Cisco Visual Networking

Index: Forecast and Trends,

2017–2022

This forecast is part of the Cisco® Visual Networking Index™ (Cisco VNI™), an ongoing initiative to

track and forecast the impact of visual networking applications. This document presents the details

of the Cisco VNI global IP traffic forecast, key trends and the underlying methodology. For more

global, regional and select country-level projections, refer to the VNI Forecast Highlights tool.

Executive summary

Global traffic projections

Annual global IP traffic will reach 4.8 ZB per year by 2022, or 396 Exabytes (EB) per month. In 2017, the

annual run rate for global IP traffic was 1.5 ZB per year, or 122 EB per month.

Global IP traffic will increase threefold over the next 5 years. Overall, IP traffic will grow at a Compound

Annual Growth Rate (CAGR) of 26 percent from 2017 to 2022. Monthly IP traffic will reach 50 GB per capita by

2022, up from 16 GB per capita in 2017.

Busy hour Internet traffic is growing more rapidly than average Internet traffic. Busy hour (or the busiest

60minute period in a day) Internet traffic will increase by a factor of 4.8 between 2017 and 2022, and average

Internet traffic will increase by a factor of 3.7.

Global internet users and devices/Connections

The number of devices connected to IP networks will be more than three times the global population by

2022. There will be 3.6 networked devices per capita by 2022, up from 2.4 networked devices per capita in

2017. There will be 28.5 billion networked devices by 2022, up from 18 billion in 2017.

M2M connections will be more than half of the global connected devices and connections by 2022. The

share of M2M connections will grow from 34 percent in 2017 to 51 percent by 2022. There will be 14.6 billion

M2M connections by 2022.

Smartphone traffic will exceed PC traffic. In 2018, PCs accounted for 41 percent of total IP traffic, but by

2022 PCs will account for only 19 percent of IP traffic. Smartphones will account for 44 percent of total IP traffic

by 2022, up from 18 percent in 2017.

© 2019 Cisco and/or its affiliates. All rights reserved.

White paperCisco public© 2019 Cisco and/or its affiliates. All rights reserved.�

Contents

Executive summary

Forecast overview

Trends

Trend 1: Continued shifts in mix of

devices and connections

Trend (loT) 2: IPv6 adoption enables

Internet of Things (loT) connectivity

Trend 3: M2M applications

across many industries

accelerate IoT growth

Trend 4: Applications traffic growth

Trend 5: “Cord-Cutting” analysis

Trend 6: Security analysis

Trend 7: Effects of accelerating

speeds on traffic growth

Trend 8: Mobility (Wi-Fi) continues

to gain momentum

Trend 9: Traffic-pattern analysis

(peak compared to average, CDN

uptake and SD-WAN)

Appendices

Appendix A:

Overview of VNI methodology

Appendix B:

Global IP traffic growth,

2017–2022

Appendix C:

Consumer IP traffic,

2017–2022

Appendix D:

Consumer internet traffic,

2017–2022

Appendix E:

Content delivery network traffic,

2017–2022

Appendix F:

Consumer-managed IP traffic,

2017–2022

Appendix G: Business IP traffic

Appendix H: Mobile data traffic

For more information

© 2019 Cisco and/or its affiliates. All rights reserved.

Global network access/Connectivity trends (Fixed/Mobile/Wi-Fi)

Traffic from wireless and mobile devices will account for 71 percent of

total IP traffic by 2022. By 2022, wired devices will account for 29 percent

of IP traffic, and Wi-Fi and mobile devices will account for 71 percent of IP

traffic. In 2017, also, wired devices accounted for less than half of the global

IP traffic, at 48 percent.

Globally, mobile data traffic will increase sevenfold between 2017 and

2022. Mobile data traffic will grow at a CAGR of 46 percent between 2017

and 2022, reaching 77.5 exabytes per month by 2022.

Global mobile data traffic will grow nearly twice as fast as fixed IP

traffic from 2017 to 2022. Fixed IP traffic will grow at a CAGR of 24 percent

between 2017 and 2022, while mobile traffic grows at a CAGR of 46

percent. Global mobile data traffic was 9 percent of total IP traffic in 2017

and will be 20 percent of total IP traffic by 2022.

Global application trends

Globally, IP video traffic will be 82 percent of all IP traffic (both business

and consumer) by 2022, up from 75 percent in 2017. Global IP video traffic

will grow four-fold from 2017 to 2022, a CAGR of 29 percent. Internet video

traffic will grow fourfold from 2017 to 2022, a CAGR of 33 percent.

Live Internet video will account for 17 percent of Internet video traffic by

2022. Live video will grow 15-fold from 2017 to 2022.

Internet video surveillance traffic will increase sevenfold between 2017

to 2022. Globally, 3 percent of all Internet video traffic will be due to video

surveillance by 2022, up from 2 percent in 2017.

Virtual Reality (VR) and Augmented Reality (AR) traffic will increase 12-

fold between 2017 and 2022 globally, a CAGR of 65 percent.

Internet video to TV will increase threefold between 2017 to 2022.

Internet video to TV will be 27 percent of fixed consumer Internet video

traffic by 2022.

Consumer Video-on-Demand (VoD) traffic will nearly double by 2022.

The amount of VoD traffic by 2022 will be equivalent to 10 billion DVDs

per month.

Internet gaming traffic will grow ninefold from 2017 to 2022, a CAGR

of 55 percent. Globally, Internet gaming traffic will be 4 percent of global IP

traffic by 2022, up from 1 percent in 2017.

Global network performance

Broadband speeds will nearly double by 2022. By 2022, global fixed

broadband speeds will reach 75.4 Mbps, up from 39 Mbps in 2017.

White paperCisco public�

Global traffic topology

Content Delivery Networks (CDNs) will carry 72 percent of Internet traffic by 2022 up from 56 percent in 2017.

Thirty-three percent of service provider network capacity will be within a metro network by 2022, up from 27

percent in 2017.

Global 5G mobile highlights

5G devices and connections will be over 3 percent of global mobile devices and connections by 2022.

By 2022, global mobile devices will grow from 8.6 billion in 2017 to 12.3 billion by 2022 - over 422 million of those

will be 5G capable.

Nearly twelve percent of global mobile traffic will be on 5G cellular connectivity by 2022. Globally, the average

5G connection will generate 21 GB of traffic per month by 2022.

Regional highlights

IP traffic is growing fastest in the Middle East and Africa, followed by Asia Pacific. Traffic in the Middle East and

Africa will grow at a CAGR of 41 percent between 2017 and 2022.

Summary of regional growth rates:

• IP traffic in Asia Pacific will reach 172.7 EB per month by 2022, growing at a CAGR of 32 percent.

- By 2022, APAC will have 2.6 billion Internet users (62 percent of population), up from 1.7 billion (41 percent of

population) in 2017.

- By 2022, APAC will have 13.1 billion networked devices/connections, up from 8.6 billion in 2017.

- By 2022, APAC’s average fixed broadband speed will reach 98.8 Mbps, 2.1-fold growth from 2017 (46.2 Mbps)

• IP traffic in North America will reach 108.4 EB per month by 2022, growing at a CAGR of 21 percent.

- By 2022, NA will have 353 million Internet users (94 percent of population), up from 331 million (92 percent of

population) in 2017.

- By 2022, NA will have 5.0 billion networked devices/connections, up from 2.9 billion in 2017.

- By 2022, NA’s average fixed broadband speed will reach 94.2 Mbps, 2.2-fold growth from 2017 (43.2 Mbps)

• IP traffic in Western Europe will reach 49.9 EB per month by 2022, growing at a CAGR of 22 percent.

- By 2022, WE will have 380 million Internet users (89 percent of population), up from 358 million (85 percent of

population) in 2017.

- By 2022, WE will have 4.0 billion networked devices/connections, up from 2.3 billion in 2017.

- By 2022, WE’s average fixed broadband speed will reach 76.0 Mbps, 2.0-fold growth from 2017 (37.9 Mbps)

IP traffic in Central and Eastern Europe will reach 25.3 EB per month by 2022, growing at a CAGR of 26 percent.

- By 2022, CEE will have 364 million Internet users (73 percent of population), up from 332 million (68 percent of

population) in 2017.

- By 2022, CEE will have 2.0 billion networked devices/connections, up from 1.2 billion in 2017.

- By 2022, CEE’s average fixed broadband speed will reach 46.7 Mbps, 1.4-fold growth from 2017 (32.8 Mbps)

White paperCisco public© 2019 Cisco and/or its affiliates. All rights reserved.�

• IP traffic in the Middle East and Africa will reach 20.9 EB per month by 2022, growing at a CAGR of 41 percent.

- By 2022, MEA will have 549 million Internet users (32 percent of population), up from 388 million (23 percent of

population) in 2017.

- By 2022, MEA will have 2.5 billion networked devices/connections, up from 1.7 billion in 2017.

- By 2022, MEA’s average fixed broadband speed will reach 20.2 Mbps, 2.0-fold to 2.6-fold growth from 2017

(7.8 Mbps)

• IP traffic in Latin America will reach 18.8 EB per month by 2022, growing at a CAGR of 21 percent.

- By 2022, LATAM will have 465 million Internet users (69 percent of population), up from 368 million (57 percent

of population) in 2017.

- By 2022, LATAM will have 2.0 billion networked devices/connections, up from 1.4 billion in 2017.

- By 2022, LATAM’s average fixed broadband speed will reach 28.1 Mbps, 2.4-fold growth from 2017 (11.7 Mbps).

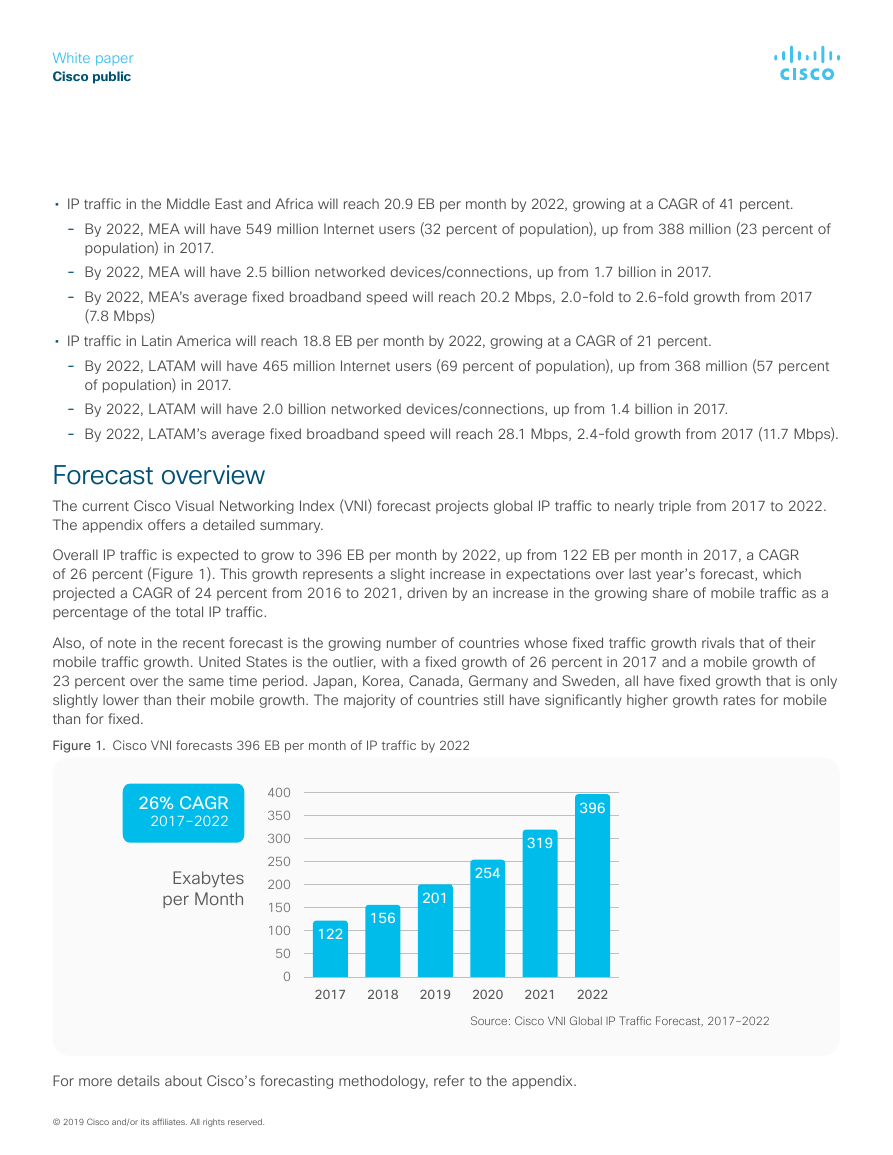

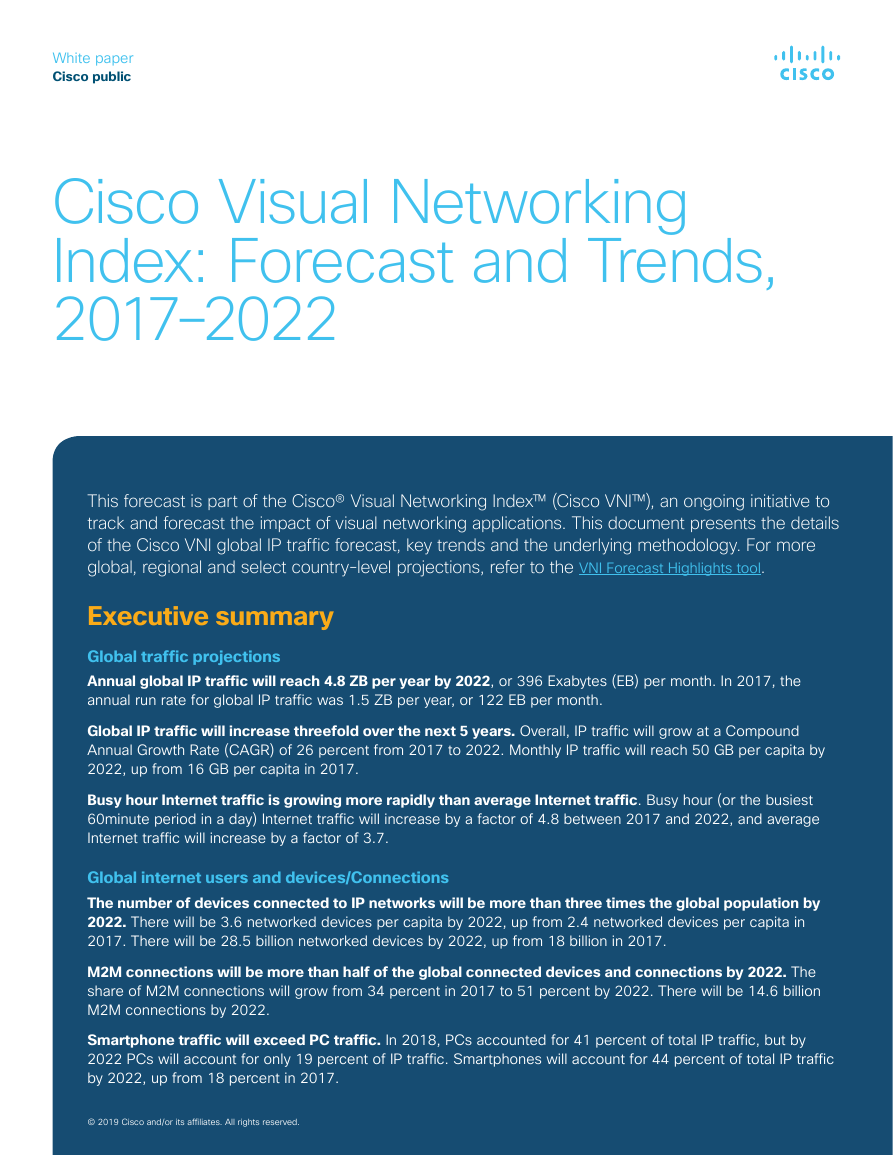

Forecast overview

The current Cisco Visual Networking Index (VNI) forecast projects global IP traffic to nearly triple from 2017 to 2022.

The appendix offers a detailed summary.

Overall IP traffic is expected to grow to 396 EB per month by 2022, up from 122 EB per month in 2017, a CAGR

of 26 percent (Figure 1). This growth represents a slight increase in expectations over last year’s forecast, which

projected a CAGR of 24 percent from 2016 to 2021, driven by an increase in the growing share of mobile traffic as a

percentage of the total IP traffic.

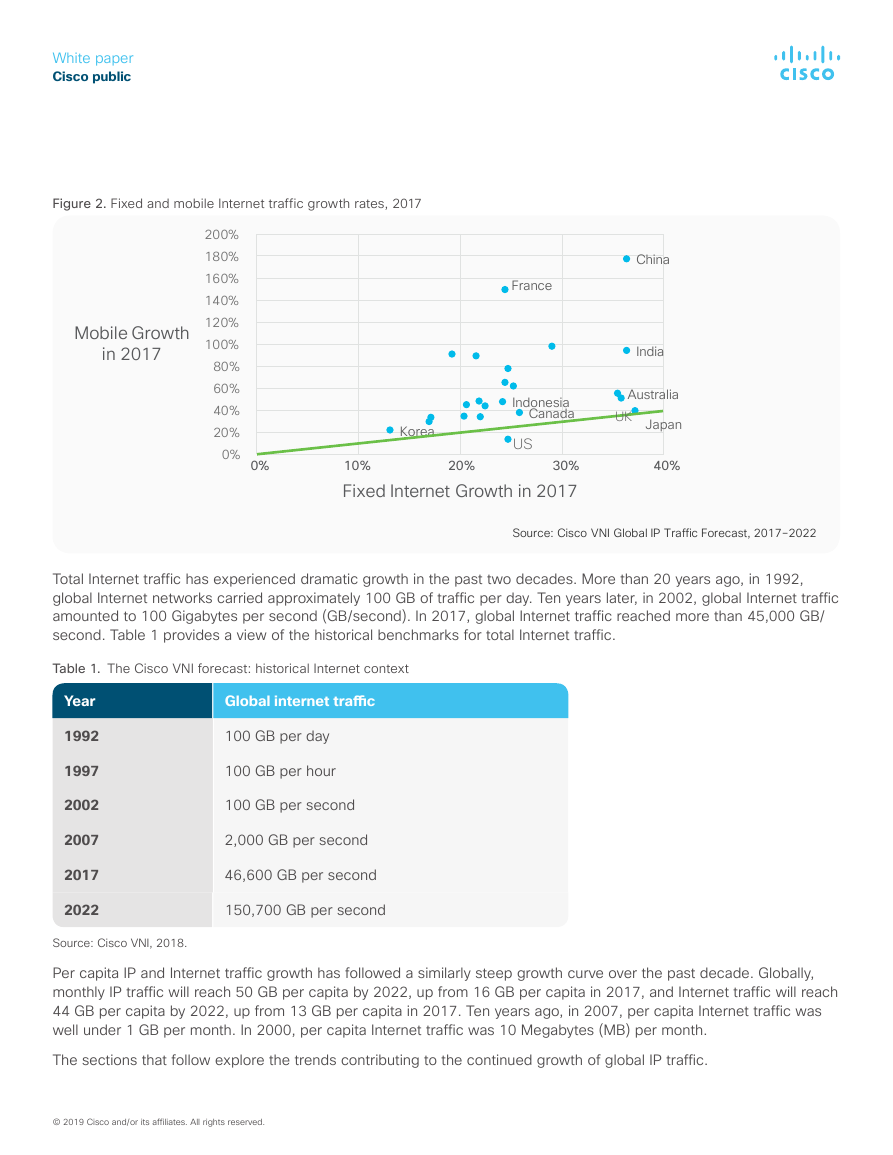

Also, of note in the recent forecast is the growing number of countries whose fixed traffic growth rivals that of their

mobile traffic growth. United States is the outlier, with a fixed growth of 26 percent in 2017 and a mobile growth of

23 percent over the same time period. Japan, Korea, Canada, Germany and Sweden, all have fixed growth that is only

slightly lower than their mobile growth. The majority of countries still have significantly higher growth rates for mobile

than for fixed.

Figure 1. Cisco VNI forecasts 396 EB per month of IP traffic by 2022

26% CAGR

2017–2022

Exabytes

per Month

400

350

300

250

200

150

100

50

0

396

319

254

201

156

122

2017

2018

2019

2020

2021

2022

Source: Cisco VNI Global IP Traffic Forecast, 2017–2022

For more details about Cisco’s forecasting methodology, refer to the appendix.

White paperCisco public© 2019 Cisco and/or its affiliates. All rights reserved.�

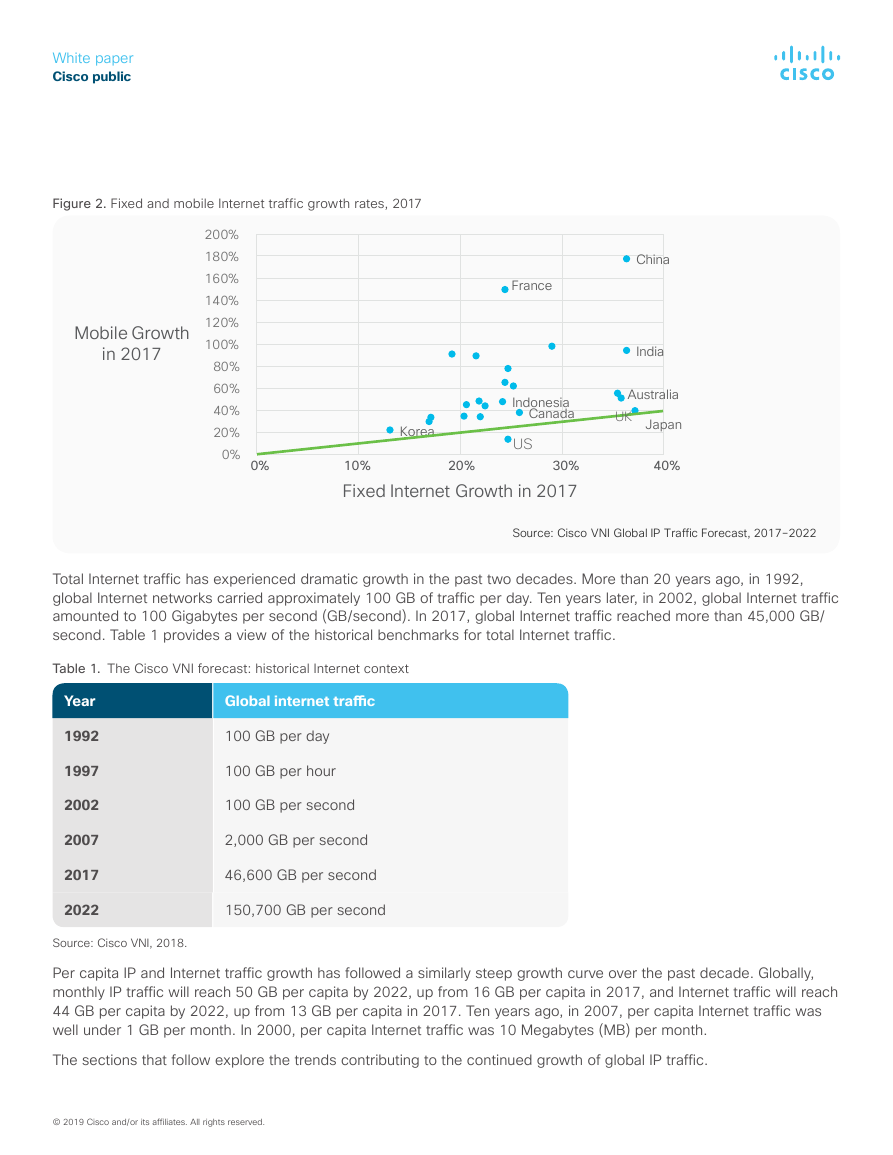

Figure 2. Fixed and mobile Internet traffic growth rates, 2017

Mobile Growth

in 2017

200%

180%

160%

140%

120%

100%

80%

60%

40%

20%

0%

France

Korea

Indonesia

Canada

US

0%

30%

10%

Fixed Internet Growth in 2017

20%

China

India

Australia

UK Japan

40%

Source: Cisco VNI Global IP Traffic Forecast, 2017–2022

Total Internet traffic has experienced dramatic growth in the past two decades. More than 20 years ago, in 1992,

global Internet networks carried approximately 100 GB of traffic per day. Ten years later, in 2002, global Internet traffic

amounted to 100 Gigabytes per second (GB/second). In 2017, global Internet traffic reached more than 45,000 GB/

second. Table 1 provides a view of the historical benchmarks for total Internet traffic.

Table 1. The Cisco VNI forecast: historical Internet context

Year

1992

1997

2002

2007

2017

2022

Global internet traffic

100 GB per day

100 GB per hour

100 GB per second

2,000 GB per second

46,600 GB per second

150,700 GB per second

Source: Cisco VNI, 2018.

Per capita IP and Internet traffic growth has followed a similarly steep growth curve over the past decade. Globally,

monthly IP traffic will reach 50 GB per capita by 2022, up from 16 GB per capita in 2017, and Internet traffic will reach

44 GB per capita by 2022, up from 13 GB per capita in 2017. Ten years ago, in 2007, per capita Internet traffic was

well under 1 GB per month. In 2000, per capita Internet traffic was 10 Megabytes (MB) per month.

The sections that follow explore the trends contributing to the continued growth of global IP traffic.

White paperCisco public© 2019 Cisco and/or its affiliates. All rights reserved.�

Trends

Trend 1: Continued shifts in mix of devices and connections

Globally, devices and connections are growing faster (10 percent CAGR) than both the population (1.0 percent CAGR)

and Internet users (7 percent CAGR). This trend is accelerating the increase in the average number of devices and

connections per household and per capita. Each year, various new devices in different form factors with increased

capabilities and intelligence are introduced and adopted in the market. A growing number of M2M applications,

such as smart meters, video surveillance, healthcare monitoring, transportation, and package or asset tracking, are

contributing in a major way to the growth of devices and connections. By 2022, M2M connections will be 51 percent

of the total devices and connections.

M2M connections will be the fastest-growing category, growing nearly 2.4-fold during the forecast period, at 19

percent CAGR, to 14.6 billion connections by 2022.

Smartphones will grow the second fastest, at a 9 percent CAGR (increasing by a factor of 1.6). Connected TVs (which

include flat-panel TVs, set-top boxes, digital media adapters [DMAs], Blu-ray disc players, and gaming consoles) will

grow next fastest at 7 percent CAGR, to 3.2 billion by 2022. PCs will continue to decline (a 2.5 percent decline) over

the forecast period. However, there will more PCs than tablets throughout the forecast period and by the end of 2022

(1.2 billion PCs vs. 790 million tablets).

By 2022, the consumer share of the total devices, including both fixed and mobile devices, will be 72 percent, with

business claiming the remaining 28 percent. Consumer share will grow at a slightly slower rate, at an 8.8 percent

CAGR relative to the business segment, which will grow at a 12.0 percent CAGR.

Figure 3. Global devices and connections growth

10% CAGR

2017–2022

Billions of

Devices

30

25

20

15

10

5

0

Other (1.6%, 2.6%)

Tablets (3%, 3%)

PCs (8%, 4%)

TVs (13%, 11%)

Non-Smartphones (16%, 4%)

Smartphones (24%, 24%)

M2M (34%, 51%)

2017

2018

2019

2020

2021

2022

* Figures (n) refer to 2017, 2022 device share

Source: Cisco VNI Global IP Traffic Forecast, 2017–2022

Globally, the average number of devices and connections per capita will grow from 2.4 in 2017 to 3.6 by 2022 (Table 2).

Among the countries that will have the highest average of per capita devices and connections by 2022 are the United

States (13.6), South Korea (11.8), and Canada (11.0).

White paperCisco public© 2019 Cisco and/or its affiliates. All rights reserved.�

Table 2. Average number of devices and connections per capita

Asia Pacific

Central and Eastern Europe

Latin America

Middle East and Africa

North America

Western Europe

Global

Source: Cisco VNI, 2018.

2017

2.1

2.5

2.1

1.1

8.0

5.4

2.4

2022

3.1

3.9

2.9

1.4

13.4

9.4

3.6

The changing mix of devices and connections and growth in multidevice ownership affects traffic and can be seen

in the changing device contribution to total IP traffic. At the end of 2017, 59 percent of IP traffic and 51 percent of

Internet traffic originated from non-PC devices. By 2022, 81 percent of IP traffic and Internet traffic will originate from

non-PC devices (Figure 4).

Figure 4. Global IP traffic by devices

26% CAGR

2017–2022

Exabytes

per Month

450

400

350

300

250

200

150

100

50

0

Other (0.01%, 0.02%)

Non-Smartphones (0.1%, 0.1%)

Tablets (5%, 6%)

M2M (3%, 6%)

PCs (41%, 19%)

TVs (32%, 24%)

Smartphones (18%, 44%)

2017

2018

2019

2020

2021

2022

* Figures (n) refer to 2017, 2022 traffic share

Source: Cisco VNI Global IP Traffic Forecast, 2017–2022

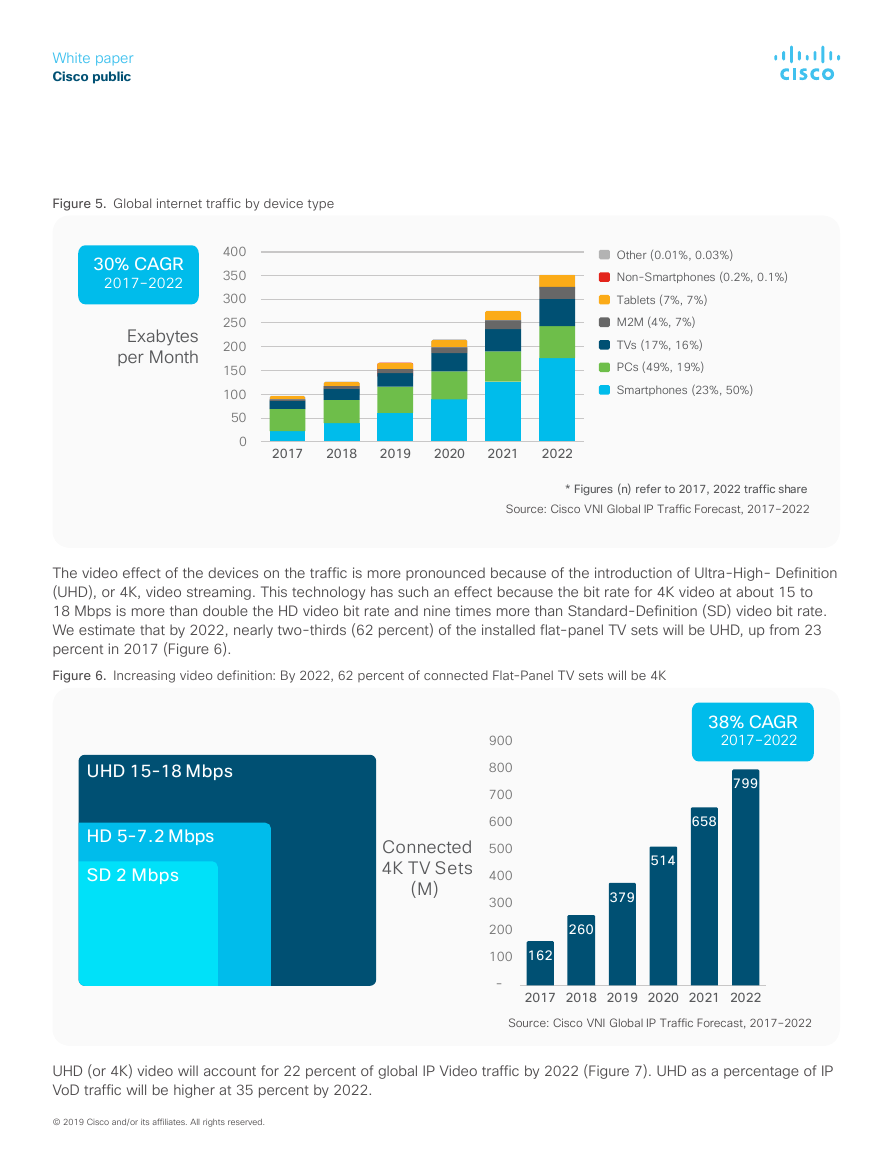

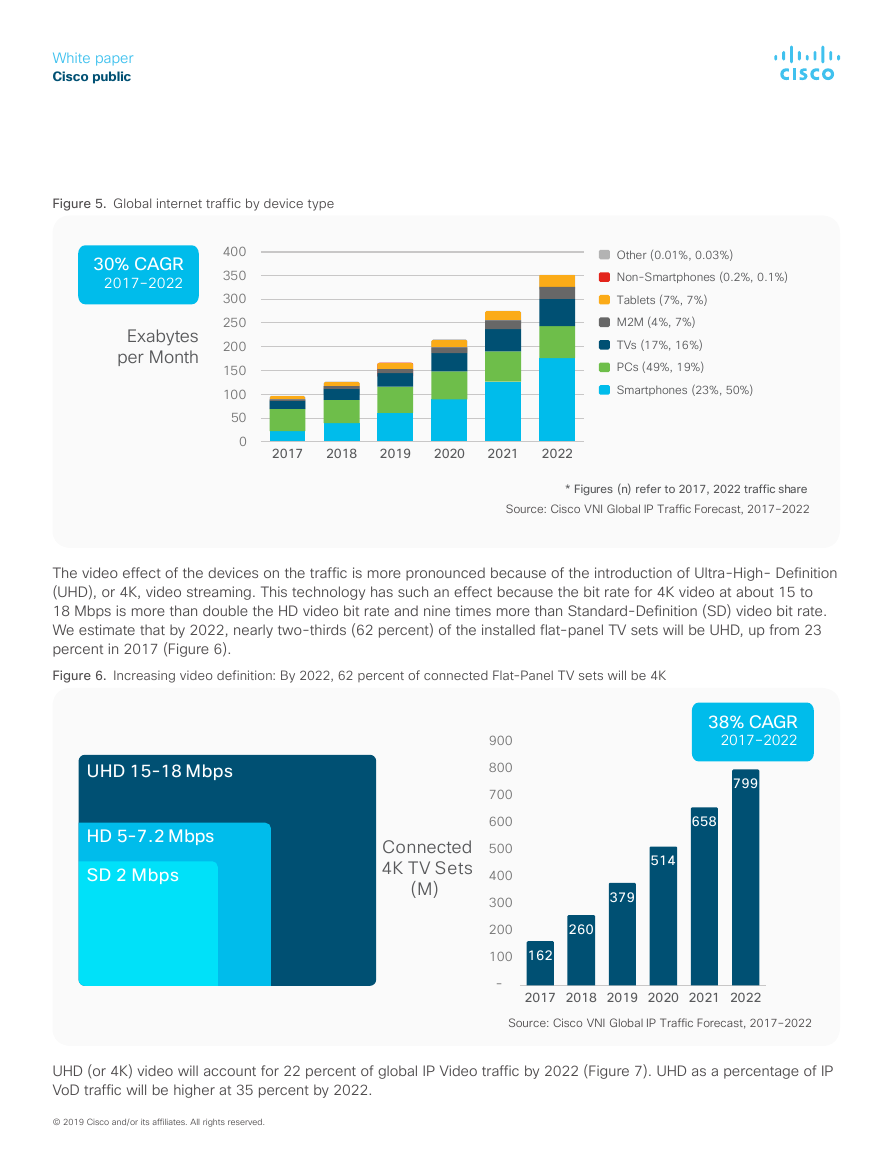

As in the case of mobile networks, video devices can have a multiplier effect on traffic. An Internet-enabled HD

television that draws 2 hours of content per day from the Internet would generate as much Internet traffic as an entire

household today. With the growth of video viewing on smartphones and tablets, traffic from these devices is growing

as a percentage of total Internet traffic. Share of PCs to total global Internet traffic will decline to 19 percent by 2022,

down from 49 percent in 2017. Smartphones will account for 50 percent of total global Internet traffic by 2022, up

from 23 percent in 2017 (Figure 5).

White paperCisco public© 2019 Cisco and/or its affiliates. All rights reserved.�

Figure 5. Global internet traffic by device type

30% CAGR

2017–2022

Exabytes

per Month

400

350

300

250

200

150

100

50

0

Other (0.01%, 0.03%)

Non-Smartphones (0.2%, 0.1%)

Tablets (7%, 7%)

M2M (4%, 7%)

TVs (17%, 16%)

PCs (49%, 19%)

Smartphones (23%, 50%)

2017

2018

2019

2020

2021

2022

* Figures (n) refer to 2017, 2022 traffic share

Source: Cisco VNI Global IP Traffic Forecast, 2017–2022

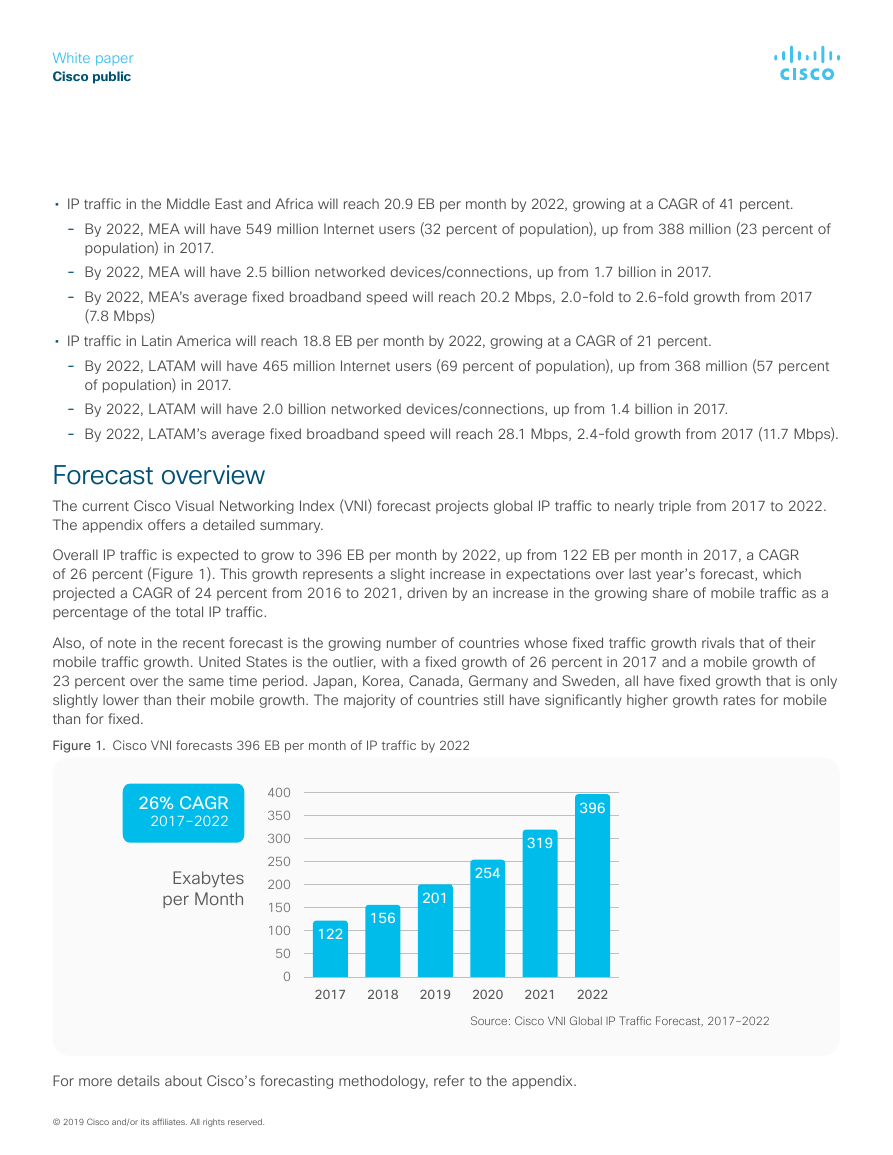

The video effect of the devices on the traffic is more pronounced because of the introduction of Ultra-High- Definition

(UHD), or 4K, video streaming. This technology has such an effect because the bit rate for 4K video at about 15 to

18 Mbps is more than double the HD video bit rate and nine times more than Standard-Definition (SD) video bit rate.

We estimate that by 2022, nearly two-thirds (62 percent) of the installed flat-panel TV sets will be UHD, up from 23

percent in 2017 (Figure 6).

Figure 6. Increasing video definition: By 2022, 62 percent of connected Flat-Panel TV sets will be 4K

UHD 15-18 Mbps

HD 5-7.2 Mbps

SD 2 Mbps

Connected

4K TV Sets

(M)

900

800

700

600

500

400

300

200

100

-

38% CAGR

2017–2022

799

658

514

379

260

162

2017 2018 2019 2020 2021 2022

Source: Cisco VNI Global IP Traffic Forecast, 2017–2022

UHD (or 4K) video will account for 22 percent of global IP Video traffic by 2022 (Figure 7). UHD as a percentage of IP

VoD traffic will be higher at 35 percent by 2022.

White paperCisco public© 2019 Cisco and/or its affiliates. All rights reserved.�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc