CFA Institute

Chartered Financial Analyst® Examination

2018 Essay Mock Exam

Guideline Answers

The following is provided for informational purposes only and may not be used in any commercial manner without prior

written permission from CFA Institute. © 2018 CFA Institute. All Rights Reserved.

2018 Level III Guideline Answers

Morning Session - Page 1 of 47

�

#1

Equity

20

LEVEL III

Question:

Topic:

Minutes:

Reading References:

#26 − “Introduction to Equity Portfolio Management,” James Clunie, and James Alan Finnegan

#27 − “Passive Equity Investing,” David M. Smith and Kevin Yousif

#28 − “Active Equity Investing: Strategies,” Bing Li, Yin Luo, and Pranay Gupta

#29 − “Active Equity Investing: Portfolio Construction,” Jacques Lussier and Marc Reinganum

LOS:

#26: The candidate should be able to:

a. describe the roles of equities in the overall portfolio;

b. describe how an equity manager’s investment universe can be segmented;

c. describe the types of income and costs associated with owning and managing an equity portfolio and their

potential effects on portfolio performance;

d. describe the potential benefits of shareholder engagement and the role an equity manager might play in

shareholder engagement;

e. describe rationales for equity investment across the passive–active

spectrum.

#27: The candidate should be able to:

a. discuss considerations in choosing a benchmark for a passively managed equity portfolio;

b. compare passive factor-based strategies to market-capitalization-weighted indexing;

c. compare different approaches to passive equity investing;

d. compare the full replication, stratified sampling, and optimization approaches for the construction of

passively managed equity portfolios;

e. discuss potential causes of tracking error and methods to control tracking error for passively managed equity

f. explain sources of return and risk to a passively managed equity portfolio.

portfolios;

#28: The candidate should be able to:

a. compare fundamental and quantitative approaches to active management;

b. analyze bottom-up active strategies, including their rationale and associated processes;

c. analyze top-down active strategies, including their rationale and associated processes;

d. analyze factor-based active strategies, including their rationale and associated processes;

e. analyze activist strategies, including their rationale and associated processes;

f. describe active strategies based on statistical arbitrage and market microstructure;

g. describe how fundamental active investment strategies are created;

h. describe how quantitative active investment strategies are created;

i. discuss equity investment style classifications.

2018 Level III Guideline Answers

Morning Session - Page 2 of 47

�

LEVEL III

Question:

Topic:

Minutes:

#29: The candidate should be able to:

#1

Equity

20

a. describe elements of a manager’s investment philosophy that influence the portfolio construction process;

b. discuss approaches for constructing actively managed equity portfolios;

c. distinguish between Active Share and active risk and discuss how each measure relates to a manager’s

investment strategy;

d. discuss the application of risk budgeting concepts in portfolio construction;

e. discuss risk measures that are incorporated in equity portfolio construction and describe how limits set on

f. discuss how assets under management, position size, market liquidity, and portfolio turnover affect equity

these measures affect portfolio construction;

portfolio construction decisions;

g. evaluate the efficiency of a portfolio structure given its investment mandate;

h. discuss the long-only, long extension, long/short, and equitized market-neutral approaches to equity portfolio

construction, including their risks, costs, and effects on potential alphas.

2018 Level III Guideline Answers

Morning Session - Page 3 of 47

�

Answer Question 1-A on This Page

Justify, with three reasons based only on Välimaa’s notes, why the use of the passive investment approach is

appropriate for the Fund’s portfolio.

The passive investment approach is appropriate for the Fund’s portfolio for the following three reasons:

• The passive approach typically has low turnover and generates lower capital gains relative to active

strategies. Since the Fund is taxed on investment income, the passive approach would likely result in lower

taxes.

• The Fund’s investment committee members believe that equity markets are highly efficient, suggesting that

a manager’s ability to generate alpha may be limited. An efficient market with limited alpha generation

potential supports the use of the passive investment approach.

• The Fund’s investment committee mandates that the portfolio shall have minimum tracking risk. The

passive approach provides low tracking risk relative to an active approach. In particular, indexing has the

goal of minimizing tracking error, subject to realistic portfolio constraints.

2018 Level III Guideline Answers

Morning Session - Page 4 of 47

�

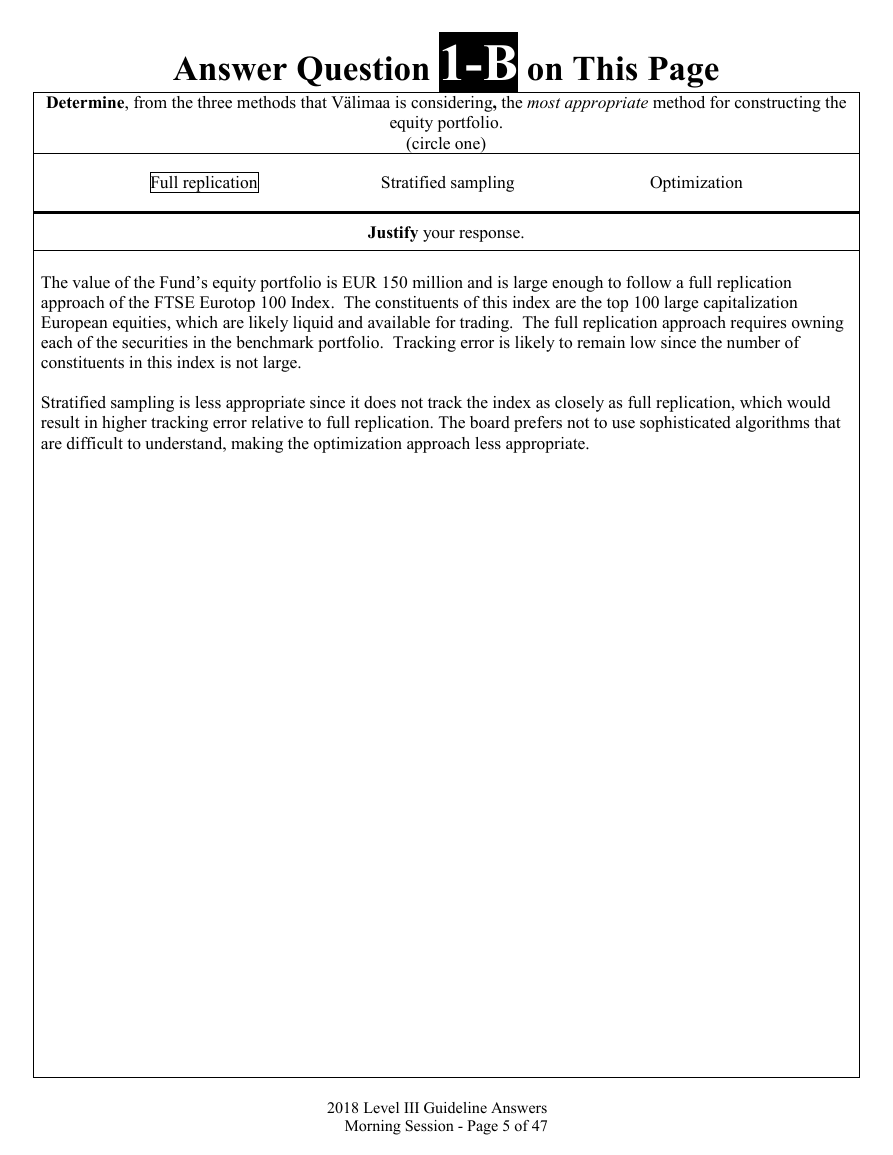

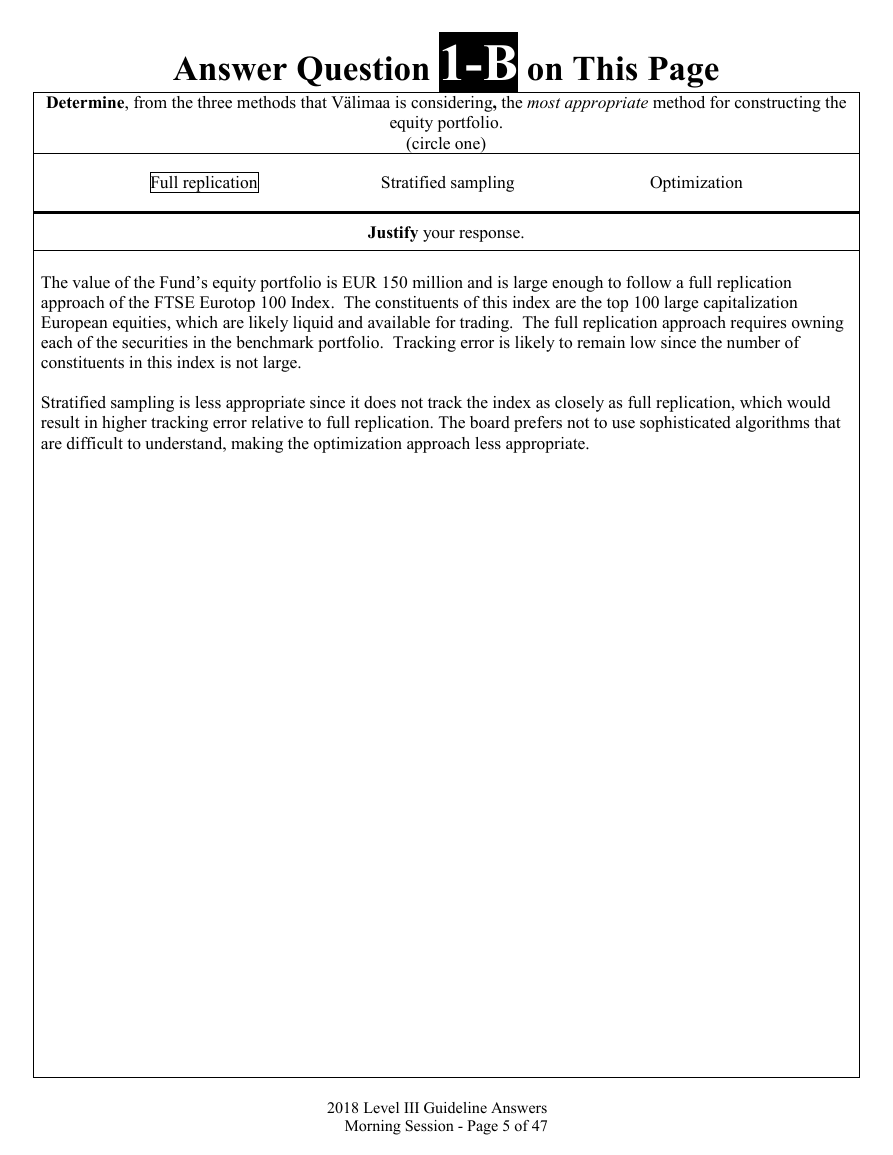

Answer Question 1-B on This Page

Determine, from the three methods that Välimaa is considering, the most appropriate method for constructing the

equity portfolio.

(circle one)

Full replication Stratified sampling Optimization

Justify your response.

The value of the Fund’s equity portfolio is EUR 150 million and is large enough to follow a full replication

approach of the FTSE Eurotop 100 Index. The constituents of this index are the top 100 large capitalization

European equities, which are likely liquid and available for trading. The full replication approach requires owning

each of the securities in the benchmark portfolio. Tracking error is likely to remain low since the number of

constituents in this index is not large.

Stratified sampling is less appropriate since it does not track the index as closely as full replication, which would

result in higher tracking error relative to full replication. The board prefers not to use sophisticated algorithms that

are difficult to understand, making the optimization approach less appropriate.

2018 Level III Guideline Answers

Morning Session - Page 5 of 47

�

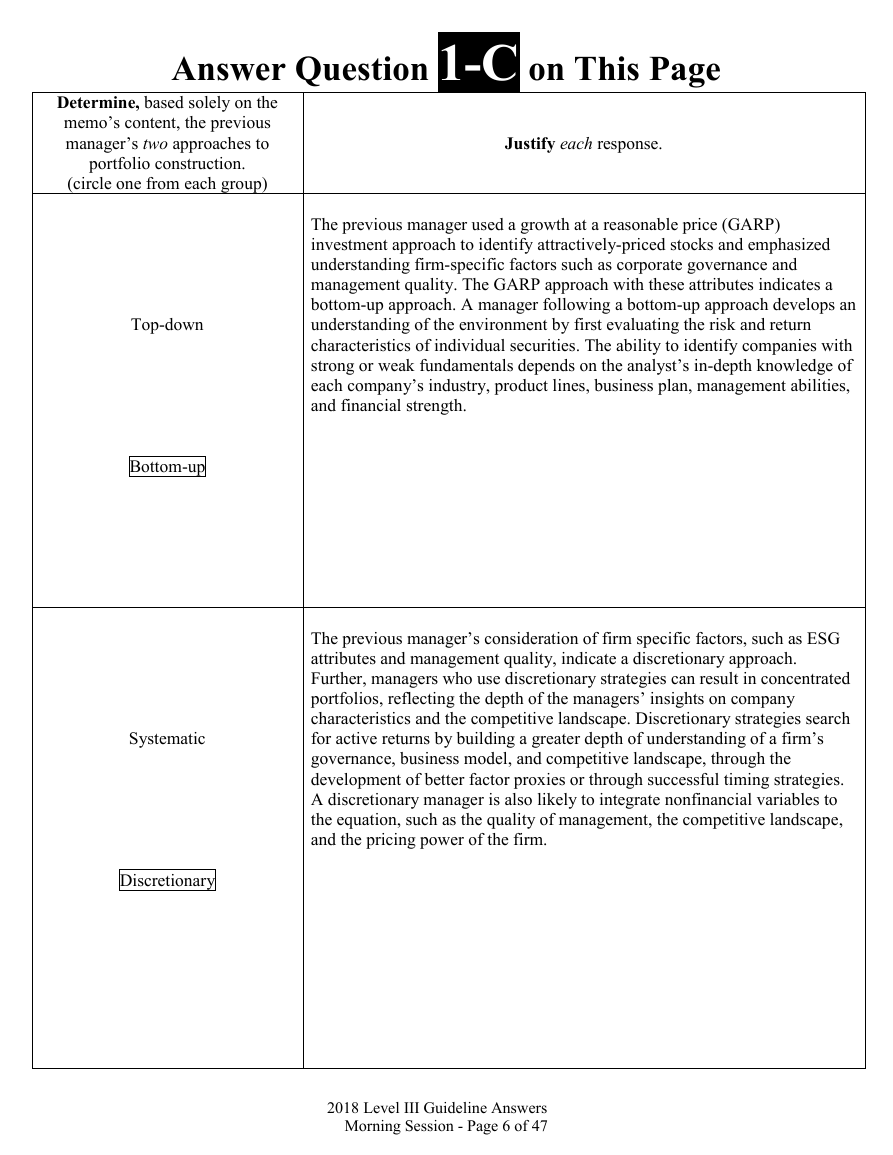

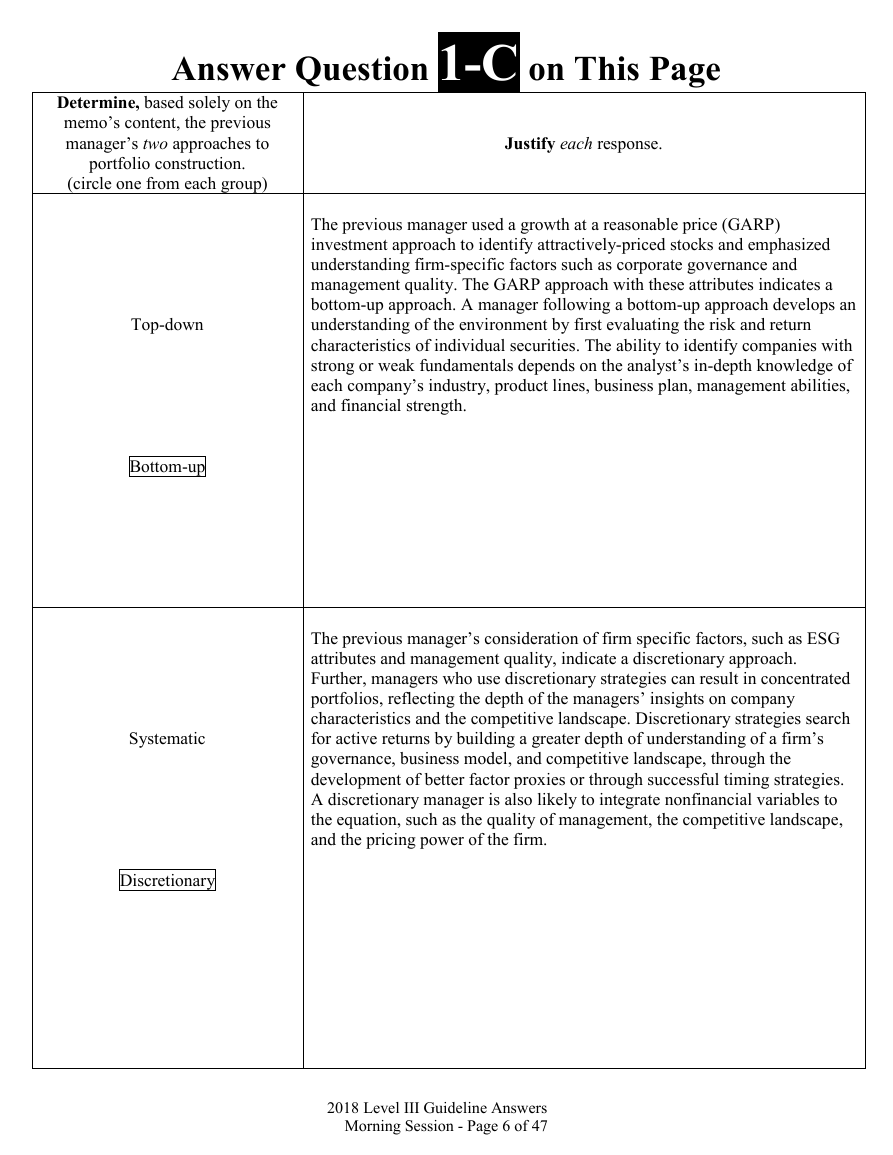

Answer Question 1-C on This Page

Determine, based solely on the

memo’s content, the previous

manager’s two approaches to

portfolio construction.

(circle one from each group)

Justify each response.

The previous manager used a growth at a reasonable price (GARP)

investment approach to identify attractively-priced stocks and emphasized

understanding firm-specific factors such as corporate governance and

management quality. The GARP approach with these attributes indicates a

bottom-up approach. A manager following a bottom-up approach develops an

understanding of the environment by first evaluating the risk and return

characteristics of individual securities. The ability to identify companies with

strong or weak fundamentals depends on the analyst’s in-depth knowledge of

each company’s industry, product lines, business plan, management abilities,

and financial strength.

The previous manager’s consideration of firm specific factors, such as ESG

attributes and management quality, indicate a discretionary approach.

Further, managers who use discretionary strategies can result in concentrated

portfolios, reflecting the depth of the managers’ insights on company

characteristics and the competitive landscape. Discretionary strategies search

for active returns by building a greater depth of understanding of a firm’s

governance, business model, and competitive landscape, through the

development of better factor proxies or through successful timing strategies.

A discretionary manager is also likely to integrate nonfinancial variables to

the equation, such as the quality of management, the competitive landscape,

and the pricing power of the firm.

2018 Level III Guideline Answers

Morning Session - Page 6 of 47

Top-down

Bottom-up

Systematic

Discretionary

�

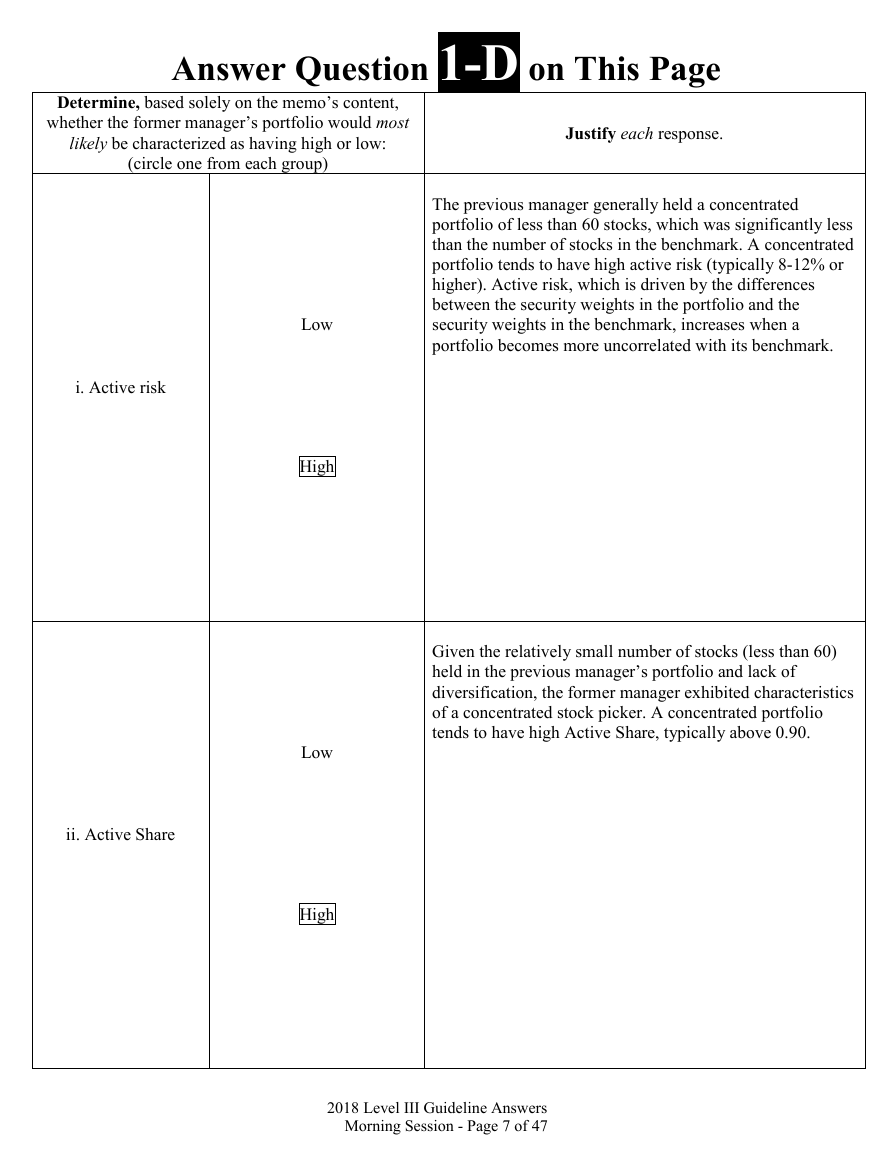

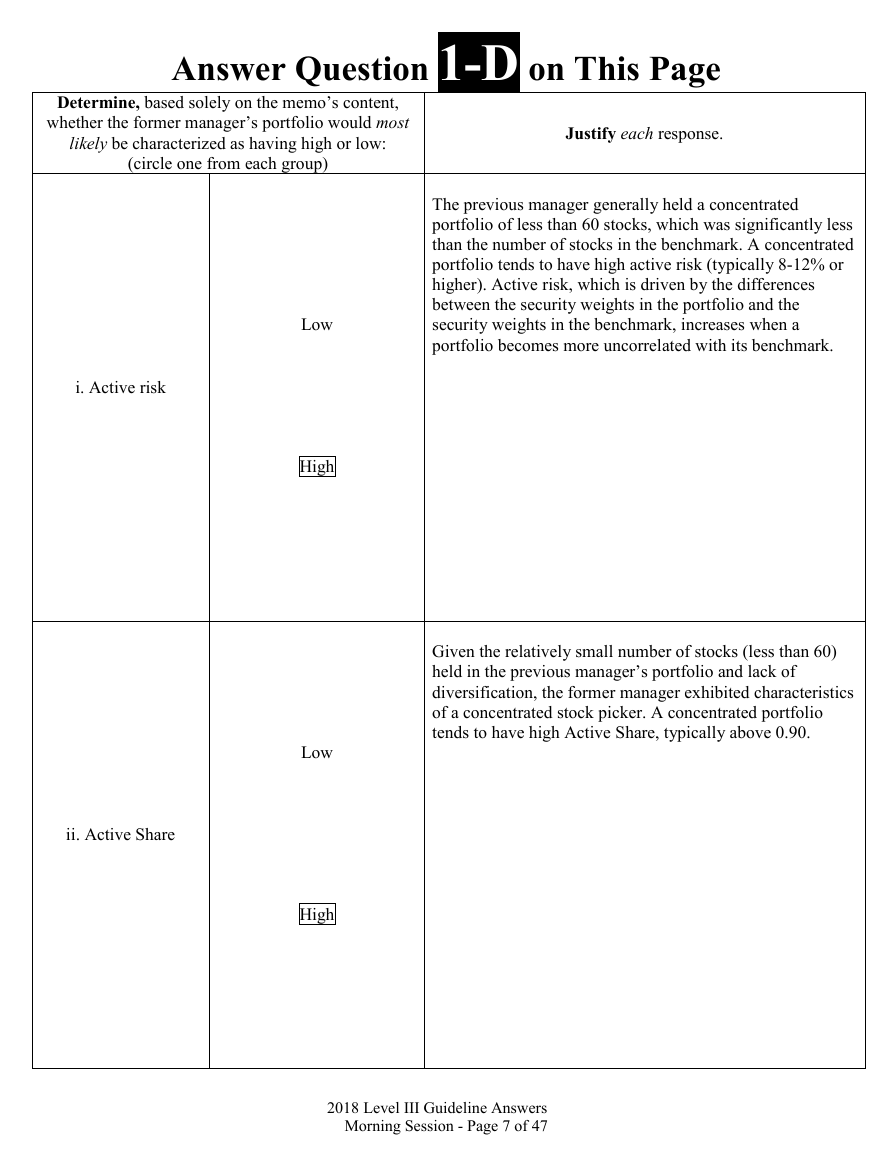

Answer Question 1-D on This Page

Determine, based solely on the memo’s content,

whether the former manager’s portfolio would most

likely be characterized as having high or low:

(circle one from each group)

Justify each response.

The previous manager generally held a concentrated

portfolio of less than 60 stocks, which was significantly less

than the number of stocks in the benchmark. A concentrated

portfolio tends to have high active risk (typically 8-12% or

higher). Active risk, which is driven by the differences

between the security weights in the portfolio and the

security weights in the benchmark, increases when a

portfolio becomes more uncorrelated with its benchmark.

Given the relatively small number of stocks (less than 60)

held in the previous manager’s portfolio and lack of

diversification, the former manager exhibited characteristics

of a concentrated stock picker. A concentrated portfolio

tends to have high Active Share, typically above 0.90.

Low

High

Low

High

i. Active risk

ii. Active Share

2018 Level III Guideline Answers

Morning Session - Page 7 of 47

�

#2

Economics

15

Question:

Topic:

Minutes:

Reading References:

#14 – Capital Market Expectations by John P. Calverley, Alan M. Meder, CPA, CFA, Brian D.

Singer, CFA, and Renato Staub, PhD

LOS:

#14: The candidate should be able to:

a. discuss the role of, and a framework for, capital market expectations in the portfolio management

process;

b. discuss challenges in developing capital market forecasts;

c. demonstrate the application of formal tools for setting capital market expectations, including

statistical tools, discounted cash flow models, the risk premium approach, and financial equilibrium

models;

d. explain the use of survey and panel methods and judgment in setting capital market expectations;

e. discuss the inventory and business cycles and the effects that consumer and business spending and

monetary and fiscal policy have on the business cycle;

f. discuss the effects that the phases of the business cycle have on short-term/long-term capital

market returns;

g. explain the relationship of inflation to the business cycle and the implications of inflation for cash,

bonds, equity, and real estate returns;

h. demonstrate the use of the Taylor rule to predict central bank behavior;

i.

interpret the shape of the yield curve as an economic predictor and discuss the relationship

between the yield curve and fiscal and monetary policy;

identify and interpret the components of economic growth trends and demonstrate the application of

economic growth trend analysis to the formulation of capital market expectations;

j.

k. explain how exogenous shocks may affect economic growth trends;

l.

m. discuss the risks faced by investors in emerging-market securities and the country risk analysis techniques

identify and interpret macroeconomic, interest rate, and exchange rate linkages between economies;

used to evaluate emerging market economies;

n. compare the major approaches to economic forecasting;

o. demonstrate the use of economic information in forecasting asset class returns;

p. explain how economic and competitive factors can affect investment markets, sectors, and specific

securities;

q. discuss the relative advantages and limitations of the major approaches to forecasting exchange rates;

r. recommend and justify changes in the component weights of a global investment portfolio based on trends and

expected changes in macroeconomic factors.

2018 Level III Guideline Answers

Morning Session - Page 8 of 47

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc