To the Shareholders of Berkshire Hathaway Inc.:

Again, we must lead off with a few words about accounting.

Since our last annual report, the accounting profession has

decided that equity securities owned by insurance companies must

be carried on the balance sheet at market value. We previously

have carried such equity securities at the lower of aggregate

cost or aggregate market value. Because we have large unrealized

gains in our insurance equity holdings, the result of this new

policy is to increase substantially both the 1978 and 1979

yearend net worth, even after the appropriate liability is

established for taxes on capital gains that would be payable

should equities be sold at such market valuations.

As you know, Blue Chip Stamps, our 60% owned subsidiary, is

fully consolidated in Berkshire Hathaway’s financial statements.

However, Blue Chip still is required to carry its equity

investments at the lower of aggregate cost or aggregate market

value, just as Berkshire Hathaway’s insurance subsidiaries did

prior to this year. Should the same equities be purchased at an

identical price by an insurance subsidiary of Berkshire Hathaway

and by Blue Chip Stamps, present accounting principles often

would require that they end up carried on our consolidated

balance sheet at two different values. (That should keep you on

your toes.) Market values of Blue Chip Stamps’ equity holdings

are given in footnote 3 on page 18.

1979 Operating Results

We continue to feel that the ratio of operating earnings

(before securities gains or losses) to shareholders’ equity with

all securities valued at cost is the most appropriate way to

measure any single year’s operating performance.

Measuring such results against shareholders’ equity with

securities valued at market could significantly distort the

operating performance percentage because of wide year-to-year

market value changes in the net worth figure that serves as the

denominator. For example, a large decline in securities values

could result in a very low “market value” net worth that, in

turn, could cause mediocre operating earnings to look

unrealistically good. Alternatively, the more successful that

equity investments have been, the larger the net worth base

becomes and the poorer the operating performance figure appears.

Therefore, we will continue to report operating performance

measured against beginning net worth, with securities valued at

cost.

On this basis, we had a reasonably good operating

performance in 1979 - but not quite as good as that of 1978 -

with operating earnings amounting to 18.6% of beginning net

worth. Earnings per share, of course, increased somewhat (about

20%) but we regard this as an improper figure upon which to

focus. We had substantially more capital to work with in 1979

than in 1978, and our performance in utilizing that capital fell

short of the earlier year, even though per-share earnings rose.

“Earnings per share” will rise constantly on a dormant savings

account or on a U.S. Savings Bond bearing a fixed rate of return

simply because “earnings” (the stated interest rate) are

continuously plowed back and added to the capital base. Thus,

even a “stopped clock” can look like a growth stock if the

dividend payout ratio is low.

The primary test of managerial economic performance is the

achievement of a high earnings rate on equity capital employed

B

E

R

K

S

H

I

R

E

H

A

T

H

A

W

A

Y

I

N

C

.

�

(without undue leverage, accounting gimmickry, etc.) and not the

achievement of consistent gains in earnings per share. In our

view, many businesses would be better understood by their

shareholder owners, as well as the general public, if managements

and financial analysts modified the primary emphasis they place

upon earnings per share, and upon yearly changes in that figure.

Long Term Results

In measuring long term economic performance - in contrast to

yearly performance - we believe it is appropriate to recognize

fully any realized capital gains or losses as well as

extraordinary items, and also to utilize financial statements

presenting equity securities at market value. Such capital gains

or losses, either realized or unrealized, are fully as important

to shareholders over a period of years as earnings realized in a

more routine manner through operations; it is just that their

impact is often extremely capricious in the short run, a

characteristic that makes them inappropriate as an indicator of

single year managerial performance.

The book value per share of Berkshire Hathaway on September

30, 1964 (the fiscal yearend prior to the time that your present

management assumed responsibility) was $19.46 per share. At

yearend 1979, book value with equity holdings carried at market

value was $335.85 per share. The gain in book value comes to

20.5% compounded annually. This figure, of course, is far higher

than any average of our yearly operating earnings calculations,

and reflects the importance of capital appreciation of insurance

equity investments in determining the overall results for our

shareholders. It probably also is fair to say that the quoted

book value in 1964 somewhat overstated the intrinsic value of the

enterprise, since the assets owned at that time on either a going

concern basis or a liquidating value basis were not worth 100

cents on the dollar. (The liabilities were solid, however.)

We have achieved this result while utilizing a low amount of

leverage (both financial leverage measured by debt to equity, and

operating leverage measured by premium volume to capital funds of

our insurance business), and also without significant issuance or

repurchase of shares. Basically, we have worked with the capital

with which we started. From our textile base we, or our Blue

Chip and Wesco subsidiaries, have acquired total ownership of

thirteen businesses through negotiated purchases from private

owners for cash, and have started six others. (It’s worth a

mention that those who have sold to us have, almost without

exception, treated us with exceptional honor and fairness, both

at the time of sale and subsequently.)

But before we drown in a sea of self-congratulation, a

further - and crucial - observation must be made. A few years

ago, a business whose per-share net worth compounded at 20%

annually would have guaranteed its owners a highly successful

real investment return. Now such an outcome seems less certain.

For the inflation rate, coupled with individual tax rates, will

be the ultimate determinant as to whether our internal operating

performance produces successful investment results - i.e., a

reasonable gain in purchasing power from funds committed - for

you as shareholders.

Just as the original 3% savings bond, a 5% passbook savings

account or an 8% U.S. Treasury Note have, in turn, been

transformed by inflation into financial instruments that chew up,

rather than enhance, purchasing power over their investment

lives, a business earning 20% on capital can produce a negative

real return for its owners under inflationary conditions not much

more severe than presently prevail.

If we should continue to achieve a 20% compounded gain - not

�

an easy or certain result by any means - and this gain is

translated into a corresponding increase in the market value of

Berkshire Hathaway stock as it has been over the last fifteen

years, your after-tax purchasing power gain is likely to be very

close to zero at a 14% inflation rate. Most of the remaining six

percentage points will go for income tax any time you wish to

convert your twenty percentage points of nominal annual gain into

cash.

That combination - the inflation rate plus the percentage of

capital that must be paid by the owner to transfer into his own

pocket the annual earnings achieved by the business (i.e.,

ordinary income tax on dividends and capital gains tax on

retained earnings) - can be thought of as an “investor’s misery

index”. When this index exceeds the rate of return earned on

equity by the business, the investor’s purchasing power (real

capital) shrinks even though he consumes nothing at all. We have

no corporate solution to this problem; high inflation rates will

not help us earn higher rates of return on equity.

One friendly but sharp-eyed commentator on Berkshire has

pointed out that our book value at the end of 1964 would have

bought about one-half ounce of gold and, fifteen years later,

after we have plowed back all earnings along with much blood,

sweat and tears, the book value produced will buy about the same

half ounce. A similar comparison could be drawn with Middle

Eastern oil. The rub has been that government has been

exceptionally able in printing money and creating promises, but

is unable to print gold or create oil.

We intend to continue to do as well as we can in managing

the internal affairs of the business. But you should understand

that external conditions affecting the stability of currency may

very well be the most important factor in determining whether

there are any real rewards from your investment in Berkshire

Hathaway.

Sources of Earnings

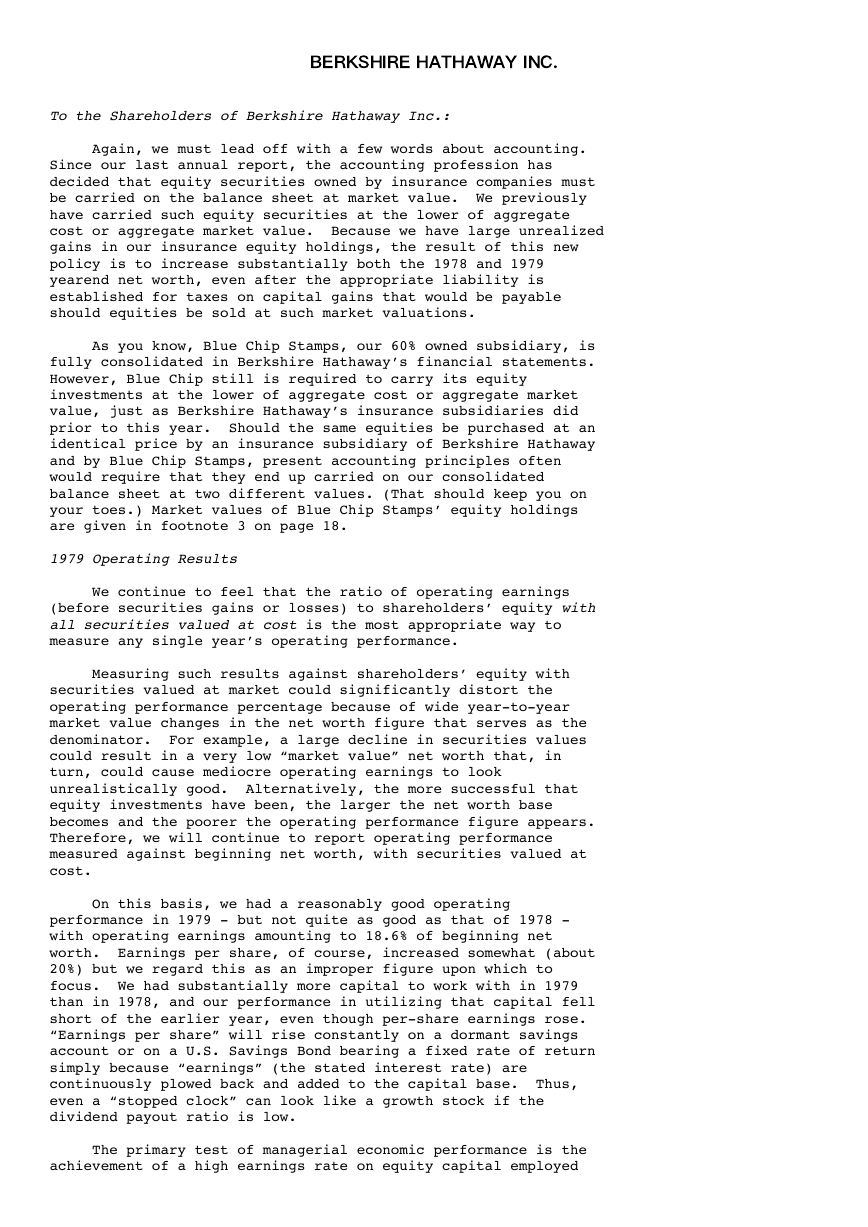

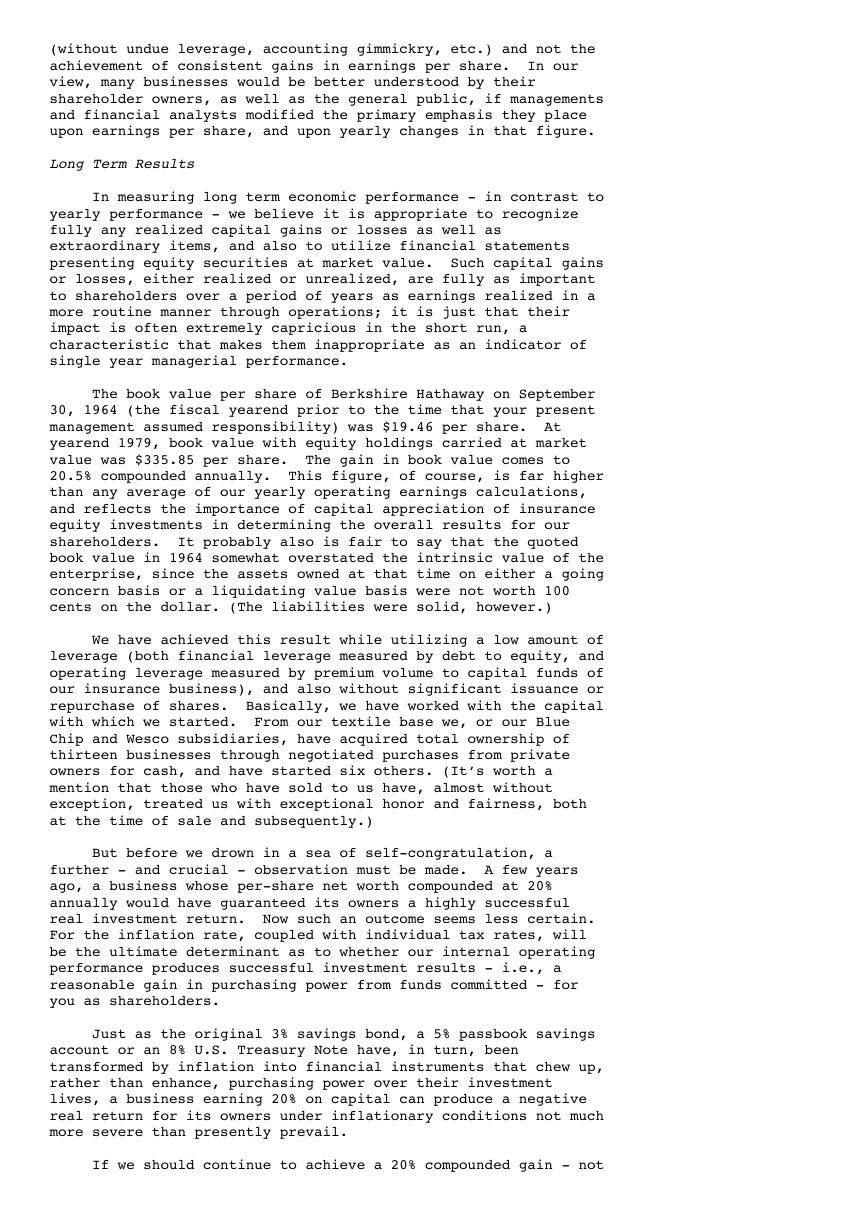

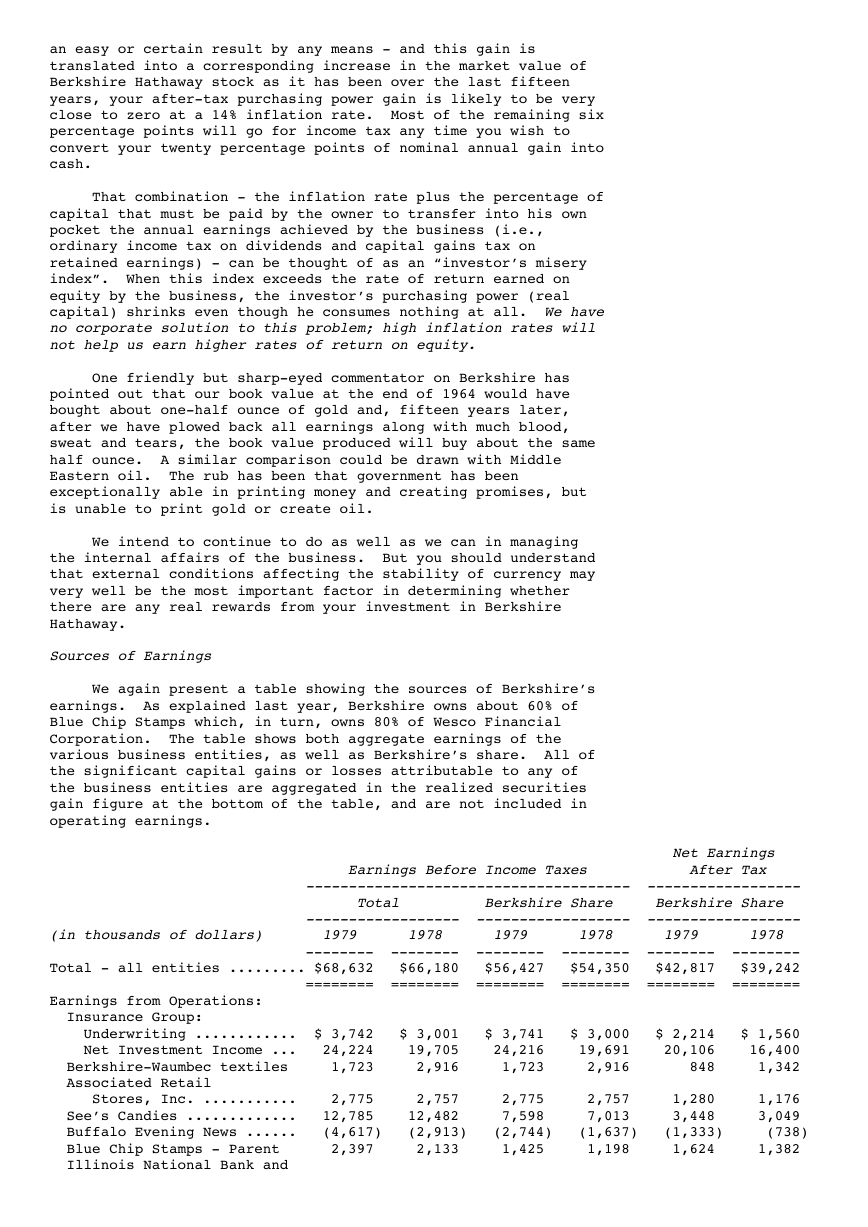

We again present a table showing the sources of Berkshire’s

earnings. As explained last year, Berkshire owns about 60% of

Blue Chip Stamps which, in turn, owns 80% of Wesco Financial

Corporation. The table shows both aggregate earnings of the

various business entities, as well as Berkshire’s share. All of

the significant capital gains or losses attributable to any of

the business entities are aggregated in the realized securities

gain figure at the bottom of the table, and are not included in

operating earnings.

Net Earnings

Earnings Before Income Taxes After Tax

-------------------------------------- ------------------

Total Berkshire Share Berkshire Share

------------------ ------------------ ------------------

(in thousands of dollars) 1979 1978 1979 1978 1979 1978

-------- -------- -------- -------- -------- --------

Total - all entities ......... $68,632 $66,180 $56,427 $54,350 $42,817 $39,242

======== ======== ======== ======== ======== ========

Earnings from Operations:

Insurance Group:

Underwriting ............ $ 3,742 $ 3,001 $ 3,741 $ 3,000 $ 2,214 $ 1,560

Net Investment Income ... 24,224 19,705 24,216 19,691 20,106 16,400

Berkshire-Waumbec textiles 1,723 2,916 1,723 2,916 848 1,342

Associated Retail

Stores, Inc. ........... 2,775 2,757 2,775 2,757 1,280 1,176

See’s Candies ............. 12,785 12,482 7,598 7,013 3,448 3,049

Buffalo Evening News ...... (4,617) (2,913) (2,744) (1,637) (1,333) (738)

Blue Chip Stamps - Parent 2,397 2,133 1,425 1,198 1,624 1,382

Illinois National Bank and

�

Trust Company .......... 5,747 4,822 5,614 4,710 5,027 4,262

Wesco Financial

Corporation - Parent ... 2,413 1,771 1,098 777 937 665

Mutual Savings and Loan

Association ............ 10,447 10,556 4,751 4,638 3,261 3,042

Precision Steel ........... 3,254 -- 1,480 -- 723 --

Interest on Debt .......... (8,248) (5,566) (5,860) (4,546) (2,900) (2,349)

Other ..................... 1,342 720 996 438 753 261

-------- -------- -------- -------- -------- --------

Total Earnings from

Operations .......... $57,984 $52,384 $46,813 $40,955 $35,988 $30,052

Realized Securities Gain 10,648 13,796 9,614 13,395 6,829 9,190

-------- -------- -------- -------- -------- --------

Total Earnings ......... $68,632 $66,180 $56,427 $54,350 $42,817 $39,242

======== ======== ======== ======== ======== ========

Blue Chip and Wesco are public companies with reporting

requirements of their own. On pages 37-43 of this report, we

have reproduced the narrative reports of the principal executives

of both companies, in which they describe 1979 operations. Some

of the numbers they mention in their reports are not precisely

identical to those in the above table because of accounting and

tax complexities. (The Yanomamo Indians employ only three

numbers: one, two, and more than two. Maybe their time will

come.) However, the commentary in those reports should be helpful

to you in understanding the underlying economic characteristics

and future prospects of the important businesses that they

manage.

A copy of the full annual report of either company will be

mailed to any shareholder of Berkshire upon request to Mr.

Robert H. Bird for Blue Chip Stamps, 5801 South Eastern Avenue,

Los Angeles, California 90040, or to Mrs. Bette Deckard for Wesco

Financial Corporation, 315 East Colorado Boulevard, Pasadena,

California 91109.

Textiles and Retailing

The relative significance of these two areas has diminished

somewhat over the years as our insurance business has grown

dramatically in size and earnings. Ben Rosner, at Associated

Retail Stores, continues to pull rabbits out of the hat - big

rabbits from a small hat. Year after year, he produces very

large earnings relative to capital employed - realized in cash

and not in increased receivables and inventories as in many other

retail businesses - in a segment of the market with little growth

and unexciting demographics. Ben is now 76 and, like our other

“up-and-comers”, Gene Abegg, 82, at Illinois National and Louis

Vincenti, 74, at Wesco, regularly achieves more each year.

Our textile business also continues to produce some cash,

but at a low rate compared to capital employed. This is not a

reflection on the managers, but rather on the industry in which

they operate. In some businesses - a network TV station, for

example - it is virtually impossible to avoid earning

extraordinary returns on tangible capital employed in the

business. And assets in such businesses sell at equally

extraordinary prices, one thousand cents or more on the dollar, a

valuation reflecting the splendid, almost unavoidable, economic

results obtainable. Despite a fancy price tag, the “easy”

business may be the better route to go.

We can speak from experience, having tried the other route.

Your Chairman made the decision a few years ago to purchase

Waumbec Mills in Manchester, New Hampshire, thereby expanding our

textile commitment. By any statistical test, the purchase price

was an extraordinary bargain; we bought well below the working

capital of the business and, in effect, got very substantial

amounts of machinery and real estate for less than nothing. But

�

the purchase was a mistake. While we labored mightily, new

problems arose as fast as old problems were tamed.

Both our operating and investment experience cause us to

conclude that “turnarounds” seldom turn, and that the same

energies and talent are much better employed in a good business

purchased at a fair price than in a poor business purchased at a

bargain price. Although a mistake, the Waumbec acquisition has

not been a disaster. Certain portions of the operation are

proving to be valuable additions to our decorator line (our

strongest franchise) at New Bedford, and it’s possible that we

may be able to run profitably on a considerably reduced scale at

Manchester. However, our original rationale did not prove out.

Insurance Underwriting

We predicted last year that the combined underwriting ratio

(see definition on page 36) for the insurance industry would

“move up at least a few points, perhaps enough to throw the

industry as a whole into an underwriting loss position”. That is

just about the way it worked out. The industry underwriting

ratio rose in 1979 over three points, from roughly 97.4% to

100.7%. We also said that we thought our underwriting performance

relative to the industry would improve somewhat in 1979 and,

again, things worked out as expected. Our own underwriting ratio

actually decreased from 98.2% to 97.1%. Our forecast for 1980 is

similar in one respect; again we feel that the industry’s

performance will worsen by at least another few points. However,

this year we have no reason to think that our performance

relative to the industry will further improve. (Don’t worry - we

won’t hold back to try to validate that forecast.)

Really extraordinary results were turned in by the portion

of National Indemnity Company’s insurance operation run by Phil

Liesche. Aided by Roland Miller in Underwriting and Bill Lyons

in Claims, this section of the business produced an underwriting

profit of $8.4 million on about $82 million of earned premiums.

Only a very few companies in the entire industry produced a

result comparable to this.

You will notice that earned premiums in this segment were

down somewhat from those of 1978. We hear a great many insurance

managers talk about being willing to reduce volume in order to

underwrite profitably, but we find that very few actually do so.

Phil Liesche is an exception: if business makes sense, he writes

it; if it doesn’t, he rejects it. It is our policy not to lay

off people because of the large fluctuations in work load

produced by such voluntary volume changes. We would rather have

some slack in the organization from time to time than keep

everyone terribly busy writing business on which we are going to

lose money. Jack Ringwalt, the founder of National Indemnity

Company, instilled this underwriting discipline at the inception

of the company, and Phil Liesche never has wavered in maintaining

it. We believe such strong-mindedness is as rare as it is sound

- and absolutely essential to the running of a first-class

casualty insurance operation.

John Seward continues to make solid progress at Home and

Automobile Insurance Company, in large part by significantly

expanding the marketing scope of that company in general

liability lines. These lines can be dynamite, but the record to

date is excellent and, in John McGowan and Paul Springman, we

have two cautious liability managers extending our capabilities.

Our reinsurance division, led by George Young, continues to

give us reasonably satisfactory overall results after allowing

for investment income, but underwriting performance remains

unsatisfactory. We think the reinsurance business is a very

tough business that is likely to get much tougher. In fact, the

�

influx of capital into the business and the resulting softer

price levels for continually increasing exposures may well

produce disastrous results for many entrants (of which they may

be blissfully unaware until they are in over their heads; much

reinsurance business involves an exceptionally “long tail”, a

characteristic that allows catastrophic current loss experience

to fester undetected for many years). It will be hard for us to

be a whole lot smarter than the crowd and thus our reinsurance

activity may decline substantially during the projected prolonged

period of extraordinary competition.

The Homestate operation was disappointing in 1979.

Excellent results again were turned in by George Billings at

Texas United Insurance Company, winner of the annual award for

the low loss ratio among Homestate companies, and Floyd Taylor at

Kansas Fire and Casualty Company. But several of the other

operations, particularly Cornhusker Casualty Company, our first

and largest Homestate operation and historically a winner, had

poor underwriting results which were accentuated by data

processing, administrative and personnel problems. We have made

some major mistakes in reorganizing our data processing

activities, and those mistakes will not be cured immediately or

without cost. However, John Ringwalt has thrown himself into the

task of getting things straightened out and we have confidence

that he, aided by several strong people who recently have been

brought aboard, will succeed.

Our performance in Worker’s Compensation was far, far better

than we had any right to expect at the beginning of 1979. We had

a very favorable climate in California for the achievement of

good results but, beyond this, Milt Thornton at Cypress Insurance

Company and Frank DeNardo at National Indemnity’s California

Worker’s Compensation operation both performed in a simply

outstanding manner. We have admitted - and with good reason -

some mistakes on the acquisition front, but the Cypress purchase

has turned out to be an absolute gem. Milt Thornton, like Phil

Liesche, follows the policy of sticking with business that he

understands and wants, without giving consideration to the impact

on volume. As a result, he has an outstanding book of business

and an exceptionally well functioning group of employees. Frank

DeNardo has straightened out the mess he inherited in Los Angeles

in a manner far beyond our expectations, producing savings

measured in seven figures. He now can begin to build on a sound

base.

At yearend we entered the specialized area of surety

reinsurance under the management of Chet Noble. At least

initially, this operation will be relatively small since our

policy will be to seek client companies who appreciate the need

for a long term “partnership” relationship with their reinsurers.

We are pleased by the quality of the insurers we have attracted,

and hope to add several more of the best primary writers as our

financial strength and stability become better known in the

surety field.

The conventional wisdom is that insurance underwriting

overall will be poor in 1980, but that rates will start to firm

in a year or so, leading to a turn in the cycle some time in

1981. We disagree with this view. Present interest rates

encourage the obtaining of business at underwriting loss levels

formerly regarded as totally unacceptable. Managers decry the

folly of underwriting at a loss to obtain investment income, but

we believe that many will. Thus we expect that competition will

create a new threshold of tolerance for underwriting losses, and

that combined ratios will average higher in the future than in

the past.

To some extent, the day of reckoning has been postponed

because of marked reduction in the frequency of auto accidents -

�

probably brought on in major part by changes in driving habits

induced by higher gas prices. In our opinion, if the habits

hadn’t changed, auto insurance rates would have been very little

higher and underwriting results would have been much worse. This

dosage of serendipity won’t last indefinitely.

Our forecast is for an average combined ratio for the

industry in the 105 area over the next five years. While we have

a high degree of confidence that certain of our operations will

do considerably better than average, it will be a challenge to us

to operate below the industry figure. You can get a lot of

surprises in insurance.

Nevertheless, we believe that insurance can be a very good

business. It tends to magnify, to an unusual degree, human

managerial talent - or the lack of it. We have a number of

managers whose talent is both proven and growing. (And, in

addition, we have a very large indirect interest in two truly

outstanding management groups through our investments in SAFECO

and GEICO.) Thus we expect to do well in insurance over a period

of years. However, the business has the potential for really

terrible results in a single specific year. If accident

frequency should turn around quickly in the auto field, we, along

with others, are likely to experience such a year.

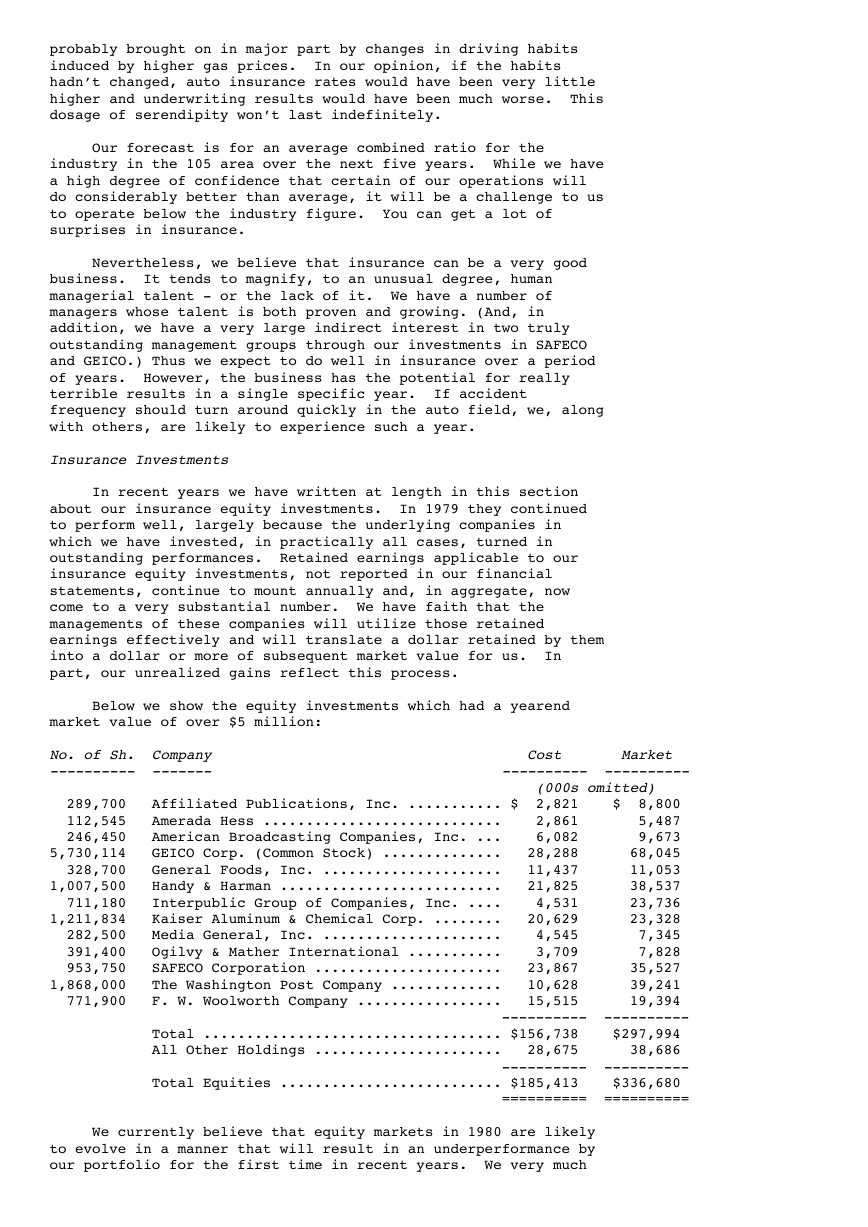

Insurance Investments

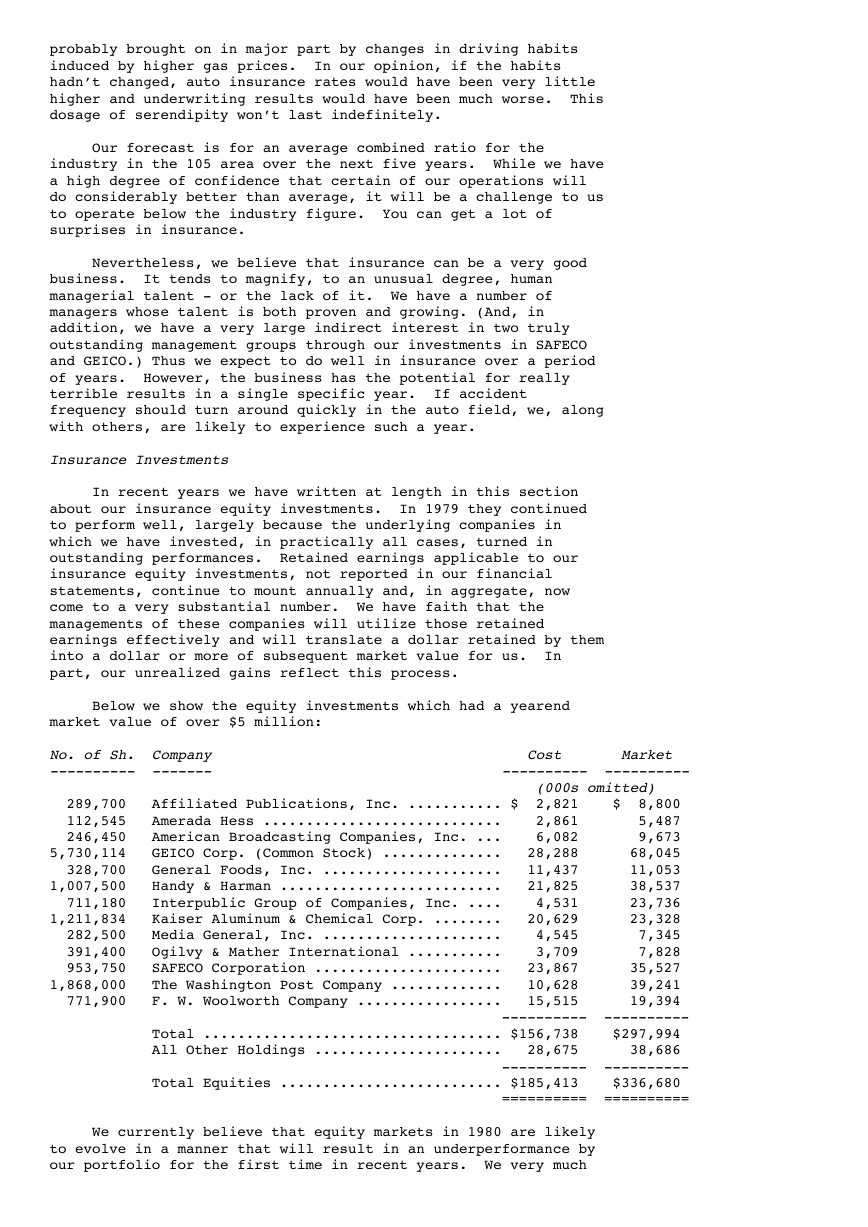

In recent years we have written at length in this section

about our insurance equity investments. In 1979 they continued

to perform well, largely because the underlying companies in

which we have invested, in practically all cases, turned in

outstanding performances. Retained earnings applicable to our

insurance equity investments, not reported in our financial

statements, continue to mount annually and, in aggregate, now

come to a very substantial number. We have faith that the

managements of these companies will utilize those retained

earnings effectively and will translate a dollar retained by them

into a dollar or more of subsequent market value for us. In

part, our unrealized gains reflect this process.

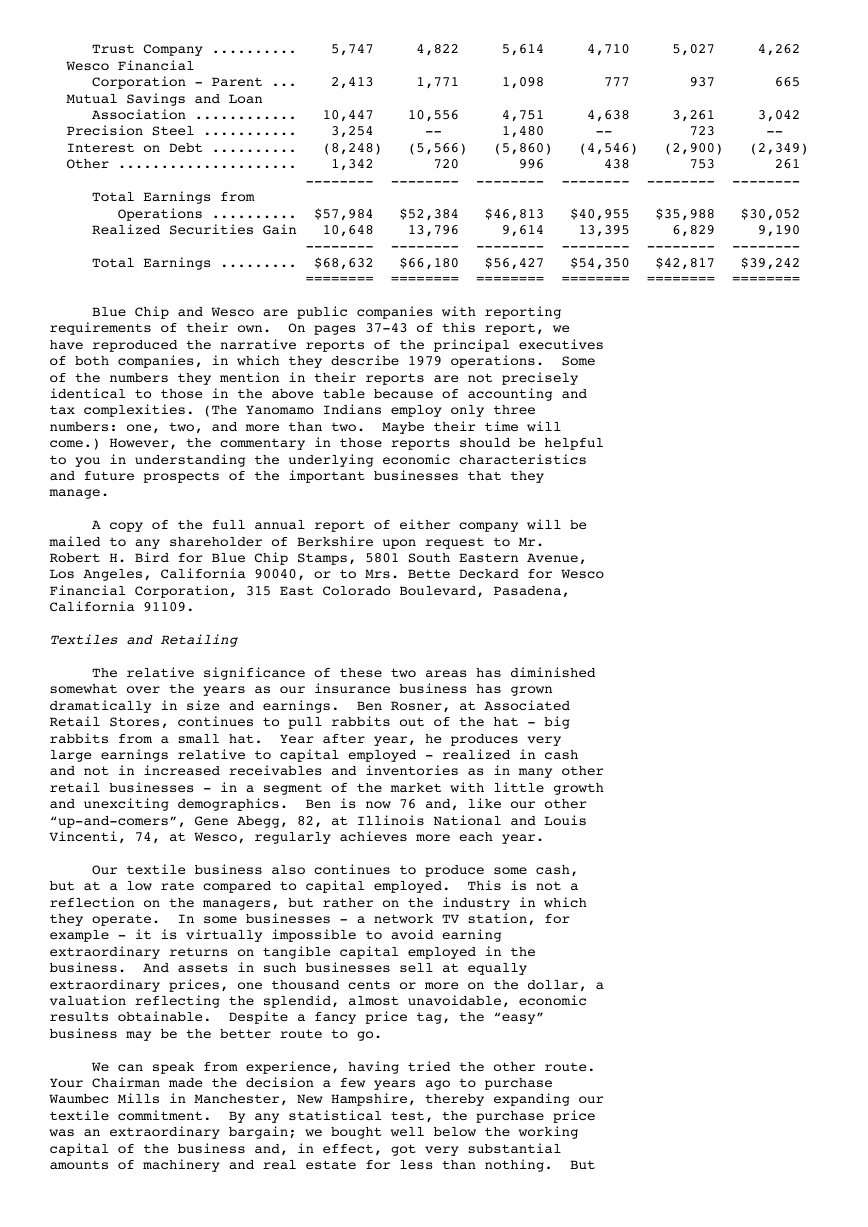

Below we show the equity investments which had a yearend

market value of over $5 million:

No. of Sh. Company Cost Market

---------- ------- ---------- ----------

(000s omitted)

289,700 Affiliated Publications, Inc. ........... $ 2,821 $ 8,800

112,545 Amerada Hess ............................ 2,861 5,487

246,450 American Broadcasting Companies, Inc. ... 6,082 9,673

5,730,114 GEICO Corp. (Common Stock) .............. 28,288 68,045

328,700 General Foods, Inc. ..................... 11,437 11,053

1,007,500 Handy & Harman .......................... 21,825 38,537

711,180 Interpublic Group of Companies, Inc. .... 4,531 23,736

1,211,834 Kaiser Aluminum & Chemical Corp. ........ 20,629 23,328

282,500 Media General, Inc. ..................... 4,545 7,345

391,400 Ogilvy & Mather International ........... 3,709 7,828

953,750 SAFECO Corporation ...................... 23,867 35,527

1,868,000 The Washington Post Company ............. 10,628 39,241

771,900 F. W. Woolworth Company ................. 15,515 19,394

---------- ----------

Total ................................... $156,738 $297,994

All Other Holdings ...................... 28,675 38,686

---------- ----------

Total Equities .......................... $185,413 $336,680

========== ==========

We currently believe that equity markets in 1980 are likely

to evolve in a manner that will result in an underperformance by

our portfolio for the first time in recent years. We very much

�

like the companies in which we have major investments, and plan

no changes to try to attune ourselves to the markets of a

specific year.

Since we have covered our philosophy regarding equities

extensively in recent annual reports, a more extended discussion

of bond investments may be appropriate for this one, particularly

in light of what has happened since yearend. An extraordinary

amount of money has been lost by the insurance industry in the

bond area - notwithstanding the accounting convention that allows

insurance companies to carry their bond investments at amortized

cost, regardless of impaired market value. Actually, that very

accounting convention may have contributed in a major way to the

losses; had management been forced to recognize market values,

its attention might have been focused much earlier on the dangers

of a very long-term bond contract.

Ironically, many insurance companies have decided that a

one-year auto policy is inappropriate during a time of inflation,

and six-month policies have been brought in as replacements.

“How,” say many of the insurance managers, “can we be expected to

look forward twelve months and estimate such imponderables as

hospital costs, auto parts prices, etc.?” But, having decided

that one year is too long a period for which to set a fixed price

for insurance in an inflationary world, they then have turned

around, taken the proceeds from the sale of that six-month

policy, and sold the money at a fixed price for thirty or forty

years.

The very long-term bond contract has been the last major

fixed price contract of extended duration still regularly

initiated in an inflation-ridden world. The buyer of money to be

used between 1980 and 2020 has been able to obtain a firm price

now for each year of its use while the buyer of auto insurance,

medical services, newsprint, office space - or just about any

other product or service - would be greeted with laughter if he

were to request a firm price now to apply through 1985. For in

virtually all other areas of commerce, parties to long-term

contracts now either index prices in some manner, or insist on

the right to review the situation every year or so.

A cultural lag has prevailed in the bond area. The buyers

(borrowers) and middlemen (underwriters) of money hardly could be

expected to raise the question of whether it all made sense, and

the sellers (lenders) slept through an economic and contractual

revolution.

For the last few years our insurance companies have not been

a net purchaser of any straight long-term bonds (those without

conversion rights or other attributes offering profit

possibilities). There have been some purchases in the straight

bond area, of course, but they have been offset by sales or

maturities. Even prior to this period, we never would buy thirty

or forty-year bonds; instead we tried to concentrate in the

straight bond area on shorter issues with sinking funds and on

issues that seemed relatively undervalued because of bond market

inefficiencies.

However, the mild degree of caution that we exercised was an

improper response to the world unfolding about us. You do not

adequately protect yourself by being half awake while others are

sleeping. It was a mistake to buy fifteen-year bonds, and yet we

did; we made an even more serious mistake in not selling them (at

losses, if necessary) when our present views began to

crystallize. (Naturally, those views are much clearer and

definite in retrospect; it would be fair for you to ask why we

weren’t writing about this subject last year.)

Of course, we must hold significant amounts of bonds or

�