Chapter 03 - Financial Statements Analysis and Financial Models

CHAPTER 3

FINANCIAL STATEMENTS ANALYSIS

AND FINANCIAL MODELS

Answers to Concepts Review and Critical Thinking Questions

1.

2.

3.

4.

Time trend analysis gives a picture of changes in the company’s financial situation over time.

Comparing a firm to itself over time allows the financial manager to evaluate whether some aspects

of the firm’s operations, finances, or investment activities have changed. Peer group analysis

involves comparing the financial ratios and operating performance of a particular firm to a set of

peer group firms in the same industry or line of business. Comparing a firm to its peers allows the

financial manager to evaluate whether some aspects of the firm’s operations, finances, or investment

activities are out of line with the norm, thereby providing some guidance on appropriate actions to

take to adjust these ratios if appropriate. Both allow an investigation into what is different about a

company from a financial perspective, but neither method gives an indication of whether the

difference is positive or negative. For example, suppose a company’s current ratio is increasing over

time. It could mean that the company had been facing liquidity problems in the past and is rectifying

those problems, or it could mean the company has become less efficient in managing its current

accounts. Similar arguments could be made for a peer group comparison. A company with a current

ratio lower than its peers could be more efficient at managing its current accounts, or it could be

facing liquidity problems. Neither analysis method tells us whether a ratio is good or bad, both

simply show that something is different, and tells us where to look.

If a company is growing by opening new stores, then presumably total revenues would be rising.

Comparing total sales at two different points in time might be misleading. Same-store sales control

for this by only looking at revenues of stores open within a specific period.

The reason is that, ultimately, sales are the driving force behind a business. A firm’s assets,

employees, and, in fact, just about every aspect of its operations and financing exist to directly or

indirectly support sales. Put differently, a firm’s future need for things like capital assets, employees,

inventory, and financing are determined by its future sales level.

Two assumptions of the sustainable growth formula are that the company does not want to sell new

equity, and that financial policy is fixed. If the company raises outside equity, or increases its debt-

equity ratio, it can grow at a higher rate than the sustainable growth rate. Of course, the company

could also grow faster than its profit margin increases, if it changes its dividend policy by increasing

the retention ratio, or its total asset turnover increases.

© 2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3-1

�

Chapter 03 - Financial Statements Analysis and Financial Models

5. The sustainable growth rate is greater than 20 percent, because at a 20 percent growth rate the

negative EFN indicates that there is excess financing still available. If the firm is 100 percent equity

financed, then the sustainable and internal growth rates are equal and the internal growth rate would

be greater than 20 percent. However, when the firm has some debt, the internal growth rate is always

less than the sustainable growth rate, so it is ambiguous whether the internal growth rate would be

greater than or less than 20 percent. If the retention ratio is increased, the firm will have more internal

funding sources available, and it will have to take on more debt to keep the debt/equity ratio constant,

so the EFN will decline. Conversely, if the retention ratio is decreased, the EFN will rise. If the

retention rate is zero, both the internal and sustainable growth rates are zero, and the EFN will rise to

the change in total assets.

6. Common-size financial statements provide the financial manager with a ratio analysis of the

company. The common-size income statement can show, for example, that cost of goods sold as a

percentage of sales is increasing. The common-size balance sheet can show a firm’s increasing

reliance on debt as a form of financing. Common-size statements of cash flows are not calculated for

a simple reason: There is no possible denominator.

7.

It would reduce the external funds needed. If the company is not operating at full capacity, it would

be able to increase sales without a commensurate increase in fixed assets.

8. ROE is a better measure of the company’s performance. ROE shows the percentage return for the

year earned on shareholder investment. Since the goal of a company is to maximize shareholder

wealth, this ratio shows the company’s performance in achieving this goal over the period.

9.

The EBITD/Assets ratio shows the company’s operating performance before interest, taxes, and

depreciation. This ratio would show how a company has controlled costs. While taxes are a cost, and

depreciation and amortization can be considered costs, they are not as easily controlled by company

management. Conversely, depreciation and amortization can be altered by accounting choices. This

ratio only uses costs directly related to operations in the numerator. As such, it gives a better metric

to measure management performance over a period than does ROA.

10. Long-term liabilities and equity are investments made by investors in the company, either in the

form of a loan or ownership. Return on investment is intended to measure the return the company

earned from these investments. Return on investment will be higher than the return on assets for a

company with current liabilities. To see this, realize that total assets must equal total debt and equity,

and total debt and equity is equal to current liabilities plus long-term liabilities plus equity. So, return

on investment could be calculated as net income divided by total assets minus current liabilities.

11. Presumably not, but, of course, if the product had been much less popular, then a similar fate would

have awaited due to lack of sales.

12. Since customers did not pay until shipment, receivables rose. The firm’s NWC, but not its cash,

increased. At the same time, costs were rising faster than cash revenues, so operating cash flow

declined. The firm’s capital spending was also rising. Thus, all three components of cash flow from

assets were negatively impacted.

13. Financing possibly could have been arranged if the company had taken quick enough action.

Sometimes it becomes apparent that help is needed only when it is too late, again emphasizing the

need for planning.

© 2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3-2

�

Chapter 03 - Financial Statements Analysis and Financial Models

14. All three were important, but the lack of cash or, more generally, financial resources, ultimately

spelled doom. An inadequate cash resource is usually cited as the most common cause of small

business failure.

15. Demanding cash upfront, increasing prices, subcontracting production, and improving financial

resources via new owners or new sources of credit are some of the options. When orders exceed

capacity, price increases may be especially beneficial.

Solutions to Questions and Problems

NOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple

steps. Due to space and readability constraints, when these intermediate steps are included in this

solutions manual, rounding may appear to have occurred. However, the final answer for each problem is

found without rounding during any step in the problem.

Basic

1. ROE = (PM)(TAT)(EM)

ROE = (.043)(1.75)(1.55) = .1166 or 11.66%

2.

The equity multiplier is:

EM = 1 + D/E

EM = 1 + 0.80 = 1.80

One formula to calculate return on equity is:

ROE = (ROA)(EM)

ROE = 0.097(1.80) = .1746 or 17.46%

ROE can also be calculated as:

ROE = NI / TE

So, net income is:

NI = ROE(TE)

NI = (.1746)($735,000) = $128,331

3.

This is a multi-step problem involving several ratios. The ratios given are all part of the Du Pont

Identity. The only Du Pont Identity ratio not given is the profit margin. If we know the profit margin,

we can find the net income since sales are given. So, we begin with the Du Pont Identity:

ROE = 0.15 = (PM)(TAT)(EM) = (PM)(S / TA)(1 + D/E)

Solving the Du Pont Identity for profit margin, we get:

PM = [(ROE)(TA)] / [(1 + D/E)(S)]

PM = [(0.15)($1,310)] / [(1 + 1.20)( $2,700)] = .0331

© 2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3-3

�

Chapter 03 - Financial Statements Analysis and Financial Models

Now that we have the profit margin, we can use this number and the given sales figure to solve for

net income:

PM = .0331 = NI / S

NI = .0331($2,700) = $89.32

4. An increase of sales to $42,300 is an increase of:

Sales increase = ($42,300 – 37,300) / $37,300

Sales increase = .134 or 13.40%

Assuming costs and assets increase proportionally, the pro forma financial statements will look like

this:

Pro forma income statement

Sales

Costs

EBIT

Taxes (34%)

Net income

$42,300.00

29,258.45

13,041.55

4,434.13

$ 8,607.43

Pro forma balance sheet

Assets

Total

$ 144,024.13 Debt

Equity

$ 144,024.13 Total

$ 30,500.00

102,272.31

$132,772.31

The payout ratio is constant, so the dividends paid this year is the payout ratio from last year times

net income, or:

Dividends = ($2,500 / $7,590)($8,607.43)

Dividends = $2,835.12

The addition to retained earnings is:

Addition to retained earnings = $8,607.43 – 2,835.12

Addition to retained earnings = $5,772.31

And the new equity balance is:

Equity = $96,500 + 5,772.31

Equity = $102,272.31

So the EFN is:

EFN = Total assets – Total liabilities and equity

EFN = $144,024.13 – 132,772.31

EFN = $11,251.82

© 2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3-4

�

Chapter 03 - Financial Statements Analysis and Financial Models

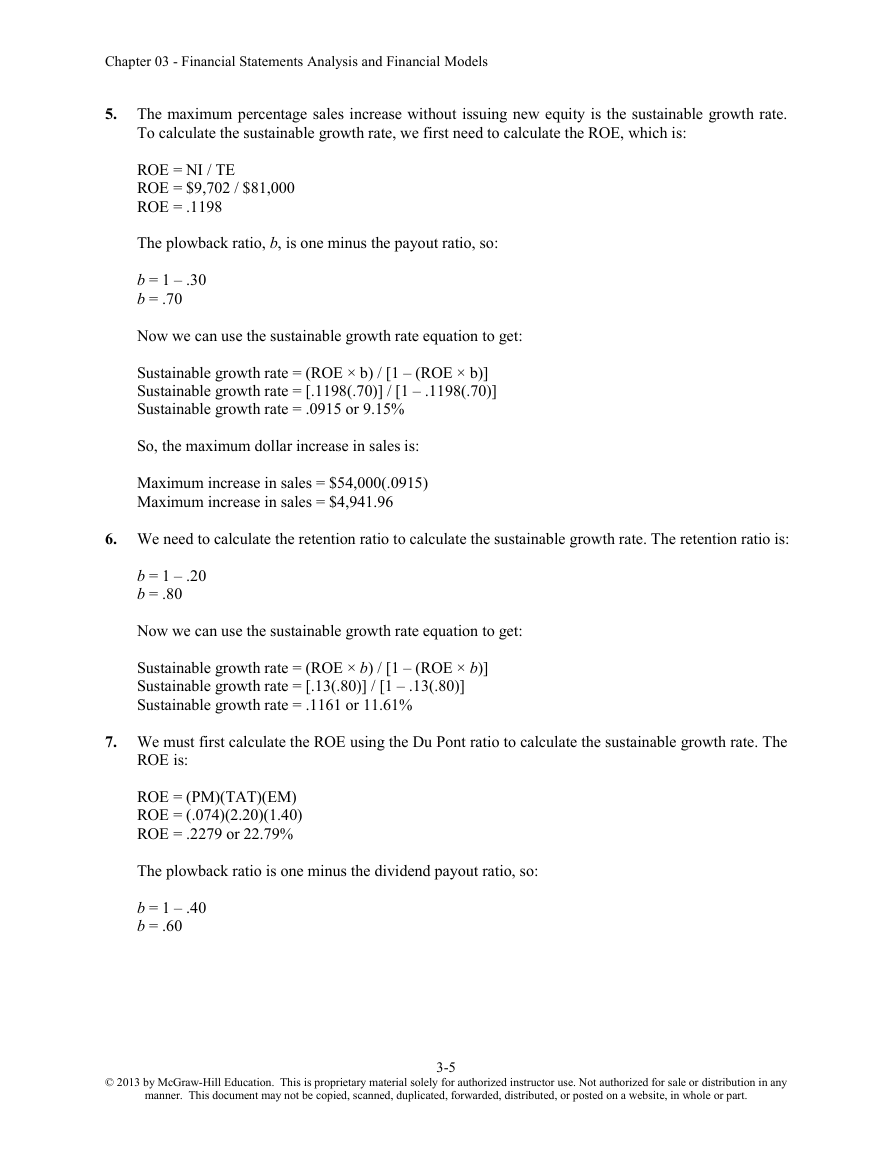

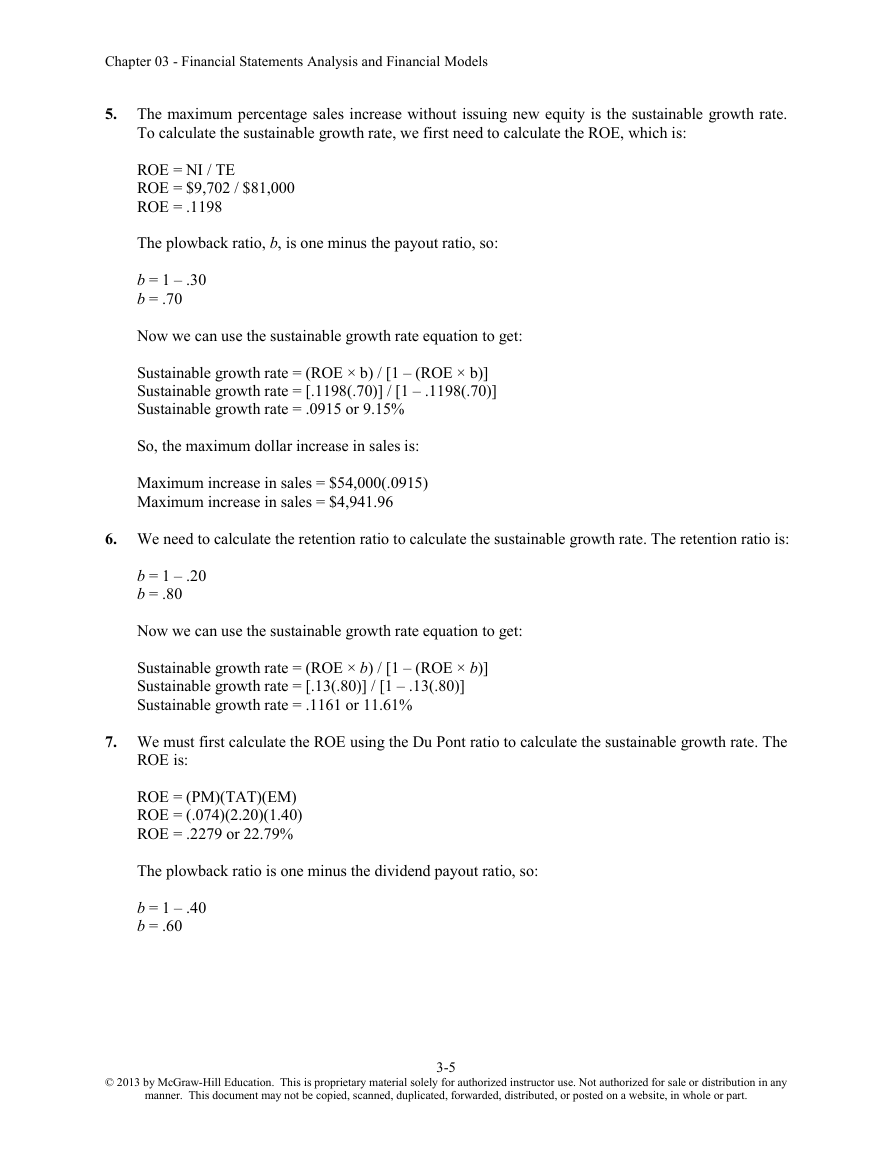

5.

The maximum percentage sales increase without issuing new equity is the sustainable growth rate.

To calculate the sustainable growth rate, we first need to calculate the ROE, which is:

ROE = NI / TE

ROE = $9,702 / $81,000

ROE = .1198

The plowback ratio, b, is one minus the payout ratio, so:

b = 1 – .30

b = .70

Now we can use the sustainable growth rate equation to get:

Sustainable growth rate = (ROE × b) / [1 – (ROE × b)]

Sustainable growth rate = [.1198(.70)] / [1 – .1198(.70)]

Sustainable growth rate = .0915 or 9.15%

So, the maximum dollar increase in sales is:

Maximum increase in sales = $54,000(.0915)

Maximum increase in sales = $4,941.96

6. We need to calculate the retention ratio to calculate the sustainable growth rate. The retention ratio is:

b = 1 – .20

b = .80

Now we can use the sustainable growth rate equation to get:

Sustainable growth rate = (ROE × b) / [1 – (ROE × b)]

Sustainable growth rate = [.13(.80)] / [1 – .13(.80)]

Sustainable growth rate = .1161 or 11.61%

7. We must first calculate the ROE using the Du Pont ratio to calculate the sustainable growth rate. The

ROE is:

ROE = (PM)(TAT)(EM)

ROE = (.074)(2.20)(1.40)

ROE = .2279 or 22.79%

The plowback ratio is one minus the dividend payout ratio, so:

b = 1 – .40

b = .60

© 2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3-5

�

Chapter 03 - Financial Statements Analysis and Financial Models

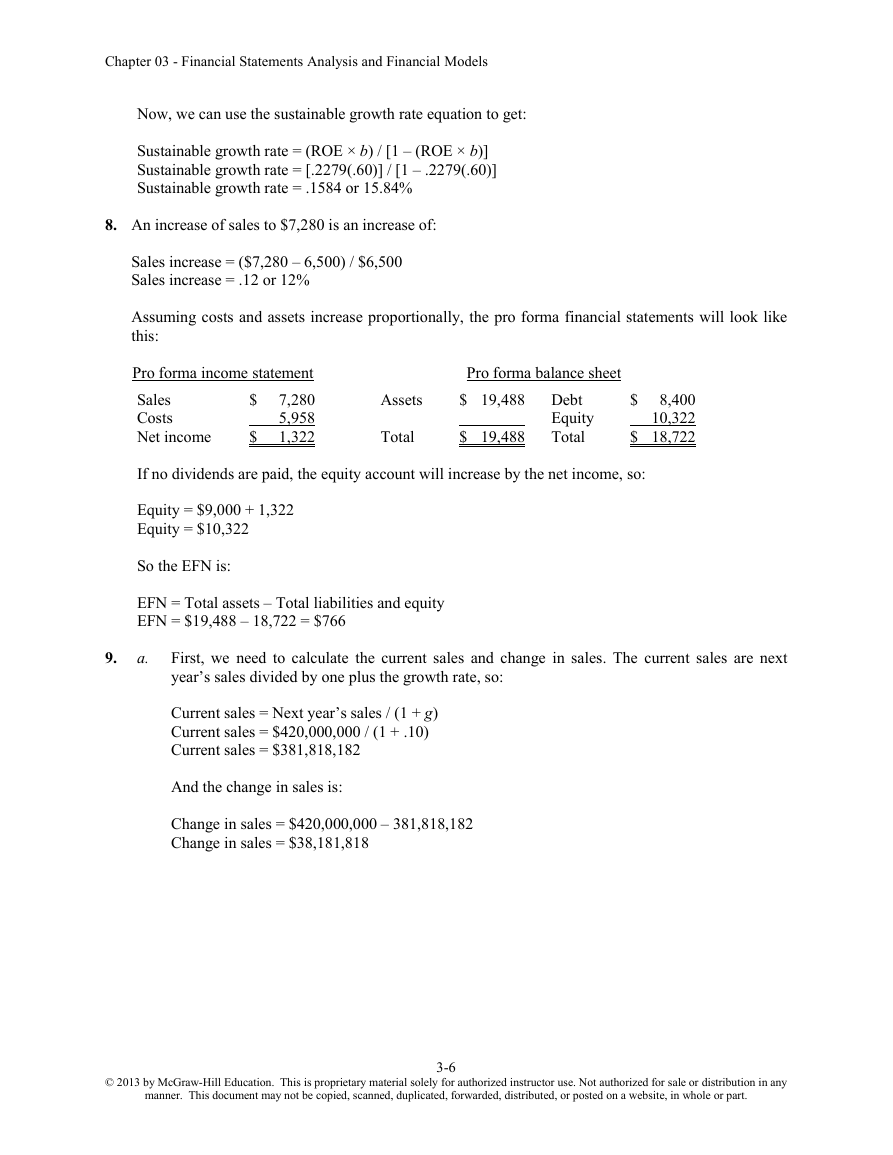

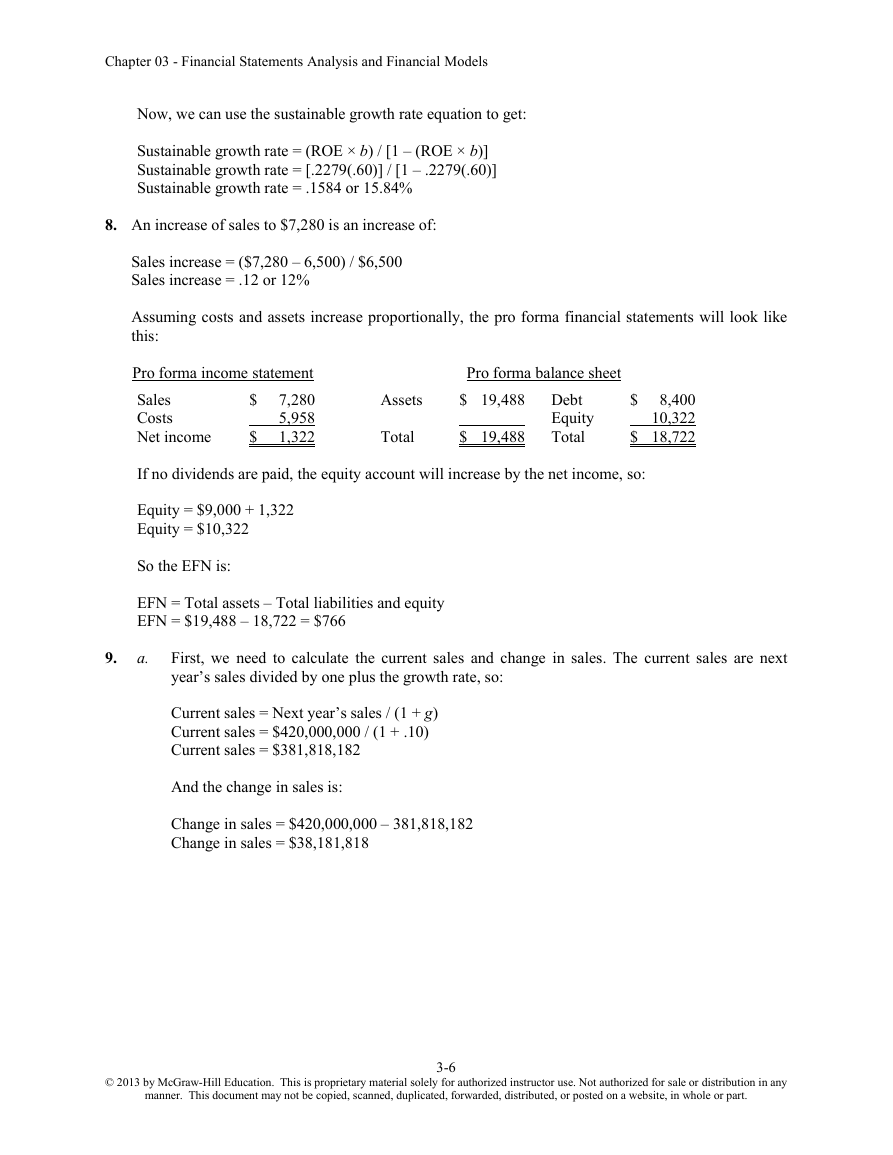

Now, we can use the sustainable growth rate equation to get:

Sustainable growth rate = (ROE × b) / [1 – (ROE × b)]

Sustainable growth rate = [.2279(.60)] / [1 – .2279(.60)]

Sustainable growth rate = .1584 or 15.84%

8. An increase of sales to $7,280 is an increase of:

Sales increase = ($7,280 – 6,500) / $6,500

Sales increase = .12 or 12%

Assuming costs and assets increase proportionally, the pro forma financial statements will look like

this:

Pro forma income statement

Sales

7,280

5,958

Costs

Net income

1,322

$

$

Assets

Total

Pro forma balance sheet

$ 19,488

$ 19,488

Debt

Equity

Total

$

8,400

10,322

$ 18,722

If no dividends are paid, the equity account will increase by the net income, so:

Equity = $9,000 + 1,322

Equity = $10,322

So the EFN is:

EFN = Total assets – Total liabilities and equity

EFN = $19,488 – 18,722 = $766

9.

a.

First, we need to calculate the current sales and change in sales. The current sales are next

year’s sales divided by one plus the growth rate, so:

Current sales = Next year’s sales / (1 + g)

Current sales = $420,000,000 / (1 + .10)

Current sales = $381,818,182

And the change in sales is:

Change in sales = $420,000,000 – 381,818,182

Change in sales = $38,181,818

© 2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3-6

�

Chapter 03 - Financial Statements Analysis and Financial Models

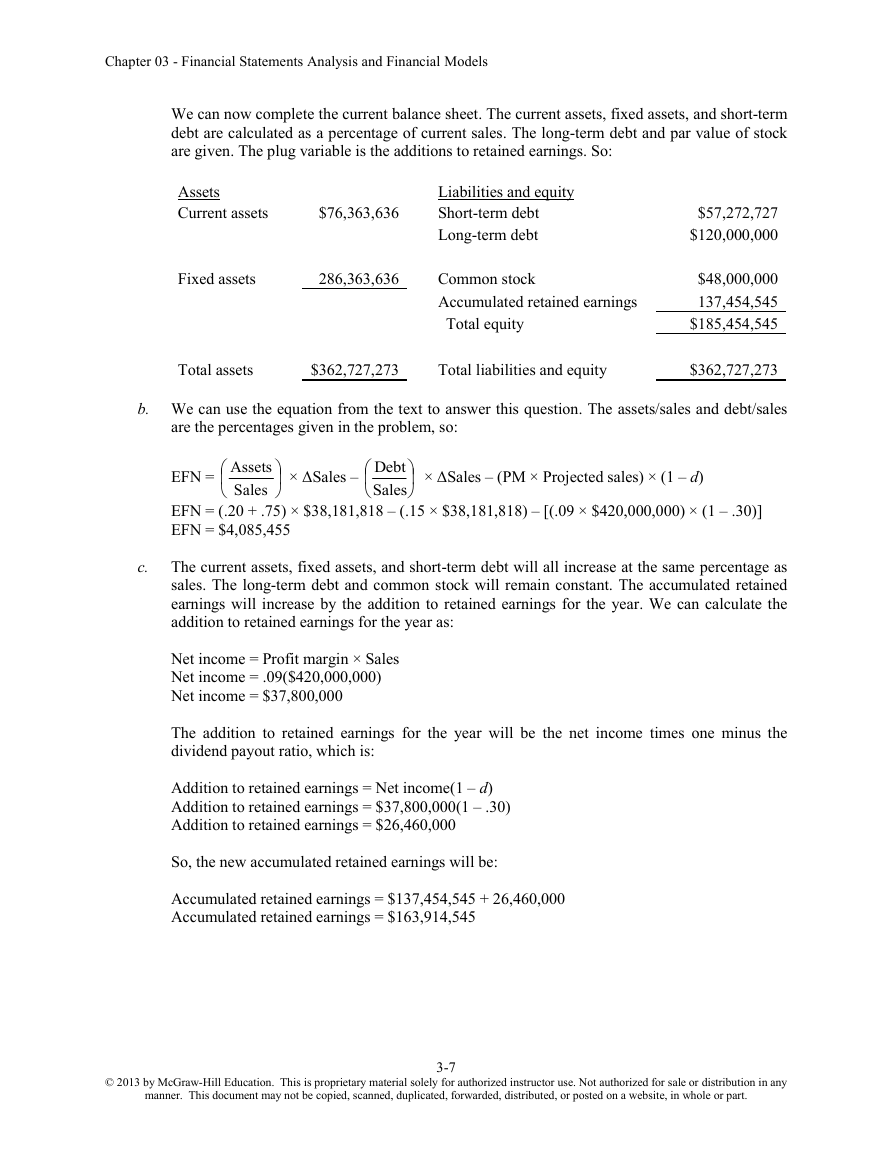

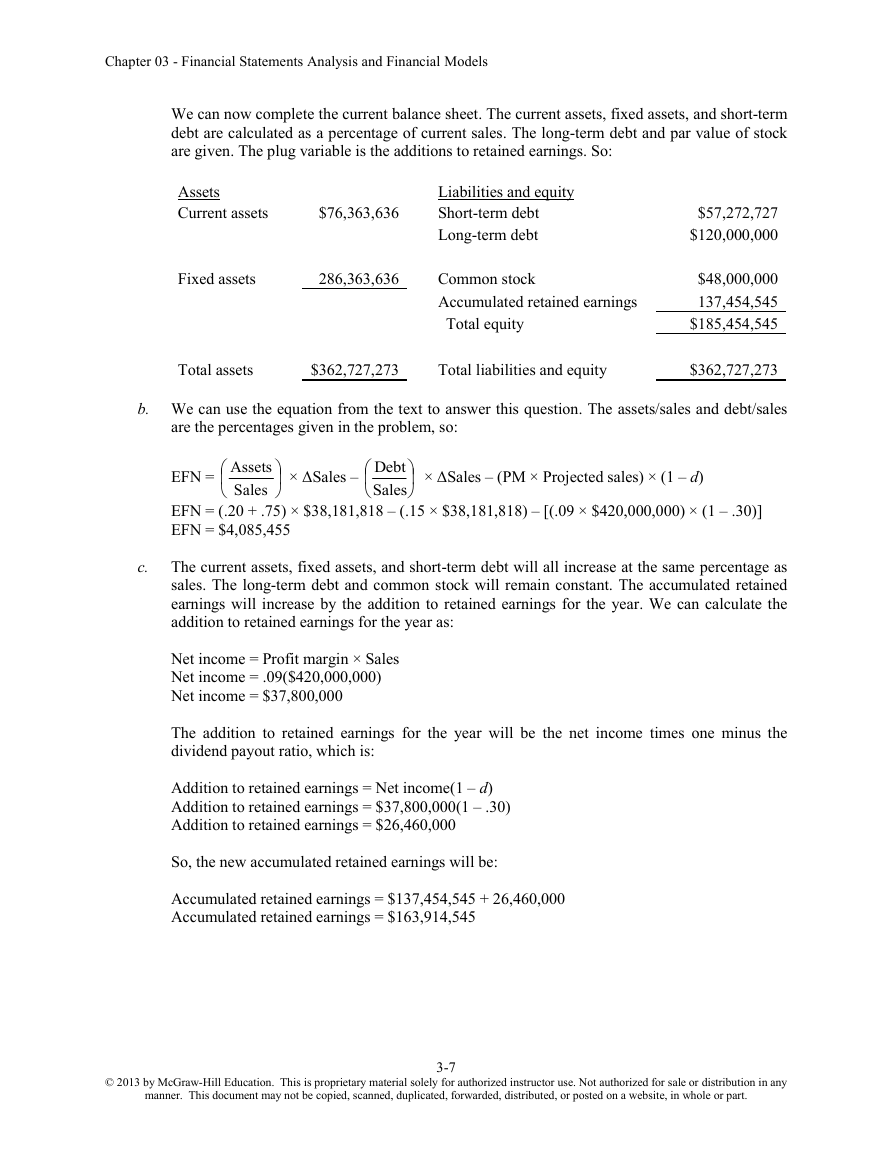

We can now complete the current balance sheet. The current assets, fixed assets, and short-term

debt are calculated as a percentage of current sales. The long-term debt and par value of stock

are given. The plug variable is the additions to retained earnings. So:

Assets

Current assets

$76,363,636

Liabilities and equity

Short-term debt

Long-term debt

Fixed assets

286,363,636

Common stock

Accumulated retained earnings

Total equity

$57,272,727

$120,000,000

$48,000,000

137,454,545

$185,454,545

Total assets

$362,727,273

Total liabilities and equity

$362,727,273

b. We can use the equation from the text to answer this question. The assets/sales and debt/sales

are the percentages given in the problem, so:

EFN =

Assets × ΔSales –

Sales

Debt

Sales

× ΔSales – (PM × Projected sales) × (1 – d)

EFN = (.20 + .75) × $38,181,818 – (.15 × $38,181,818) – [(.09 × $420,000,000) × (1 – .30)]

EFN = $4,085,455

c.

The current assets, fixed assets, and short-term debt will all increase at the same percentage as

sales. The long-term debt and common stock will remain constant. The accumulated retained

earnings will increase by the addition to retained earnings for the year. We can calculate the

addition to retained earnings for the year as:

Net income = Profit margin × Sales

Net income = .09($420,000,000)

Net income = $37,800,000

The addition to retained earnings for the year will be the net income times one minus the

dividend payout ratio, which is:

Addition to retained earnings = Net income(1 – d)

Addition to retained earnings = $37,800,000(1 – .30)

Addition to retained earnings = $26,460,000

So, the new accumulated retained earnings will be:

Accumulated retained earnings = $137,454,545 + 26,460,000

Accumulated retained earnings = $163,914,545

© 2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3-7

�

Chapter 03 - Financial Statements Analysis and Financial Models

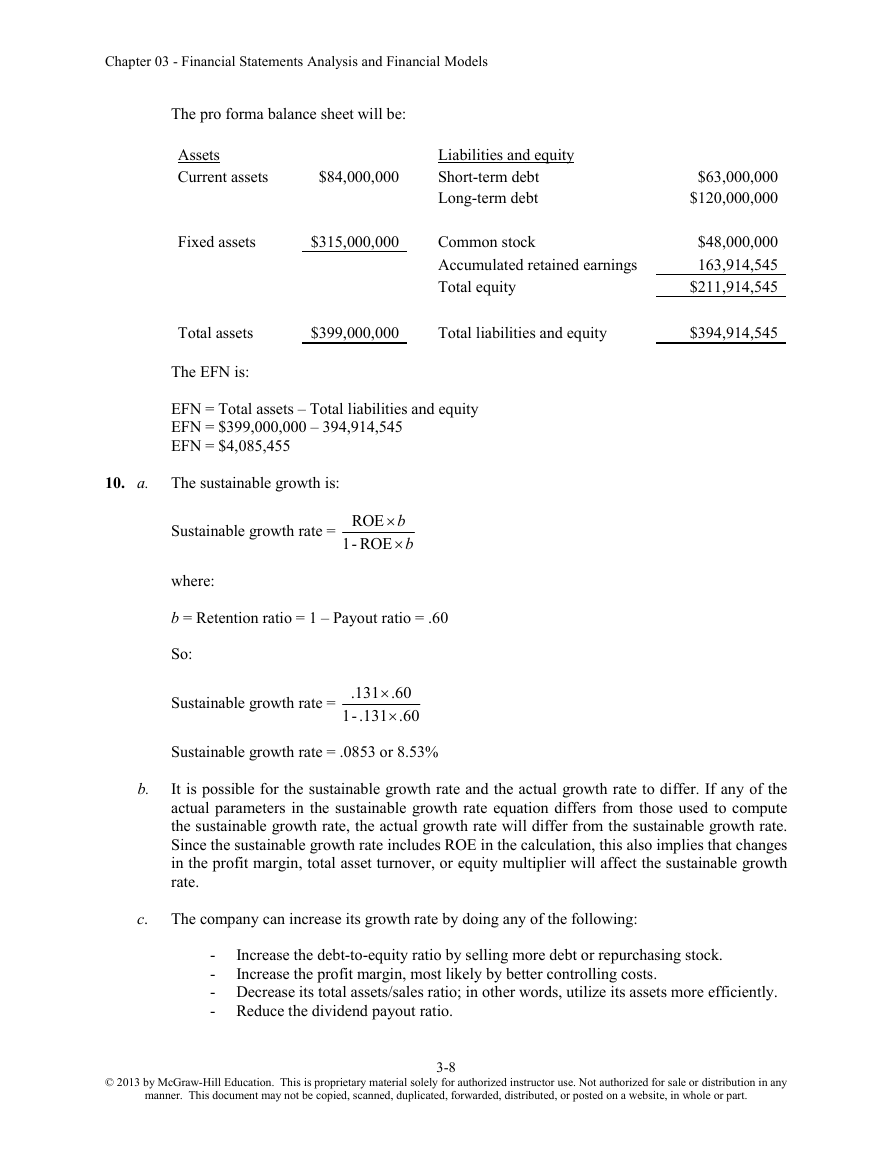

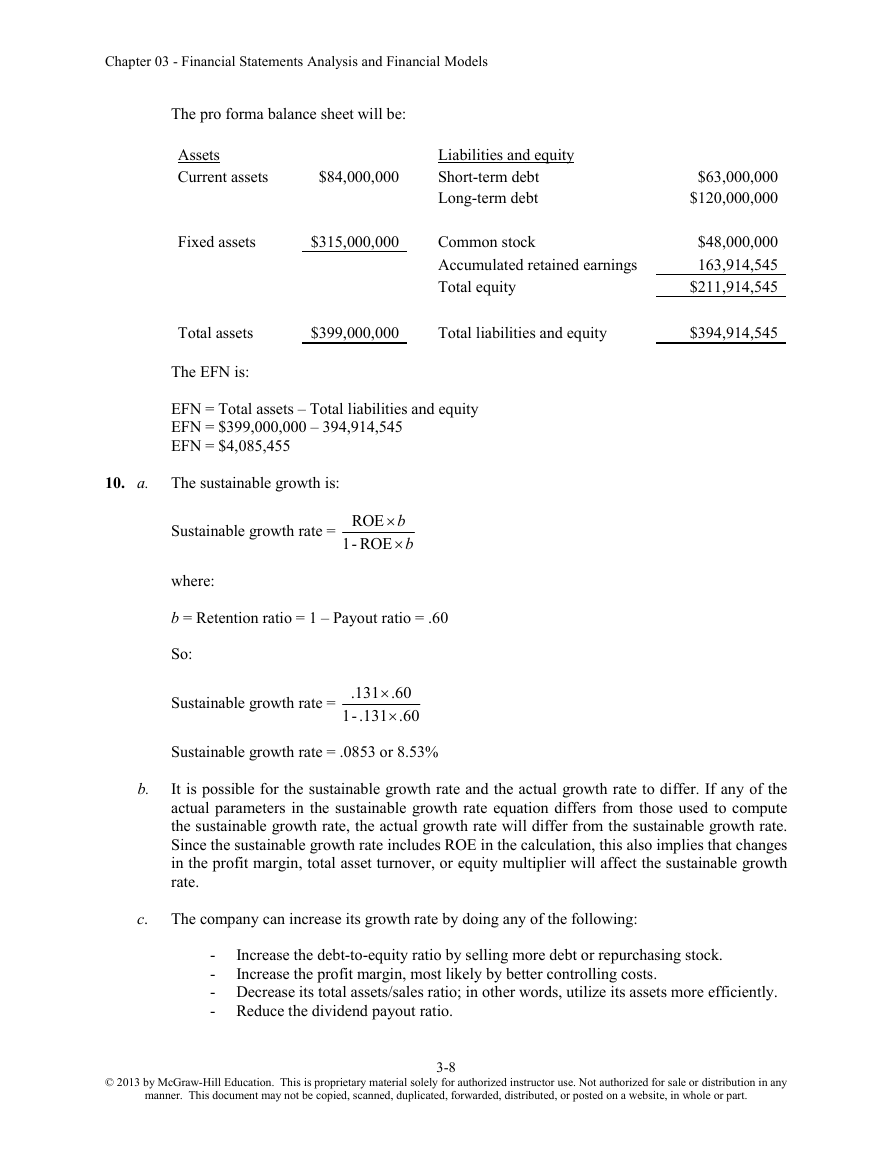

The pro forma balance sheet will be:

Assets

Current assets

$84,000,000

Fixed assets

$315,000,000

Liabilities and equity

Short-term debt

Long-term debt

Common stock

Accumulated retained earnings

Total equity

$63,000,000

$120,000,000

$48,000,000

163,914,545

$211,914,545

Total assets

$399,000,000

Total liabilities and equity

$394,914,545

The EFN is:

EFN = Total assets – Total liabilities and equity

EFN = $399,000,000 – 394,914,545

EFN = $4,085,455

10. a.

The sustainable growth is:

Sustainable growth rate =

ROE

b

ROE

- 1

b

where:

b = Retention ratio = 1 – Payout ratio = .60

So:

Sustainable growth rate =

.131

.60

.60

.131

- 1

Sustainable growth rate = .0853 or 8.53%

b.

It is possible for the sustainable growth rate and the actual growth rate to differ. If any of the

actual parameters in the sustainable growth rate equation differs from those used to compute

the sustainable growth rate, the actual growth rate will differ from the sustainable growth rate.

Since the sustainable growth rate includes ROE in the calculation, this also implies that changes

in the profit margin, total asset turnover, or equity multiplier will affect the sustainable growth

rate.

c.

The company can increase its growth rate by doing any of the following:

Increase the debt-to-equity ratio by selling more debt or repurchasing stock.

Increase the profit margin, most likely by better controlling costs.

-

-

- Decrease its total assets/sales ratio; in other words, utilize its assets more efficiently.

- Reduce the dividend payout ratio.

© 2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3-8

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc