�

INTRODUCTION TO

STOCHASTIC CALCULUS

WITH APPLICATIONS

SECOND EDITION

This page intentionally left blank

�

Fima C Klebaner

Monash University, Australia

Imperial College Press

�

Published by

Imperial College Press

57 Shelton Street

Covent Garden

London WC2H 9HE

Distributed by

World Scientific Publishing Co. Pte. Ltd.

5 Toh Tuck Link, Singapore 596224

USA office: 27 Warren Street, Suite 401-402, Hackensack, NJ 07601

UK office: 57 Shelton Street, Covent Garden, London WC2H 9HE

British Library Cataloguing-in-Publication Data

A catalogue record for this book is available from the British Library.

INTRODUCTION TO STOCHASTIC CALCULUS WITH APPLICATIONS

(Second Edition)

Copyright © 2005 by Imperial College Press

All rights reserved. This book, or parts thereof, may not be reproduced in any form or by any means,

electronic or mechanical, including photocopying, recording or any information storage and retrieval

system now known or to be invented, without written permission from the Publisher.

For photocopying of material in this volume, please pay a copying fee through the Copyright

Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, USA. In this case permission to

photocopy is not required from the publisher.

ISBN 1-86094-555-4

ISBN 1-86094-566-X (pbk)

Printed in Singapore.

�

Preface

Preface to the Second Edition

The second edition is revised, expanded and enhanced. This is now a more

complete text in Stochastic Calculus, from both a theoretical and an appli-

cations point of view. Changes came about, as a result of using this book

for teaching courses in Stochastic Calculus and Financial Mathematics over a

number of years. Many topics are expanded with more worked out examples

and exercises. Solutions to selected exercises are included. A new chapter

on bonds and interest rates contains derivations of the main pricing mod-

els, including currently used market models (BGM). The change of numeraire

technique is demonstrated on interest rate, currency and exotic options. The

presentation of Applications in Finance is now more comprehensive and self-

contained. The models in Biology introduced in the new edition include the

age-dependent branching process and a stochastic model for competition of

species. These Markov processes are treated by Stochastic Calculus tech-

niques using some new representations, such as a relation between Poisson

and Birth-Death processes. The mathematical theory of filtering is based on

the methods of Stochastic Calculus. In the new edition, we derive stochastic

equations for a non-linear filter first and obtain the Kalman-Bucy filter as a

corollary. Models arising in applications are treated rigorously demonstrating

how to apply theoretical results to particular models. This approach might

not make certain places easy reading, however, by using this book, the reader

will accomplish a working knowledge of Stochastic Calculus.

Preface to the First Edition

This book aims at providing a concise presentation of Stochastic Calculus with

some of its applications in Finance, Engineering and Science.

During the past twenty years, there has been an increasing demand for tools

and methods of Stochastic Calculus in various disciplines. One of the greatest

demands has come from the growing area of Mathematical Finance, where

Stochastic Calculus is used for pricing and hedging of financial derivatives,

v

�

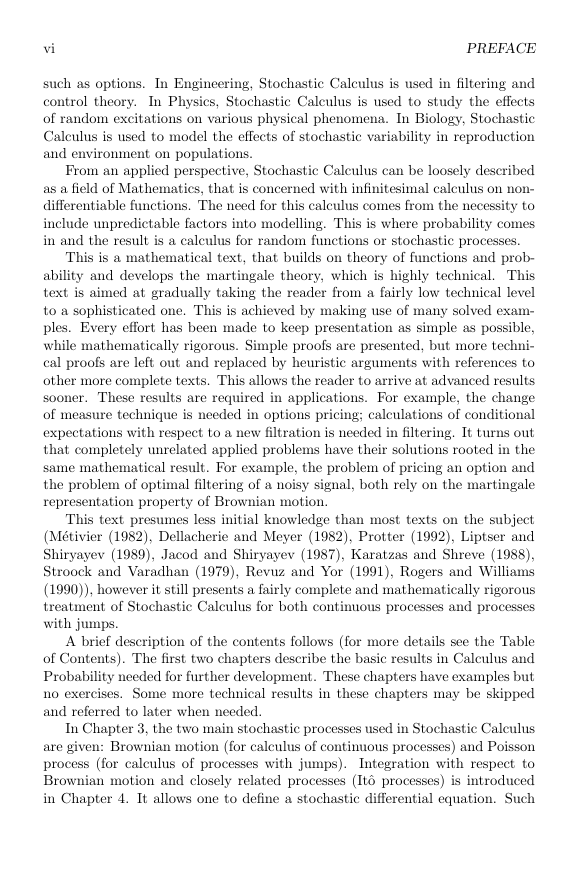

vi

PREFACE

such as options. In Engineering, Stochastic Calculus is used in filtering and

control theory.

In Physics, Stochastic Calculus is used to study the effects

of random excitations on various physical phenomena. In Biology, Stochastic

Calculus is used to model the effects of stochastic variability in reproduction

and environment on populations.

From an applied perspective, Stochastic Calculus can be loosely described

as a field of Mathematics, that is concerned with infinitesimal calculus on non-

differentiable functions. The need for this calculus comes from the necessity to

include unpredictable factors into modelling. This is where probability comes

in and the result is a calculus for random functions or stochastic processes.

This is a mathematical text, that builds on theory of functions and prob-

ability and develops the martingale theory, which is highly technical. This

text is aimed at gradually taking the reader from a fairly low technical level

to a sophisticated one. This is achieved by making use of many solved exam-

ples. Every effort has been made to keep presentation as simple as possible,

while mathematically rigorous. Simple proofs are presented, but more techni-

cal proofs are left out and replaced by heuristic arguments with references to

other more complete texts. This allows the reader to arrive at advanced results

sooner. These results are required in applications. For example, the change

of measure technique is needed in options pricing; calculations of conditional

expectations with respect to a new filtration is needed in filtering. It turns out

that completely unrelated applied problems have their solutions rooted in the

same mathematical result. For example, the problem of pricing an option and

the problem of optimal filtering of a noisy signal, both rely on the martingale

representation property of Brownian motion.

This text presumes less initial knowledge than most texts on the subject

(M´etivier (1982), Dellacherie and Meyer (1982), Protter (1992), Liptser and

Shiryayev (1989), Jacod and Shiryayev (1987), Karatzas and Shreve (1988),

Stroock and Varadhan (1979), Revuz and Yor (1991), Rogers and Williams

(1990)), however it still presents a fairly complete and mathematically rigorous

treatment of Stochastic Calculus for both continuous processes and processes

with jumps.

A brief description of the contents follows (for more details see the Table

of Contents). The first two chapters describe the basic results in Calculus and

Probability needed for further development. These chapters have examples but

no exercises. Some more technical results in these chapters may be skipped

and referred to later when needed.

In Chapter 3, the two main stochastic processes used in Stochastic Calculus

are given: Brownian motion (for calculus of continuous processes) and Poisson

process (for calculus of processes with jumps).

Integration with respect to

Brownian motion and closely related processes (Itˆo processes) is introduced

in Chapter 4. It allows one to define a stochastic differential equation. Such

�

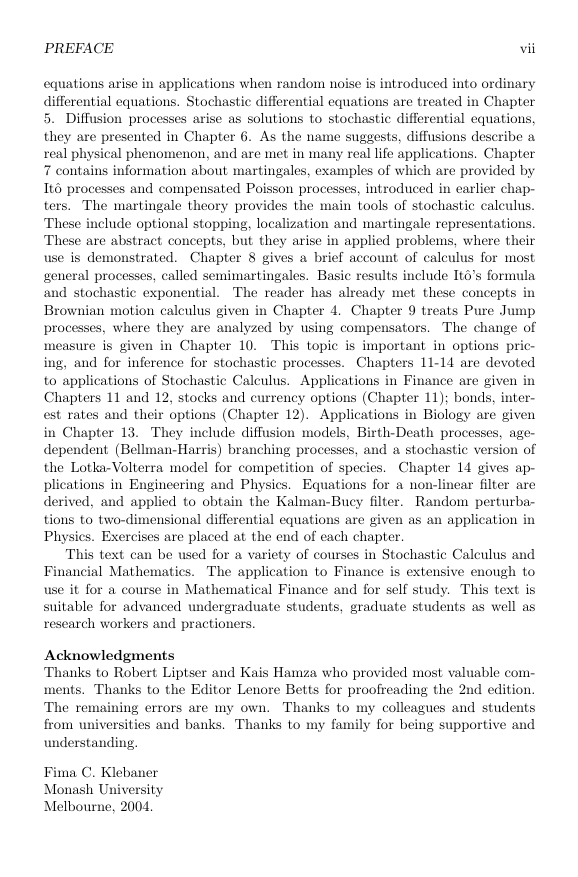

PREFACE

vii

equations arise in applications when random noise is introduced into ordinary

differential equations. Stochastic differential equations are treated in Chapter

5. Diffusion processes arise as solutions to stochastic differential equations,

they are presented in Chapter 6. As the name suggests, diffusions describe a

real physical phenomenon, and are met in many real life applications. Chapter

7 contains information about martingales, examples of which are provided by

Itˆo processes and compensated Poisson processes, introduced in earlier chap-

ters. The martingale theory provides the main tools of stochastic calculus.

These include optional stopping, localization and martingale representations.

These are abstract concepts, but they arise in applied problems, where their

use is demonstrated. Chapter 8 gives a brief account of calculus for most

general processes, called semimartingales. Basic results include Itˆo’s formula

and stochastic exponential. The reader has already met these concepts in

Brownian motion calculus given in Chapter 4. Chapter 9 treats Pure Jump

processes, where they are analyzed by using compensators. The change of

measure is given in Chapter 10. This topic is important in options pric-

ing, and for inference for stochastic processes. Chapters 11-14 are devoted

to applications of Stochastic Calculus. Applications in Finance are given in

Chapters 11 and 12, stocks and currency options (Chapter 11); bonds, inter-

est rates and their options (Chapter 12). Applications in Biology are given

in Chapter 13. They include diffusion models, Birth-Death processes, age-

dependent (Bellman-Harris) branching processes, and a stochastic version of

the Lotka-Volterra model for competition of species. Chapter 14 gives ap-

plications in Engineering and Physics. Equations for a non-linear filter are

derived, and applied to obtain the Kalman-Bucy filter. Random perturba-

tions to two-dimensional differential equations are given as an application in

Physics. Exercises are placed at the end of each chapter.

This text can be used for a variety of courses in Stochastic Calculus and

Financial Mathematics. The application to Finance is extensive enough to

use it for a course in Mathematical Finance and for self study. This text is

suitable for advanced undergraduate students, graduate students as well as

research workers and practioners.

Acknowledgments

Thanks to Robert Liptser and Kais Hamza who provided most valuable com-

ments. Thanks to the Editor Lenore Betts for proofreading the 2nd edition.

The remaining errors are my own. Thanks to my colleagues and students

from universities and banks. Thanks to my family for being supportive and

understanding.

Fima C. Klebaner

Monash University

Melbourne, 2004.

�

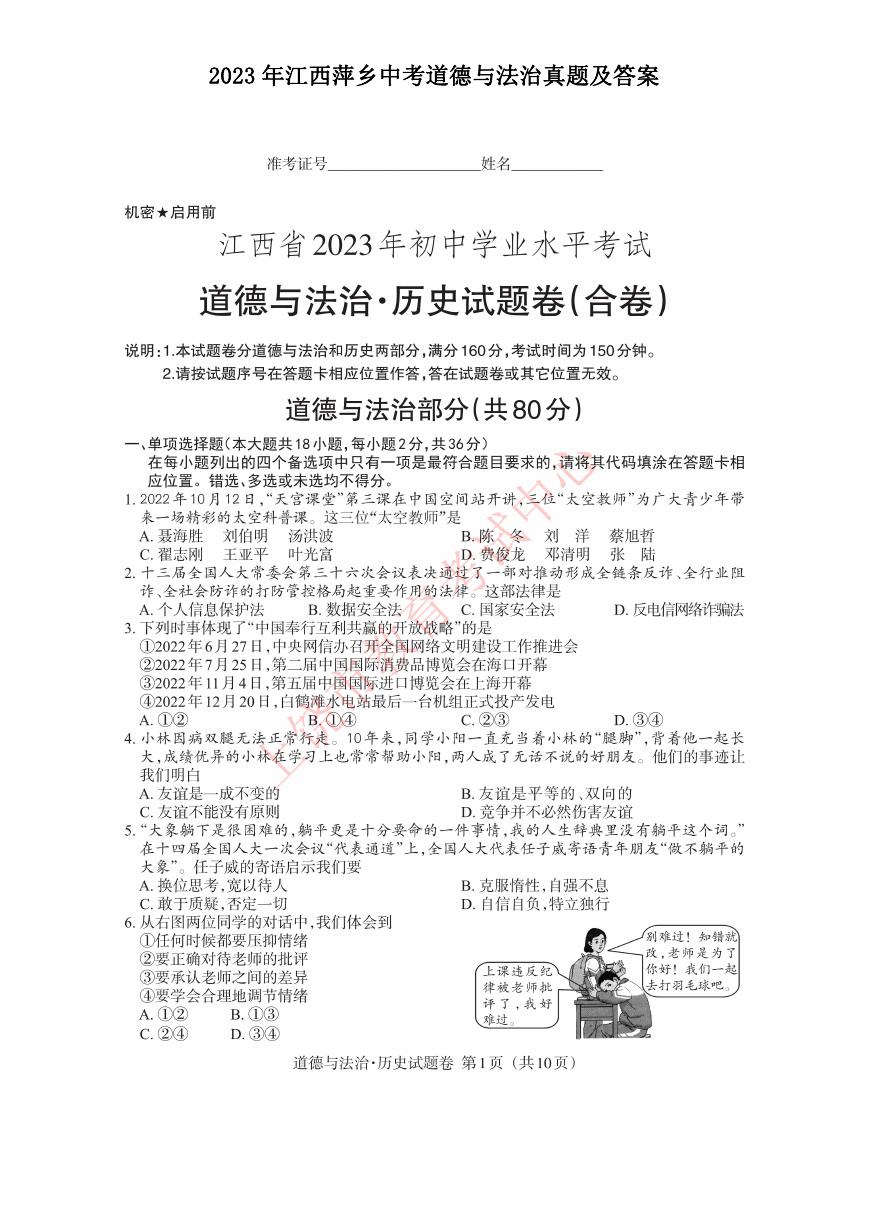

2023年江西萍乡中考道德与法治真题及答案.doc

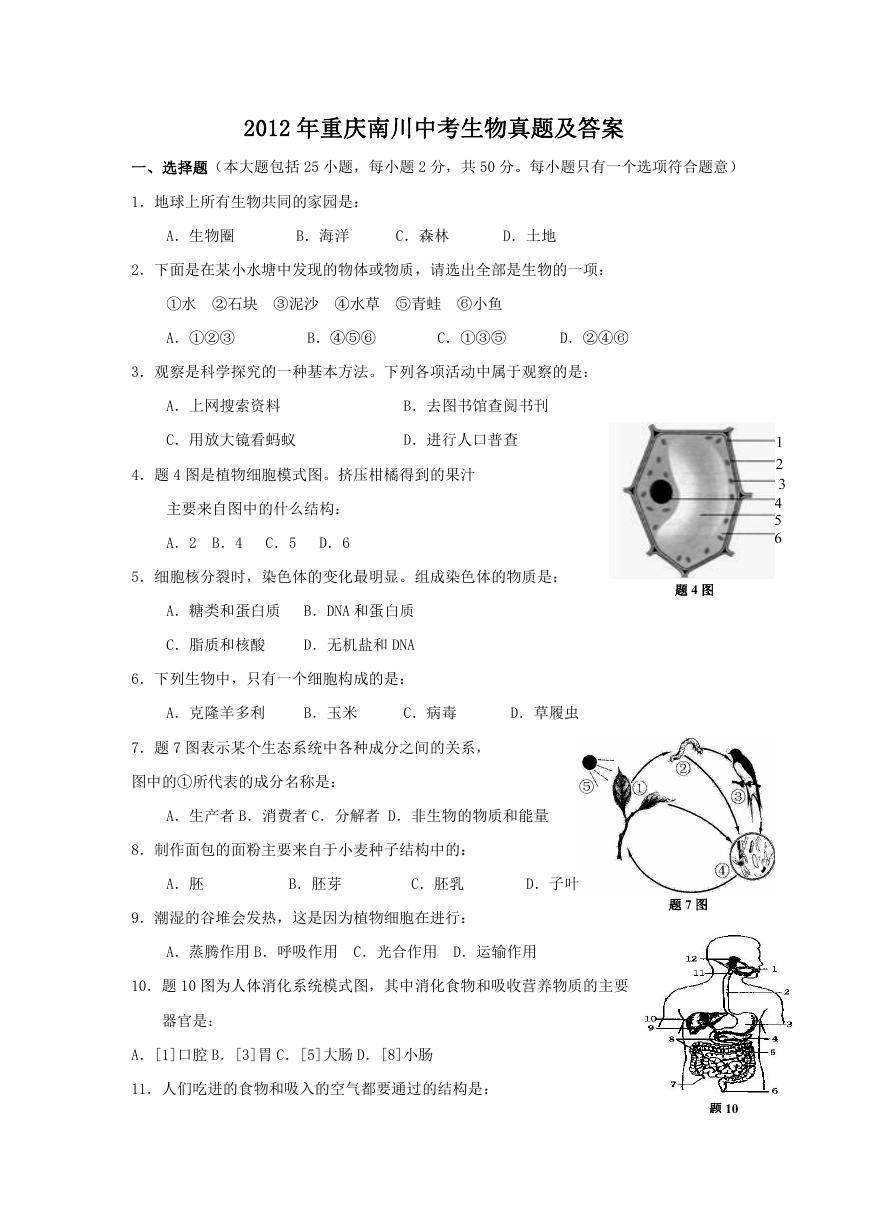

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

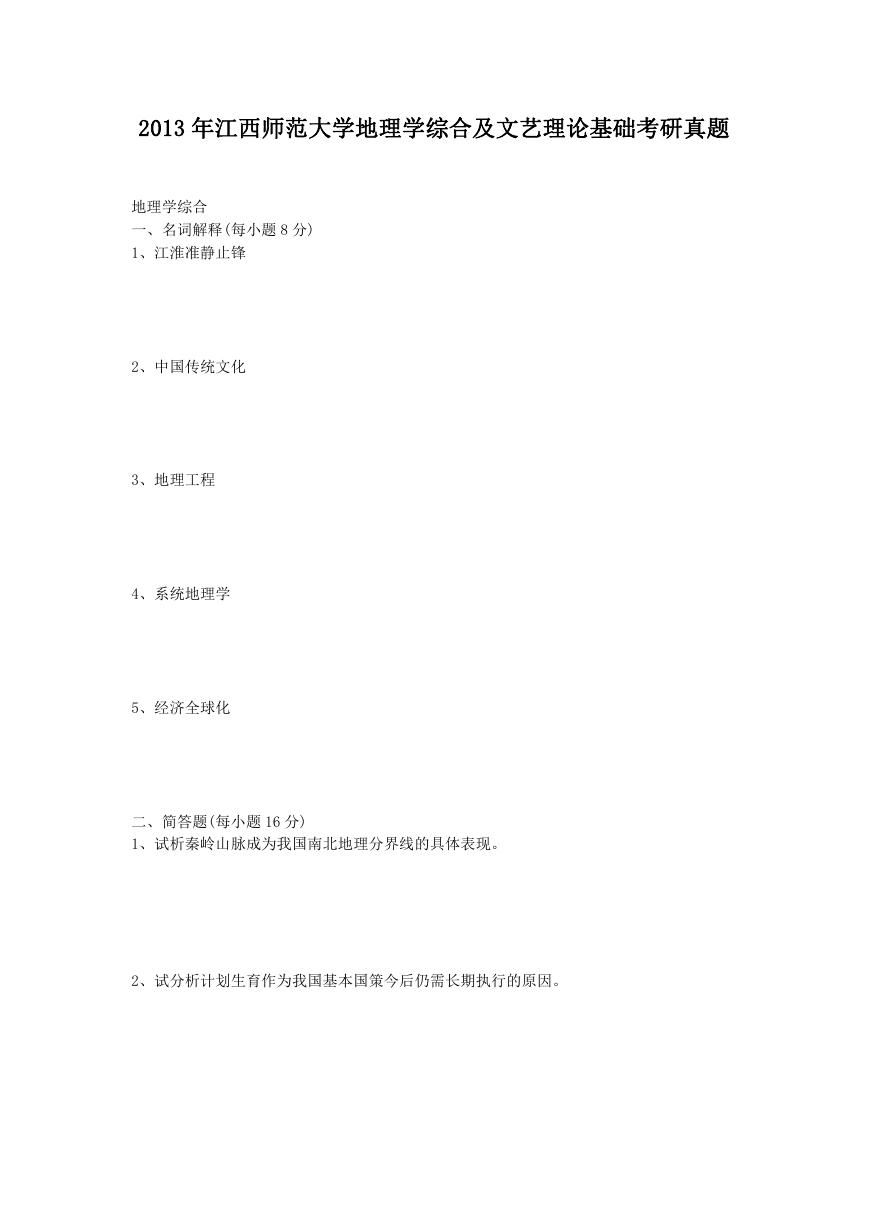

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

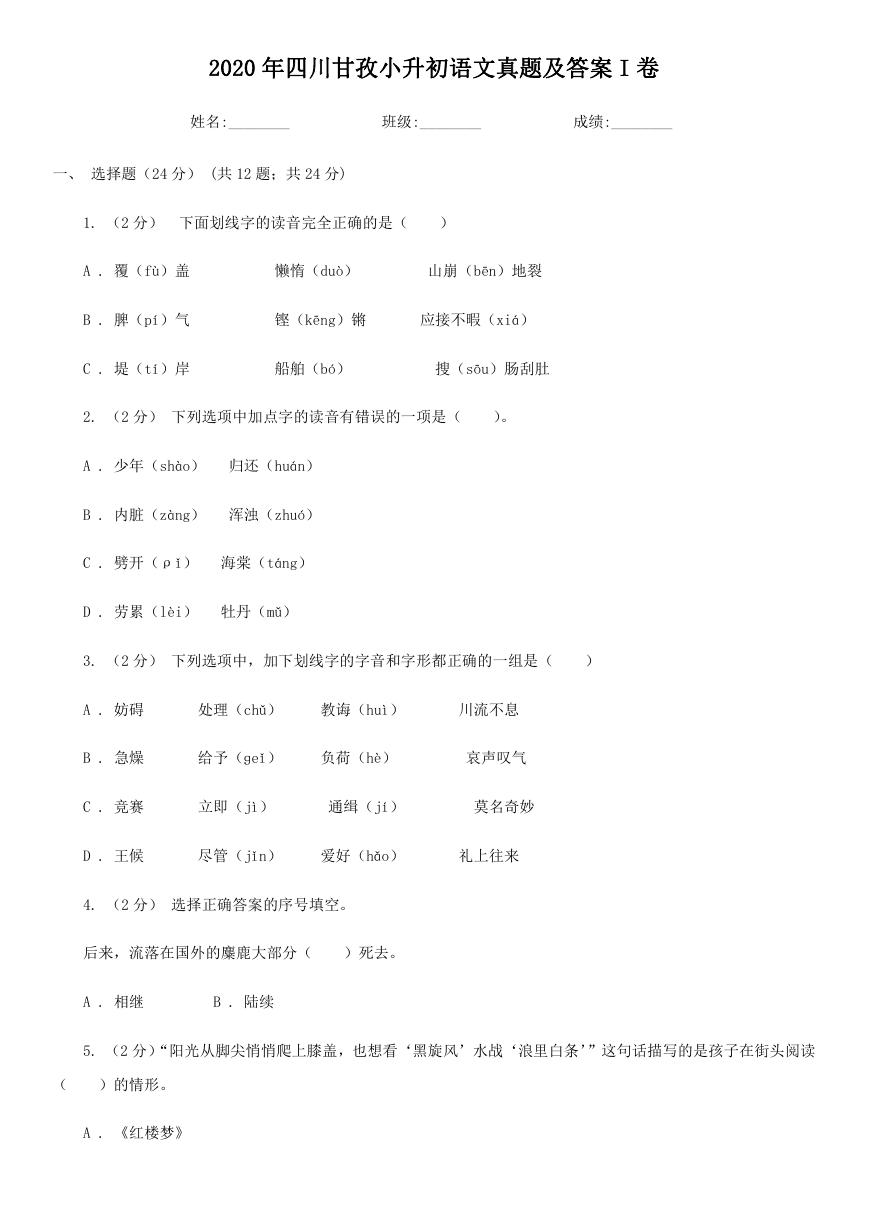

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

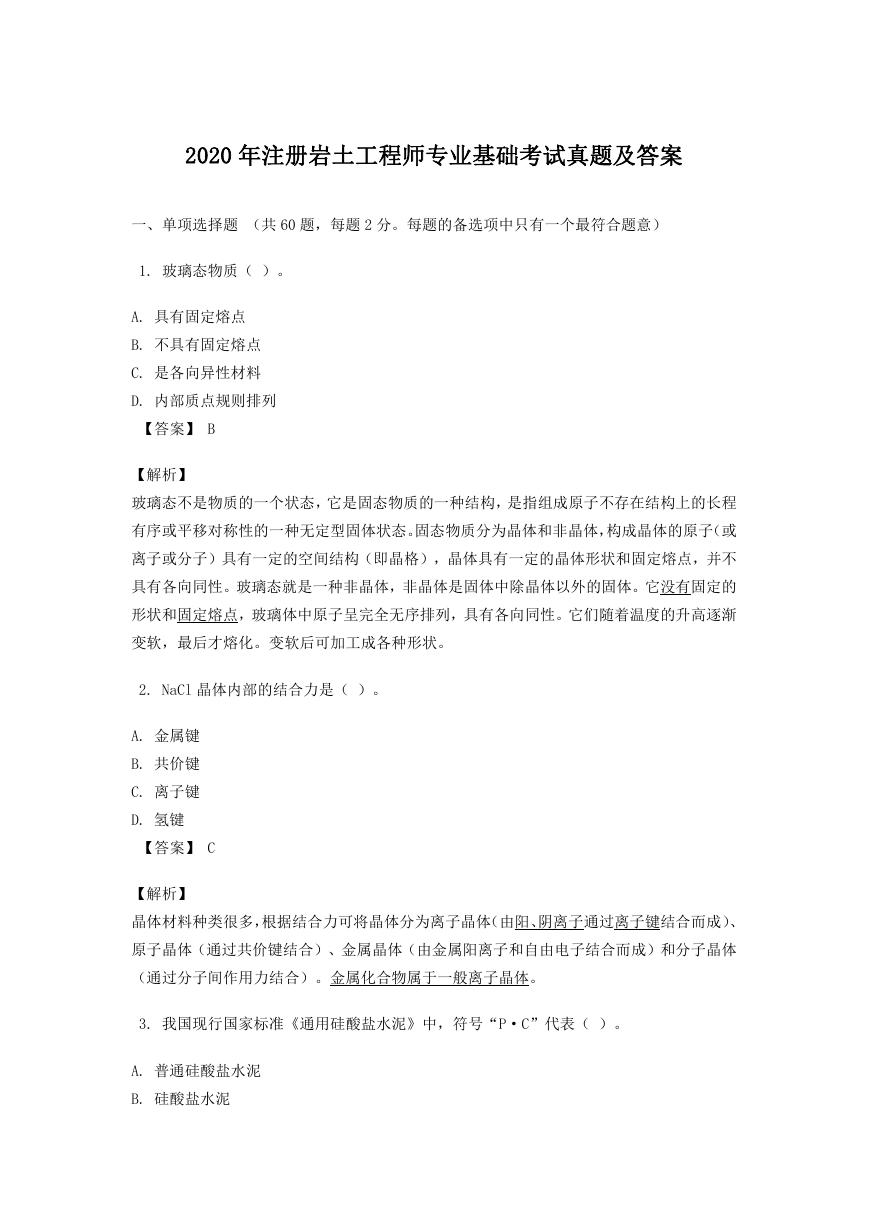

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

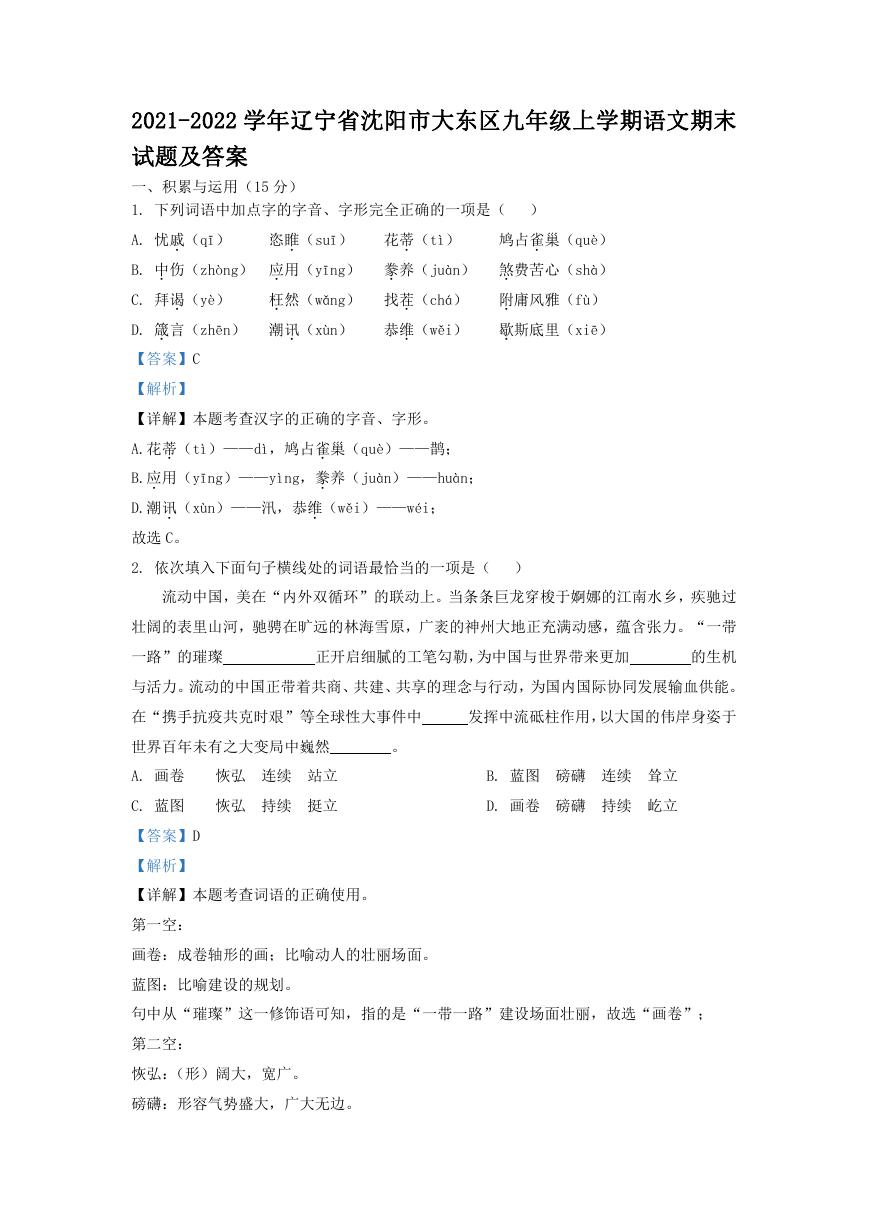

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

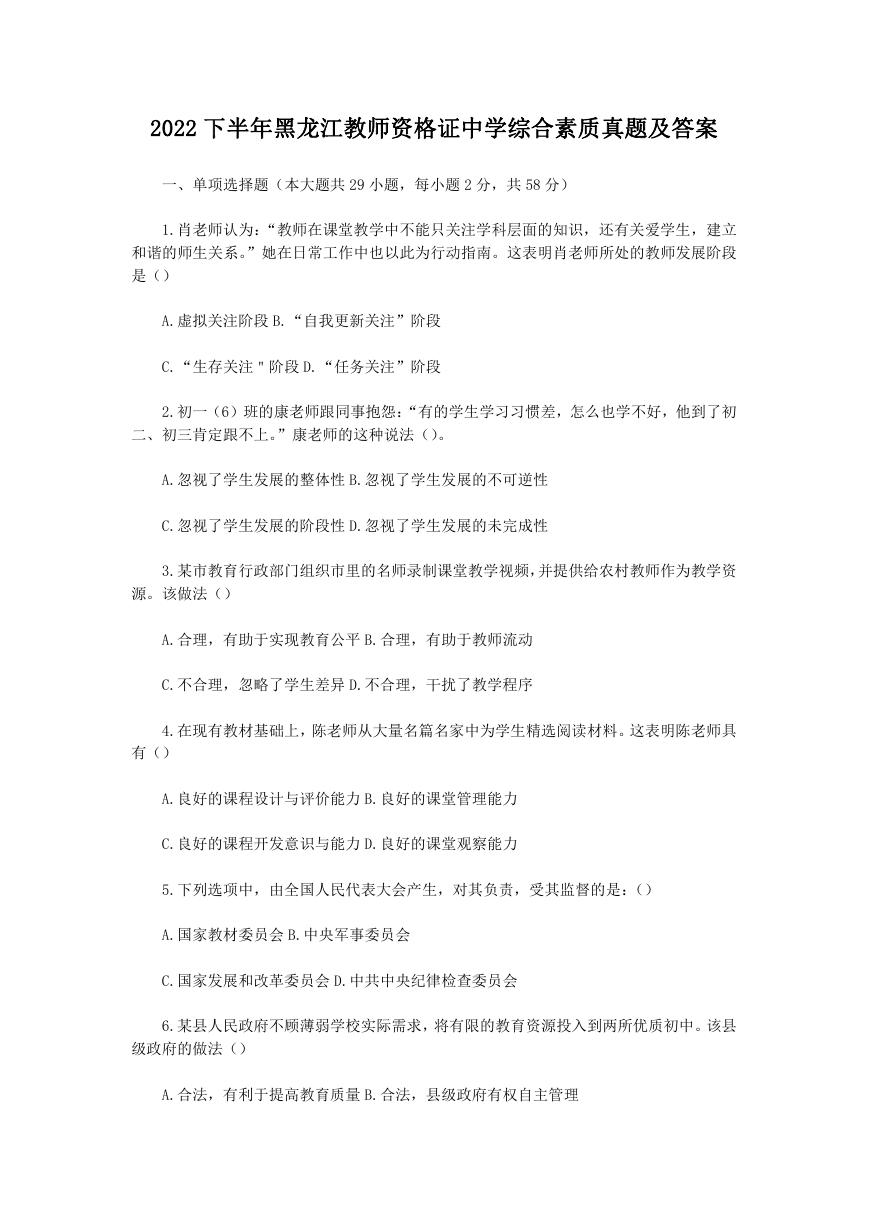

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc