Cover

Title Page

Copyright Page

About the Authors

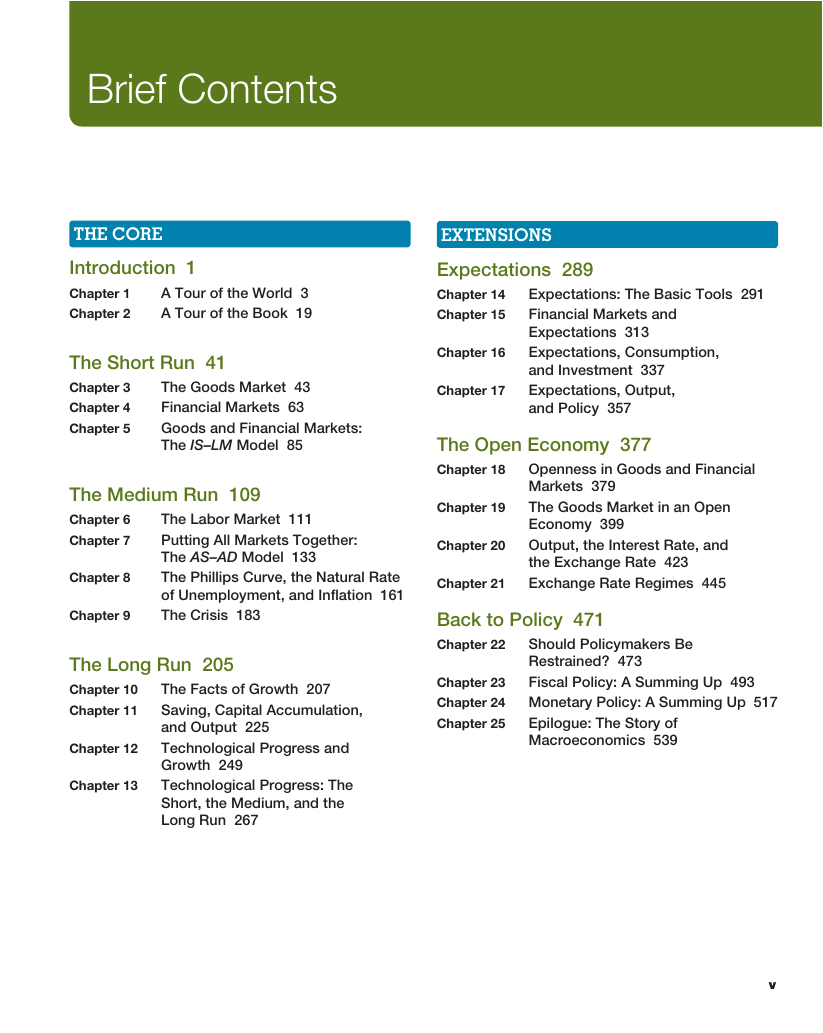

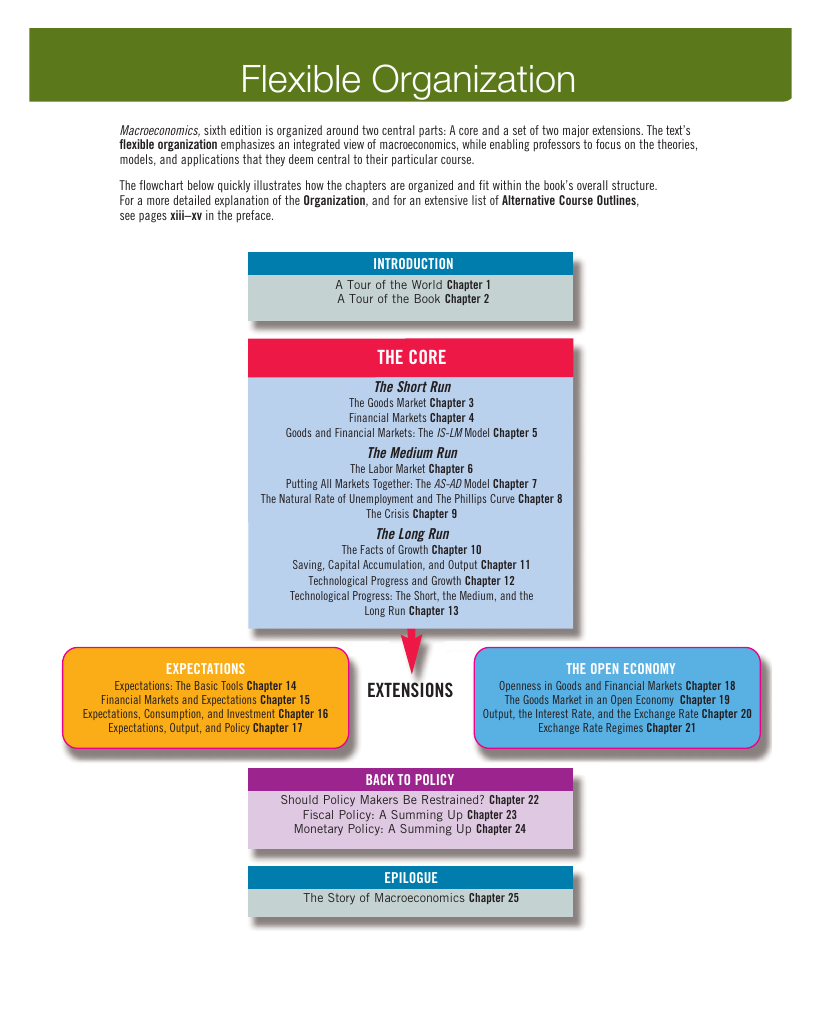

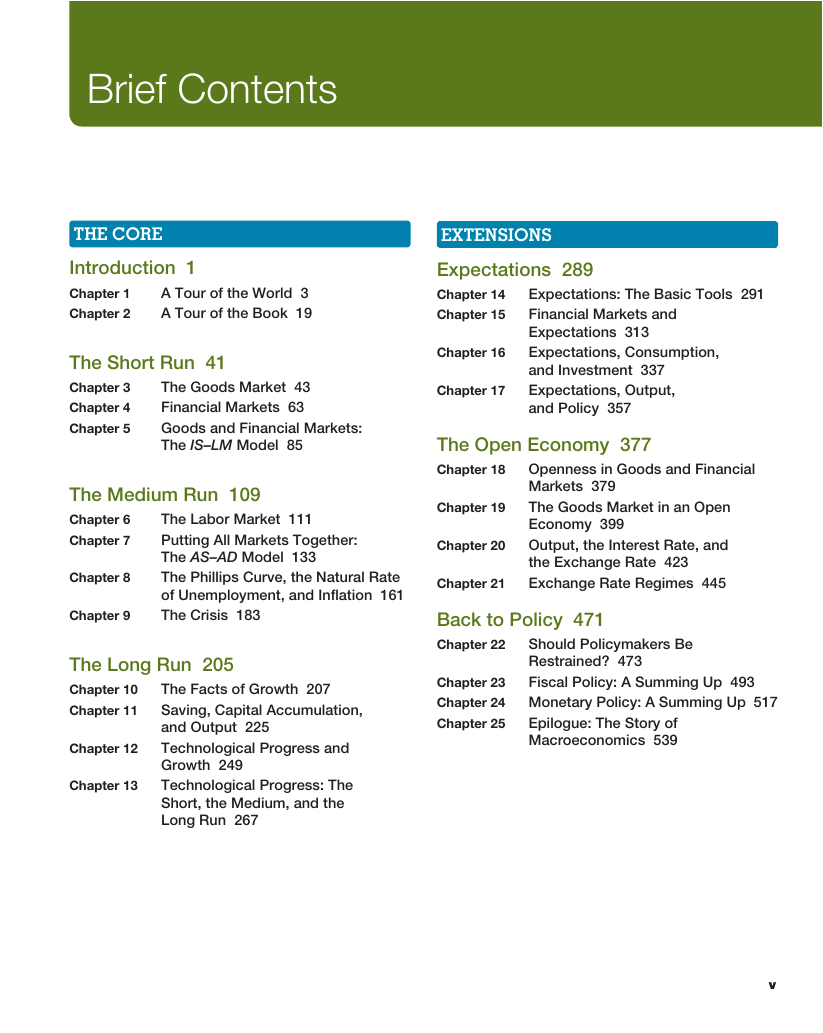

Contents

Preface

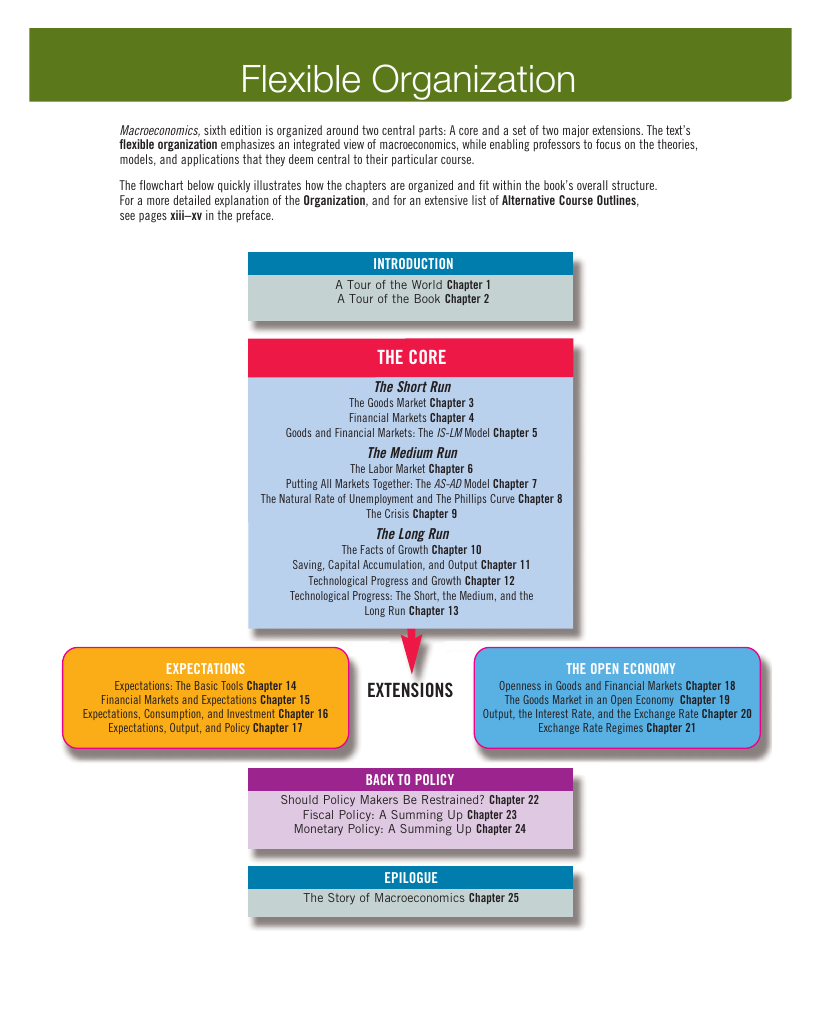

THE CORE

Introduction

Chapter 1 A Tour of the World

1-1 The Crisis

1-2 The United States

1-3 The Euro Area

1-4 China

1-5 Looking Ahead

Appendix: Where to Find the Numbers

Chapter 2 A Tour of the Book

2-1 Aggregate Output

2-2 The Unemployment Rate

2-3 The Inflation Rate

2-4 Output, Unemployment, and the Inflation Rate: Okun’s Law and the Phillips Curve

2-5 The Short Run, the Medium Run, the Long Run

2-6 A Tour of the Book

Appendix: The Construction of Real GDP, and Chain-Type Indexes

The Short Run

Chapter 3 The Goods Market

3-1 The Composition of GDP

3-2 The Demand for Goods

3-3 The Determination of Equilibrium Output

3-4 Investment Equals Saving: An Alternative Way of Thinking about Goods—Market Equilibrium

3-5 Is the Government Omnipotent? A Warning

Chapter 4 Financial Markets

4-1 The Demand for Money

4-2 Determining the Interest Rate: I

4-3 Determining the Interest Rate: II

4-4 Two Alternative ways of looking at the Equilibrium

Chapter 5 Goods and Financial Markets: The IS-LM Model

5-1 The Goods Market and the IS Relation

5-2 Financial Markets and the LM Relation

5-3 Putting the IS and the LM Relations Together

5-4 Using a Policy Mix

5-5 How Does the IS-LM Model Fit the Facts?

Appendix: An Alternative Derivation of the LM Relation as an Interest Rate Rule

The Medium Run

Chapter 6 The Labor Market

6-1 A Tour of the Labor Market

6-2 Movements in Unemployment

6-3 Wage Determination

6-4 Price Determination

6-5 The Natural Rate of Unemployment

6-6 Where We Go from Here

Appendix: Wage- and Price-Setting Relations versus Labor Supply and Labor Demand

Chapter 7 Putting All Markets Together: The AS–AD Model

7-1 Aggregate Supply

7-2 Aggregate Demand

7-3 Equilibrium in the Short Run and in the Medium Run

7-4 The Effects of a Monetary Expansion

7-5 A Decrease in the Budget Deficit

7-6 An Increase in the Price of Oil

7-7 Conclusions

Chapter 8 The Phillips Curve, the Natural Rate of Unemployment, and Inflation

8-1 Inflation, Expected Inflation, and Unemployment

8-2 The Phillips Curve

8-3 A Summary and Many Warnings

Appendix: From the Aggregate Supply Relation to a Relation between Inflation, Expected Inflation, and Unemployment

Chapter 9 The Crisis

9-1 From a Housing Problem to a Financial Crisis

9-2 The Use and Limits of Policy

9-3 The Slow Recovery

The Long Run

Chapter 10 The Facts of Growth

10-1 Measuring the Standard of Living

10-2 Growth in Rich Countries since 1950

10-3 A Broader Look across Time and Space

10-4 Thinking About Growth: A Primer

Chapter 11 Saving, Capital Accumulation, and Output

11-1 Interactions between Output and Capital

11-2 The Implications of Alternative Saving Rates

11-3 Getting a Sense of Magnitudes

11-4 Physical versus Human Capital

Appendix: The Cobb-Douglas Production Function and the Steady State

Chapter 12 Technological Progress and Growth

12-1 Technological Progress and the Rate of Growth

12-2 The Determinants of Technological Progress

12-3 The Facts of Growth Revisited

Appendix: Constructing a Measure of Technological Progress

Chapter 13 Technological Progress: The Short, the Medium, and the Long Run

13-1 Productivity, Output, and Unemployment in the Short Run

13-2 Productivity and the Natural Rate of Unemployment

13-3 Technological Progress, Churning, and Distribution Effects

13-4 Institutions, Technological Progress, and Growth

EXTENSIONS

Expectations

Chapter 14 Expectations: The Basic Tools

14-1 Nominal versus Real Interest Rates

14-2 Nominal and Real Interest Rates, and the IS–LM Model

14-3 Money Growth, Inflation, Nominal and Real Interest Rates

14-4 Expected Present Discounted Values

Appendix: Deriving the Expected Present Discounted Value Using Real or Nominal Interest Rates

Chapter 15 Financial Markets and Expectations

15-1 Bond Prices and Bond Yields

15-2 The Stock Market and Movements in Stock Prices

15-3 Risk, Bubbles, Fads, and Asset Prices

Chapter 16 Expectations, Consumption, and Investment

16-1 Consumption

16-2 Investment

16-3 The Volatility of Consumption and Investment

Appendix: Derivation of the Expected Present Value of Profits under Static Expectations

Chapter 17 Expectations, Output, and Policy

17-1 Expectations and Decisions: Taking Stock

17-2 Monetary Policy, Expectations, and Output

17-3 Deficit Reduction, Expectations, and Output

The Open Economy

Chapter 18 Openness in Goods and Financial Markets

18-1 Openness in Goods Markets

18-2 Openness in Financial Markets

18-3 Conclusions and a Look Ahead

Chapter 19 The Goods Market in an Open Economy

19-1 The IS Relation in the Open Economy

19-2 Equilibrium Output and the Trade Balance

19-3 Increases in Demand, Domestic or Foreign

19-4 Depreciation, the Trade Balance, and Output

19-5 Looking at Dynamics: The J-Curve

19-6 Saving, Investment, and the Current Account Balance

Appendix: Derivation of the Marshall-Lerner Condition

Chapter 20 Output, the Interest Rate, and the Exchange Rate

20-1 Equilibrium in the Goods Market

20-2 Equilibrium in Financial Markets

20-3 Putting Goods and Financial Markets Together

20-4 The Effects of Policy in an Open Economy

20-5 Fixed Exchange Rates

Appendix: Fixed Exchange Rates, Interest Rates, and Capital Mobility

Chapter 21 Exchange Rate Regimes

21-1 The Medium Run

21-2 Exchange Rate Crises under Fixed Exchange Rates

21-3 Exchange Rate Movements under Flexible Exchange Rates

21-4 Choosing between Exchange Rate Regimes

Appendix 1: Deriving Aggregate Demand under Fixed Exchange Rates

Appendix 2: The Real Exchange Rate and Domestic and Foreign Real Interest Rates

Back to Policy

Chapter 22 Should Policy Makers Be Restrained?

22-1 Uncertainty and Policy

22-2 Expectations and Policy

22-3 Politics and Policy

Chapter 23 Fiscal Policy: A Summing Up

23-1 What We Have Learned

23-2 The Government Budget Constraint: Deficits, Debt, Spending, and Taxes

23-3 Ricardian Equivalence, Cyclical Adjusted Deficits, and War Finance

23-4 The Dangers of High Debt

Chapter 24 Monetary Policy: A Summing Up

24-1 What We Have Learned

24-2 The Optimal Inflation Rate

24-3 The Design of Monetary Policy

24-4 Challenges from the Crisis

Chapter 25 Epilogue: The Story of Macroeconomics

25-1 Keynes and the Great Depression

25-2 The Neoclassical Synthesis

25-3 The Rational Expectations Critique

25-4 Developments in Macroeconomics to the 2009 Crisis

25-5 First Lessons for Macro-economics after the Crisis

Appendix 1 An Introduction to National Income and Product Accounts

Appendix 2 A Math Refresher

Appendix 3 An Introduction to Econometrics

Glossary

A

B

C

D

E

F

G

H

I

J

L

M

N

O

P

Q

R

S

T

U

V

W

Y

Index

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

Y

Z

Credits

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc