Global Mobile Trends 2021

Navigating Covid-19 and beyond

December 2020

Copyright © 2020 GSM Association

gsmaintelligence.com @GSMAi

�

The GSMA represents the interests of mobile operators worldwide, uniting

more than 750 operators with nearly 400 companies in the broader mobile

ecosystem, including handset and device makers, software companies,

equipment providers and internet companies, as well as organisations in

adjacent industry sectors. The GSMA also produces the industry-leading

MWC events held annually in Barcelona, Los Angeles and Shanghai, as well

as the Mobile 360 Series of regional conferences.

For more information, please visit the GSMA corporate website at

www.gsma.com

Follow the GSMA on Twitter: @GSMA

GSMA Intelligence is the definitive source of global mobile operator data,

analysis and forecasts, and publisher of authoritative industry reports and

research. Our data covers every operator group, network and MVNO in every

country worldwide – from Afghanistan to Zimbabwe. It is the most accurate

and complete set of industry metrics available, comprising tens of millions of

individual data points, updated daily.

GSMA Intelligence is relied on by leading operators, vendors, regulators,

financial institutions and third-party industry players, to support strategic

decision-making and long-term investment planning. The data is used as

an industry reference point and is frequently cited by the media and by the

industry itself.

Our team of analysts and experts produce regular thought-leading research

reports across a range of industry topics.

www.gsmaintelligence.com

info@gsmaintelligence.com

�

3

GLOBAL MOBILE TRENDS

Growth beyond connectivity

5G outlook

Network transformation

IoT and enterprise verticals

The digital consumer

The next billion

Regional outlook

Telecoms in the

global macro

context

Covid-19 emerges

into an already

uncertain world

�

Telecoms in the global macro context

4

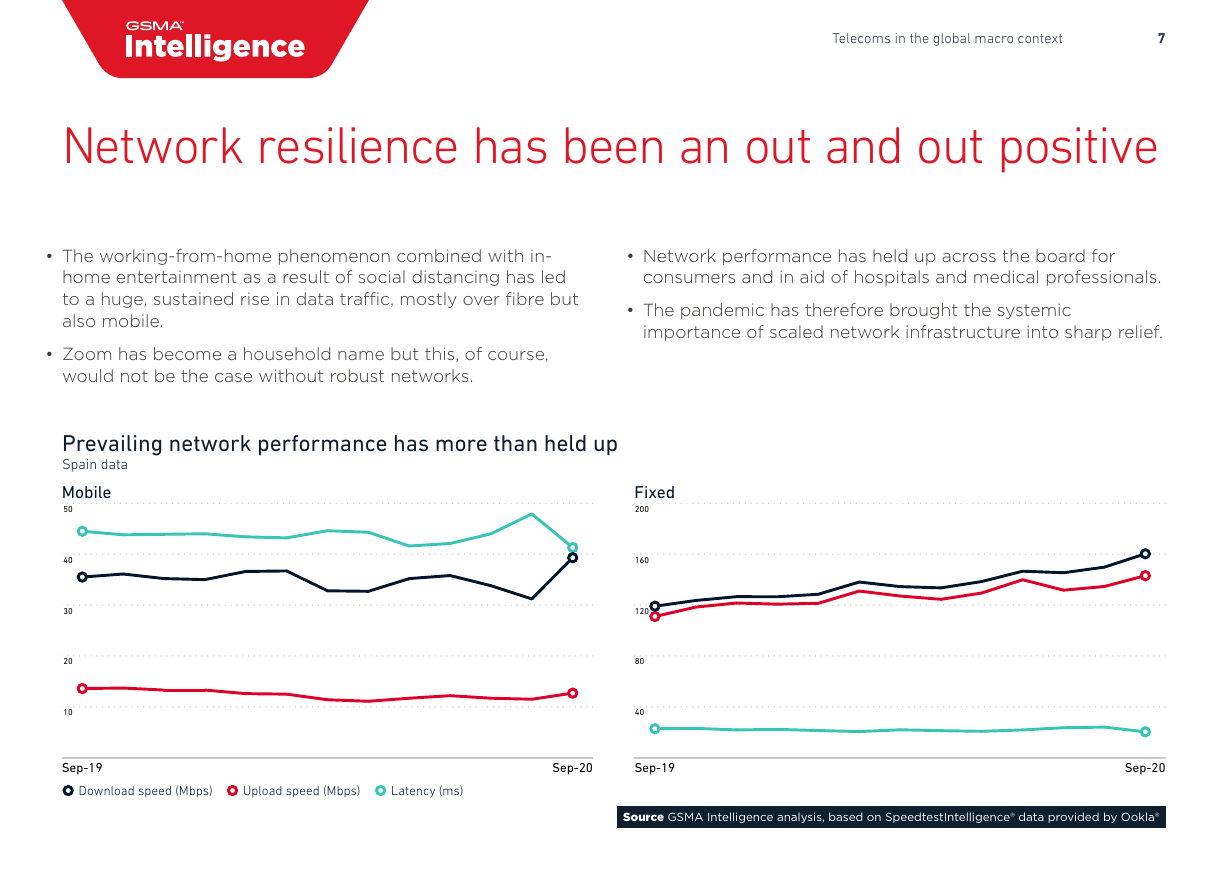

A shock to the world at large

• The arrival of a global pandemic could hardly

have been a more inauspicious welcome to the

new decade.

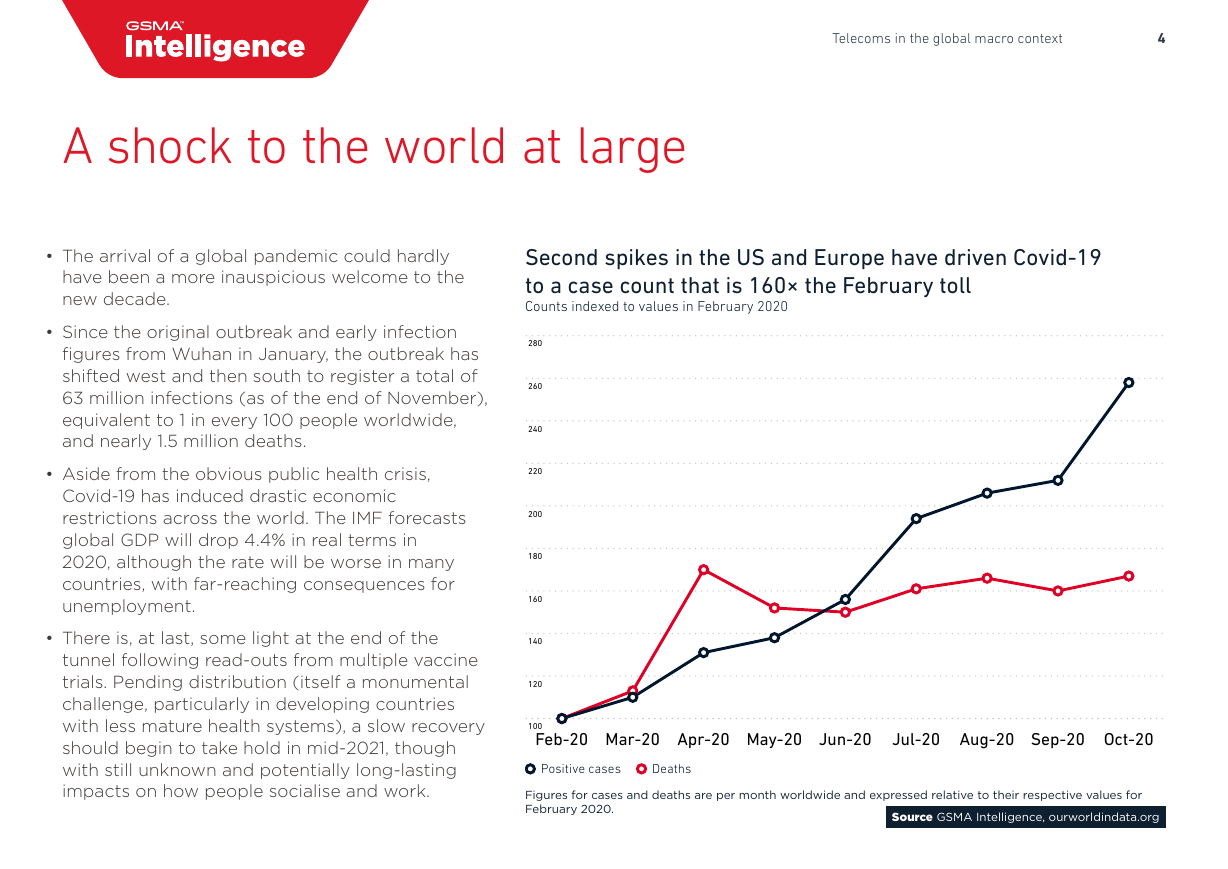

Second spikes in the US and Europe have driven Covid-19

to a case count that is 160× the February toll

Counts indexed to values in February 2020

• Since the original outbreak and early infection

figures from Wuhan in January, the outbreak has

shifted west and then south to register a total of

63 million infections (as of the end of November),

equivalent to 1 in every 100 people worldwide,

and nearly 1.5 million deaths.

• Aside from the obvious public health crisis,

Covid-19 has induced drastic economic

restrictions across the world. The IMF forecasts

global GDP will drop 4.4% in real terms in

2020, although the rate will be worse in many

countries, with far-reaching consequences for

unemployment.

• There is, at last, some light at the end of the

tunnel following read-outs from multiple vaccine

trials. Pending distribution (itself a monumental

challenge, particularly in developing countries

with less mature health systems), a slow recovery

should begin to take hold in mid-2021, though

with still unknown and potentially long-lasting

impacts on how people socialise and work.

280

260

240

220

200

180

160

140

120

100

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Positive cases

Deaths

Figures for cases and deaths are per month worldwide and expressed relative to their respective values for

February 2020.

Source GSMA Intelligence, ourworldindata.org

�

Telecoms in the global macro context

5

Telecoms takes a hit but the impact is less severe

than on the broader economy

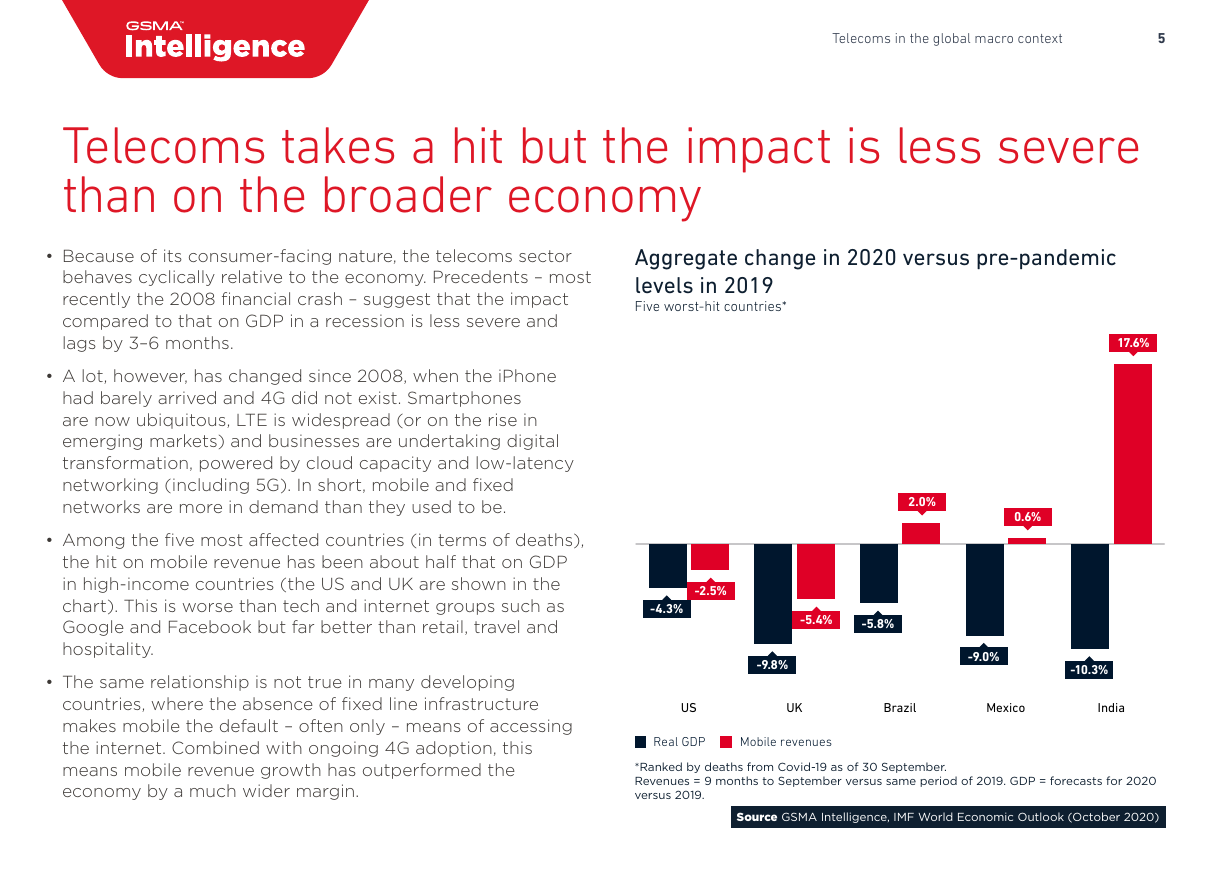

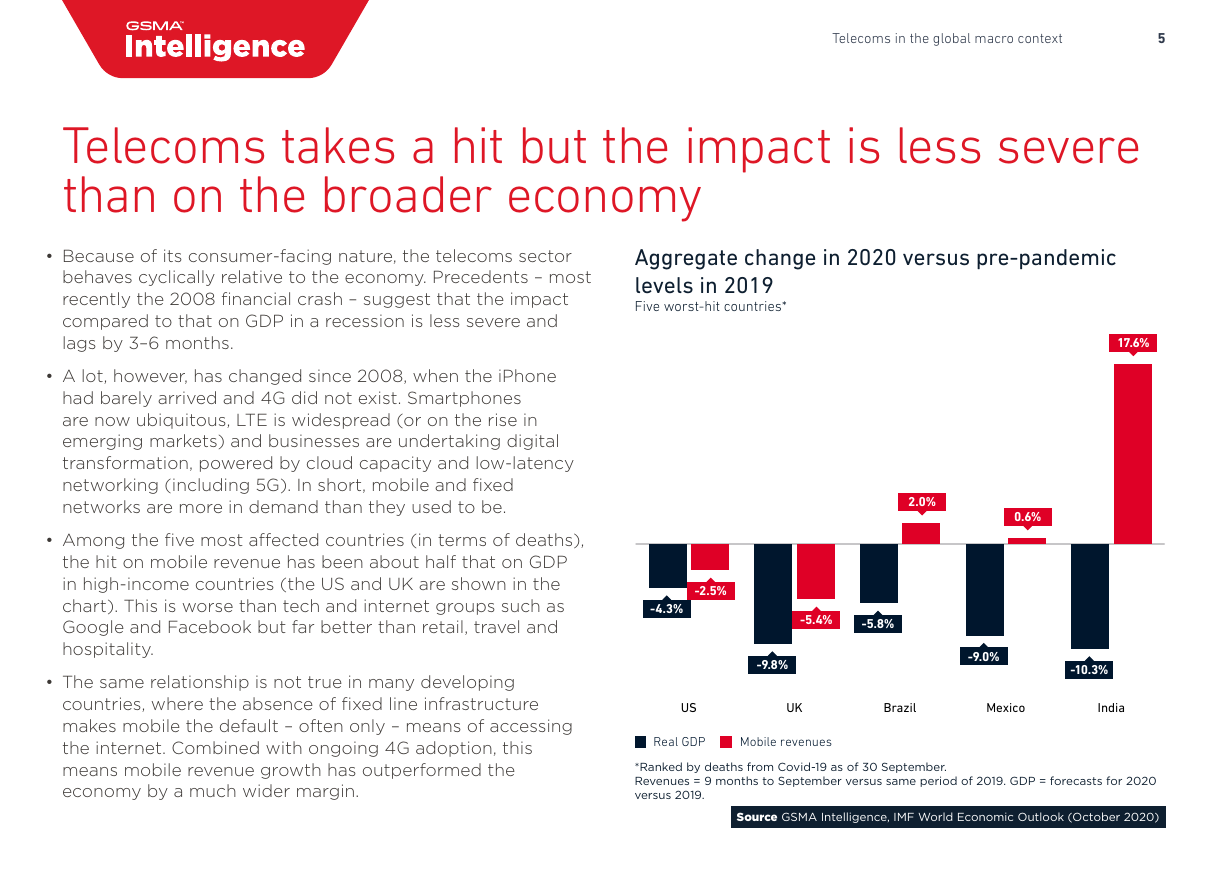

• Because of its consumer-facing nature, the telecoms sector

behaves cyclically relative to the economy. Precedents – most

recently the 2008 financial crash – suggest that the impact

compared to that on GDP in a recession is less severe and

lags by 3–6 months.

• A lot, however, has changed since 2008, when the iPhone

had barely arrived and 4G did not exist. Smartphones

are now ubiquitous, LTE is widespread (or on the rise in

emerging markets) and businesses are undertaking digital

transformation, powered by cloud capacity and low-latency

networking (including 5G). In short, mobile and fixed

networks are more in demand than they used to be.

• Among the five most affected countries (in terms of deaths),

the hit on mobile revenue has been about half that on GDP

in high-income countries (the US and UK are shown in the

chart). This is worse than tech and internet groups such as

Google and Facebook but far better than retail, travel and

hospitality.

• The same relationship is not true in many developing

countries, where the absence of fixed line infrastructure

makes mobile the default – often only – means of accessing

the internet. Combined with ongoing 4G adoption, this

means mobile revenue growth has outperformed the

economy by a much wider margin.

Aggregate change in 2020 versus pre-pandemic

levels in 2019

Five worst-hit countries*

17.6%

2.0%

0.6%

-2.5%

-4.3%

-5.4%

-5.8%

-9.8%

-9.0%

-10.3%

US

UK

Brazil

Mexico

India

Real GDP

Mobile revenues

*Ranked by deaths from Covid-19 as of 30 September.

Revenues = 9 months to September versus same period of 2019. GDP = forecasts for 2020

versus 2019.

Source GSMA Intelligence, IMF World Economic Outlook (October 2020)

�

Telecoms in the global macro context

6

The Covid-19 impact has focussed on roaming,

handsets and enterprise

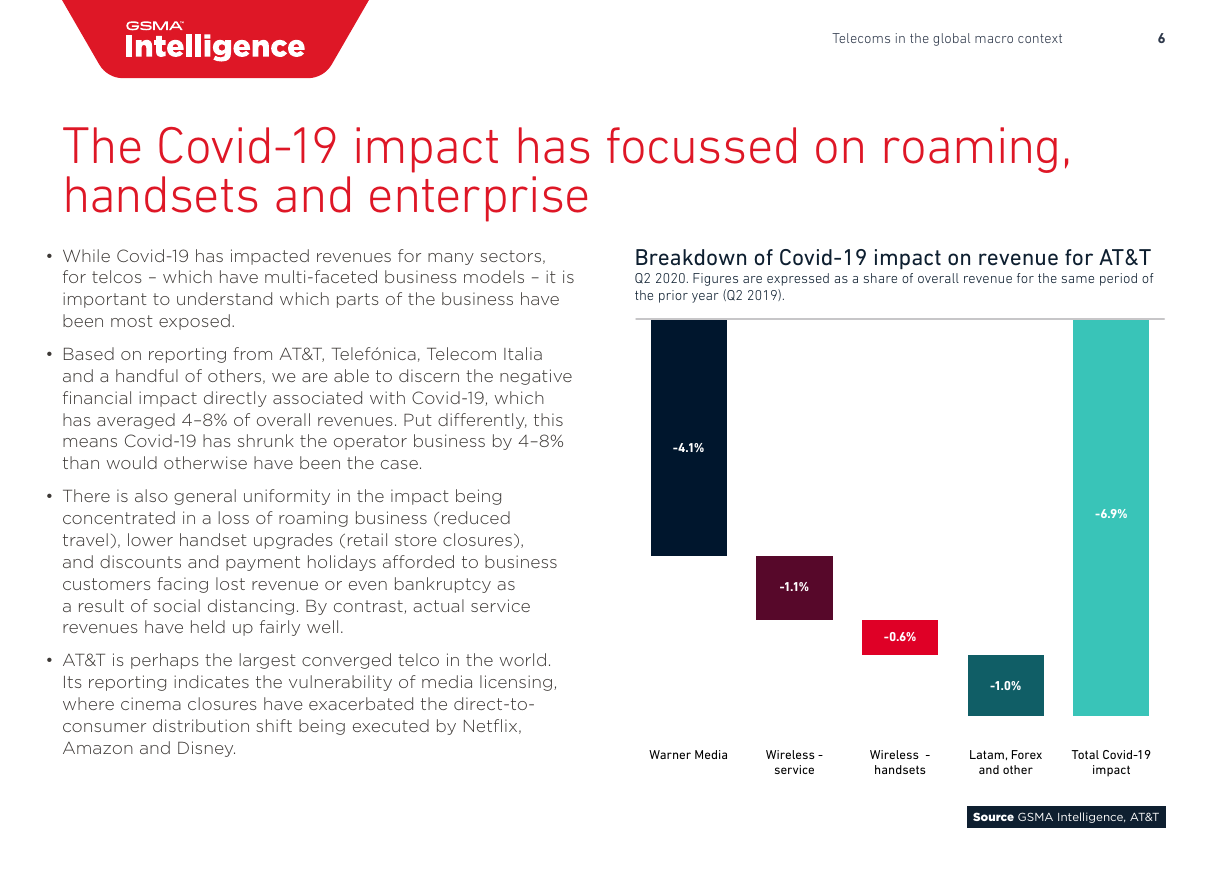

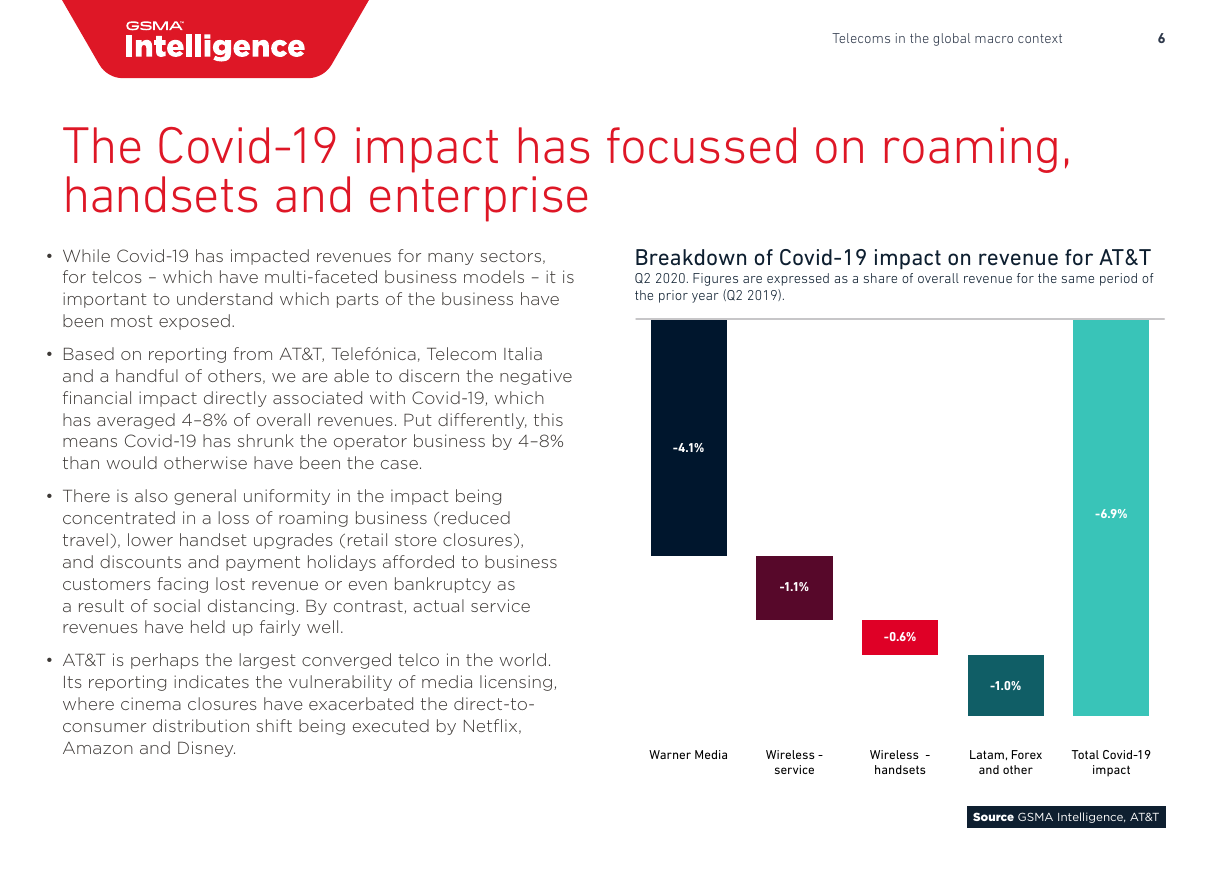

• While Covid-19 has impacted revenues for many sectors,

for telcos – which have multi-faceted business models – it is

important to understand which parts of the business have

been most exposed.

• Based on reporting from AT&T, Telefónica, Telecom Italia

and a handful of others, we are able to discern the negative

financial impact directly associated with Covid-19, which

has averaged 4–8% of overall revenues. Put differently, this

means Covid-19 has shrunk the operator business by 4–8%

than would otherwise have been the case.

• There is also general uniformity in the impact being

concentrated in a loss of roaming business (reduced

travel), lower handset upgrades (retail store closures),

and discounts and payment holidays afforded to business

customers facing lost revenue or even bankruptcy as

a result of social distancing. By contrast, actual service

revenues have held up fairly well.

• AT&T is perhaps the largest converged telco in the world.

Its reporting indicates the vulnerability of media licensing,

where cinema closures have exacerbated the direct-to-

consumer distribution shift being executed by Netflix,

Amazon and Disney.

Breakdown of Covid-19 impact on revenue for AT&T

Q2 2020. Figures are expressed as a share of overall revenue for the same period of

the prior year (Q2 2019).

-4.1%

-6.9%

-1.1%

-0.6%

-1.0%

Warner Media

Wireless -

service

Wireless -

handsets

Latam, Forex

and other

Total Covid-19

impact

Source GSMA Intelligence, AT&T

�

Telecoms in the global macro context

7

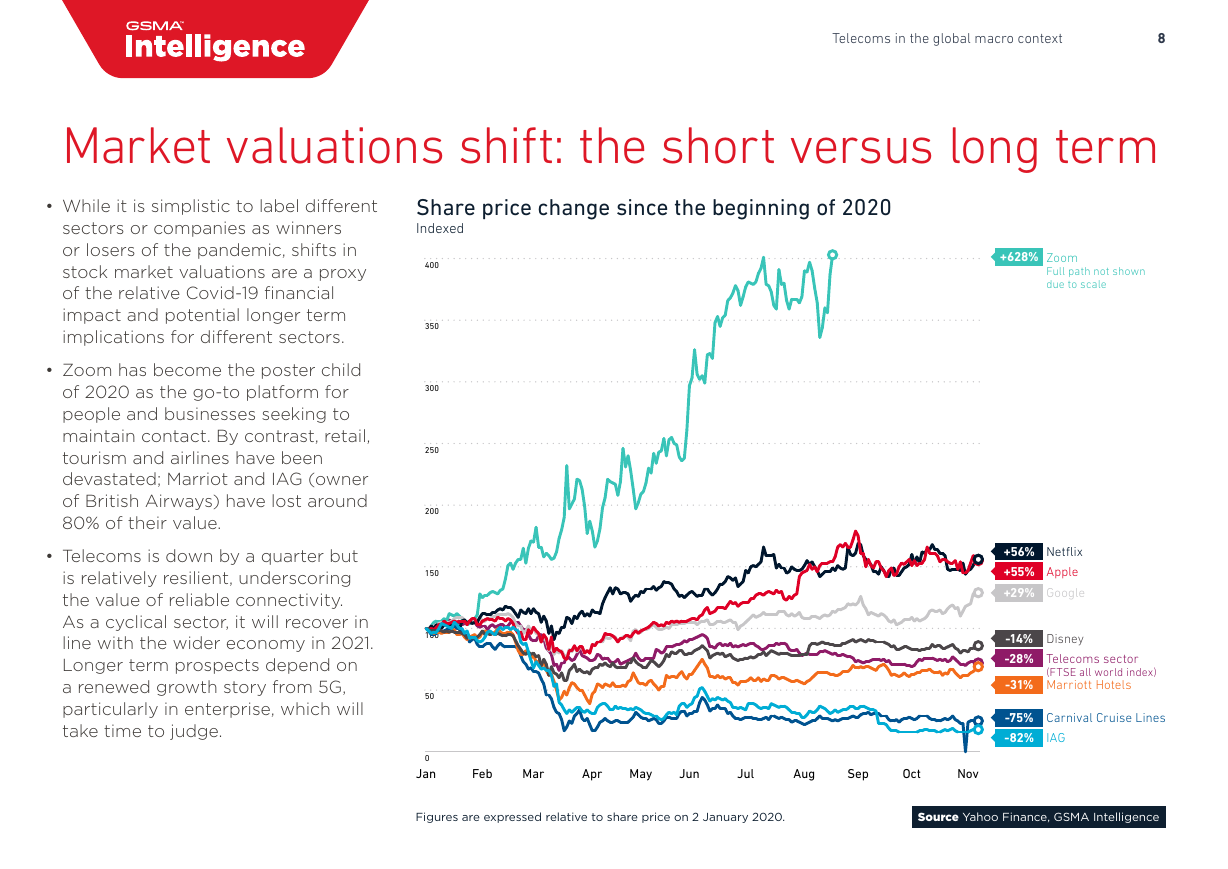

Network resilience has been an out and out positive

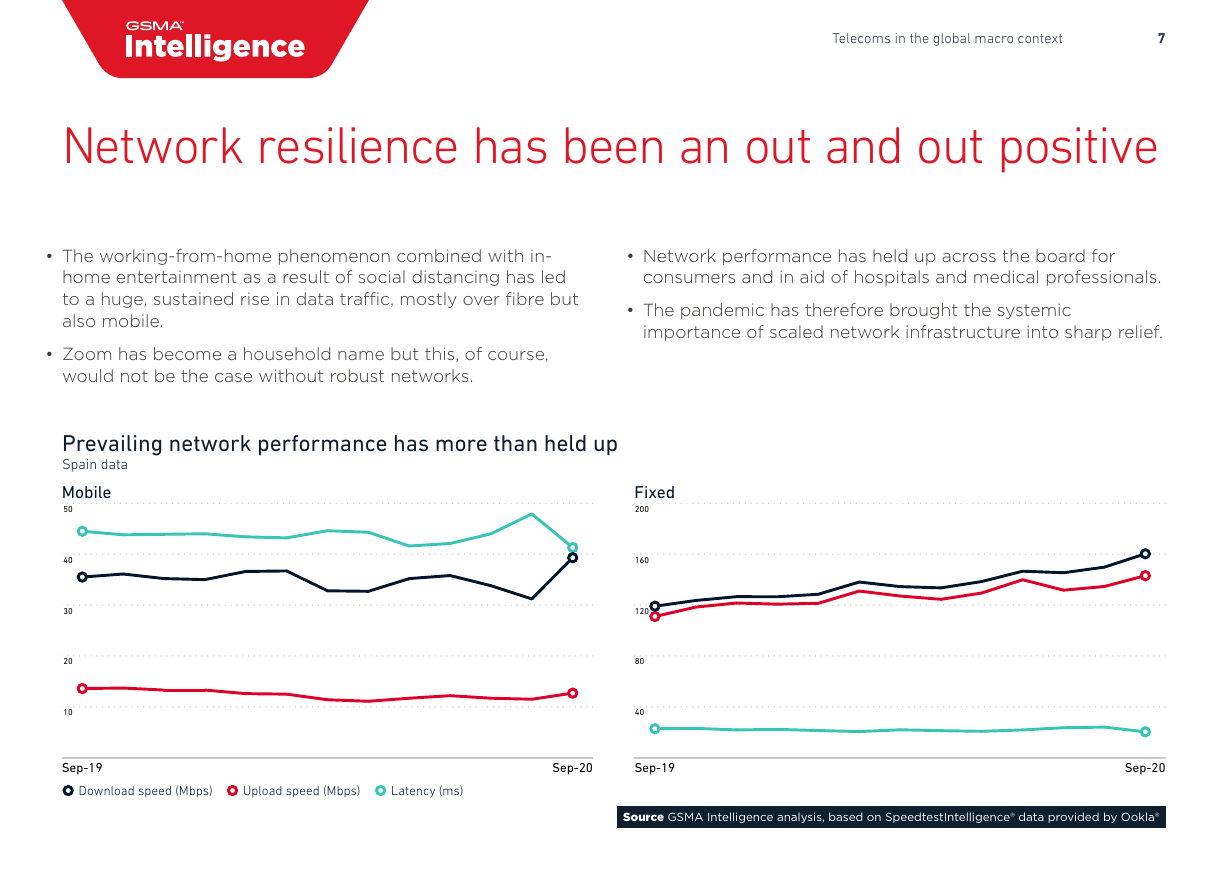

• The working-from-home phenomenon combined with in-

• Network performance has held up across the board for

home entertainment as a result of social distancing has led

to a huge, sustained rise in data traffic, mostly over fibre but

also mobile.

• Zoom has become a household name but this, of course,

would not be the case without robust networks.

consumers and in aid of hospitals and medical professionals.

• The pandemic has therefore brought the systemic

importance of scaled network infrastructure into sharp relief.

Prevailing network performance has more than held up

Spain data

Mobile

50

40

30

20

10

Fixed

200

160

120

80

40

Sep-19

Sep-20

Sep-19

Sep-20

Download speed (Mbps)

Upload speed (Mbps)

Latency (ms)

Source GSMA Intelligence analysis, based on SpeedtestIntelligence® data provided by Ookla®

�

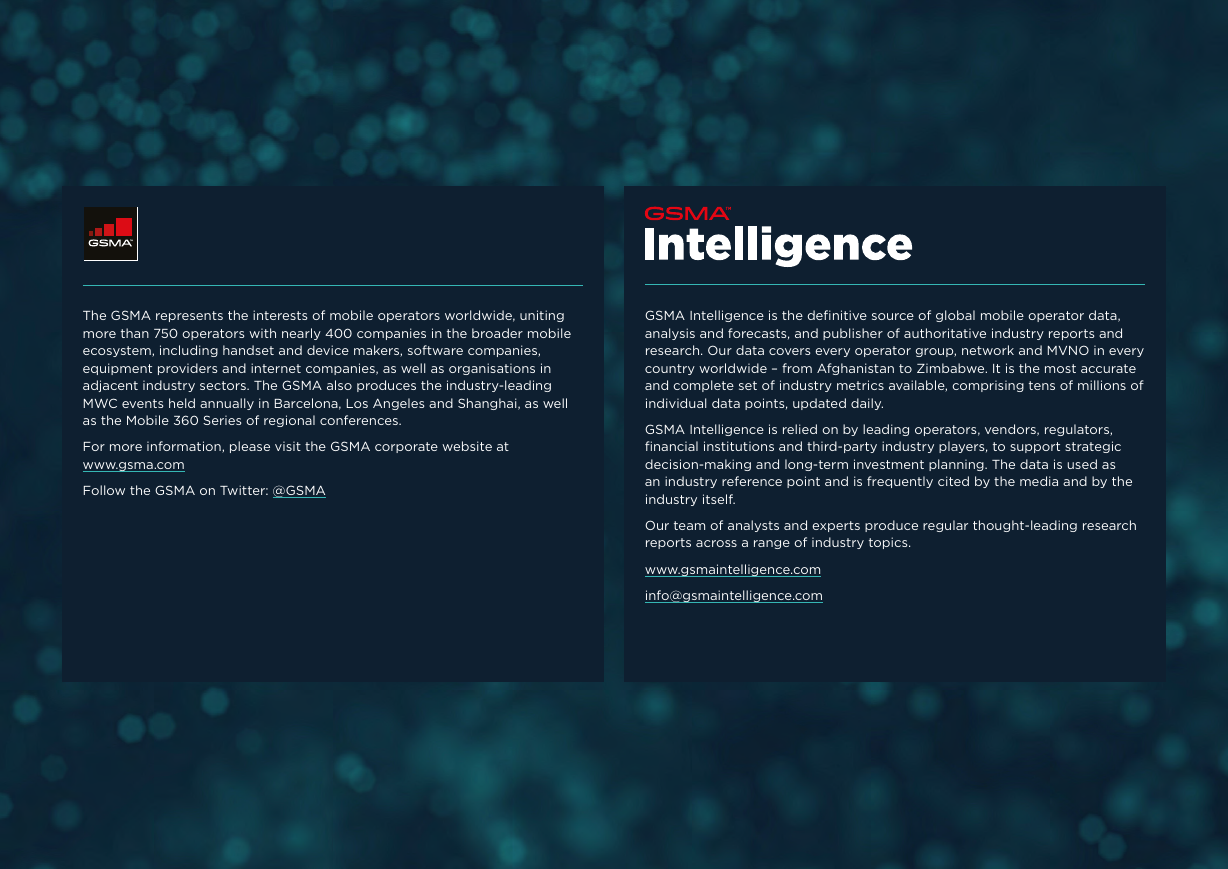

Market valuations shift: the short versus long term

Telecoms in the global macro context

8

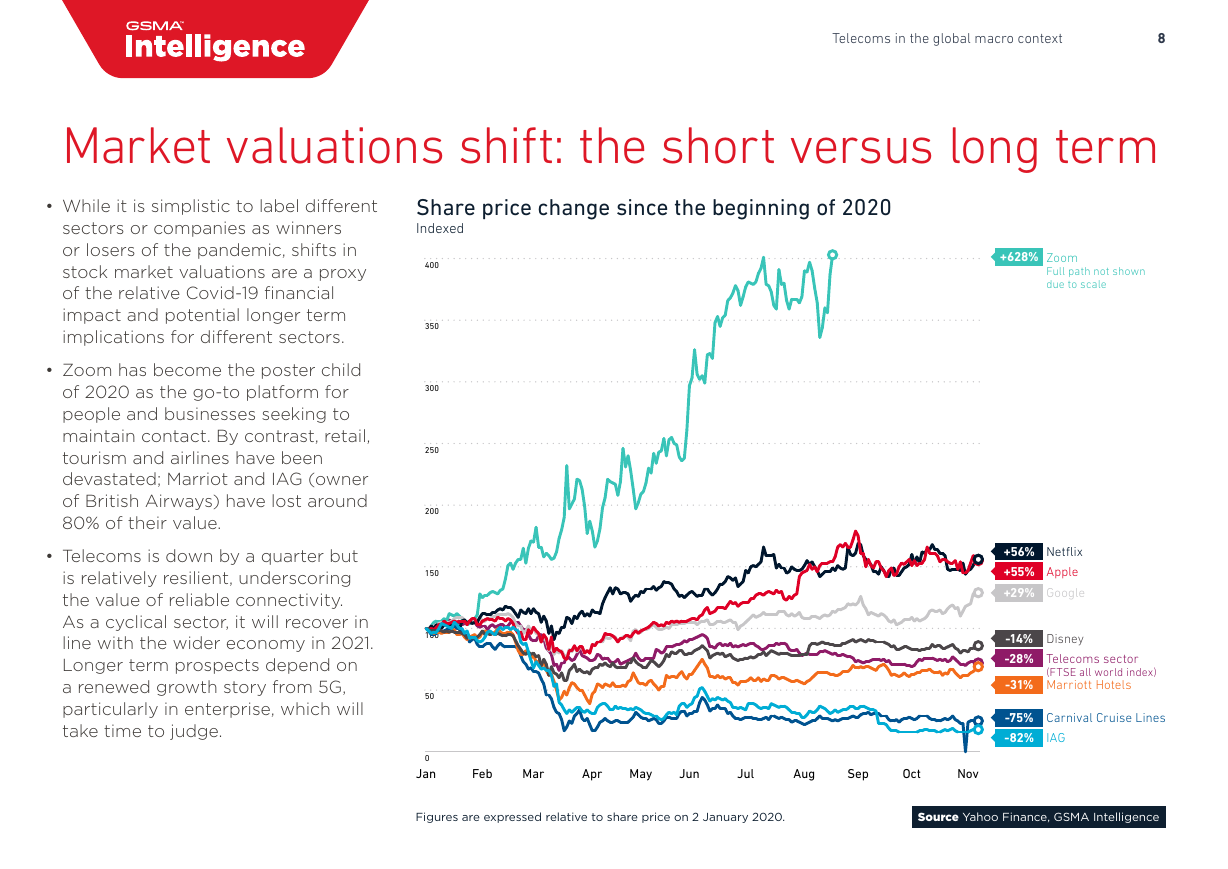

• While it is simplistic to label different

sectors or companies as winners

or losers of the pandemic, shifts in

stock market valuations are a proxy

of the relative Covid-19 financial

impact and potential longer term

implications for different sectors.

• Zoom has become the poster child

of 2020 as the go-to platform for

people and businesses seeking to

maintain contact. By contrast, retail,

tourism and airlines have been

devastated; Marriot and IAG (owner

of British Airways) have lost around

80% of their value.

• Telecoms is down by a quarter but

is relatively resilient, underscoring

the value of reliable connectivity.

As a cyclical sector, it will recover in

line with the wider economy in 2021.

Longer term prospects depend on

a renewed growth story from 5G,

particularly in enterprise, which will

take time to judge.

Share price change since the beginning of 2020

Indexed

400

350

300

250

200

150

100

50

0

Jan

+628% Zoom

Full path not shown

due to scale

+56% Netflix

+55% Apple

+29% Google

-14% Disney

-28% Telecoms sector

(FTSE all world index)

-31% Marriott Hotels

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

-75% Carnival Cruise Lines

-82% IAG

Figures are expressed relative to share price on 2 January 2020.

Source Yahoo Finance, GSMA Intelligence

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc