1. De¯nition

We then calculate the cross-sample entropy between the two coarse-grained time

series fuð�Þg and fvð�Þg. m and r are input parameters, where m is embedding

dimension, and r is the tolerance for accepting matches. Form vector sequences

xmðiÞ ¼ ðuð�ÞðiÞ; uð�Þði þ 1Þ; . . . ; uð�Þði þ m � 1ÞÞ;

ymðjÞ ¼ ðvð�ÞðjÞ; vð�Þðj þ 1Þ; . . . ; vð�Þðj þ m � 1ÞÞ;

1 � i � N=� � m;

1 � j � N=� � m

for uð�Þ and vð�Þ, respectively.

For each i � N=� � m, set

i ðrÞðvð�Þjjuð�ÞÞ ¼ number of 1 � j � N=� � m such that d½xmðiÞ; ymðjÞ � r

B m

N=� � m

;

where

d½xmðiÞ; ymðjÞ ¼ maxfjuð�Þði þ kÞ � vð�Þðj þ kÞj : 0 � k � m � 1g

i.e. the maximum di®erence in their respective scalar components. B m

the probability that any ymðjÞ is within r of xmðiÞ. Then, de¯ne

i ðrÞðvð�Þjjuð�ÞÞ

B m

N=� � m

BmðrÞðvð�Þjjuð�ÞÞ ¼

N=��m

i¼1

P

i ðvð�Þjjuð�ÞÞ is

which is the average value of B m

i ðrÞðvð�Þjjuð�ÞÞ.

1550071-4

Int. J. Mod. Phys. C Downloaded from www.worldscientific.comby BEIJING JIAOTONG UNIVERSITY on 11/25/14. For personal use only.�

Similarly, we de¯ne

The multiscale analysis between stock market time series

i ðrÞðvð�Þjjuð�ÞÞ ¼ number of 1 � j � N=� � m such that d½xmþ1ðiÞ; ymþ1ðjÞ � r

A m

N=� � m

and

AmðrÞðvð�Þjjuð�ÞÞ ¼

P

N=��m

i¼1

i ðrÞðvð�Þjjuð�ÞÞ

A m

N=� � m

which is the average value of A m

i ðrÞðvð�Þjjuð�ÞÞ.

In this way, BmðrÞðvð�Þjjuð�ÞÞ is the probability that the two templates matches for

m points, and AmðrÞðvð�Þjjuð�ÞÞ is the probability that the two templates matches for

m þ 1 points.

Finally, we de¯ne

cross � SampEn ¼ � ln

�

�

:

AmðrÞðvð�Þjjuð�ÞÞ

BmðrÞðvð�Þjjuð�ÞÞ

Set B ¼ ðN=� � mÞ2BmðrÞðvð�Þjjuð�ÞÞ and A ¼ ðN=� � mÞ2AmðrÞðvð�Þjjuð�ÞÞ, so

that B is the total number of pairs of vectors of length m from the two series that

match within r, and A is the number of pairs of forward matches of length m þ 1.

2.3.2. The con¯dence interval of the cross-SampEn

We extend the computation of con¯dence interval for SampEn32 to cross-SampEn.

Let CP ¼ A=B, which estimates the conditional probability of a match of length

m þ 1 given there is a match of length m. The number of matches of length m þ 1

can be expressed as

X

A ¼

Uij; where Uij ¼ 1 if d½xmþ1ðiÞ; ymþ1ðjÞ � r;

0 otherwise:

�

The summation can be restricted to the B pairs ði; jÞ of matches of length m, where

d½xmðiÞ; ymðjÞ � r. Thus, the variance of CP is

X

X

CP ¼ VarðAÞ

B2 ¼ 1

For the B pairs where i ¼ k and j ¼ l

� 2

B2

CovðUij; UklÞ:

i;j

k;l

CovðUij; UklÞ ¼ VarðUijÞ ¼ CPð1 � CPÞ:

If the templates involved for Uij and Ukl have no points in common, they are inde-

pendent and thus uncorrelated so that CovðUij; UklÞ ¼ 0. If the templates overlap,

i.e. minfji � kj;jj � ljg � m the covariance can be estimated by UijUkl � CP2, which

is 1 � CP2 when both pairs of m þ 1 templates match and �CP2 otherwise. So the

1550071-5

Int. J. Mod. Phys. C Downloaded from www.worldscientific.comby BEIJING JIAOTONG UNIVERSITY on 11/25/14. For personal use only.�

W. Shi & P. Shang

variance of CP is estimated as

CP ¼ CPð1 � CPÞ

� 2

B

þ 1

B2 ½KA � KBðCPÞ2;

where KA is the number of pairs of matching templates of length m þ 1 that overlap

and KB is the number of pairs of matching templates of length m that overlap. Using

the standard approximation �gðCPÞ � jg0ðCPÞj�CP with gðCPÞ ¼ � logðCPÞ and the

¯rst derivative g0ðCPÞ ¼ 1=�CP, the standard error of cross-SampEn can be esti-

mated by �CP=CP. As Lake et al.33 did, the cross-SampEn is assumed to be normally

distributed, and we de¯ne the 95% con¯dence interval for each cross-SampEn

calculation to be

�logðCPÞ � 1:96ð�CP=CPÞ:

2.3.3. Choosing the parameters m and r

General experiences lead to the use of values of r between 0:1 and 0:25 and values of

m of 1 or 2 for data records of length N ranging from 100 to 5000.32 In this paper, we

determine m according to the estimated AR process order of each return time series,

where the AR process order is estimated using the maximum likelihood method and

the AIC criteria. We use the criterion proposed by Lake et al.33 to select r which

minimizes the quantity

�

�

max

�CP

CP

;

�CP

�logðCPÞCP

that is the maximum of the relative error of SampEn and the CP estimator,

respectively.

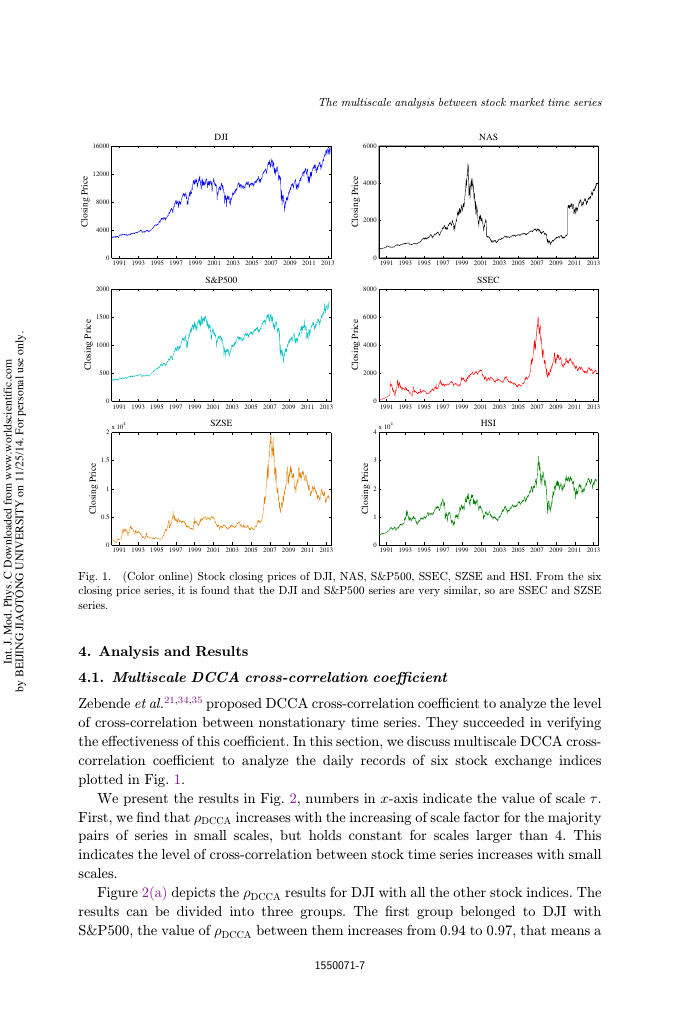

3. Data

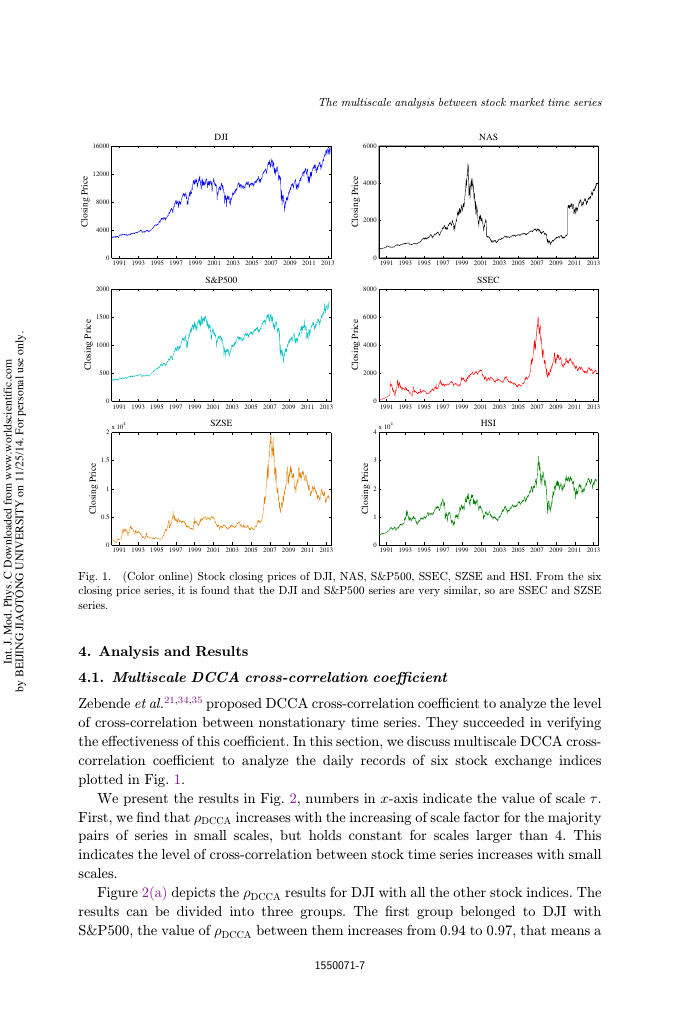

The analyzed dataset consists of six indices: three US stock indices, Dow Jones Index

(DJI), Nasdaq Composite Index (NAS) and Standard & Poor's 500 index (S&P500)

together with three Chinese stock indices, Hang Seng Index (HSI), Shanghai secu-

rities composite index (SSEC) and Shenzhen Stock Exchange Component Index

(SZSE). The data are recorded every day of closing prices from 3rd April, 1991, to

13th November, 2013. Because of the US stock markets and the Chinese stock

markets have the di®erent opening dates. So, we exclude or complement the asyn-

chronous datum and then reconnect the remaining parts of the original series to

obtain the same length time series. The overall run of indices after the preprocessing

is displayed in Fig. 1.

In practice, we usually apply standardized time series. Denoting the stock market

index as fxðtÞg, the logarithmic daily return is de¯ned by gðtÞ ¼ logðxðtÞÞ�

logðxðt � 1ÞÞ. The normalized daily return is de¯ned as RðtÞ ¼ ðgðtÞ � hgðtÞiÞ=�,

where � is the standard deviation of the series gðtÞ.

1550071-6

Int. J. Mod. Phys. C Downloaded from www.worldscientific.comby BEIJING JIAOTONG UNIVERSITY on 11/25/14. For personal use only.�

DJI

16000

12000

The multiscale analysis between stock market time series

6000

4000

2000

0

8000

6000

4000

2000

e

c

i

r

P

g

n

i

s

o

l

C

e

c

i

r

P

g

n

i

s

o

l

C

0

4

3

2

1

0

e

c

i

r

P

g

n

i

s

o

l

C

NAS

1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013

SSEC

1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013

x 104

HSI

1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013

e

c

i

r

P

g

n

i

s

o

l

C

e

c

i

r

P

g

n

i

s

o

l

C

1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013

S&P500

8000

4000

0

2000

1500

1000

500

0

2

1.5

1

0.5

0

e

c

i

r

P

g

n

i

s

o

l

C

1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013

x 104

SZSE

1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013

Fig. 1.

(Color online) Stock closing prices of DJI, NAS, S&P500, SSEC, SZSE and HSI. From the six

closing price series, it is found that the DJI and S&P500 series are very similar, so are SSEC and SZSE

series.

4. Analysis and Results

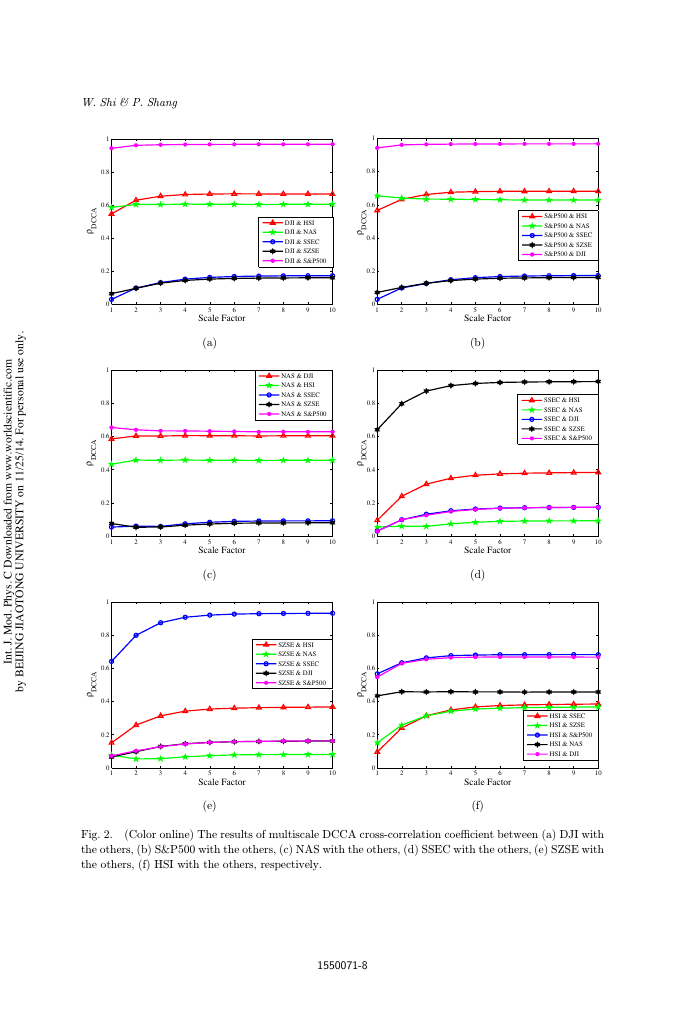

4.1. Multiscale DCCA cross-correlation coe±cient

Zebende et al.21,34,35 proposed DCCA cross-correlation coe±cient to analyze the level

of cross-correlation between nonstationary time series. They succeeded in verifying

the e®ectiveness of this coe±cient. In this section, we discuss multiscale DCCA cross-

correlation coe±cient to analyze the daily records of six stock exchange indices

plotted in Fig. 1.

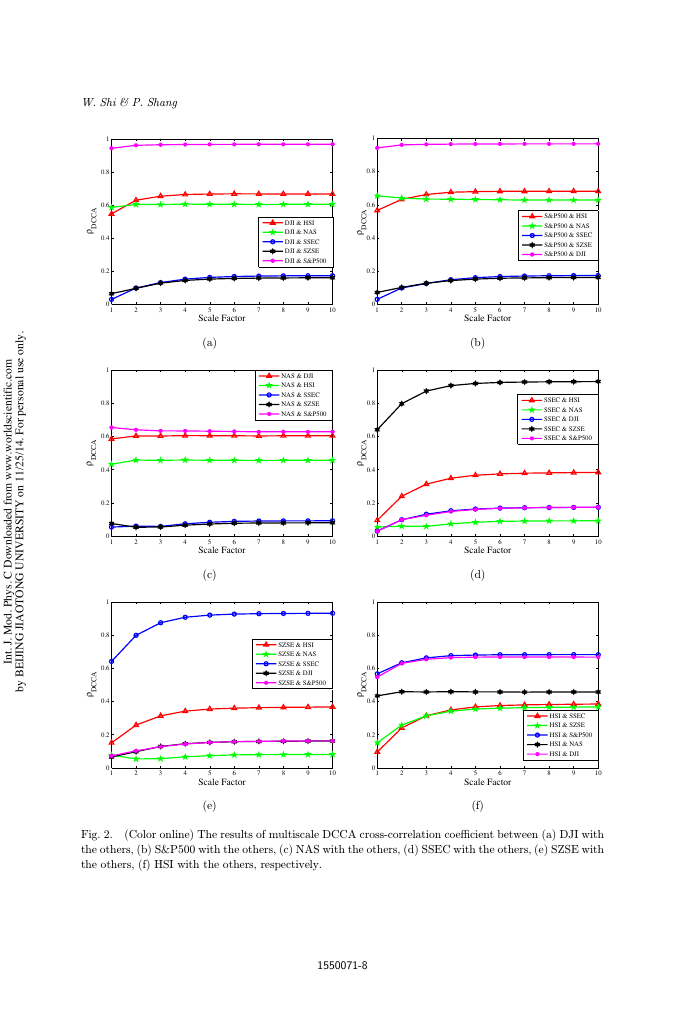

We present the results in Fig. 2, numbers in x-axis indicate the value of scale �.

First, we ¯nd that �DCCA increases with the increasing of scale factor for the majority

pairs of series in small scales, but holds constant for scales larger than 4. This

indicates the level of cross-correlation between stock time series increases with small

scales.

Figure 2(a) depicts the �DCCA results for DJI with all the other stock indices. The

results can be divided into three groups. The ¯rst group belonged to DJI with

S&P500, the value of �DCCA between them increases from 0.94 to 0.97, that means a

1550071-7

Int. J. Mod. Phys. C Downloaded from www.worldscientific.comby BEIJING JIAOTONG UNIVERSITY on 11/25/14. For personal use only.�

W. Shi & P. Shang

1

0.8

0.6

0.4

0.2

A

C

C

D

ρ

0

1

2

3

4

1

0.8

0.6

0.4

0.2

A

C

C

D

ρ

0

1

2

3

4

1

0.8

0.6

0.4

0.2

A

C

C

D

ρ

0

1

2

3

4

DJI & HSI

DJI & NAS

DJI & SSEC

DJI & SZSE

DJI & S&P500

7

8

9

10

NAS & DJI

NAS & HSI

NAS & SSEC

NAS & SZSE

NAS & S&P500

7

8

9

10

SZSE & HSI

SZSE & NAS

SZSE & SSEC

SZSE & DJI

SZSE & S&P500

7

8

9

10

5

6

Scale Factor

(a)

5

6

Scale Factor

(c)

5

6

Scale Factor

1

0.8

0.6

A

C

C

D

ρ

0.4

0.2

0

1

1

0.8

0.6

A

C

C

D

ρ

0.4

0.2

0

1

1

0.8

0.6

2

3

4

2

3

4

5

6

Scale Factor

(b)

5

6

Scale Factor

(d)

A

C

C

D

ρ

0.4

0.2

0

1

2

3

4

5

6

Scale Factor

S&P500 & HSI

S&P500 & NAS

S&P500 & SSEC

S&P500 & SZSE

S&P500 & DJI

7

8

9

10

SSEC & HSI

SSEC & NAS

SSEC & DJI

SSEC & SZSE

SSEC & S&P500

7

8

9

10

HSI & SSEC

HSI & SZSE

HSI & S&P500

HSI & NAS

HSI & DJI

7

8

9

10

(e)

(f)

Fig. 2.

(Color online) The results of multiscale DCCA cross-correlation coe±cient between (a) DJI with

the others, (b) S&P500 with the others, (c) NAS with the others, (d) SSEC with the others, (e) SZSE with

the others, (f) HSI with the others, respectively.

1550071-8

Int. J. Mod. Phys. C Downloaded from www.worldscientific.comby BEIJING JIAOTONG UNIVERSITY on 11/25/14. For personal use only.�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc