To the Shareholders of Berkshire Hathaway Inc.:

Our gain in net worth during 1984 was $152.6 million, or

$133 per share. This sounds pretty good but actually it’s

mediocre. Economic gains must be evaluated by comparison with

the capital that produces them. Our twenty-year compounded

annual gain in book value has been 22.1% (from $19.46 in 1964 to

$1108.77 in 1984), but our gain in 1984 was only 13.6%.

As we discussed last year, the gain in per-share intrinsic

business value is the economic measurement that really counts.

But calculations of intrinsic business value are subjective. In

our case, book value serves as a useful, although somewhat

understated, proxy. In my judgment, intrinsic business value and

book value increased during 1984 at about the same rate.

Using my academic voice, I have told you in the past of the

drag that a mushrooming capital base exerts upon rates of return.

Unfortunately, my academic voice is now giving way to a

reportorial voice. Our historical 22% rate is just that -

history. To earn even 15% annually over the next decade

(assuming we continue to follow our present dividend policy,

about which more will be said later in this letter) we would need

profits aggregating about $3.9 billion. Accomplishing this will

require a few big ideas - small ones just won’t do. Charlie

Munger, my partner in general management, and I do not have any

such ideas at present, but our experience has been that they pop

up occasionally. (How’s that for a strategic plan?)

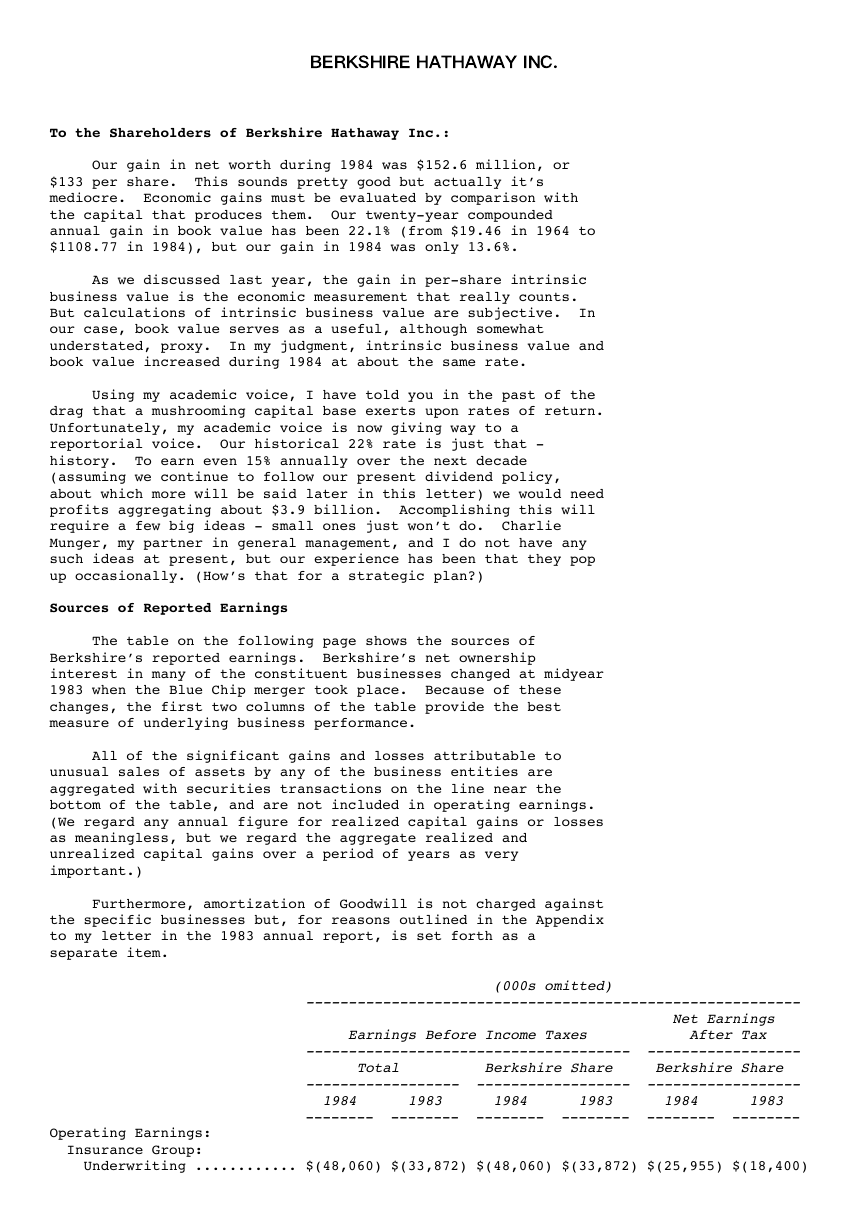

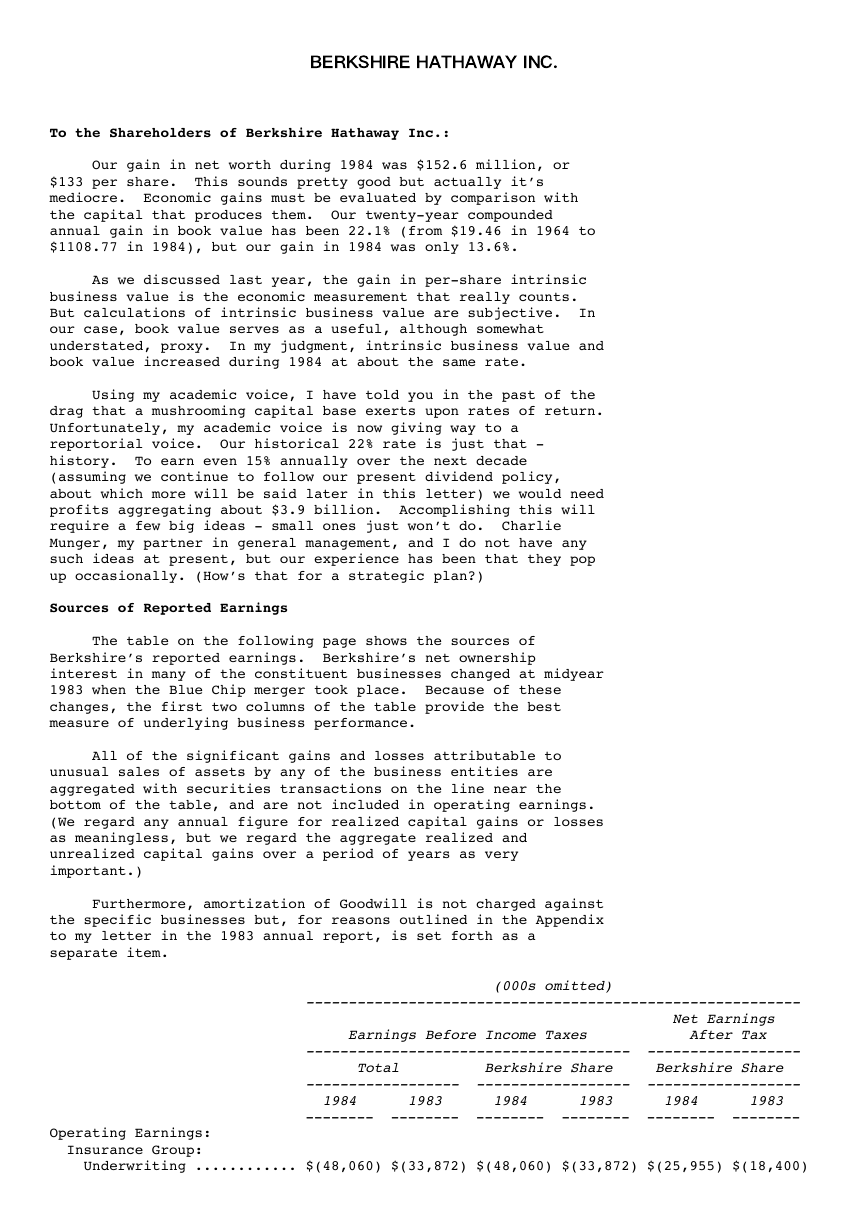

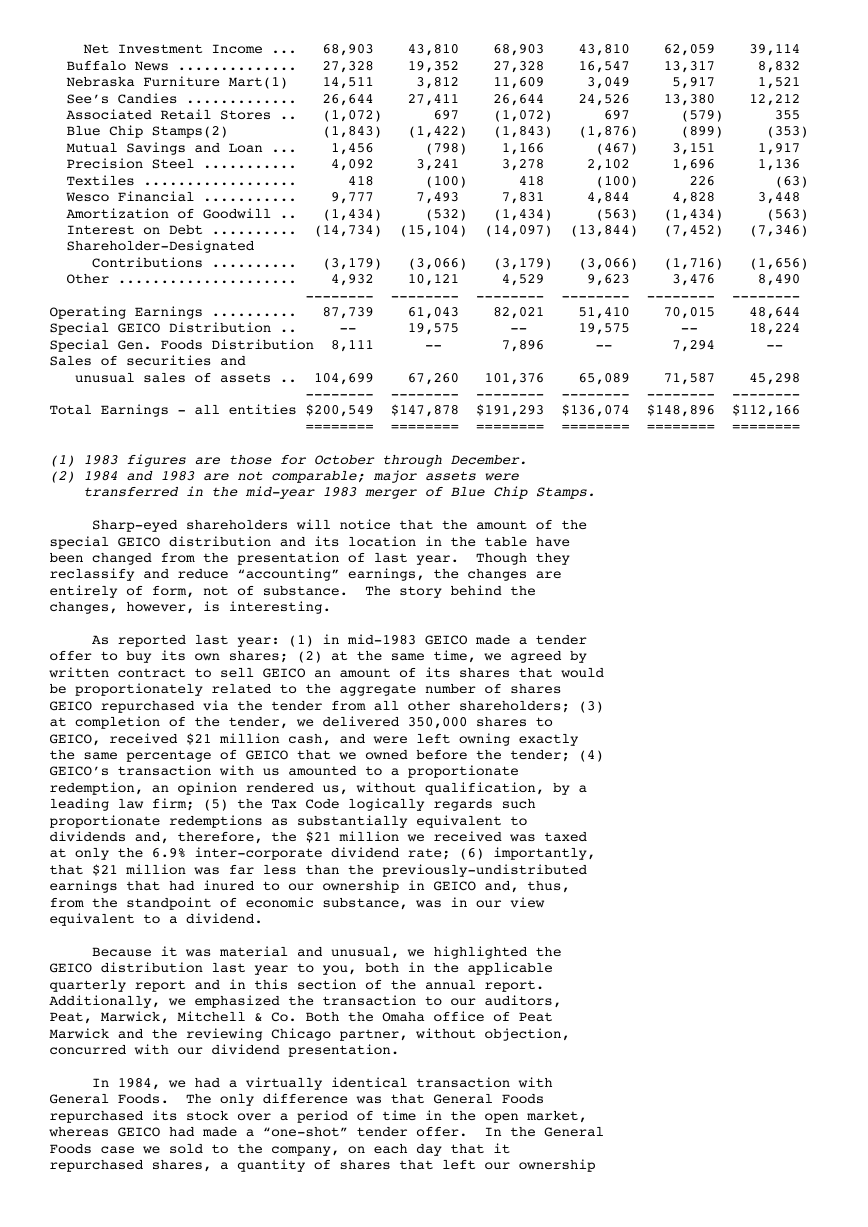

Sources of Reported Earnings

The table on the following page shows the sources of

Berkshire’s reported earnings. Berkshire’s net ownership

interest in many of the constituent businesses changed at midyear

1983 when the Blue Chip merger took place. Because of these

changes, the first two columns of the table provide the best

measure of underlying business performance.

All of the significant gains and losses attributable to

unusual sales of assets by any of the business entities are

aggregated with securities transactions on the line near the

bottom of the table, and are not included in operating earnings.

(We regard any annual figure for realized capital gains or losses

as meaningless, but we regard the aggregate realized and

unrealized capital gains over a period of years as very

important.)

Furthermore, amortization of Goodwill is not charged against

the specific businesses but, for reasons outlined in the Appendix

to my letter in the 1983 annual report, is set forth as a

separate item.

(000s omitted)

----------------------------------------------------------

Net Earnings

Earnings Before Income Taxes After Tax

-------------------------------------- ------------------

Total Berkshire Share Berkshire Share

------------------ ------------------ ------------------

1984 1983 1984 1983 1984 1983

-------- -------- -------- -------- -------- --------

Operating Earnings:

Insurance Group:

Underwriting ............ $(48,060) $(33,872) $(48,060) $(33,872) $(25,955) $(18,400)

B

E

R

K

S

H

I

R

E

H

A

T

H

A

W

A

Y

I

N

C

.

�

Net Investment Income ... 68,903 43,810 68,903 43,810 62,059 39,114

Buffalo News .............. 27,328 19,352 27,328 16,547 13,317 8,832

Nebraska Furniture Mart(1) 14,511 3,812 11,609 3,049 5,917 1,521

See’s Candies ............. 26,644 27,411 26,644 24,526 13,380 12,212

Associated Retail Stores .. (1,072) 697 (1,072) 697 (579) 355

Blue Chip Stamps(2) (1,843) (1,422) (1,843) (1,876) (899) (353)

Mutual Savings and Loan ... 1,456 (798) 1,166 (467) 3,151 1,917

Precision Steel ........... 4,092 3,241 3,278 2,102 1,696 1,136

Textiles .................. 418 (100) 418 (100) 226 (63)

Wesco Financial ........... 9,777 7,493 7,831 4,844 4,828 3,448

Amortization of Goodwill .. (1,434) (532) (1,434) (563) (1,434) (563)

Interest on Debt .......... (14,734) (15,104) (14,097) (13,844) (7,452) (7,346)

Shareholder-Designated

Contributions .......... (3,179) (3,066) (3,179) (3,066) (1,716) (1,656)

Other ..................... 4,932 10,121 4,529 9,623 3,476 8,490

-------- -------- -------- -------- -------- --------

Operating Earnings .......... 87,739 61,043 82,021 51,410 70,015 48,644

Special GEICO Distribution .. -- 19,575 -- 19,575 -- 18,224

Special Gen. Foods Distribution 8,111 -- 7,896 -- 7,294 --

Sales of securities and

unusual sales of assets .. 104,699 67,260 101,376 65,089 71,587 45,298

-------- -------- -------- -------- -------- --------

Total Earnings - all entities $200,549 $147,878 $191,293 $136,074 $148,896 $112,166

======== ======== ======== ======== ======== ========

(1) 1983 figures are those for October through December.

(2) 1984 and 1983 are not comparable; major assets were

transferred in the mid-year 1983 merger of Blue Chip Stamps.

Sharp-eyed shareholders will notice that the amount of the

special GEICO distribution and its location in the table have

been changed from the presentation of last year. Though they

reclassify and reduce “accounting” earnings, the changes are

entirely of form, not of substance. The story behind the

changes, however, is interesting.

As reported last year: (1) in mid-1983 GEICO made a tender

offer to buy its own shares; (2) at the same time, we agreed by

written contract to sell GEICO an amount of its shares that would

be proportionately related to the aggregate number of shares

GEICO repurchased via the tender from all other shareholders; (3)

at completion of the tender, we delivered 350,000 shares to

GEICO, received $21 million cash, and were left owning exactly

the same percentage of GEICO that we owned before the tender; (4)

GEICO’s transaction with us amounted to a proportionate

redemption, an opinion rendered us, without qualification, by a

leading law firm; (5) the Tax Code logically regards such

proportionate redemptions as substantially equivalent to

dividends and, therefore, the $21 million we received was taxed

at only the 6.9% inter-corporate dividend rate; (6) importantly,

that $21 million was far less than the previously-undistributed

earnings that had inured to our ownership in GEICO and, thus,

from the standpoint of economic substance, was in our view

equivalent to a dividend.

Because it was material and unusual, we highlighted the

GEICO distribution last year to you, both in the applicable

quarterly report and in this section of the annual report.

Additionally, we emphasized the transaction to our auditors,

Peat, Marwick, Mitchell & Co. Both the Omaha office of Peat

Marwick and the reviewing Chicago partner, without objection,

concurred with our dividend presentation.

In 1984, we had a virtually identical transaction with

General Foods. The only difference was that General Foods

repurchased its stock over a period of time in the open market,

whereas GEICO had made a “one-shot” tender offer. In the General

Foods case we sold to the company, on each day that it

repurchased shares, a quantity of shares that left our ownership

�

percentage precisely unchanged. Again our transaction was

pursuant to a written contract executed before repurchases began.

And again the money we received was far less than the retained

earnings that had inured to our ownership interest since our

purchase. Overall we received $21,843,601 in cash from General

Foods, and our ownership remained at exactly 8.75%.

At this point the New York office of Peat Marwick came into

the picture. Late in 1984 it indicated that it disagreed with

the conclusions of the firm’s Omaha office and Chicago reviewing

partner. The New York view was that the GEICO and General Foods

transactions should be treated as sales of stock by Berkshire

rather than as the receipt of dividends. Under this accounting

approach, a portion of the cost of our investment in the stock of

each company would be charged against the redemption payment and

any gain would be shown as a capital gain, not as dividend

income. This is an accounting approach only, having no bearing

on taxes: Peat Marwick agrees that the transactions were

dividends for IRS purposes.

We disagree with the New York position from both the

viewpoint of economic substance and proper accounting. But, to

avoid a qualified auditor’s opinion, we have adopted herein Peat

Marwick’s 1984 view and restated 1983 accordingly. None of this,

however, has any effect on intrinsic business value: our

ownership interests in GEICO and General Foods, our cash, our

taxes, and the market value and tax basis of our holdings all

remain the same.

This year we have again entered into a contract with General

Foods whereby we will sell them shares concurrently with open

market purchases that they make. The arrangement provides that

our ownership interest will remain unchanged at all times. By

keeping it so, we will insure ourselves dividend treatment for

tax purposes. In our view also, the economic substance of this

transaction again is the creation of dividend income. However,

we will account for the redemptions as sales of stock rather than

dividend income unless accounting rules are adopted that speak

directly to this point. We will continue to prominently identify

any such special transactions in our reports to you.

While we enjoy a low tax charge on these proportionate

redemptions, and have participated in several of them, we view

such repurchases as at least equally favorable for shareholders

who do not sell. When companies with outstanding businesses and

comfortable financial positions find their shares selling far

below intrinsic value in the marketplace, no alternative action

can benefit shareholders as surely as repurchases.

(Our endorsement of repurchases is limited to those dictated

by price/value relationships and does not extend to the

“greenmail” repurchase - a practice we find odious and repugnant.

In these transactions, two parties achieve their personal ends by

exploitation of an innocent and unconsulted third party. The

players are: (1) the “shareholder” extortionist who, even before

the ink on his stock certificate dries, delivers his “your-

money-or-your-life” message to managers; (2) the corporate

insiders who quickly seek peace at any price - as long as the

price is paid by someone else; and (3) the shareholders whose

money is used by (2) to make (1) go away. As the dust settles,

the mugging, transient shareholder gives his speech on “free

enterprise”, the muggee management gives its speech on “the best

interests of the company”, and the innocent shareholder standing

by mutely funds the payoff.)

The companies in which we have our largest investments have

all engaged in significant stock repurhases at times when wide

discrepancies existed between price and value. As shareholders,

we find this encouraging and rewarding for two important reasons

�

- one that is obvious, and one that is subtle and not always

understood. The obvious point involves basic arithmetic: major

repurchases at prices well below per-share intrinsic business

value immediately increase, in a highly significant way, that

value. When companies purchase their own stock, they often find

it easy to get $2 of present value for $1. Corporate acquisition

programs almost never do as well and, in a discouragingly large

number of cases, fail to get anything close to $1 of value for

each $1 expended.

The other benefit of repurchases is less subject to precise

measurement but can be fully as important over time. By making

repurchases when a company’s market value is well below its

business value, management clearly demonstrates that it is given

to actions that enhance the wealth of shareholders, rather than

to actions that expand management’s domain but that do nothing

for (or even harm) shareholders. Seeing this, shareholders and

potential shareholders increase their estimates of future returns

from the business. This upward revision, in turn, produces

market prices more in line with intrinsic business value. These

prices are entirely rational. Investors should pay more for a

business that is lodged in the hands of a manager with

demonstrated pro-shareholder leanings than for one in the hands

of a self-interested manager marching to a different drummer. (To

make the point extreme, how much would you pay to be a minority

shareholder of a company controlled by Robert Wesco?)

The key word is “demonstrated”. A manager who consistently

turns his back on repurchases, when these clearly are in the

interests of owners, reveals more than he knows of his

motivations. No matter how often or how eloquently he mouths

some public relations-inspired phrase such as “maximizing

shareholder wealth” (this season’s favorite), the market

correctly discounts assets lodged with him. His heart is not

listening to his mouth - and, after a while, neither will the

market.

We have prospered in a very major way - as have other

shareholders - by the large share repurchases of GEICO,

Washington Post, and General Foods, our three largest holdings.

(Exxon, in which we have our fourth largest holding, has also

wisely and aggressively repurchased shares but, in this case, we

have only recently established our position.) In each of these

companies, shareholders have had their interests in outstanding

businesses materially enhanced by repurchases made at bargain

prices. We feel very comfortable owning interests in businesses

such as these that offer excellent economics combined with

shareholder-conscious managements.

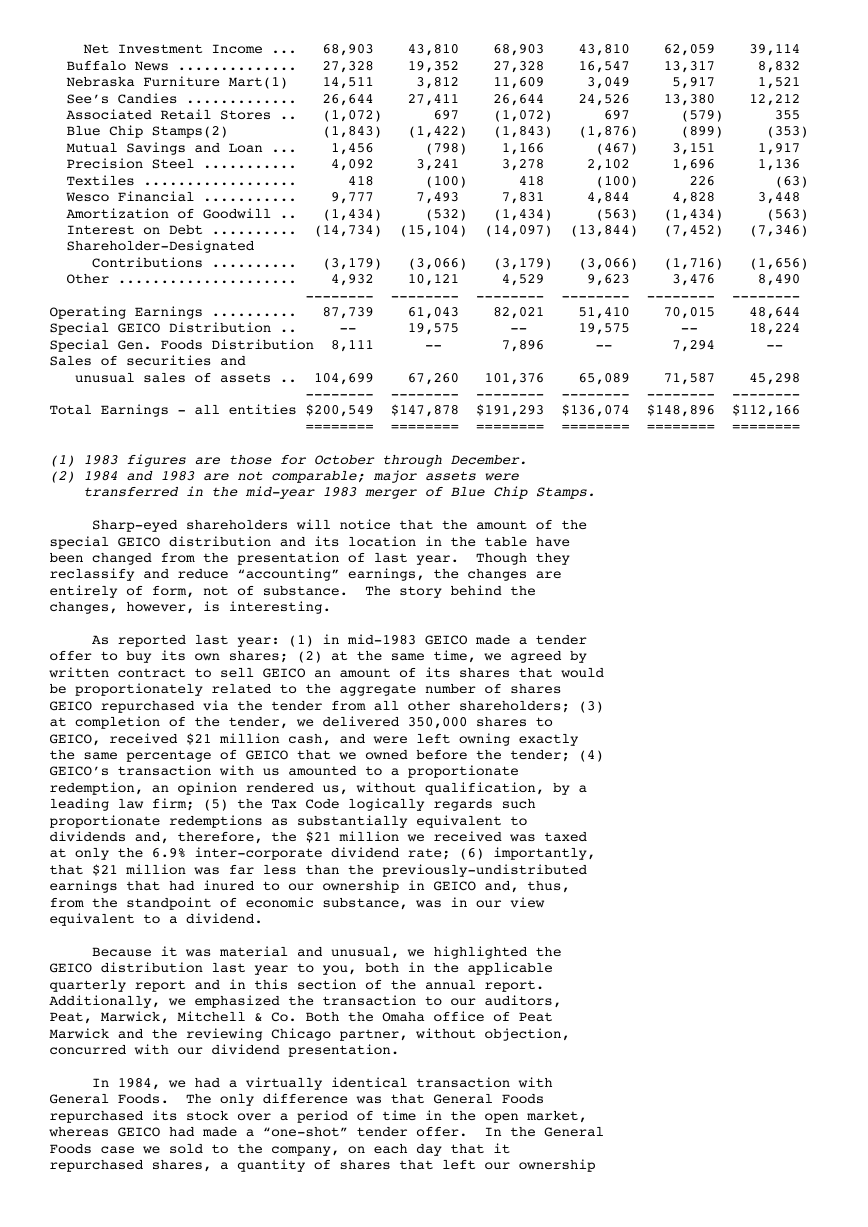

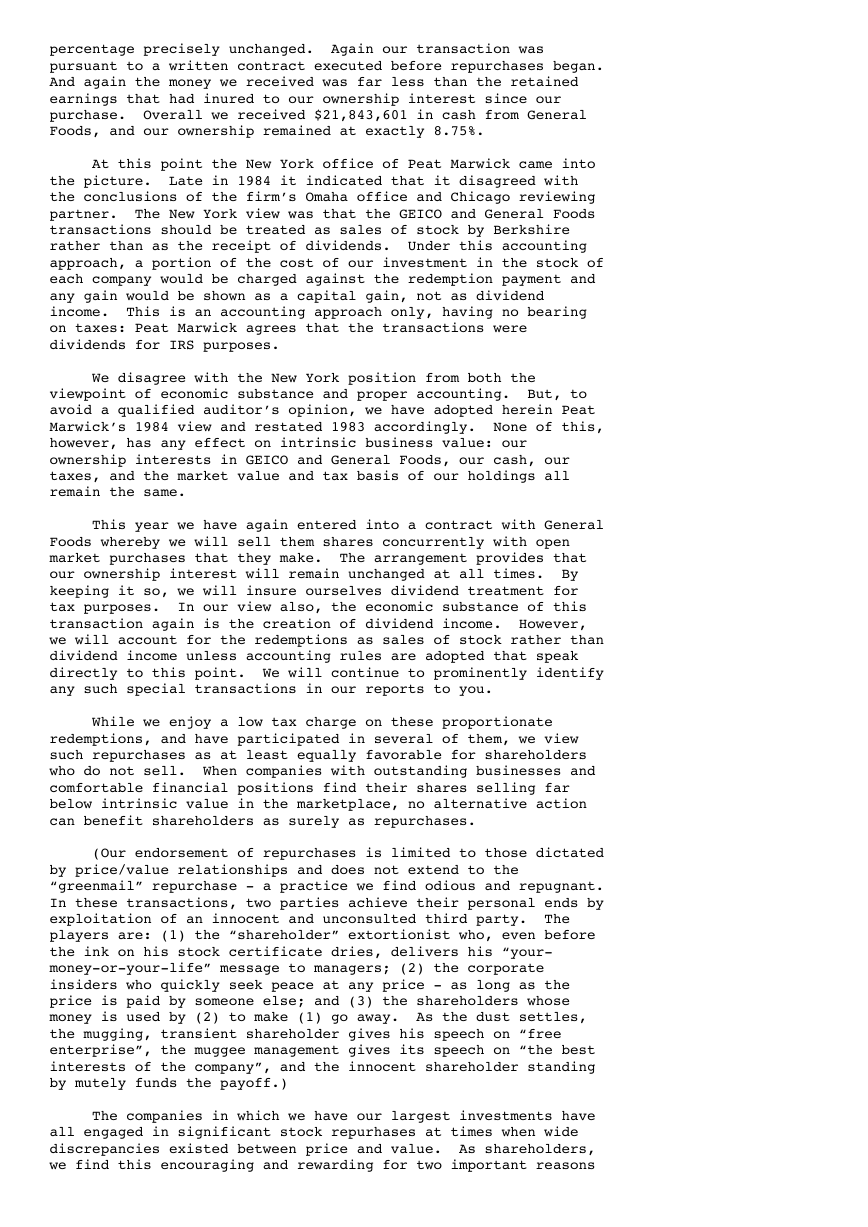

The following table shows our 1984 yearend net holdings in

marketable equities. All numbers exclude the interests

attributable to minority shareholders of Wesco and Nebraska

Furniture Mart.

No. of Shares Cost Market

------------- ---------- ----------

(000s omitted)

690,975 Affiliated Publications, Inc. ....... $ 3,516 $ 32,908

740,400 American Broadcasting Companies, Inc. 44,416 46,738

3,895,710 Exxon Corporation ................... 173,401 175,307

4,047,191 General Foods Corporation ........... 149,870 226,137

6,850,000 GEICO Corporation ................... 45,713 397,300

2,379,200 Handy & Harman ...................... 27,318 38,662

818,872 Interpublic Group of Companies, Inc. 2,570 28,149

555,949 Northwest Industries 26,581 27,242

2,553,488 Time, Inc. .......................... 89,327 109,162

1,868,600 The Washington Post Company ......... 10,628 149,955

---------- ----------

�

$573,340 $1,231,560

All Other Common Stockholdings 11,634 37,326

---------- ----------

Total Common Stocks $584,974 $1,268,886

========== ==========

It’s been over ten years since it has been as difficult as

now to find equity investments that meet both our qualitative

standards and our quantitative standards of value versus price.

We try to avoid compromise of these standards, although we find

doing nothing the most difficult task of all. (One English

statesman attributed his country’s greatness in the nineteenth

century to a policy of “masterly inactivity”. This is a strategy

that is far easier for historians to commend than for

participants to follow.)

In addition to the figures supplied at the beginning of this

section, information regarding the businesses we own appears in

Management’s Discussion on pages 42-47. An amplified discussion

of Wesco’s businesses appears in Charlie Munger’s report on pages

50-59. You will find particularly interesting his comments about

conditions in the thrift industry. Our other major controlled

businesses are Nebraska Furniture Mart, See’s, Buffalo Evening

News, and the Insurance Group, to which we will give some special

attention here.

Nebraska Furniture Mart

Last year I introduced you to Mrs. B (Rose Blumkin) and her

family. I told you they were terrific, and I understated the

case. After another year of observing their remarkable talents

and character, I can honestly say that I never have seen a

managerial group that either functions or behaves better than the

Blumkin family.

Mrs. B, Chairman of the Board, is now 91, and recently was

quoted in the local newspaper as saying, “I come home to eat and

sleep, and that’s about it. I can’t wait until it gets daylight

so I can get back to the business”. Mrs. B is at the store seven

days a week, from opening to close, and probably makes more

decisions in a day than most CEOs do in a year (better ones,

too).

In May Mrs. B was granted an Honorary Doctorate in

Commercial Science by New York University. (She’s a “fast track”

student: not one day in her life was spent in a school room prior

to her receipt of the doctorate.) Previous recipients of honorary

degrees in business from NYU include Clifton Garvin, Jr., CEO of

Exxon Corp.; Walter Wriston, then CEO of Citicorp; Frank Cary,

then CEO of IBM; Tom Murphy, then CEO of General Motors; and,

most recently, Paul Volcker. (They are in good company.)

The Blumkin blood did not run thin. Louie, Mrs. B’s son,

and his three boys, Ron, Irv, and Steve, all contribute in full

measure to NFM’s amazing success. The younger generation has

attended the best business school of them all - that conducted by

Mrs. B and Louie - and their training is evident in their

performance.

Last year NFM’s net sales increased by $14.3 million,

bringing the total to $115 million, all from the one store in

Omaha. That is by far the largest volume produced by a single

home furnishings store in the United States. In fact, the gain

in sales last year was itself greater than the annual volume of

many good-sized successful stores. The business achieves this

success because it deserves this success. A few figures will

tell you why.

In its fiscal 1984 10-K, the largest independent specialty

�

retailer of home furnishings in the country, Levitz Furniture,

described its prices as “generally lower than the prices charged

by conventional furniture stores in its trading area”. Levitz,

in that year, operated at a gross margin of 44.4% (that is, on

average, customers paid it $100 for merchandise that had cost it

$55.60 to buy). The gross margin at NFM is not much more than

half of that. NFM’s low mark-ups are possible because of its

exceptional efficiency: operating expenses (payroll, occupancy,

advertising, etc.) are about 16.5% of sales versus 35.6% at

Levitz.

None of this is in criticism of Levitz, which has a well-

managed operation. But the NFM operation is simply extraordinary

(and, remember, it all comes from a $500 investment by Mrs. B in

1937). By unparalleled efficiency and astute volume purchasing,

NFM is able to earn excellent returns on capital while saving its

customers at least $30 million annually from what, on average, it

would cost them to buy the same merchandise at stores maintaining

typical mark-ups. Such savings enable NFM to constantly widen

its geographical reach and thus to enjoy growth well beyond the

natural growth of the Omaha market.

I have been asked by a number of people just what secrets

the Blumkins bring to their business. These are not very

esoteric. All members of the family: (1) apply themselves with

an enthusiasm and energy that would make Ben Franklin and Horatio

Alger look like dropouts; (2) define with extraordinary realism

their area of special competence and act decisively on all

matters within it; (3) ignore even the most enticing propositions

failing outside of that area of special competence; and, (4)

unfailingly behave in a high-grade manner with everyone they deal

with. (Mrs. B boils it down to “sell cheap and tell the truth”.)

Our evaluation of the integrity of Mrs. B and her family was

demonstrated when we purchased 90% of the business: NFM had never

had an audit and we did not request one; we did not take an

inventory nor verify the receivables; we did not check property

titles. We gave Mrs. B a check for $55 million and she gave us

her word. That made for an even exchange.

You and I are fortunate to be in partnership with the

Blumkin family.

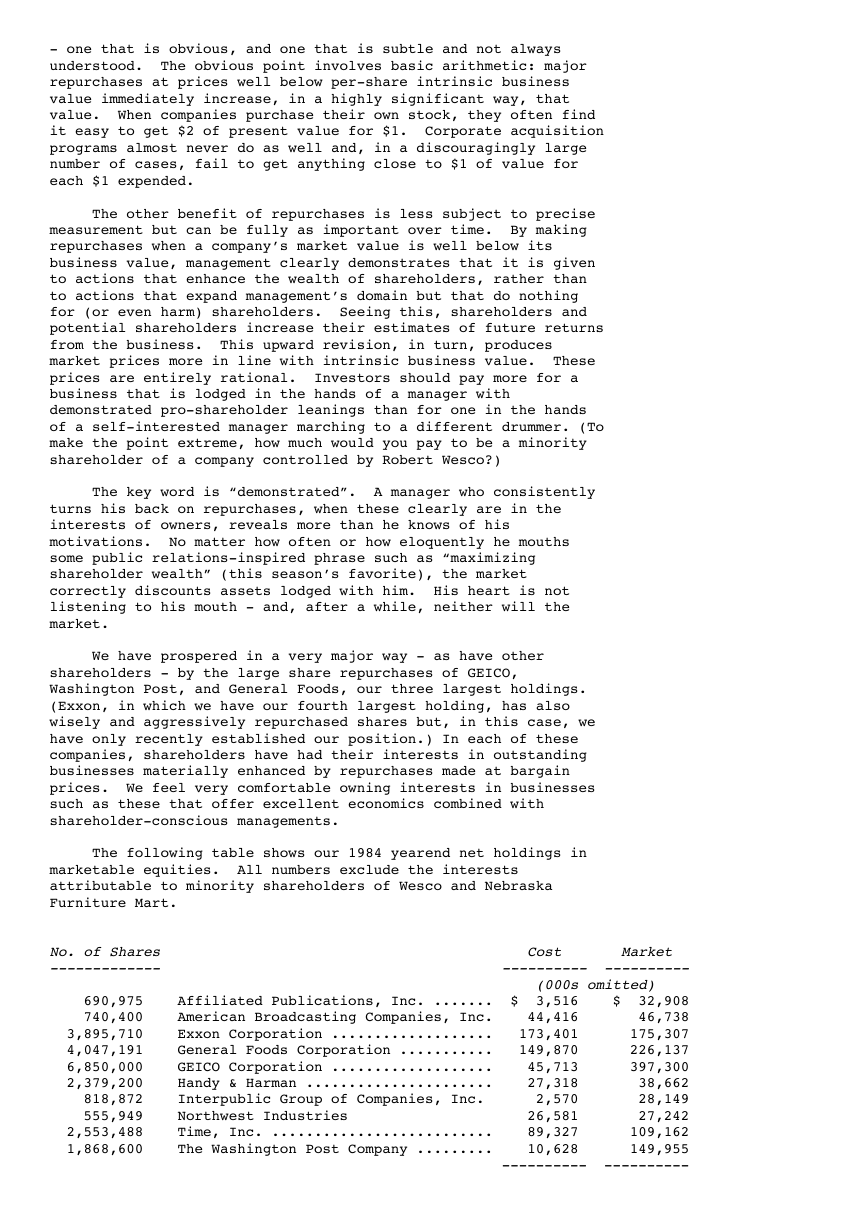

See’s Candy Shops, Inc.

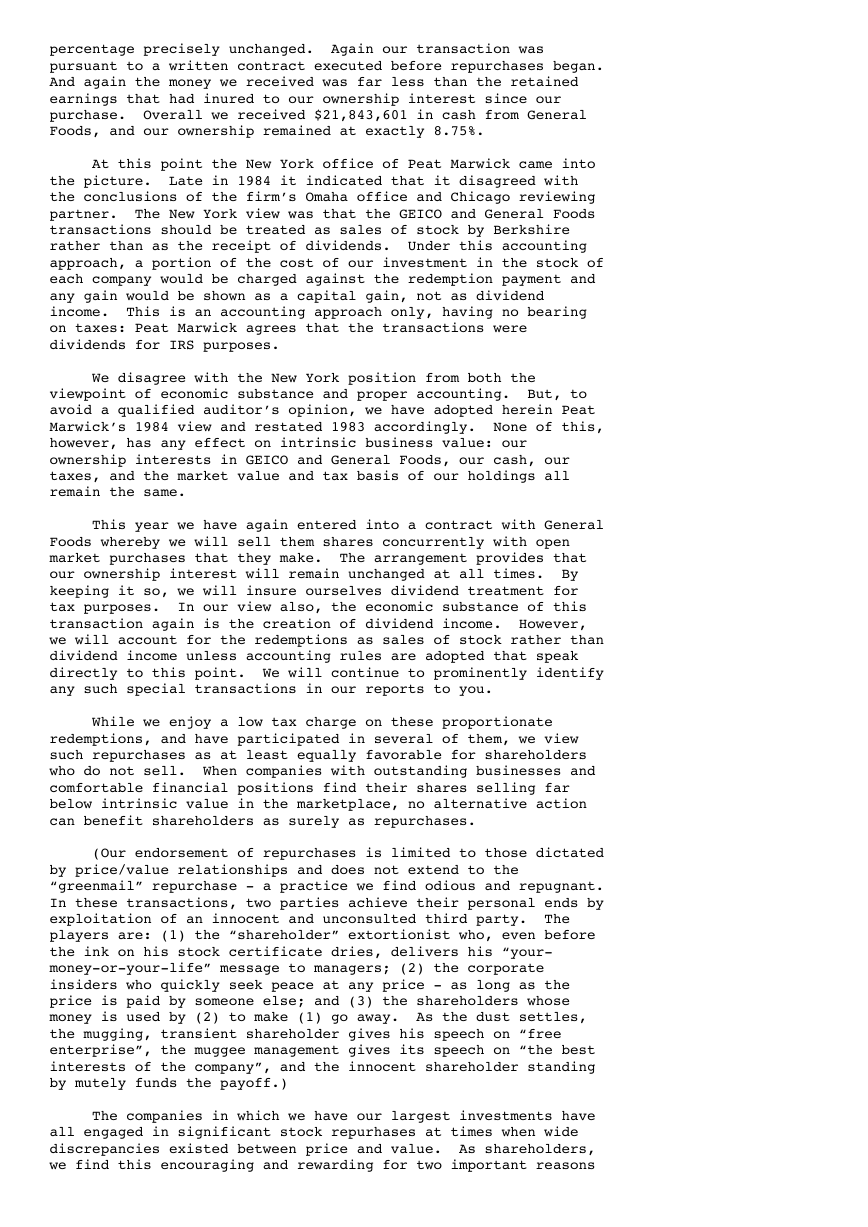

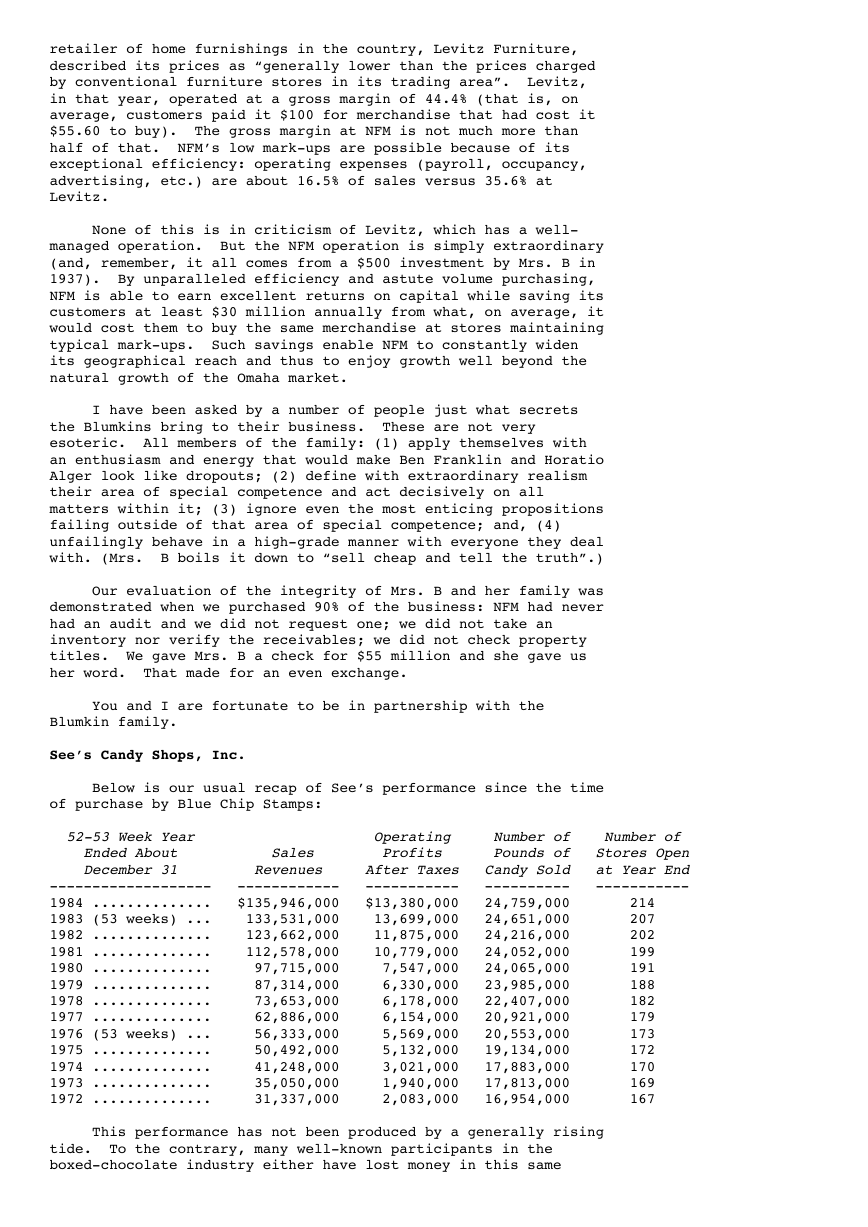

Below is our usual recap of See’s performance since the time

of purchase by Blue Chip Stamps:

52-53 Week Year Operating Number of Number of

Ended About Sales Profits Pounds of Stores Open

December 31 Revenues After Taxes Candy Sold at Year End

------------------- ------------ ----------- ---------- -----------

1984 .............. $135,946,000 $13,380,000 24,759,000 214

1983 (53 weeks) ... 133,531,000 13,699,000 24,651,000 207

1982 .............. 123,662,000 11,875,000 24,216,000 202

1981 .............. 112,578,000 10,779,000 24,052,000 199

1980 .............. 97,715,000 7,547,000 24,065,000 191

1979 .............. 87,314,000 6,330,000 23,985,000 188

1978 .............. 73,653,000 6,178,000 22,407,000 182

1977 .............. 62,886,000 6,154,000 20,921,000 179

1976 (53 weeks) ... 56,333,000 5,569,000 20,553,000 173

1975 .............. 50,492,000 5,132,000 19,134,000 172

1974 .............. 41,248,000 3,021,000 17,883,000 170

1973 .............. 35,050,000 1,940,000 17,813,000 169

1972 .............. 31,337,000 2,083,000 16,954,000 167

This performance has not been produced by a generally rising

tide. To the contrary, many well-known participants in the

boxed-chocolate industry either have lost money in this same

�

period or have been marginally profitable. To our knowledge,

only one good-sized competitor has achieved high profitability.

The success of See’s reflects the combination of an exceptional

product and an exceptional manager, Chuck Huggins.

During 1984 we increased prices considerably less than has

been our practice in recent years: per-pound realization was

$5.49, up only 1.4% from 1983. Fortunately, we made good

progress on cost control, an area that has caused us problems in

recent years. Per-pound costs - other than those for raw

materials, a segment of expense largely outside of our control -

increased by only 2.2% last year.

Our cost-control problem has been exacerbated by the problem

of modestly declining volume (measured by pounds, not dollars) on

a same-store basis. Total pounds sold through shops in recent

years has been maintained at a roughly constant level only by the

net addition of a few shops annually. This more-shops-to-get-

the-same-volume situation naturally puts heavy pressure on per-

pound selling costs.

In 1984, same-store volume declined 1.1%. Total shop volume,

however, grew 0.6% because of an increase in stores. (Both

percentages are adjusted to compensate for a 53-week fiscal year

in 1983.)

See’s business tends to get a bit more seasonal each year.

In the four weeks prior to Christmas, we do 40% of the year’s

volume and earn about 75% of the year’s profits. We also earn

significant sums in the Easter and Valentine’s Day periods, but

pretty much tread water the rest of the year. In recent years,

shop volume at Christmas has grown in relative importance, and so

have quantity orders and mail orders. The increased

concentration of business in the Christmas period produces a

multitude of managerial problems, all of which have been handled

by Chuck and his associates with exceptional skill and grace.

Their solutions have in no way involved compromises in

either quality of service or quality of product. Most of our

larger competitors could not say the same. Though faced with

somewhat less extreme peaks and valleys in demand than we, they

add preservatives or freeze the finished product in order to

smooth the production cycle and thereby lower unit costs. We

reject such techniques, opting, in effect, for production

headaches rather than product modification.

Our mall stores face a host of new food and snack vendors

that provide particularly strong competition at non-holiday

periods. We need new products to fight back and during 1984 we

introduced six candy bars that, overall, met with a good

reception. Further product introductions are planned.

In 1985 we will intensify our efforts to keep per-pound cost

increases below the rate of inflation. Continued success in

these efforts, however, will require gains in same-store

poundage. Prices in 1985 should average 6% - 7% above those of

1984. Assuming no change in same-store volume, profits should

show a moderate gain.

Buffalo Evening News

Profits at the News in 1984 were considerably greater than

we expected. As at See’s, excellent progress was made in

controlling costs. Excluding hours worked in the newsroom, total

hours worked decreased by about 2.8%. With this productivity

improvement, overall costs increased only 4.9%. This performance

by Stan Lipsey and his management team was one of the best in the

industry.

�

However, we now face an acceleration in costs. In mid-1984

we entered into new multi-year union contracts that provided for

a large “catch-up” wage increase. This catch-up is entirely

appropriate: the cooperative spirit of our unions during the

unprofitable 1977-1982 period was an important factor in our

success in remaining cost competitive with The Courier-Express.

Had we not kept costs down, the outcome of that struggle might

well have been different.

Because our new union contracts took effect at varying

dates, little of the catch-up increase was reflected in our 1984

costs. But the increase will be almost totally effective in 1985

and, therefore, our unit labor costs will rise this year at a

rate considerably greater than that of the industry. We expect

to mitigate this increase by continued small gains in

productivity, but we cannot avoid significantly higher wage costs

this year. Newsprint price trends also are less favorable now

than they were in 1984. Primarily because of these two factors,

we expect at least a minor contraction in margins at the News.

Working in our favor at the News are two factors of major

economic importance:

(1) Our circulation is concentrated to an unusual degree

in the area of maximum utility to our advertisers.

“Regional” newspapers with wide-ranging circulation, on

the other hand, have a significant portion of their

circulation in areas that are of negligible utility to

most advertisers. A subscriber several hundred miles

away is not much of a prospect for the puppy you are

offering to sell via a classified ad - nor for the

grocer with stores only in the metropolitan area.

“Wasted” circulation - as the advertisers call it -

hurts profitability: expenses of a newspaper are

determined largely by gross circulation while

advertising revenues (usually 70% - 80% of total

revenues) are responsive only to useful circulation;

(2) Our penetration of the Buffalo retail market is

exceptional; advertisers can reach almost all of their

potential customers using only the News.

Last year I told you about this unusual reader acceptance:

among the 100 largest newspapers in the country, we were then

number one, daily, and number three, Sunday, in penetration. The

most recent figures show us number one in penetration on weekdays

and number two on Sunday. (Even so, the number of households in

Buffalo has declined, so our current weekday circulation is down

slightly; on Sundays it is unchanged.)

I told you also that one of the major reasons for this

unusual acceptance by readers was the unusual quantity of news

that we delivered to them: a greater percentage of our paper is

devoted to news than is the case at any other dominant paper in

our size range. In 1984 our “news hole” ratio was 50.9%, (versus

50.4% in 1983), a level far above the typical 35% - 40%. We will

continue to maintain this ratio in the 50% area. Also, though we

last year reduced total hours worked in other departments, we

maintained the level of employment in the newsroom and, again,

will continue to do so. Newsroom costs advanced 9.1% in 1984, a

rise far exceeding our overall cost increase of 4.9%.

Our news hole policy costs us significant extra money for

newsprint. As a result, our news costs (newsprint for the news

hole plus payroll and expenses of the newsroom) as a percentage

of revenue run higher than those of most dominant papers of our

size. There is adequate room, however, for our paper or any

other dominant paper to sustain these costs: the difference

between “high” and “low” news costs at papers of comparable size

�