February 26, 1982

To the Shareholders of Berkshire Hathaway Inc.:

Operating earnings of $39.7 million in 1981 amounted to

15.2% of beginning equity capital (valuing securities at cost)

compared to 17.8% in 1980. Our new plan that allows stockholders

to designate corporate charitable contributions (detailed later)

reduced earnings by about $900,000 in 1981. This program, which

we expect to continue subject to annual evaluation of our

corporate tax position, had not been initiated in 1980.

Non-Controlled Ownership Earnings

In the 1980 annual report we discussed extensively the

concept of non-controlled ownership earnings, i.e., Berkshire’s

share of the undistributed earnings of companies we don’t control

or significantly influence but in which we, nevertheless, have

important investments. (We will be glad to make available to new

or prospective shareholders copies of that discussion or others

from earlier reports to which we refer in this report.) No

portion of those undistributed earnings is included in the

operating earnings of Berkshire.

However, our belief is that, in aggregate, those

undistributed and, therefore, unrecorded earnings will be

translated into tangible value for Berkshire shareholders just as

surely as if subsidiaries we control had earned, retained - and

reported - similar earnings.

We know that this translation of non-controlled ownership

earnings into corresponding realized and unrealized capital gains

for Berkshire will be extremely irregular as to time of

occurrence. While market values track business values quite well

over long periods, in any given year the relationship can gyrate

capriciously. Market recognition of retained earnings also will

be unevenly realized among companies. It will be disappointingly

low or negative in cases where earnings are employed non-

productively, and far greater than dollar-for-dollar of retained

earnings in cases of companies that achieve high returns with

their augmented capital. Overall, if a group of non-controlled

companies is selected with reasonable skill, the group result

should be quite satisfactory.

In aggregate, our non-controlled business interests have

more favorable underlying economic characteristics than our

controlled businesses. That’s understandable; the area of choice

has been far wider. Small portions of exceptionally good

businesses are usually available in the securities markets at

reasonable prices. But such businesses are available for

purchase in their entirety only rarely, and then almost always at

high prices.

General Acquisition Behavior

As our history indicates, we are comfortable both with total

ownership of businesses and with marketable securities

representing small portions of businesses. We continually look

for ways to employ large sums in each area. (But we try to avoid

small commitments - “If something’s not worth doing at all, it’s

not worth doing well”.) Indeed, the liquidity requirements of our

B

E

R

K

S

H

I

R

E

H

A

T

H

A

W

A

Y

I

N

C

.

�

insurance and trading stamp businesses mandate major investments

in marketable securities.

Our acquisition decisions will be aimed at maximizing real

economic benefits, not at maximizing either managerial domain or

reported numbers for accounting purposes. (In the long run,

managements stressing accounting appearance over economic

substance usually achieve little of either.)

Regardless of the impact upon immediately reportable

earnings, we would rather buy 10% of Wonderful Business T at X

per share than 100% of T at 2X per share. Most corporate

managers prefer just the reverse, and have no shortage of stated

rationales for their behavior.

However, we suspect three motivations - usually unspoken -

to be, singly or in combination, the important ones in most high-

premium takeovers:

(1) Leaders, business or otherwise, seldom are deficient in

animal spirits and often relish increased activity and

challenge. At Berkshire, the corporate pulse never

beats faster than when an acquisition is in prospect.

(2) Most organizations, business or otherwise, measure

themselves, are measured by others, and compensate their

managers far more by the yardstick of size than by any

other yardstick. (Ask a Fortune 500 manager where his

corporation stands on that famous list and, invariably,

the number responded will be from the list ranked by

size of sales; he may well not even know where his

corporation places on the list Fortune just as

faithfully compiles ranking the same 500 corporations by

profitability.)

(3) Many managements apparently were overexposed in

impressionable childhood years to the story in which the

imprisoned handsome prince is released from a toad’s

body by a kiss from a beautiful princess. Consequently,

they are certain their managerial kiss will do wonders

for the profitability of Company T(arget).

Such optimism is essential. Absent that rosy view,

why else should the shareholders of Company A(cquisitor)

want to own an interest in T at the 2X takeover cost

rather than at the X market price they would pay if they

made direct purchases on their own?

In other words, investors can always buy toads at the

going price for toads. If investors instead bankroll

princesses who wish to pay double for the right to kiss

the toad, those kisses had better pack some real

dynamite. We’ve observed many kisses but very few

miracles. Nevertheless, many managerial princesses

remain serenely confident about the future potency of

their kisses - even after their corporate backyards are

knee-deep in unresponsive toads.

In fairness, we should acknowledge that some acquisition

records have been dazzling. Two major categories stand out.

The first involves companies that, through design or

accident, have purchased only businesses that are particularly

well adapted to an inflationary environment. Such favored

business must have two characteristics: (1) an ability to

increase prices rather easily (even when product demand is flat

and capacity is not fully utilized) without fear of significant

loss of either market share or unit volume, and (2) an ability to

accommodate large dollar volume increases in business (often

�

produced more by inflation than by real growth) with only minor

additional investment of capital. Managers of ordinary ability,

focusing solely on acquisition possibilities meeting these tests,

have achieved excellent results in recent decades. However, very

few enterprises possess both characteristics, and competition to

buy those that do has now become fierce to the point of being

self-defeating.

The second category involves the managerial superstars - men

who can recognize that rare prince who is disguised as a toad,

and who have managerial abilities that enable them to peel away

the disguise. We salute such managers as Ben Heineman at

Northwest Industries, Henry Singleton at Teledyne, Erwin Zaban at

National Service Industries, and especially Tom Murphy at Capital

Cities Communications (a real managerial “twofer”, whose

acquisition efforts have been properly focused in Category 1 and

whose operating talents also make him a leader of Category 2).

From both direct and vicarious experience, we recognize the

difficulty and rarity of these executives’ achievements. (So do

they; these champs have made very few deals in recent years, and

often have found repurchase of their own shares to be the most

sensible employment of corporate capital.)

Your Chairman, unfortunately, does not qualify for Category

2. And, despite a reasonably good understanding of the economic

factors compelling concentration in Category 1, our actual

acquisition activity in that category has been sporadic and

inadequate. Our preaching was better than our performance. (We

neglected the Noah principle: predicting rain doesn’t count,

building arks does.)

We have tried occasionally to buy toads at bargain prices

with results that have been chronicled in past reports. Clearly

our kisses fell flat. We have done well with a couple of princes

- but they were princes when purchased. At least our kisses

didn’t turn them into toads. And, finally, we have occasionally

been quite successful in purchasing fractional interests in

easily-identifiable princes at toad-like prices.

Berkshire Acquisition Objectives

We will continue to seek the acquisition of businesses in

their entirety at prices that will make sense, even should the

future of the acquired enterprise develop much along the lines of

its past. We may very well pay a fairly fancy price for a

Category 1 business if we are reasonably confident of what we are

getting. But we will not normally pay a lot in any purchase for

what we are supposed to bring to the party - for we find that we

ordinarily don’t bring a lot.

During 1981 we came quite close to a major purchase

involving both a business and a manager we liked very much.

However, the price finally demanded, considering alternative uses

for the funds involved, would have left our owners worse off than

before the purchase. The empire would have been larger, but the

citizenry would have been poorer.

Although we had no success in 1981, from time to time in the

future we will be able to purchase 100% of businesses meeting our

standards. Additionally, we expect an occasional offering of a

major “non-voting partnership” as discussed under the Pinkerton’s

heading on page 47 of this report. We welcome suggestions

regarding such companies where we, as a substantial junior

partner, can achieve good economic results while furthering the

long-term objectives of present owners and managers.

Currently, we find values most easily obtained through the

open-market purchase of fractional positions in companies with

�

excellent business franchises and competent, honest managements.

We never expect to run these companies, but we do expect to

profit from them.

We expect that undistributed earnings from such companies

will produce full value (subject to tax when realized) for

Berkshire and its shareholders. If they don’t, we have made

mistakes as to either: (1) the management we have elected to

join; (2) the future economics of the business; or (3) the price

we have paid.

We have made plenty of such mistakes - both in the purchase

of non-controlling and controlling interests in businesses.

Category (2) miscalculations are the most common. Of course, it

is necessary to dig deep into our history to find illustrations

of such mistakes - sometimes as deep as two or three months back.

For example, last year your Chairman volunteered his expert

opinion on the rosy future of the aluminum business. Several

minor adjustments to that opinion - now aggregating approximately

180 degrees - have since been required.

For personal as well as more objective reasons, however, we

generally have been able to correct such mistakes far more

quickly in the case of non-controlled businesses (marketable

securities) than in the case of controlled subsidiaries. Lack of

control, in effect, often has turned out to be an economic plus.

As we mentioned last year, the magnitude of our non-recorded

“ownership” earnings has grown to the point where their total is

greater than our reported operating earnings. We expect this

situation will continue. In just four ownership positions in

this category - GEICO Corporation, General Foods Corporation, R.

J. Reynolds Industries, Inc. and The Washington Post Company -

our share of undistributed and therefore unrecorded earnings

probably will total well over $35 million in 1982. The

accounting rules that entirely ignore these undistributed

earnings diminish the utility of our annual return on equity

calculation, or any other single year measure of economic

performance.

Long-Term Corporate Performance

In measuring long-term economic performance, equities held

by our insurance subsidiaries are valued at market subject to a

charge reflecting the amount of taxes that would have to be paid

if unrealized gains were actually realized. If we are correct in

the premise stressed in the preceding section of this report, our

unreported ownership earnings will find their way, irregularly

but inevitably, into our net worth. To date, this has been the

case.

An even purer calculation of performance would involve a

valuation of bonds and non-insurance held equities at market.

However, GAAP accounting does not prescribe this procedure, and

the added purity would change results only very slightly. Should

any valuation difference widen to significant proportions, as it

has at most major insurance companies, we will report its effect

to you.

On a GAAP basis, during the present management’s term of

seventeen years, book value has increased from $19.46 per share

to $526.02 per share, or 21.1% compounded annually. This rate of

return number is highly likely to drift downward in future years.

We hope, however, that it can be maintained significantly above

the rate of return achieved by the average large American

corporation.

Over half of the large gain in Berkshire’s net worth during

�

1981 - it totaled $124 million, or about 31% - resulted from the

market performance of a single investment, GEICO Corporation. In

aggregate, our market gain from securities during the year

considerably outstripped the gain in underlying business values.

Such market variations will not always be on the pleasant side.

In past reports we have explained how inflation has caused

our apparently satisfactory long-term corporate performance to be

illusory as a measure of true investment results for our owners.

We applaud the efforts of Federal Reserve Chairman Volcker and

note the currently more moderate increases in various price

indices. Nevertheless, our views regarding long-term

inflationary trends are as negative as ever. Like virginity, a

stable price level seems capable of maintenance, but not of

restoration.

Despite the overriding importance of inflation in the

investment equation, we will not punish you further with another

full recital of our views; inflation itself will be punishment

enough. (Copies of previous discussions are available for

masochists.) But, because of the unrelenting destruction of

currency values, our corporate efforts will continue to do a much

better job of filling your wallet than of filling your stomach.

Equity Value-Added

An additional factor should further subdue any residual

enthusiasm you may retain regarding our long-term rate of return.

The economic case justifying equity investment is that, in

aggregate, additional earnings above passive investment returns -

interest on fixed-income securities - will be derived through the

employment of managerial and entrepreneurial skills in

conjunction with that equity capital. Furthermore, the case says

that since the equity capital position is associated with greater

risk than passive forms of investment, it is “entitled” to higher

returns. A “value-added” bonus from equity capital seems natural

and certain.

But is it? Several decades back, a return on equity of as

little as 10% enabled a corporation to be classified as a “good”

business - i.e., one in which a dollar reinvested in the business

logically could be expected to be valued by the market at more

than one hundred cents. For, with long-term taxable bonds

yielding 5% and long-term tax-exempt bonds 3%, a business

operation that could utilize equity capital at 10% clearly was

worth some premium to investors over the equity capital employed.

That was true even though a combination of taxes on dividends and

on capital gains would reduce the 10% earned by the corporation

to perhaps 6%-8% in the hands of the individual investor.

Investment markets recognized this truth. During that

earlier period, American business earned an average of 11% or so

on equity capital employed and stocks, in aggregate, sold at

valuations far above that equity capital (book value), averaging

over 150 cents on the dollar. Most businesses were “good”

businesses because they earned far more than their keep (the

return on long-term passive money). The value-added produced by

equity investment, in aggregate, was substantial.

That day is gone. But the lessons learned during its

existence are difficult to discard. While investors and managers

must place their feet in the future, their memories and nervous

systems often remain plugged into the past. It is much easier

for investors to utilize historic p/e ratios or for managers to

utilize historic business valuation yardsticks than it is for

either group to rethink their premises daily. When change is

slow, constant rethinking is actually undesirable; it achieves

little and slows response time. But when change is great,

�

yesterday’s assumptions can be retained only at great cost. And

the pace of economic change has become breathtaking.

During the past year, long-term taxable bond yields exceeded

16% and long-term tax-exempts 14%. The total return achieved

from such tax-exempts, of course, goes directly into the pocket

of the individual owner. Meanwhile, American business is

producing earnings of only about 14% on equity. And this 14%

will be substantially reduced by taxation before it can be banked

by the individual owner. The extent of such shrinkage depends

upon the dividend policy of the corporation and the tax rates

applicable to the investor.

Thus, with interest rates on passive investments at late

1981 levels, a typical American business is no longer worth one

hundred cents on the dollar to owners who are individuals. (If

the business is owned by pension funds or other tax-exempt

investors, the arithmetic, although still unenticing, changes

substantially for the better.) Assume an investor in a 50% tax

bracket; if our typical company pays out all earnings, the income

return to the investor will be equivalent to that from a 7% tax-

exempt bond. And, if conditions persist - if all earnings are

paid out and return on equity stays at 14% - the 7% tax-exempt

equivalent to the higher-bracket individual investor is just as

frozen as is the coupon on a tax-exempt bond. Such a perpetual

7% tax-exempt bond might be worth fifty cents on the dollar as

this is written.

If, on the other hand, all earnings of our typical American

business are retained and return on equity again remains

constant, earnings will grow at 14% per year. If the p/e ratio

remains constant, the price of our typical stock will also grow

at 14% per year. But that 14% is not yet in the pocket of the

shareholder. Putting it there will require the payment of a

capital gains tax, presently assessed at a maximum rate of 20%.

This net return, of course, works out to a poorer rate of return

than the currently available passive after-tax rate.

Unless passive rates fall, companies achieving 14% per year

gains in earnings per share while paying no cash dividend are an

economic failure for their individual shareholders. The returns

from passive capital outstrip the returns from active capital.

This is an unpleasant fact for both investors and corporate

managers and, therefore, one they may wish to ignore. But facts

do not cease to exist, either because they are unpleasant or

because they are ignored.

Most American businesses pay out a significant portion of

their earnings and thus fall between the two examples. And most

American businesses are currently “bad” businesses economically -

producing less for their individual investors after-tax than the

tax-exempt passive rate of return on money. Of course, some

high-return businesses still remain attractive, even under

present conditions. But American equity capital, in aggregate,

produces no value-added for individual investors.

It should be stressed that this depressing situation does

not occur because corporations are jumping, economically, less

high than previously. In fact, they are jumping somewhat higher:

return on equity has improved a few points in the past decade.

But the crossbar of passive return has been elevated much faster.

Unhappily, most companies can do little but hope that the bar

will be lowered significantly; there are few industries in which

the prospects seem bright for substantial gains in return on

equity.

Inflationary experience and expectations will be major (but

not the only) factors affecting the height of the crossbar in

future years. If the causes of long-term inflation can be

�

tempered, passive returns are likely to fall and the intrinsic

position of American equity capital should significantly improve.

Many businesses that now must be classified as economically “bad”

would be restored to the “good” category under such

circumstances.

A further, particularly ironic, punishment is inflicted by

an inflationary environment upon the owners of the “bad”

business. To continue operating in its present mode, such a low-

return business usually must retain much of its earnings - no

matter what penalty such a policy produces for shareholders.

Reason, of course, would prescribe just the opposite policy.

An individual, stuck with a 5% bond with many years to run before

maturity, does not take the coupons from that bond and pay one

hundred cents on the dollar for more 5% bonds while similar bonds

are available at, say, forty cents on the dollar. Instead, he

takes those coupons from his low-return bond and - if inclined to

reinvest - looks for the highest return with safety currently

available. Good money is not thrown after bad.

What makes sense for the bondholder makes sense for the

shareholder. Logically, a company with historic and prospective

high returns on equity should retain much or all of its earnings

so that shareholders can earn premium returns on enhanced

capital. Conversely, low returns on corporate equity would

suggest a very high dividend payout so that owners could direct

capital toward more attractive areas. (The Scriptures concur. In

the parable of the talents, the two high-earning servants are

rewarded with 100% retention of earnings and encouraged to expand

their operations. However, the non-earning third servant is not

only chastised - “wicked and slothful” - but also is required to

redirect all of his capital to the top performer. Matthew 25:

14-30)

But inflation takes us through the looking glass into the

upside-down world of Alice in Wonderland. When prices

continuously rise, the “bad” business must retain every nickel

that it can. Not because it is attractive as a repository for

equity capital, but precisely because it is so unattractive, the

low-return business must follow a high retention policy. If it

wishes to continue operating in the future as it has in the past

- and most entities, including businesses, do - it simply has no

choice.

For inflation acts as a gigantic corporate tapeworm. That

tapeworm preemptively consumes its requisite daily diet of

investment dollars regardless of the health of the host organism.

Whatever the level of reported profits (even if nil), more

dollars for receivables, inventory and fixed assets are

continuously required by the business in order to merely match

the unit volume of the previous year. The less prosperous the

enterprise, the greater the proportion of available sustenance

claimed by the tapeworm.

Under present conditions, a business earning 8% or 10% on

equity often has no leftovers for expansion, debt reduction or

“real” dividends. The tapeworm of inflation simply cleans the

plate. (The low-return company’s inability to pay dividends,

understandably, is often disguised. Corporate America

increasingly is turning to dividend reinvestment plans, sometimes

even embodying a discount arrangement that all but forces

shareholders to reinvest. Other companies sell newly issued

shares to Peter in order to pay dividends to Paul. Beware of

“dividends” that can be paid out only if someone promises to

replace the capital distributed.)

Berkshire continues to retain its earnings for offensive,

not defensive or obligatory, reasons. But in no way are we

�

immune from the pressures that escalating passive returns exert

on equity capital. We continue to clear the crossbar of after-

tax passive return - but barely. Our historic 21% return - not

at all assured for the future - still provides, after the current

capital gain tax rate (which we expect to rise considerably in

future years), a modest margin over current after-tax rates on

passive money. It would be a bit humiliating to have our

corporate value-added turn negative. But it can happen here as

it has elsewhere, either from events outside anyone’s control or

from poor relative adaptation on our part.

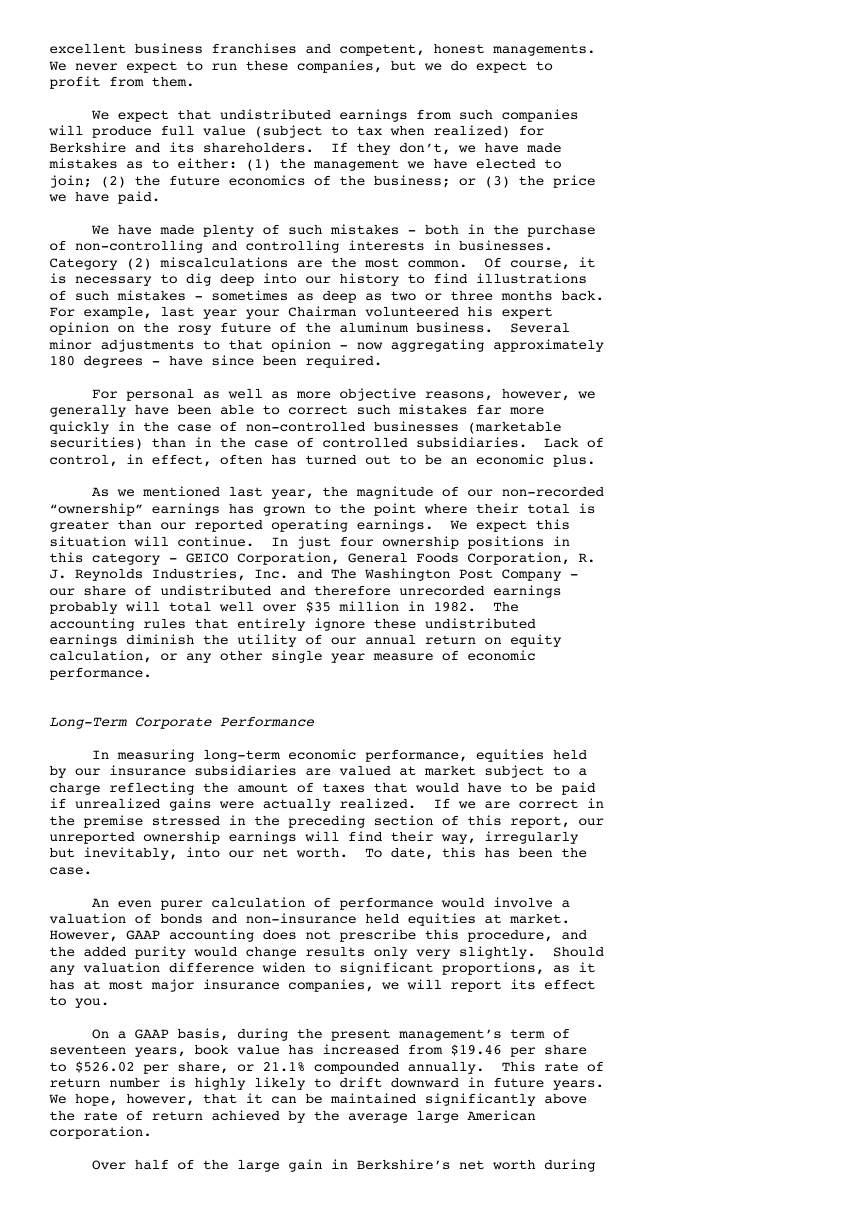

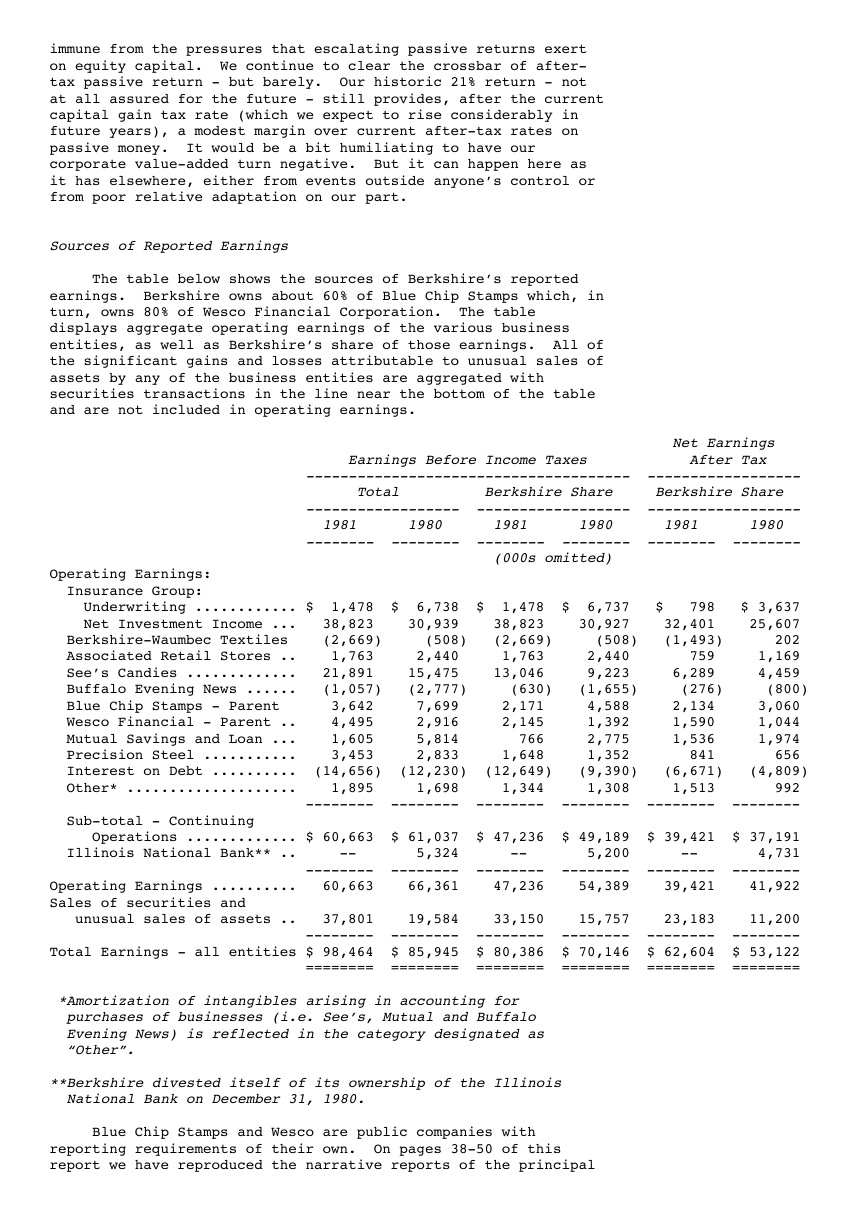

Sources of Reported Earnings

The table below shows the sources of Berkshire’s reported

earnings. Berkshire owns about 60% of Blue Chip Stamps which, in

turn, owns 80% of Wesco Financial Corporation. The table

displays aggregate operating earnings of the various business

entities, as well as Berkshire’s share of those earnings. All of

the significant gains and losses attributable to unusual sales of

assets by any of the business entities are aggregated with

securities transactions in the line near the bottom of the table

and are not included in operating earnings.

Net Earnings

Earnings Before Income Taxes After Tax

-------------------------------------- ------------------

Total Berkshire Share Berkshire Share

------------------ ------------------ ------------------

1981 1980 1981 1980 1981 1980

-------- -------- -------- -------- -------- --------

(000s omitted)

Operating Earnings:

Insurance Group:

Underwriting ............ $ 1,478 $ 6,738 $ 1,478 $ 6,737 $ 798 $ 3,637

Net Investment Income ... 38,823 30,939 38,823 30,927 32,401 25,607

Berkshire-Waumbec Textiles (2,669) (508) (2,669) (508) (1,493) 202

Associated Retail Stores .. 1,763 2,440 1,763 2,440 759 1,169

See’s Candies ............. 21,891 15,475 13,046 9,223 6,289 4,459

Buffalo Evening News ...... (1,057) (2,777) (630) (1,655) (276) (800)

Blue Chip Stamps - Parent 3,642 7,699 2,171 4,588 2,134 3,060

Wesco Financial - Parent .. 4,495 2,916 2,145 1,392 1,590 1,044

Mutual Savings and Loan ... 1,605 5,814 766 2,775 1,536 1,974

Precision Steel ........... 3,453 2,833 1,648 1,352 841 656

Interest on Debt .......... (14,656) (12,230) (12,649) (9,390) (6,671) (4,809)

Other* .................... 1,895 1,698 1,344 1,308 1,513 992

-------- -------- -------- -------- -------- --------

Sub-total - Continuing

Operations ............. $ 60,663 $ 61,037 $ 47,236 $ 49,189 $ 39,421 $ 37,191

Illinois National Bank** .. -- 5,324 -- 5,200 -- 4,731

-------- -------- -------- -------- -------- --------

Operating Earnings .......... 60,663 66,361 47,236 54,389 39,421 41,922

Sales of securities and

unusual sales of assets .. 37,801 19,584 33,150 15,757 23,183 11,200

-------- -------- -------- -------- -------- --------

Total Earnings - all entities $ 98,464 $ 85,945 $ 80,386 $ 70,146 $ 62,604 $ 53,122

======== ======== ======== ======== ======== ========

*Amortization of intangibles arising in accounting for

purchases of businesses (i.e. See’s, Mutual and Buffalo

Evening News) is reflected in the category designated as

“Other”.

**Berkshire divested itself of its ownership of the Illinois

National Bank on December 31, 1980.

Blue Chip Stamps and Wesco are public companies with

reporting requirements of their own. On pages 38-50 of this

report we have reproduced the narrative reports of the principal

�