Chapter 1: Financial Management Setup

CHAPTER 1: FINANCIAL MANAGEMENT SETUP

Objectives

The objectives are:

• Explain the fields on the General Ledger Setup window.

• Explain and set up Accounting Periods.

• Explain and set up Trail Codes, including Source Codes and Reason

Codes.

Prior to processing financials in Microsoft Dynamics™ NAV 5.0, the following

areas in Financial Management must be set up:

Introduction

• General Ledger

• Accounting Periods

• Trail Codes, including:

– Source Codes

– Reason Codes

In this section, these set up areas are explained.

NOTE: There are other setup areas in the General Ledger, such as Currencies,

No. Series, Dimensions, and Posting Groups. The set up of these areas is

discussed in the sections specific to these topics in the Application Setup

content.

1-1

Microsoft Official Training Materials for Microsoft Dynamics ™ Your use of this content is subject to your current services agreement �

Finance in Microsoft Dynamics™ NAV 5.0

General Ledger Setup

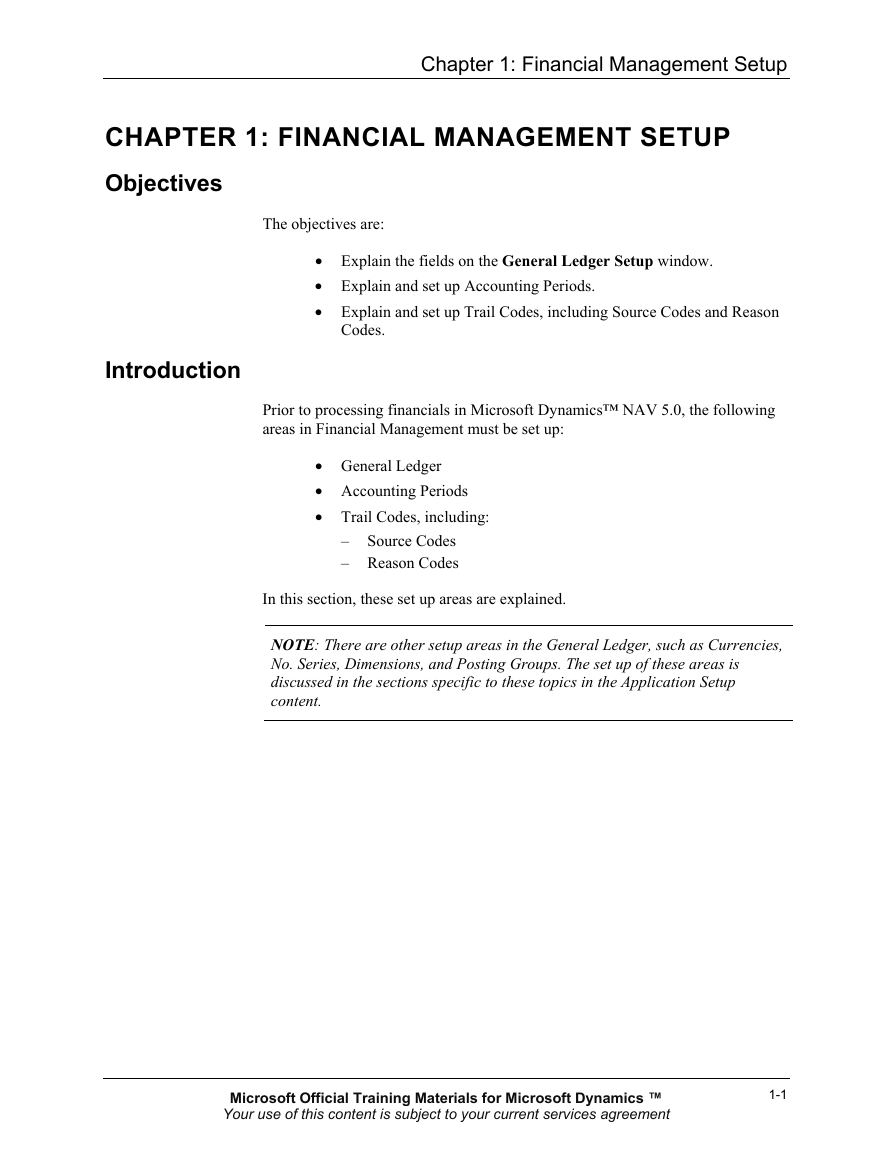

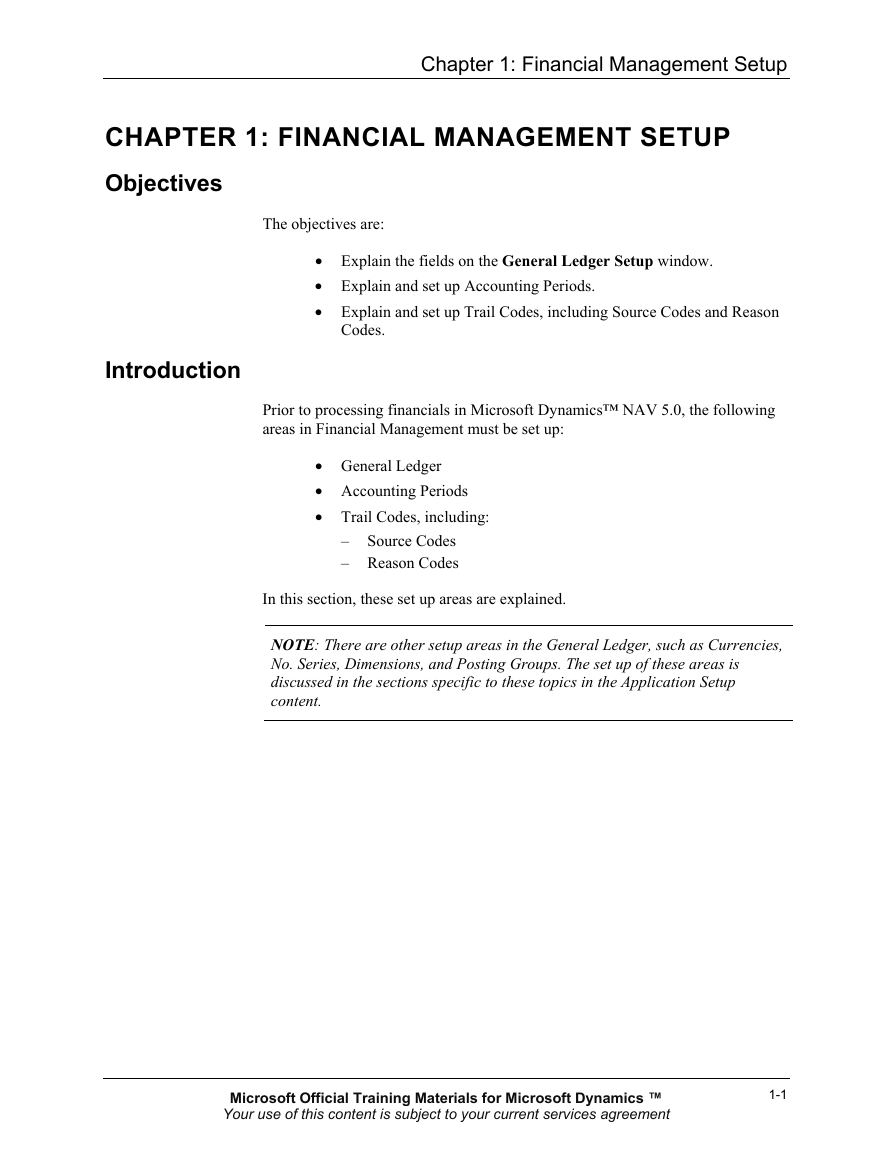

The General Ledger Setup window is used to specify default setting for the

general ledger and all finance related application areas. The General Ledger

Setup window must be completed for each company set up in Microsoft

Dynamics NAV 5.0.

This section describes the five tabs and fields on the General Ledger Setup

window. For more information on these fields, press F1 to access online help.

To access the General Ledger Setup window, on the Navigation Pane, click

Financial Management > Setup > General Ledger Setup.

FIGURE 1.1 GENERAL LEDGER SETUP WINDOW

General Tab

The General tab contains the basic setup defaults for General Ledger, including:

Field

Allow Posting From / Allow

Posting To

Definition

Specify the company default posting dates;

that is, the date range that all users can post

transactions in.

Since a period closing process is not required

in Microsoft Dynamics NAV 5.0, setting the

posting date range prevents users from posting

entries that can change prior period data.

NOTE: Specific user posting date restrictions

are specified in the User Setup window. If

there are no user restrictions, the company

defaults are in effect. If there are no company

defaults, there are no restrictions on dates for

data entry and posting.

1-2

Microsoft Official Training Materials for Microsoft Dynamics ™ Your use of this content is subject to your current services agreement �

Chapter 1: Financial Management Setup

Field

Register Time

Local Address Format

Local Cont. Addr. Format

Invoice Rounding Precision

(LCY)

Invoice Rounding Type

(LCY)

Allow G/L Acc. Deletion

Before

Check G/L Account Usage

EMU Currency

LCY Code

Pmt. Disc. Excl. VAT

Adjust for Payment Disc.

Unrealized VAT

Max. VAT Difference

Allowed

Definition

Specify whether the program registers the

user's time usage.

Specify the address format used on printed

documents.

Specify where the contact name needs to

appear in mailing addresses.

Specify the size of the interval to be used

when rounding amounts in local currency

(LCY).

Specify if invoice amounts are rounded up or

down. The option selected here is used with

the rounding interval specified in the Invoice

Rounding Precision (LCY) field.

The date in this field determines if and when

G/L accounts can be deleted. G/L accounts

with entries on or after the date specified in

this field cannot be deleted.

If selected, the program prevents G/L accounts

that are used in setup tables, such as posting

groups, from being deleted.

Select this field if LCY is an EMU currency.

This field is only used when applying entries

in different currencies.

Enter the currency code for LCY. The value is

only used on printouts, since the program uses

as the indicator for LCY when

displaying information in tables.

Specify whether the payment discount is based

on amounts including or excluding VAT.

If selected, the program recalculates VAT

amounts when posting payments that trigger

payment discounts.

Specify whether the program manages

unrealized VAT. For more information, refer

to “VAT and Intrastat.”

Enter the maximum VAT correction amount

allowed for the local currency.

1-3

Microsoft Official Training Materials for Microsoft Dynamics ™ Your use of this content is subject to your current services agreement �

Finance in Microsoft Dynamics™ NAV 5.0

Field

VAT Rounding Type

Bill-to/Sell-to VAT Calc.

Print VAT Specification in

LCY

Numbering Tab

Definition

Select how VAT is rounded when calculated

for the local currency.

By default this field is set to Bill-to/Pay-to

No., which indicates that the VAT Business

Posting Group is taken from the Bill-to

customer or Pay-to vendor for orders/invoices.

Select Sell-to/Buy-from No. to use the VAT

Business Posting Group for the Sell-to

customer or Buy-from vendor for

orders/invoices.

If selected, a line is added on printed sales

documents that specifies the VAT details in

LCY in addition to the invoicing currency. If

not selected, VAT details will only print in the

invoicing currency.

Bank Account Nos. is the only field on the Numbering tab. In this field, enter

the code for the number series that will be used to assign numbers to bank

accounts.

No. Series are described and set up in the Application Setup content.

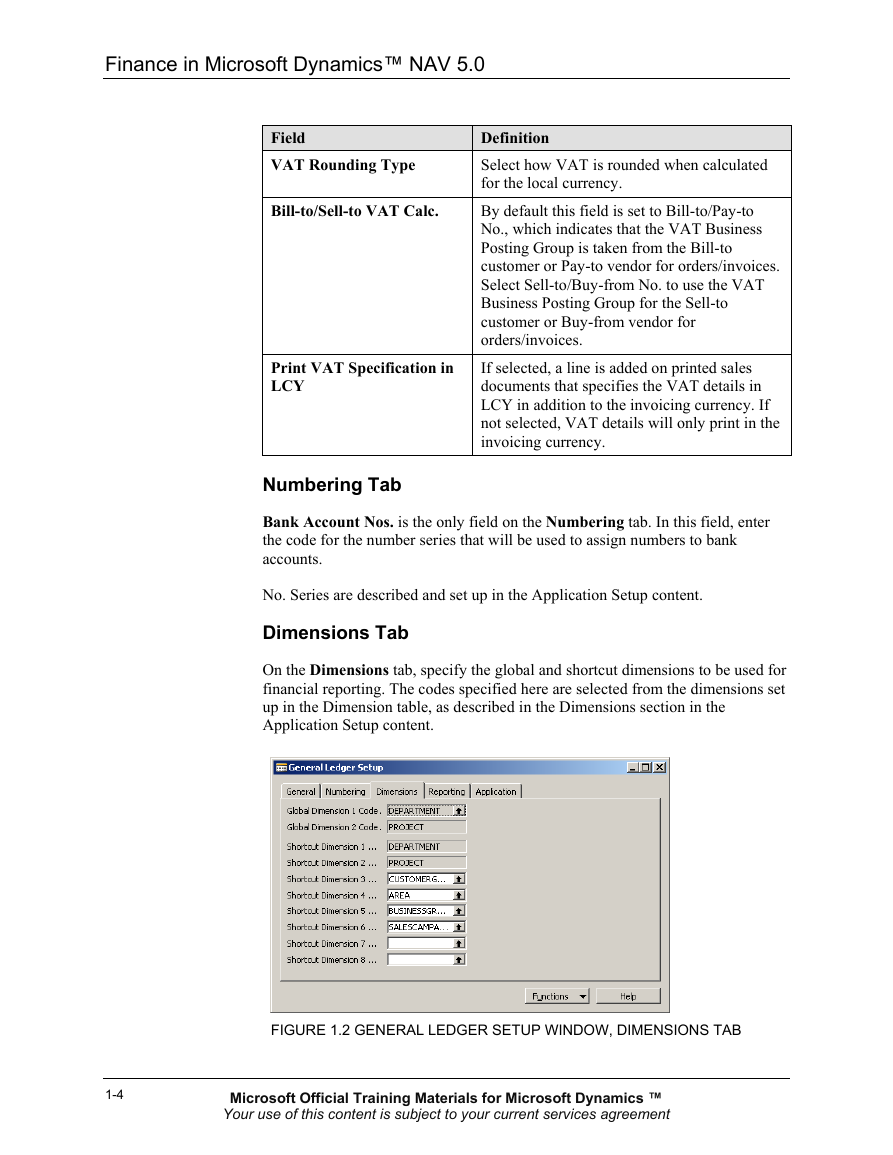

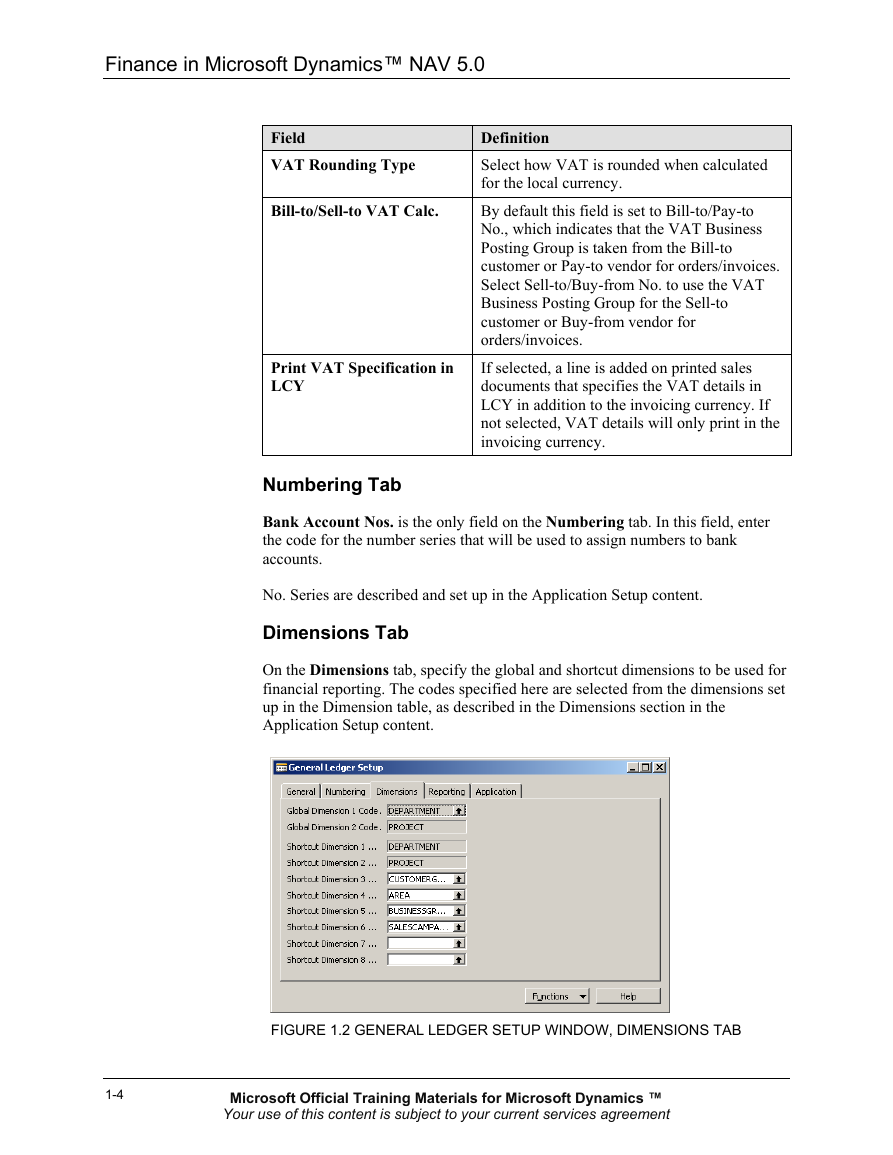

Dimensions Tab

On the Dimensions tab, specify the global and shortcut dimensions to be used for

financial reporting. The codes specified here are selected from the dimensions set

up in the Dimension table, as described in the Dimensions section in the

Application Setup content.

FIGURE 1.2 GENERAL LEDGER SETUP WINDOW, DIMENSIONS TAB

1-4

Microsoft Official Training Materials for Microsoft Dynamics ™ Your use of this content is subject to your current services agreement �

Chapter 1: Financial Management Setup

Global dimensions can be used:

• As filters for G/L entries.

• On all reports, account schedules, and batch jobs.

Determine which two dimensions are likely to be analyzed most frequently and

select these as the two global dimensions.

Shortcut dimensions offer a fast and convenient way to enter dimension

information directly on the line in journals and in sales and purchase documents.

The program automatically creates the first two shortcut dimensions using the

Global Dimensions. The other six shortcut dimensions are available only if

Advanced Dimensions are purchased.

Functions Button

The Functions button on the General Ledger Setup window contains two

functions:

• Change Global Dimensions

• Change Payment Tolerance

Use the Change Global Dimensions batch job to change either one or both of

the global dimensions.

NOTE: Changing a global dimension code requires that the program make

changes to entries already posted. It is important to carefully consider which

dimension codes are designated as global dimension to minimize the need for

future changes.

Use the Change Payment Tolerance batch job to:

• Change either the maximum payment tolerance or the payment

tolerance percentage.

• Filter by currency.

Reporting Tab

The Reporting tab is used to determine if and how additional reporting currency

is used. Additional reporting currency is used when transaction information also

needs to be available in a currency other than local currency.

1-5

Microsoft Official Training Materials for Microsoft Dynamics ™ Your use of this content is subject to your current services agreement �

Finance in Microsoft Dynamics™ NAV 5.0

The fields on the Reporting tab are:

Field

Additional Reporting Currency

Definition

Specify the currency used as an

additional reporting currency in the

General Ledger area. If specified:

• G/L and other entries, including

VAT entries in both LCY, and

additional reporting currency are

automatically recorded.

the additional reporting currency.

VAT Exchange Rate Adjustment Used with the Additional Reporting

• Reports are printed in either LCY or

Currency field, to specify how the

accounts set up for VAT posting in the

VAT Posting Setup table are adjusted for

exchange rate fluctuations between LCY

and the additional reporting currency.

Application Tab

The fields on the Application tab are used to specify:

• Currency rounding tolerance

• How payments are applied to outstanding amounts, including:

– Payments from customers

– Payments to vendors

The Application tab contains the following fields:

Field

Appln. Rounding Precision

Payment Disc. Tolerance Warning,

Payment Disc. Tolerance Posting,

and Payment Discount Grace Period

Definition

Specify the size of the interval allowed

as a rounding difference for LCY

when applying LCY entries to entries

in a different currency.

Complete these fields to allow

tolerance on payment discount terms.

More information concerning payment

discount tolerance is available in the

Receivables Management and

Payables Management sections of the

Finance content.

1-6

Microsoft Official Training Materials for Microsoft Dynamics ™ Your use of this content is subject to your current services agreement �

Chapter 1: Financial Management Setup

Field

Payment Tolerance Warning and

Payment Tolerance Posting

Definition

Complete these fields to close

outstanding receivables and payables

with payment amounts that are

different from what is owed. More

information concerning payment

tolerance is available in the

Receivables Management and

Payables Management sections of the

Finance content.

Matching Activity: General Ledger Setup Window

Task: The following are characteristics of the General Ledger Setup window.

Match the characteristic to the elements on General Ledger Setup window.

_____ 1. Contains only one field.

_____ 2. Prevent entries that can change

prior period data.

_____ 3. Used to specify two globals and

up to eight shortcuts.

_____ 4. A function can be run from this

window to change this.

_____ 5. LCY is the acronym for this.

_____ 6. Determine if and how additional

reporting currency is used.

a. Allow Posting From /

Allow Posting To fields

b. Local Currency

c. Dimensions tab

d. Reporting tab

e. Numbering tab

f. Payment Tolerance

Accounting Periods

Before posting in a fiscal year in Microsoft Dynamics NAV 5.0:

• The fiscal year must be opened.

• Accounting periods must be defined.

The shortest possible accounting period is one day and at least one accounting

period must be set up for each fiscal year.

The Accounting Periods window is used to:

• Open new fiscal years

• Define accounting periods

• Close fiscal years

1-7

Microsoft Official Training Materials for Microsoft Dynamics ™ Your use of this content is subject to your current services agreement �

Finance in Microsoft Dynamics™ NAV 5.0

Accounting periods can be used as a time reference in Microsoft Dynamics NAV

5.0. For example, when reviewing posted entries in a Balance/Budget window,

the length of the accounting period, such as one month or one quarter, is

specified.

In this section, Accounting Periods are set up.

Set up an Accounting Period Manually

Accounting Periods can be created using one of the following methods:

• Manually

• Automatically using the Create Fiscal Year batch job.

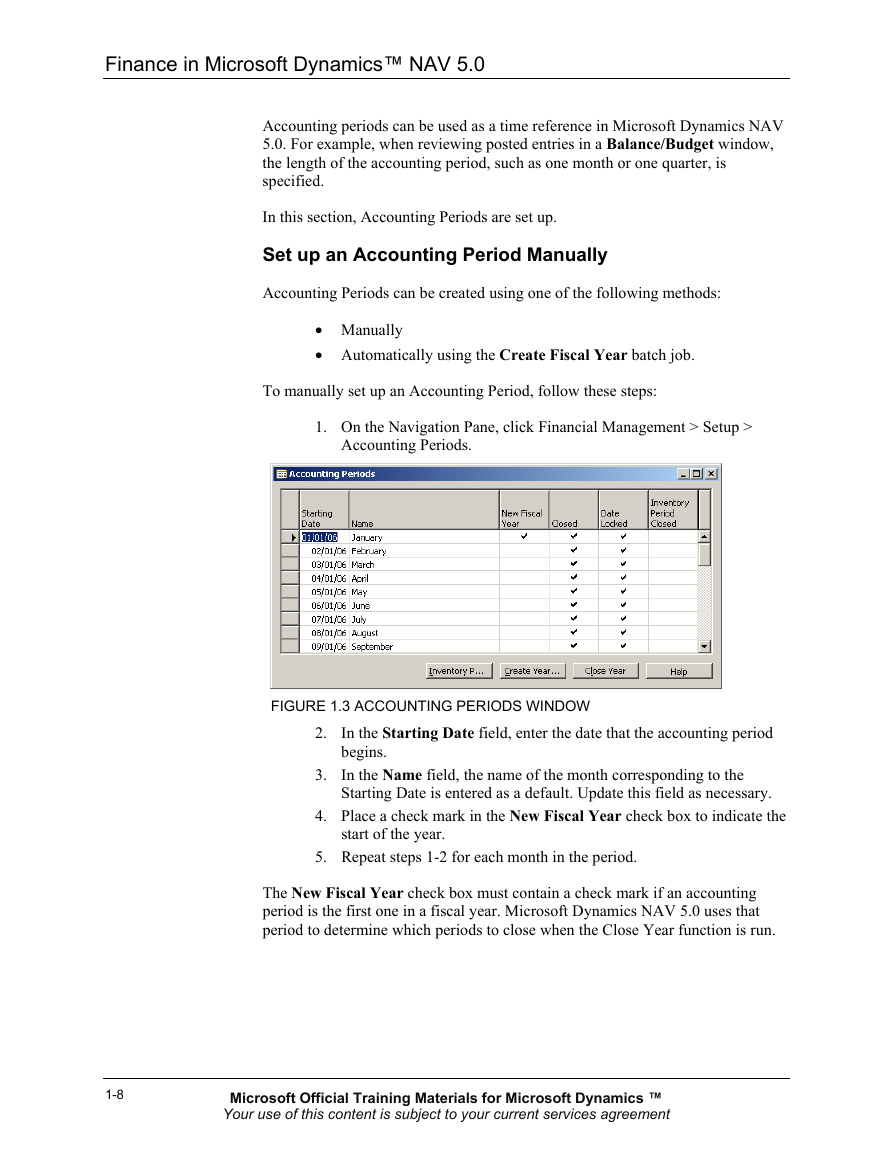

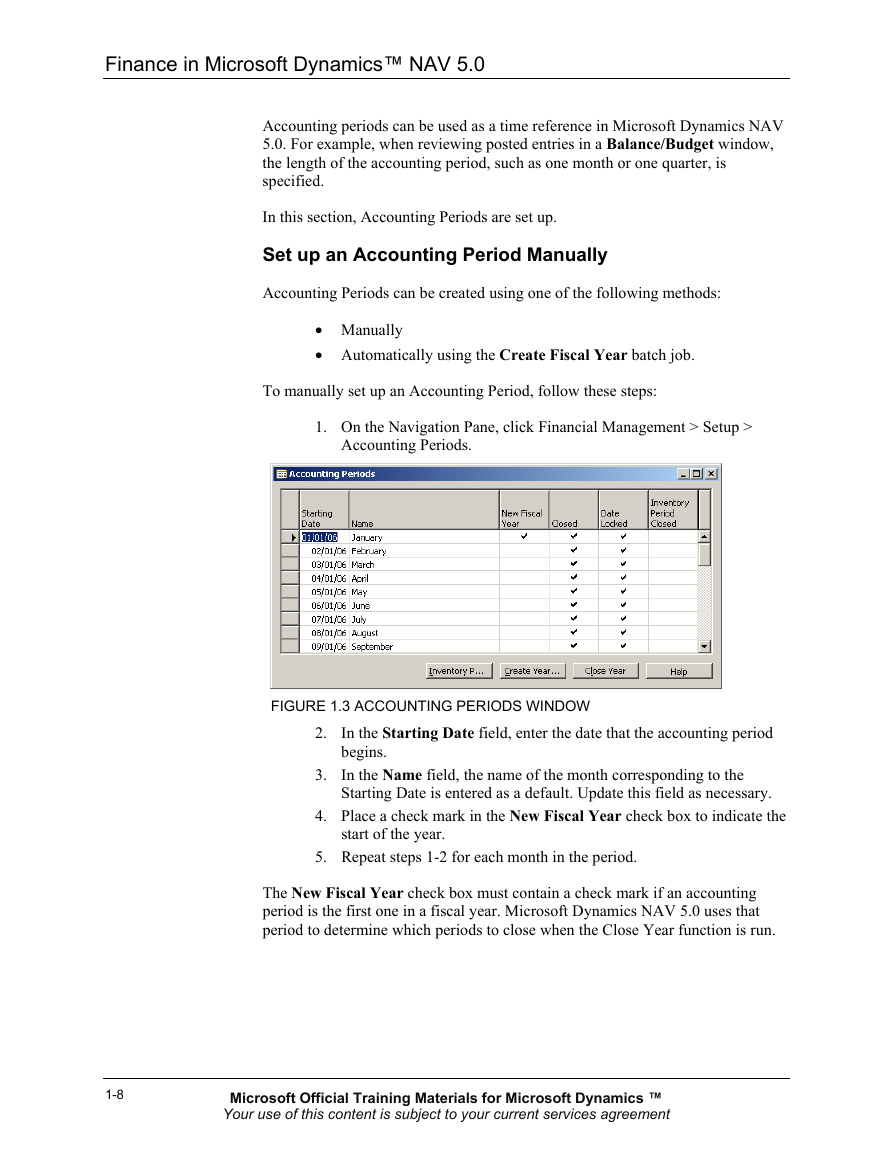

To manually set up an Accounting Period, follow these steps:

1. On the Navigation Pane, click Financial Management > Setup >

Accounting Periods.

FIGURE 1.3 ACCOUNTING PERIODS WINDOW

2. In the Starting Date field, enter the date that the accounting period

begins.

3. In the Name field, the name of the month corresponding to the

Starting Date is entered as a default. Update this field as necessary.

4. Place a check mark in the New Fiscal Year check box to indicate the

start of the year.

5. Repeat steps 1-2 for each month in the period.

The New Fiscal Year check box must contain a check mark if an accounting

period is the first one in a fiscal year. Microsoft Dynamics NAV 5.0 uses that

period to determine which periods to close when the Close Year function is run.

1-8

Microsoft Official Training Materials for Microsoft Dynamics ™ Your use of this content is subject to your current services agreement �

2023年江西萍乡中考道德与法治真题及答案.doc

2023年江西萍乡中考道德与法治真题及答案.doc 2012年重庆南川中考生物真题及答案.doc

2012年重庆南川中考生物真题及答案.doc 2013年江西师范大学地理学综合及文艺理论基础考研真题.doc

2013年江西师范大学地理学综合及文艺理论基础考研真题.doc 2020年四川甘孜小升初语文真题及答案I卷.doc

2020年四川甘孜小升初语文真题及答案I卷.doc 2020年注册岩土工程师专业基础考试真题及答案.doc

2020年注册岩土工程师专业基础考试真题及答案.doc 2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc

2023-2024学年福建省厦门市九年级上学期数学月考试题及答案.doc 2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc

2021-2022学年辽宁省沈阳市大东区九年级上学期语文期末试题及答案.doc 2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc

2022-2023学年北京东城区初三第一学期物理期末试卷及答案.doc 2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc

2018上半年江西教师资格初中地理学科知识与教学能力真题及答案.doc 2012年河北国家公务员申论考试真题及答案-省级.doc

2012年河北国家公务员申论考试真题及答案-省级.doc 2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc

2020-2021学年江苏省扬州市江都区邵樊片九年级上学期数学第一次质量检测试题及答案.doc 2022下半年黑龙江教师资格证中学综合素质真题及答案.doc

2022下半年黑龙江教师资格证中学综合素质真题及答案.doc