Session #12

Monte-Carlo Simulation with Crystal Ball®

Page 1

Monte-Carlo Simulation with Crystal Ball®

To run a simulation using Crystal Ball®:

1. Setup Spreadsheet

Build a spreadsheet that will calculate the performance measure (e.g., profit) in terms of

the inputs (random or not). For random inputs, just enter any number.

2. Define Assumptions—i.e., random variables

Define which cells are random, and what distribution they should follow.

3. Define Forecast—i.e., output or performance measure

Define which cell(s) you are interested in forecasting (typically the performance

measure, e.g., profit).

4. Choose Number of Trials

Select the number of trials. If you would later like to generate the Sensitivity Analysis

chart, choose ―Sensitivity Analysis‖ under Options in Run Preferences.

5. Run Simulation

Run the simulation. If you would like to change parameters and re-run the simulation,

you should ―reset‖ the simulation (click on the ―Reset Simulation‖ button on the toolbar

or in the Run menu) first.

6. View Results

The forecast window showing the results of the simulation appears automatically after

(or during) the simulation. Many different results are available (frequency chart,

cumulative chart, statistics, percentiles, sensitivity analysis, and trend chart). The results

can be copied into the worksheet.

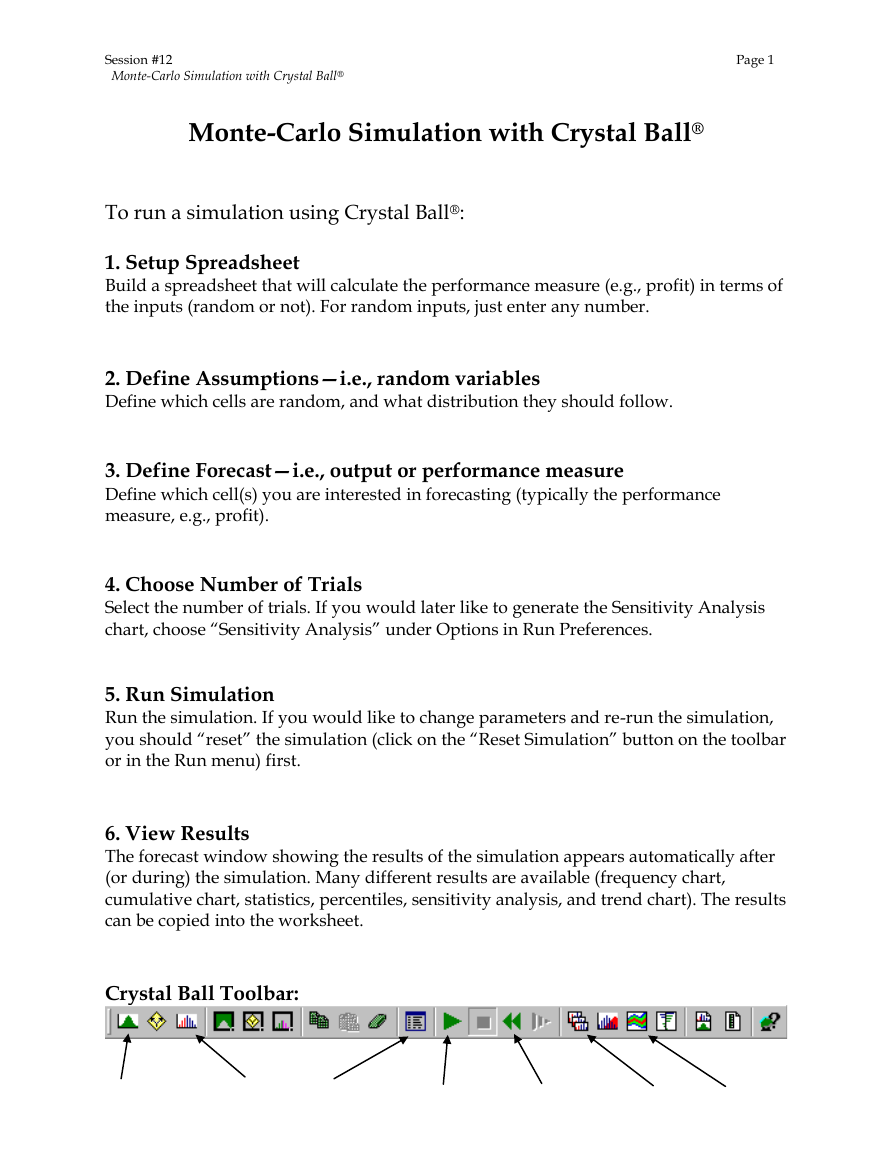

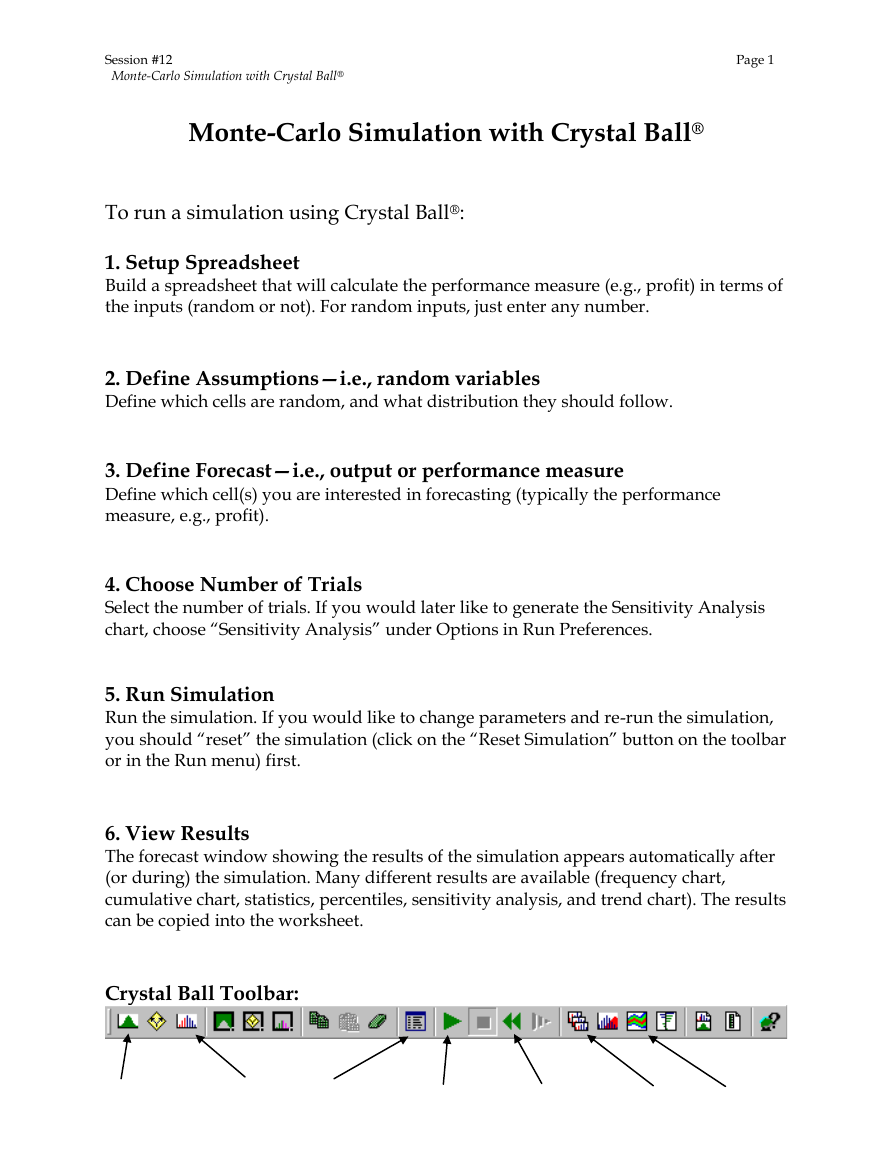

Crystal Ball Toolbar:

�

Session #12

Monte-Carlo Simulation with Crystal Ball®

Define

Assumptions Forecast

Define

Start

Page 2

Run

Forecast Trend

Preferences Simulation Simulation Window Chart

Reset

�

Session #12

Monte-Carlo Simulation with Crystal Ball®

Page 3

Walton Bookstore Simulation with Crystal Ball®

Recall the Walton Bookstore example: It is August, and they must decide

how many of next year’s nature calendars to order. Each calendar costs the

bookstore $7.50 and is sold for $10. After February, all unsold calendars are

returned to the publisher for a refund of $2.50 per calendar. Suppose

Walton predicts demand will be somewhere between 100 and 300 (discrete

uniform).

Demand

= d ~ Uniform[100, 300]

Order Quantity = Q (decision variable)

Revenue

Cost

Refund

Profit

= $10 * Min(Q, d)

= $7.50 * Q

= $2.50 * Max(Q–d, 0)

= Revenue – Cost + Refund

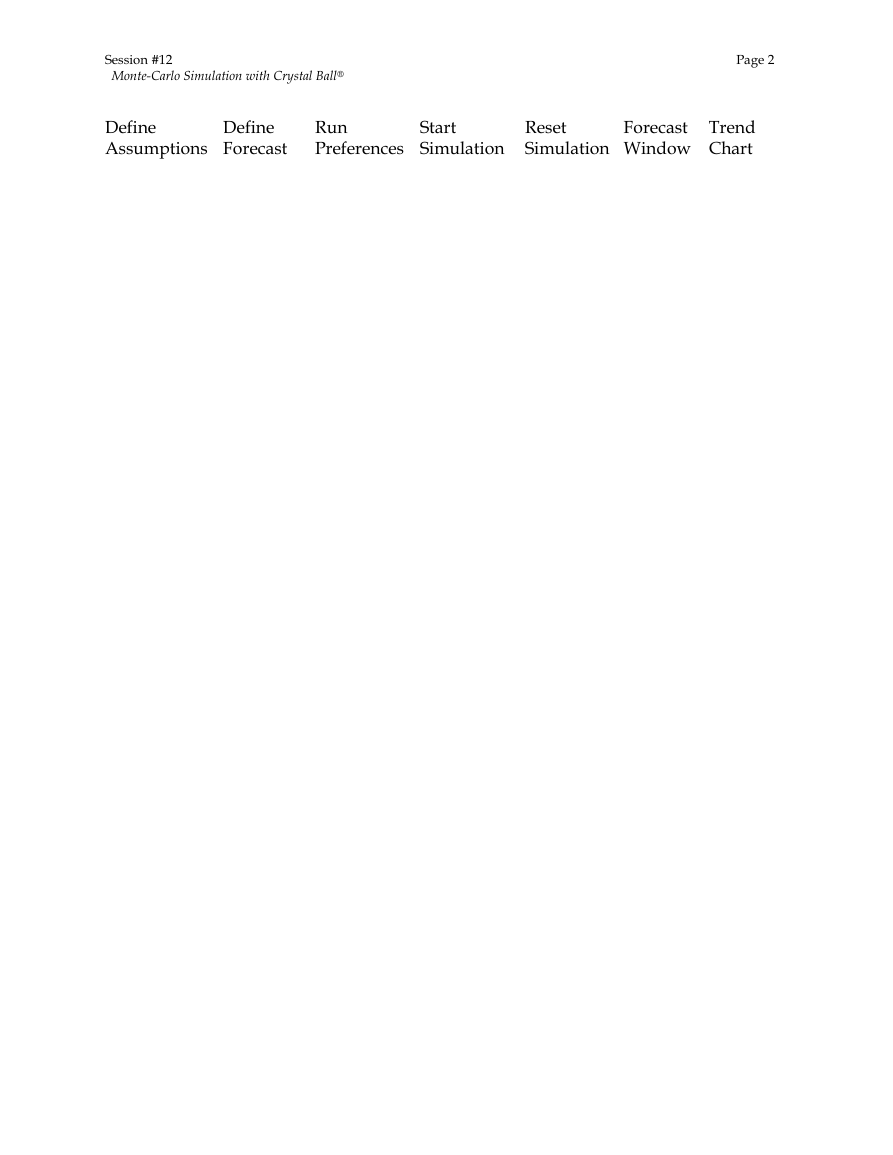

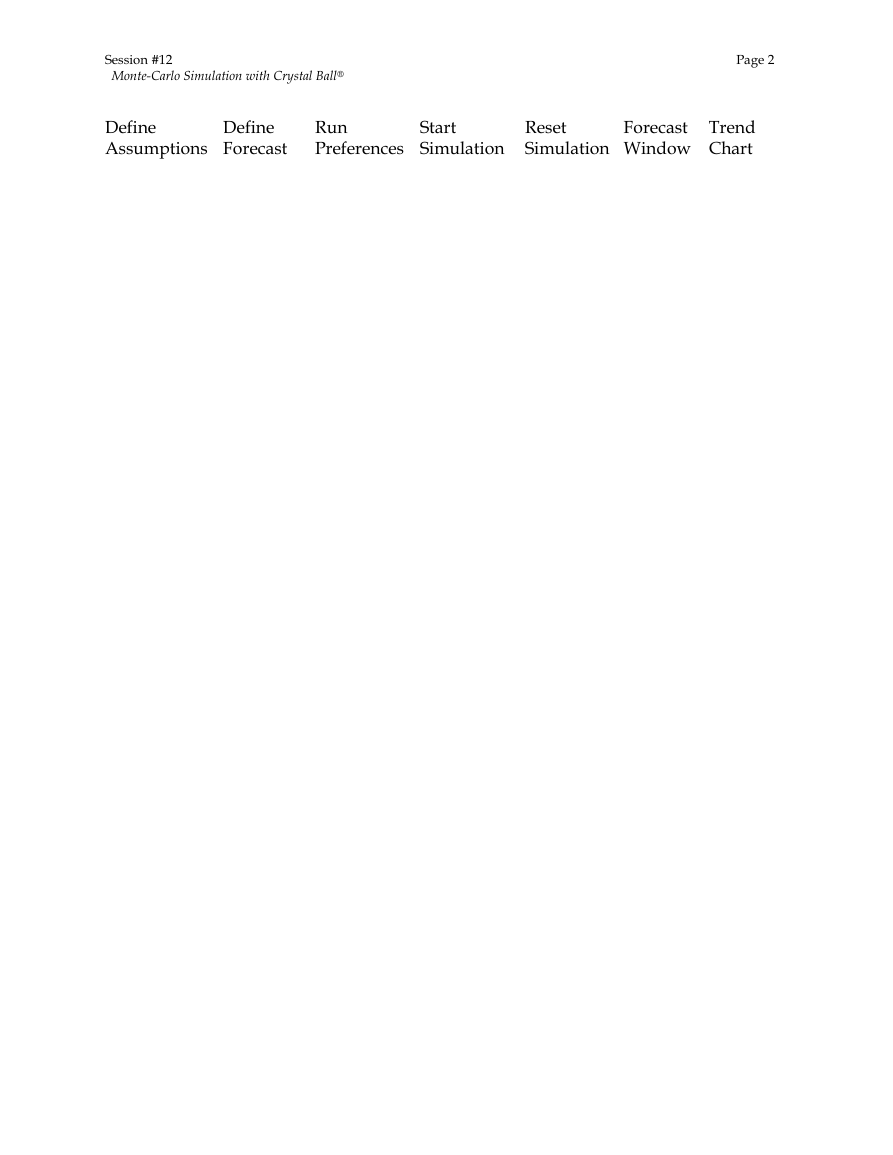

Step #1 (Setup Spreadsheet)

1234567891011121314151617ABCDEFSimulation of Walton's BookstoreDataUnit Cost =$7.50Unit Price =$10.00Unit Refund =$2.50Demand Distribution (Uniform)Minimum =100Maximum =300Decision VariableOrder Quantity =200SimulationDemandRevenueCostRefundProfit200$2,000.00$1,500.00$0.00$500.00151617BCDEFSimulationDemandRevenueCostRefundProfit200=C5*MIN(C13,B17)=C4*C13=C6*MAX(C13-B17,0)=C17-D17+E17�

Session #12

Monte-Carlo Simulation with Crystal Ball®

Page 4

Walton Bookstore Simulation with Crystal Ball®

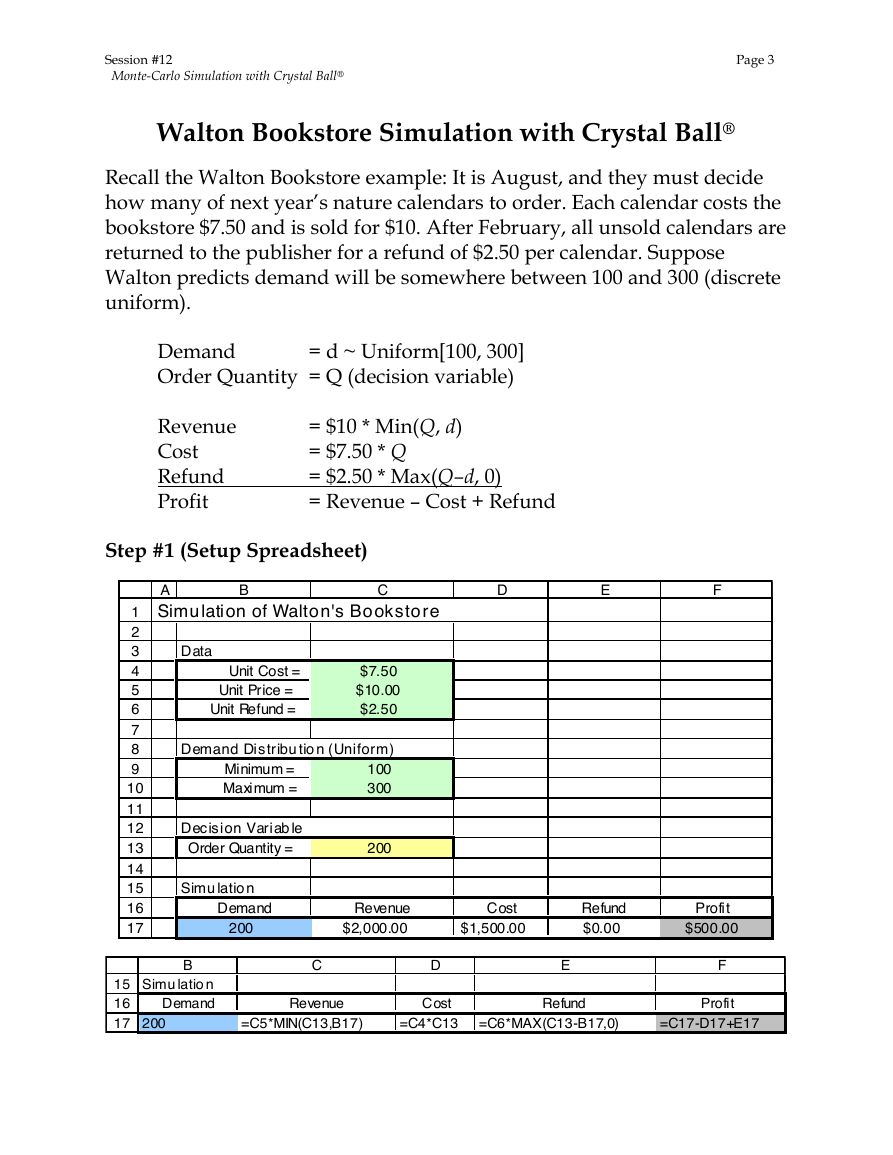

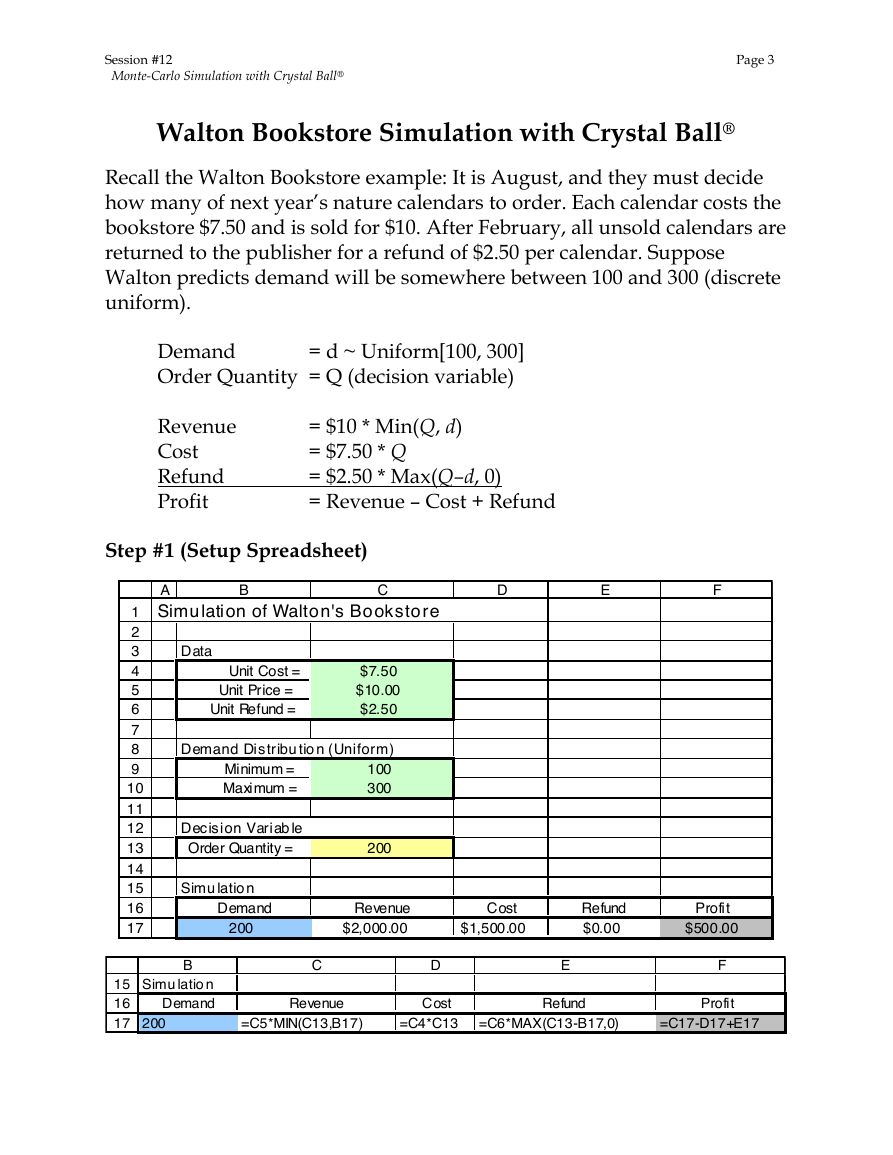

Step #2 (Define Assumptions—i.e., random variables)

Select the cell that contains the random variable (B17) — color code (blue):

and click on the ―Define Assumptions‖ button in toolbar (or in the Cell menu):

Select type of distribution:

Provide parameters of distributions:

1617BDemand2008910BCDemand Distribution (Uniform)Minimum =100Maximum =300�

Session #12

Monte-Carlo Simulation with Crystal Ball®

Page 5

Walton Bookstore Simulation with Crystal Ball®

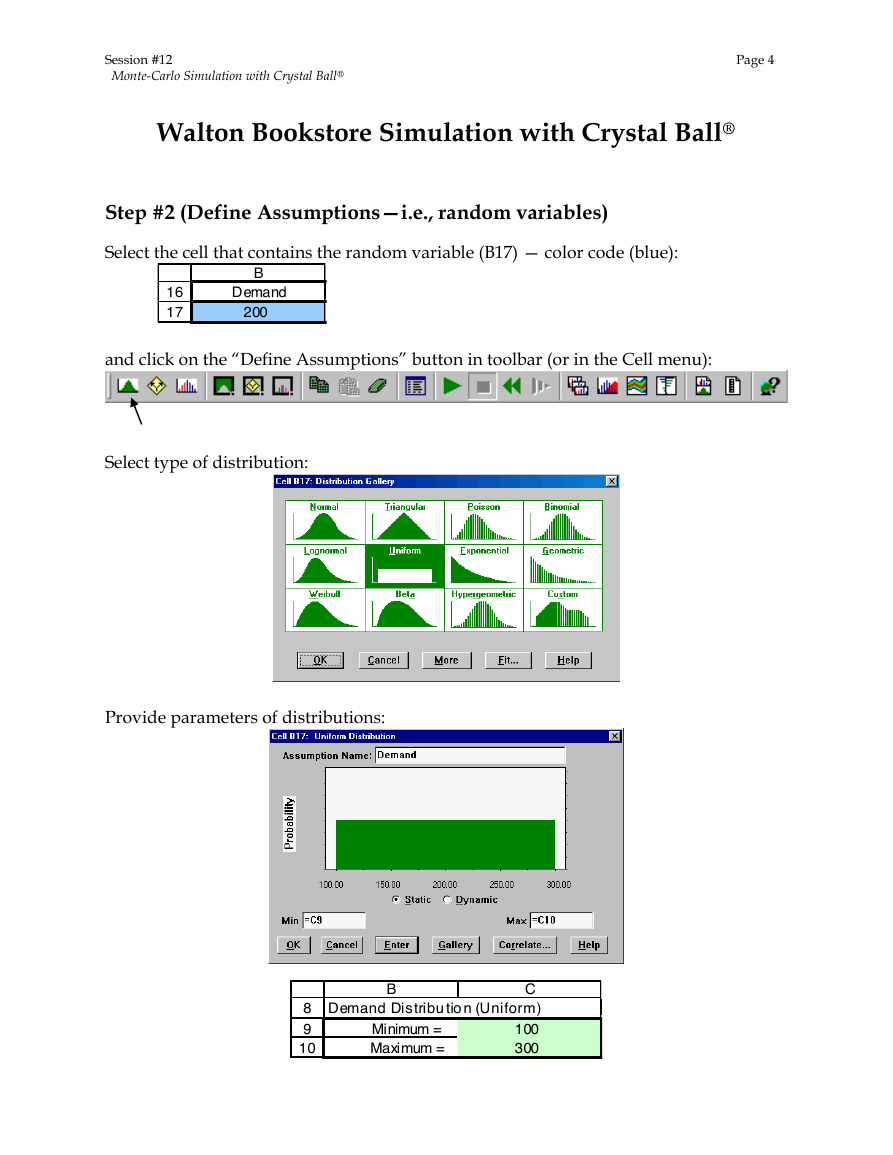

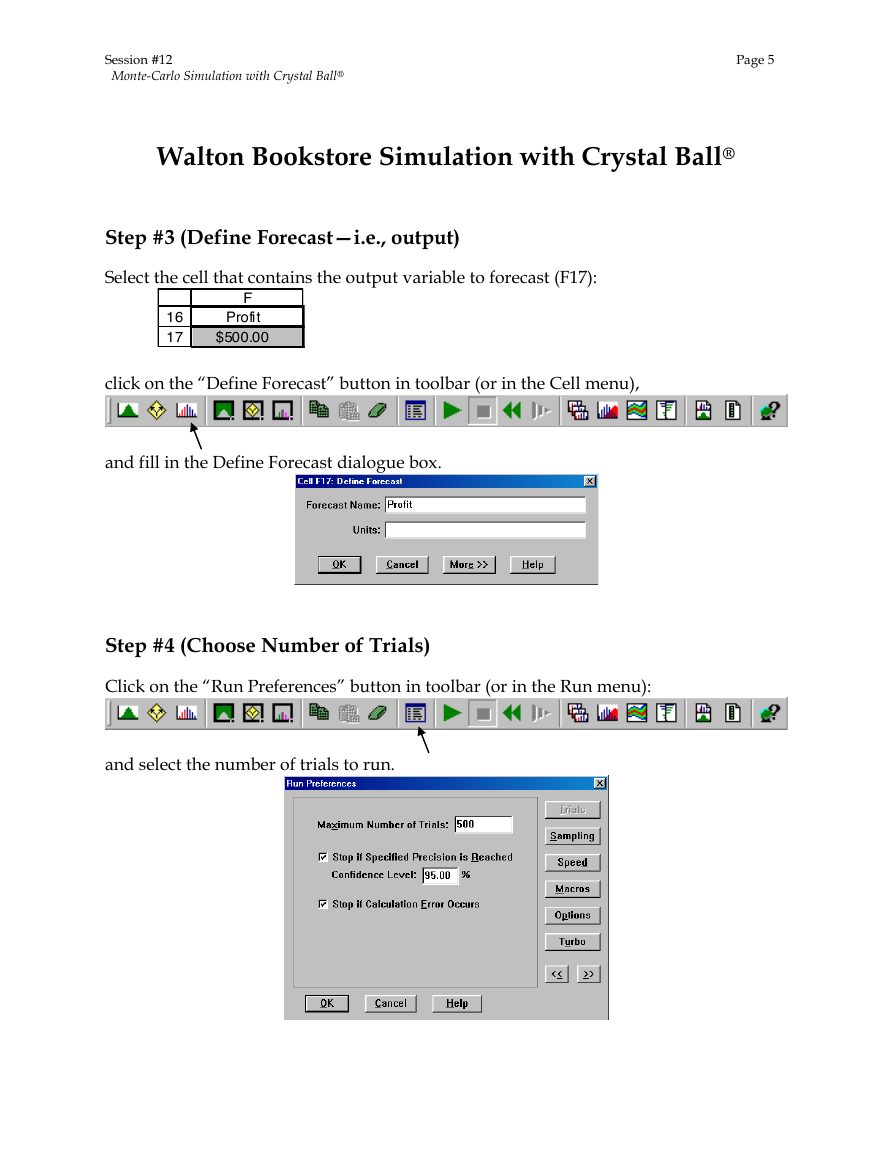

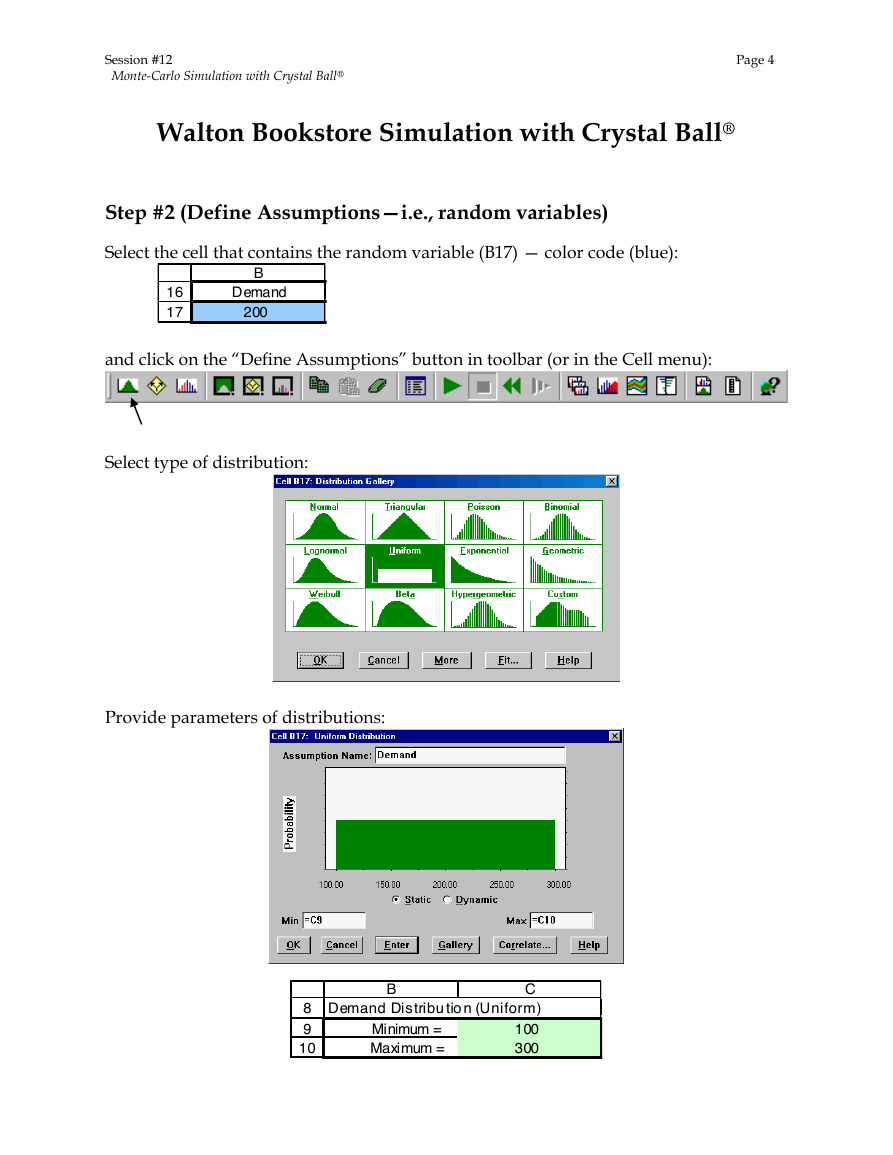

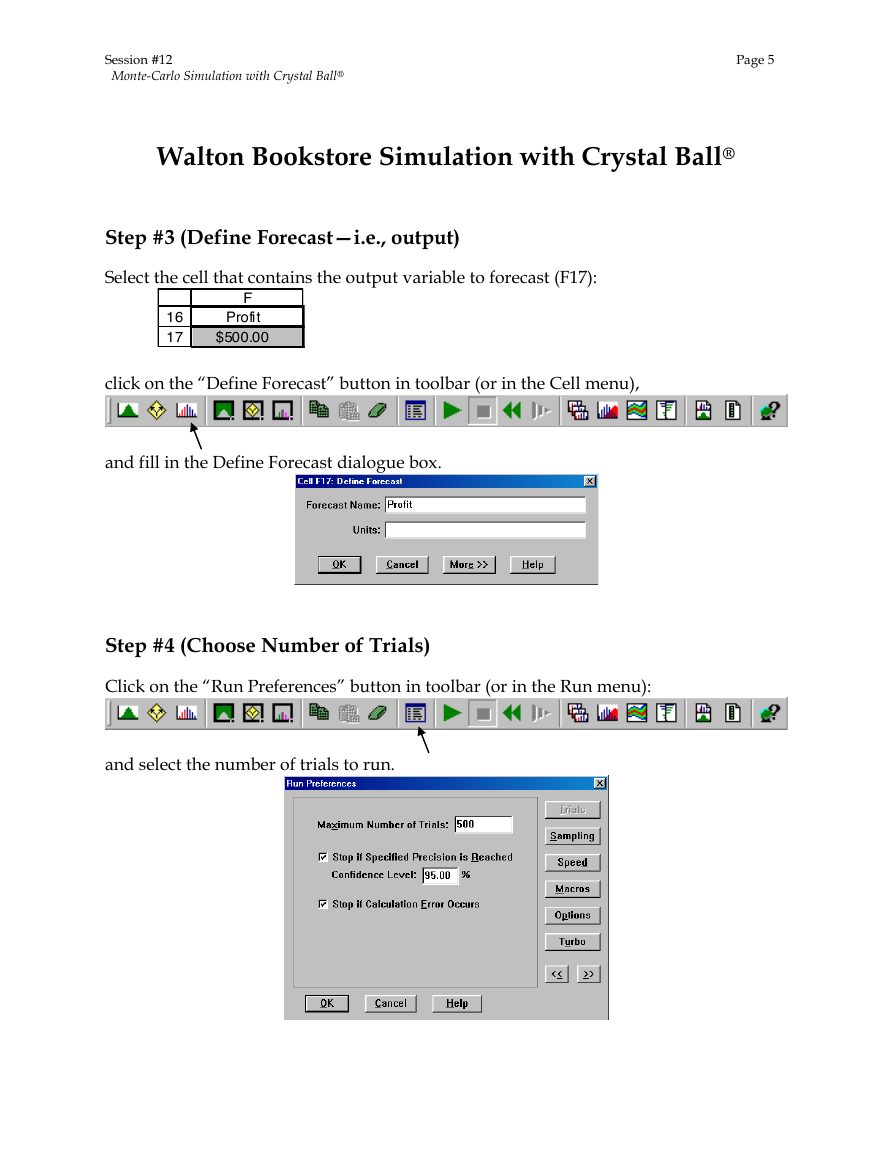

Step #3 (Define Forecast—i.e., output)

Select the cell that contains the output variable to forecast (F17):

click on the ―Define Forecast‖ button in toolbar (or in the Cell menu),

and fill in the Define Forecast dialogue box.

Step #4 (Choose Number of Trials)

Click on the ―Run Preferences‖ button in toolbar (or in the Run menu):

and select the number of trials to run.

1617FProfit$500.00�

Session #12

Monte-Carlo Simulation with Crystal Ball®

Page 6

Walton Bookstore Simulation with Crystal Ball®

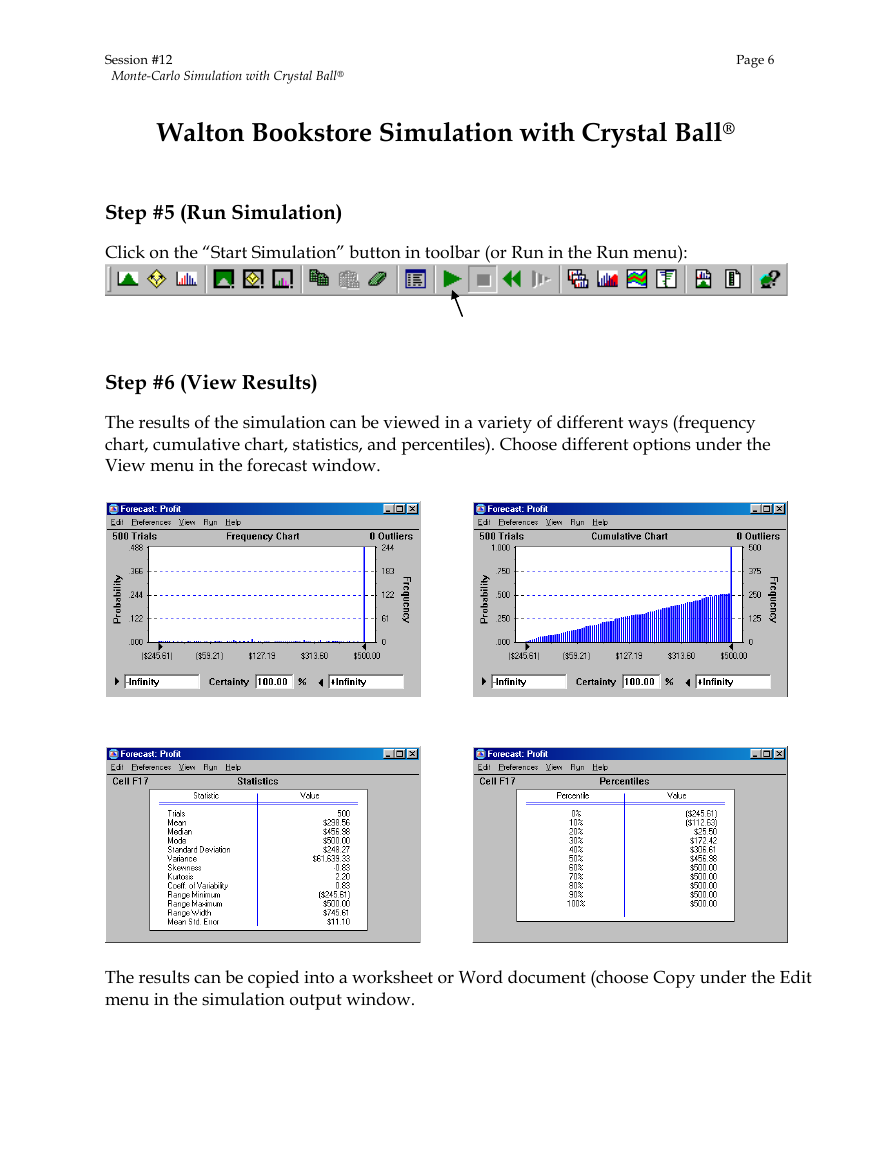

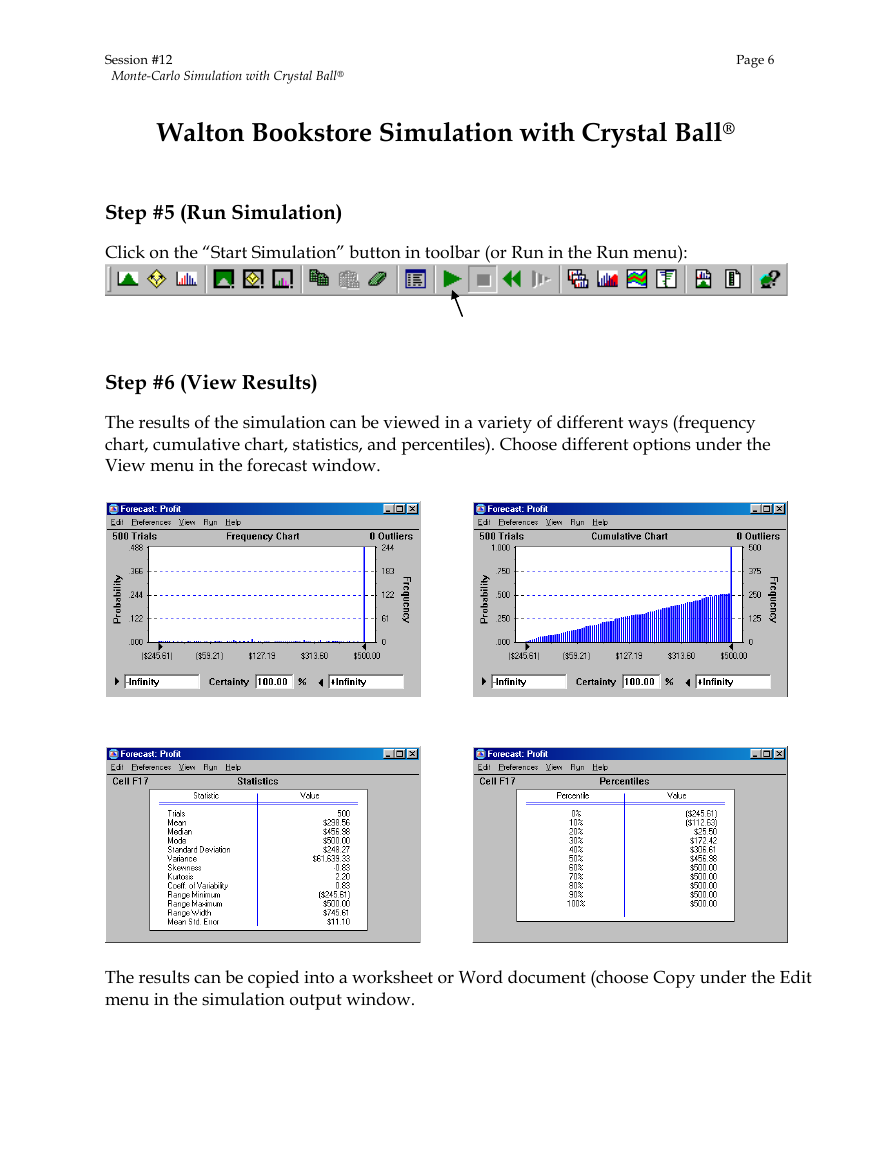

Step #5 (Run Simulation)

Click on the ―Start Simulation‖ button in toolbar (or Run in the Run menu):

Step #6 (View Results)

The results of the simulation can be viewed in a variety of different ways (frequency

chart, cumulative chart, statistics, and percentiles). Choose different options under the

View menu in the forecast window.

The results can be copied into a worksheet or Word document (choose Copy under the Edit

menu in the simulation output window.

�

Session #12

Monte-Carlo Simulation with Crystal Ball®

Page 7

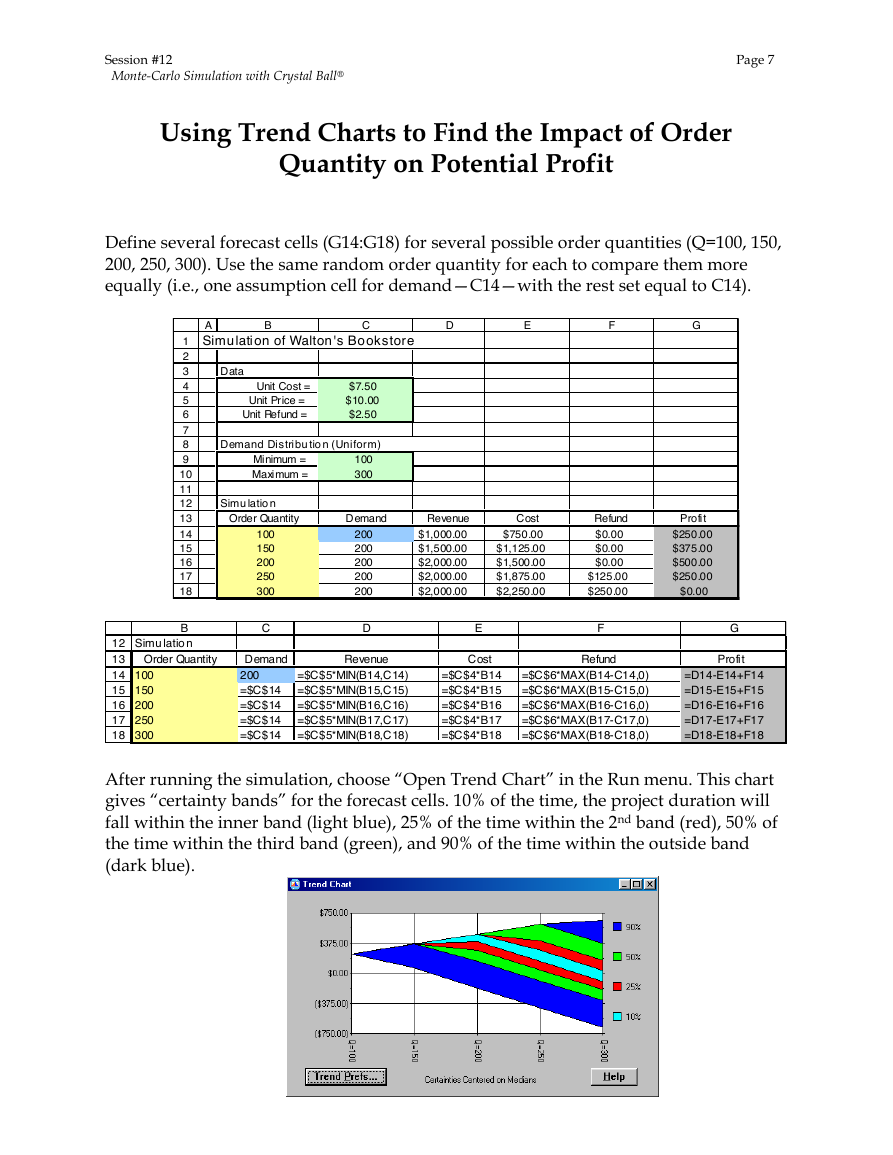

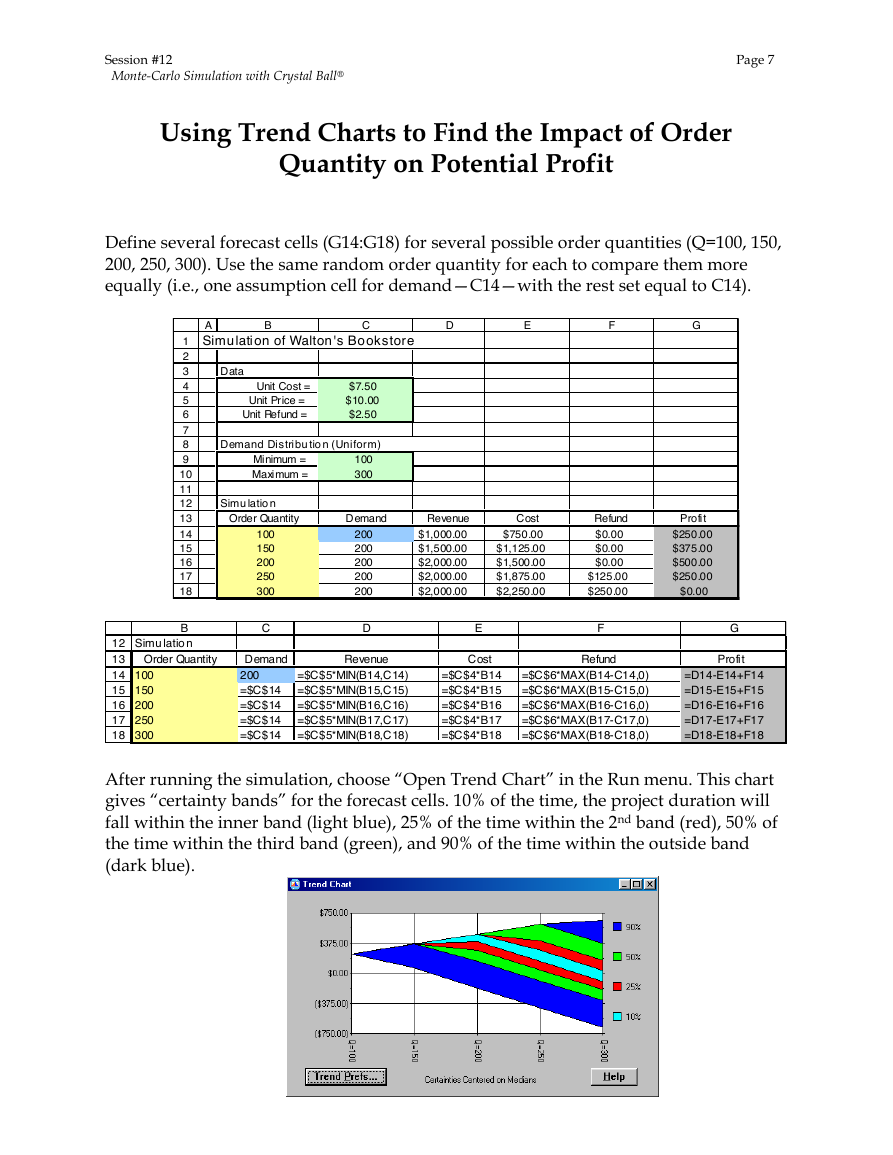

Using Trend Charts to Find the Impact of Order

Quantity on Potential Profit

Define several forecast cells (G14:G18) for several possible order quantities (Q=100, 150,

200, 250, 300). Use the same random order quantity for each to compare them more

equally (i.e., one assumption cell for demand—C14—with the rest set equal to C14).

After running the simulation, choose ―Open Trend Chart‖ in the Run menu. This chart

gives ―certainty bands‖ for the forecast cells. 10% of the time, the project duration will

fall within the inner band (light blue), 25% of the time within the 2nd band (red), 50% of

the time within the third band (green), and 90% of the time within the outside band

(dark blue).

123456789101112131415161718ABCDEFGSimulation of Walton's BookstoreDataUnit Cost =$7.50Unit Price =$10.00Unit Refund =$2.50Demand Distribution (Uniform)Minimum =100Maximum =300SimulationOrder QuantityDemandRevenueCostRefundProfit100200$1,000.00$750.00$0.00$250.00150200$1,500.00$1,125.00$0.00$375.00200200$2,000.00$1,500.00$0.00$500.00250200$2,000.00$1,875.00$125.00$250.00300200$2,000.00$2,250.00$250.00$0.0012131415161718BCDEFGSimulationOrder QuantityDemandRevenueCostRefundProfit100200=$C$5*MIN(B14,C14)=$C$4*B14=$C$6*MAX(B14-C14,0)=D14-E14+F14150=$C$14=$C$5*MIN(B15,C15)=$C$4*B15=$C$6*MAX(B15-C15,0)=D15-E15+F15200=$C$14=$C$5*MIN(B16,C16)=$C$4*B16=$C$6*MAX(B16-C16,0)=D16-E16+F16250=$C$14=$C$5*MIN(B17,C17)=$C$4*B17=$C$6*MAX(B17-C17,0)=D17-E17+F17300=$C$14=$C$5*MIN(B18,C18)=$C$4*B18=$C$6*MAX(B18-C18,0)=D18-E18+F18�

Session #12

Monte-Carlo Simulation with Crystal Ball®

Page 8

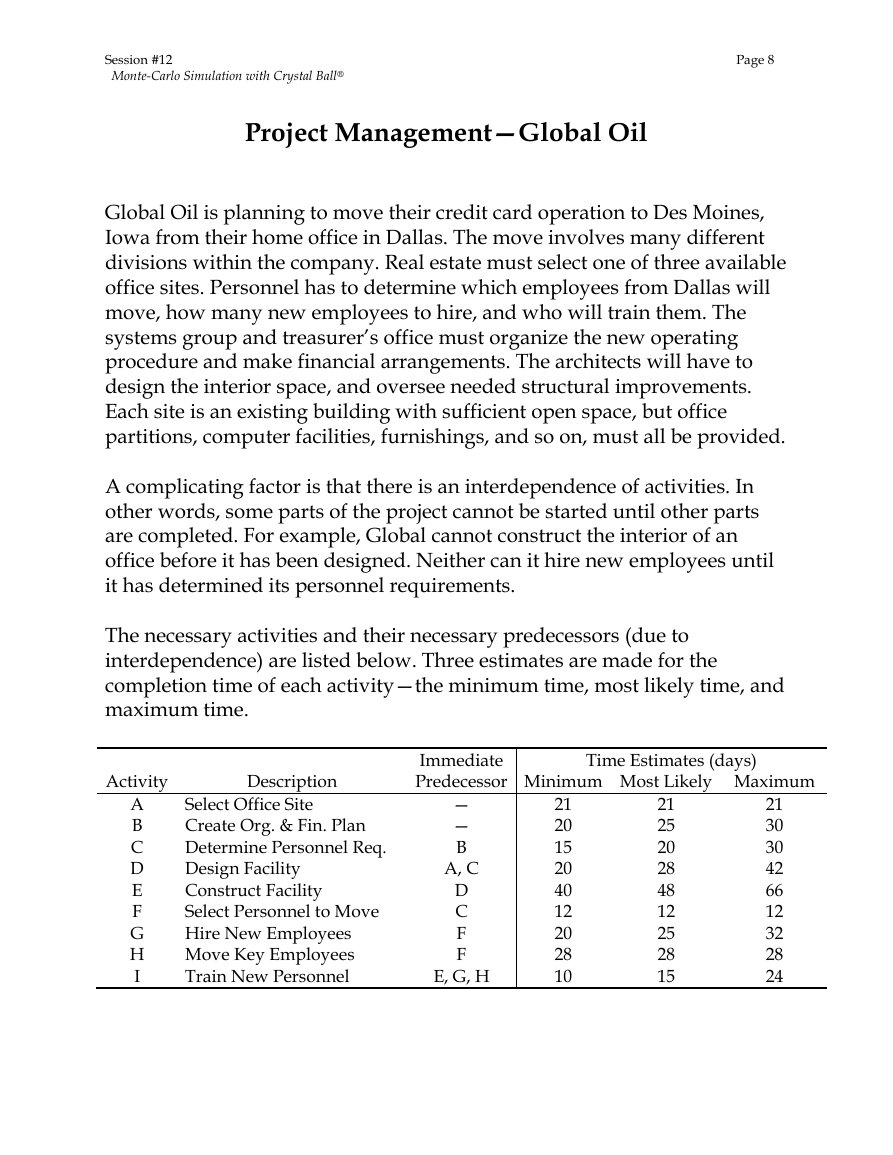

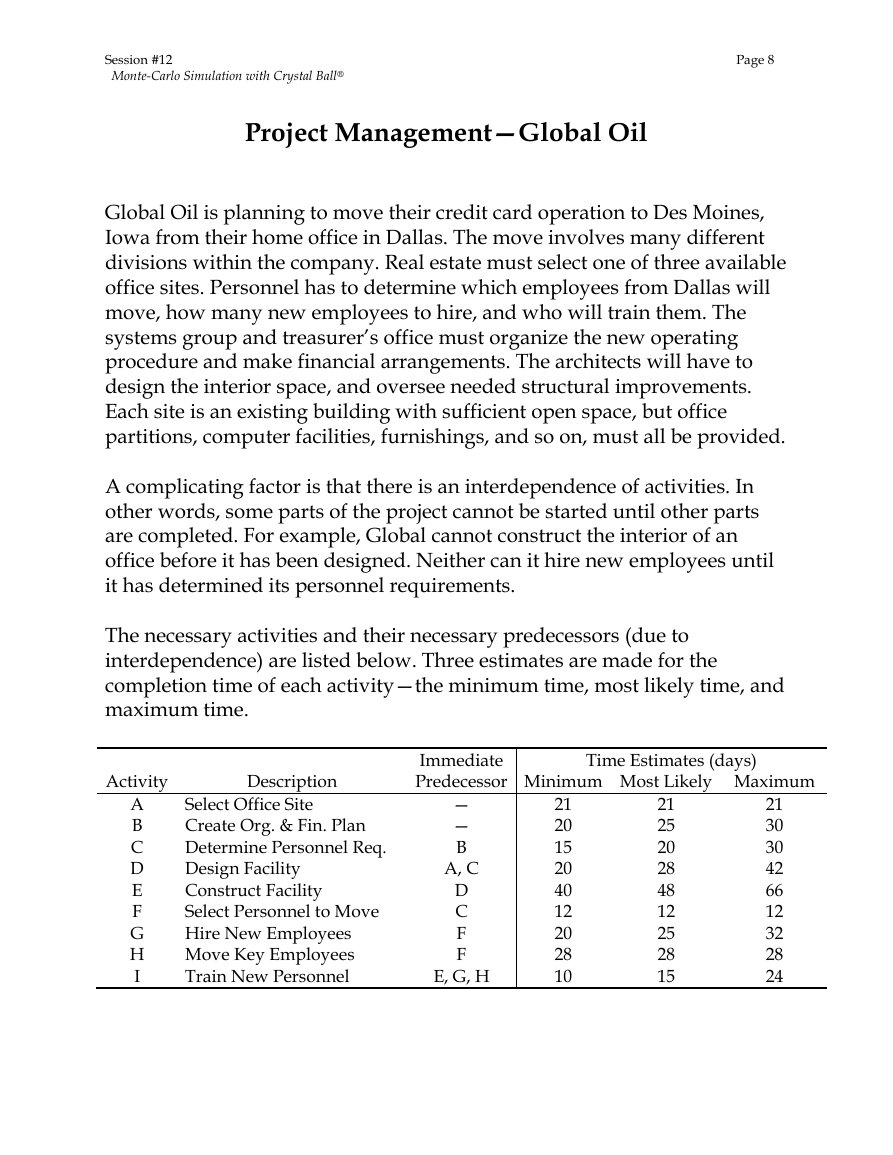

Project Management—Global Oil

Global Oil is planning to move their credit card operation to Des Moines,

Iowa from their home office in Dallas. The move involves many different

divisions within the company. Real estate must select one of three available

office sites. Personnel has to determine which employees from Dallas will

move, how many new employees to hire, and who will train them. The

systems group and treasurer’s office must organize the new operating

procedure and make financial arrangements. The architects will have to

design the interior space, and oversee needed structural improvements.

Each site is an existing building with sufficient open space, but office

partitions, computer facilities, furnishings, and so on, must all be provided.

A complicating factor is that there is an interdependence of activities. In

other words, some parts of the project cannot be started until other parts

are completed. For example, Global cannot construct the interior of an

office before it has been designed. Neither can it hire new employees until

it has determined its personnel requirements.

The necessary activities and their necessary predecessors (due to

interdependence) are listed below. Three estimates are made for the

completion time of each activity—the minimum time, most likely time, and

maximum time.

Activity

Description

Immediate

Predecessor Minimum Most Likely Maximum

Time Estimates (days)

Select Office Site

Create Org. & Fin. Plan

Determine Personnel Req.

Design Facility

Construct Facility

Select Personnel to Move

Hire New Employees

Move Key Employees

Train New Personnel

—

—

B

A, C

D

C

F

F

E, G, H

21

20

15

20

40

12

20

28

10

21

25

20

28

48

12

25

28

15

21

30

30

42

66

12

32

28

24

A

B

C

D

E

F

G

H

I

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc