�

Game Theory for Applied

Economists

Robert Gibbons

Princeton University Press

Princeton, New Jersey

Contents

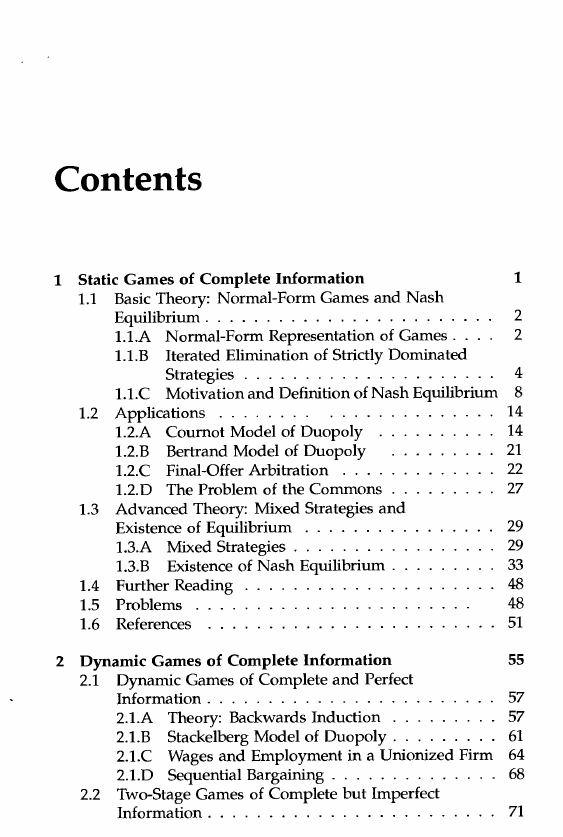

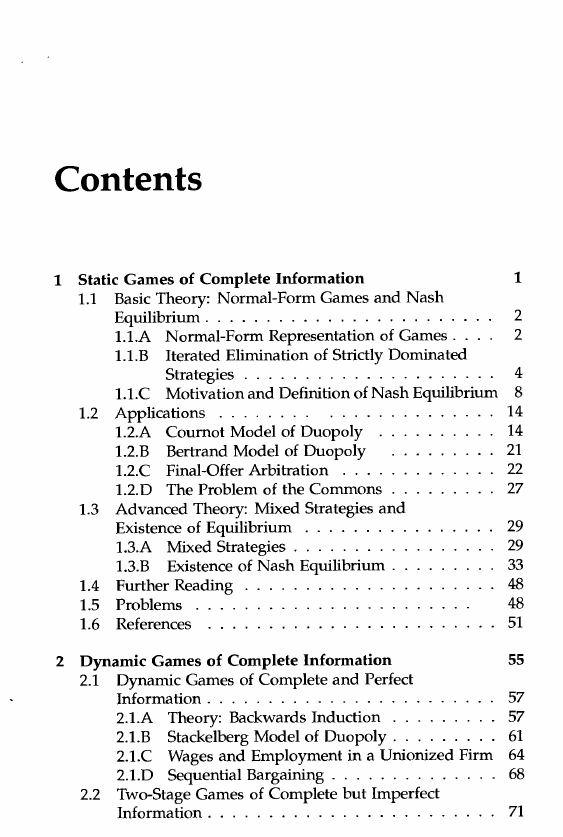

1 Static Games of Complete Information

1.1 Basic Theory: Normal-Form Games and Nash

Equilibrium. . . . . . . . . . . . . . . . . . . . .

1.1.A Normal-Form Representation of Games.

1.1.B

Iterated Elimination of Strictly Dominated

Strategies . . . . . . . . . . . . . . . . . . .

1

2

2

1.2 Applications

. . . . . . . .

4

1.1.C Motivation and Definition of Nash Equilibrium 8

14

14

21

22

27

1.2.A Coumot Model of Duopoly

1.2.B Bertrand Model of Duopoly

1.2.C Final-Offer Arbitration

. . .

1.2.D The Problem of the Commons

1.3 Advanced Theory: Mixed Strategies and

. . . . . . . .

Existence of Equilibrium

1.3.A Mixed Strategies . . . . . . . . .

1.3.B Existence of Nash Equilibrium .

1.4 Further Reading

1.5 Problems

1.6 References ...

2 Dynamic Games of Complete Information

2.1 Dynamic Games of Complete and Perfect

29

29

33

48

48

51

55

57

Information. . . . . . . . . . . . . . . .

2.1.A Theory: Backwards Induction . . .

57

2.1.B Stackelberg Model of Duopoly. . .

61

2.1.C Wages and Employment in a Unionized Firm 64

68

2.1.D Sequential Bargaining . . . . . . . . . .

2.2 Two-Stage Games of Complete but Imperfect

Information. . . . . . . . . . . . . . . . . . . .

71

�

viii

CONTENTS

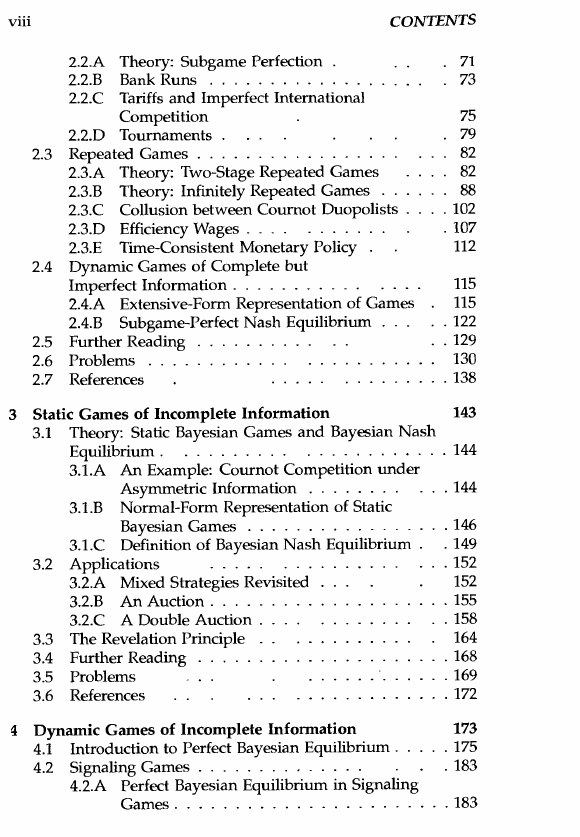

2.2.A Theory: Subgame Perfection .

2.2.B Bank Runs

. . . . . . . . . . .

2.2.C Tariffs and Imperfect International

Competition

2.2.D Tournaments .

2.3 Repeated Games . . .

2.3.A Theory: Two-Stage Repeated Games

2.3.B Theory: Infinitely Repeated Games

2.3.C Collusion between Coumot Duopolists .

2.3.0 Efficiency Wages . . .. . . . . .

2.3.E Time-Consistent Monetary Policy

2.4 Dynamic Games of Complete but

Imperfect Information. . . . . . . . . . .

2.4.A Extensive-Form Representation of Games

2.4.B Subgame-Perfect Nash Equilibrium

2.5 Further Reading

2.6 Problems

2.7 References

. . . . . . .

3 Static Games of Incomplete Information

71

73

75

79

82

82

88

. 102

. 107

112

115

115

. 122

. 129

130

. 138

143

3.1 Theory: Static Bayesian Games and Bayesian Nash

Equilibrium . . . . . . . . . . . . . . . . . . . . . 144

3.1.A An Example: Cournot Competition under

Asymmetric Information

. . . . . . . .

3.1.B Normal-Form Representation of Static

Bayesian Games . . . . . . . . . . . . .

3.1.C Definition of Bayesian Nash Equilibrium

3.2 Applications

. . . . .

3.2.A Mixed Strategies Revisited

3.2.B An Auction . . . . .

3.2.C A Double Auction .

The Revelation Principle

Further Reading

Problems

References

3.3

3.4

3.5

3.6

II Dynamic Games of Incomplete Information

Introduction to Perfect Bayesian Equilibrium.

4.1

4.2 Signaling Games . . . . . . . . . . . . . .

4.2.A Perfect Bayesian Equilibrium in Signaling

.144

.146

.149

.152

152

.155

.158

164

.168

.169

.172

173

. 175

. 183

Games. . . . . . . . . . . . . . . . . . . .. .183

�

Contents

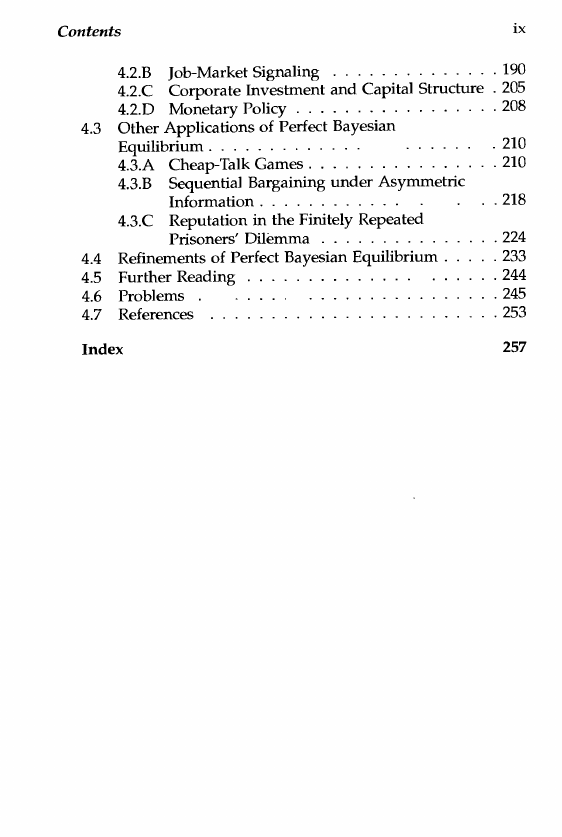

4.3

Job-Market Signaling

4.2.B

. . . . . . . . . . . . .

4.2.C Corporate Investment and Capital Structure

4.2.0 Monetary Policy . . . . . . . . .

Other Applications of Perfect Bayesian

Equilibrium . . . . . . . . . . . . .

4.3.A Cheap-Talk Games. . . . . . . .

4.3.B Sequential Bargaining under Asymmetric

Information. . . . . . . . . . . .

4.3.C Reputation in the Finitely Repeated

Prisoners' Dilemma . . . . . . . . .

4.4

4.5

4.6

4.7

Refinements of Perfect Bayesian Equilibrium .

Further Reading

Problems

References

.

Index

ix

.190

. 205

.208

.210

.210

.218

.224

.233

.244

.245

.253

257

�

Preface

Game theory is the study of multiperson decision problems. Such

problems arise frequently in economics. As is widely appreciated,

for example, oligopolies present multiperson problems -

each

firm must consider what the others will do. But many other ap

plications of game theory arise in fields of economics other than

industrial organization. At the micro level, models of trading

processes (such as bargaining and auction models) involve game

theory. At an intermediate level of aggregation, labor and finan

cial economics include game-theoretic models of the behavior of

a firm in its input markets (rather than its output market, as in

an oligopoly). There also are multiperson problems within a firm:

many workers may vie for one promotion; several divisions may

compete for the corporation's investment capital. Finally, at a high

level of aggregation, international economics includes models in

which countries compete (or collude) in choosing tariffs and other

trade policies, and macroeconomics includes models in which the

monetary authority and wage or price setters interact strategically

to determine the effects of monetary policy.

This book is designed to introduce game theory to those who

will later construct (or at least consume) game-theoretic models

in applied fields within economics. The exposition emphasizes

the economic applications of the theory at least as much as the

pure theory itself, for three reasons. First, the applications help

teach the theory; formal arguments about abstract games also ap

pear but playa lesser role. Second, the applications illustrate the

process of model building -

mal description of a multiperson decision situation into a formal,

game-theoretic problem to be analyzed. Third, the variety of ap

plications shows that similar issues arise in different areas of eco

nomics, and that the same game-theoretic tools can be applied in

the process of translating an infor

�

xii

PREFACE

each setting. In order to emphasize the broad potential scope 01 :

the theory, conventional applications from industrial organization.

largely have been replaced by applications from labor, macro, and

other applied fields in economics. l

We will discuss four classes of games: static games of com

(A game has incomplete information if one

plete information, dynamic games of complete information, static

games of incomplete information, and dynamic games of incom

plete information.

player does not know another player's payoff, such as in an auc

tion when one bidder does not know how much another bidder

is willing to pay for the good being sold.) Corresponding to these

four classes of games will be four notions of equilibrium in games:

Nash equilibrium, subgame-perfect Nash equilibrium, Bayesian

Nash equilibrium, and perfect Bayesian equilibrium.

Two (related) ways to organize one's thinking about these equi

librium concepts are as follows. First, one could construct se

quences of equilibrium concepts of increasing strength, where

stronger (Le., more restrictive) concepts are attempts to eliminate

implausible equilibria allowed by weaker notions of equilibrium.

We will see, for example, that subgame-perfect Nash equilibrium

is stronger than Nash equilibrium and that perfect Bayesian equi

librium in turn is stronger than sub game-perfect Nash equilib

rium. Second, one could say that the equilibrium concept of in

terest is always perfect Bayesian equilibrium (or perhaps an even

stronger equilibrium concept), but that it is equivalent to Nash

equilibrium in static games of complete information, equivalent

to subgame-perfection in dynamic games of complete (and per

fect) information, and equivalent to Bayesian Nash equilibrium in

static games of incomplete information.

The book can be used in two ways. For first-year graduate stu

dents in economics, many of the applications will already be famil

iar, so the game theory can be covered in a half-semester course,

leaving many of the applications to be studied outside of class.

For undergraduates, a full-semester course can present the theory

a bit more slowly, as well as cover virtually all the applications in

class. The main mathematical prerequisite is single-variable cal

culus; the rudiments of probability and analysis are introduced as

needed.

1 A good source for applications of game theory in industrial organization is

Tirole's The Theory of Industrial Organization (MIT Press, 1988).

�

Preface

xiii

I learned game theory from David Kreps, John Roberts, and

Bob Wilson in graduate school, and from Adam Brandenburger,

Drew Fudenberg, and Jean Tirole afterward. lowe the theoreti

cal perspective in this book to them. The focus on applications

and other aspects of the pedagogical style, however, are largely

due to the students in the MIT Economics Department from 1985

to 1990, who inspired and rewarded the courses that led to this

book. I am very grateful for the insights and encouragement all

these friends have provided, as well as for the many helpful com

ments on the manuscript I received from Joe Farrell, Milt Harris,

George Mailath, Matthew Rabin, Andy Weiss, and several anony

mous reviewers. Finally, I am glad to acknowledge the advice and

encouragement of Jack Repcheck of Princeton University Press and

finandal support from an Olin Fellowship in Economics at the Na

tional Bureau of Economic Research.

�

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc