EQUITABLE GROWTH, FINANCE, AND INSTITUTIONS POLICY NOTE

Is a Global Recession Imminent?

Justin Damien Guénette, M. Ayhan Kose, and Naotaka Sugawara

EFI Policy Note 4

SEPTEMBER 2022

�

Is a Global Recession Imminent?

Justin Damien Guénette, M. Ayhan Kose, and Naotaka Sugawara∗∗∗∗

6995

Equitable Growth, Finance, and Institutions Policy Notes (EFI Policy Notes) are prepared under the direction of the Vice President

for Equitable Growth, Finance, and Institutions (EFI). EFI Policy notes analyze topical issues of importance to policy makers in

emerging market and developing economies. The findings, interpretations, and conclusions expressed in this paper are entirely

those of the authors. They do not necessarily represent the views of the International Bank for Reconstruction and

Development/World Bank and its affiliated organizations, or those of the Executive Directors of the World Bank or the governments

they represent.

∗ Guénette: World Bank, Email: jguenette@worldbank.org; Kose: World Bank, Brookings Institution, CEPR, CAMA,

Email: akose@worldbank.org; Sugawara: World Bank, Email: nsugawara@worldbank.org. We thank Amat Adarov,

Carlos Arteta, Kevin Clinton, Antonio Fatas, Indermit Gill, Jongrim Ha, Graham Hacche, Patrick Kirby, Franziska

Ohnsorge, Joseph Rebello, James Rowe, Franz Ulrich Ruch, and Christopher Towe for their detailed comments and

suggestions. Lorez Qehaja and Kaltrina Temaj provided excellent research assistance.

�

CONTENTS

EXECUTIVE SUMMARY

I. INTRODUCTION

II. GLOBAL RECESSIONS SINCE 1970

II.1. MAIN CHARACTERISTICS

II.2. EVENTS DURING GLOBAL RECESSIONS AND DOWNTURNS

III. GLOBAL ACTIVITY

III.1. EVOLUTION OF GROWTH FORECASTS

III.2. RECENT DEVELOPMENTS IN HISTORICAL CONTEXT

IV. POLICY RESPONSES

IV.1. EVOLUTION OF POLICIES

IV.2. RECENT POLICY ACTIONS IN HISTORICAL CONTEXT

V. GLOBAL GROWTH SCENARIOS

V.1. BASELINE SCENARIO

V.2. SHARP DOWNTURN SCENARIO

V.3. GLOBAL RECESSION SCENARIO

VI. CONCLUSION

APPENDIX I. IDENTIFYING THE TURNING POINTS OF THE GLOBAL BUSINESS CYCLE

APPENDIX II. GLOBAL ECONOMIC MODEL

REFERENCES

FIGURES

Figure 0. Global recession: activity, policies, and outcomes

Figure 1. Global context

Figure 2. Global recessions

Figure 3. Growth forecasts

Figure 4. Recent developments and global recessions

Figure 5. Interest rates, government expenditures, and debt

Figure 6. Inflation, interest rates, and fiscal balances

Figure 7. Policies during global recessions

Figure 8. Global scenarios: GDP and trade growth

Figure 9. Global scenarios: inflation, interest rates, and oil prices

Figure 10. Scenarios in relation to past global recessions

Figure 11. Vulnerabilities, crises, and growth

TABLES

Table 1. Global scenarios: global inflation, nominal and real interest rates

Table 2A. Global scenarios: GDP growth

Table 2B. Global scenarios: Per capita GDP growth

Table I.1. GDP growth during global recessions

Table I.2. Global recessions: duration and amplitude (with quarterly series)

Table I.3. GDP growth during global downturns

Table I.4. List of lowest and highest growth rates

1

3

7

7

8

10

10

12

14

14

17

21

22

24

27

31

35

38

41

2

4

8

11

13

16

17

20

23

26

28

33

25

29

30

35

36

36

37

�

The odds of recession in Europe, the United States, and China

are significant and increasing, and a collapse in one region will

raise the odds of collapse in the others… The risks of a global

recession trifecta are rising by the day.

Kenneth Rogoff, April 26, 2022

A global recession is entirely avoidable… Even by laxer

criteria like GDP growth below 2.5 percent, global

recession is very far from inevitable.

Jeffrey Frankel, August 25, 2022

Whether the balance of risks is toward inflation, recession,

or a smooth landing from current turbulence depends on

unknowns such as the duration of the Ukraine war…

…. But a global recession is certainly not inevitable.

Anne O. Krueger, August 25, 2022

… If these two economies (the US and China) are both in their

respective versions of recession, then that will virtually guarantee a

global downturn. Given their current weaknesses and challenges,

such a scenario is quite possible… But I am less convinced

of this than I probably was a few months ago…

Jim O’Neill, August 25, 2022

Notwithstanding the pitfalls of forecasting anything these days,

my cracked and worn crystal ball sees a global recession occurring

in the next year…. Collectively, Europe, the US, and China make up

about half of world GDP on a purchasing-power-parity basis. With

no other economy able to fill the void, I am afraid a global

recession does indeed appear inevitable.

Stephen S. Roach, August 25, 2022

�

EXECUTIVE SUMMARY

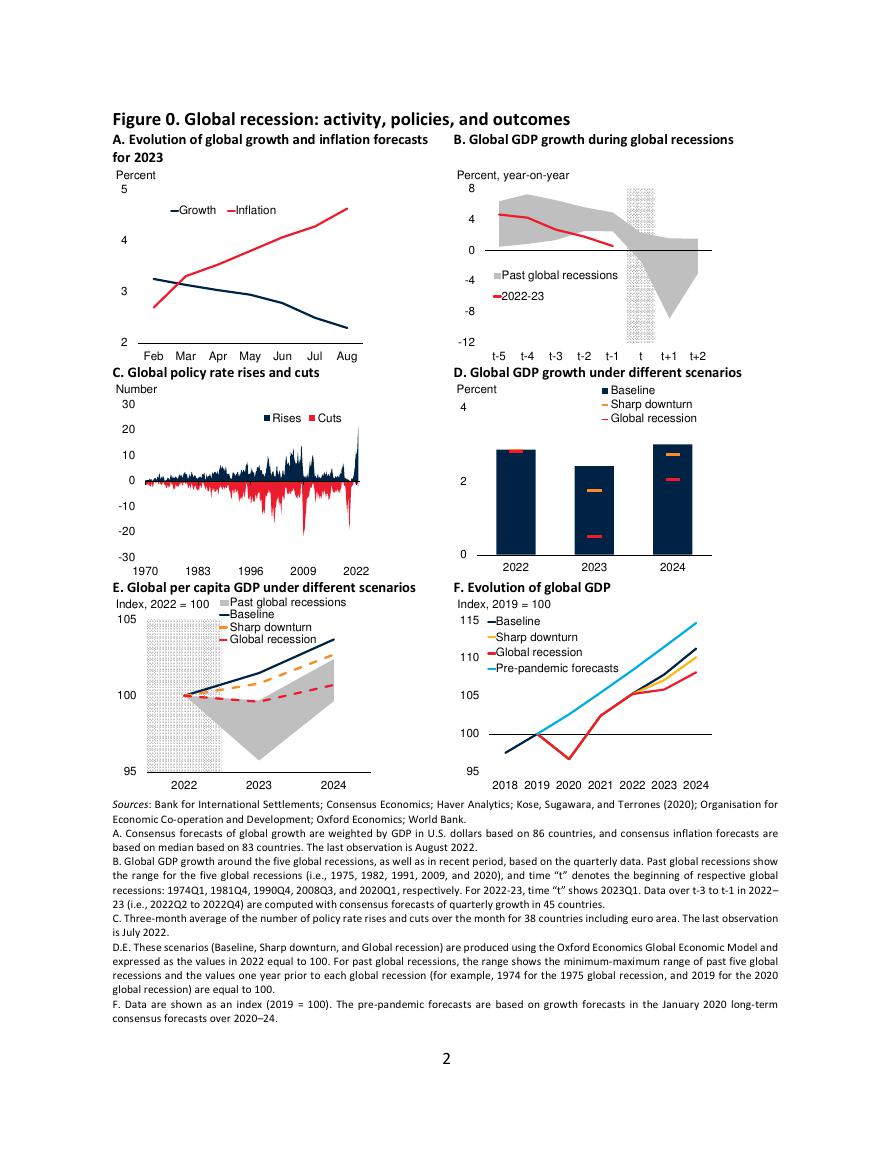

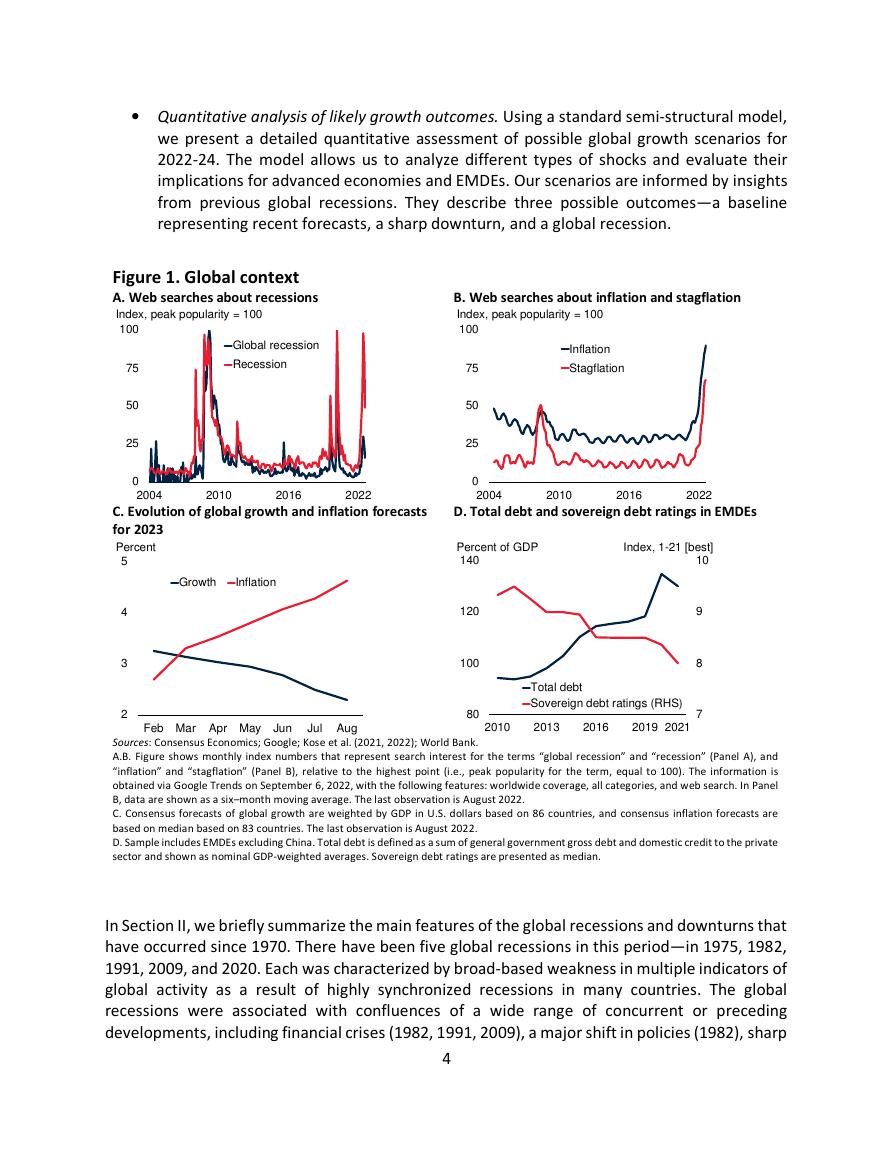

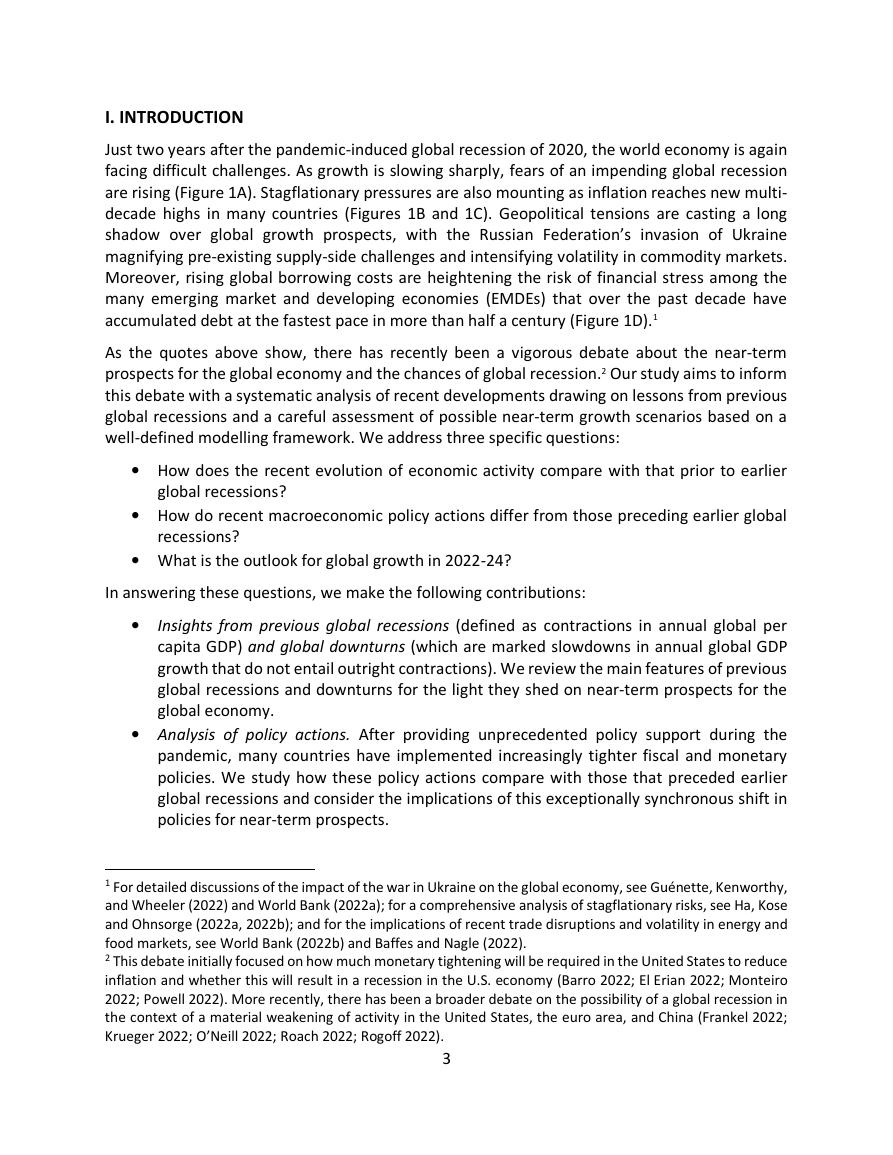

Context. Since the beginning of the year, a rapid deterioration of growth prospects, coupled with rising

inflation and tightening financing conditions, has ignited a debate about the possibility of a global

recession—a contraction in global per capita GDP (Figure 0.A). Drawing on insights gained from previous

global recessions, this study presents a systematic analysis of the recent evolution of economic activity

and policies, and a model-based assessment of possible near-term macroeconomic outcomes.

Evolution of activity. Consensus forecasts for global growth in 2022 and 2023 have been downgraded

significantly since the beginning of the year. Although these forecasts do not point to a global recession

in 2022–23, experience from earlier recessions suggests that at least two developments—which either

have already materialized in recent months or may be underway—heighten the likelihood of a global

recession in the near future. First, every global recession since 1970 was preceded by a significant

weakening of global growth in the previous year, as has happened recently (Figure 0.B). Second, all

previous global recessions coincided with sharp slowdowns or outright recessions in several major

economies.

Evolution of policies. Despite the current slowdown in global growth, inflation has risen to multi-decade

highs in many countries. To stem risks from persistently high inflation, and in a context of limited fiscal

space, many countries are withdrawing monetary and fiscal support. As a result, the global economy is in

the midst of one of the most internationally synchronous episodes of monetary and fiscal policy tightening

of the past five decades (Figure 0.C). These policy actions are necessary to contain inflationary pressures,

but their mutually compounding effects could produce larger impacts than intended, both in tightening

financial conditions and in steepening the growth slowdown. This synchronous policy tightening contrasts

with the policies adopted around the 1975 global recession but is similar to those implemented ahead of

the 1982 recession. A major lesson from these two episodes is that making necessary policy adjustments

in a timely fashion is essential to containing inflationary pressures and reducing the output costs of policy

interventions.

Near-term growth outcomes. Three scenarios for the global economy over 2022-24 are analyzed using a

large-scale, cross-country model (Figure 0.D). The first, baseline scenario, aligns closely with recent

consensus forecasts of growth and inflation, as well as market expectations for policy interest rates.

However, it implies that the degree of monetary policy tightening currently expected may not be enough

to restore low inflation in a timely fashion. The second scenario, sharp downturn, assumes an upward drift

in inflation expectations, which triggers additional synchronous monetary policy tightening by major

central banks. In this scenario, the global economy would still escape a recession in 2023 but would

experience a sharp downturn without restoring low inflation by the end of the forecast horizon. In the

third scenario, global recession, additional increases in policy rates would trigger a sharp re-pricing of risk

in global financial markets and result in a global recession in 2023 (Figure 0.E). If the ongoing global

slowdown turns into a recession, the global economy could end up experiencing large permanent output

losses relative to its pre-pandemic trend (Figure 0.F). This would have severe consequences for the long-

term growth prospects of emerging market and developing economies that were already hit hard by the

pandemic-induced global recession of 2020.

Policy responses. Policymakers need to navigate a narrow path that requires a comprehensive set of

demand- and supply-side measures. On the demand side, monetary policy must be employed consistently

to restore, in a timely manner, price stability. Fiscal policy needs to prioritize medium-term debt

sustainability while providing targeted support to vulnerable groups. Policymakers need to stand ready to

manage the potential spillovers from globally synchronous withdrawal of policies supporting growth. On

the supply-side, they need to put in place measures to ease the constraints that confront labor markets,

energy markets, and trade networks.

1

�

Figure 0. Global recession: activity, policies, and outcomes

A. Evolution of global growth and inflation forecasts

for 2023

Percent

5

Percent, year-on-year

8

B. Global GDP growth during global recessions

4

0

-4

-8

-12

Past global recessions

2022-23

t-5

t-4

t-3

t-2

t-1

t

t+1 t+2

D. Global GDP growth under different scenarios

Percent

Baseline

Sharp downturn

Global recession

Growth

Inflation

4

3

2

Feb Mar Apr May

Jun

Jul Aug

C. Global policy rate rises and cuts

Number

30

20

10

0

-10

-20

-30

Rises Cuts

4

2

0

1970

1983

1996

2009

2022

E. Global per capita GDP under different scenarios

Index, 2022 = 100

105

Past global recessions

Baseline

Sharp downturn

Global recession

100

95

110

105

100

95

2024

2022

2023

F. Evolution of global GDP

Index, 2019 = 100

115

Baseline

Sharp downturn

Global recession

Pre-pandemic forecasts

2022

2023

2024

2018 2019 2020 2021 2022 2023 2024

Sources: Bank for International Settlements; Consensus Economics; Haver Analytics; Kose, Sugawara, and Terrones (2020); Organisation for

Economic Co-operation and Development; Oxford Economics; World Bank.

A. Consensus forecasts of global growth are weighted by GDP in U.S. dollars based on 86 countries, and consensus inflation forecasts are

based on median based on 83 countries. The last observation is August 2022.

B. Global GDP growth around the five global recessions, as well as in recent period, based on the quarterly data. Past global recessions show

the range for the five global recessions (i.e., 1975, 1982, 1991, 2009, and 2020), and time “t” denotes the beginning of respective global

recessions: 1974Q1, 1981Q4, 1990Q4, 2008Q3, and 2020Q1, respectively. For 2022-23, time “t” shows 2023Q1. Data over t-3 to t-1 in 2022–

23 (i.e., 2022Q2 to 2022Q4) are computed with consensus forecasts of quarterly growth in 45 countries.

C. Three-month average of the number of policy rate rises and cuts over the month for 38 countries including euro area. The last observation

is July 2022.

D.E. These scenarios (Baseline, Sharp downturn, and Global recession) are produced using the Oxford Economics Global Economic Model and

expressed as the values in 2022 equal to 100. For past global recessions, the range shows the minimum-maximum range of past five global

recessions and the values one year prior to each global recession (for example, 1974 for the 1975 global recession, and 2019 for the 2020

global recession) are equal to 100.

F. Data are shown as an index (2019 = 100). The pre-pandemic forecasts are based on growth forecasts in the January 2020 long-term

consensus forecasts over 2020–24.

2

�

I. INTRODUCTION

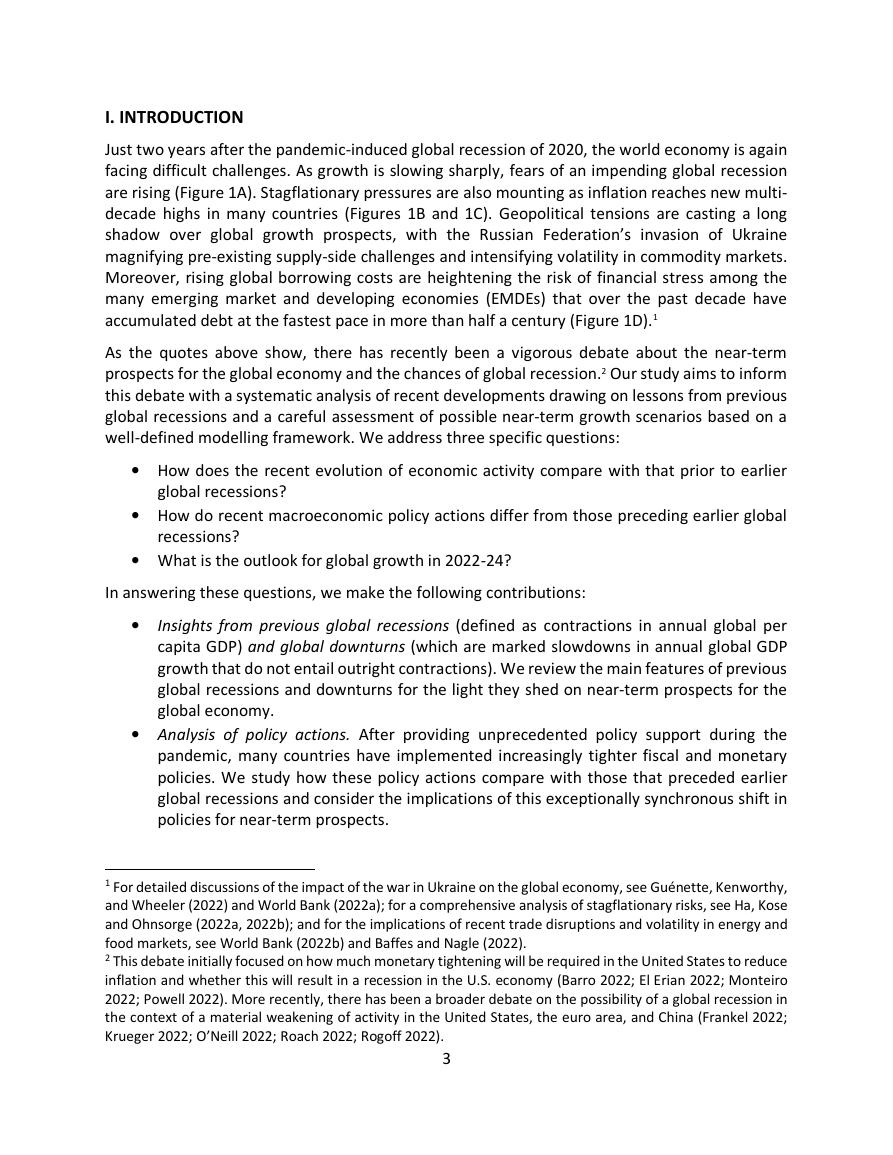

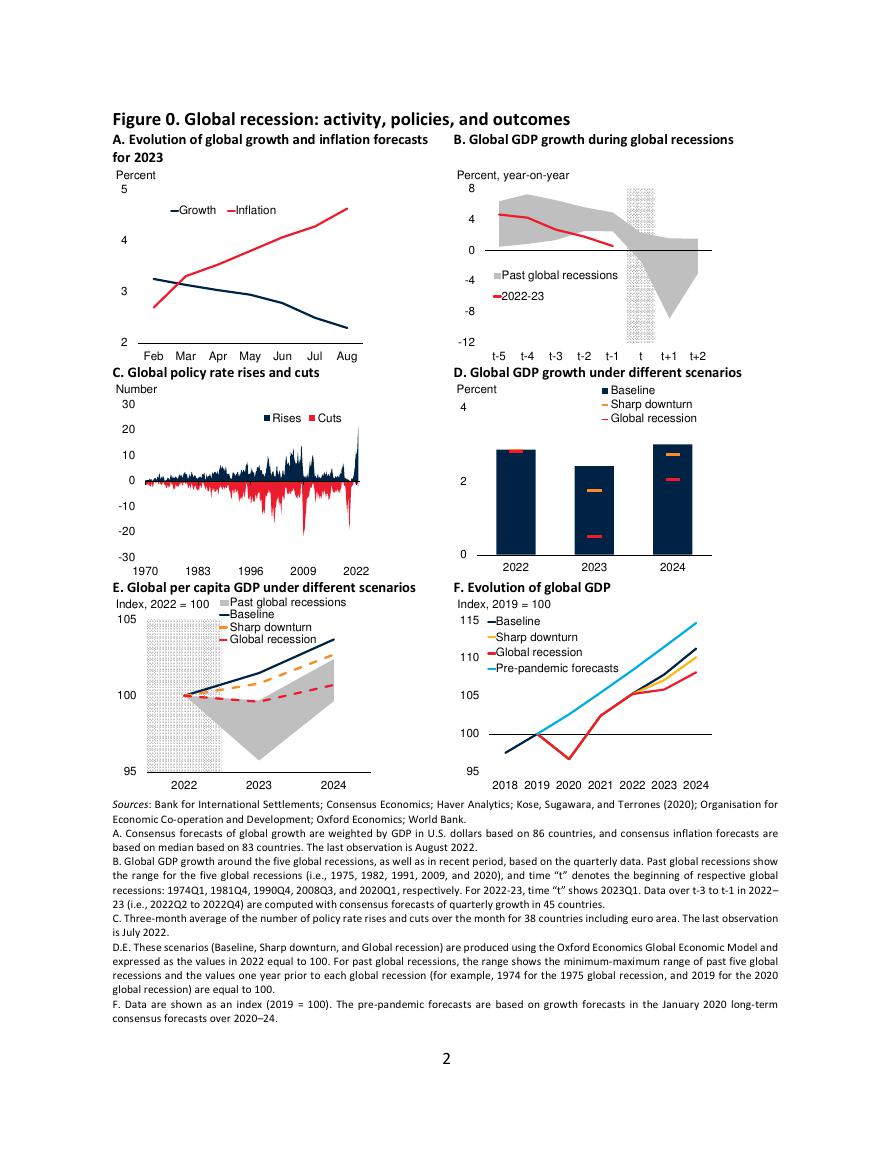

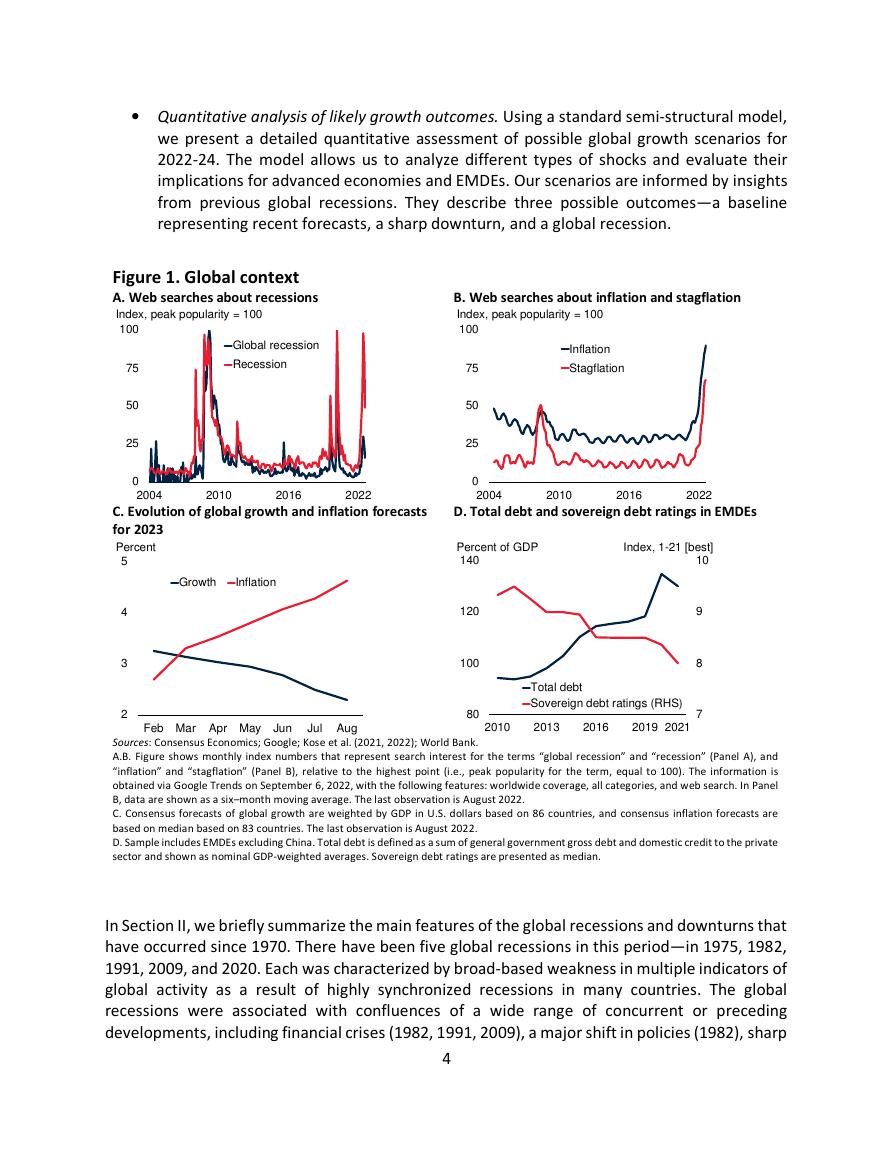

Just two years after the pandemic-induced global recession of 2020, the world economy is again

facing difficult challenges. As growth is slowing sharply, fears of an impending global recession

are rising (Figure 1A). Stagflationary pressures are also mounting as inflation reaches new multi-

decade highs in many countries (Figures 1B and 1C). Geopolitical tensions are casting a long

shadow over global growth prospects, with the Russian Federation’s invasion of Ukraine

magnifying pre-existing supply-side challenges and intensifying volatility in commodity markets.

Moreover, rising global borrowing costs are heightening the risk of financial stress among the

many emerging market and developing economies (EMDEs) that over the past decade have

accumulated debt at the fastest pace in more than half a century (Figure 1D).1

As the quotes above show, there has recently been a vigorous debate about the near-term

prospects for the global economy and the chances of global recession.2 Our study aims to inform

this debate with a systematic analysis of recent developments drawing on lessons from previous

global recessions and a careful assessment of possible near-term growth scenarios based on a

well-defined modelling framework. We address three specific questions:

• How does the recent evolution of economic activity compare with that prior to earlier

global recessions?

• How do recent macroeconomic policy actions differ from those preceding earlier global

recessions?

• What is the outlook for global growth in 2022-24?

In answering these questions, we make the following contributions:

•

Insights from previous global recessions (defined as contractions in annual global per

capita GDP) and global downturns (which are marked slowdowns in annual global GDP

growth that do not entail outright contractions). We review the main features of previous

global recessions and downturns for the light they shed on near-term prospects for the

global economy.

• Analysis of policy actions. After providing unprecedented policy support during the

pandemic, many countries have implemented increasingly tighter fiscal and monetary

policies. We study how these policy actions compare with those that preceded earlier

global recessions and consider the implications of this exceptionally synchronous shift in

policies for near-term prospects.

1 For detailed discussions of the impact of the war in Ukraine on the global economy, see Guénette, Kenworthy,

and Wheeler (2022) and World Bank (2022a); for a comprehensive analysis of stagflationary risks, see Ha, Kose

and Ohnsorge (2022a, 2022b); and for the implications of recent trade disruptions and volatility in energy and

food markets, see World Bank (2022b) and Baffes and Nagle (2022).

2 This debate initially focused on how much monetary tightening will be required in the United States to reduce

inflation and whether this will result in a recession in the U.S. economy (Barro 2022; El Erian 2022; Monteiro

2022; Powell 2022). More recently, there has been a broader debate on the possibility of a global recession in

the context of a material weakening of activity in the United States, the euro area, and China (Frankel 2022;

Krueger 2022; O’Neill 2022; Roach 2022; Rogoff 2022).

3

�

• Quantitative analysis of likely growth outcomes. Using a standard semi-structural model,

we present a detailed quantitative assessment of possible global growth scenarios for

2022-24. The model allows us to analyze different types of shocks and evaluate their

implications for advanced economies and EMDEs. Our scenarios are informed by insights

from previous global recessions. They describe three possible outcomes—a baseline

representing recent forecasts, a sharp downturn, and a global recession.

B. Web searches about inflation and stagflation

Index, peak popularity = 100

100

75

50

25

0

2004

Inflation

Stagflation

2010

2016

2022

D. Total debt and sovereign debt ratings in EMDEs

Percent of GDP

140

Index, 1-21 [best]

10

120

100

80

9

8

7

Total debt

Sovereign debt ratings (RHS)

2010

2013

2016

2019 2021

Figure 1. Global context

A. Web searches about recessions

Index, peak popularity = 100

100

75

50

25

0

2004

Global recession

Recession

2010

2016

2022

C. Evolution of global growth and inflation forecasts

for 2023

Percent

5

Growth

Inflation

4

3

2

Feb Mar Apr May

Jun

Jul Aug

Sources: Consensus Economics; Google; Kose et al. (2021, 2022); World Bank.

A.B. Figure shows monthly index numbers that represent search interest for the terms “global recession” and “recession” (Panel A), and

“inflation” and “stagflation” (Panel B), relative to the highest point (i.e., peak popularity for the term, equal to 100). The information is

obtained via Google Trends on September 6, 2022, with the following features: worldwide coverage, all categories, and web search. In Panel

B, data are shown as a six–month moving average. The last observation is August 2022.

C. Consensus forecasts of global growth are weighted by GDP in U.S. dollars based on 86 countries, and consensus inflation forecasts are

based on median based on 83 countries. The last observation is August 2022.

D. Sample includes EMDEs excluding China. Total debt is defined as a sum of general government gross debt and domestic credit to the private

sector and shown as nominal GDP-weighted averages. Sovereign debt ratings are presented as median.

In Section II, we briefly summarize the main features of the global recessions and downturns that

have occurred since 1970. There have been five global recessions in this period—in 1975, 1982,

1991, 2009, and 2020. Each was characterized by broad-based weakness in multiple indicators of

global activity as a result of highly synchronized recessions in many countries. The global

recessions were associated with confluences of a wide range of concurrent or preceding

developments, including financial crises (1982, 1991, 2009), a major shift in policies (1982), sharp

4

�