FOUNDER ALL HANDS MAY 2022

Adapting to Endure

�

ROELOF BOTHA

Why We’re Here

● Why we’re here:

○

I want to take you back to early 2000, when I was CFO at PayPal…

It was March 2000. We had closed $100M at $500M.

A month later, the Nasdaq experienced a sharp decline. It

bounced back a little in mid-year, and then sank dramatically by

year-end.

Michael Moritz quickly provided the Sequoia perspective:

recognize the moment, expand runway, become a business.

It was a get-real moment for the team. We had 7 months of

runway left. So we:

●

●

Ran cost exercises in opex

Turned product market fit into a business

○

○

June 2000 introduced fees

GM% - fraud, instant ACH innovation

■

■

■

■

■

■

■

Eventually reached nearly $250M revenue in 2002, profitable and

generating cash. Market cap north of $1B, acquisition of $1.5B.

Today PayPal is worth $90B, with $25B in annual revenue and

$4B in pre-tax net income.

Needed to survive, needed to focus, needed to innovate.

○

○

Given the market tumult of the last week and ongoing macroeconomic

pressures, we felt it would be valuable to bring our community of

founders together to share insight into what is happening and why, and

more importantly, what it means for you about the road ahead.

This is not a time to panic. It is a time to pause and reassess.

�

Why We’re Here

The Macro Environment

The Public Markets

What History Tells Us

How to Emerge Stronger

Leading From the Front

What’s Next

Roelof Botha

Kevin Kelly

Jeff Wang

Doug Leone

Alfred Lin

Carl Eschenbach

Roelof Botha

What We’ll Cover

SEQUOIA CONFIDENTIAL

● What we’ll cover:

○

○

○

○

○

The Sequoia perspective is rooted in our ability to connect experiences

and information from across our business lines (SCGE, Heritage, Early,

and Growth) and the experience that comes from having maneuvered

through similarly challenging moments over our 50 year history.

You will hear from various members of the Sequoia team today, including

partners Doug Leone, Alfred Lin, and Carl Eschenbach, as well as Kevin

Kelly and Jeff Wang from our Heritage and Global Equities teams, who

will share what they’re seeing take place in the macro environment and

public markets.

As you will hear from Kevin and Jeff, the cost of capital has

fundamentally increased. Over the past two years, monetary policy

loosened to avert an economic disaster in the midst of the pandemic.

Negative real interest rates led to effortless fundraising for growth

companies and record valuation levels. Given the circumstances, that

was perfectly rational. But now rates are rising, money is no longer free,

and that has massive implications for valuations and fundraising.

The financial markets are a barometer on the real economy. The

valuation swings we all see are a reflection of uncertainty about demand,

changing labor market conditions, supply chain uncertainties, and war.

These are all factors that will ultimately affect your businesses.

Many of you have had to navigate the headwinds and tailwinds arising

from the pandemic over the last two years. Others are just early in their

journey, and this may be the first of many bumps experienced.

�

Regardless, we believe this is a Crucible Moment, one that will present

challenges and opportunities for many of you. First and foremost, we

must recognize the changing environment and shift our mindset to

respond with intention rather than regret.

○ We foresaw some of this when we first published our Black Swan memo

○

at the start of COVID in early 2020. What we got wrong then was

monetary and fiscal policy response that followed and the distortion field

that created. This time, many of those tools have been exhausted. And

sustained inflation, and geopolitical conflicts further limit the ability for a

quick-fix policy solution. As such, we do not believe that this is going to

be another steep correction followed by an equally swift V-shaped

recovery like we saw at the outset of the pandemic. We expect the

market downturn to impact consumer behavior, labor markets, supply

chains and more. It will be a longer recovery and while we can't predict

how long, we can advise you on ways to prepare and get through to the

other side.

�

KEVIN KELLY, SEQUOIA HERITAGE

The Macro Environment

�

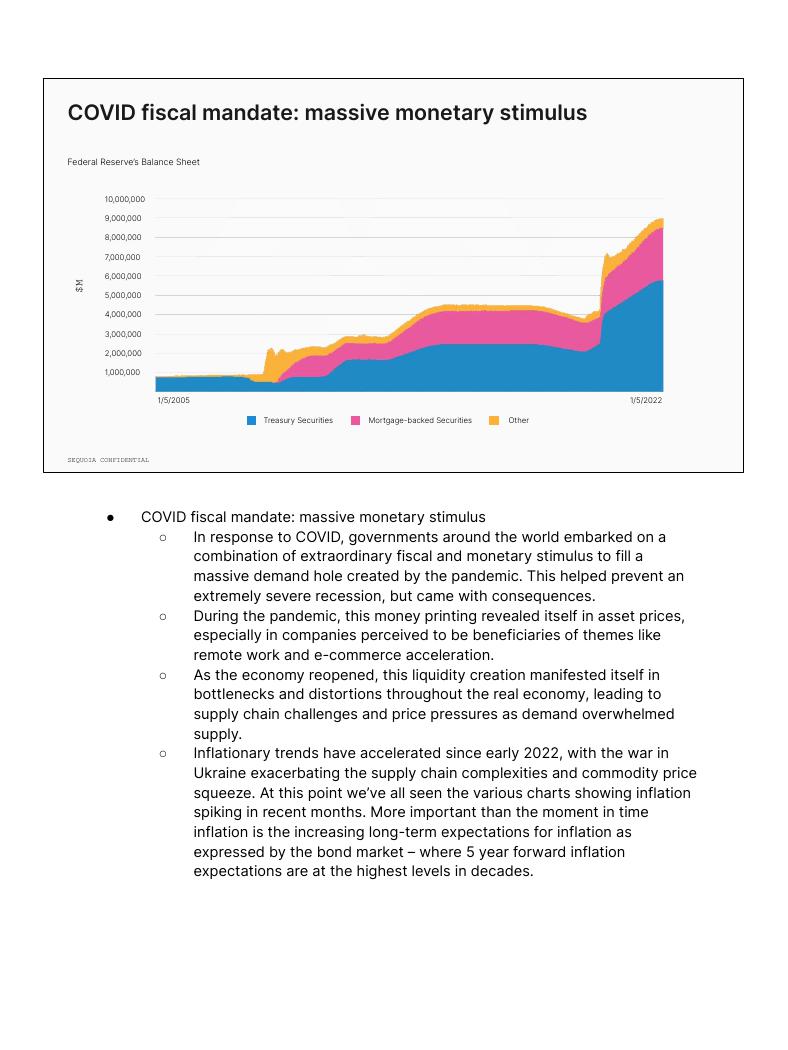

COVID fiscal mandate: massive monetary stimulus

Federal Reserve’s Balance Sheet

M

$

10,000,000

9,000,000

8,000,000

7,000,000

6,000,000

5,000,000

4,000,000

3,000,000

2,000,000

1,000,000

SEQUOIA CONFIDENTIAL

1/5/2005

1/5/2022

Treasury Securities

Mortgage-backed Securities

Other

●

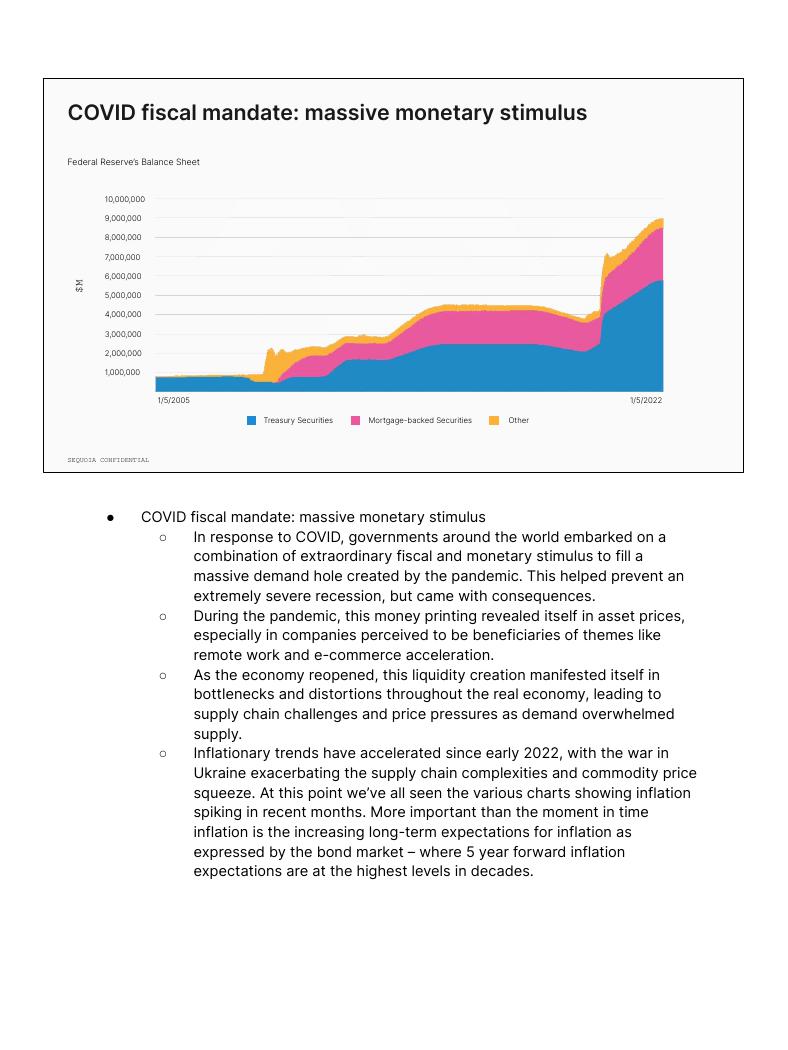

COVID fiscal mandate: massive monetary stimulus

○

○

○

○

In response to COVID, governments around the world embarked on a

combination of extraordinary fiscal and monetary stimulus to fill a

massive demand hole created by the pandemic. This helped prevent an

extremely severe recession, but came with consequences.

During the pandemic, this money printing revealed itself in asset prices,

especially in companies perceived to be beneficiaries of themes like

remote work and e-commerce acceleration.

As the economy reopened, this liquidity creation manifested itself in

bottlenecks and distortions throughout the real economy, leading to

supply chain challenges and price pressures as demand overwhelmed

supply.

Inflationary trends have accelerated since early 2022, with the war in

Ukraine exacerbating the supply chain complexities and commodity price

squeeze. At this point we’ve all seen the various charts showing inflation

spiking in recent months. More important than the moment in time

inflation is the increasing long-term expectations for inflation as

expressed by the bond market – where 5 year forward inflation

expectations are at the highest levels in decades.

�

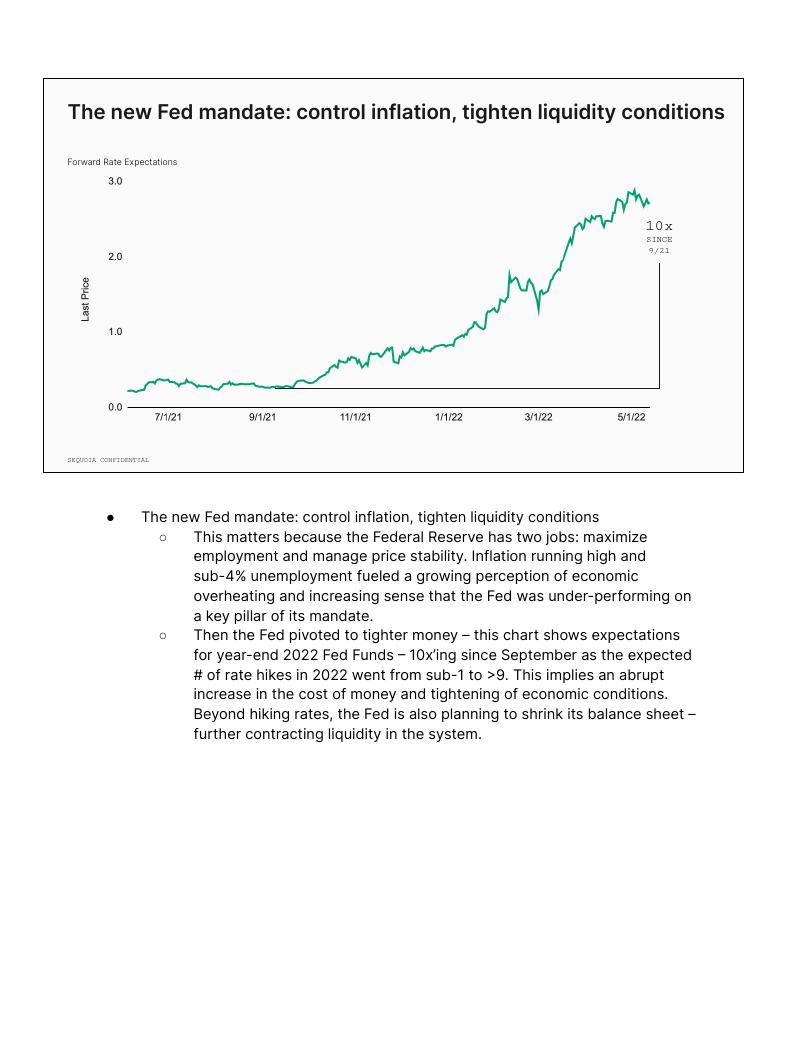

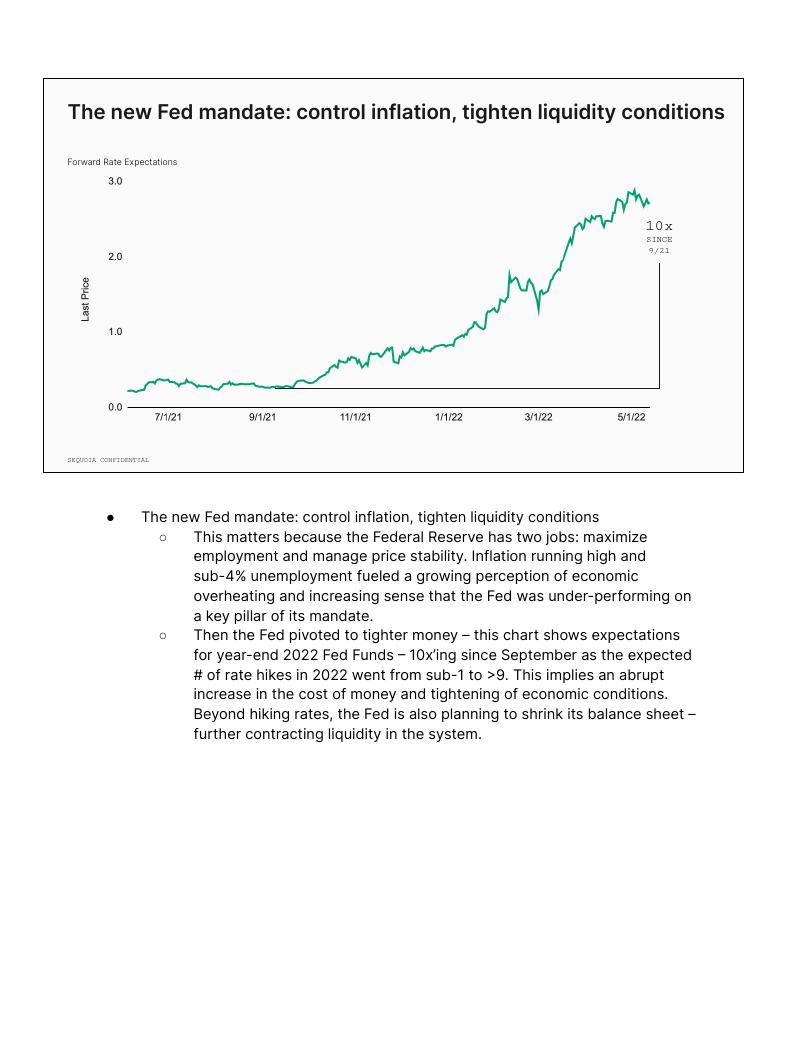

The new Fed mandate: control inflation, tighten liquidity conditions

Forward Rate Expectations

10x

SINCE

9/21

SEQUOIA CONFIDENTIAL

○

○

●

The new Fed mandate: control inflation, tighten liquidity conditions

This matters because the Federal Reserve has two jobs: maximize

employment and manage price stability. Inflation running high and

sub-4% unemployment fueled a growing perception of economic

overheating and increasing sense that the Fed was under-performing on

a key pillar of its mandate.

Then the Fed pivoted to tighter money – this chart shows expectations

for year-end 2022 Fed Funds – 10x’ing since September as the expected

# of rate hikes in 2022 went from sub-1 to >9. This implies an abrupt

increase in the cost of money and tightening of economic conditions.

Beyond hiking rates, the Fed is also planning to shrink its balance sheet –

further contracting liquidity in the system.

�

Capital was free.

Now it’s expensive.

When capital was free, the best performing companies were

capital consumptive.

As capital has gotten expensive, these have become the worst

performing companies.

What are the other implications of capital being expensive?

Given every dollar is more precious than it was, how are you

going to change your priorities?

SEQUOIA CONFIDENTIAL

●

Capital was free. Now it’s expensive.

○

○

As this pivot was digested by the markets, the best performing assets

when rate expectations were falling – including technology,

biotechnology, and recent IPOs – have been the worst performing assets.

Simply put, the world is reassessing how business models fare in a world

where capital has a cost and reconsidering how much credit to give

companies for profits many years into the future. My partner Jeff will

describe this in further detail momentarily.

This would matter less if it was solely about new multiples ascribed to

each dollar of revenue. However, market indicators, including broader

equity prices, high yield spreads, and the yield curve, are beginning to

flash warning signs of further economic deterioration… so it might not

just be a question of valuations resetting.

○ We are just beginning to see how the increasing cost of money flows

through to impact the real economy. To give just one example in the

housing sector. In the last 6 months, due to the changing cost of money,

a new mortgage is 67% more expensive for the same house – the largest

percentage shock in 50 years and putting housing affordability back to

levels last seen at the peak of the housing boom. For this reason, public

markets are already anticipating a severe slowdown in housing activity

with homebuilders down ~30% from their highs.

Undoubtedly, calls like this one are happening across sectors in response

to recent market dynamics. If you’re stepping back and thinking twice,

it’s not just you. Belt tightening and priority reassessment will have

○

�