For office use only

T1

T2

T3

T4

For office use only

F1

F2

F3

F4

Team Control Number

1904381

Problem Chosen

F

2019

MCM/ICM

Summary Sheet

Digital Currency System is Coming

Summary

In recent years, digital currency has developed rapidly and become an in-

dispensable part of the modern economic system. We construct a brand-new

dynamic macroeconomic operation system, taking digital currency into account.

Our model is based on three perspectives: individual choice, national economy,

international economy. We first consider the individual behavior choice deci-

sion, which is because the aggregate demand of all micro-individuals selections

determine the domestic economic operation state, describing as the product mar-

ket equilibrium and money market equilibrium. We use models to analyze three

short-term economic as well as a long-term economic performance objective, un-

der different exchange rate systems, economic shocks and policies.

We first build a virtual country whose central bank issues the new digital

currency. The impact of digital currency on the current banking system and

macroeconomic system is determined by the economic interaction with a par-

ticular country in the real world.

We discuss two different exchange rate systems that a country will choose.

Using theoretical analysis and R, we find that either systems would achieve in-

ternal and external equilibrium and realize economic objects if proper policies

are implemented when digital currency is introduced.

The innovation of our model is that we introduce the parameters of interna-

tional capital flows (ICF) to the model. We analyze the impact of ICF on economy

of the country both theoretically and empirically. It is inspiring that we find that

decentralized digital currency can not only run the economy more efficiently by

removing barriers to currency flows, but also enhance the world’s welfare by the

ultra-high liquidity of digital currency.

To ensure the new banking and the macroeconomic systems involving digital

currency can operate with stability and effectiveness we propose all countries

accepting digital currencies co-create a United Nations-affiliated organization–

the World Digital Money Bank (WDCB) and develop a series of regulations.

Keywords: digital currency;fixed exchange rate ;float exchange rate

�

Team # 1904381

1

Introduction

1.1 Background

Page 1 of 27

Considering the application of the digital currency, there lies both advantages

and disadvantages. Its digital forms can enable instantaneous transactions and

borderless transfer-of-ownership, which improves the efficiency of the markets

and constructs a more convenient form of financial exchange. But in the mean-

time, while not technically money, their value is tied to real-world currencies

which from the very beginning has placed them in a very precarious situation.

Lack of regulation around these currencies and their anonymity also bring risk

to both citizens and economic analysts.

Therefore, modeling the working mechanism of financial system adding the

new type of currency is necessary. This model would enable us to have a clear

overview of the market model and help make policies with regard to both regu-

lations of the currency market and stablity of the system.

1.2 Statement of the Problem

• Task1: Construct a model in which digital currency is taken into consider-

ation, and the model should adequately elucidate this financial system.

• Task2: Identify the viability and effects of a global decentralized digital

financial market and develop a kind of general digital currency.

• Task3: Identify major factors which will limit or facilitate its growth, access,

security, and stability at both the individual, national, and global levels.

• Task4: How will the countries modify their current banking and monetary

models according to their different needs and their willingness to work

with this new financial marketplace? And what are the consequences of

these modifications?

• Task5: Include the mechanisms for oversight of the global digital currency

built above.

• Task6: Analyze the long-term effects of this system on the current banking

industry; the local, regional, and world economy; and international rela-

tions between countries.

• Task7: What will happen if the countries abandon their own currency and

only use digital currency?

�

Team # 1904381

Page 2 of 27

2 Assumptions and Notations

2.1 Assumptions

In order to better quantify our model, we may relax some of the assumptions.

• Consumption and savings occur in individuals, while production and in-

vestment occur in the enterprise sector. Individuals and enterprises have

to pay taxes.

• Consumers are rational and pursue maximum utility.

• The government has two kinds of behavior: government purchase expen-

diture and tax revenue.

• Depreciation and undistributed profits are zero. GDP, NDP, NI, PI and DPI

are equal.

• The government aims to achieve economic growth, adequate employment,

price stability and internal and external equilibrium under balance of inter-

national payments.

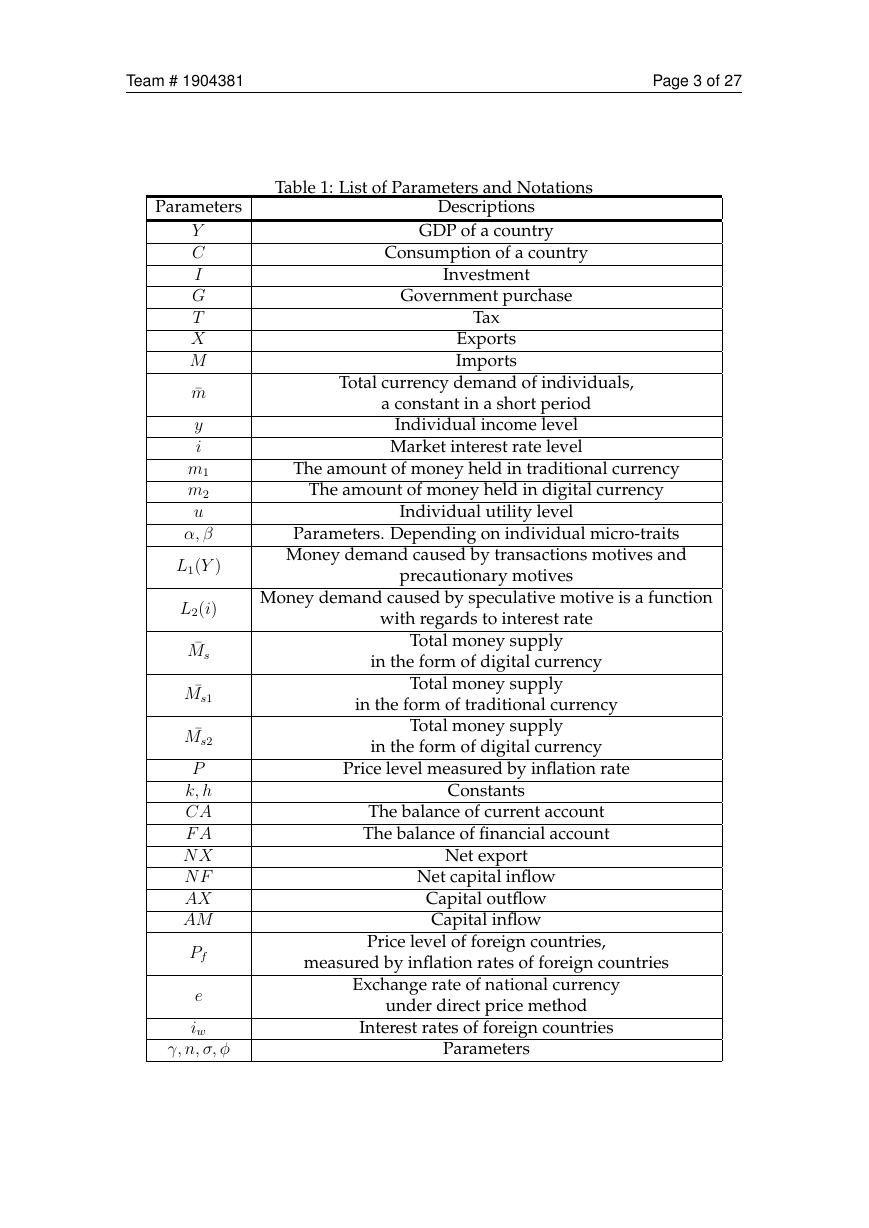

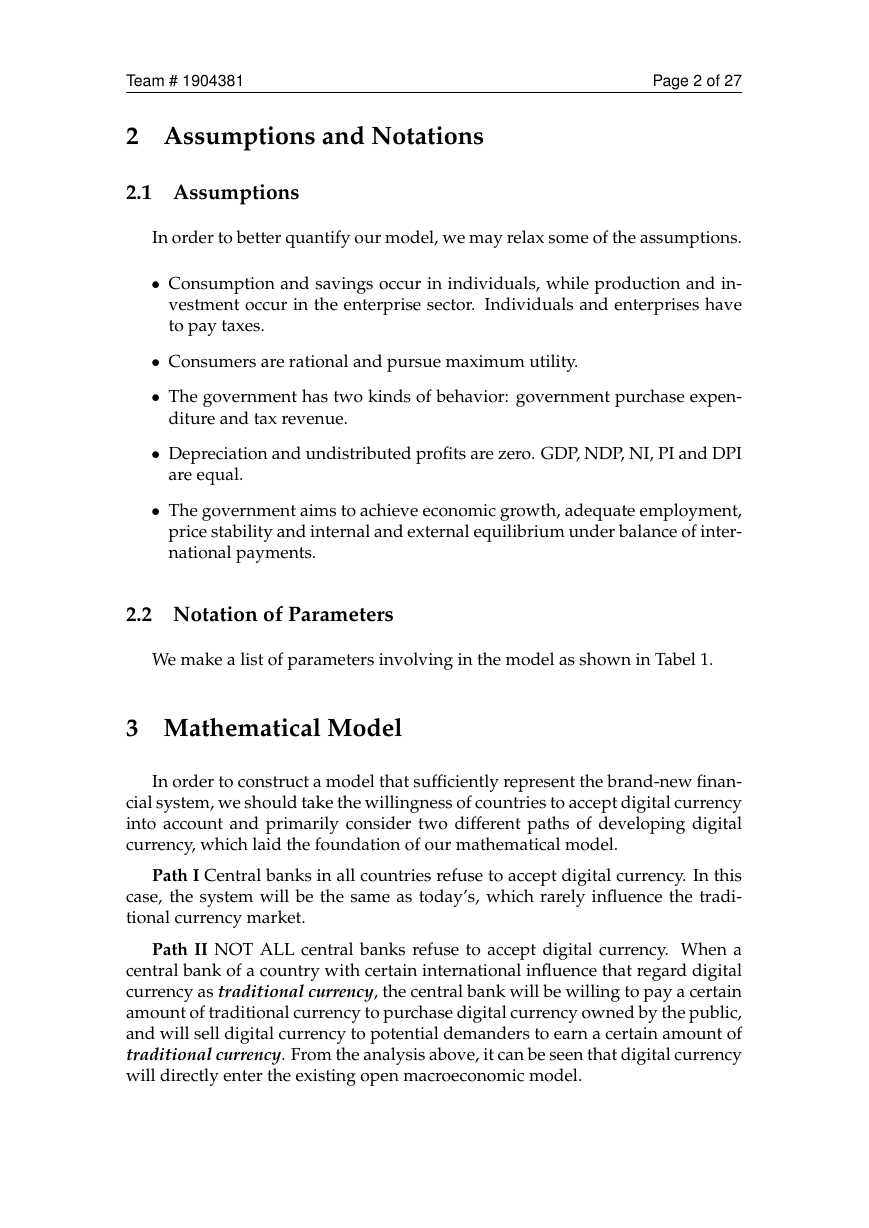

2.2 Notation of Parameters

We make a list of parameters involving in the model as shown in Tabel 1.

3 Mathematical Model

In order to construct a model that sufficiently represent the brand-new finan-

cial system, we should take the willingness of countries to accept digital currency

into account and primarily consider two different paths of developing digital

currency, which laid the foundation of our mathematical model.

Path I Central banks in all countries refuse to accept digital currency. In this

case, the system will be the same as today’s, which rarely influence the tradi-

tional currency market.

Path II NOT ALL central banks refuse to accept digital currency. When a

central bank of a country with certain international influence that regard digital

currency as traditional currency, the central bank will be willing to pay a certain

amount of traditional currency to purchase digital currency owned by the public,

and will sell digital currency to potential demanders to earn a certain amount of

traditional currency. From the analysis above, it can be seen that digital currency

will directly enter the existing open macroeconomic model.

�

Team # 1904381

Page 3 of 27

Parameters

Table 1: List of Parameters and Notations

Descriptions

Y

C

I

G

T

X

M

¯m

y

i

m1

m2

u

α, β

L1(Y )

L2(i)

¯Ms

¯Ms1

¯Ms2

P

k, h

CA

F A

N X

N F

AX

AM

Pf

e

iw

γ, n, σ, φ

GDP of a country

Consumption of a country

Investment

Government purchase

Tax

Exports

Imports

Total currency demand of individuals,

a constant in a short period

Individual income level

Market interest rate level

The amount of money held in traditional currency

The amount of money held in digital currency

Individual utility level

Parameters. Depending on individual micro-traits

Money demand caused by transactions motives and

precautionary motives

Money demand caused by speculative motive is a function

with regards to interest rate

Total money supply

in the form of digital currency

Total money supply

in the form of traditional currency

Total money supply

in the form of digital currency

Price level measured by inflation rate

Constants

The balance of current account

The balance of financial account

Net export

Net capital inflow

Capital outflow

Capital inflow

Price level of foreign countries,

measured by inflation rates of foreign countries

Exchange rate of national currency

under direct price method

Interest rates of foreign countries

Parameters

�

Team # 1904381

Page 4 of 27

In the following sections, we will mainly focus on path two. Our idea is to

discuss the details of our mathematical model from three different perspectives

in macroeconomics: 1) the domestic product market 2) the money market in-

cluding individual level and nationanl level 3) the foreign exchange market. In

addition, we would observe how every single model changes with the introduc-

tion of digital currency and analyze the working mechanism of all these three

general models.

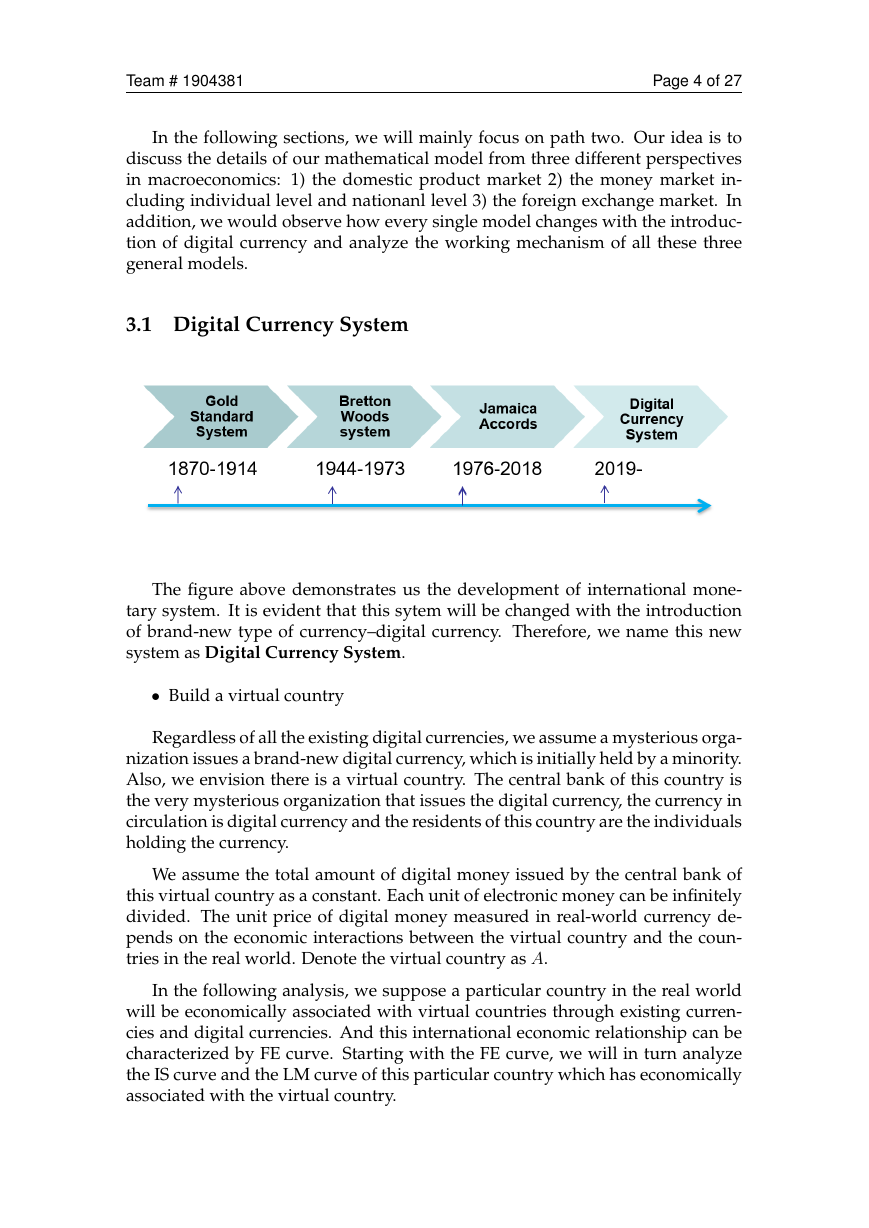

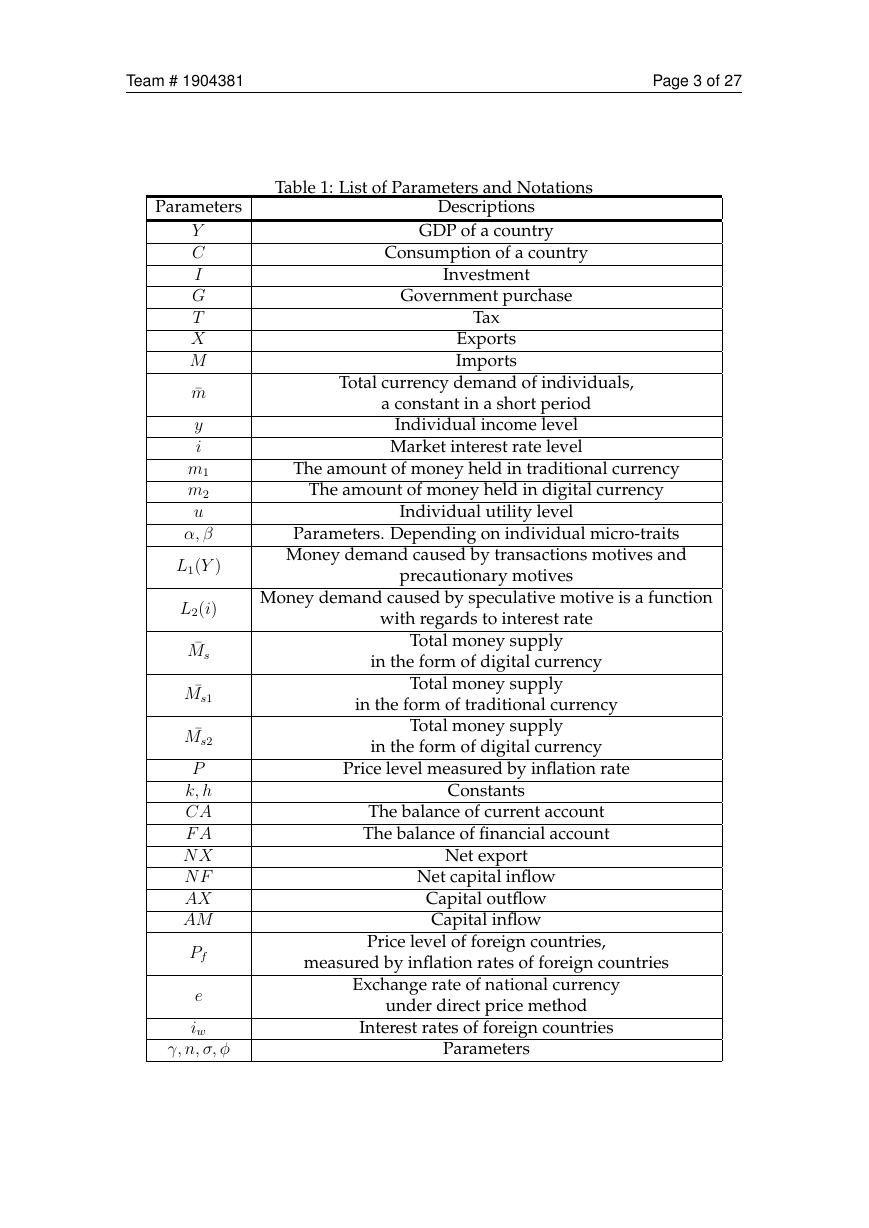

3.1 Digital Currency System

The figure above demonstrates us the development of international mone-

tary system. It is evident that this sytem will be changed with the introduction

of brand-new type of currency–digital currency. Therefore, we name this new

system as Digital Currency System.

• Build a virtual country

Regardless of all the existing digital currencies, we assume a mysterious orga-

nization issues a brand-new digital currency, which is initially held by a minority.

Also, we envision there is a virtual country. The central bank of this country is

the very mysterious organization that issues the digital currency, the currency in

circulation is digital currency and the residents of this country are the individuals

holding the currency.

We assume the total amount of digital money issued by the central bank of

this virtual country as a constant. Each unit of electronic money can be infinitely

divided. The unit price of digital money measured in real-world currency de-

pends on the economic interactions between the virtual country and the coun-

tries in the real world. Denote the virtual country as A.

In the following analysis, we suppose a particular country in the real world

will be economically associated with virtual countries through existing curren-

cies and digital currencies. And this international economic relationship can be

characterized by FE curve. Starting with the FE curve, we will in turn analyze

the IS curve and the LM curve of this particular country which has economically

associated with the virtual country.

�

Team # 1904381

Page 5 of 27

3.2 The Money Market

3.2.1 Basic Theory

• Money Supply

Money supply refers to the process in which the economic entity creates the

money supply and puts it into circulation. That is, the behavior and process

of the central bank and commercial banks investing, expanding or contracting

the money in circulation.

The money supply refers to the sum of the currency held by enterprises, in-

dividuals and foreign countries outside the banking system and other deposit

currencies that are freely available at any time.

• Money Demand

Money demand refers to the amount of money the public is willing to hold

after comprehensively weighing the benefits and costs of various assets.

• Liquidity Preference Theory

Keynes’s study of money demand is based on a study of the motives of de-

mand for economic agents. Keynes believed that peopleâ ˘A ´Zs demand for money

is determined by three motives:

1. The transactions motive: in order to make daily transactions, people must

hold money

2. The precautionary motive: people prefer to have liquidity to cope with

unexpected situations.

3. Speculative motive: due to the uncertainty of the future interest rate, peo-

ple will adjust the asset structure and demand more money to hold in order to

avoid capital loss or increase capital gains.

3.2.2

Individual Level - Micro Level

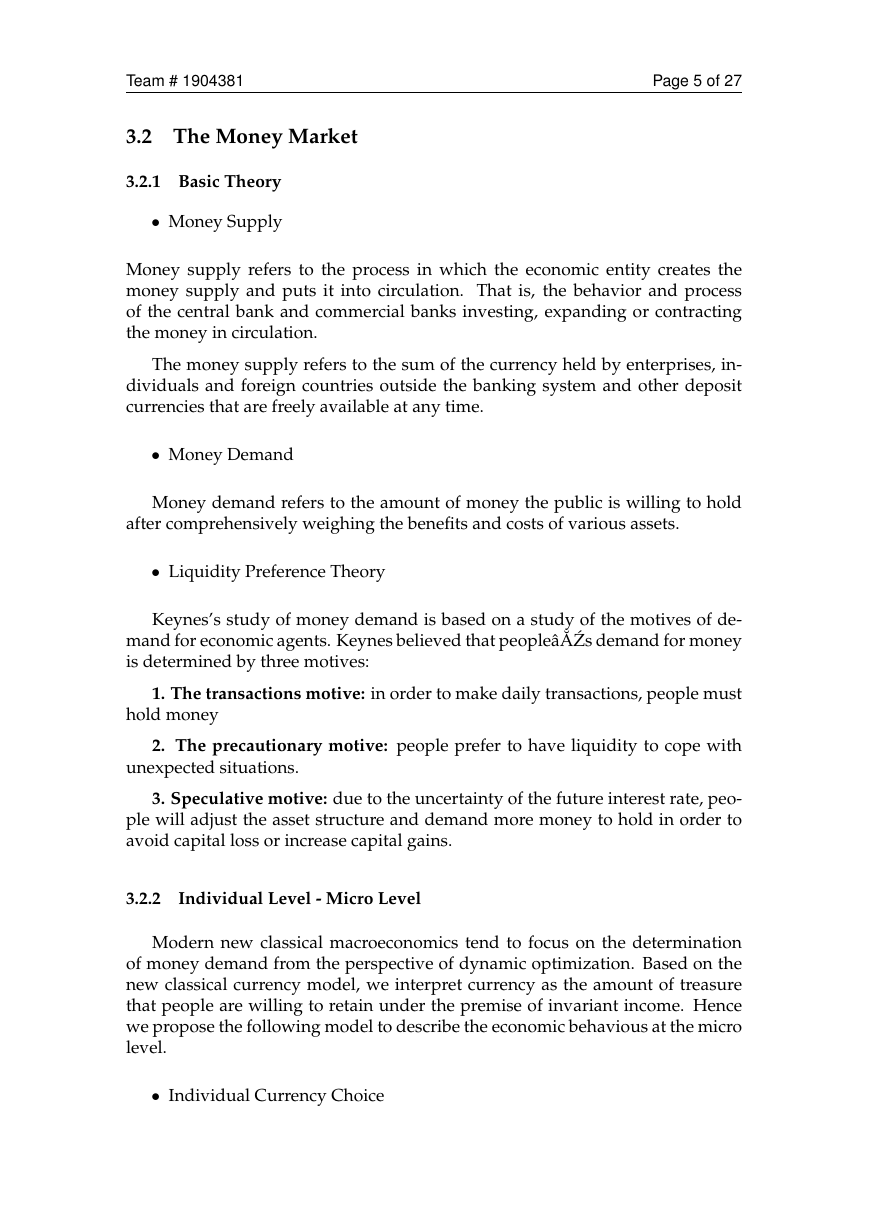

Modern new classical macroeconomics tend to focus on the determination

of money demand from the perspective of dynamic optimization. Based on the

new classical currency model, we interpret currency as the amount of treasure

that people are willing to retain under the premise of invariant income. Hence

we propose the following model to describe the economic behavious at the micro

level.

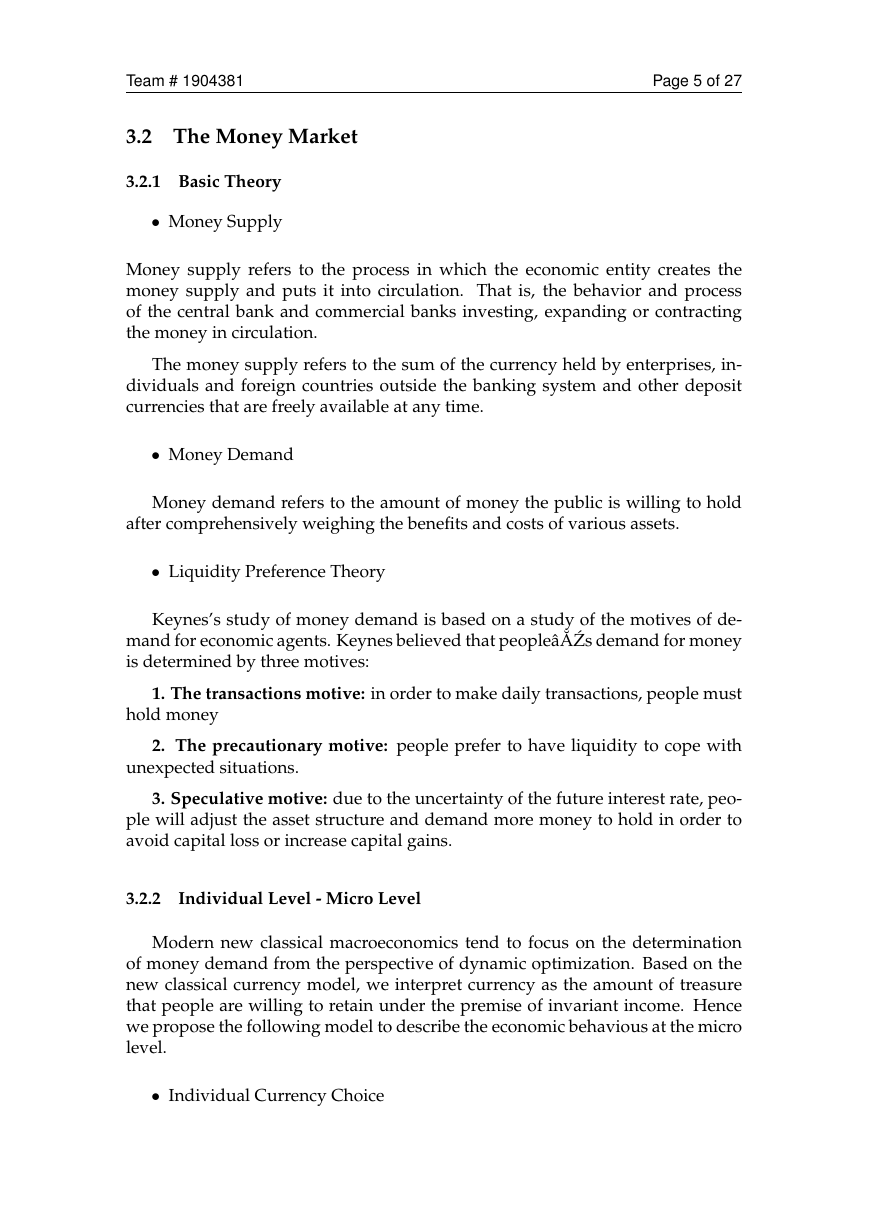

• Individual Currency Choice

�

Team # 1904381

Page 6 of 27

Denote ¯m ¯m(y, i). According to our model, we have ¯m = m1 + m2

• Individual Money Utility Function

Indifferent Curve:

u = mα

1 mβ

2

where α, β are parameters. They depend on individual micro-traits, such as risk

preferences, liquidity preferences, etc.

Assumptions: 1. Individual preference is normal. 2. Monotonicity. 3. Con-

vexity.

In the next section, we try to solve this equation through both mathematical

calculation and explicit figures.

max

m1,m2

u = mα

1 mβ

2

subject to

¯m = m1 + m2

We assume that both u and ¯m have continuous first partial derivatives. To

find the maxium of this function, we introduce a new variable λ as the Lagrange

multiplier.

L(m1, m2, λ) = mα

2 − λ(m1 + m2 − ¯m)

1 mβ

We take the partial derivatives with regard to m1, m2 and λ.

∂L

∂m1

∂L

∂m2

∂L

∂λ

= αmα−1

1 mβ

1 mβ−1

2 − λ = 0

2 − λ = 0

= βmα

= ¯m − m1 − m2 = 0

=⇒

m1 =

m2 =

α

α + β

β

α + β

¯m

¯m

(1)

�

Team # 1904381

Page 7 of 27

(a) individual choice between currency

(b) The points that are not on the curve

Figure 1: The slope

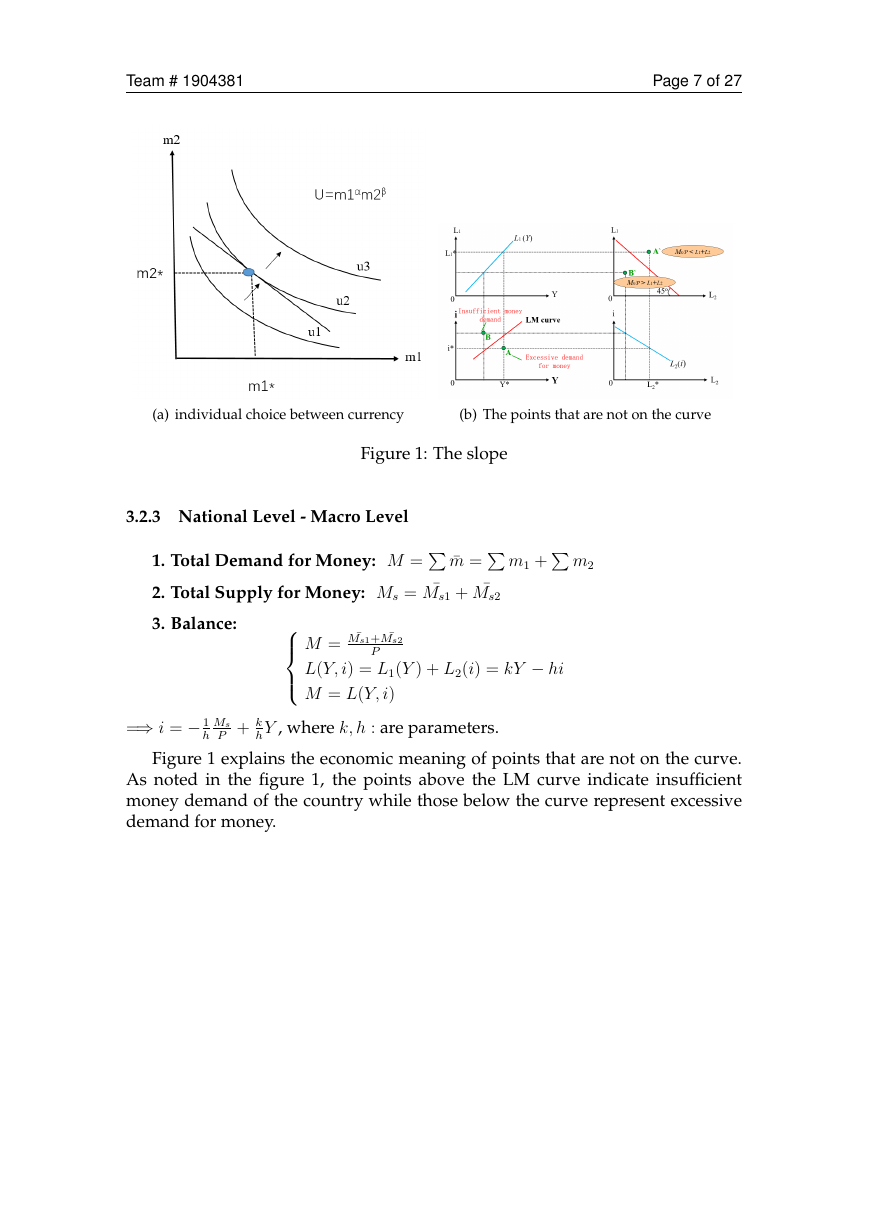

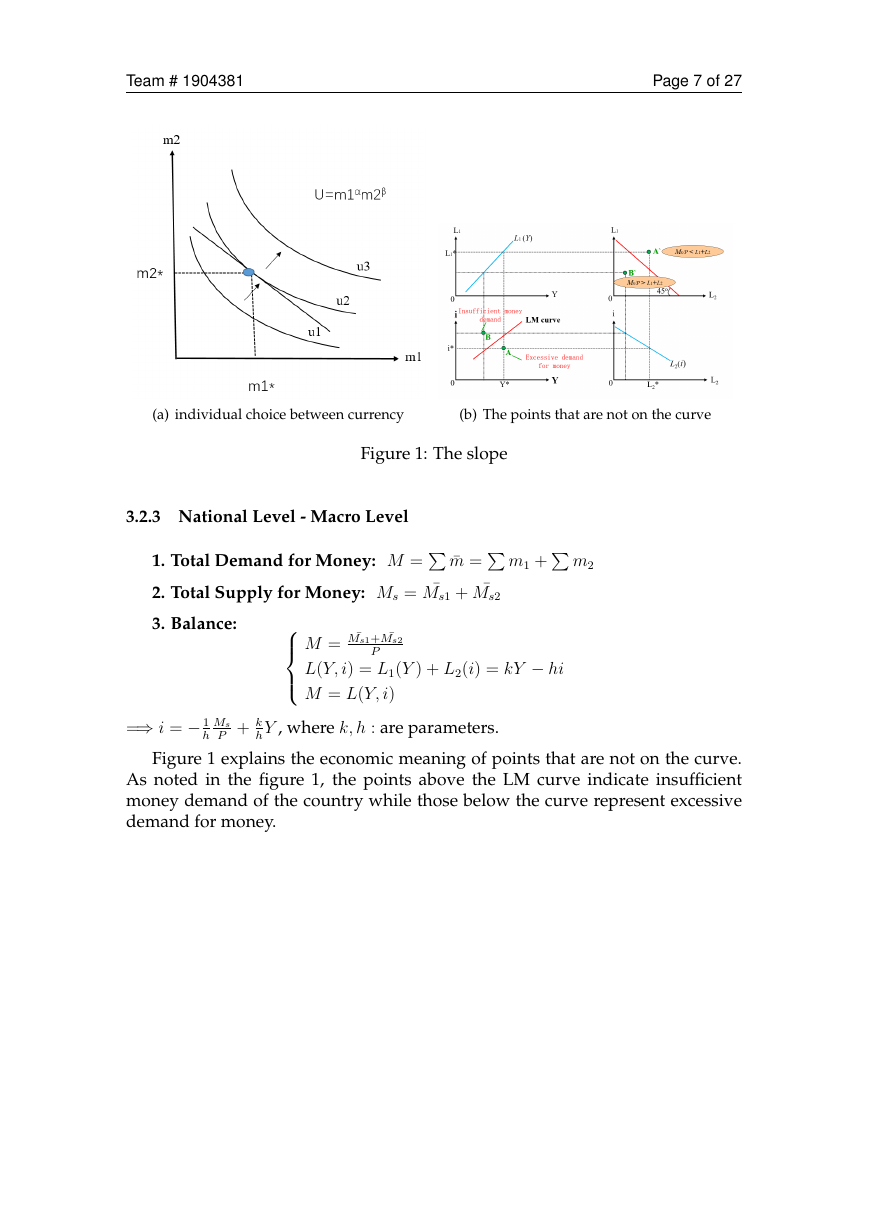

3.2.3 National Level - Macro Level

1. Total Demand for Money: M = ¯m = m1 + m2

2. Total Supply for Money: Ms = ¯Ms1 + ¯Ms2

3. Balance:

L(Y, i) = L1(Y ) + L2(i) = kY − hi

M = L(Y, i)

M = ¯Ms1+ ¯Ms2

P

=⇒ i = − 1

h

Ms

P + k

h Y , where k, h : are parameters.

Figure 1 explains the economic meaning of points that are not on the curve.

As noted in the figure 1, the points above the LM curve indicate insufficient

money demand of the country while those below the curve represent excessive

demand for money.

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc