Table of Contents

As filed with the Securities and Exchange Commission on October 28, 2019

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

REGISTRATION STATEMENT

THE SECURITIES ACT OF 1933

UNDER

Phoenix Tree Holdings Limited

(Exact name of Registrant as specified in its charter)

Cayman Islands

(State or Other Jurisdiction of

Incorporation or Organization)

Not Applicable

(I.R.S. Employer

Identification Number)

7370

(Primary Standard Industrial

Classification Code Number)

Room 212, Chao Yang Shou Fu

8 Chao Yang Men Nei Street

People's Republic of China

Dongcheng District, Beijing 100010

+86-10-5717-6925

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Cogency Global Inc.

10 E. 40th Street, 10th Floor

New York, NY10016, United States

+1-212-947-7200

(Name, address, including zip code, and telephone number, including area code of agent for service)

Copies to:

Chris K.H. Lin, Esq.

Daniel Fertig, Esq.

Simpson Thacher &

35th Floor, ICBC Tower

Central, Hong Kong

Bartlett LLP

3 Garden Road

+852-2514-7600

Benjamin Su, Esq.

Daying Zhang, Esq.

Latham & Watkins LLP

18th Floor, One Exchange

Square

8 Connaught Place

Central, Hong Kong

+852-2912-2500

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering. o

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ý

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities

to be Registered(1)

Proposed Maximum

Aggregate Offering

Price(2)(3)

Amount of

Registration Fee

F

-

1

1

a

2

2

3

9

8

3

4

z

f

-

1

.

h

t

m

F

-

1

U

s

e

t

h

e

s

e

l

i

n

k

s

t

o

r

a

p

i

d

l

y

r

e

v

i

e

w

t

h

e

d

o

c

u

m

e

n

t

T

A

B

L

E

O

F

C

O

N

T

E

N

T

S

P

H

O

E

N

I

X

T

R

E

E

H

O

L

D

I

N

G

S

L

I

M

I

T

E

D

I

N

D

E

X

T

O

T

H

E

C

O

N

S

O

L

I

D

A

T

E

D

F

I

N

A

N

C

I

A

L

S

T

A

T

E

M

E

N

T

S

�

Class A ordinary shares, par value US$0.00002 per share

US$100,000,000

US$12,980.00

(1)

(2)

(3)

American depositary shares, or ADSs, issuable upon deposit of the Class A ordinary shares registered hereby will be registered under a separate registration statement on Form F-6 (Registration

No. 333- ). Each ADS represents Class A ordinary shares.

Includes (a) Class A ordinary shares represented by ADSs that may be purchased by the underwriters pursuant to their over-allotment option and (b) all Class A ordinary shares represented by ADSs

initially offered and sold outside the United States that may be resold from time to time in the United States either as part of the distribution or within 40 days after the later of the effective date of this

registration statement and the date the securities are first bona fide offered to the public.

Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall

become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

�

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the United States

Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the

offer or sale is not permitted.

Subject to Completion. Dated , 2019.

American Depositary Shares

Phoenix Tree Holdings Limited

Representing Class A Ordinary Shares

This is an initial public offering of American depositary shares, or ADSs, representing Class A ordinary shares of Phoenix Tree Holdings Limited.

We are offering ADSs. Each ADS represents Class A ordinary shares, US$0.00002 par value per share. We anticipate the initial public offering price per ADS will be

between US$ and US$ .

Prior to this offering, there has been no public market for the ADSs or our shares. We will apply to list the ADSs on the New York stock Exchange, or the NYSE, under the symbol

"DNK."

We are an "emerging growth company" under applicable United States federal securities laws and are eligible for reduced public company reporting requirements.

See "Risk Factors" on page 22 to read about factors you should consider before buying the ADSs.

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or

adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Initial public offering price

Underwriting discounts and commissions(1)

Proceeds, before expenses, to us

Per ADS

US$

US$

US$

Total

US$

US$

US$

For additional information on underwriting compensation, see "Underwriting."

(1)

To the extent that the underwriters sell more than ADSs in this offering, the underwriters have a 30-day option to purchase up to an aggregate of additional ADSs from us at

the initial public offering price less the underwriting discounts and commissions.

Upon the completion of this offering, our outstanding share capital will consist of Class A ordinary shares and Class B ordinary shares. Holders of Class A ordinary shares and Class B

ordinary shares have the same rights except for voting and conversion rights. Each Class A ordinary share is entitled to one vote; and each Class B ordinary share is entitled to twenty (20)

votes and is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances.

Upon the completion of this offering, we will be a "controlled company" as defined under the NYSE Listed Company Manual because Jing Gao, our co-founder, director and chief executive

officer, will beneficially own all of our Class B ordinary shares representing % of the voting power of our total issued and outstanding shares immediately after the completion of this

offering, assuming the underwriters do not exercise their option to purchase additional ADSs.

The underwriters expect to deliver the ADSs against payment in New York, New York on , 2019.

Citigroup

Credit Suisse

(in alphabetical order)

J.P. Morgan

Prospectus dated , 2019

�

Table of Contents

�

Table of Contents

�

Table of Contents

TABLE OF CONTENTS

Prospectus Summary

The Offering

Summary Consolidated Financial and Operating Data

Risk Factors

Special Note Regarding Forward Looking Statements and Industry Data

Use of Proceeds

Dividend Policy

Capitalization

Dilution

Enforcement of Civil Liabilities

Our History and Corporate Structure

Selected Consolidated Financial and Operating Data

Management's Discussion and Analysis of Financial Condition and Results of Operations

Industry Overview

Business

Regulations

Management

Principal Shareholders

Related Party Transactions

Description of Share Capital

Description of American Depositary Shares

Shares Eligible for Future Sale

Taxation

Underwriting

Expenses Related to This Offering

Legal Matters

Experts

Where You Can Find More Information

Index to Consolidated Financial Statements

1

14

17

22

68

70

71

72

74

76

78

81

86

111

116

143

154

166

170

171

184

196

198

206

217

218

219

220

F-1

No dealer, salesperson or other person is authorized to give any information or to represent as to anything not contained in this prospectus or in any free writing prospectus we may

authorize to be delivered or made available to you. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell, and we are seeking offers to buy,

only the ADSs offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date,

regardless of the time of delivery of this prospectus or any sale of the ADSs.

Neither we nor the underwriters have done anything that would permit this offering or the possession or distribution of this prospectus or any filed free writing prospectus in any

jurisdiction where other action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus or any free writing

prospectus filed with the United States Securities and Exchange Commission, or SEC, must inform themselves about, and observe any restrictions relating to, the offering of the ADSs and the

distribution of this prospectus or any filed free writing prospectus outside of the United States.

Until , 2019 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade ADSs, whether or not participating in this offering, may be required to deliver a

prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

�

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary may not contain all of the information that you should

consider before investing in our ADSs. You should carefully read the entire prospectus, including "Risk Factors" and the financial statements, before making an investment decision. This

prospectus contains information from an industry report commissioned by us and prepared by iResearch Global Inc., or iResearch, an independent industry research firm, to provide

information regarding our industry and our market position in China. We refer to this report, which was dated August 28, 2019, as the iResearch Report.

Our Mission

Our mission is to help people live better.

Our Business

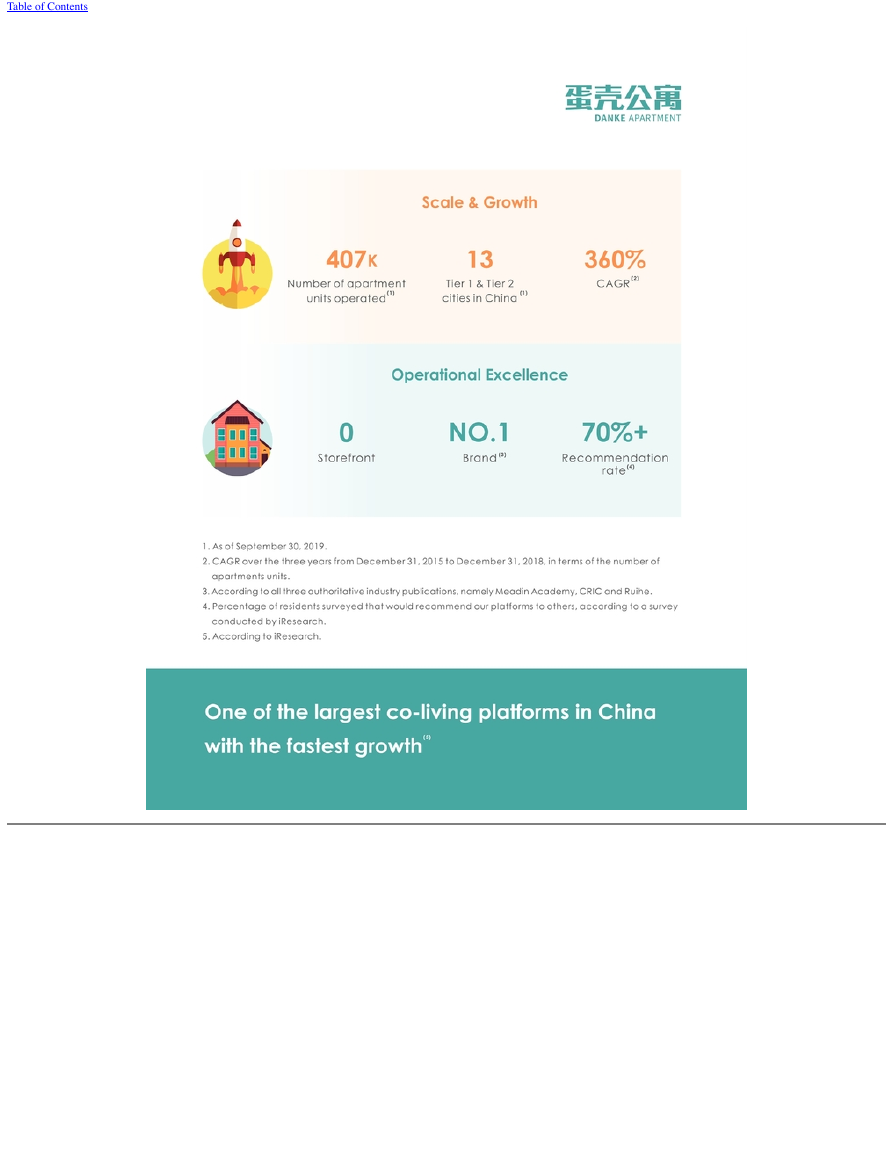

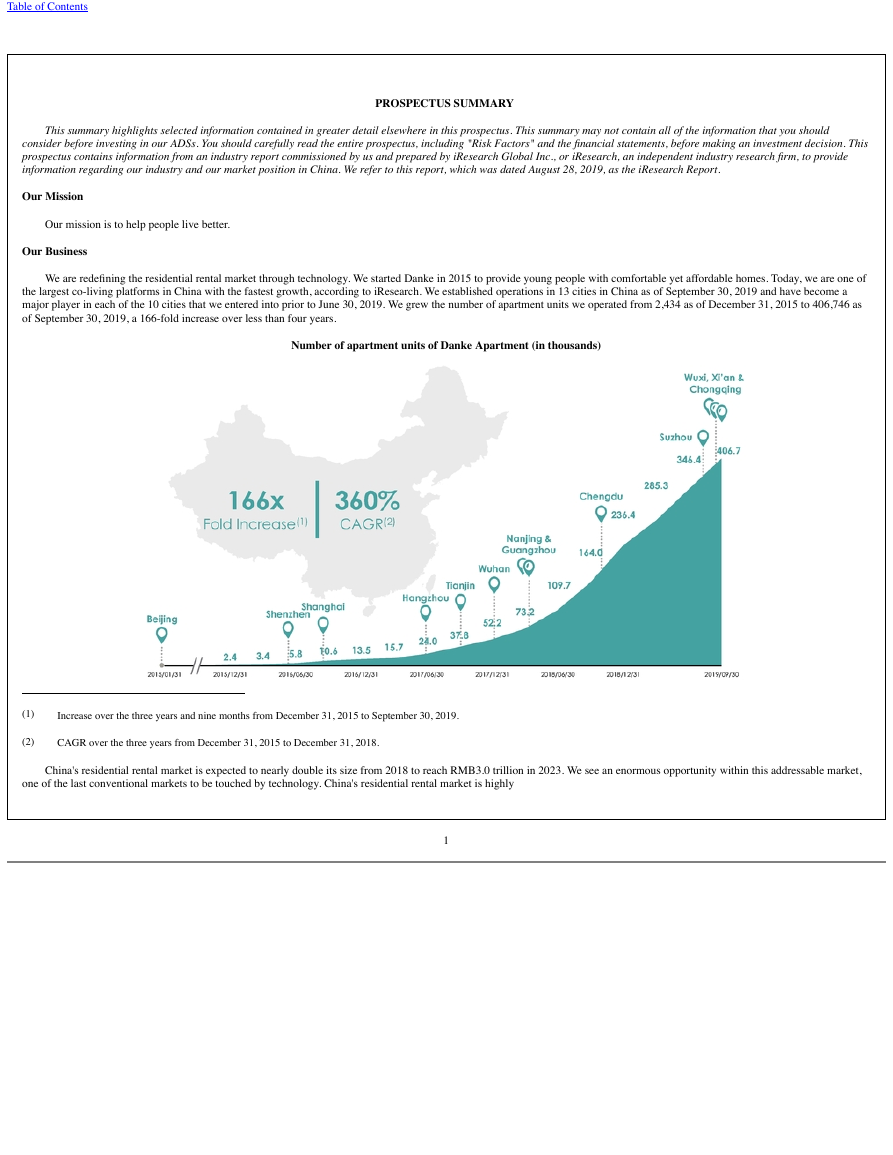

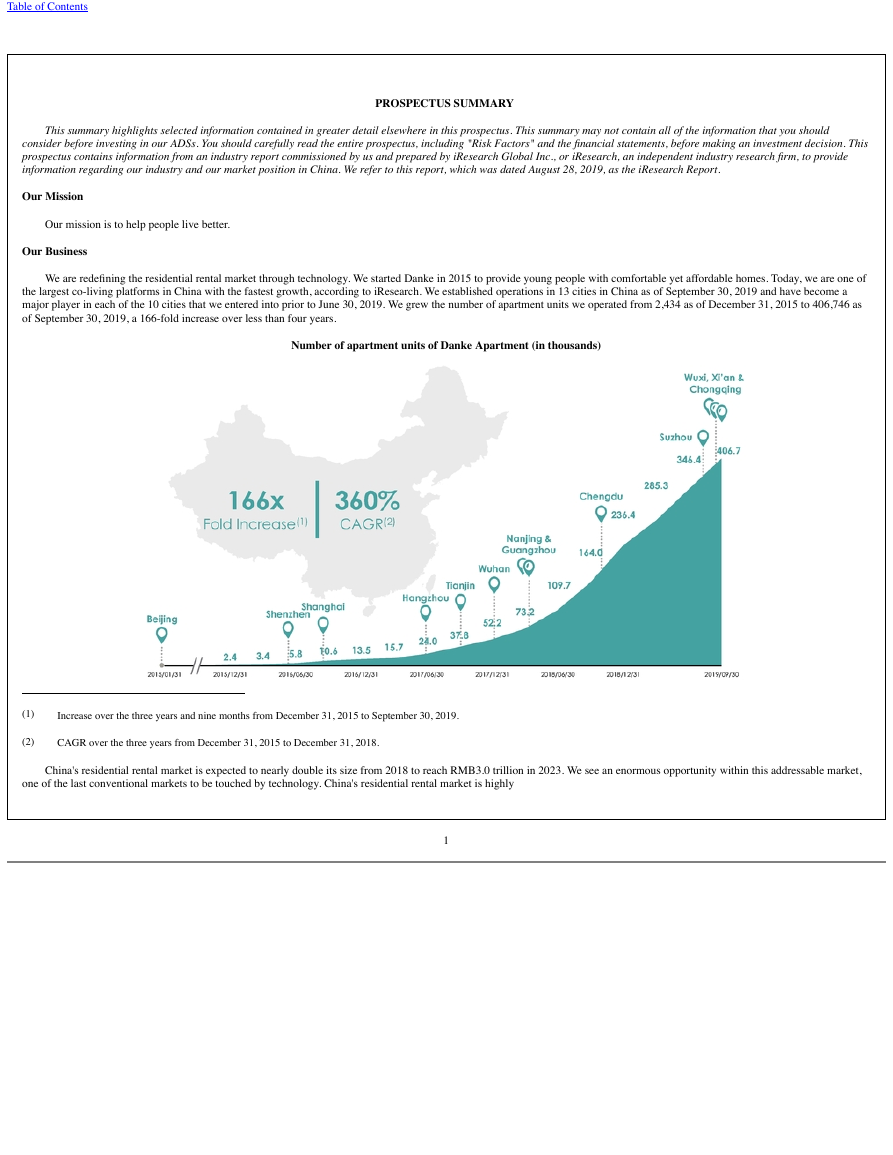

We are redefining the residential rental market through technology. We started Danke in 2015 to provide young people with comfortable yet affordable homes. Today, we are one of

the largest co-living platforms in China with the fastest growth, according to iResearch. We established operations in 13 cities in China as of September 30, 2019 and have become a

major player in each of the 10 cities that we entered into prior to June 30, 2019. We grew the number of apartment units we operated from 2,434 as of December 31, 2015 to 406,746 as

of September 30, 2019, a 166-fold increase over less than four years.

Number of apartment units of Danke Apartment (in thousands)

(1)

Increase over the three years and nine months from December 31, 2015 to September 30, 2019.

CAGR over the three years from December 31, 2015 to December 31, 2018.

(2)

China's residential rental market is expected to nearly double its size from 2018 to reach RMB3.0 trillion in 2023. We see an enormous opportunity within this addressable market,

one of the last conventional markets to be touched by technology. China's residential rental market is highly

1

�

Table of Contents

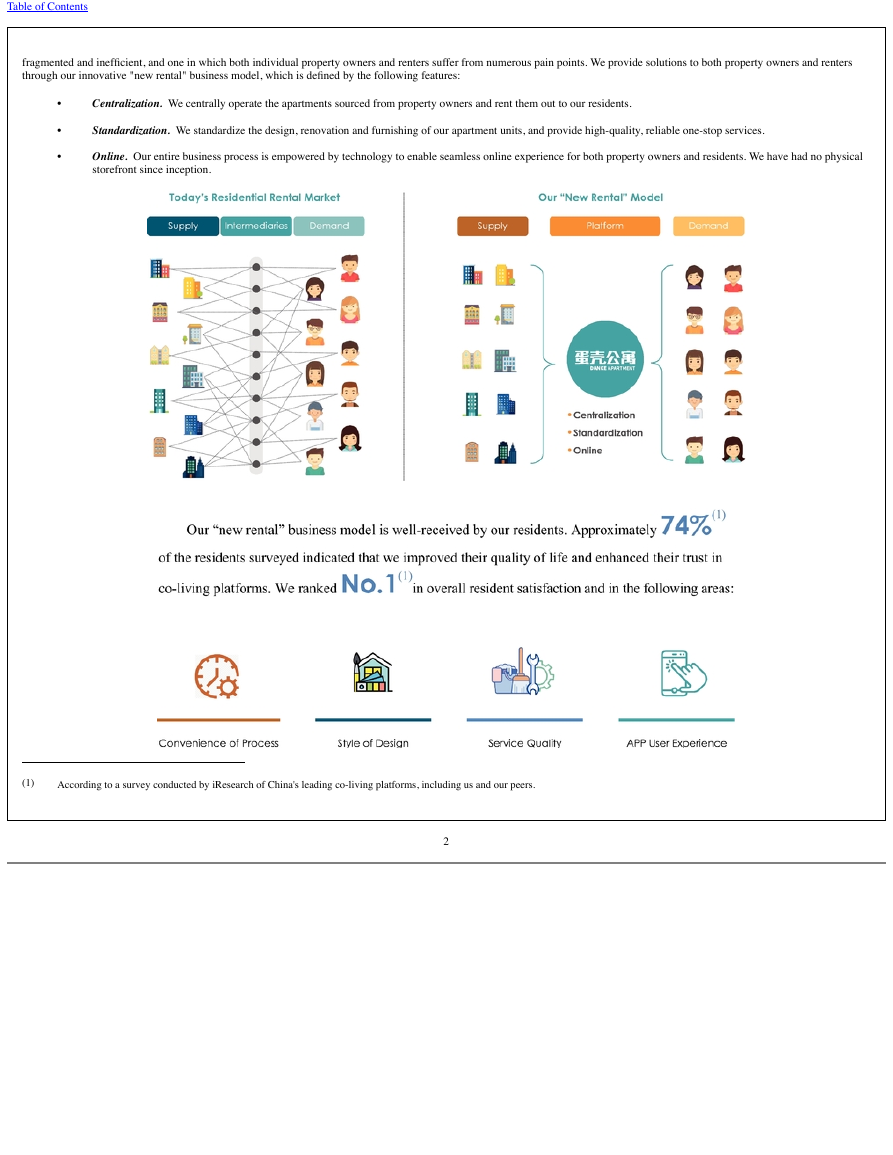

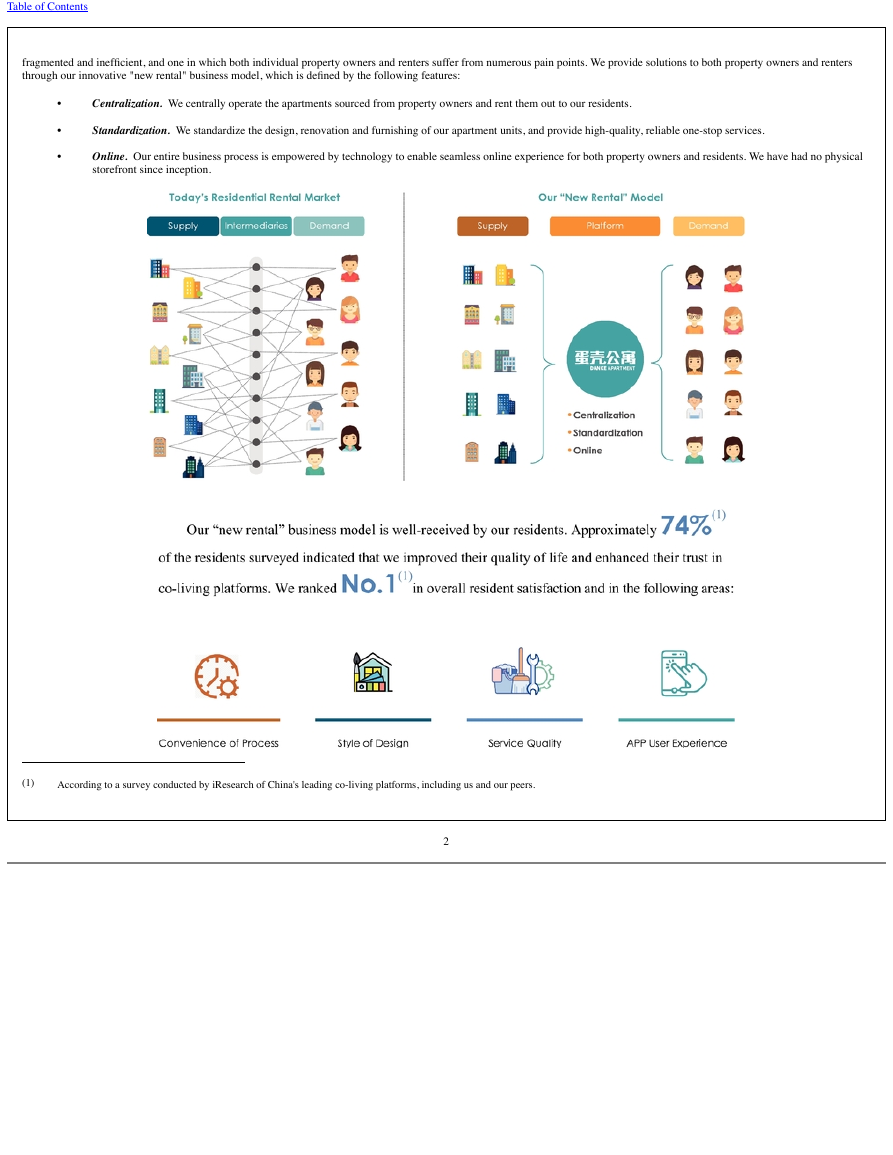

fragmented and inefficient, and one in which both individual property owners and renters suffer from numerous pain points. We provide solutions to both property owners and renters

through our innovative "new rental" business model, which is defined by the following features:

•

•

•

Centralization. We centrally operate the apartments sourced from property owners and rent them out to our residents.

Standardization. We standardize the design, renovation and furnishing of our apartment units, and provide high-quality, reliable one-stop services.

Online. Our entire business process is empowered by technology to enable seamless online experience for both property owners and residents. We have had no physical

storefront since inception.

(1)

According to a survey conducted by iResearch of China's leading co-living platforms, including us and our peers.

2

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc