I lHE EASY WAY lO GEl STARTEO I

Everything You Need lo Know, Including:

• The internal configuration of a high-frequency

trading systelll

• COlllparisons of benefits and drawbacks,

as we" as analyscs of inhcrcnt risks

• Who profits frOIll high-frcqucncy trading

and how they do it

MICHAEL DURBIN

�

All About

HIGH-FREQUENCY

TRADING

MICHAEL DURBIN

New York Chicago San Francisco Lisbon London Madrid Mexico City

Milan New Delhi San Juan Seoul Singapore Sydney Toronto

�

Copyright © 2010 by The McGraw-Hill Companies, Inc. All rights reserved. Except as

permitted under the United States Copyright Act of 1976, no part of this publication may

be reproduced or distributed in any form or by any means, or stored in a database or re-

trieval system, without the prior written permission of the publisher.

ISBN: 978-0-07-174345-7

MHID: 0-07-174345-6

The material in this eBook also appears in the print version of this title: ISBN: 978-0-07-174344-0,

MHID: 0-07-174344-8.

All trademarks are trademarks of their respective owners. Rather than put a trademark

symbol after every occurrence of a trademarked name, we use names in an editorial

fashion only, and to the benefi t of the trademark owner, with no intention of infringement

of the trademark. Where such designations appear in this book, they have been printed

with initial caps.

McGraw-Hill eBooks are available at special quantity discounts to use as premiums and

sales promotions, or for use in corporate training programs. To contact a representative

please e-mail us at bulksales@mcgraw-hill.com.

Trademarks: McGraw-Hill, the McGraw-Hill Publishing logo, All About, and related trade

dress are trademarks or registered trademarks of The McGraw-Hill Companies and/or its

affi liates in the United States and other countries and may not be used without written

permission. All other trademarks are the property of their respective owners. The McGraw-

Hill Companies is not associated with any product or vendor mentioned in this book.

This publication is designed to provide accurate and authoritative information in regard

to the subject matter covered. It is sold with the understanding that neither the author

nor the publisher is engaged in rendering legal, accounting, securities trading, or other

professional services. If legal advice or other expert assistance is required, the services of

a competent professional person should be sought.

— From a Declaration of Principles Jointly Adopted by a Committee of the

American Bar Association and a Committee of Publishers and Associations

TERMS OF USE

This is a copyrighted work and The McGraw-Hill Companies, Inc. (“McGrawHill”) and

its licensors reserve all rights in and to the work. Use of this work is subject to these terms.

Except as permitted under the Copyright Act of 1976 and the right to store and retrieve

one copy of the work, you may not decompile, disassemble, reverse engineer, reproduce,

modify, create derivative works based upon, transmit, distribute, disseminate, sell, publish

or sublicense the work or any part of it without McGraw-Hill’s prior consent. You may

use the work for your own noncommercial and personal use; any other use of the work

is strictly prohibited. Your right to use the work may be terminated if you fail to comply

with these terms.

THE WORK IS PROVIDED “AS IS.” McGRAW-HILL AND ITS LICENSORS MAKE

NO GUARANTEES OR WARRANTIES AS TO THE ACCURACY, ADEQUACY

OR COMPLETENESS OF OR RESULTS TO BE OBTAINED FROM USING THE

WORK, INCLUDING ANY INFORMATION THAT CAN BE ACCESSED THROUGH

THE WORK VIA HYPERLINK OR OTHERWISE, AND EXPRESSLY DISCLAIM

ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO

IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTIC-

ULAR PURPOSE. McGraw-Hill and its licensors do not warrant or guarantee that the

functions contained in the work will meet your requirements or that its operation will be unin-

terrupted or error free. Neither McGraw-Hill nor its licensors shall be liable to you or anyone

else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages

resulting therefrom. McGraw-Hill has no responsibility for the content of any information

accessed through the work. Under no circumstances shall McGraw-Hill and/or its licensors

be liable for any indirect, incidental, special, punitive, consequential or similar damages

that result from the use of or inability to use the work, even if any of them has been advised

of the possibility of such damages. This limitation of liability shall apply to any claim or

cause whatsoever whether such claim or cause arises in contract, tort or otherwise.

�

C O N T E N T S

Preface v

Acknowledgments xiii

Chapter 1

Busted 1

Chapter 2

Trading 101 9

Chapter 3

Trading Strategies 43

Chapter 4

Achieving Speed 95

Chapter 5

Under the Hood 131

Chapter 6

The High-Frequency Trading Debate 173

Now What? 195

Glossary 197

Bibliography 215

Index 219

iii

�

This page intentionally left blank

�

P R E F A C E

Customer: How much are these?

Merchant: A buck fifty.

Customer: I’ll take some.

Merchant: They’re a buck fifty-one.

Customer: Um, you said a buck fifty.

Merchant: That was before I knew you wanted some.

Customer: You can’t do that.

Merchant: It’s my shop.

Customer: But I need to buy a hundred!

Merchant: A hundred? Then it’s a buck fifty-two.

Customer: You’re ripping me off.

Merchant: Supply and demand, pal. You want ’em or not?

What is high- frequency trading? Great question! And it’s

about time for an answer, because everyone seems to be talk-

ing about it—and forming strong opinions about it—and

when that happens, it’s usually a good thing to know just

what it is. Does high- frequency trading relate only to stock

trading? Or does it include automated trading of stock deriva-

tives such as options? Does it encompass any type of auto-

mated trading, where computers make the decisions humans

once did? Or does it pertain only to the dubious practices of

the sharks sophisticated trading firms who, like the merchant

above, move markets in their favor just because they can get

away with it? Well, since nobody can quite answer these ques-

tions, let’s just make our own definition and get on with it.

In general, high- frequency trading (HFT) refers to the buy-

ing or selling of securities wherein success depends on how

v

�

vi

Preface

quickly you act, where a delay of a few thousandths of a sec-

ond, or milliseconds,1 can mean the difference between profit

and loss. HFT happens not only in the stock markets but in the

markets for stock options and futures as well. Naturally, not

every reason for trading requires speedy execution. Certainly

not, say, buying stock because you think the company will do

well over the coming years or cashing out your 401(k) to buy

the Harley you’ve had your eye on since you were sixteen.

But plenty of trading strategies do indeed depend on how

quickly you can spot a profitable trading opportunity in the

market—and how quickly you respond with a trade order

to seize that opportunity before somebody else does. We’ll

describe a number of such strategies later on.

The high- frequency trader evolved from the ranks of the

traditional market-maker, or specialist, whose primary source

of profit was the spread between the prices at which he bought

and sold. Unlike the traditional market-maker, however, and

owing to developments like decimalization2 and advances in

technology, the high- frequency trader must settle for much

narrower spreads—razor-thin margins of a penny or less.

As such, high- frequency traders operate in massive scales.

Indeed, the larger high- frequency trading firms now glide

through the markets scooping up vast mouthfuls of trades

like a whale does krill.

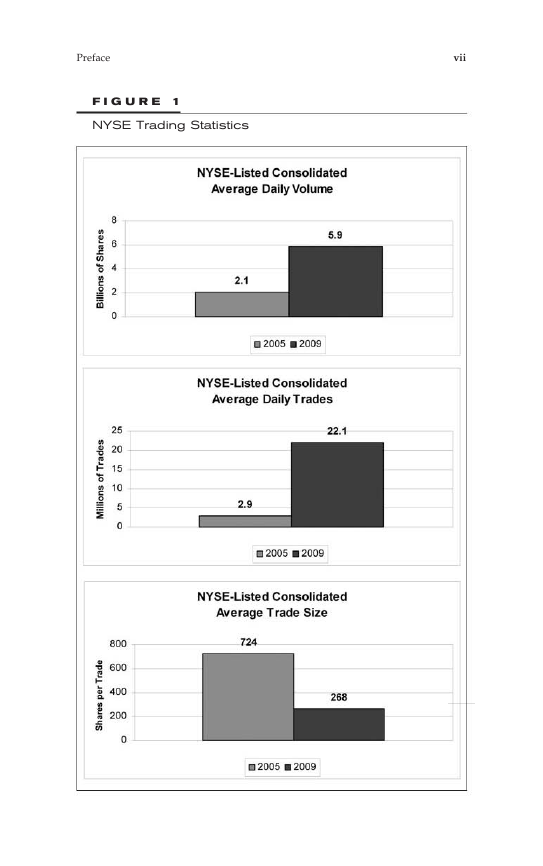

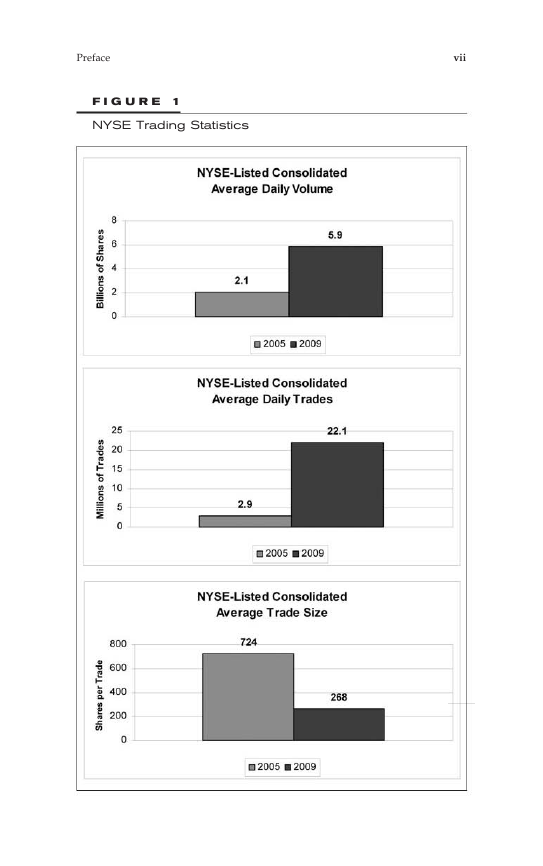

Signs of the likely effects of high- frequency trading, and

the growth of the number of firms practicing it, are not hard to

find. Figure 1 shows the Security and Exchange Commission’s

(SEC) calculation of the nearly threefold increase in daily

1 Increasingly, and perhaps by the time you read this book, microseconds—or

millionths of a second—also matter. And it’s only a matter of time before

we’re talking about nanoseconds, or billionths of a second.

2 Decimalization refers to the shift, in the early 2000s, from trading stocks

in fractions of dollars to doing so in pennies, dramatically reducing the

potential spread between the prices at which one can buy and sell a stock.

�

Preface

vii

F I G U R E 1

NYSE Trading Statistics

8

! .6

• , .

L

ID

o

25

~ 20

~ 15 ,

j 10

~ 5

o

800

.: 600

~ ! 400

i 200 • o

NYSE-Listed Consolidated

Average Daily Volume

2.1

.2005 . 2009

NYSE-Listed Consolidated

Average DailyTrades

22.1

2.9

11 2005 • 2009

NYSE-Listed Consolidated

Average Trade Size

,,.

268

.2005 . 2009

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc