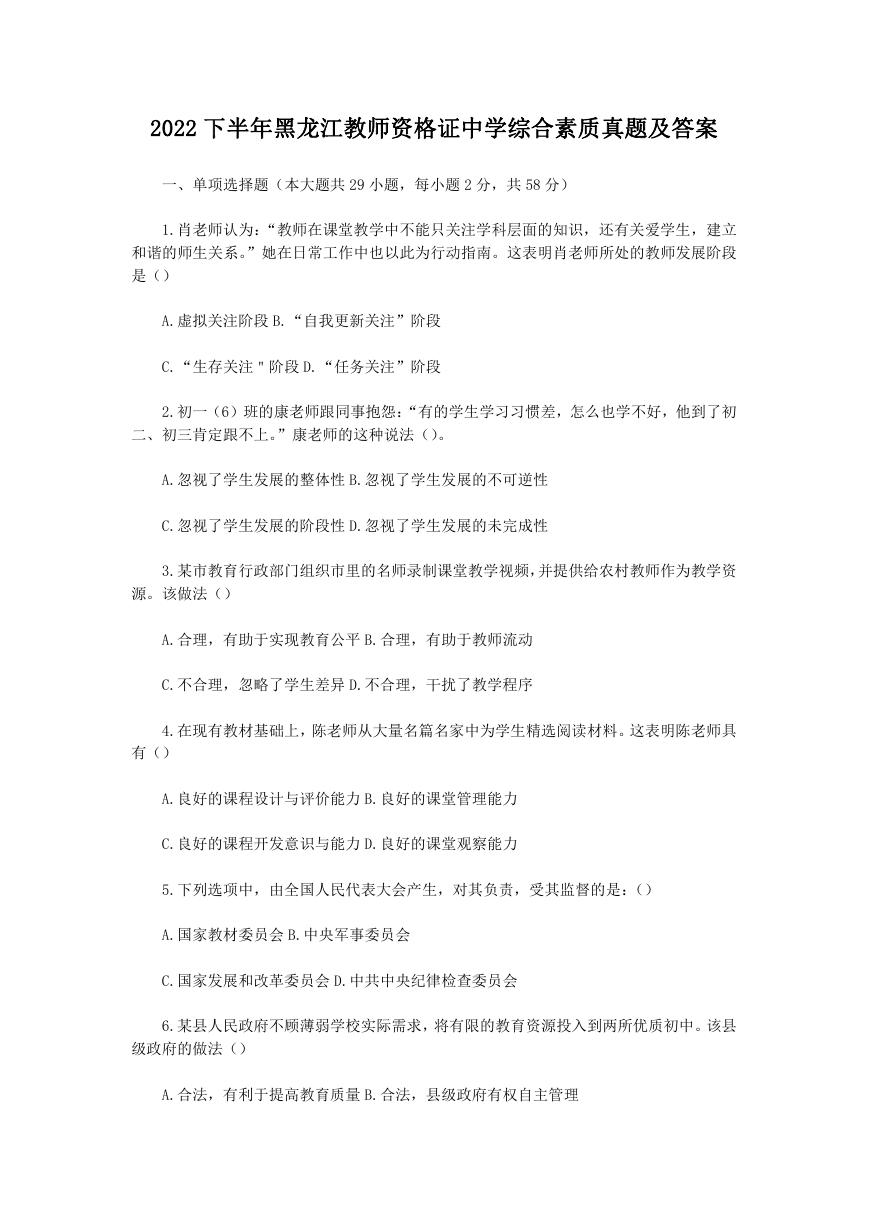

Licensed for Distribution

Magic Quadrant for Analytics and

Business Intelligence Platforms

Published 11 February 2019 - ID G00354763 - 109 min read

By Analysts Cindi Howson, James Richardson, Rita Sallam, Austin Kronz

Modern analytics and BI platforms are now mainstream purchases for which

key differentiators are augmented analytics and support for Mode 1 reporting in

a single platform. This Magic Quadrant will help data and analytics leaders

complement their existing solutions or move to an entirely new vendor.

Strategic Planning Assumptions

By 2020, augmented analytics will be a dominant driver of new purchases of analytics and

business intelligence, data science and machine learning platforms, and embedded analytics.

By 2020, 50% of analytical queries either will be generated via search, natural language processing

or voice, or will be automatically generated.

By 2020, organizations that offer users access to a curated catalog of internal and external data

will derive twice as much business value from analytics investments as those that do not.

By 2020, the number of data and analytics experts in business units will grow at three times the

rate of experts in IT departments, which will force companies to rethink their organizational

models and skill sets.

By 2021, natural language processing and conversational analytics will boost analytics and

business intelligence adoption from 35% of employees to over 50%, including new classes of

users, particularly front-office workers.

Market Definition/Description

Modern analytics and business intelligence (BI) platforms are characterized by easy-to-use tools

that support the full analytic workflow — from data preparation and ingestion to visual exploration

and insight generation. They are most differentiated from traditional BI platforms by not requiring

�

significant involvement from IT staff to predefine data models or store data in traditional data

warehouses (see “Technology Insight for Modern Analytics and Business Intelligence Platforms”).

The emphasis is on self-service and agility. Most modern analytics and BI platforms also have

their own self-contained in-memory columnar engine to ensure fast performance and support

rapid prototyping, but many can optionally use existing modeled data sources. The growing use of

data lakes and logical data warehouses dovetails with the capabilities of modern analytics and BI

platforms that can ingest data from these less-modeled data sources (see “The Practical Logical

Data Warehouse: A Strategic Plan for a Modern Data Management Solution for Analytics”).

The crowded analytics and BI market includes everything from long-standing and large technology

players to startups backed by venture capital and smaller, privately funded software vendors.

Vendors of traditional BI platforms have evolved their capabilities to include modern, visual-based

data discovery that also includes governance, and more recently, augmented analytics. Newer

vendors continue to evolve the capabilities that once focused primarily on agility, by extending

them to enable greater governance and scalability, as well as publishing and sharing. The holy

grail is for customers to have both Mode 1 and Mode 2 capabilities (see Note 1) in a single,

seamless platform that draws on existing assets but also has emerging best-of-breed capabilities.

As disruptive as visual-based data discovery has been to traditional BI, a third wave of disruption

has emerged in the form of augmented analytics, with machine learning (ML) generating insights

on increasingly vast amounts of data. Augmented analytics also includes natural language

processing (NLP) as a way of querying data and of generating narratives to explain drivers and

graphics. Vendors that have augmented analytics as a differentiator are better able to command

premium prices for their products (see “Augmented Analytics Is the Future of Data and

Analytics”).

This Magic Quadrant focuses on products that meet Gartner’s criteria for a modern analytics and

BI platform (see “Technology Insight for Modern Analytics and Business Intelligence Platforms”).

It is this type of platform that accounts for the majority of net new mainstream purchases in the

analytics and BI platform market. Products that do not meet our criteria for a modern platform —

either because of the upfront requirements for IT to predefine data models, or because they are

reporting-centric — are covered in our “Market Guide for Traditional Enterprise Reporting

Platforms.”

This Magic Quadrant refers throughout to composite measures of success based on a survey of

vendors’ reference customers. Reference customers scored vendors on each of the metrics

defined in Note 2 (see also the Evidence section). Opinions from Gartner Peer Insights

contributors are also factored into our assessments; these contributors are referred to as Gartner

Peer Insights reviewers.

The Five Use Cases and 15 Critical Capabilities of an Analytics

and BI Platform

�

We define and assess product capabilities across the following five use cases:

■

■

■

■

■

Agile, centralized BI provisioning: Supports an agile IT-enabled workflow, from data to centrally

delivered and managed analytic content, using the platform’s self-contained data management

capabilities.

Decentralized analytics: Supports a workflow from data to self-service analytics, and includes

analytics for individual business units and users.

Governed data discovery: Supports a workflow from data to self-service analytics to system of

record (SOR), IT-managed content with governance, reusability and promotability of user-

generated content to certified data and analytics content.

OEM or embedded analytics: Supports a workflow from data to embedded BI content in a

process or application.

Extranet deployment: Supports a workflow similar to agile, centralized BI provisioning for the

external customer or, in the public sector, citizen access to analytic content.

We assess vendors on the 15 critical capabilities listed below. (Any changes to the previous year’s

critical capabilities are listed in Note 3. Subcriteria for each capability are published in “Toolkit:

Analytics and BI Platform RFP.” How well vendors’ platforms support these critical capabilities is

explored in greater detail in “Critical Capabilities for Analytics and Business Intelligence

Platforms.”)

Infrastructure

1. BI platform administration, security and architecture: Capabilities that enable platform

security, administering of users, auditing of platform access and utilization, and high availability

and disaster recovery.

2. Cloud BI: Platform-as-a-service and analytic-application-as-a-service capabilities for building,

deploying and managing analytics and analytic applications in the cloud, based on data both in

the cloud and on-premises.

3. Data source connectivity and ingestion: Capabilities that enable users to connect to structured

and unstructured data contained within various types of storage platform (relational and

nonrelational), both on-premises and in the cloud.

Data Management

4. Metadata management: Tools enabling users to leverage a common semantic model and

metadata. These should provide a robust and centralized way for administrators to search,

�

capture, store, reuse and publish metadata objects such as dimensions, hierarchies, measures,

performance metrics/key performance indicators (KPIs), and to report layout objects,

parameters and so on. Administrators should have the ability to promote a business-user-

defined data mashup and metadata to the SOR metadata.

5. Data storage and loading options: Platform capabilities for accessing, integrating,

transforming and loading data into a self-contained performance engine, with the ability to

index data, manage data loads and refresh scheduling.

6. Data preparation: “Drag and drop” user-driven data combination of different sources, and the

creation of analytic models such as user-defined measures, sets, groups and hierarchies.

Advanced capabilities include machine learning-enabled semantic autodiscovery, intelligent

joins, intelligent profiling, hierarchy generation, data lineage and data blending on varied data

sources, including multistructured data.

7. Scalability and data model complexity: The degree to which the in-memory engine or in-

database architecture handles high volumes of data, complex data models, performance

optimization and large user deployments.

Analysis and Content Creation

8. Advanced analytics for citizen data scientists: Enables users to easily access advanced

analytics capabilities that are self-contained within the platform, through menu-driven options

or through the import and integration of externally developed models.

9. Analytic dashboards: The ability to create highly interactive dashboards and content with visual

exploration and embedded advanced and geospatial analytics for consumption by others.

10. Interactive visual exploration: Enables the exploration of data via an array of visualization

options that go beyond those of basic pie, bar and line charts to include heat and tree maps,

geographic maps, scatter plots and other special-purpose visuals. These features enable users

to analyze and manipulate data by interacting directly with a visual representation of it, to

display it as percentages, bins and groups.

11. Augmented data discovery: Automatically finds, visualizes and narrates important findings

such as correlations, exceptions, clusters, links and predictions in data that are relevant to

users without requiring them to build models or write algorithms. Users explore data via

visualizations, natural-language-generated narration, search and natural language query (NLQ)

technologies.

12. Mobile exploration and authoring: Enables organizations to develop and deliver content to

mobile devices in a publishing and/or interactive mode, and takes advantage of mobile devices’

�

native capabilities, such as touchscreen, camera and location awareness.

Sharing of Findings

13. Embedding of analytic content: Capabilities including a software developer kit with APIs and

support for open standards for creating and modifying analytic content, visualizations and

applications, embedding them in a business process and/or an application or portal. These

capabilities can reside outside the application, reusing the analytic infrastructure, but must be

easily and seamlessly accessible from inside the application without forcing users to switch

between systems. The capabilities for integrating analytics and BI with the application

architecture will enable users to choose where in the business process the analytics should be

embedded.

14. Publish, share and collaborate on analytic content: Capabilities that enable users to publish,

deploy and operationalize analytic content through various output types and distribution

methods, with support for content search, scheduling and alerts. These capabilities enable

users to share, discuss and track information, analysis, analytic content and decisions via

discussion threads, chat and annotations.

Overall Platform

15. Ease of use, visual appeal and workflow integration: The ease of administering and deploying

the platform, creating content, and consuming and interacting with content, as well as the

degree to which the product is visually appealing. This capability also considers the degree to

which capabilities are offered in a single, seamless product and workflow, or across multiple

products with little integration.

Magic Quadrant

�

Figure 1. Magic Quadrant for Analytics and Business Intelligence Platforms

Source: Gartner (February 2019)

Vendor Strengths and Cautions

Birst

Birst provides an end-to-end data warehouse, reporting and visualization platform built for the

cloud. Birst was an early cloud-native vendor, but also offers its product as an on-premises

appliance running on commodity hardware.

In 2017, Birst was acquired by Infor. It now operates as a stand-alone subdivision within Infor.

Infor has been gradually replacing its packaged analytic applications for Infor’s business

�

application solutions (previously built with IBM Cognos) with Birst, dubbing the new applications

Birst for CloudSuite. The Birst analytics and BI team, meanwhile, has gained a global footprint,

additional sales representatives and data science talent. Birst’s new Smart Analytics capabilities,

powered by Coleman AI, were on limited release in 4Q18.

Birst is a Niche Player in this Magic Quadrant. Birst’s reference customers primarily use its

platform for agile, centralized BI provisioning (58%). The next most common use is for

decentralized analytics (45%).

Strengths

■

Cloud-native support for Mode 1 and Mode 2: Birst provides data preparation, dashboards,

visual exploration and formatted, scheduled reports on a single platform. Few other vendors

support both usage styles in this way. The networked semantic layer enables business units to

create data models that can then be promoted to the enterprise. A new orchestration capability

enables this content to be replicated to multiple instances. Birst supports live connectivity to

on-premises data sources. However, its rapid creation of a data model and all-in-one data

warehouse that can draw on a range of storage options (Microsoft SQL Server Analysis

Services, SAP HANA, Amazon Redshift) is a unique selling point. Sixty-one percent of Birst’s

surveyed reference customers use Birst as their only analytics and BI standard.

■

■

Vertical applications: Birst for CloudSuite now gives Infor ERP customers prebuilt extraction,

transformation and loading (ETL), data models, and dashboards that are fully integrated into

Infor business applications. For non-Infor data sources, Birst provides solution accelerators for

specific domains, such as wealth management, insurance, sales and marketing.

Global presence: With the acquisition by Infor, Birst has gained access to a global salesforce

and additional R&D talent, particularly in the field of data science. It now also has a physical

presence in 44 countries, an increase from three in 2016 when Birst was a stand-alone vendor.

Cautions

■

Workflow and performance: Although Birst offers a single platform, workflow across the

authoring interfaces is not seamless. A large percentage of Birst’s reference customers (42%)

highlighted poor performance (the highest figure for any vendor in this regard) and 26%

complained about absent or weak functionality. Although Coleman AI marks some innovation

from Birst, initial tests of the limited release software show a cumbersome workflow, and it

rarely finds drivers for key metrics.

■

Poor operations: Quality and timeliness of support have been perennial problems for Birst, and

this has not improved in the past year or under Infor’s ownership. Birst’s reference customers’

scores for support and product quality place it bottom, with 10% considering its operations

poor or limited. Gartner Peer Insights reviewers were less negative, however, with Birst being

only slightly below average for service and support.

�

■

Reduced relevance in analytics and BI market: There has been a decline in Gartner searches

and inquiries related to Birst, in comparison with 2017. Reference customers’ responses

indicate a decline in the product’s viability in this market (Birst was the only vendor for which

there was negative sentiment in this regard, which suggests that customers do not see Infor’s

ownership as a net positive). Birst points to double-digit growth in revenue, but it is unclear how

much of this growth derives from only the Infor installed base. Birst also had the highest

percentage of reference customers considering discontinuing use of its product.

BOARD International

BOARD International delivers a single, integrated system that provides BI, analytics and financial

planning capabilities. The company’s stated aim is to provide an “end-to-end decision-making

platform.” BOARD continues to report strong revenue growth in excess of 50% year over year, with

almost 20% of its revenue now coming from outside Europe, where the company originated.

In January 2019, Board announced that private equity firm Nordic Capital will become a majority

shareholder. The deal is expected to close in 1Q19.

BOARD is a Niche Player in this Magic Quadrant. It successfully serves a submarket for

centralized, single-instance analytics, BI and financial planning and analysis (FP&A) solutions.

BOARD has a narrow focus and the market’s awareness of this vendor is limited, although its

regional adoption is growing. BOARD has successfully transitioned to a cloud/subscription-based

model. Its reference customers reported that the most common use cases for BOARD’s system

are agile, centralized BI provisioning (61%) and decentralized analytics (57%).

Strengths

■

Unified analytics, BI and FP&A: BOARD is one of only two vendors offering a modern analytics

and BI platform with integrated financial planning and reporting functionality (the other being

SAP, with SAP Analytics Cloud). As such, it is highly differentiated for the relatively small

number of buyers looking to close the gap between BI and financial processes. BOARD is also

used for read-only analytics and BI deployments, although, in Gartner’s view, this is less

commonly the case. BOARD’s new self-service reporting capabilities strengthen its Mode 1

support.

■

■

Breadth of usage: BOARD ranks in the top third of vendors in this Magic Quadrant for

complexity of analysis. Reference customers use BOARD for a wide range of BI tasks — from

viewing reports, creating personalized dashboards and doing simple ad hoc analysis, to

performing complex queries, undertaking data preparation and using predictive models.

System integrator ecosystem: For a relatively small vendor, BOARD has a well-established and

growing network of system integrator (SI) partners, which are helping to drive its growth,

whether as influencers or resellers. BOARD offers them a reliable solution for the niche it

operates in. Reference customers identify the main business benefit of using BOARD’s platform

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc