Slide Number 1

Slide Number 2

“We use CB Insights to find emerging trends �and interesting companies that might signal a shift in technology or require us to reallocate resources.”

The CBI Community — Membership Has Benefits�events.cbinsights.com

Slide Number 5

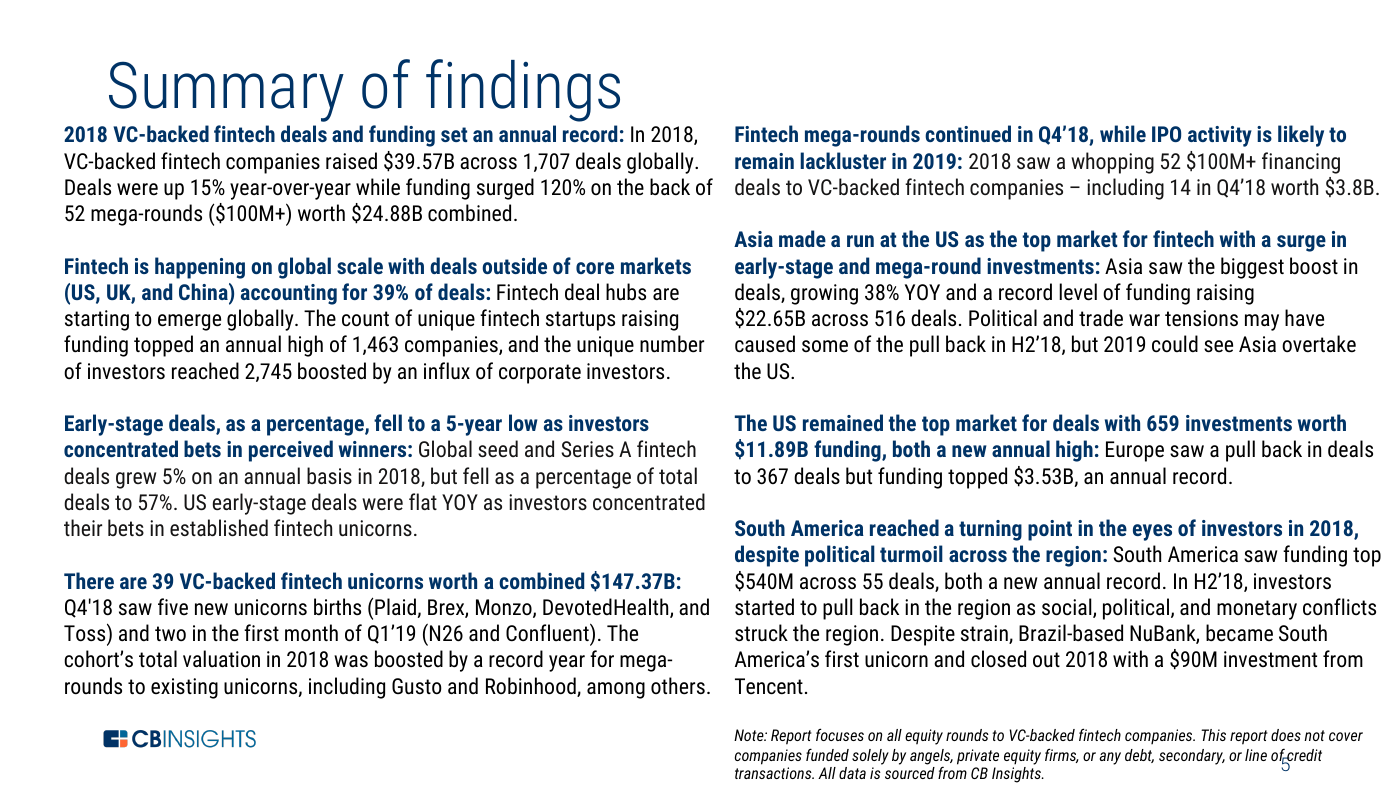

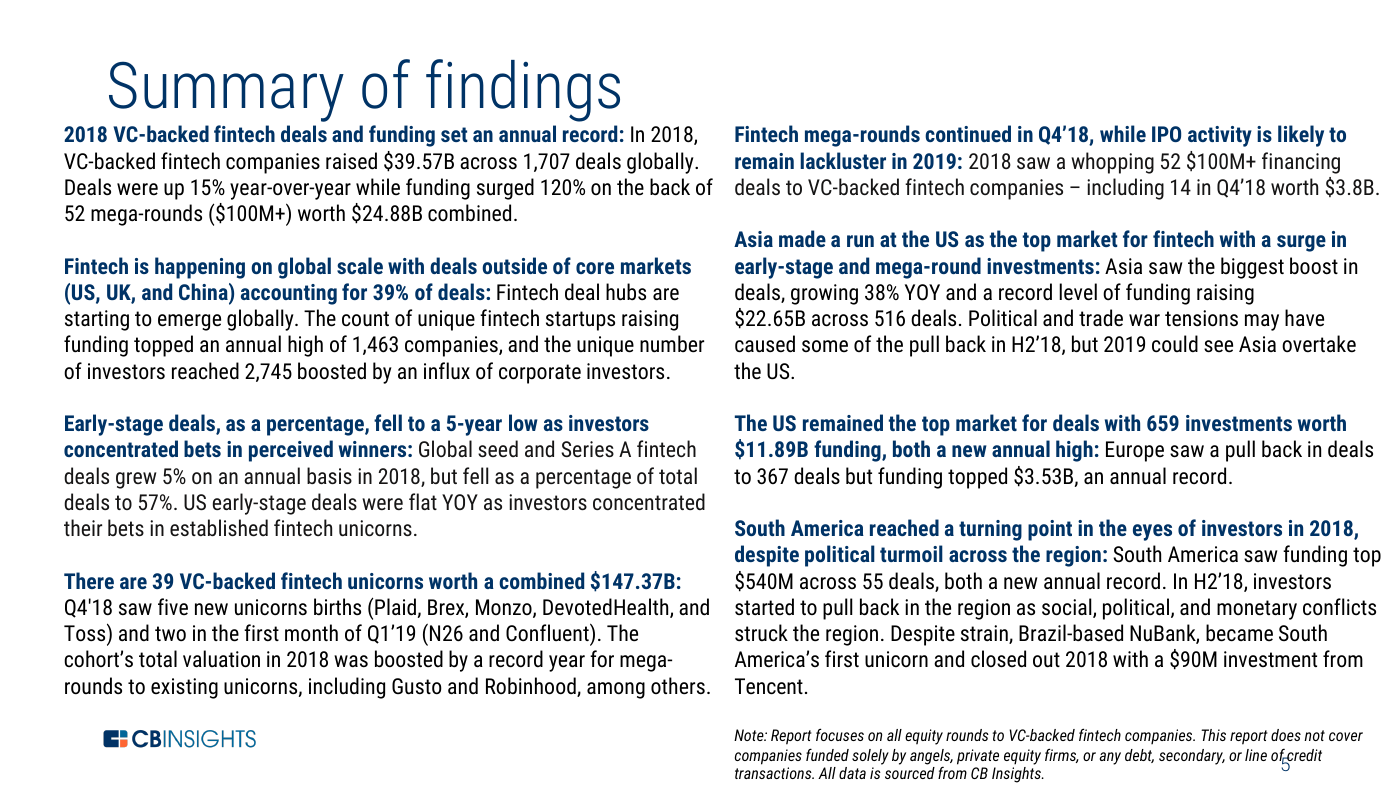

Summary of findings

Slide Number 7

Slide Number 8

First, a look at what happened in 2018…

Global fintech investment tops $39B in 2018

Ant Financial’s $14B investment accounted for 35% of total funding in 2018

VC-backed fintech deals declined in Q4’18 but remain above 2017 levels

North America is no longer powering global fintech funding growth

Deals grew in every market except Europe in 2018

Early-stage fintech deal share falls for the 5th year

39 FINTECH UNICORNS� �$147.37 BILLION

39 fintech unicorns valued at $147.37B

16 fintech unicorn births in 2018

2018: 52 fintech mega-rounds total $24.88B

A third of global fintech deals include a CVC

Traditional hubs no longer power fintech growth

Slide Number 22

Slide Number 23

Slide Number 24

The battle for deposits

Fintech firms look for their second act

Fintech moves from mono-line to multi-line

Banking-as-a-service platforms facilitate US fintech companies to expand to bank accounts

Abroad, fintech firms are looking to build their own chartered banks

The battle for distribution will start with deposits

Fintech firms up focus on regulatory compliance

Emboldened regulators globally are…

Regulators are upping oversight on bad actors, issuing massive “unicorn” level fines

Regulators are increasing their scrutiny of high-profile consumer fintech challengers

“I disagree with the statement that these funds are protected by SIPC. Had they called us, I would have told them what I just told you in that �I have serious concerns about this. This has gigantic ramifications for the banking industry.”

But regulators have also lowered barriers

As tech startups take advantage of open banking access, they will need in-house regulatory teams

Southeast Asia sees hotbed of fintech activity

Fintech in Southeast Asia is heating up with record year for deals and funding, up 143% YOY

Southeast Asia fintech startups are attracting bigger financings and foreign investors

Ant Financial is becoming more aggressive in expanding its reach in Southeast Asia

Ride-hailing platforms may end up as biggest fintech winners in Southeast Asia

The next Ant Financial & WeChat Pay

QR codes are the entry point to digital payments

Alipay and WeChat Pay are leading China’s transition to a cashless economy

Fintech is powering the growth of MercadoLibre in Latin America

Line is looking to build an ecosystem resembling Alipay/WeChat Pay in Japan

Grab and Go-Jek have emerged as leading mobile payments players in Southeast Asia

Unbundling the paycheck

Household debt balances have accelerated and total over $13 trillion

First, startups went direct to consumer to head off debt

Fintech firms are unbundling the paycheck to alleviate and prevent predatory debt

Startups are partnering with employers to offer salary linked benefits

Slide Number 54

New investment platforms and asset classes

Fintech is democratizing investing

Alternative investment apps will continue to rise in prominence among next-gen investors

New investment models will be created to open up markets and create asset classes

Startups borrowing existing biz models to open up real estate investing to retail investors

Fintech meets reale state

Slide Number 61

Mortgage debt dwarfs all others categories

First, fintech startups digitize the mortgage lifecycle and created alternative lending platforms

As home values rise, fintech is moving into home equity

And abstracting away the mortgage as startups look to make cash offers for home buyers

Rent-to-buy: Startups look to enable gradual home equity ownership

Fintech is integrating home insurance deeper into the home buying process

Startups look to disrupt the $15B title insurance market

Rise of impact fintech

“Going green” is not new, but there is renewed demand driving how ESG scales

Impact investing and ESG are on the rise

Global sustainability goals will be top of mind for policy makers, but measuring progress is subjective

Quantifying progress and impact is subjective because there is no “gold standard” of green data

Slide Number 74

With $30T from the ‘great wealth transfer,’ millennials will expect choices that have a positive ROI & impact

The first layer of impact fintechs are establishing green data credibility for financial services firms

The next layer of impact fintech will establish credibility with next-gen investors, ahead of wealth transfer

Lack of fintech M&A by banks continues

Slide Number 79

2018 saw banks launch a wave of digital products

But while banks continue to embrace mobile banking…

..incumbents still miss on mobile UX/UI, a key to acquiring and engaging next-gen customers

Banks will remain trigger shy on acquisitions

No-go for fintech IPOs

2018 started the year with 25 unicorns valued at $75.9B

Despite hype, only three fintech unicorns went public

Adyen makes record public debut in Europe

Alternative lenders ‘bear’ market volatility

Record fintech mega-rounds will likely delay IPOs�

Slide Number 90

2018 global fintech �year-in-review

$11.89 BILLION� �659 DEALS

US fintech funding hits 5-year high as $100M mega-rounds tops record

Slide Number 94

$22.65 BILLION� �516 DEALS

Fintech funding in Asia spikes to $22.6B on the back of $14B Ant Financial investment

$3.53 Billion� �367 DEALS

Fintech deals in Europe level off, as funding hits $3.5B in 2018

Slide Number 99

Slide Number 100

Top 11 global fintech deals in 2018

Top 11 global fintech deals in 2018

The most active fintech VCs in 2018

The most active fintech VCs in 2018 (continued)

Methodology

Slide Number 106

Switch.pdf

Traditional hubs no longer power fintech growth

Traditional hubs no longer power fintech growth

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc