CHAPTER 1 Introduction

The Standard for Portfolio Management – Second Edition, has been significantly expanded from the original

version. Starting with the basic original materials, two knowledge areas specific to managing portfolios have been

added.

Design of the Document

The Standard for Portfolio Management is organized into two sections:

• Section 1: Portfolio Management Overview, Framework, and Processes. This section provides a

basis for understanding Portfolio Management. There are three chapters in this section.

o Chapter 1: The introduction presents a basis for the standard. It defines what a portfolio is and

discusses portfolio management, the interaction among project, program, and portfolio

management, and presents an outline of the remaining document.

o Chapter 2: Portfolio Management Overview and Organization provides an overview of the

process, describes stakeholder roles, and organization influences.

o Chapter 3: Portfolio Management Processes defines the two process groups: Aligning and

Monitoring and Controlling and maps the portfolio knowledge areas to those.

• Section 2: Portfolio Management Knowledge Areas. This section lists the portfolio management

processes and enumerates the inputs, tools and techniques, and outputs for each area. Each chapter

focuses on a portfolio specific knowledge area.

o Chapter 4, Portfolio Governance, describes the processes involved in developing a structure for

ensuring quality and oversight to the portfolio. The chapter consists of the following processes:

a.

b.

c.

d.

e.

f.

g.

h.

i.

j.

Identify Components,

Categorize Components,

Evaluate Components,

Select Components,

Prioritize Components,

Balance Portfolio,

Communicate Portfolio Adjustment,

Authorize Components,

Review and Report Portfolio Performance, and

Monitor Business Strategy Changes.

o Chapter 5, Portfolio Risk Management, describes the processes concerned with conducting risk

management for portfolios. The chapter consists of the following processes:

a.

b.

c.

d.

Identify Portfolio Risks,

Analyze Portfolio Risks,

Develop Portfolio Risk Responses, and

Monitor and Control Portfolio Risks.

�

1.1 Purpose of The Standard for Portfolio Management

The primary purpose of The Standard for Portfolio Management is to describe generally recognized good

practices associated with portfolio management. “Generally recognized” means that the knowledge and

practices described are applicable to most portfolios most of the time, and that there is widespread consensus

about their value and usefulness. This standard is an expansion of and companion to information already

provided in A Guide to the Project Management Body of Knowledge (PMBOK® Guide) – Fourth Edition, The

Standard for Program Management – Second Edition, and the Organizational Project Management Maturity

Model (OPM3®) – Second Edition. As a foundational reference, this standard is neither intended to be

comprehensive nor all-inclusive.

This standard focuses on portfolio management as it relates to the disciplines of project and program

management. Its application is intended for all types of enterprises (i.e., profit, nonprofit, and government).

When the term “enterprise” is used here, it applies generally to these three types of enterprises. If any portion of

this standard typically is applicable to only to a subset of these, the subset is identified.

1.1.1 Audience for The Standard for Portfolio Management

This standard provides a foundational reference for anyone interested in managing a portfolio of projects and

programs. This includes, but is not limited to:

• Senior executives making decisions about enterprise strategy,

• Management staff responsible for developing enterprise strategy or those making recommendations to

senior executives,

• Portfolio managers,

• Researchers analyzing portfolio management,

• Members of a portfolio or program management office,

• Managers of project and program managers,

• Program managers,

• Project managers and other project team members,

• Consultants and other specialists in project, program, and portfolio management and related fields,

• Functional managers and process owners with resources in a portfolio,

• Customers and other stakeholders, and

• Educators teaching the management of portfolios and related subjects.

1.2 What is a Portfolio?

A portfolio is a collection of projects (temporary endeavors undertaken to create a unique product, service, or

result) and/or programs (a group of related projects managed in a coordinated way to obtain benefits and control

not available from managing them individually) and other work (such as maintenance on an initiative already

complete) that are grouped together to facilitate the effective management of that work to meet strategic business

objectives. These components of a portfolio are quantifiable; that is, they can be measured, ranked, and prioritized.

A portfolio always exists within an organization and it consists of a set of current components and planned

or future initiatives. Therefore, portfolios are not temporary like projects or programs. Proposed initiatives

become part of the portfolio when they are selected and approved.

�

At any given moment, the portfolio represents a view of its selected components and reflects the strategic

goals of the organization; however, specific projects or programs within the portfolio are not necessarily

interdependent or directly related. By reflecting investments made or planned by an organization, the portfolio

is where priorities are identified, investment decisions made, and resources allocated. Therefore, the portfolio

represents the work selected to be done, but not necessarily the work that should be done. If a portfolio’s

components are not aligned to its organizational strategy, the organization can reasonably question why the

work is being undertaken. Therefore, a portfolio is a true measure of an organization’s intent, direction, and

progress.

1.2.1 Portfolios vs. Programs vs. Projects

All components of a portfolio exhibit certain common features:

• They represent investments made or planned by the organization.

• They are aligned with the organization’s strategic goals and objectives.

• They typically have some distinguishing features that permit the organization to group them for more

effective management.

• The components of a portfolio are quantifiable; they can be measured, ranked, and prioritized.

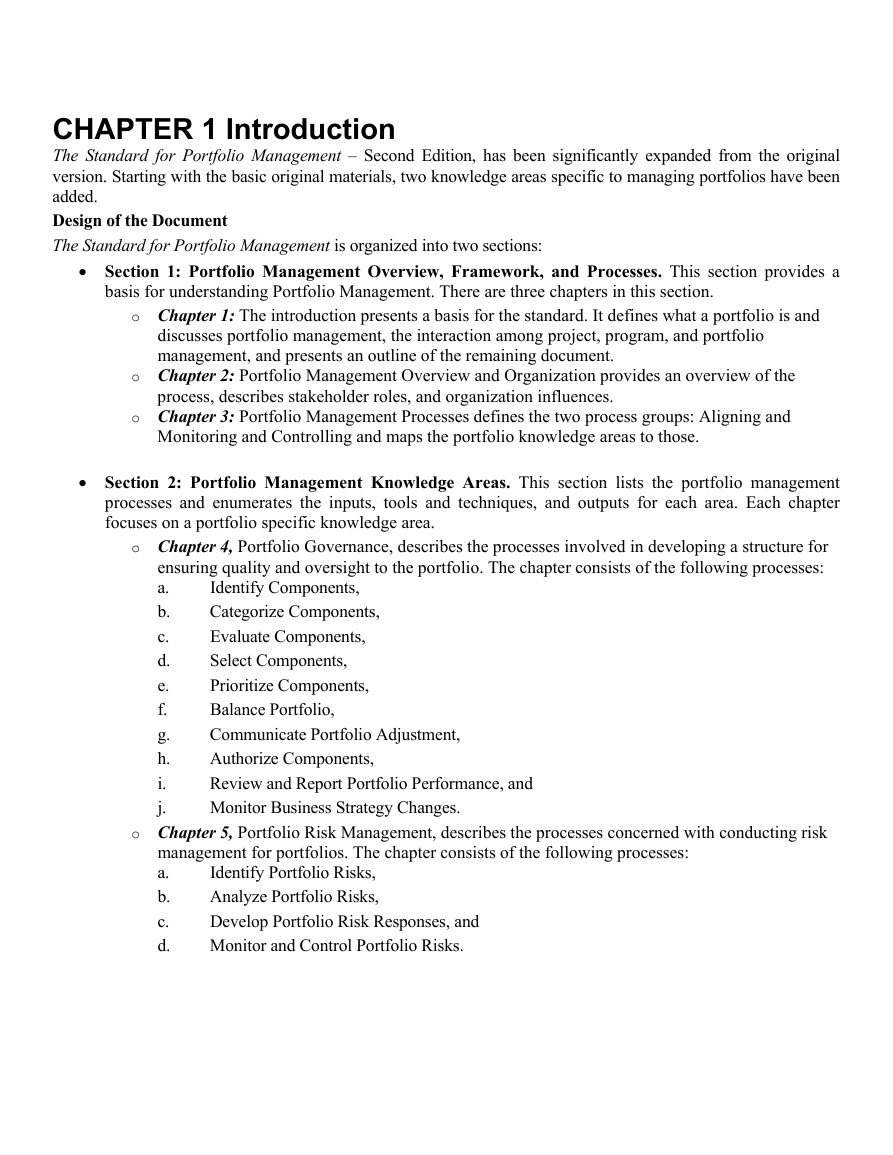

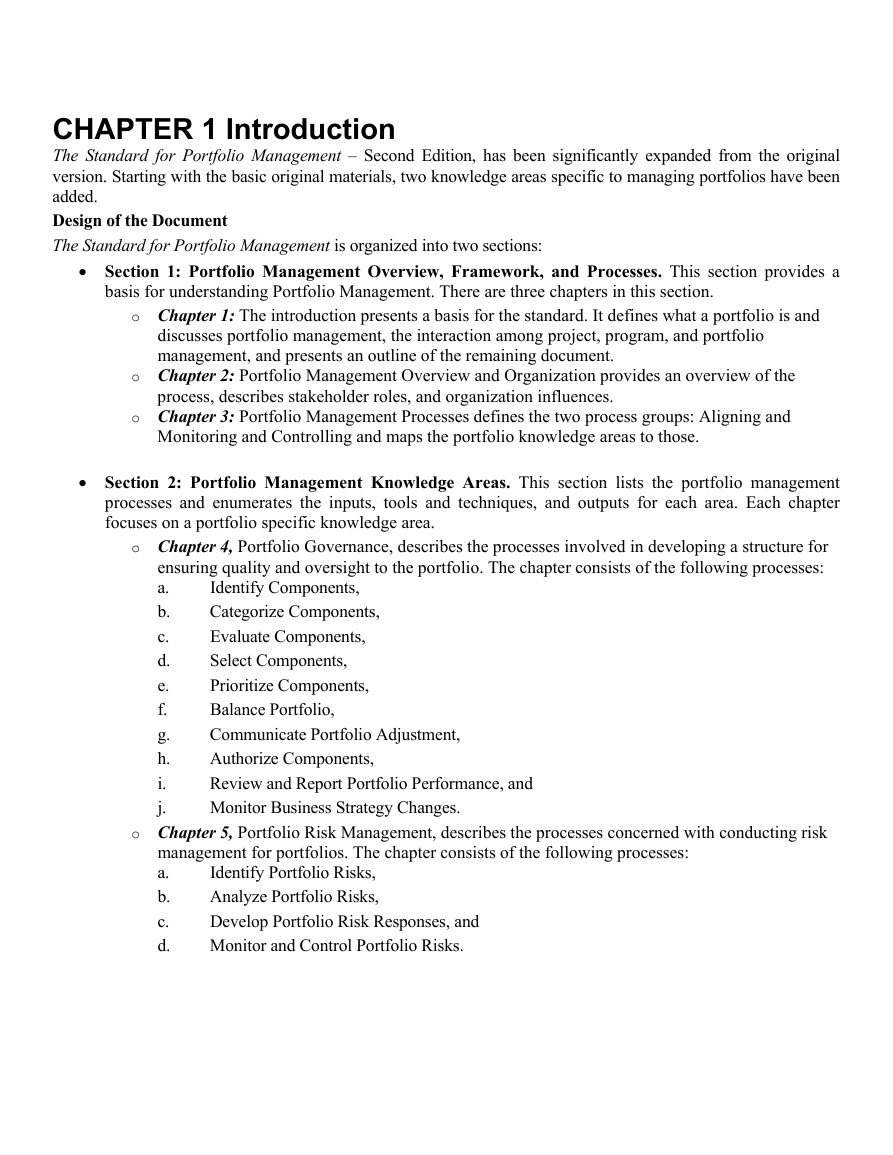

Figure 1-1 illustrates the relationship of a portfolio and its components.

Figure 1-1. Portfolio Relationships—Example

A portfolio focuses on ensuring programs and projects are considered in relation to one another so resources

(e.g., people, funding) can be allocated in alignment to and consistent with organizational priorities. Programs

focus on achieving the benefits expected from the portfolio as determined by strategic organizational objectives.

Projects are largely concerned with achieving specific deliverables that support narrowly defined objectives.

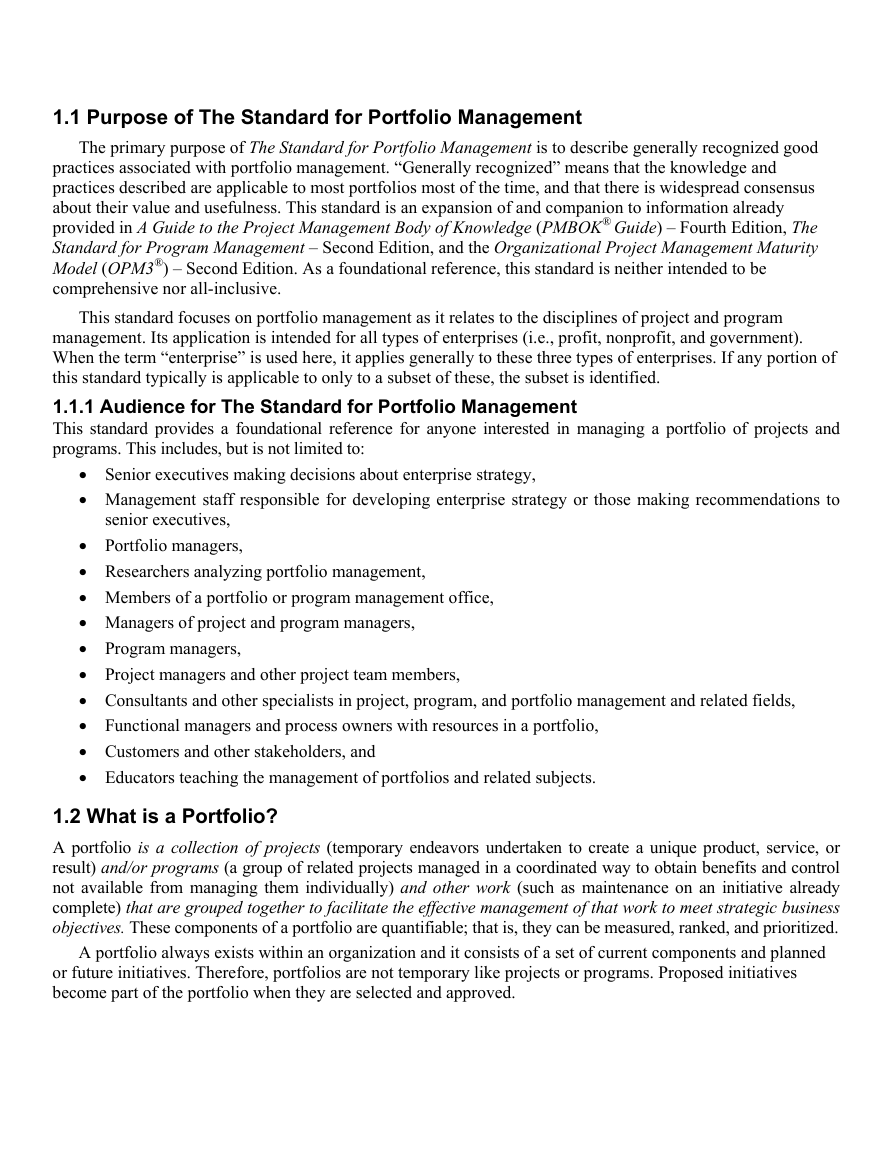

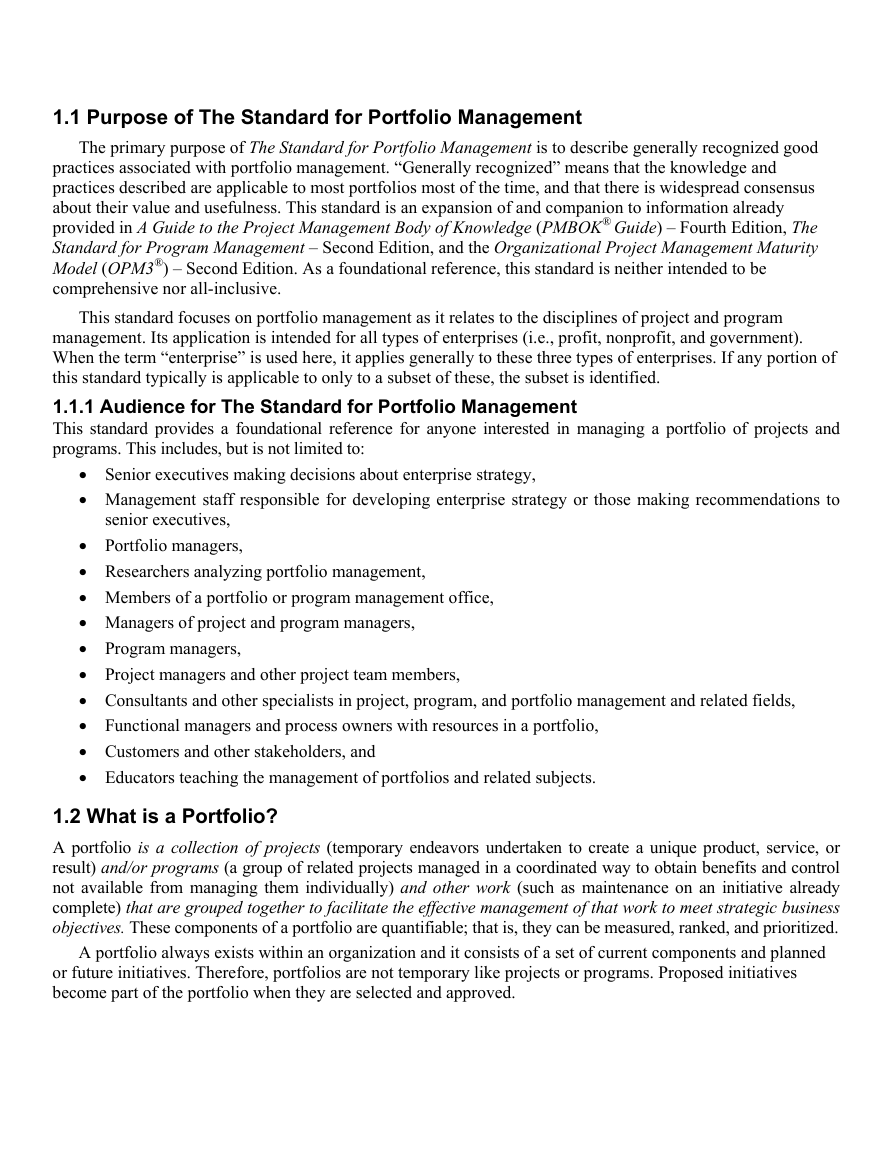

The components of a portfolio can be further differentiated as shown in Table 1-1.

Table 1-1. Comparison of Project, Program, and Portfolio Attributes

�

1.3 What Is Portfolio Management?

Portfolio management is the centralized management of portfolio components to achieve specific business

objectives. While this standard focuses on “project portfolio management,” it is referred to throughout as simply

“portfolio management.”

Portfolio management is also an opportunity for a governing body to make decisions that control or

influence the direction of a group of components (a sub-portfolio, program, projects, or other work) as they

work to achieve specific outcomes. It uses the tools and techniques described in this standard to identify, select,

prioritize, govern, measure, and report the contributions of the components to, and their relative alignment with,

organizational objectives. It is not concerned with managing the components. The goal of portfolio management

is to ensure that the organization is “doing the right work,” rather than “doing work right.”

1.4 The Link between Portfolio Management and Organizational Governance

Organizations have governance frameworks in place to guide the execution of organizational activities.

Organizational governance establishes the limits of power, rules of conduct, and protocols that organizations use

to manage progress towards the achievement of their strategic goals. This is accomplished through controls

intended to maximize the delivery of value while minimizing risk. For the purposes of this standard,

organizational governance is the process by which an organization directs and controls its operations and strategic

activities, and by which the organization responds to the legitimate rights, expectations, and desires of its

stakeholders. Project portfolio governance is the process by which an organization prioritizes, selects, and

allocates limited internal resources to best accomplish organizational objectives.

Portfolio management is one discipline within organizational governance. Organizations that do not link

portfolio management to governance risk misaligned or low priority initiatives which will consume critical

resources. Therefore, applying the techniques of portfolio management within the context of organizational

governance provides reasonable assurance that the organizational strategy can be achieved.

Portfolio management is both a framework and a management activity. The framework directs the activity

of translating the organizational strategy into a portfolio of strategic and operational initiatives. The

management activity ensures actualization of those initiatives through the use of organizational resources.

�

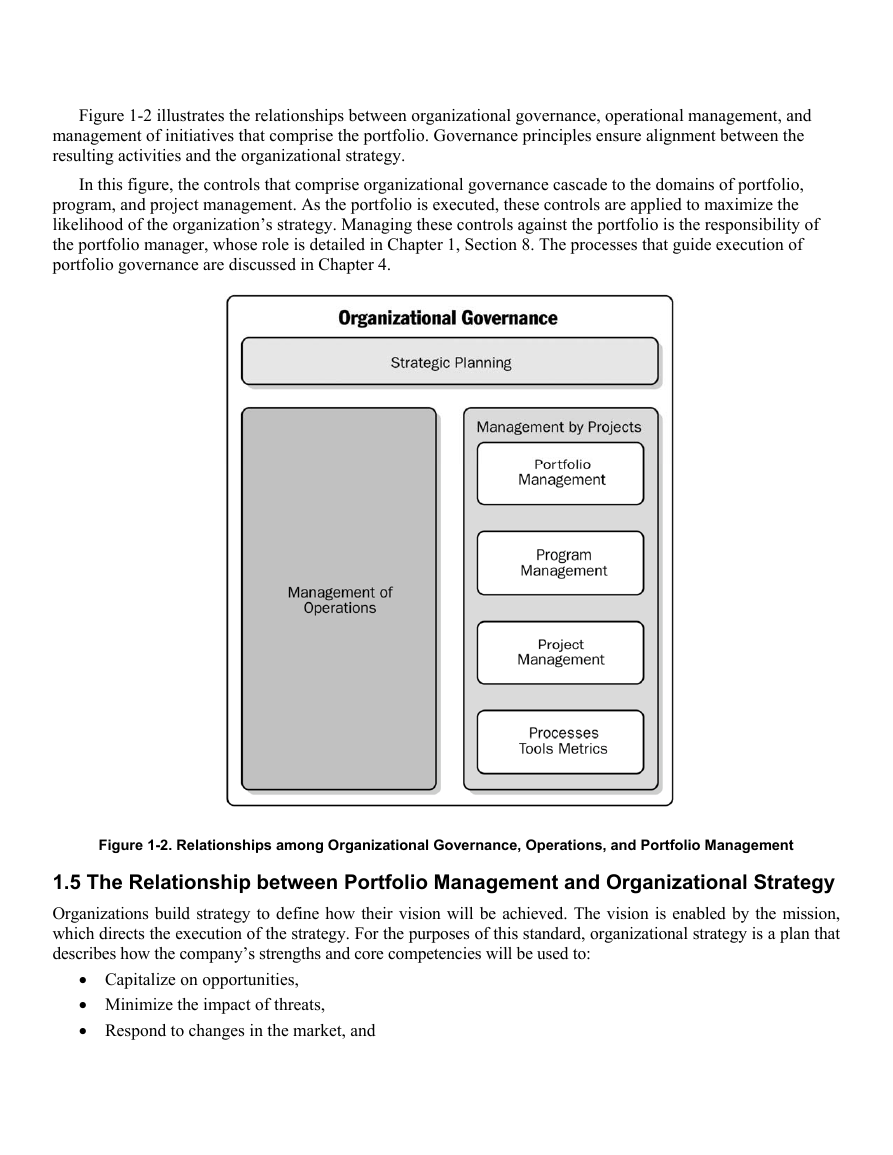

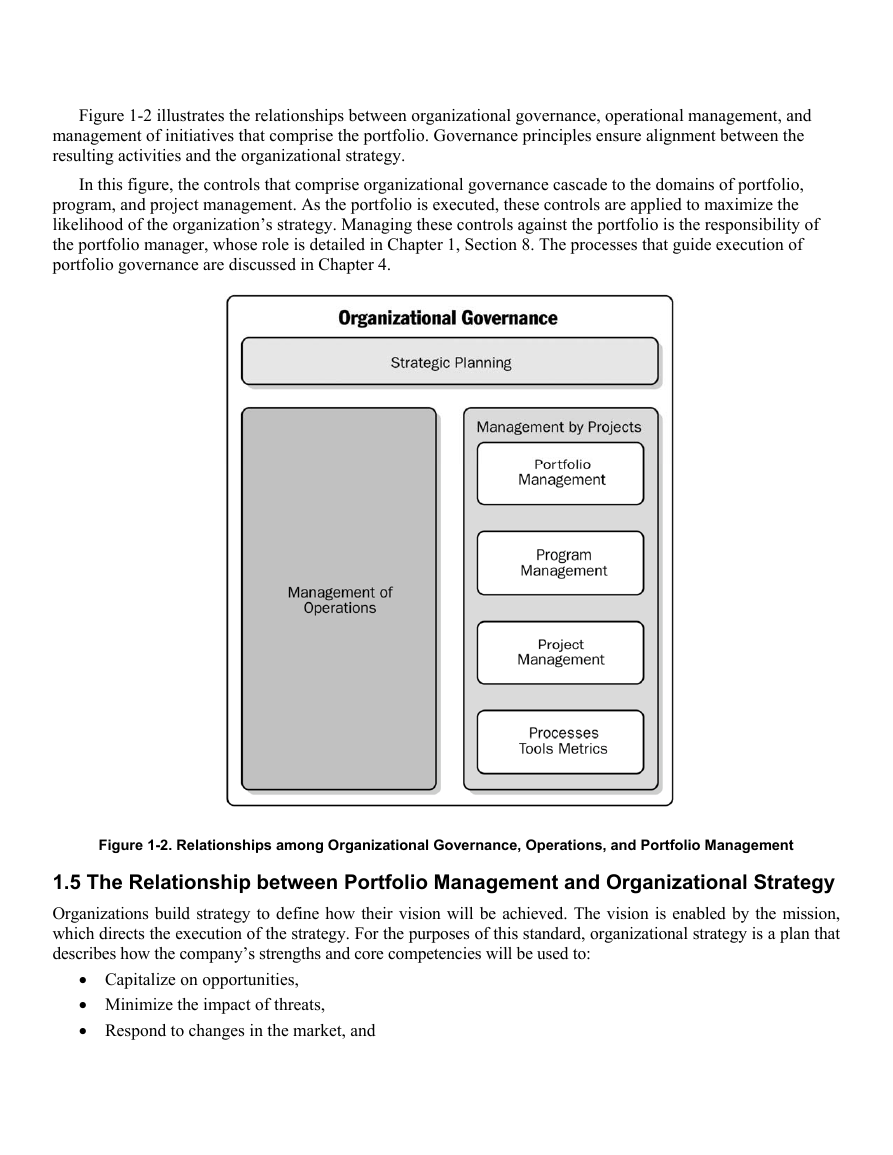

Figure 1-2 illustrates the relationships between organizational governance, operational management, and

management of initiatives that comprise the portfolio. Governance principles ensure alignment between the

resulting activities and the organizational strategy.

In this figure, the controls that comprise organizational governance cascade to the domains of portfolio,

program, and project management. As the portfolio is executed, these controls are applied to maximize the

likelihood of the organization’s strategy. Managing these controls against the portfolio is the responsibility of

the portfolio manager, whose role is detailed in Chapter 1, Section 8. The processes that guide execution of

portfolio governance are discussed in Chapter 4.

Figure 1-2. Relationships among Organizational Governance, Operations, and Portfolio Management

1.5 The Relationship between Portfolio Management and Organizational Strategy

Organizations build strategy to define how their vision will be achieved. The vision is enabled by the mission,

which directs the execution of the strategy. For the purposes of this standard, organizational strategy is a plan that

describes how the company’s strengths and core competencies will be used to:

• Capitalize on opportunities,

• Minimize the impact of threats,

• Respond to changes in the market, and

�

• Reinforce focus on critical operational activities.

The goal of linking portfolio management to the strategy is to balance the use of resources to maximize

value in executing strategic and operational activities.

The organizational strategy is a result of the strategic planning cycle, where the vision and mission are

translated into a strategic plan. The strategic plan is subdivided into a set of initiatives that are influenced by

market dynamics, customer and partner requests, shareholders, government regulations, and competitor plans

and actions. These initiatives establish strategic and operational portfolios to be executed in the planned period.

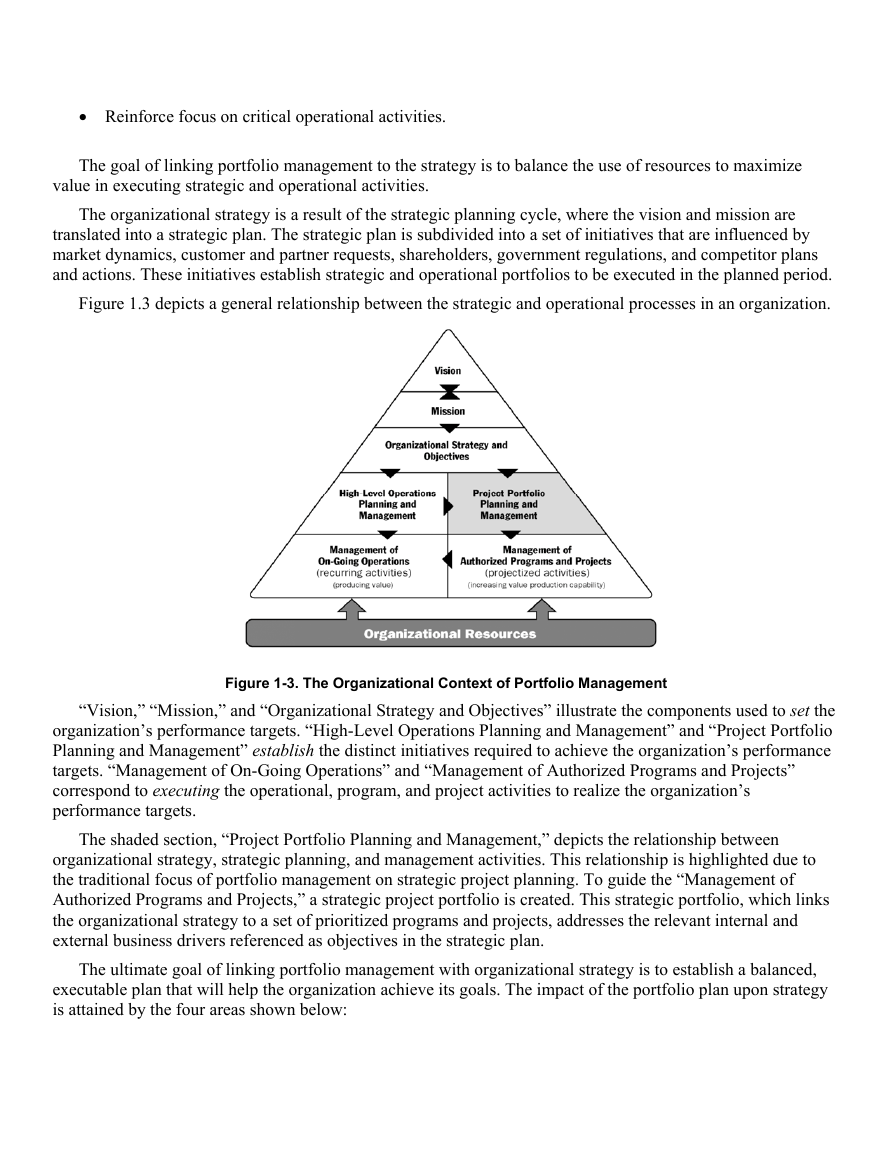

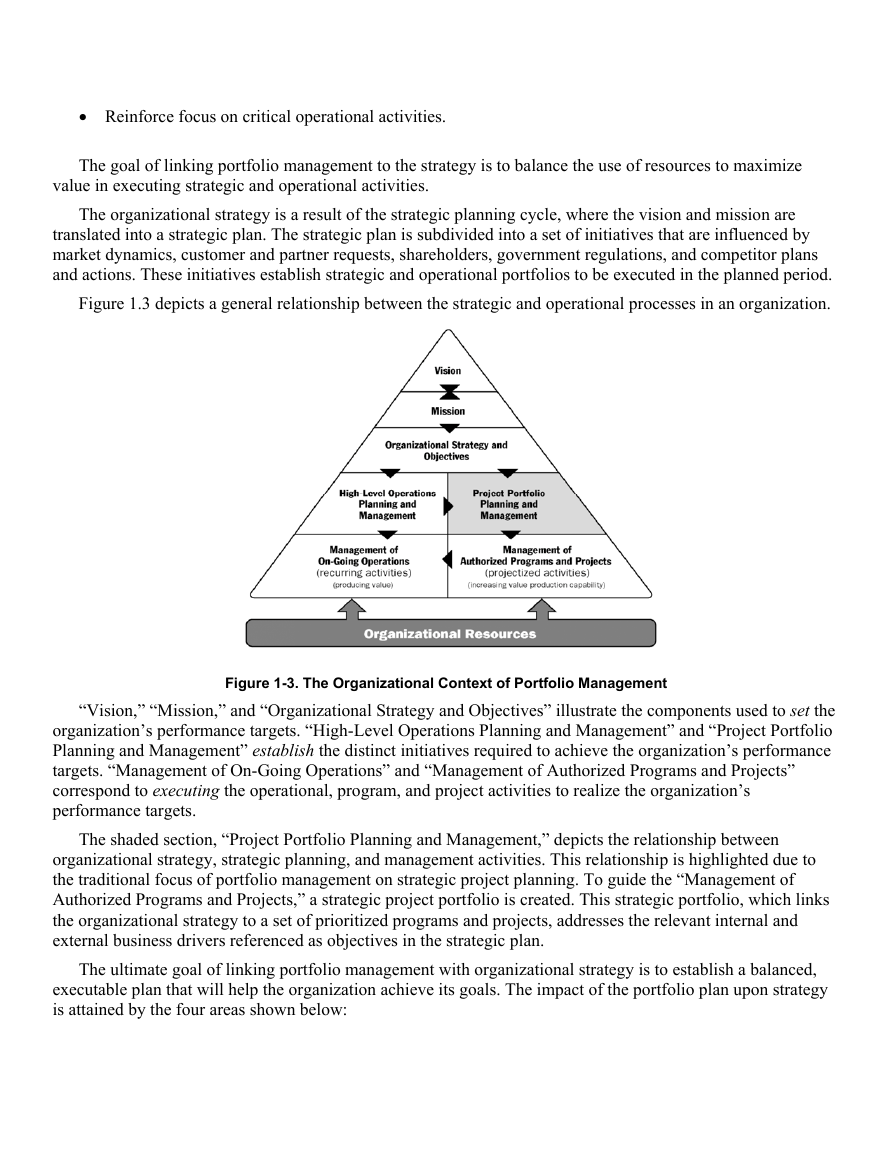

Figure 1.3 depicts a general relationship between the strategic and operational processes in an organization.

Figure 1-3. The Organizational Context of Portfolio Management

“Vision,” “Mission,” and “Organizational Strategy and Objectives” illustrate the components used to set the

organization’s performance targets. “High-Level Operations Planning and Management” and “Project Portfolio

Planning and Management” establish the distinct initiatives required to achieve the organization’s performance

targets. “Management of On-Going Operations” and “Management of Authorized Programs and Projects”

correspond to executing the operational, program, and project activities to realize the organization’s

performance targets.

The shaded section, “Project Portfolio Planning and Management,” depicts the relationship between

organizational strategy, strategic planning, and management activities. This relationship is highlighted due to

the traditional focus of portfolio management on strategic project planning. To guide the “Management of

Authorized Programs and Projects,” a strategic project portfolio is created. This strategic portfolio, which links

the organizational strategy to a set of prioritized programs and projects, addresses the relevant internal and

external business drivers referenced as objectives in the strategic plan.

The ultimate goal of linking portfolio management with organizational strategy is to establish a balanced,

executable plan that will help the organization achieve its goals. The impact of the portfolio plan upon strategy

is attained by the four areas shown below:

�

1. Maintaining portfolio alignment. Each component should be aligned to one or more strategic goals.

Alignment cannot occur without a clear understanding of those goals, and any proposal would describe

how it supports the goals.

2. Allocating financial resources. The priority of each component guides financial allocation decisions,

while at the same time each component requires an allocation if it is to be executed.

3. Allocating human resources. The priority of each component guides resource planning, hiring efforts,

and time and skill allocations.

4. Measuring component contributions. If the purpose of undertaking the component is to achieve a

strategic goal, its contribution must be measured in the context of that goal.

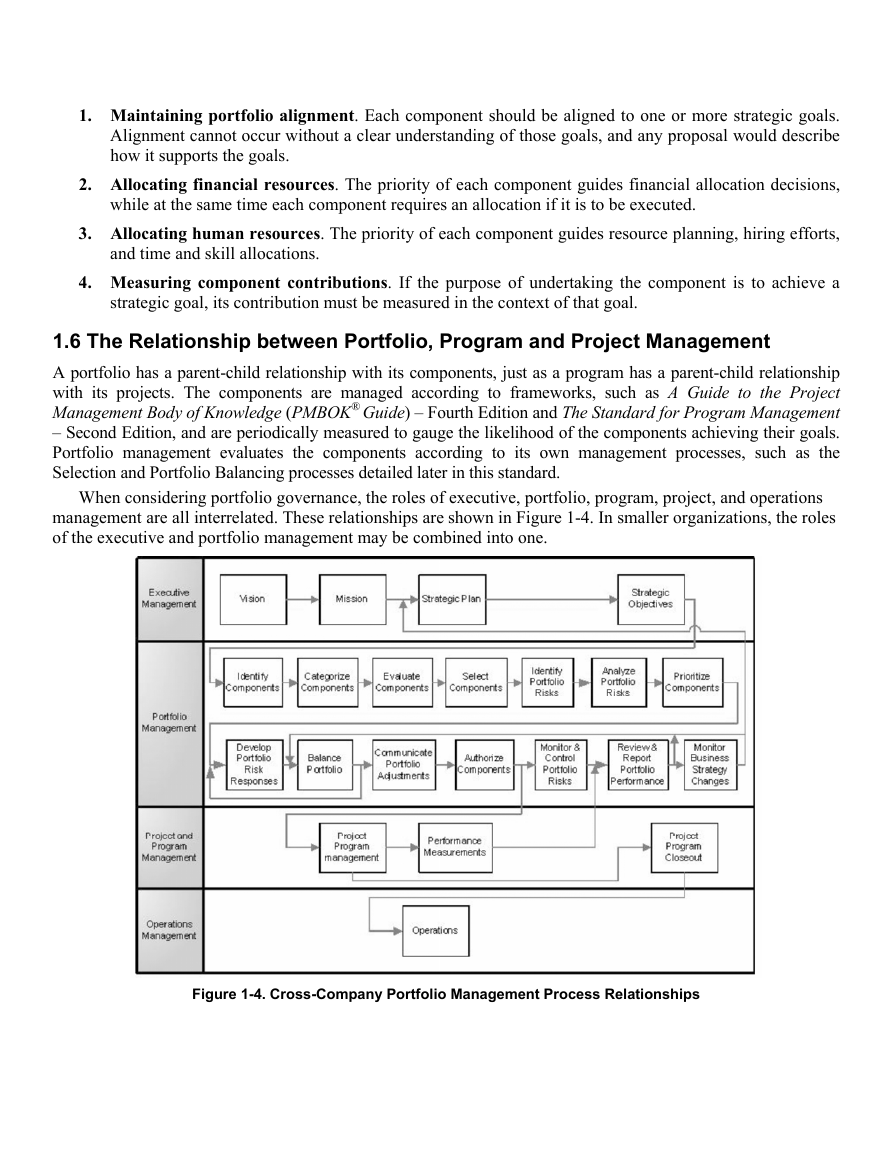

1.6 The Relationship between Portfolio, Program and Project Management

A portfolio has a parent-child relationship with its components, just as a program has a parent-child relationship

with its projects. The components are managed according to frameworks, such as A Guide to the Project

Management Body of Knowledge (PMBOK® Guide) – Fourth Edition and The Standard for Program Management

– Second Edition, and are periodically measured to gauge the likelihood of the components achieving their goals.

Portfolio management evaluates the components according to its own management processes, such as the

Selection and Portfolio Balancing processes detailed later in this standard.

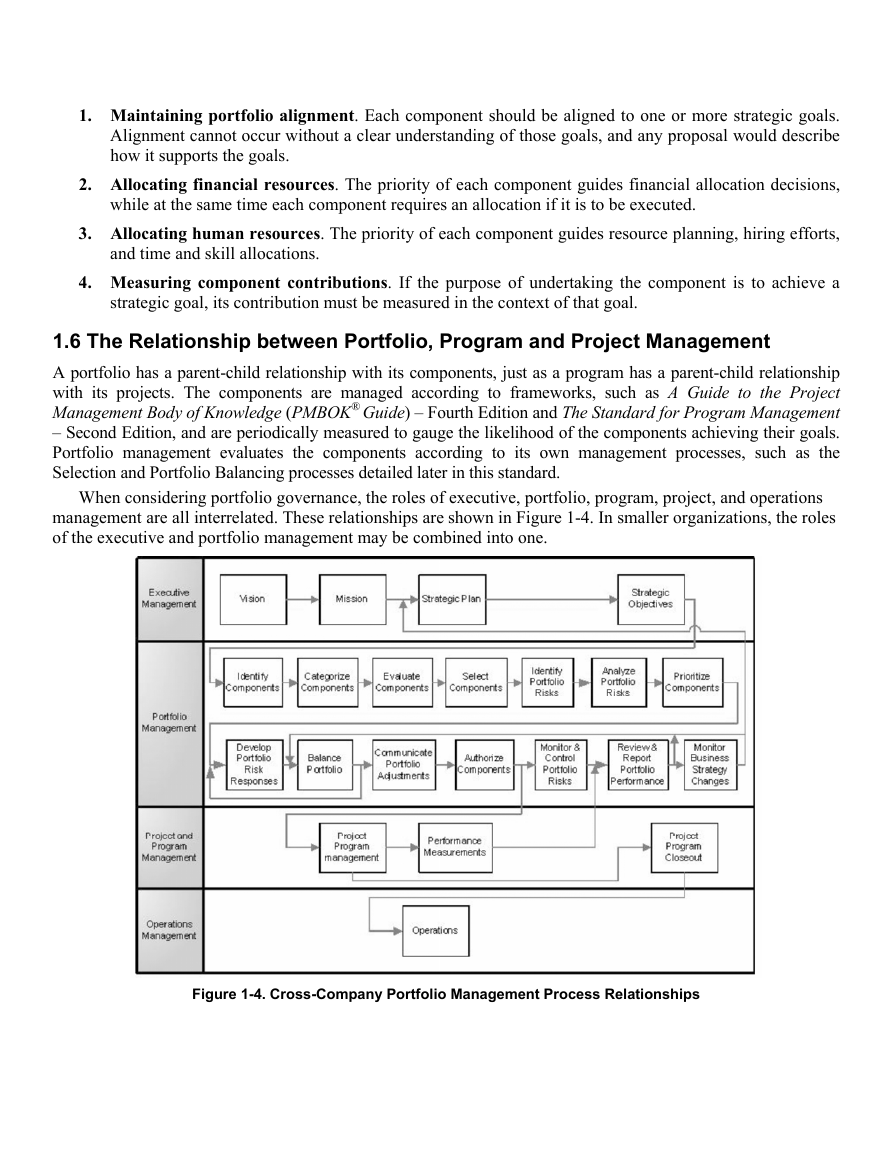

When considering portfolio governance, the roles of executive, portfolio, program, project, and operations

management are all interrelated. These relationships are shown in Figure 1-4. In smaller organizations, the roles

of the executive and portfolio management may be combined into one.

Figure 1-4. Cross-Company Portfolio Management Process Relationships

�

1.7 The Link between Portfolio Management and Operations Management

Portfolio management interacts with and impacts a number of organizational functions. Functional groups can be

stakeholders in the portfolio and can also serve as sponsors of various components. The achievement of portfolio

objectives may impact functional groups within an organization in their daily operations. Moreover, an operational

budget may be influenced by portfolio management decisions, including allocation of resources to support

portfolio components.

“Operations” is a term used to describe day-to-day organizational activities. The organization’s operations

may include production, manufacturing, finance, marketing, legal, information services, human resources, and

administrative services to name just a few.

Processes and deliverables used by operational management are often outputs of the portfolio components.

Therefore, the portfolio team must manage relationships and interfaces with operations effectively if the full

value of each component is to be realized.

1.7.1 The Link between Portfolio Management and Operational Projects

Operational projects are often as critical as strategic projects, and are translated into a distinct portfolio defined in

the area of Figure 1-3 labeled “High–Level Operations Planning and Management.” This portfolio encompasses

the work executed in “Management of On-Going Operations.”

The portfolio of operational projects links that subset of recurring activities managed as projects to the

organizational strategy. As operational projects are delivered, the organization will have a solid foundation on

which to execute strategic components.

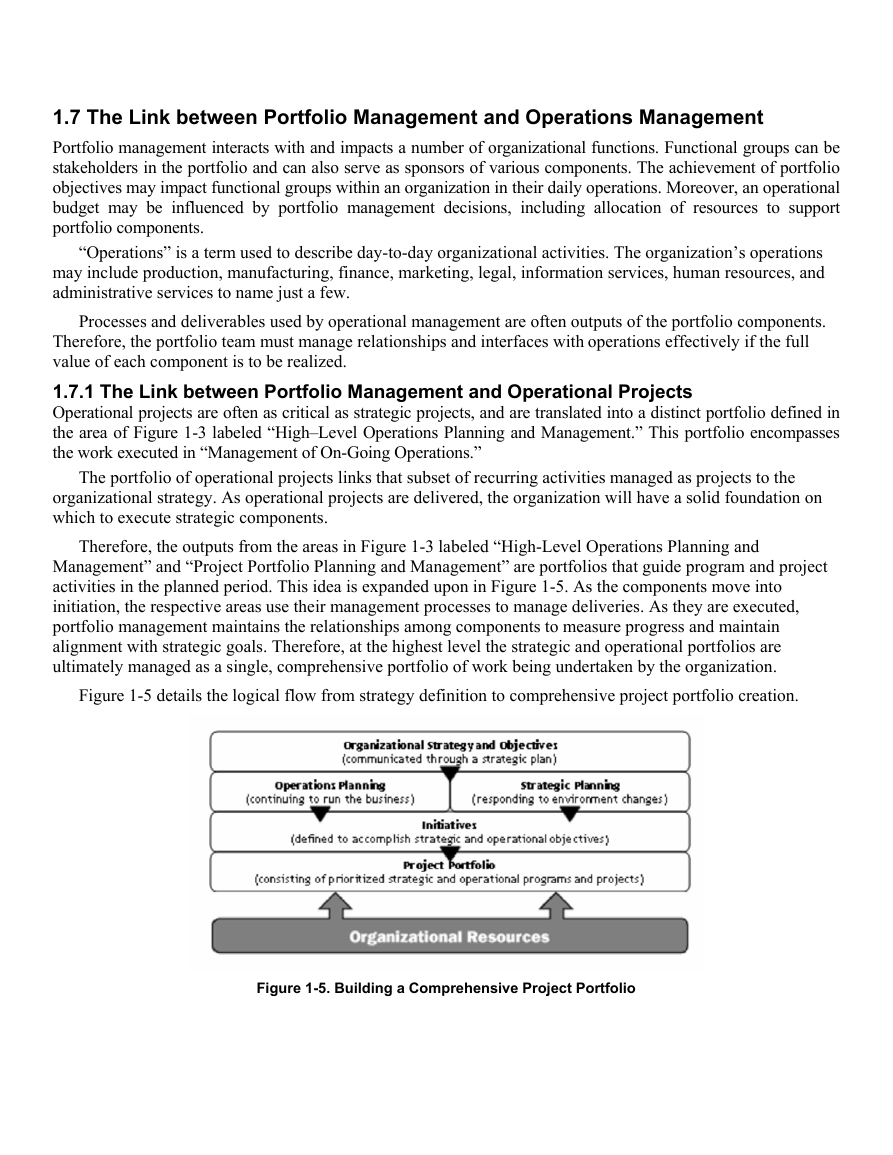

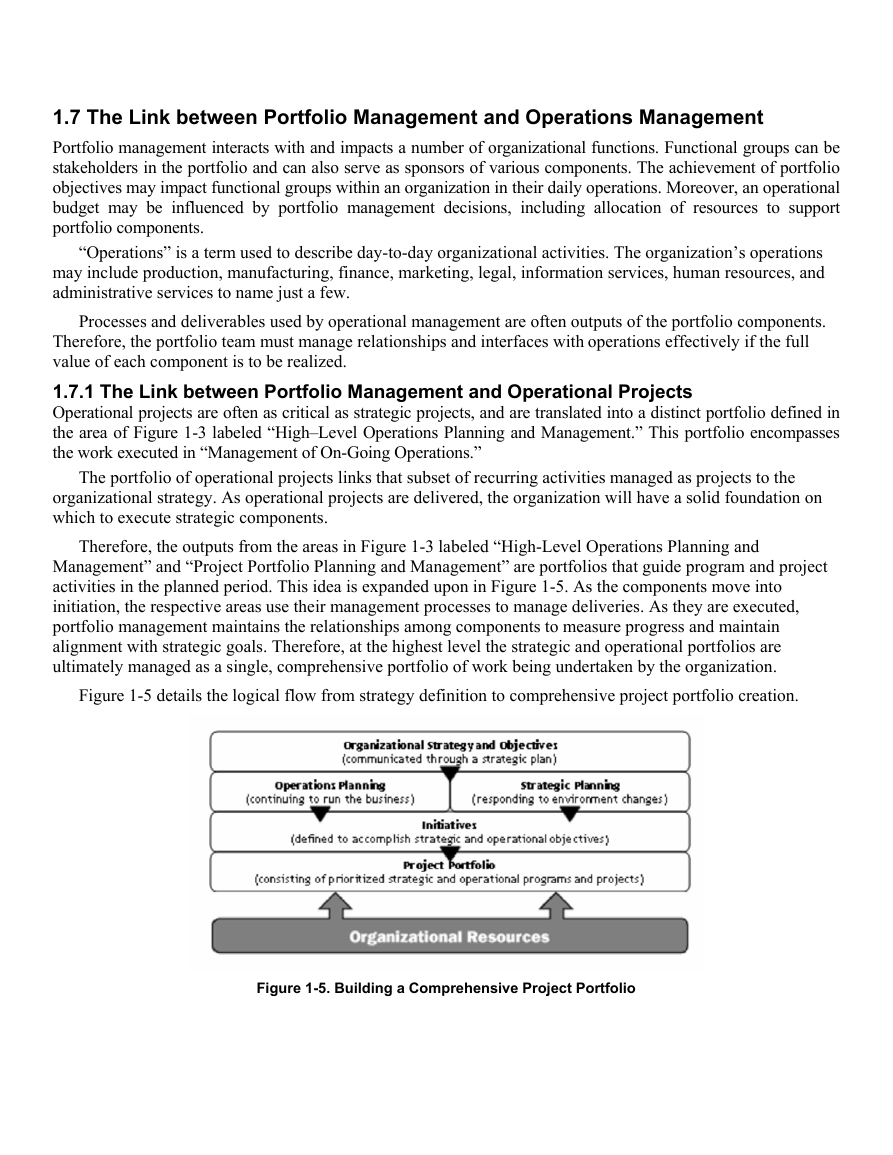

Therefore, the outputs from the areas in Figure 1-3 labeled “High-Level Operations Planning and

Management” and “Project Portfolio Planning and Management” are portfolios that guide program and project

activities in the planned period. This idea is expanded upon in Figure 1-5. As the components move into

initiation, the respective areas use their management processes to manage deliveries. As they are executed,

portfolio management maintains the relationships among components to measure progress and maintain

alignment with strategic goals. Therefore, at the highest level the strategic and operational portfolios are

ultimately managed as a single, comprehensive portfolio of work being undertaken by the organization.

Figure 1-5 details the logical flow from strategy definition to comprehensive project portfolio creation.

Figure 1-5. Building a Comprehensive Project Portfolio

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc