Tendermint: Consensus without Mining

Jae Kwon

yk239@cornell.edu

Draft v.0.6 (outdated)

This is from 2014.

The current spec is on github.com/tendermint/tendermint/wiki

Abstract. Cryptocurrencies such as Bitcoin enable users to submit

payment transactions without going through a centralized trusted or-

ganization. Bitcoin relies on proof-of-work mining to secure consensus

which is problematic; mining requires a massive expenditure of energy,

confirmation of transactions is slow, and security is difficult to quantify.

We propose a solution to the blockchain consensus problem that does

not require mining by adapting an existing solution to the Byzantine

Generals Problem.

1. Introduction

Cryptocurrencies have come into the spotlight since the introduction of Bit-

coin [1]. The objective of cryptocurrency protocols such as Bitcoin is to maintain a

live decentralized transaction ledger while defending against double-spend attacks

from malicious Byzantine actors that deviate from the protocol. Consensus of the

Bitcoin transaction ledger is secured by a network of miners who compete for re-

wards in the blockchain. This mining, or proof-of-work, comes with a hefty cost.

At today’s Bitcoin prices and reward schedule, miners are rewarded on the order of

$1,500,000 a day to secure the blockchain – and a significant portion of that money

is spent on electricity. Proof-of-work based consensus protocols are also slow, re-

quiring up to an hour to reasonably confirm a payment to prevent double-spending.

Alternative protocols have been proposed by the cryptocurrency commu-

nity to replace proof-of-work mining [2, 3]. Some of these protocols suffer from the

nothing at stake problem; participants have nothing to lose by contributing to mul-

tiple blockchain forks, so consensus on a single blockchain is not guaranteed. Other

protocols require participant to accurately gauge the trustworthiness of other key

participants, which makes analysis of security difficult to quantify.

Our contribution is a novel consensus protocol that requires no proof-of-work

mining and has a high level of protection against double-spend attacks. We make

a weak assumption about the participant’s abilities to keep time, and we assume

partial synchrony of the network. Our algorithm is based on a modified version of

the DLS protocol [4], and is resilient up to 1/3 of Byzantine participants.

1

�

2. The Difficulty of Quantifying Security

Security analysis of cryptocurrency protocols is complicated by many factors.

One such complicating factor is the rational self-interested nature of participants.

The ideal protocol is an incentive compatible Nash equilibrium such that deviating

from the protocol does not result in a net gain [5]. Recent work by Eyal and Sirer

[6] showed that the Bitcoin protocol is susceptible to a minority collusion group

that can grow to become a centralized majority. They propose a modification to

the Bitcoin protocol such that it can tolerate colluding groups that control up to 1/4

of the mining power – less than the previously assumed bound of 1/2 of Byzantine

mining power which requires an honest mining majority that follows the prescribed

protocol.

Another complicating factor is whether the power to achieve or disrupt con-

sensus is extrinsic in origin (e.g. access to the production of mining equipment or

access to cheap electricity) or intrinsic in origin (e.g. the “stake” of validators in

proof-of-stake protocols) and whether the disruption of consensus – especially via a

successful double-spend attack – is associated with a commensurate penalty. The

problem with extrinsic factors of security is that they are not easily quantifiable

for analysis. For example, the depreciation costs of Bitcoin mining hardware in the

event of a successful double-spend attack may not be significant compared to the

running costs of electricity. On the other hand existing proof-of-stake protocols do

not have a well defined intrinsic penalty for instigators of a double-spend attack.

This is commonly called, ironically, the “nothing at stake” problem. Newer protocols

like the BitShares delegated-proof-of-stake protocol attempt to address this prob-

lem by placing the role of ranked-delegate at stake [3], but security is dependant on

the extrinsic ability of stakeholders to accurately predict the future performance of

delegates.

Security analysis is much simpler for an intrinsically secure cryptocurrency

protocol when it can be proved that launching a double-spend attack necessarily

results in a very high intrinsic penalty compared to the possible intrinsic gains.

Then, the protocol may be considered resistant to double-spent attacks assuming

no further extrinsic complications.

3. Terms

Nodes are connected to each other in a peer-to-peer network and relay new

information by gossip. Each node keeps a complete copy of a totally ordered se-

quence of events in the form of a blockchain as in Bitcoin. Users keep an account

in the system, where the user’s account is identified by the user’s public key or

address. Each account can hold a sum of coins that can change with new transac-

tions. Nodes relay new transactions as they are signed and submitted by users to

2

�

a node of the network. A transaction is valid if it follows the rules of our protocol

(e.g. sufficient funds to send, etc).

4. Block Structure

Valid transactions are grouped into blocks with a structure shown in figure 1.

The validation and transactions hashes are merkle tree root hashes of the signatures

and transaction data included in the block [7]. The state hash, included in the

header, is likewise the merkle root hash of the persistent account state (external to

the blockchain) after applying the transactions of the block. Finally the block hash

is computed by hashing the header, validation, and transactions hashes. This way,

the block hash itself is a merkle root hash such that any component of the block

and account state can be verified with a merkle hash trail that leads to the block

hash. A block is said to be valid if all the transactions in the block are valid and

sufficient signatures are included in the validation.

Figure 1: Block structure

5. Validators

Validators are users with accounts that have coins locked in a bond deposit

by posting a bond transaction. These validators participate in the consensus pro-

tocol by broadcasting cryptographic signatures, or votes, to agree upon the next

block. We say that a validator has voting power equal to the amount of the bonded

coins. The validator can later unlock its coins by posting an unbonding transaction.

Afterwards the coins remain locked for a predetermined period of time called the

unbonding period, after which the validator is free to transfer or spend those coins

3

�

to other accounts. A set of validators with at least 2/3 of total voting power is also

called a 2/3 majority of validators. Similarly, a set of validators with at least 1/3 of

total voting power is called a 1/3 majority of validators.

A block is considered committed when a 2/3 majority of validators sign com-

mit votes for that block. A fork occurs when two blocks at the same height are

each signed by a 2/3 majority of validators. By simple arithmetic, a fork can only

happen when at least a 1/3 majority of validators signs duplicitously.

When a validator signs duplicitously, a short evidence transaction can be

generated by anyone with the two conflicting commit-vote signatures. This ev-

idence is committed into the blockchain which destroys the bonded coins of the

guilty validator(s). As long as the evidence is committed before the guilty valida-

tor’s coins are spent (that is, before the unbonding period is over), the validator

can be duly punished. Note that this does not preclude a 2/3 majority of validators

from publishing a blockchain fork after they had unbonded and sold their coins to

an unsuspecting party. This is called a long-range double-spend attack. A user can

avoid long-range attacks by syncing their blockchain periodically within the bounds

of the unbonding period.

A double-spend attack implies a fork in the blockchain. A short-range

double-spend attack occurs when a fork happens at a recent height: recent enough

that the guilty validators still have their coins locked in bond. Since a fork re-

quires at least a 1/3 majority of validators to have signed duplicitously, the penalty

for a short-range double-spend attack is a significant proportion (1/3) of the total

amount of bonded coins. Thus we can adjust the minimum cost of launching a

double-spend attack by tuning the incentive to become a validator. For example,

the cryptocurrency can be inflationary by way of block rewards divided amongst the

validators in proportion to their voting power. The inflation rate need not be fixed,

but can depend on the past average weighted transaction volume of the network as

measured by coin-days-destroyed [8]. If the marginal cost of securing a validator

node is negligible, the reward scheme need not be inflationary; the transaction fees

paid by users may be sufficient.

6. Consensus

6.1 On Byzantine Consensus

Fischer et al have shown in a seminal paper [9] that in an asynchronous

system (where no assumptions are made about time) of deterministic processes,

no protocol can guarantee consensus even with one faulty process. This is called

the FLP impossibility result. Much research has gone into understanding ways

to circumvent the FLP impossibility result by slightly modifying the problem do-

4

�

main, e.g. by sacrificing determinism, adding time, adding oracles etc [10]. Bitcoin

circumvents the FLP impossibility result by making some assumptions about the

synchrony of the network (i.e. nodes soon sync up with the network) and time (i.e.

miners dedicate limited time and resources to the best blockchain).

Our algorithm is based on algorithm 2’ from section 4 of [4] (Dwork et al).

It assumes that the network is partially synchronous; there is assumed to be some

unknown upper bound ∆ on the time of messages to be delivered. Intuitively, there

may be arbitrary but finite latency in the network. We also assume that all non-

byzantine nodes have access to an internal clock that can stay sufficiently accurate

for a short duration of time until consensus on the next block is achieved. The

clocks do not need to agree on a global time and may drift at some bounded rate

relative to global time. The algorithm is adapted to work with blockchains on a

gossip network. As in the algorithm proposed by Dwork et al, it can tolerate of up

to 1/3 byzantine voting power.

6.2 Algorithm

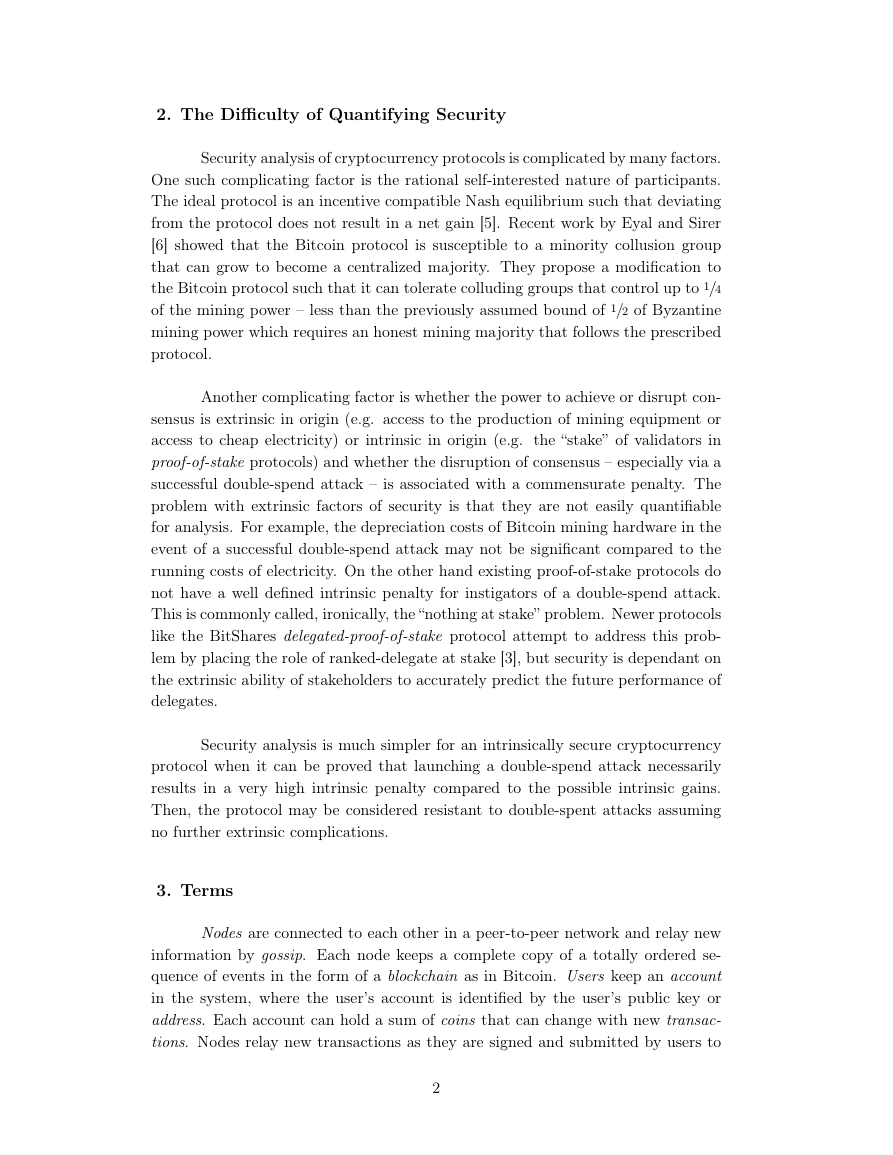

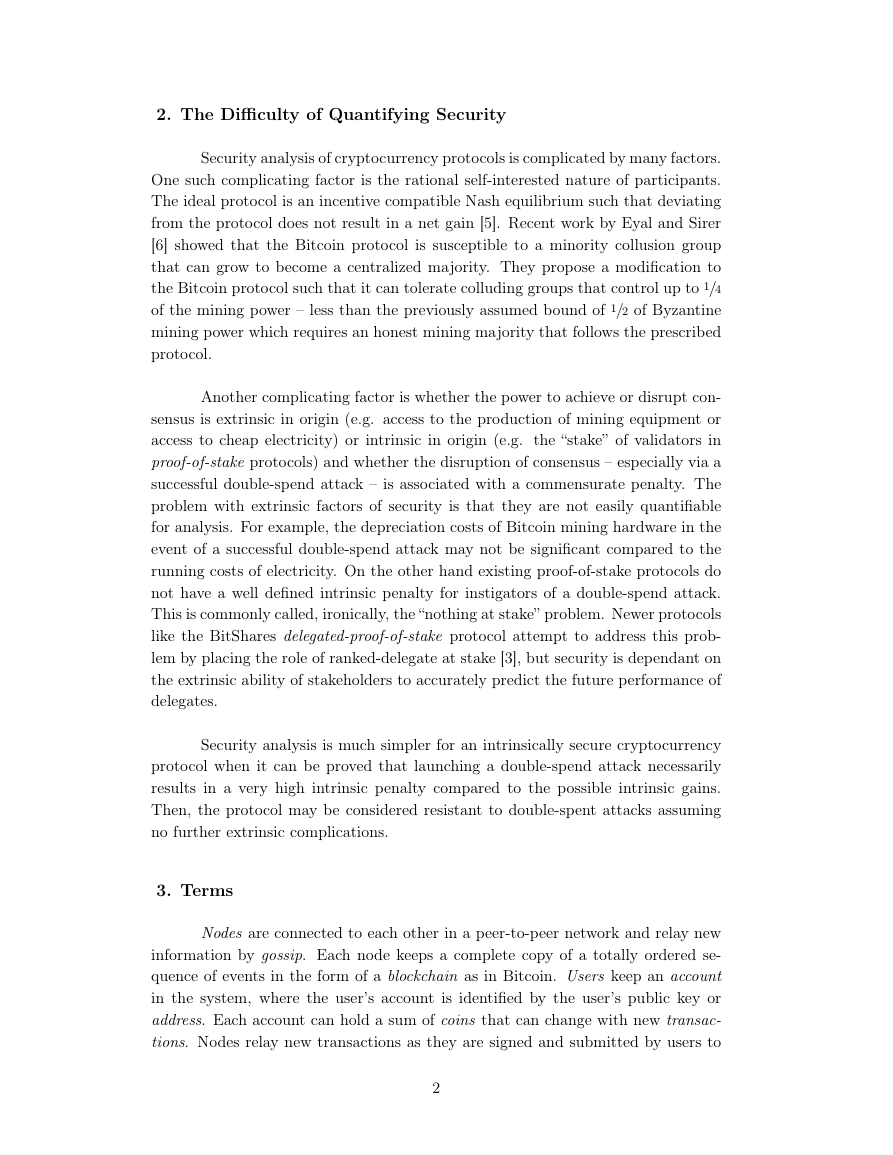

validators participate in the consensus process by signing votes for blocks.

There are three types of votes: a prevote, a precommit and a commit. To receive

more than 2/3 of commits means to receive commits from a 2/3 majority of validators.

A block is said to be committed by the network when a 2/3 majority of validators

had signed and broadcast commits for that block.

Figure 2: Vote structure

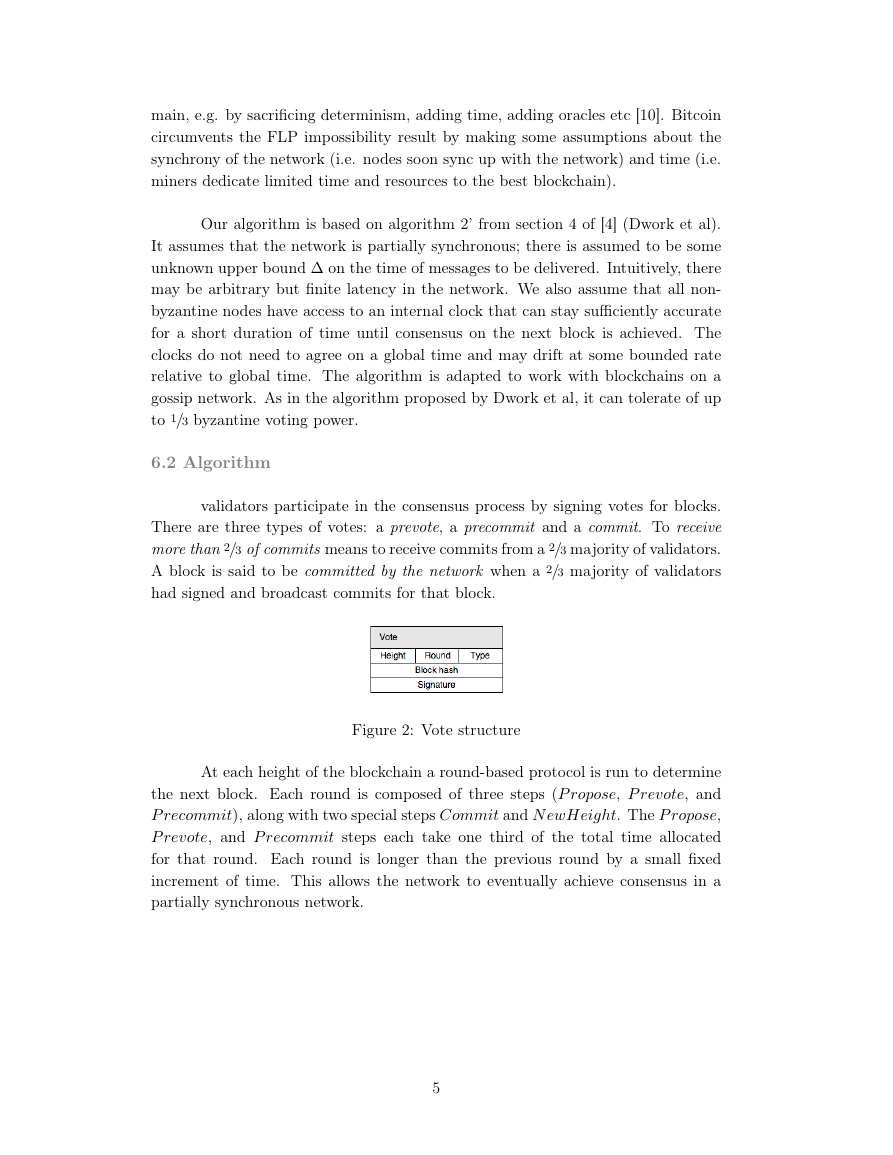

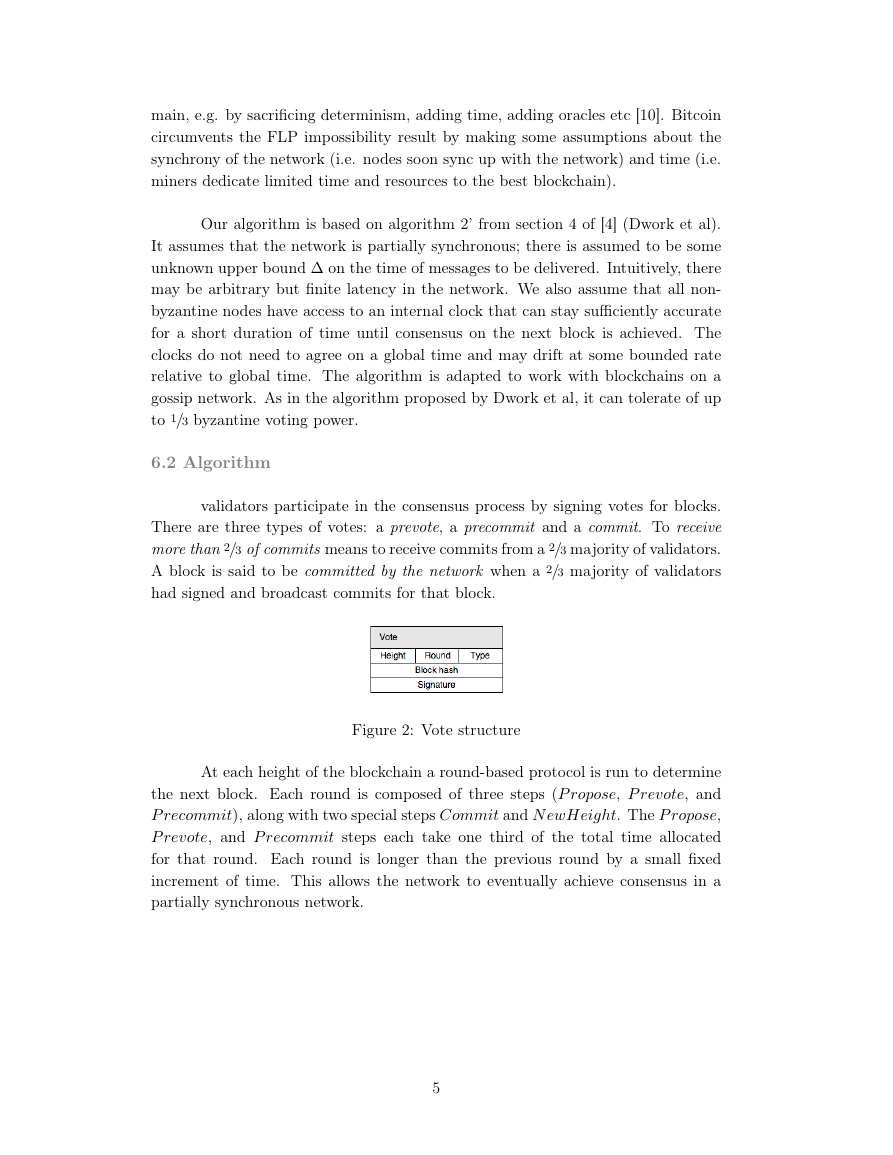

At each height of the blockchain a round-based protocol is run to determine

the next block. Each round is composed of three steps (P ropose, P revote, and

P recommit), along with two special steps Commit and N ewHeight. The P ropose,

P revote, and P recommit steps each take one third of the total time allocated

for that round. Each round is longer than the previous round by a small fixed

increment of time. This allows the network to eventually achieve consensus in a

partially synchronous network.

5

�

Figure 3: Overview of state machine

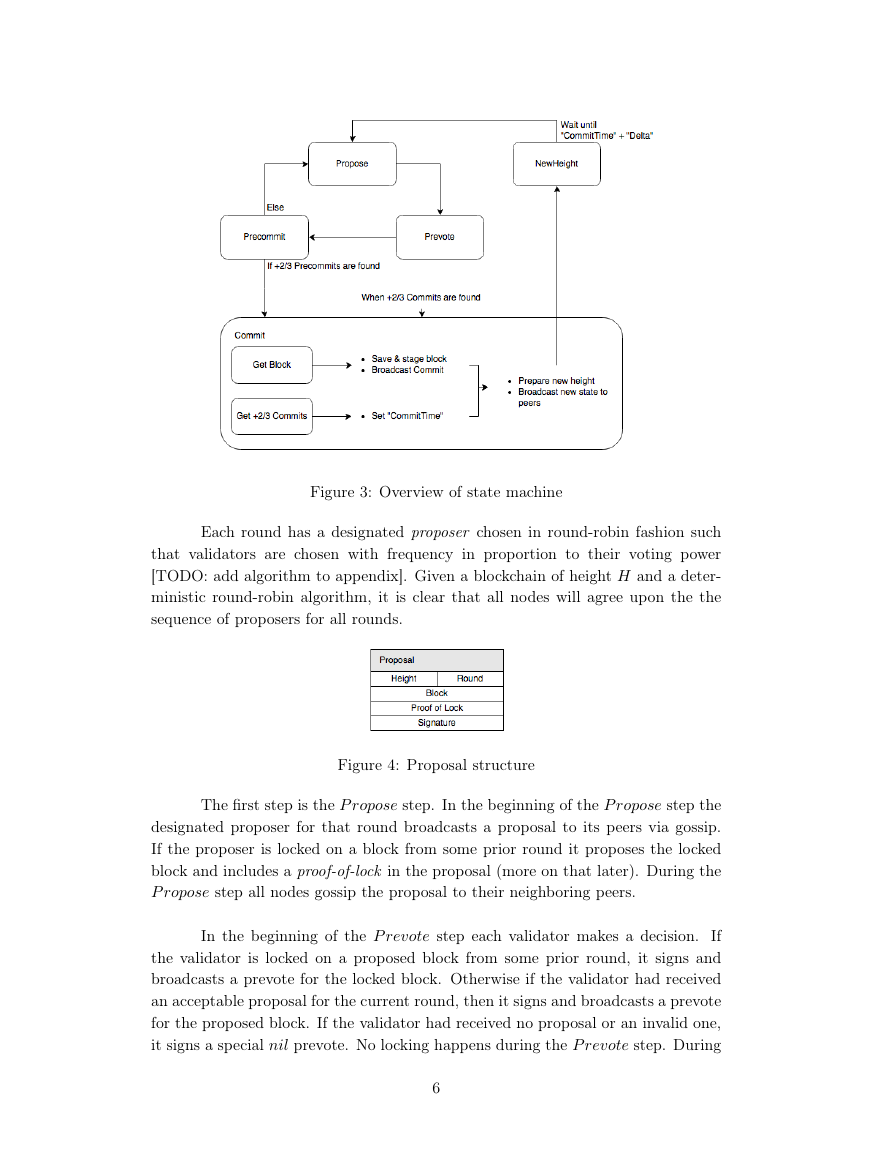

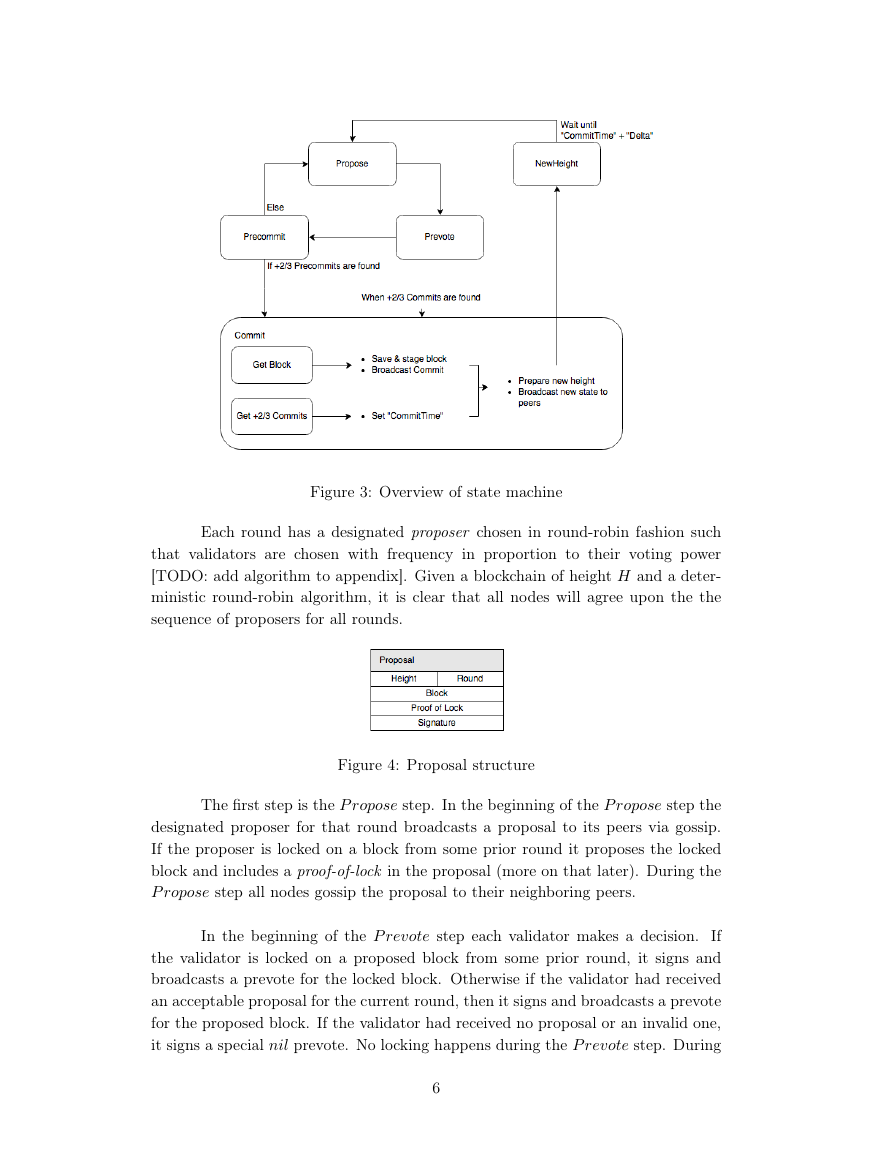

Each round has a designated proposer chosen in round-robin fashion such

that validators are chosen with frequency in proportion to their voting power

[TODO: add algorithm to appendix]. Given a blockchain of height H and a deter-

ministic round-robin algorithm, it is clear that all nodes will agree upon the the

sequence of proposers for all rounds.

Figure 4: Proposal structure

The first step is the P ropose step. In the beginning of the P ropose step the

designated proposer for that round broadcasts a proposal to its peers via gossip.

If the proposer is locked on a block from some prior round it proposes the locked

block and includes a proof-of-lock in the proposal (more on that later). During the

P ropose step all nodes gossip the proposal to their neighboring peers.

In the beginning of the P revote step each validator makes a decision.

If

the validator is locked on a proposed block from some prior round, it signs and

broadcasts a prevote for the locked block. Otherwise if the validator had received

an acceptable proposal for the current round, then it signs and broadcasts a prevote

for the proposed block. If the validator had received no proposal or an invalid one,

it signs a special nil prevote. No locking happens during the P revote step. During

6

�

the P revote step all nodes gossip all prevotes for the round to their neighboring

peers.

In the beginning of the P recommit step each validator makes a decision.

If the validator had received more than 2/3 of prevotes for a particular acceptable

block then the validator signs and broadcasts a precommit for that block. It also

locks onto that block and releases any prior locks. A node has a lock on at most

one block at a time. If the node had received more than 2/3 of nil prevotes then

it simply unlocks. When locking (or unlocking) the node gathers the prevotes for

the locked block (or the prevotes for nil) and packages them into a proof-of-lock

for later when it is its turn to propose. If a node had not received more than 2/3

of prevotes for a particular block (or nil), then it does not sign or lock anything.

During the P recommit step all nodes gossip all precommits for the round to all

neighboring peers.

At the end of the P recommit step each node makes a decision. If the node

had received more than 2/3 of precommits for a particular block, then the node

enters the Commit step. Otherwise it continues onto the P ropose step of the next

round. Even if a node hadn’t yet received the block precommitted by the network,

it enters the Commit step.

The Commit step is a special step. There are two parallel conditions that

must both be satisfied before finalizing the round. First, the node must receive the

block committed by the network if it hadn’t already. Once the block is received

by a validator it signs and broadcasts a commit for that block. Second, the node

must wait until it receive at least 2/3 of commits for the block precommitted by the

network. Once both conditions are satisfied the node sets its CommitT ime to the

current time and transitions to the N ewHeight step. The asynchronous and local

nature of CommitT ime allows the network to maintain consensus despite drifting

clocks, as long as the clocks remain accurate enough during the consensus process

of a given height.

Before the first round (round 0) at height H is the N ewHeight step whose

purpose is to gather additional commits for the previously committed block at

height H-1. Nodes stay at this step until some fixed duration of time past Commit-

Time. This allows block proposals to include more than the minimum 2/3 of com-

mits, thus allowing the commits of slower validators to be included in the blockchain.

At any time during the consensus process if a node receives more than 2/3 of

commits for a particular block, it immediately enters the Commit step if it hadn’t

already. Thus there are two ways to enter the Commit step. A commit-vote for

a block at round R counts as prevotes and precommits for all rounds R where

R < R. Commit-votes are gossipped to neighboring peers in the background re-

7

�

gardless of the current round or step.

At any time during the consensus process if a node is locked on a block from

round R but receives a proof-of-lock for a round R where R < R, the node unlocks.

6.3 Proof of Safety

If there are less than 1/3 in Byzantine voting power and at least one good

validator decides on a block B, then no good validator will decide on any block

other than B. Consider the earliest round R where at least one good validator

commits block B at round R. This validator received more than 2/3 of precommits

for block B at round R. Considering that less than 1/3 are Byzantine, by arithmetic

at least 1/3 of good validators must have precommitted block B at round R. These

good validators must have a lock on block B at round R. No other block can be

committed by good validators unless some of the good validators unlock from B,

which is impossible.

6.4 Proof of Liveness

If there are less than 1/3 in Byzantine voting power then this protocol does

not deadlock. The only way the consensus process can deadlock is if two different

blocks had been locked by some good validators from different rounds (a rare oc-

currence without an active global adversary). Say that some good validators locked

on block B and round R, and some good validators locked on block B at round

R, where R < R. In this case the proof-of-lock from R included in a proposal by

a good validator will eventually unlock those validators locked on R allowing the

consensus process to continue.

6.5 Cooperation

Since validators divide the transaction fees of block H amongst themselves,

a greedy validator might be tempted to exclude some signatures when proposing the

next block H+1. This is an inferior strategy when considering that other validators

are game optimal participants. Given that the total amount of fees to be divided

in a block is f1, and that the sum of the voting powers vi of all validators that

have signed and successfully broadcasted their signatures is 1, consider proposer P

with voting power vp < 1 who is considering whether to include validator Alice’s

signature with voting power va < 1. At stake is Alice’s fair share of the fees which

is f1 · va. Of this, P ’s incremental benefit of excluding Alice’s signature is:

f1 · va · vp/(1 − va)

Then, Alice could react tit-for-tat by excluding P ’s signature when it be-

comes Alice’s turn to propose the next block, where the sum of the fees in that

8

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc