American Journal of Industrial and Business Management, 2019, 9, 2231-2249

https://www.scirp.org/journal/ajibm

ISSN Online: 2164-5175

ISSN Print: 2164-5167

The Impacts of Population Aging on Saving,

Capital Formation, and Economic Growth

Yuan-Ho Hsu1*, Huei-Chun Lo2

1Department of Economics, National Cheng Kung University, Taiwan

2National Open College of Continuing Education, Taichung University of Science and Technology, Taiwan

How to cite this paper: Hsu, Y.-H. and Lo,

H.-C. (2019) The Impacts of Population

Aging on Saving, Capital Formation, and

Economic Growth. American Journal of

Industrial and Business Management, 9,

2231-2249.

https://doi.org/10.4236/ajibm.2019.912148

Received: November 25, 2019

Accepted: December 21, 2019

Published: December 24, 2019

Copyright © 2019 by author(s) and

Scientific Research Publishing Inc.

This work is licensed under the Creative

Commons Attribution International

License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Open Access

Abstract

The evolving population aging scenarios of the industrialized countries can

be attributed to two major demographic dynamics: the declining fertility and

fast aging population. The increasing old age dependency ratio, decreasing

young dependency ratio, and shrinking share of working-age population in

the aging economies generate substantial impacts on individual as well as ag-

gregate consumption, saving and employment. Because retired people save

less, an aging society with increasing proportion of retirees would experience

a decline in aggregate savings, which in turn leads to lower capital formation

and reduces economic growth. This paper focuses on the effect of population

aging on aggregate saving, physical capital formation, and economic growth

in Japan. The current study theorizes the effect of aging demographic dy-

namics on savings and capital formation. Taking into account the effects of

population dynamics, saving, and capital formation together, this paper steps

further in examining the implications of population aging for economic

growth and discusses policy implications for the aging economy.

Keywords

Population Aging, Saving, Capital Formation, Economic Growth

1. Introduction

The evolving population aging scenarios of the industrialized countries can be

attributed to two major demographic dynamics: the declining fertility and fast

aging population. The increasing old age dependency ratio, decreasing young

dependency ratio, and shrinking share of working-age population in the aging

economies generate substantial impacts on individual as well as aggregate con-

sumption, saving and employment. Since retired people save less, an aging so-

DOI: 10.4236/ajibm.2019.912148 Dec. 24, 2019

2231

American Journal of Industrial and Business Management

�

Y.-H. Hsu, H.-C. Lo

ciety with increasing proportion of retirees would experience a decline in aggre-

gate savings, which in turn leads to lower capital formation and reduced eco-

nomic growth. This paper focuses on the effect of population aging on aggregate

saving, physical capital formation, and economic growth in Japan.

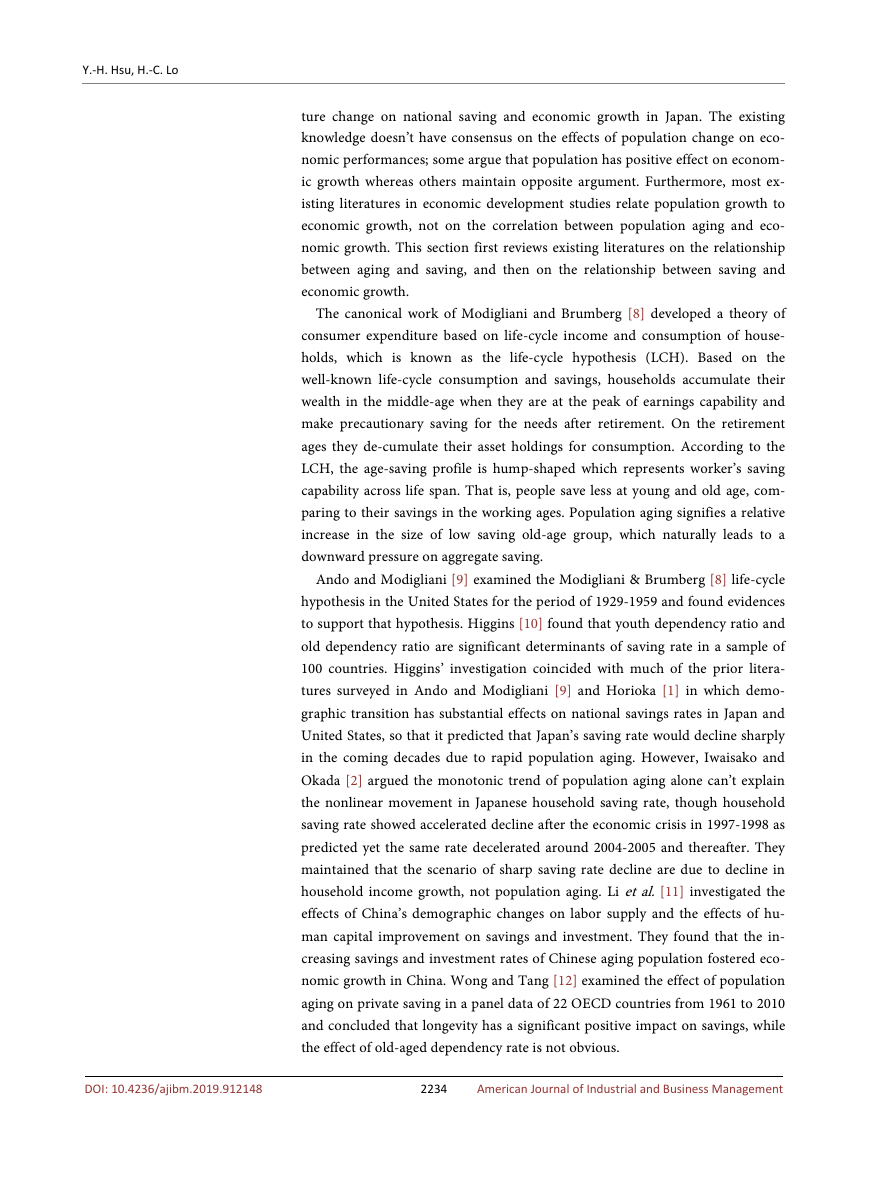

The newborn population in Japan peaked at 2,091,983 in 1973 and then stea-

dily declined to 1,071,304 in 2010. In 2017, the number of newborn population

further declined to 946,065. On the other hand, the proportion of people aged 65

and over has reached 23% in 2010 and is expected to reach 32% by 2030. In or-

der to analyze the effect of this demographic development on aggregate eco-

nomic performance, this paper adopts Japanese population statistics published

by the Statistics Bureau, Ministry of Internal Affairs and Communications, to-

gether with the latest population projection made by National Institute of Popu-

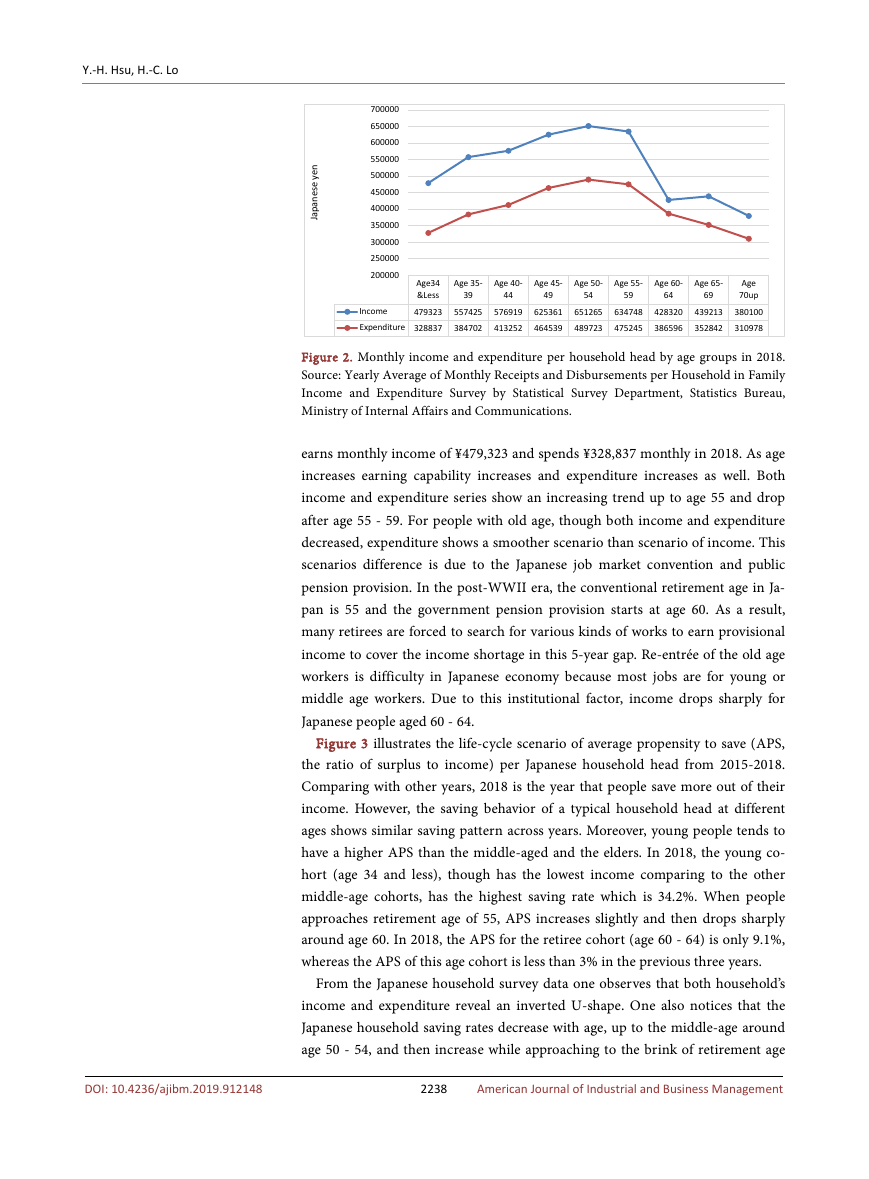

lation and Social Security Research (IPSS), Japan. Figure 1 illustrates the age

compositions of historical and forecasted Japanese population from 1946 to

2065. A vertical line drawn on year 2016 in Figure 1 divides the Japanese popu-

lation scenarios into historical and forecasted parts; to the left of this vertical line

is the historical data adopted from Statistical Bureau of Japan and to its right is

the forecasted series taken from National Institute of Population and Social Se-

curity Research, Japan. In this graph, a data labeled with suffix “H” signifies his-

torical data (e.g., POPH) and data labeled with suffix “F” represents forecasted

series.

The left panel of Figure 1 indicates that Japanese aggregate population had

reached its climax around 2010. However, the working age population, people

with age 16 to age 64, had already reached its peak circa 1995 (see AGE1564H in

the right panel). The right panel of Figure 1 also shows that the number of

young-age population (AGE0014) has been shrinking rapidly while the old-age

people (AGE65up) has increased rapidly between 1950 and 2010. The size of

old-age population will continue to increase up to the time circa 2050 and decline

130,000

120,000

110,000

100,000

90,000

80,000

1970

1980

1990

2000

2010

2020

2030

2040

2050

2060

Total Population

POPH

POPF

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

1950

1960

1970

1980

1990

2000

2010

2020

2030

2040

2050

2060

Figure 1. Total population and the size of three age-groups. Data Source: Population Estimates of Japan, 1920-2015, Statistics

Bureau Japan; Population Projections for Japan (2016-2065), National Institute of Population and Social Security Research, Japan.

DOI: 10.4236/ajibm.2019.912148

American Journal of Industrial and Business Management

2232

AGE0014H

AGE0014F

AGE1564H

AGE1564F

AGE65UPH

AGE65UPF

�

Y.-H. Hsu, H.-C. Lo

slowly thereafter. The forecasted size of young generation, people aged 0 - 14

(AGE0014F), shows a continuous declining trend in the future. Comparing the

forecasted age compositions of Japanese population, it is noticeable that the con-

tinuing decline in the proportion of the working-age population (i.e., people

aged 15 - 64) is an alarming signal for future economic development and social

welfare expenditures in Japan.

Various studies have examined the implications of these evolving demo-

graphic dynamics in Japan. Some addressed aging effect on saving behavior

(Horioka [1]; Iwaisako and Okada [2]); others focused on its labor market effects

(Ito [3]; Ogawa et al. [4]), and some others investigated overall macroeconomic

effects of population aging in Japan (e.g. Muto et al. [5]). Razin et al. [6] and

Bloom et al. [7] investigated the implications of population aging on social wel-

fare and old-age health care. Of all these published works, one issue that has not

been fully investigated is the effect of demographic transition on capital accu-

mulation and its consequence on labor productivity and economic growth.

Therefore, the current paper wishes to bridge the gap and focuses on the ma-

croeconomic effect of population aging on capital formation and economic

growth in the aged economy.

It is recognized that capital accumulation enhances overall quality of the na-

tion’s workforce and thus contributes to economic growth and national compe-

titiveness. The effect of aging population on capital formation is an issue worth

exploring. In order to have a better understanding of the dynamic interactions

among various macroeconomic variables, this paper use Japan as an example to

explore the effects of population aging on national saving, and thus national

saving on capital formation and economic growth.

This research adopts data from National Tax Agency of Japan, Penn World

Table (PWT) version 9.1, and the 2019 Revision of the World Population Pros-

pects,1 ranged 1968-2100. The study first builds a theoretical growth model

which takes into account of life-cycle saving behavior, life-cycle income capabil-

ity, and age-composition dynamics to investigate the effect of population aging

on aggregate savings. Then, it goes further to elaborate the effect of age structure

change on savings, physical capital formation, and economic growth, respec-

tively, under alternative hypothetical scenarios.

The remainder of this paper is organized as follows. Section 2 reviews pre-

vious literatures of population aging, saving and economic growth. Section 3 il-

lustrates the specification of theoretical model and methodology employed in

this study. Section 4 presents the major findings of this work and discusses poli-

cy implications drawn from this study. Section 5 draws conclusions from this

study and presents extension to discuss policy implications from this research.

2. Literature Reviews

The research interest of this study focuses on the effects of demographic struc-

1Population Division, Department of Economics and Social Welfare, United Nations. Available at:

http://esa.un.org/wpp/.

2233

American Journal of Industrial and Business Management

DOI: 10.4236/ajibm.2019.912148

�

Y.-H. Hsu, H.-C. Lo

DOI: 10.4236/ajibm.2019.912148

ture change on national saving and economic growth in Japan. The existing

knowledge doesn’t have consensus on the effects of population change on eco-

nomic performances; some argue that population has positive effect on econom-

ic growth whereas others maintain opposite argument. Furthermore, most ex-

isting literatures in economic development studies relate population growth to

economic growth, not on the correlation between population aging and eco-

nomic growth. This section first reviews existing literatures on the relationship

between aging and saving, and then on the relationship between saving and

economic growth.

The canonical work of Modigliani and Brumberg [8] developed a theory of

consumer expenditure based on life-cycle income and consumption of house-

holds, which is known as the life-cycle hypothesis (LCH). Based on the

well-known life-cycle consumption and savings, households accumulate their

wealth in the middle-age when they are at the peak of earnings capability and

make precautionary saving for the needs after retirement. On the retirement

ages they de-cumulate their asset holdings for consumption. According to the

LCH, the age-saving profile is hump-shaped which represents worker’s saving

capability across life span. That is, people save less at young and old age, com-

paring to their savings in the working ages. Population aging signifies a relative

increase in the size of low saving old-age group, which naturally leads to a

downward pressure on aggregate saving.

Ando and Modigliani [9] examined the Modigliani & Brumberg [8] life-cycle

hypothesis in the United States for the period of 1929-1959 and found evidences

to support that hypothesis. Higgins [10] found that youth dependency ratio and

old dependency ratio are significant determinants of saving rate in a sample of

100 countries. Higgins’ investigation coincided with much of the prior litera-

tures surveyed in Ando and Modigliani [9] and Horioka [1] in which demo-

graphic transition has substantial effects on national savings rates in Japan and

United States, so that it predicted that Japan’s saving rate would decline sharply

in the coming decades due to rapid population aging. However, Iwaisako and

Okada [2] argued the monotonic trend of population aging alone can’t explain

the nonlinear movement in Japanese household saving rate, though household

saving rate showed accelerated decline after the economic crisis in 1997-1998 as

predicted yet the same rate decelerated around 2004-2005 and thereafter. They

maintained that the scenario of sharp saving rate decline are due to decline in

household income growth, not population aging. Li et al. [11] investigated the

effects of China’s demographic changes on labor supply and the effects of hu-

man capital improvement on savings and investment. They found that the in-

creasing savings and investment rates of Chinese aging population fostered eco-

nomic growth in China. Wong and Tang [12] examined the effect of population

aging on private saving in a panel data of 22 OECD countries from 1961 to 2010

and concluded that longevity has a significant positive impact on savings, while

the effect of old-aged dependency rate is not obvious.

2234

American Journal of Industrial and Business Management

�

Y.-H. Hsu, H.-C. Lo

We have reviewed the literature on the effects of population aging on national

saving; we proceed to review literatures exploring the correlation between saving

and economic growth. The acknowledged theoretical investigation of the effect

of saving on economic growth dated back to Harrod [13], Domar [14] [15], and

Solow [16]. Given that aggregate output is the function of physical capital and

labor inputs, these models proposed that economic growth depends on saving

rate and that higher saving rate contributes to higher economic growth. In the

exploration of source of economic growth, the extended model incorporated one

demographic variable, population growth rate, and investigated the effect of

population growth on economic growth. However, in these growth models pop-

ulation growth rate is assumed to be positive and constant. Neither a negative

growth rate of the population, nor a shift in the age structure is considered in

these models. Over the later decades, studies of economic growth model have

extended previous works by taking into account additional factors, such as

technology, human capital, urbanization, institutions, openness to international

trade, and geographic factors, in the determination of economic growth.2

Most recent development in growth theory, the endogenous growth theory

whose pioneer studies are Romer [24], Lucas [25], and Rebelo [26], considers

saving rate as one of the key determinants of economic growth. It predicts that

an increase in the saving rate will lead to a permanently higher growth rate.

However, these empirical studies on the relationship between economic growth

and savings have not reached unanimous conclusion, due to their difference in

the methods, periods of study, and countries being selected for studied. Miller

[27] found the cointegrated relation between national saving and domestic in-

vestment rate in the US only existed prior to 1971. Kim and Lee [28] used panel

Vector-Auto Regressive (VAR) model and found negative effects of population

aging on national saving and current account balances in East Asia. Kumar Na-

rayan [29] used the bound testing approach of cointegration analysis to investi-

gate the correlation between saving and investment for Japan over the period

1960-1999; the empirical results indicated that saving and investment are coin-

tegrated with bidirectional causality. Andrei and Huidumac-Petrescu [30] ex-

amined the long-run relationship between saving and the real economic growth

for Euro area countries. Their empirical results showed the existence of a unidi-

rectional causality from real GDP growth rate to gross national saving rate.

Bayar [31] used panel cointegration tests and vector error correction model in

the study and found that domestic savings, domestic investment and foreign di-

rect investment had positive effect on economic growth in emerging Asian

economies for the period 1982-2012.

Many empirical studies address the effect of demographic transition on

household savings behavior and economic growth. Most findings support the

predictions of the LCH and OLG models, particularly with respect to the posi-

tive influence of the proportion of working-age population on national saving

2For example, see Becker et al. [17], Romer [18], Barro [19], Barro and Lee [20]; Mankiw et al. [21],

Jones [22], and Bloom et al. [23].

2235

American Journal of Industrial and Business Management

DOI: 10.4236/ajibm.2019.912148

�

Y.-H. Hsu, H.-C. Lo

rates, while the effect of old-age population on saving is less conclusive. For ex-

ample, Braun et al. [32] found the Japanese demographic factors account for the

decline in Japan’s national saving rate in the 1990s. Bloom et al. [33] demon-

strated the demographic dividends of the working-age population for economic

growth. Li et al. [11] examined the effects of demographic structure on economic

growth by using 29 provincial panel dataset in China and found that the old age

dependency ratio has a positive effect on savings, investment, and economic

growth rate. Bloom et al. [7] argued population aging will lower labor force par-

ticipation and savings rates, which leads to decline in economic growth.

3. Model Specification and Methodology

According to Harrod [13], Domar [14] and Solow [16], saving is a key driver to

economic growth. The current study investigates the effects of population aging

on economic growth based on the idea of the life-cycle hypothesis of Modigliani

and Brumberg [8] and the saving-growth connection of Harrod-Domar-Solow

schema. Since saving varies with individual’s age-specific position in his/her life

span and working-age population are the major savers of the economy, it is fore-

seeable that population aging alters relative share of working-age cohort and

hence the economy’s aggregate savings. As a result, the current study assumes

that changes in demographic structure exert potentially effects on national saving.

The current study theorizes the effect of demographic dynamics on savings

and capital formation in an aging economy. Taking into account the effects of

population dynamics, saving, and capital formation together, this effort allows

us to go one step further in examining the implications of population aging for

economic growth. With this endeavor, the current study modifies Solow’s growth

model and allows saving rate to vary with change in age structure of population,

which is in accordance to the life-cycle hypothesis of saving. This revision of

age-related saving behavior would allow us to analyze the effect of population

aging on aggregate savings and per capita income.

t

t

t

=

Y C I

t

Consider a simple closed economy with no government that all output ( tY ) is

either used for consumption (

tC ) or investment ( tI ). The national income iden-

tity is

+ . Investment ( tI ) is used to create new units of physical capital

(

tC from both sides

1tKδ − ). Subtracting

tK ) or to replace old, worn-out capital (

of the national income identity, one obtains national saving:

. In

S

equilibrium, the amount saved equals to the amount invested. Investment makes

new injection to existing capital stock whereas depreciation wipes out a certain

portion of existing capital. Assume that the capital stock wears out at a constant

depreciation rate δ. Savings finance investment projects so that the amount of

capital accumulation is determined by proportion of income saved; that is, the

saving rate s. At any given level of income, higher saving rate implies higher sav-

ing and investment.

≡

Y C

t

t

−

=

I

t

DOI: 10.4236/ajibm.2019.912148

Assume that aggregate output is a function of technology, physical capital, and

labor with a standard Cobb-Douglas aggregate production function of constant

2236

American Journal of Industrial and Business Management

�

returns to scale:

Y

t

=

AF K N

,

t

(

Y.-H. Hsu, H.-C. Lo

)

t

=

AK Nα

t

1

α−

t

(1)

tK and

tY is aggregate output or gross domestic product (GDP); A denotes a

where

“Hicks-neutral” technological progress. The input factors,

tN , represent

physical capital and labor, respectively. α and 1 α− are the partial production

elasticities of physical capital and labor and they are also the shares of physical

capital and labor in income. Economic growth is determined by the growth of

three elements: technological progress (A), physical capital (

tK ) and labor input

(

tN ).

Assume population grows at a constant rate of n and labor grows at the same

rate as aggregate population. Technological advancement as well as increase in

physical capital and labor inputs raises production productivity. Define k as the

stock of physical capital per unit of labor ( t

ty as the level of

k

output per unit of labor (

). One can re-write (1) in terms of output

per capita and yields3

) and

K N

Y N

t

y

t

=

=

t

t

t

Taking natural logarithms of (2) and calculating the first difference, one ob-

y

t

=

Akα

t

(2)

tains growth rate of output per capita:

A

∆

A

y

∆

y

=

+ ⋅

α

k

∆

k

(3)

)

k k

(

α⋅ ∆

the growth rate of technological progress ( A A∆

elasticity of capital and the growth rate of physical capital per labor (

Equation (3) shows that the growth rate of GDP per capita is determined by

) and the product of output

).

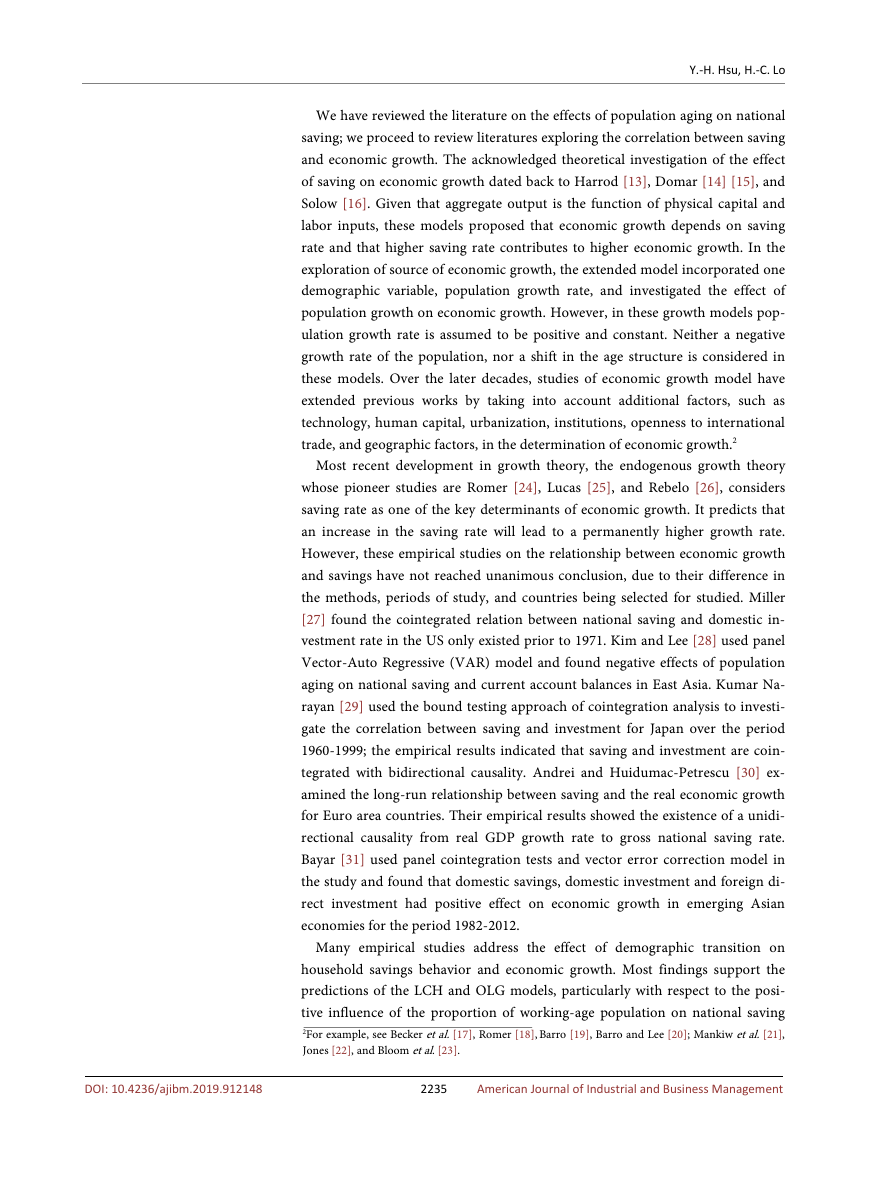

In Solow’s model, saving contributes to the accumulation of the physical capi-

tal stock which increases the labor efficiency of production. However, the saving

rate in Solow’s model is assumed to be constant over time. According to life-cycle

hypothesis (LCH) individual saving varies with age; the empirical data from

“Family Income and Expenditure Survey” of Japan also shows that saving and

consumption is age-dependent. As a result, it would be confidently to take

household head as a representative individual in the economy and relate his/her

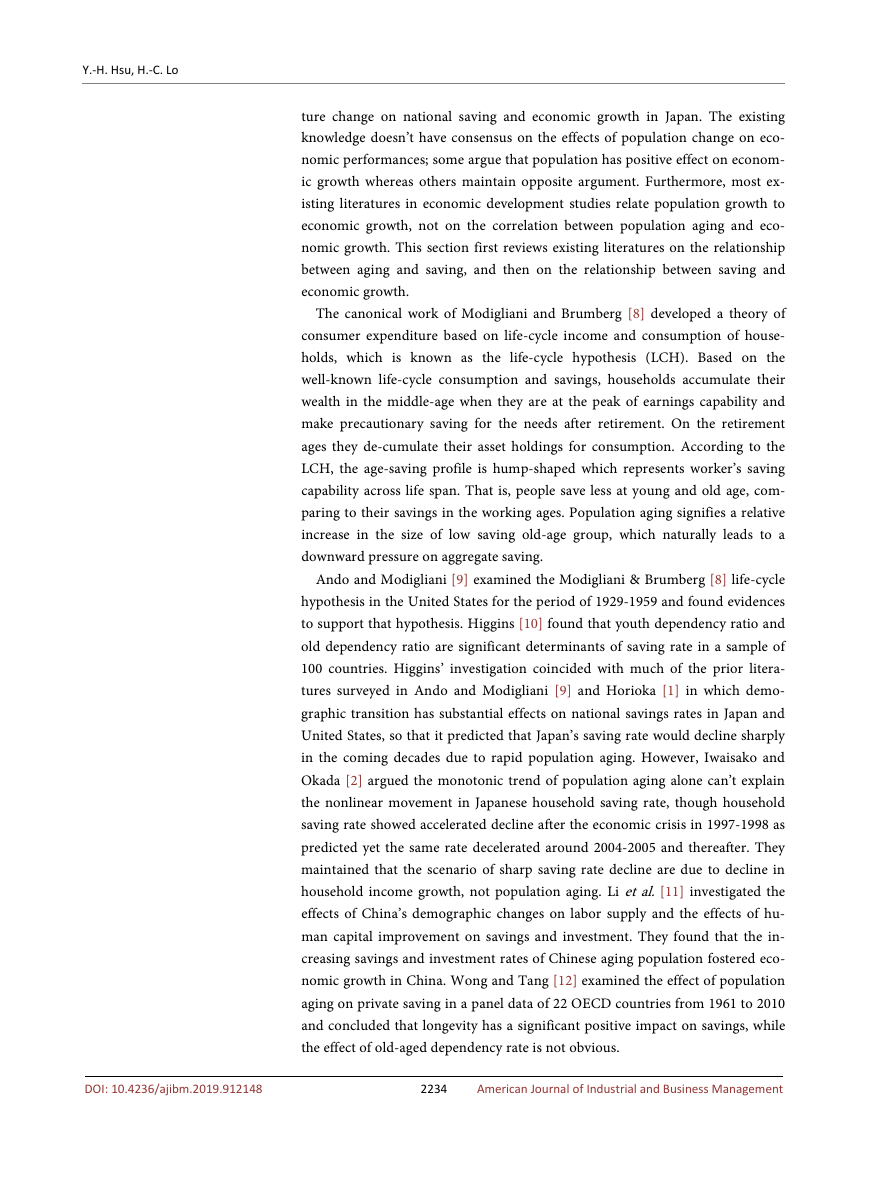

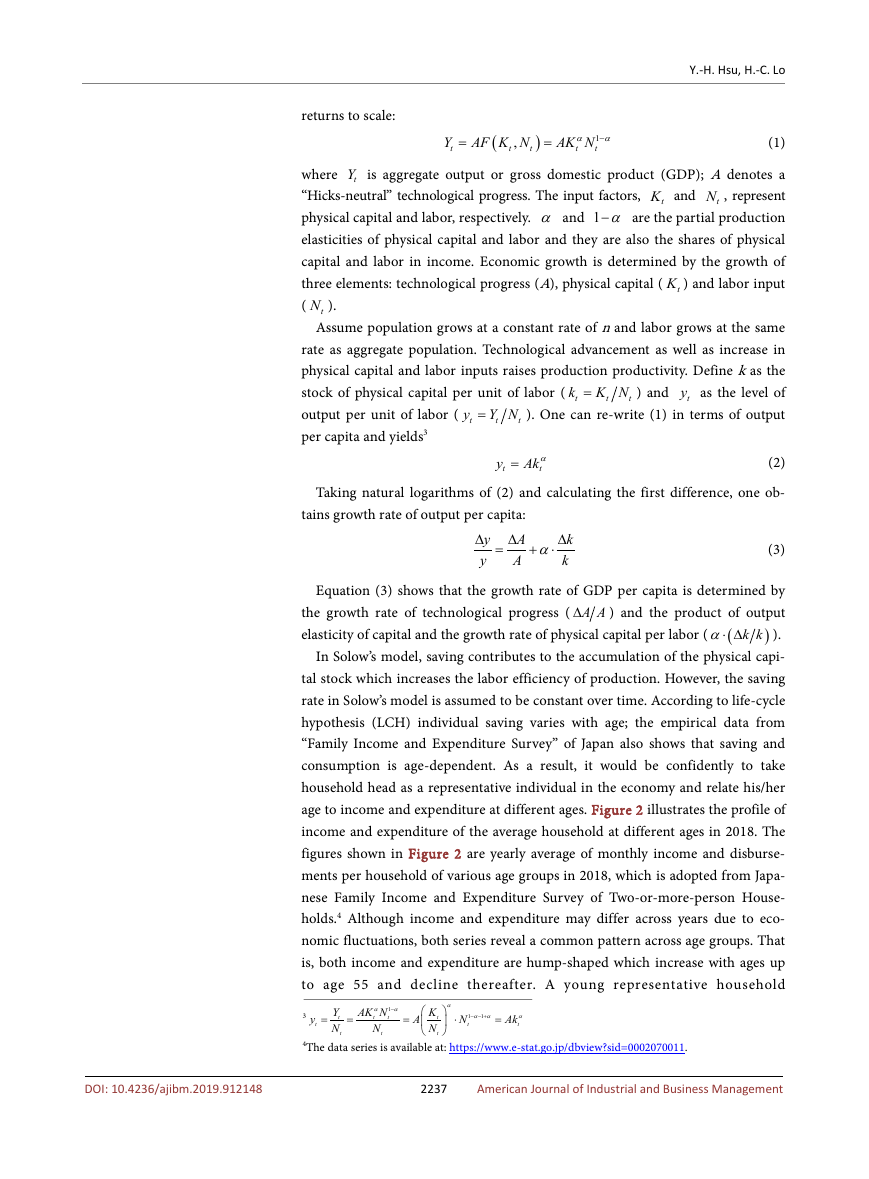

age to income and expenditure at different ages. Figure 2 illustrates the profile of

income and expenditure of the average household at different ages in 2018. The

figures shown in Figure 2 are yearly average of monthly income and disburse-

ments per household of various age groups in 2018, which is adopted from Japa-

nese Family Income and Expenditure Survey of Two-or-more-person House-

holds.4 Although income and expenditure may differ across years due to eco-

nomic fluctuations, both series reveal a common pattern across age groups. That

is, both income and expenditure are hump-shaped which increase with ages up

to age 55 and decline thereafter. A young representative household

3

y

t

=

t

Y

N

t

=

α

t

AK N

N

t

1

−

α

t

=

A

K

N

t

t

α

⋅

N

1

1

− − +

α α

t

=

Ak

α

t

DOI: 10.4236/ajibm.2019.912148

4The data series is available at: https://www.e-stat.go.jp/dbview?sid=0002070011.

2237

American Journal of Industrial and Business Management

�

Y.-H. Hsu, H.-C. Lo

n

e

y

e

s

e

n

a

p

a

J

700000

650000

600000

550000

500000

450000

400000

350000

300000

250000

200000

Age34

&Less

Income

479323

Expenditure 328837

Age 35-

39

Age 40-

44

Age 45-

49

Age 50-

54

Age 55-

59

Age 60-

64

Age 65-

69

557425

384702

576919

413252

625361

464539

651265

489723

634748

475245

428320

386596

439213

352842

Age

70up

380100

310978

Figure 2. Monthly income and expenditure per household head by age groups in 2018.

Source: Yearly Average of Monthly Receipts and Disbursements per Household in Family

Income and Expenditure Survey by Statistical Survey Department, Statistics Bureau,

Ministry of Internal Affairs and Communications.

earns monthly income of ¥479,323 and spends ¥328,837 monthly in 2018. As age

increases earning capability increases and expenditure increases as well. Both

income and expenditure series show an increasing trend up to age 55 and drop

after age 55 - 59. For people with old age, though both income and expenditure

decreased, expenditure shows a smoother scenario than scenario of income. This

scenarios difference is due to the Japanese job market convention and public

pension provision. In the post-WWII era, the conventional retirement age in Ja-

pan is 55 and the government pension provision starts at age 60. As a result,

many retirees are forced to search for various kinds of works to earn provisional

income to cover the income shortage in this 5-year gap. Re-entrée of the old age

workers is difficulty in Japanese economy because most jobs are for young or

middle age workers. Due to this institutional factor, income drops sharply for

Japanese people aged 60 - 64.

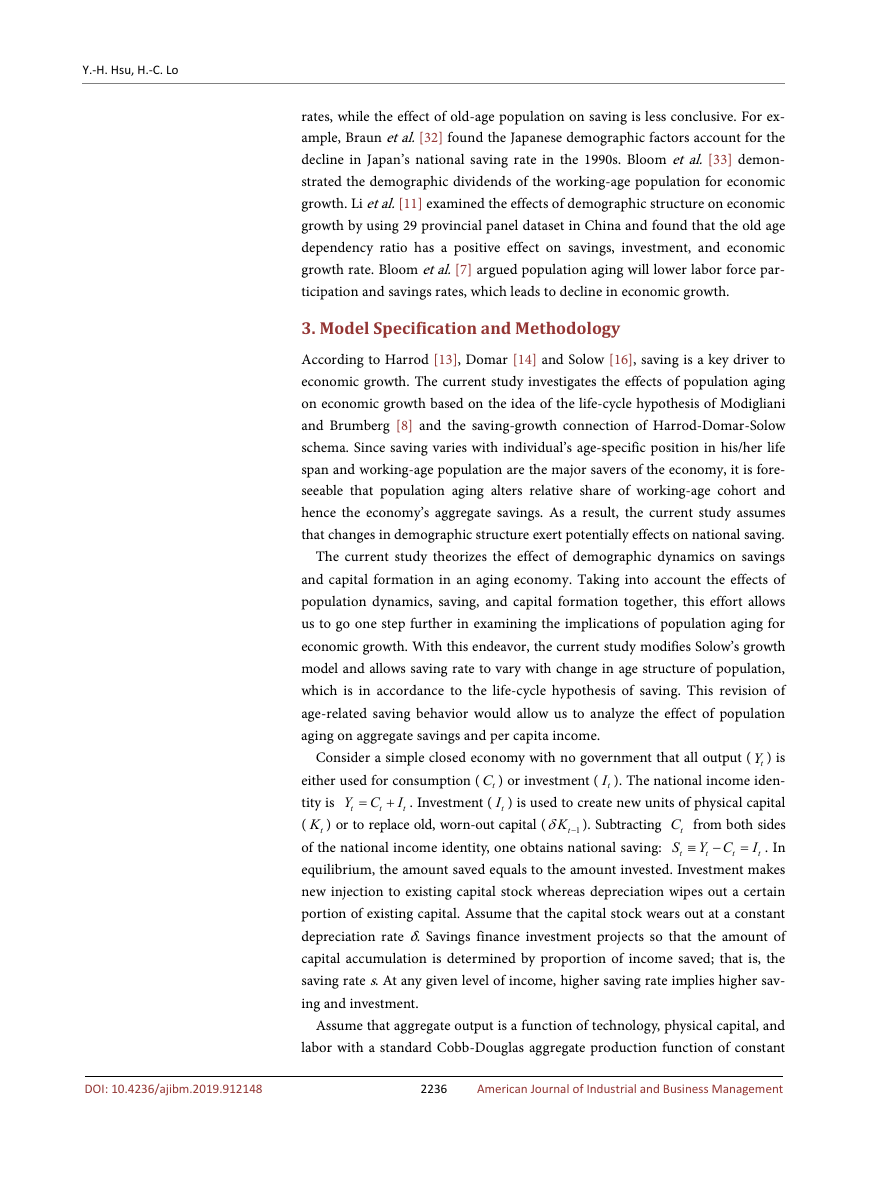

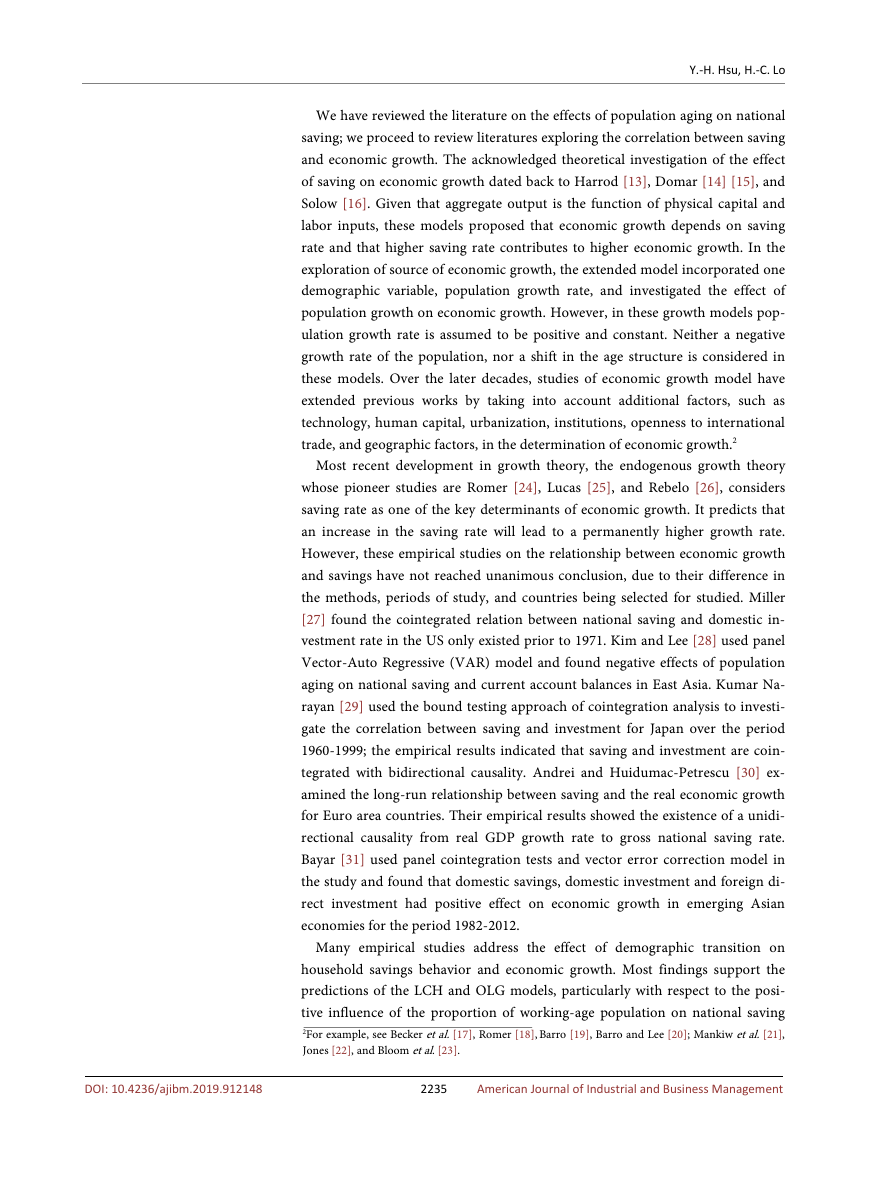

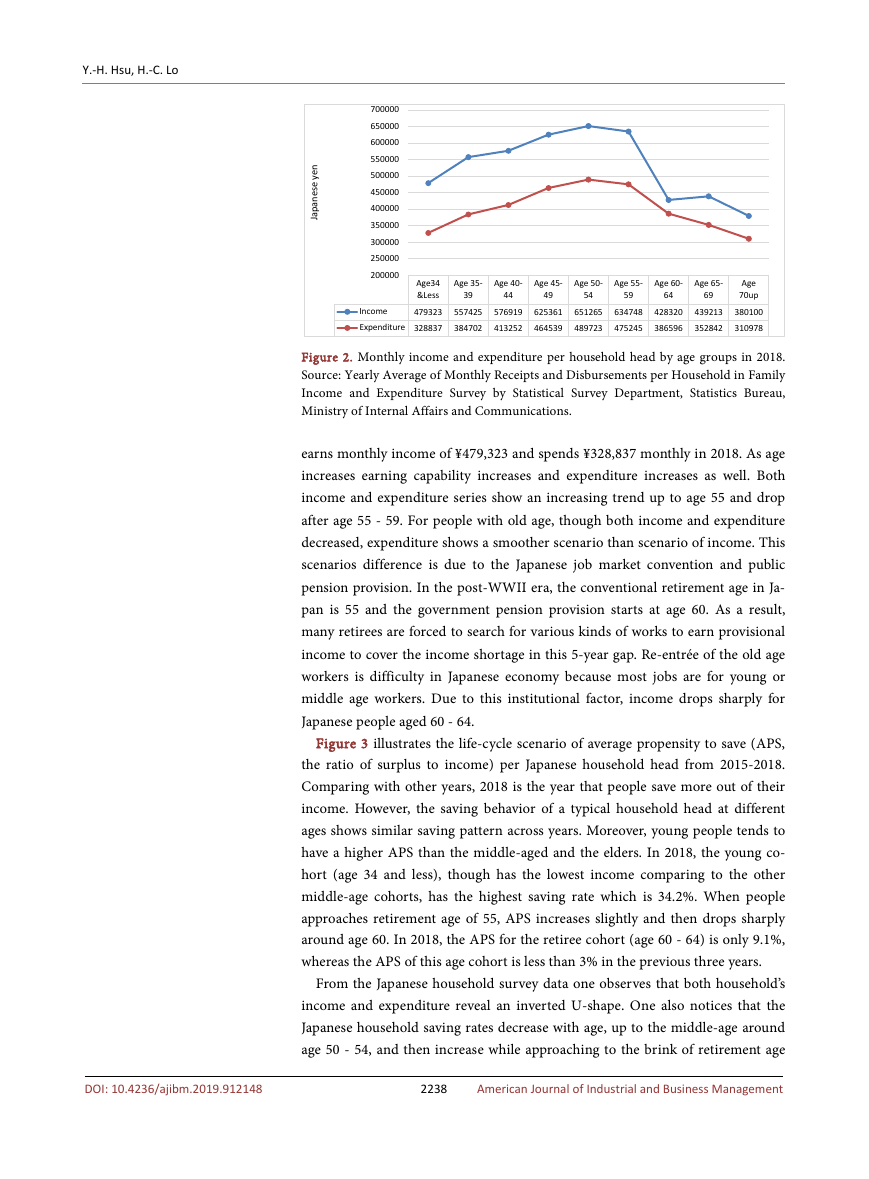

Figure 3 illustrates the life-cycle scenario of average propensity to save (APS,

the ratio of surplus to income) per Japanese household head from 2015-2018.

Comparing with other years, 2018 is the year that people save more out of their

income. However, the saving behavior of a typical household head at different

ages shows similar saving pattern across years. Moreover, young people tends to

have a higher APS than the middle-aged and the elders. In 2018, the young co-

hort (age 34 and less), though has the lowest income comparing to the other

middle-age cohorts, has the highest saving rate which is 34.2%. When people

approaches retirement age of 55, APS increases slightly and then drops sharply

around age 60. In 2018, the APS for the retiree cohort (age 60 - 64) is only 9.1%,

whereas the APS of this age cohort is less than 3% in the previous three years.

From the Japanese household survey data one observes that both household’s

income and expenditure reveal an inverted U-shape. One also notices that the

Japanese household saving rates decrease with age, up to the middle-age around

age 50 - 54, and then increase while approaching to the brink of retirement age

2238

American Journal of Industrial and Business Management

DOI: 10.4236/ajibm.2019.912148

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc