000

front-matter

Econometrics of Financial High-Frequency Data

Preface

Contents

001

Chapter 1: Introduction

1.1 Motivation

1.2 Structure of the Book

References

002

Chapter 2: Microstructure Foundations

2.1 The Institutional Framework of Trading

2.1.1 Types of Traders and Forms of Trading

2.1.2 Types of Orders

2.1.3 Market Structures

2.1.3.1 Quote-Driven Dealer Markets

2.1.3.2 Order-Driven Markets

2.1.3.3 Brokered Markets

2.1.4 Order Precedence and Pricing Rules

2.1.5 Trading Forms at Selected International Exchanges

2.1.5.1 The New York Stock Exchange (NYSE)

2.1.5.2 NASDAQ

2.1.5.3 XETRA

2.1.5.4 Australian Stock Exchange

2.2 A Review of Market Microstructure Theory

2.2.1 Asymmetric Information Based Models

2.2.1.1 Sequential Trade Models

2.2.1.2 Strategic Trade Models

2.2.2 Inventory Models

2.2.3 Major Implications for Trading Variables

2.2.4 Models for Limit Order Book Markets

References

003

Chapter 3: Empirical Properties of High-Frequency Data

3.1 Handling High-Frequency Data

3.1.1 Databases and Trading Variables

3.1.2 Matching Trades and Quotes

3.1.3 Data Cleaning

3.1.4 Split-Transactions

3.1.5 Identification of Buyer- and Seller-Initiated Trades

3.2 Aggregation by Trading Events: Financial Durations

3.2.1 Trade and Order Arrival Durations

3.2.2 Price and Volume Durations

3.3 Properties of Financial Durations

3.4 Properties of Trading Characteristics

3.5 Properties of Time Aggregated Data

3.6 Summary of Major Empirical Findings

References

004

Chapter 4: Financial Point Processes

4.1 Basic Concepts of Point Processes

4.1.1 Fundamental Definitions

4.1.1.1 Point Processes

4.1.1.2 Counting Processes

4.1.1.3 Durations and Backward Recurrence Times

4.1.1.4 Filtrations and (Time-Varying) Covariates

4.1.2 Compensators and Intensities

4.1.3 The Homogeneous Poisson Process

4.1.4 Generalizations of Poisson Processes

4.1.5 A Random Time Change Argument

4.1.6 Intensity-Based Inference

4.1.7 Simulation and Diagnostics

4.2 Four Ways to Model Point Processes

4.2.1 Intensity Models

4.2.2 Hazard Models

4.2.2.1 Proportional Hazard (PH) Models

4.2.2.2 Accelerated Failure Time Models

4.2.3 Duration Models

4.2.4 Count Data Models

4.3 Censoring and Time-Varying Covariates

4.3.1 Censoring

4.3.2 Time-Varying Covariates

4.4 An Outlook on Dynamic Extensions

References

005

Chapter 5: Univariate Multiplicative Error Models

5.1 ARMA Models for Log Variables

5.2 A MEM for Durations: The ACD Model

5.3 Estimation of the ACD Model

5.3.1 QML Estimation

5.3.2 ML Estimation

5.4 Seasonalities and Explanatory Variables

5.5 The Log-ACD Model

5.6 Testing the ACD Model

5.6.1 Portmanteau Tests

5.6.2 Independence Tests

5.6.3 Distribution Tests

5.6.4 Lagrange Multiplier Tests

5.6.5 Conditional Moment Tests

5.6.5.1 Adapting Newey's Conditional Moment Test

5.6.5.2 Integrated Conditional Moment Tests

5.6.6 Monte Carlo Evidence

References

006

Chapter 6: Generalized Multiplicative Error Models

6.1 A Class of Augmented ACD Models

6.1.1 Special Cases

6.1.1.1 Additive and Multiplicative ACD (AMACD) Model

6.1.1.2 Box–Cox ACD (BACD) Model

6.1.1.3 EXponential ACD (EXACD) Model

6.1.1.4 Augmented Box–Cox ACD (ABACD) Model

6.1.1.5 Hentschel ACD (HACD) Model

6.1.1.6 Augmented Hentschel ACD (AHACD) Model

6.1.1.7 Spline News Impact ACD (SNIACD) Model

6.1.2 Theoretical Properties

6.1.3 Empirical Illustrations

6.2 Regime-Switching ACD Models

6.2.1 Threshold ACD Models

6.2.2 Smooth Transition ACD Models

6.2.3 Markov Switching ACD Models

6.3 Long Memory ACD Models

6.4 Mixture and Component Multiplicative Error Models

6.4.1 The Stochastic Conditional Duration Model

6.4.2 Stochastic Multiplicative Error Models

6.4.3 Component Multiplicative Error Models

6.5 Further Generalizations of Multiplicative Error Models

6.5.1 Competing Risks ACD Models

6.5.2 Semiparametric ACD Models

6.5.3 Stochastic Volatility Duration Models

References

007

Chapter 7: Vector Multiplicative Error Models

7.1 VMEM Processes

7.1.1 The Basic VMEM Specification

7.1.2 Statistical Inference

7.1.3 Applications

7.2 Stochastic Vector Multiplicative Error Models

7.2.1 Stochastic VMEM Processes

7.2.2 Simulation-Based Inference

7.2.3 Modelling Trading Processes

References

008

Chapter 8: Modelling High-Frequency Volatility

8.1 Intraday Quadratic Variation Measures

8.1.1 Maximum Likelihood Estimation

8.1.2 The Realized Kernel Estimator

8.1.3 The Pre-averaging Estimator

8.1.4 Empirical Evidence

8.1.5 Modelling and Forecasting Intraday Variances

8.2 Spot Variances and Jumps

8.3 Trade-Based Volatility Measures

8.4 Volatility Measurement Using Price Durations

8.5 Modelling Quote Volatility

References

009

Chapter 9: Estimating Market Liquidity

9.1 Simple Spread and Price Impact Measures

9.1.1 Spread Measures

9.1.2 Price Impact Measures

9.2 Volume Based Measures

9.2.1 The VNET Measure

9.2.2 Excess Volume Measures

9.2.2.1 Determinants of Excess Volume Durations

9.2.2.2 Measuring Realized Market Depth

9.3 Modelling Order Book Depth

9.3.1 A Cointegrated VAR Model for Quotes and Depth

9.3.2 A Dynamic Nelson–Siegel Type Order Book Model

9.3.3 A Semiparametric Dynamic Factor Model

References

010

Chapter 10: Semiparametric Dynamic Proportional Hazard Models

10.1 Dynamic Integrated Hazard Processes

10.2 The Semiparametric ACPH Model

10.3 Properties of the Semiparametric ACPH Model

10.3.1 Autocorrelation Structure

10.3.2 Estimation Quality

10.4 Extended SACPH Models

10.4.1 Regime-Switching Baseline Hazard Functions

10.4.2 Censoring

10.4.3 Unobserved Heterogeneity

10.5 Testing the SACPH Model

10.6 Estimating Volatility Using the SACPH Model

10.6.1 Data and the Generation of Price Events

10.6.2 Empirical Findings

References

011

Chapter 11: Univariate Dynamic Intensity Models

11.1 The Autoregressive Conditional Intensity Model

11.2 Generalized ACI Models

11.2.1 Long-Memory ACI Models

11.2.2 An AFT-Type ACI Model

11.2.3 A Component ACI Model

11.2.4 Empirical Application

11.3 Hawkes Processes

References

012

Chapter 12: Multivariate Dynamic Intensity Models

12.1 Multivariate ACI Models

12.2 Applications of Multivariate ACI Models

12.2.1 Estimating Simultaneous Buy/Sell Intensities

12.2.2 Modelling Order Aggressiveness

12.3 Multivariate Hawkes Processes

12.3.1 Statistical Properties

12.3.2 Estimating Multivariate Price Intensities

12.4 Stochastic Conditional Intensity Processes

12.4.1 Model Structure

12.4.2 Probabilistic Properties of the SCI Model

12.4.3 Statistical Inference

12.5 SCI Modelling of Multivariate Price Intensities

References

013

Chapter 13: Autoregressive Discrete Processes and Quote Dynamics

13.1 Univariate Dynamic Count Data Models

13.1.1 Autoregressive Conditional Poisson Models

13.1.2 Extended ACP Models

13.1.3 Empirical Illustrations

13.2 Multivariate ACP Models

13.3 A Simple Model for Transaction Price Dynamics

13.4 Autoregressive Conditional Multinomial Models

13.5 Autoregressive Models for Integer-Valued Variables

13.6 Modelling Ask and Bid Quote Dynamics

13.6.1 Cointegration Models for Ask and Bid Quotes

13.6.2 Decomposing Quote Dynamics

References

014

Appendix A: Important Distributions for Positive-Valued Data

Poisson Distribution

Negative Binomial Distribution

Log-Normal Distribution

Exponential Distribution

Gamma Distribution

Weibull Distribution

Generalized Gamma Distribution

Generalized F Distribution

Burr Distribution

Extreme Value Type I Distribution

Burr Type II Distribution

Pareto Distribution

Index

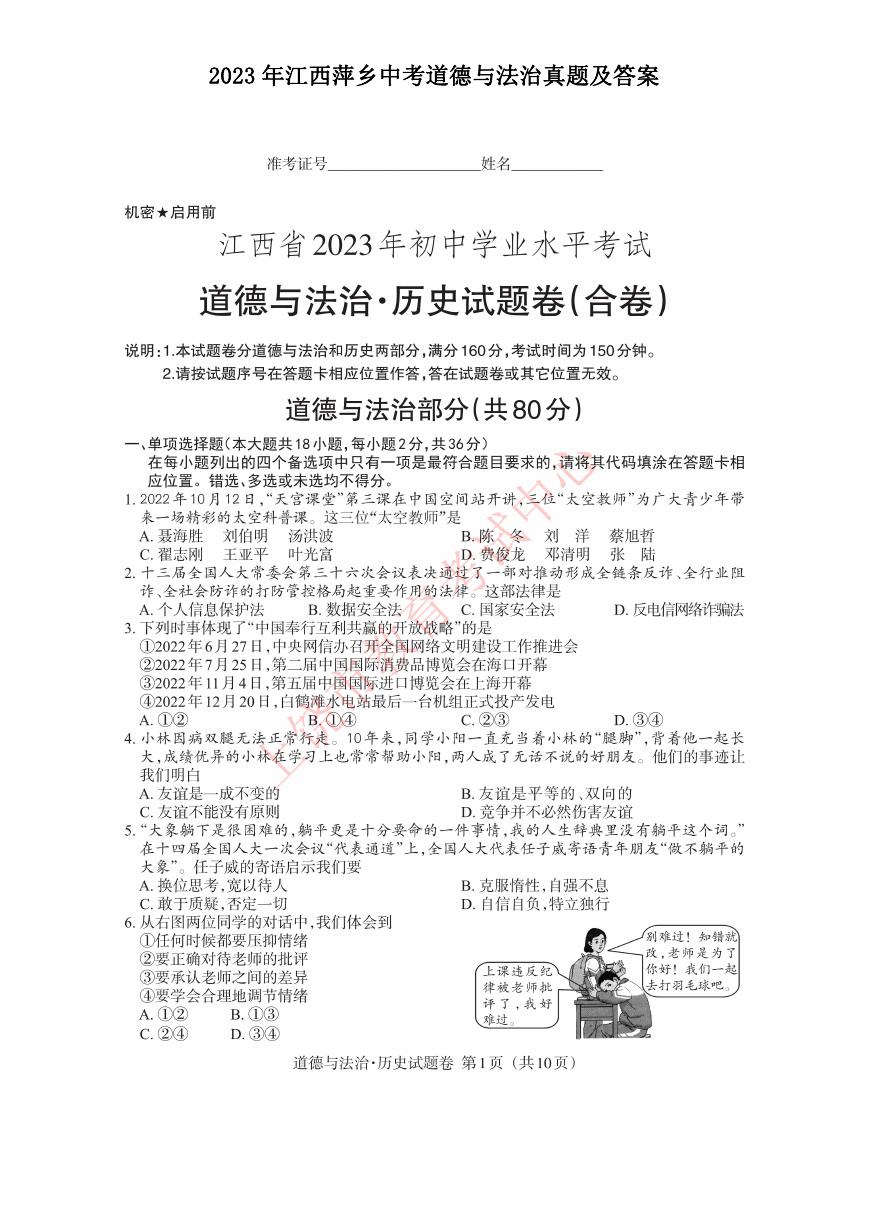

2023年江西萍乡中考道德与法治真题及答案.doc

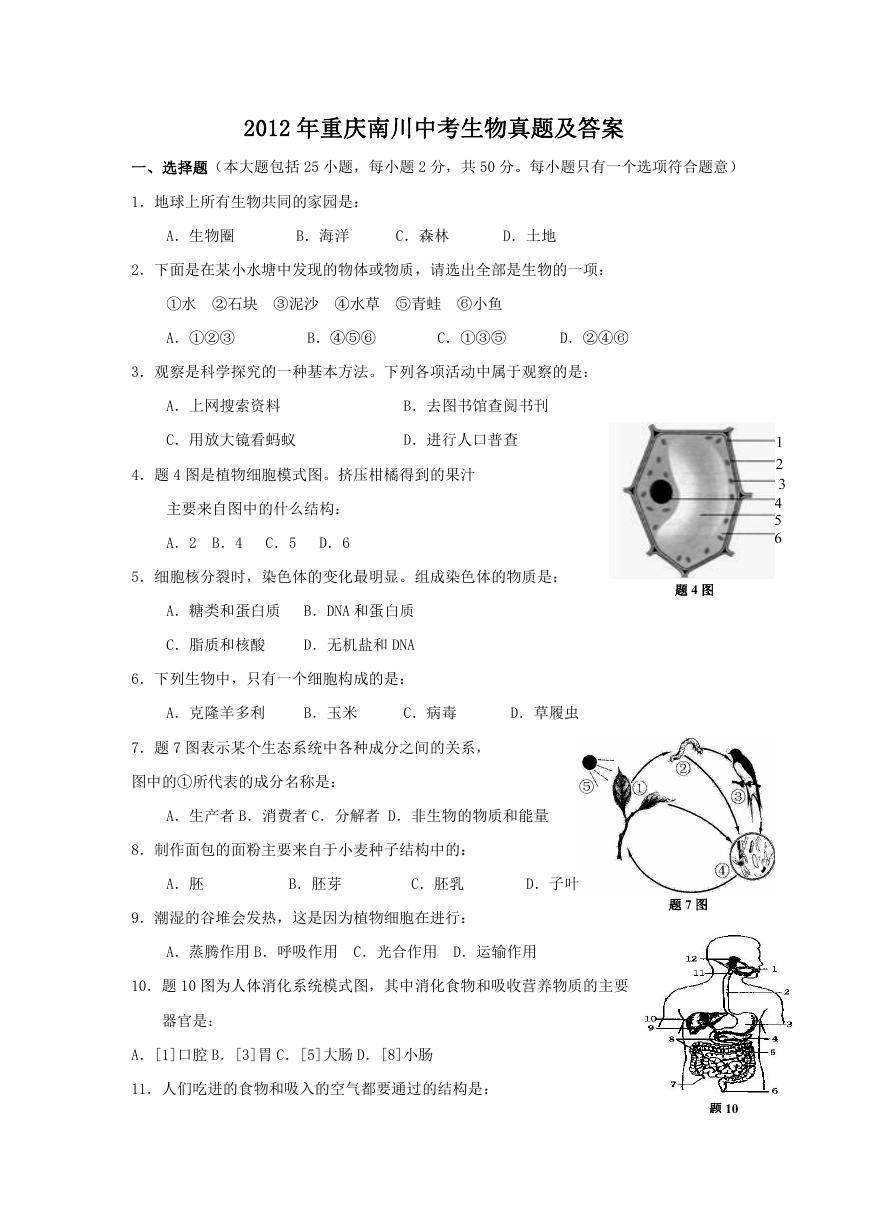

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

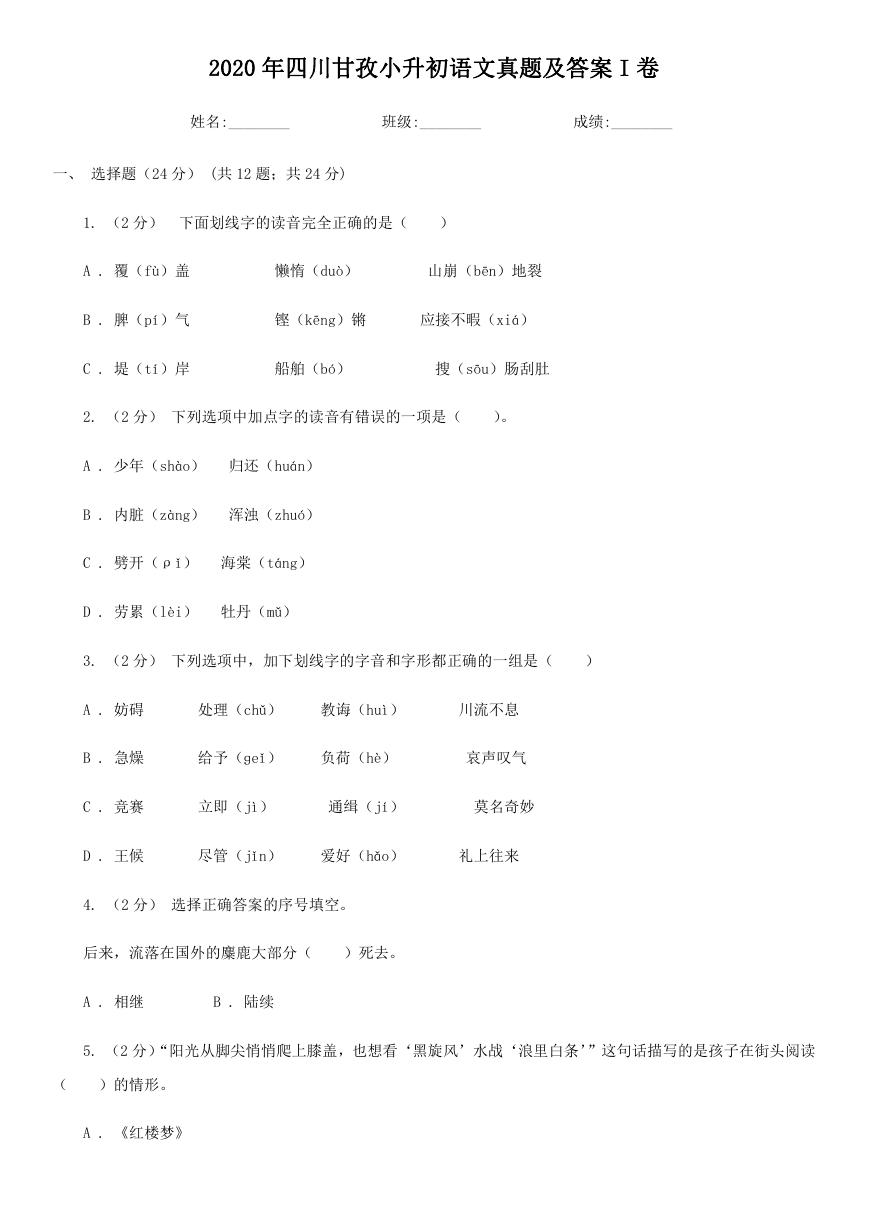

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc