Answers to Selected

Exercises

For

Principles of Econometrics, Fourth Edition

R. CARTER HILL

Louisiana State University

WILLIAM E. GRIFFITHS

University of Melbourne

GUAY C. LIM

University of Melbourne

JOHN WILEY & SONS, INC

New York / Chichester / Weinheim / Brisbane / Singapore / Toronto

�

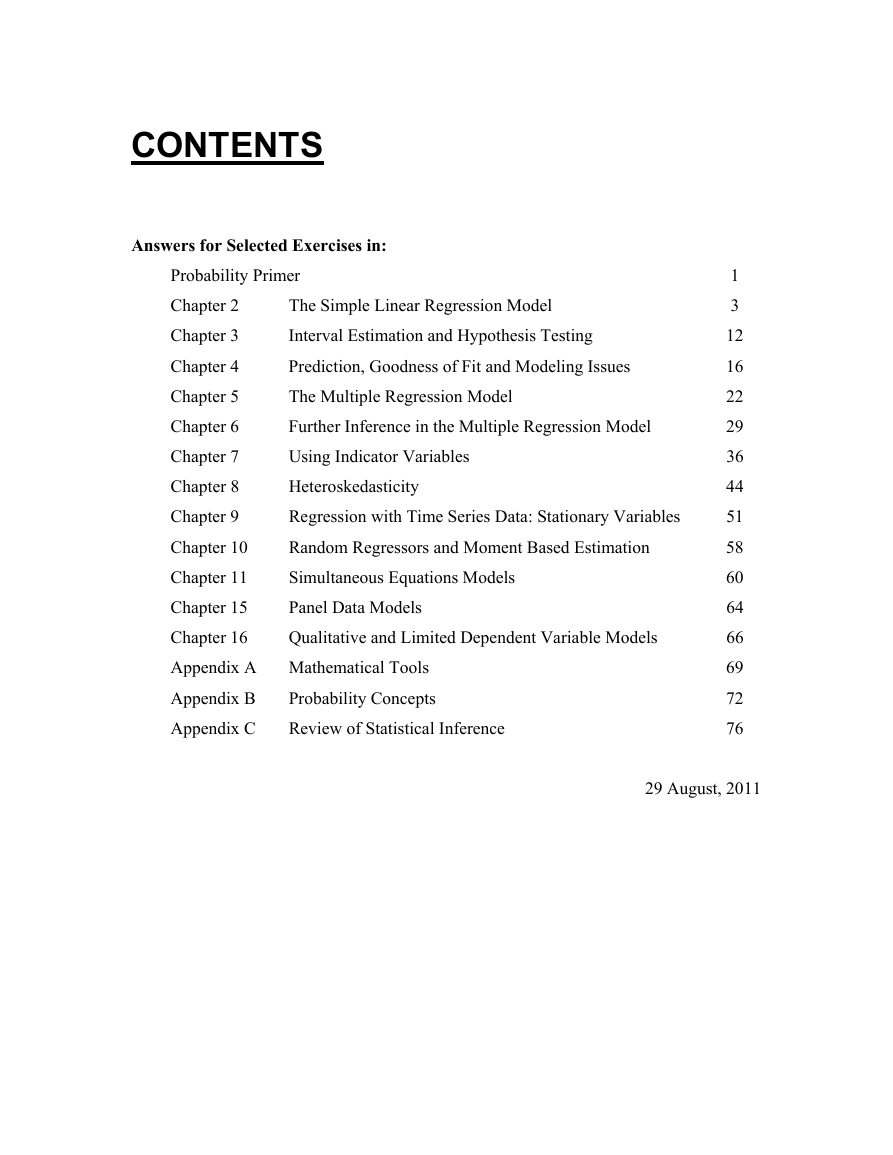

CONTENTS

Answers for Selected Exercises in:

Probability Primer

Chapter 2

Chapter 3

Chapter 4

Chapter 5

Chapter 6

Chapter 7

Chapter 8

Chapter 9

Chapter 10

Chapter 11

Chapter 15

Chapter 16

Appendix A Mathematical Tools

Appendix B

Appendix C

The Simple Linear Regression Model

Interval Estimation and Hypothesis Testing

Prediction, Goodness of Fit and Modeling Issues

The Multiple Regression Model

Further Inference in the Multiple Regression Model

Using Indicator Variables

Heteroskedasticity

Regression with Time Series Data: Stationary Variables

Random Regressors and Moment Based Estimation

Simultaneous Equations Models

Panel Data Models

Qualitative and Limited Dependent Variable Models

Probability Concepts

Review of Statistical Inference

1

3

12

16

22

29

36

44

51

58

60

64

66

69

72

76

29 August, 2011

�

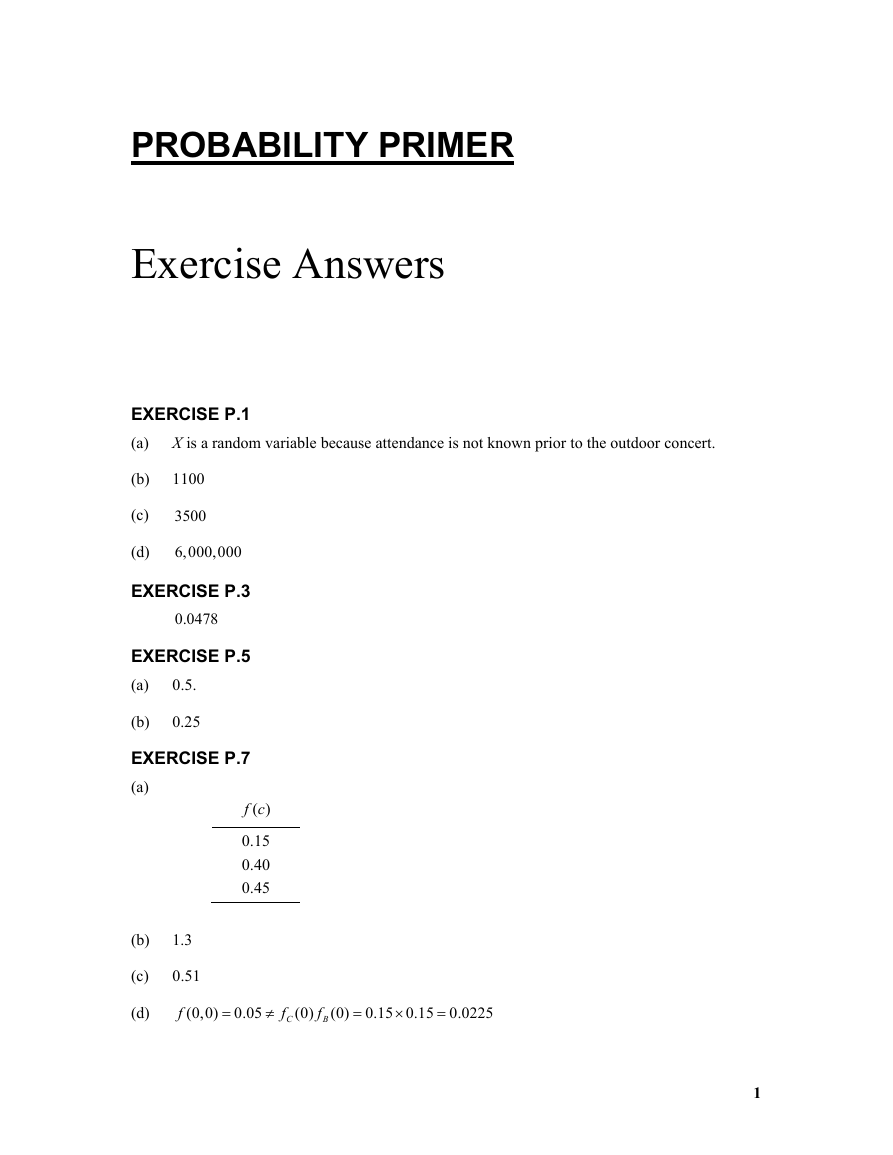

PROBABILITY PRIMER

Exercise Answers

EXERCISE P.1

(a)

X is a random variable because attendance is not known prior to the outdoor concert.

(b)

(c)

(d)

1100

3500

6,000,000

EXERCISE P.3

0.0478

EXERCISE P.5

(a)

0.5.

(b)

0.25

EXERCISE P.7

(a)

f c

( )

0.15

0.40

0.45

(b)

(c)

(d)

1.3

0.51

f

(0,0) 0.05

f

C

(0)

f

B

(0) 0.15 0.15 0.0225

1

�

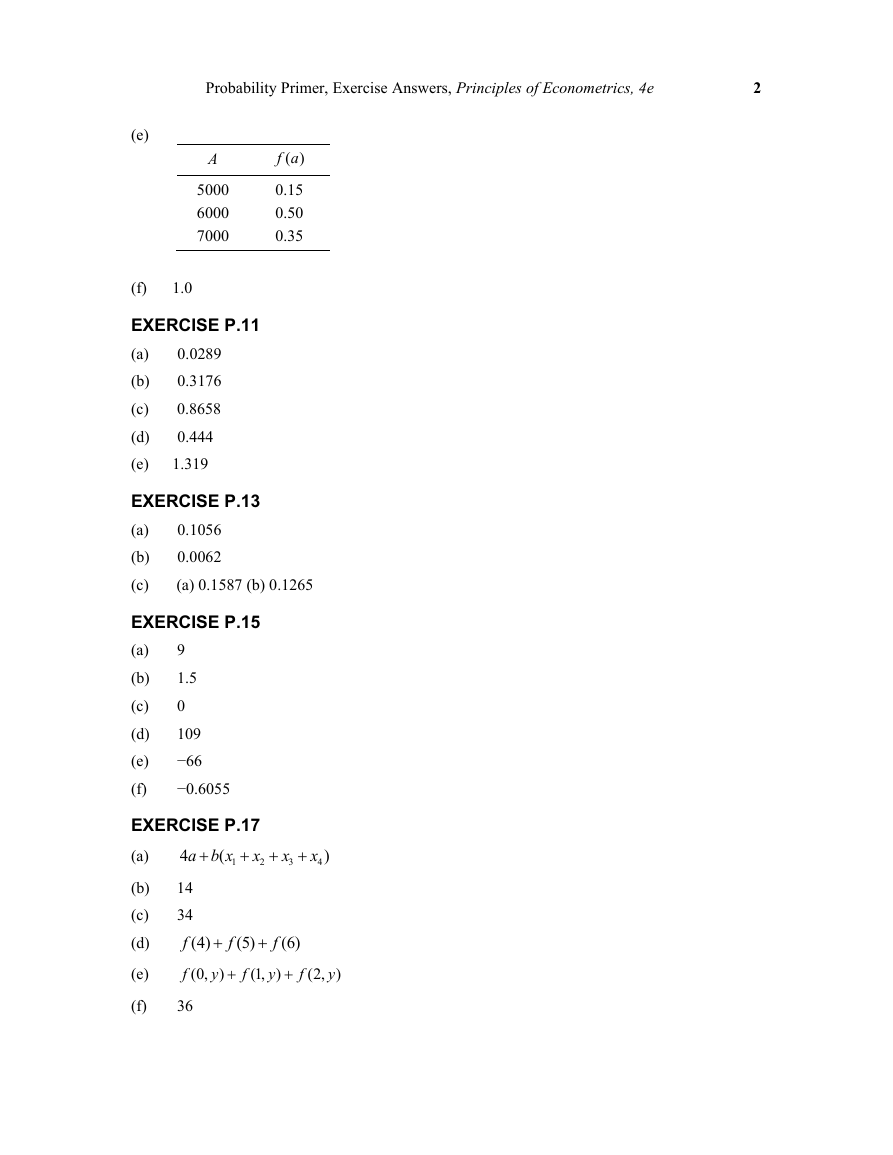

Probability Primer, Exercise Answers, Principles of Econometrics, 4e

2

(e)

A

5000

6000

7000

f a

( )

0.15

0.50

0.35

(f)

1.0

EXERCISE P.11

(a)

(b)

(c)

(d)

(e)

0.0289

0.3176

0.8658

0.444

1.319

EXERCISE P.13

(a)

(b)

(c)

0.1056

0.0062

(a) 0.1587 (b) 0.1265

EXERCISE P.15

(a)

(b)

(c)

(d)

(e)

(f)

9

1.5

0

109

−66

−0.6055

EXERCISE P.17

x

(a)

2

(b)

(c)

(d)

(e)

(f)

a b x

4

(

1

14

34

f

(4)

f

(0,

36

(5)

f

(1,

y

)

f

x

3

x

4

)

f

y

)

(6)

f

(2,

y

)

�

CHAPTER 2

Exercise Answers

EXERCISE 2.3

(a)

The line drawn for part (a) will depend on each student’s subjective choice about the

position of the line. For this reason, it has been omitted.

1.514286

b

2

b

1 10.8

(b)

Figure xr2.3 Observations and fitted line

0

1

8

6

4

2

1

2

3

x

4

y

Fitted values

5

6

y

x

ˆ

y

5.5

3.5

5.5

(c)

3

�

Chapter 2, Exercise Answers Principles of Econometrics, 4e

4

Exercise 2.3 (Continued)

(d)

ˆie

0.714286

0.228571

−1.257143

0.257143

−1.228571

1.285714

(e)

ie

ˆ

0.

ix e

ˆ

i

0

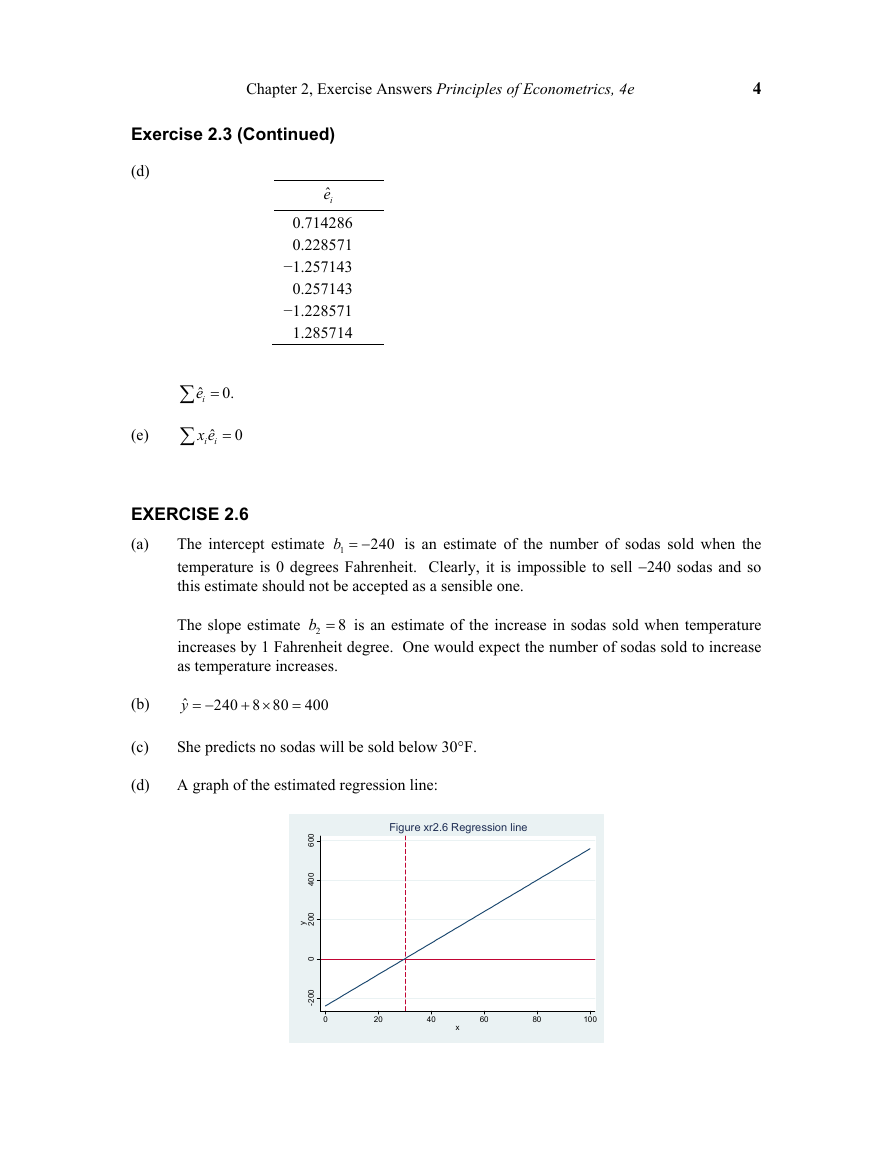

240

b

1

is an estimate of the number of sodas sold when the

The intercept estimate

temperature is 0 degrees Fahrenheit. Clearly, it is impossible to sell 240 sodas and so

this estimate should not be accepted as a sensible one.

b is an estimate of the increase in sodas sold when temperature

The slope estimate

2

increases by 1 Fahrenheit degree. One would expect the number of sodas sold to increase

as temperature increases.

ˆ

y

240 8 80

400

She predicts no sodas will be sold below 30F.

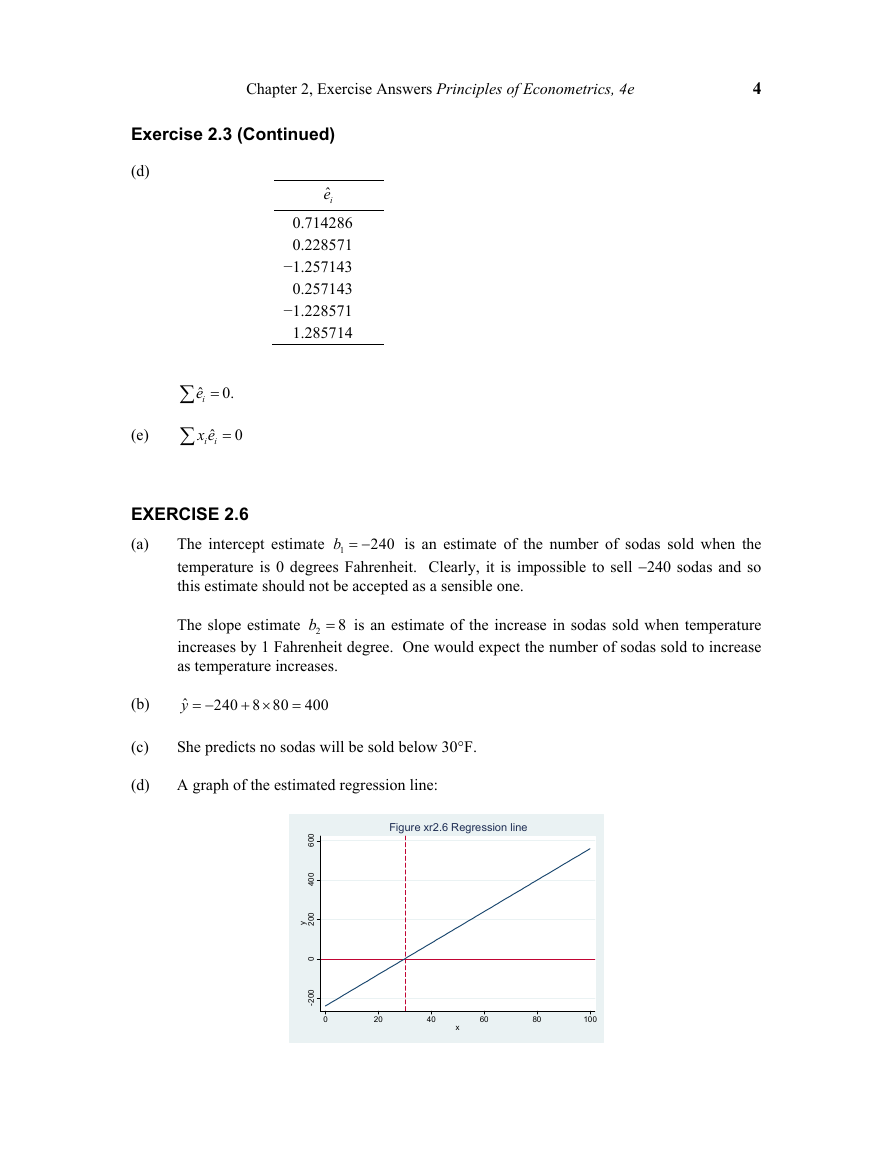

A graph of the estimated regression line:

Figure xr2.6 Regression line

0

0

6

0

0

4

0

0

2

y

0

0

0

2

-

0

20

40

x

60

80

100

EXERCISE 2.6

(a)

8

(b)

(c)

(d)

�

Chapter 2, Exercise Answers Principles of Econometrics, 4e

5

EXERCISE 2.9

(a)

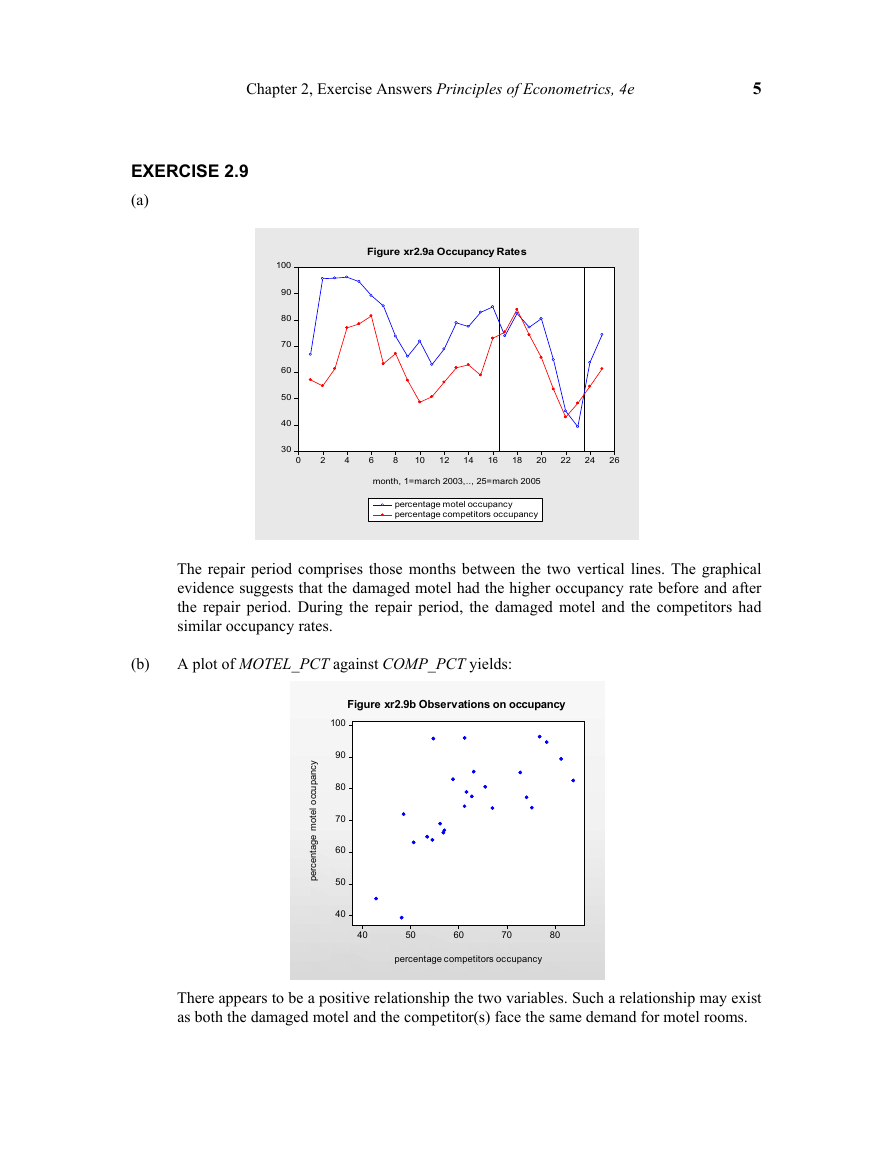

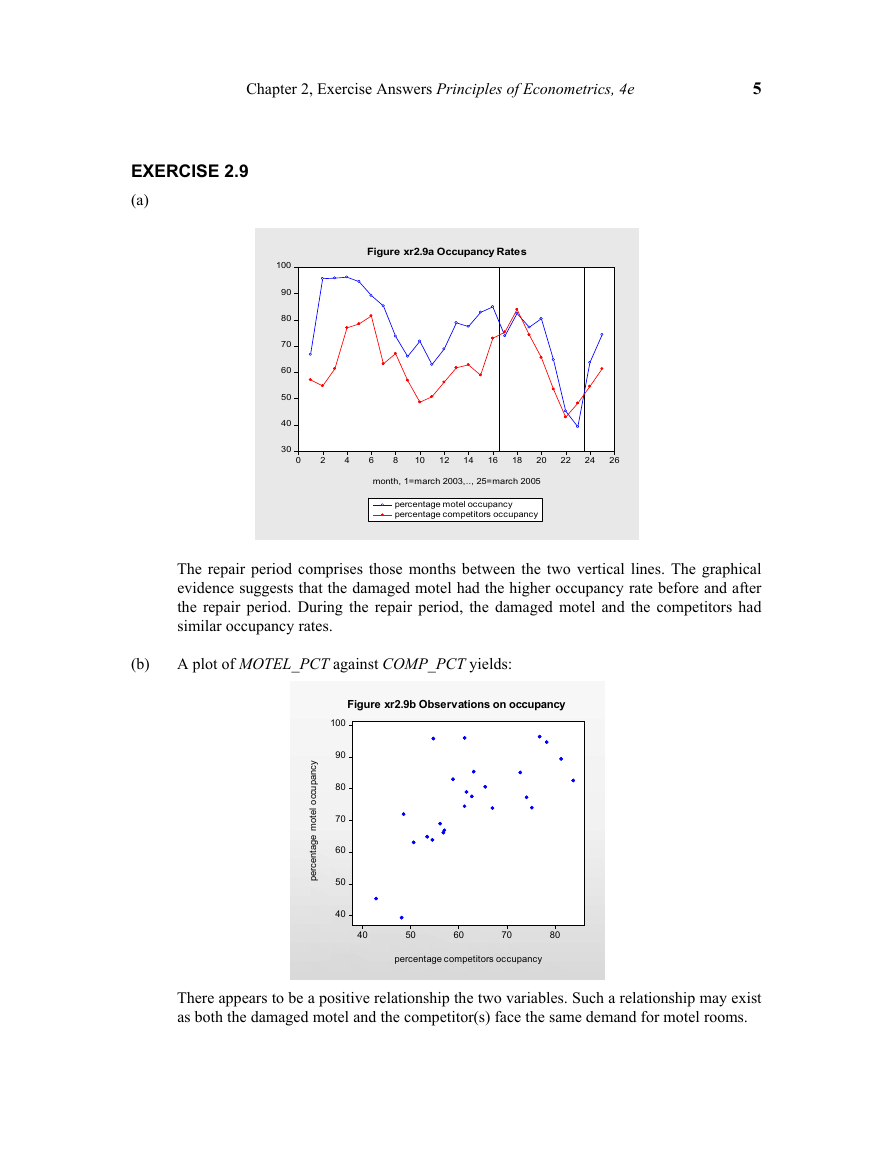

Figure xr2.9a Occupancy Rates

100

90

80

70

60

50

40

30

0

2

4

6

8

10

12

14

16

18

20

22

24

26

month, 1=march 2003,.., 25=march 2005

percentage motel occupancy

percentage competitors occupancy

The repair period comprises those months between the two vertical lines. The graphical

evidence suggests that the damaged motel had the higher occupancy rate before and after

the repair period. During the repair period, the damaged motel and the competitors had

similar occupancy rates.

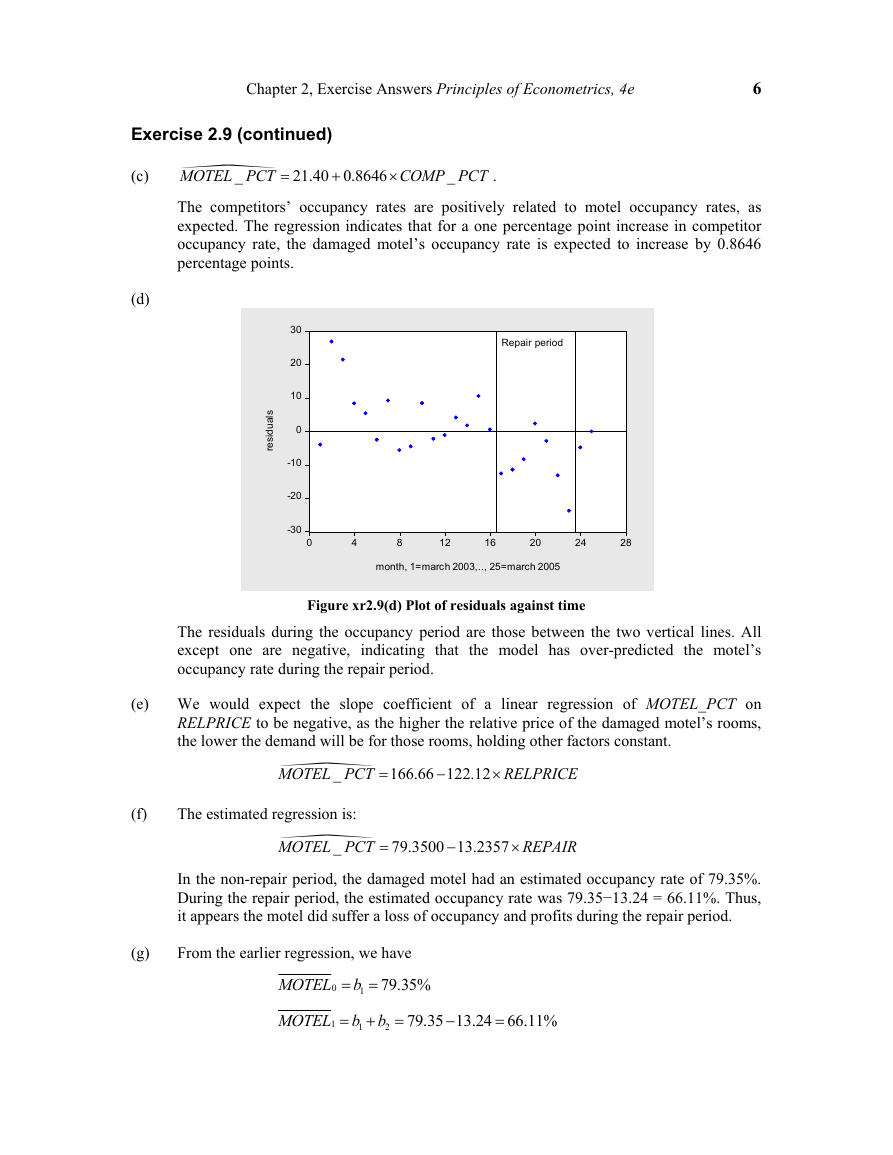

A plot of MOTEL_PCT against COMP_PCT yields:

Figure xr2.9b Observations on occupancy

(b)

100

90

80

70

60

50

40

y

c

n

a

p

u

c

c

o

l

e

t

o

m

e

g

a

t

n

e

c

r

e

p

40

50

60

70

80

percentage competitors occupancy

There appears to be a positive relationship the two variables. Such a relationship may exist

as both the damaged motel and the competitor(s) face the same demand for motel rooms.

�

Chapter 2, Exercise Answers Principles of Econometrics, 4e

6

Exercise 2.9 (continued)

21.40 0.8646

(c) _

MOTEL PCT

The competitors’ occupancy rates are positively related to motel occupancy rates, as

expected. The regression indicates that for a one percentage point increase in competitor

occupancy rate, the damaged motel’s occupancy rate is expected to increase by 0.8646

percentage points.

COMP PCT

_

.

(d)

l

s

a

u

d

s

e

r

i

30

20

10

0

-10

-20

-30

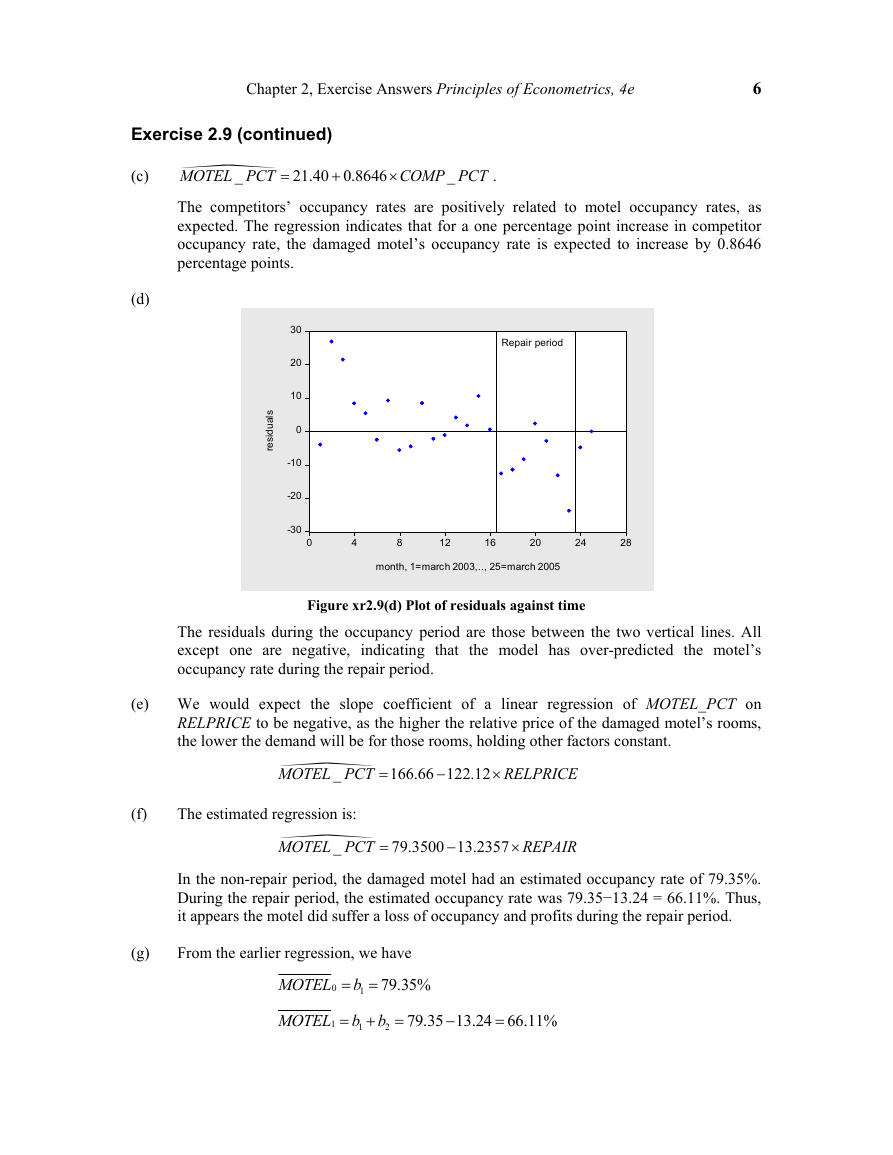

Repair period

0

4

8

12

16

20

24

28

month, 1=march 2003,.., 25=march 2005

Figure xr2.9(d) Plot of residuals against time

The residuals during the occupancy period are those between the two vertical lines. All

except one are negative, indicating that the model has over-predicted the motel’s

occupancy rate during the repair period.

(e) We would expect the slope coefficient of a linear regression of MOTEL_PCT on

RELPRICE to be negative, as the higher the relative price of the damaged motel’s rooms,

the lower the demand will be for those rooms, holding other factors constant.

_

MOTEL PCT

166.66 122.12

RELPRICE

(f)

The estimated regression is:

_

MOTEL PCT

In the non-repair period, the damaged motel had an estimated occupancy rate of 79.35%.

During the repair period, the estimated occupancy rate was 79.35−13.24 = 66.11%. Thus,

it appears the motel did suffer a loss of occupancy and profits during the repair period.

79.3500 13.2357

REPAIR

(g)

From the earlier regression, we have

MOTEL

0

MOTEL

1

b

1 79.35%

b

1

b

2

79.35 13.24 66.11%

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc